The practice of identifying, measuring, analyzing, interpreting, and communicating financial information to managers to achieve the goals of an organization is managerial accounting (also known as cost accounting or management accounting). Managerial accounting focuses on internal decision-making, unlike financial accounting, which is mainly based on the proper organization and reporting of the company’s financial transactions to outsiders (e.g. investors, lenders). In other words, Management accounting requires directors within a company to make choices; this can also be referred to as cost accounting. Most non-accounting majors generally assume that managerial accounting is more important to their profession.

According to the Institute of Management Accountants (IMA): “Management accounting is a discipline that includes partnering in decision-making in management, developing processes for planning and performance management, and providing financial reporting and control skills to assist management in formulating and executing the strategy of a company.”

Managerial accounting differs from financial accounting because management accounting’s intended function is to assist the company’s internal users in making well-informed business decisions. It looks at the incidents that arise in and around an organization when considering the company’s needs. This need to break down different occasions and operational measurements to make an interpretation of information into valuable data that can be utilized by the organization’s administration in their dynamic cycle.

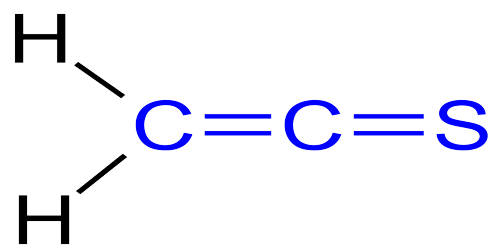

(Example of Managerial Accounting)

Managerial accountants use data relating to the cost and sales revenue produced by the business for products and services. They are more worried about forward-looking and making choices that will influence the eventual fate of the association, than in the verifiable chronicle and consistence (scorekeeping) parts of the calling. Cost accounting is a wide subset of management accounting which focuses primarily on capturing the total production costs of a business by evaluating the variable costs of each production step, as well as fixed costs. This helps corporations to recognize and decrease wasteful spending and increase profits.

Managerial accounting depends on a number of different strategies, including the following, to accomplish its objectives:

- Margin analysis: The study of margin analysis mainly with the marginal benefits of increased output. In managerial accounting, margin analysis is one of the most basic and important techniques. It involves the breakeven point estimate that specifies the optimum sales mix for the goods of the company.

- Constraint analysis: Examination of constraints analysis of the constraints within a sales process or production line. Managerial accountants figure out where the constraints exist and assess the effect on cash flow, sales, and benefit.

- Capital budgeting: The review of the information needed to make the requisite decisions relevant to capital budgeting concerns capital budgeting. Managerial accountants measure the net present value (NPV) and the internal rate of return (IRR) in capital budgeting analysis to help managers decide on new decisions on capital budgeting.

- Inventory valuation and product costing: Identification and review of the real costs associated with the goods and inventory of the business include inventory valuation. In general, the mechanism involves estimating and allocating overhead charges, as well as determining the direct costs associated with the cost of the goods sold (COGS).

- Trend analysis and forecasting: It is an essential aspect of managerial accounting to review the trend line for such costs and to examine unexpected variances or anomalies. Decisions are taken to measure and forecast future financial conditions by using previous information such as historical prices, market volumes, geographical position, consumer trends, and financial details.

Managerial accounting includes evaluating plans, determining if the goods or services are needed, and finding the best way to fund the purchase. It likewise plots restitution periods so the executives can foresee future monetary advantages. Managerial accounting reports use spending reports to help direct chiefs to offer better representative motivators, reduced expenses, and rework terms with merchants and providers.

Information Sources: