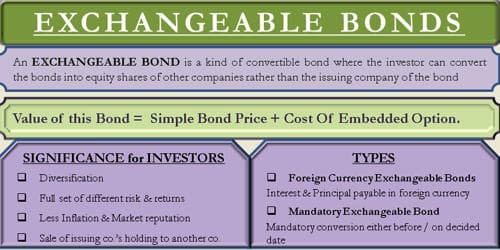

Exchangeable bond (XB) is a type of hybrid security consisting of a straight bond and an embedded option to exchange the bond for the stock of a company other than the issuer at some future date and under prescribed conditions. It is a type of hybrid debt security that can be converted into the shares of a company other than the issuing company. An exchangeable bond is different from a convertible bond. A convertible bond gives the holder the option to convert the bond into shares of the issuer. Companies issue exchangeable debt for a number of reasons, including tax savings and divesting a large stake in another company or subsidiary.

For example, let’s consider a Company XYZ bond that is exchangeable into shares of Company ABC at an exchange ratio of 50:1. This means that you could exchange every $1,000 of par value you own of XYZ bonds into 50 shares of ABC stock.

The pricing of an exchangeable bond is similar to that of a convertible bond, splitting it in a straight debt part and an embedded option part and valuing the two separately. It gives the holder the option to exchange the bond for the stock of a company other than the issuer (usually a subsidiary) at some future date and under prescribed conditions. In the pricing of an exchangeable bond, the bond portion and the embedded option are valued separately, and the overall yield on an exchangeable bond is typically lower than that of a straight bond. One risk of investing in exchangeable bonds is that the investor is exposed to an underlying stock that may have entirely different risk and return profiles from the issuer. Exchangeable bonds are typically issued with a maturity of three to six years.

Exchangeable Bonds are a way to ease the interest rate burden on the company for a short while. These bonds are a good candidate for creating diversification in the portfolio. A company’s financial structure is based on different types of financial instruments with bonds being as one. It provides a complete set of different risks and returns from the issuing company to the investors. Bonds are a debt instrument that companies issue for acquiring funds for their business and pay interest on the same. Investors have the right to take part in the share price appreciation of the offered company.

TYPES

There are two other kinds of Exchangeable bonds apart from normal exchangeable convertible bonds which are –

Foreign Currency Exchangeable Bonds – The offered company which is the company, whose equity shares can be purchased by the bondholder to exercise the right to conversion, must receive foreign investments.

Mandatory Exchangeable Bonds – These bonds have to be converted to equity shares either before or on the predetermined date for conversion.