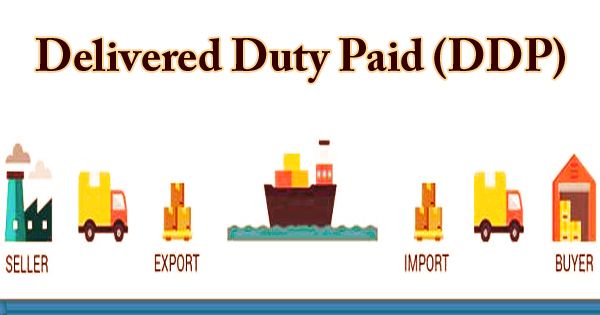

In foreign trade, the term Delivered Duty Paid (DDP) is used to describe an agreement in which the seller of goods agrees to pay all costs before the goods reach the destination mutually agreed in the contract. This agreement/contract incorporates paying for delivery costs, fare and import obligations, protection, and some other costs brought about during transportation to a settled upon area in the purchaser’s country. In place of the “Free In Store (FIS)” in non-Incoterm, DDP is also used. This term puts on the seller the full obligations and on the buyer the minimum obligations. The purchaser should accept accountability just for emptying the merchandise and moving them from the port to the stockroom if the commonly settled upon terminal objective is the purchaser’s port. At times, the agreement may require the dealer to pay for cargo from the port to the purchaser’s door.

No responsibility or liability shall be passed to the customer before the goods are delivered at the specified destination. The word “DDP” can also, however, be used if any of the expense of the seller is omitted. For example, it is possible to exclude value-added tax, or VAT, from the obligations of the seller. In this case, the term used is “DDP, VAT unpaid.” The main thought for DDP terms is that the vendor is answerable for clearing the products through traditions in the purchaser’s nation, including both paying the obligations and burdens, and acquiring the fundamental approvals and enlistments from the experts in that country.

(Example of Delivered Duty Paid)

As they assume less risk and less risks in the shipping process, the advantages of DDP lean in favor of the buyer, which also puts a great deal of pressure on the seller. However, most of the time, the shipper is the one who pays any VAT. This has to be considered when assessing the profit margin if a wholesaler pays VAT. Some of the wholesalers’ pros of Delivery Duty Paid to include:

- The buyer allows the seller to handle many of the responsibilities.

- A third-party DDP solution company can be used to lower risk.

- Landed cost is known at the time the goods are purchased.

- Absence of administrative management of the supply chain.

Since the vendor accepts the vast majority of the danger in such agreements, all the expenses are reflected in the selling cost. Accordingly, the purchaser needs to follow through on a greater expense for the products in these arrangements. The vendor shall arrange for transportation by any carrier of any kind and shall be liable for the expense of that carrier and for the procurement of customs clearance in the country of the purchaser, including the receipt of necessary approvals from the authorities of that country. Additionally, the vendor may have to get a permit for importation. Be that as it may, the dealer isn’t liable for emptying the merchandise.

Generally, in situations where the supply of products is reliable and predictable, DDPs are used. It may be because of the design of the commodity, the shipping procedures, or even the shipping route that may be influenced by geopolitical considerations (such as the Strait of Hormuz). Since the merchant is liable to more market hazards, they would want to utilize a DDP. DDP likewise incorporates customs freedom and it applies paying little heed to delivery strategy. Since the greater part of the weight is on the dealer, the vender should do the accompanying:

- Provision goods according to the contract with the buyer – Provide the industrial or electronic edition of the commercial invoice, as well as the products. It is important to stick to all points in the contract.

- Take care of formalities, licenses, and authorizations – Proper import and export licenses or other permits must be obtained by the seller. Where required, carry out customs formalities.

- Establish the contract of carriage and insurance – Goods are transported to the accepted distribution stage. The vendor selects the item and names the location that best fits the distribution of the products. Unless stated in the contract between the seller and the buyer, there is no requirement to carry insurance on a shipment.

- Goods must be delivered in a way that they are easily obtainable by the buyer – When they are stateside, the buyer must be able to purchase the products quickly.

It isn’t generally feasible for the transporter to clear the merchandise through traditions in far off nations. Customs prerequisites for DDP shipments shift by a nation. In certain nations, import freedom is convoluted and protracted, so it is ideal if the purchaser, who has close information on the cycle, deals with this cycle. Unless the rules and regulations in the buyer’s country are quite well known, both in terms of delays and unexpected additional costs, DDP terms can be a very big danger and should be used with caution. If DDP is handled poorly, it is possible that inbound shipments will be checked by customs, causing delays. Late shipments may also occur because, in order to minimize their prices, a seller may use cheaper, less efficient transport services.

Information Sources: