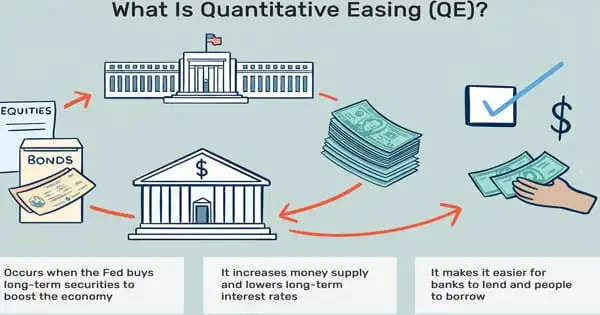

Quantitative Easing (QE) is a non-traditional monetary policy in which a central bank purchases a large number of securities in order to stimulate the economy. It accomplishes this by making large-scale asset purchases. For example, in response to the coronavirus pandemic, the Fed has begun purchasing longer-maturity Treasuries and commercial bonds. When QE is effective, the increased money supply encourages lending, lowers interest rates, and leads to economic growth.

Here’s how the simple act of purchasing assets on the open market improves the economy (mostly):

How does quantitative easing work –

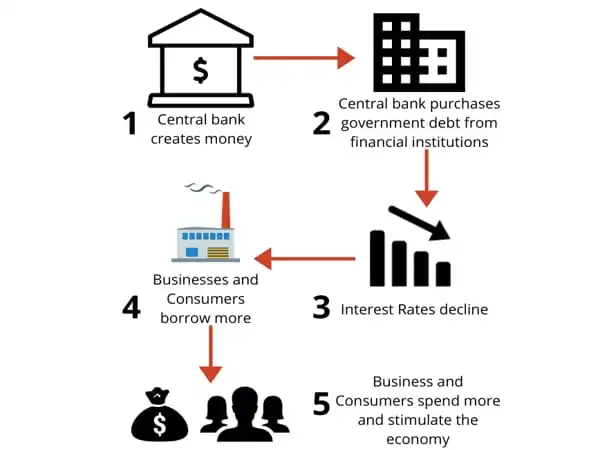

Using QE to add new money to the economy sets a powerful chain of events in motion:

- The Fed creates credit

By creating bank reserves on its balance sheet, the central bank adds credit (money) to the banking system. The injection of money into the economy aims to prevent problems in the financial system, such as a credit crunch, which occurs when available loans are reduced or the criteria for borrowing money are significantly raised. The Fed is sometimes referred to as “printing money.” This ensures that the financial markets continue to function normally.

- The Fed buys assets

By creating bank reserves on its balance sheet, the Fed can create money out of thin air, a process known as money printing. These assets are long-term Treasury bonds and other financial assets traded on the open market. With QE, the central bank uses newly created bank reserves to purchase long-term Treasuries from major financial institutions on the open market (primary dealers).

- Demand increases

Investors are more likely to invest in higher-returning assets, such as stocks, given the lower returns on fixed income assets. Bond prices rise as the Fed purchases more of these securities, while yield (the return on the securities) falls. As a result of quantitative easing, the overall stock market could see stronger gains.

- New money (credit) enters the economy

The Fed’s purchases inject new money (in the form of credit) into the accounts of the financial institutions that sell long-term securities to the government. As a result of these transactions, financial institutions have more cash in their accounts that they can keep, lend to consumers or businesses, or use to purchase other assets.

- Interest rates go down

With the Fed purchasing billions of dollars in Treasury bonds and other fixed-income assets, bond prices rise (due to increased Fed demand) and yields fall (bondholders earn less). Because financial institutions are motivated to lend the extra cash they have, interest rates on loans fall. Lower interest rates make borrowing money more affordable, encouraging consumers and businesses to take out loans for large-ticket items that could boost economic activity.

- The economy grows

The Fed has reassured markets and the broader economy through QE. Borrowing by businesses and individuals increases, as does investment, and stock prices rise (since bonds are now a poor investment). Businesses and consumers may be more likely to borrow money, invest in the stock market, hire more people, and spend more money, all of which contributes to the economy’s growth. As a result, the economy is stimulated and unemployment is reduced.