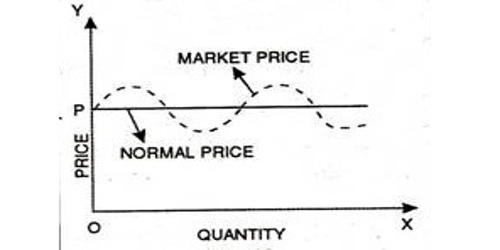

Market Price

The market price is the current price at which an asset or service can be bought or sold. It refers to the value of a thing prevailing in the market during a short period when there is the possibility of adjusting the supply of a commodity to the influences of demand. It is the price of an asset or product as determined by supply and demand. It is the amount a product or service can be bought or sold for. To find the market price, balance supply, and consumer demand. When supply and demand shift or fluctuate, the market price can also change.

There are two main reasons why you might reevaluate market price, including:

- If there’s a decrease in product or service availability – The rarity of the product or service increases, items become more valuable to the market and consumers.

- If product or service availability increases – When products and services are easier to obtain, consumers typically refuse to pay higher prices for them. If consumers know they can easily access a good or service, they will likely purchase it elsewhere at a lower cost.

To comprehend how a market price is derived, it is important to understand some basic trading concepts. In order for a trade to occur, there must be a buyer and a seller that meet at the same price. In financial markets, the market price can change quickly as people change their bid or offer prices, or as sellers hit the bid or buyers hit the offer.

In securities trading, the market price is the current price as dictated by the last recorded trade. This may vary from the current bid and offer. It can also be associated with the stock market. The market price in the bond market is the last reported price excluding accrued interest; this is called the clean price. The market price per share of stock, or the share price, is the amount investors are willing to pay for one share of a company’s stock. It is also used as a comparison tool; if the recorded cost of an asset is higher than its market price, accounting rules may require that the recorded cost of the asset be reduced to its market price or an adjusted version of the market price.

To determine market price, find where supply equals demand. Price is determined by local supply and demand, the property’s condition and what other similar properties have sold for without adding in the value component. Find market price by researching things like market trends, and the number of suppliers and existing buyers. Calculating market price can be challenging because it doesn’t use regular business formulas. Manufacturers, retailers, and service providers want high market prices because they encourage more production to boost profits and business revenue.