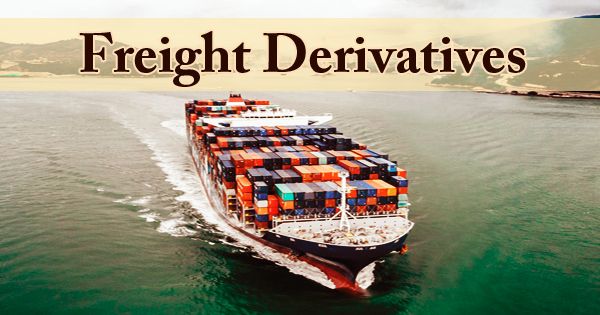

Freight derivatives are monetary instruments, which incorporates forward freight agreements (FFA), holder cargo trade arrangements, compartment cargo subsidiaries, physical-deliverable cargo subordinates, and alternatives dependent on these, whose worth is gotten from the future degrees of cargo rates, similar to dry mass conveying rates and oil big hauler rates. Freight derivatives are also used to reduce risk and protect against market fluctuations in the supply chain by end-users (ship owners and grain-houses) and by manufacturers (integrated oil firms and multinational trading corporations). Notwithstanding, likewise with any subsidiary, market examiners like mutual funds and retail brokers participate in both the purchasing and selling of cargo contracts accommodating another, more fluid, commercial center.

A derivative is a contract which derives its value from an underlying entity’s results. Exchange-traded futures, swap futures, forward freight agreements (FFAs), container freight swap agreements, container freight derivatives, and physical deliverable freight derivatives are included as freight derivatives. Exchanges can be surrendered for clearing by the representative to one of the clearinghouses that help such exchanges or be executed in incorporated electronic trade. These instruments are settled against the different freight rate indices issued by the Baltic Exchange (for Dry and most Wet Contracts), the Shanghai Shipping Exchange (International and Domestic Dry Bulk and International Containers), and Platt’s (Asian Wet Contracts) or the Shanghai Shipping Freight Exchange physically delivered.

(Example of Freight Derivatives)

Cleared agreements, conversely, are margined consistently through the assigned clearinghouse. Toward the finish of every day, financial specialists get or owe the distinction between the cost of the paper contracts and the market file. Big financial trading houses, including banks and hedge funds, have recently joined the market, with commodities at the forefront of international economics. With delivery markets bearing more danger, cargo subsidiaries have become a suitable strategy for transport proprietors and administrators, oil organizations, exchanging organizations, and grain houses to oversee cargo rate hazards.

The dry freight derivatives trading volume, a business estimated to be worth about $200 billion in 2007, rose as those wanting ships sought to control their risks and investment banks and hedge funds were looking to make money from price fluctuations speculation. At the end of the 2007 monetary year, the quantity of exchanged parts on dry FFAs multiplied the determined actual item. The London-based Baltic Exchange gives the everyday Baltic Dry Index as a market gauge and driving pointer of the delivery business. It offers investors insight into the price of shipping big raw materials by sea, but also allows freight derivatives to be priced. The index includes 20 shipping routes measured on a time chart basis and covers numerous dry bulk carriers of different sizes, including Handysize, Supramax, Panamax, and Capesize.

Shanghai Shipping Freight Exchange is the primary electronic delivery cargo trade on the planet. It has three lines of organizations, including International Dry Bulk, Domestic Coastal Coal, and International Container. To track and defend against a decline in freight rates, a ship-owner uses the index. On the other side, Charters is using it to mitigate the risks of increasing freight prices. The Baltic Dry Index is considered a leading economic activity tracker because the rise in dry bulk shipping indicates an increase in growth-boosting raw materials for processing.

FFAs were produced for transportation in the mid-1990s. FFAs are exchanged both over-the-counter (OTC) and trade exchanged. Exchanges are frequently unpublished and done on trust alone. The contract ends on the settlement date and the provider pays the difference to the contract buyer if the negotiated price is higher than the settlement price. Meanwhile, the buyer pays the seller the difference if the negotiated price is lower than the settlement price. The settlement and agreement value distinction is then increased by the freight size or the voyage duration.

Information Sources: