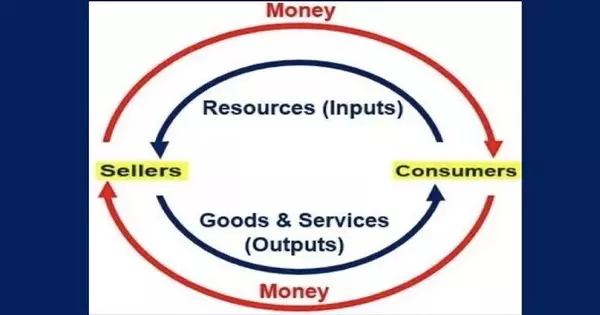

The customer, according to Neoclassical Economics, is ultimately in control of market forces such as price and demand because the consumer’s goal is utility maximization and the organization’s goal is profit maximization. According to the theory, supply and demand are related to an individual’s rationality and ability to maximize utility. It analyzes various aspects of economics using mathematical equations.

The over-reliance on mathematical approaches in neoclassical economics has been criticized. The study lacks empirical science. The study, which is overly based on theoretical models, is insufficient to explain the actual economy, particularly the interdependence of individuals with the system.

Critics of Neoclassical Economics

According to the Neoclassical theory, consumers frequently perceive a product to be more valuable than the cost of production, and the perceived value is dependent on the utility of the product and influences its demand. Classical economics, on the other hand, calculates a product’s value as the cost of materials plus the cost of labor. This notion of product cost is rejected by neoclassical thought.

One of the most common criticisms leveled at neoclassical economics is that it makes unrealistic assumptions. The assumption of rational behavior ignores human nature’s vulnerability and irrationality. Behavioral economics is the study of irrational economic decision-making behaviors. The study provides empirical evidence of human behaviors in an economy. It is also argued whether utility or profit maximization is the only goal of an individual or company.

The Neoclassical economists argue, the consumers want to maximize their personal satisfaction and thus they make informed decisions based on the evaluation utility of a product. This is similar to the rational behavior theory which argues that people rationally make economic decisions.

According to this theory, competition leads to the efficient allocation of resources within an economy. This resource allocation is said to establish market equilibrium between supply and demand. Neoclassical economic theory is criticized by critics because it is based on unrealistic assumptions that are far from reality. It assumes that all parties act rationally when making an economic decision, but this assumption ignores human nature’s susceptibility to other forces. A consumer’s decision is not free, and they may make irrational choices as a result of other forces.

Neoclassical economics is also considered overly dependent on complex, unrealistic mathematical models. The complex models are not applicable to describe the real economy. In response to the criticism, American educator and economist Milton Friedman claimed that a theory should be judged by its ability to predict. The complexity of the model or realism of the assumptions is not a standard to judge a theory.

According to neoclassical theory, matters such as labor law will improve naturally as a result of the economic situation. Many economists believe that this argument leads to inequalities in global debt and trade relations.

According to neoclassical theory, there is no upper limit to a capitalist’s profit-making ability. Capitalists can profit from the fact that the value of a product is determined by consumer perception. The economic surplus is the selling price minus the cost of production.