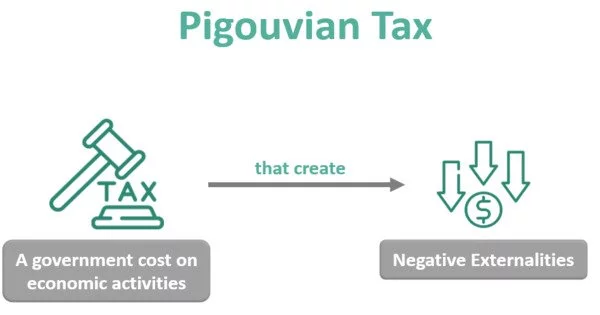

A Pigouvian tax is a type of tax on economic activities that generate negative externalities, which are costs imposed on society as a whole that are not fully reflected in the market price. The tax is named after the British economist Arthur Pigou, who first proposed the idea in the early 20th century. It is a tax levied on any market activity that has negative externalities (i.e., external costs incurred by the producer that are not included in the market price).

The tax is typically imposed by the government to correct an undesirable or inefficient market outcome (a market failure), and it is equal to the external marginal cost of the negative externalities. When there are negative externalities, the social cost includes both the private cost and the external cost caused by the negative externalities. This means that the private cost of a market activity does not cover the social cost of the activity.

In such a case, the market outcome is inefficient and may result in excessive product consumption. Often-cited examples of negative externalities are environmental pollution and increased public healthcare costs associated with tobacco and sugary drink consumption.

Purpose

The purpose of a Pigouvian tax is to internalize the external costs of the activity by increasing the price of the goods or services involved, so that the cost to society is reflected in the market price. By making the activity more expensive, the tax is intended to reduce the demand for the activity and encourage individuals and firms to seek alternative, less harmful activities.

For example, a Pigouvian tax might be applied to gasoline or other fossil fuels to account for the negative externalities associated with climate change, air pollution, and other environmental costs. The tax would increase the price of gasoline, making it more expensive to drive and incentivizing individuals to use public transportation or purchase electric or hybrid vehicles.

The Pigovian tax is intended to discourage activities that shift production costs to third parties and society as a whole. Negative externalities, according to Pigou, prevent a market economy from reaching equilibrium when producers do not bear all costs of production. He proposed that this negative effect be mitigated by levying taxes equal to the externalized costs. Ideally, the tax would be equal to the external damage caused by the producer, reducing future external costs.

Pigouvian taxes can be an effective policy tool for addressing negative externalities and reducing the social costs of economic activities. However, they can also be politically controversial, as they increase the cost of certain goods and services and can be perceived as burdensome on individuals and businesses.