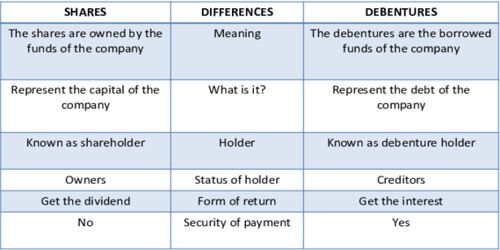

Shares and debentures both are ways to raise capital however debentures are borrowed capital whereas shares are a portion of the company’s capital itself. The smallest division of the company’s capital is known as shares. The shares are movable i.e. transferable and consist of a distinctive number. Debentures are a long-term debt instrument issued by the company under its common seal, to the debenture holder showing the indebtedness of the company. While shares give you a share in the profits, debentures give you priority in the case the company is getting wound up.

Differences between Shares and Debentures –

Following are the main differences between shares and debentures:

(1) Ownership

- A share refers to the share capital of the company. The share of a company provides ownership to the shareholders. It describes the right of the holder to the specified amount of the share capital of the company.

- Debenture-holders are creditors of a company who provide loan to the company. Debenture implies a long term instrument showing the debt of the company towards the external party.

(2) Identity

- Person holding share is known as shareholder. The shares represent ownership of the shareholders in the company.

- Person holding debenture is known as debenture-holder. Debentures represent indebtedness of the company.

(3) Certainty of Return

- No certainty of return in case of loss for the shareholder. The payment of dividend can be made only out of current profits of the business and not otherwise.

- Debenture-holder receives the interest even if there is no profit. Unlike the interest on debentures which has to be paid by the company to debenture holders, no matter company has earned profit or not.

(4) Convertibility

- Shares can not be converted into debentures. Dividend is not a business expense and so is not allowed as deduction.

- Debentures can be converted into shares. Interest on debentures is a expense and so allowed as a deduction.

(5) Control

- Shareholders have the right to participate and vote in company’s meeting. Shares are issued at a discount subject to some legal compliance.

- Debenture holders do not possess any voting right and can not participate in meeting. Debentures can be issued at a discount without any legal compliance.

So, a debenture is a debt tool used by a company that supports long term loans. Shares are a tiny part of a firm’s capital is identified as shares and is usually sold in the stock market to raise funds for a business. Both are ways to be invested in a company are at two fags ends of a curve.

Information Source: