As a consequence of a shift in any operation, an incremental cost is a difference in overall costs. Incremental costs are determined by analyzing, with one additional unit of production, the additional costs involved in the production process, such as raw materials. Incremental costs are likewise alluded to as the differential expenses and they might be the pertinent expenses for certain short-run choices including two other options. Understanding gradual expenses can assist organizations with boosting creation productivity and gainfulness.

When deciding to make another product, producers look at incremental costs. New products also use the same assembly lines and raw materials as products already manufactured. Incremental costs are typically smaller than the overall unit cost of generating incremental costs. Tragically, more often than not when makers take on new product offerings there are extra expenses to make these items. Gradual expenses are constantly contained variable costs, which are the costs that vacillate with creation volumes.

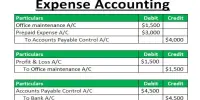

(Incremental Cost)

Until it agrees to start manufacturing the new product, management must look at these incremental costs and equate them to the additional revenue. The following may contain incremental expenditures:

- Raw materials such as inventory

- Utilities, such as the extra electricity required for the equipment to power

- Wages or direct labor that’s only involved in the production

- Shipping and packaging

When formulating the price to charge a client as part of a one-time offer to sell additional units, incremental costs may be beneficial. For example, if a company has space in its production schedule for 10 additional units and the variable cost of those units (that is, their incremental cost) is a total of $100, then the company can produce a profit from any price paid that exceeds $100. It is also possible to extend the definition to cost reduction research.

In other words, incremental costs depend solely on the amount of output. Conversely, fixed costs are omitted from incremental cost analysis, such as rent and overhead, because these costs usually do not change with production levels. Fixed costs can also be difficult to attribute to any one part of the market. Sometimes, incremental costs are known as marginal costs.

Incremental costs are additionally utilized in the administration choice to make or purchase an item. A gradual cost investigation just surveys those costs that will change as the aftereffect of a choice. All different expenses are viewed as insignificant to the choice. Some custom items probably won’t be promptly accessible for the business to purchase, so the business needs to experience the cycle of custom requesting it or making it. In order to optimize output levels and profitability, businesses look to evaluate the incremental cost of production. When assessing the profitability of a business segment, only the related incremental costs that can be specifically tied to the business segment are taken into account.

It may not be worth the marginal costs of manufacturing the product. The organization could be better off purchasing it by tradition. If for a special order a discounted price is set, then it is important that the profits earned from the special order at least cover the incremental costs. Otherwise, a net loss arises from the special order.

Information Sources: