Partners’ Drawing Accounts with Interest on Drawing

A partnership draw is a money or property taken out of a business by one of its partners. The accounting transaction typically found in a drawing account is a credit to the cash account and a debit to the drawing account. Whenever partners withdrew money from the partnership firm for their private purpose it could be termed as drawings. Usually, each partner has a separate drawing account to facilitate accurate record-keeping. Draws differ from loans, as the partner can keep the money or assets. It is temporary in nature and it is closed by transferring the balance to an owner’s equity account at the end of the fiscal year. The drawings could be of following nature:

1. Drawings against salary or commission

2. Drawings against interest on capital

3. Drawing against a share of profits etc.

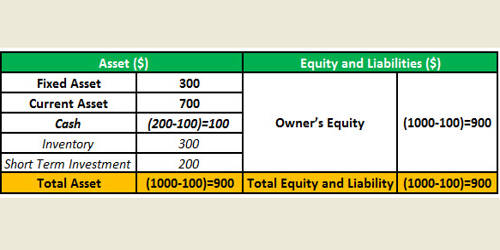

When a partner takes a draw, he essentially reduces the business’ equity. It should be noted that the provisions of drawings must be laid down in the partnership deed. The capital account is used to record the amounts the co-owners of a company invest in the business. When any partner withdraws money then that amount will be debited to his/her drawings account or current account and is credited to cash/bank account. Thus, a drawing account deduction reduces the asset side of the balance sheet and reduces the equity side at the same time. To close the partners drawing account, they are transferred to partners capital account or partners current account at the end of the year by passing the following entry:

Fluctuating Capital Method

- Partners’ capital A/C…………….Dr.

- To Partners drawings A/C

Fixed Capital Method

- Partners’ current A/C……………Dr.

- To partners’ drawings A/C

Interest on Drawings

The drawing account is not an expense – rather, it represents a reduction of owners’ equity in the business. It is used primarily for businesses that are taxed as sole proprietorships or partnerships. Interest in the drawing is an income of the partnership firm and is credited to profit and loss appropriation account.

On charging interest on drawings

- Partners’ capital A/C……………….Dr.

- To interest on drawings A/C

To close the interest on drawings

- Interest on drawings A/C………………….Dr.

- To profit and loss appropriation A/C

Information Source: