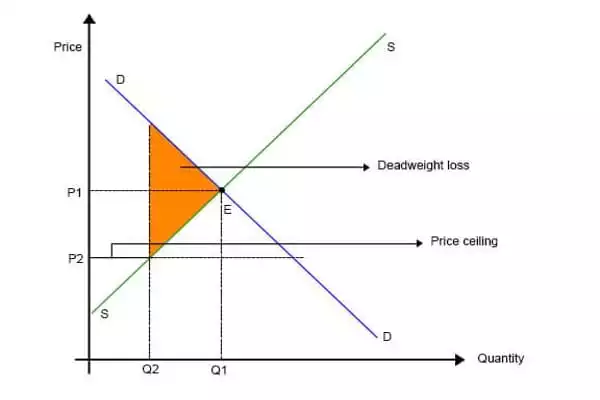

Excess burden, also known as deadweight loss, is a measure of lost economic efficiency caused by the failure to generate the socially optimal quantity of an item or service. It is the loss of economic efficiency in terms of utility for consumers/producers, which prevents optimal or allocative efficiency from being realized. It is a societal cost caused by market inefficiency, which happens when supply and demand are out of balance. Excess Burden or deadweight loss occurs when supply and demand are out of balance, resulting in market inefficiencies. It is mostly caused by poor resource allocation caused by various interventions such as price ceilings, price floors, monopolies, and levies.

These factors cause a product’s price to be inaccurately portrayed, resulting in goods that are either overpriced or underpriced. If a product’s price is not adequately portrayed, it causes changes in consumer and producer behavior, which usually has a negative impact on the economy. Overpriced prices, for example, may result in larger profit margins for a corporation, but it has a detrimental impact on product consumers. In the case of inelastic items, which means that demand for that specific good or service does not vary when the price rises or falls, the additional cost may deter consumers from purchasing in other market sectors.

It is defined as the reduction in overall welfare or the social surplus as a result of factors like as taxes or subsidies, price ceilings or floors, externalities, and monopolistic pricing. It is the additional burden imposed as a result of a loss of gain to trade participants, which can be individuals as consumers, producers, or the government. There is an economic cost when things are oversupplied. A baker, for example, may create 100 loaves of bread but only sell 80 of them. The remaining 20 loaves will get dry and moldy and must be discarded, resulting in a deadweight loss.

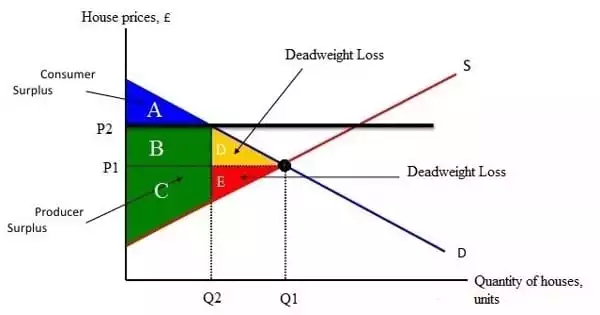

Non-optimal production can be generated by highly concentrated wealth and income (economic inequality), monopoly pricing in the case of artificial scarcity, a positive or negative externality, a tax or subsidy, or a legally binding price limit or floor, such as a minimum wage. Price ceilings, such as price restrictions and rent controls; price floors, such as minimum wage and living wage legislation; and taxation can all result in deadweight losses. With a lower degree of trade, a society’s resource allocation may become inefficient.

Minimum wage and living wage legislation might result in a deadweight loss by forcing firms to overpay employees and making it difficult for low-skilled individuals to find work. Price limits and rent controls can also result in a deadweight loss by discouraging production and reducing the supply of goods, services, or housing below what customers genuinely demand. Consumers face scarcity, while producers earn less than they would otherwise.

Monopolies and oligopolies impose an excessive burden because they eliminate the characteristics of a perfect market in which fair competition precisely establishes a price. Monopolies and oligopolies can manipulate supply for a certain item or service, inflating its price. This would eventually result in fewer goods and services being sold.