One of the key genres of financial risk is reinvestment risk; it refers to the probability that an investor may not be able to reinvest cash flows (e.g. coupon payments) at a rate equal to their current return rate. The term defines the risk that a specific investment may somehow be canceled or stopped, that one might have to find a new place to invest the money with the risk that a similarly desirable investment may not be available. This risk is most ordinarily found with bond contributing, however, it can apply to any money creating speculation. Zero-coupon bonds are the main fixed-pay security that has no speculation hazard as no coupon installments are made.

When it comes to bond investing, reinvestment risk is most prominent, but any form of investment that generates cash flow will expose the investor to this kind of risk. Reinvestment risk reduction strategies include the use of non-callable bonds, zero-coupon instruments, long-term loans, bond ladders, and bond funds that are actively controlled. The risk coming about because of the way that premiums or profits procured from a venture will most likely be unable to be reinvested so that they acquire the very pace of return as the contributed reserves that created them.

(Example of Reinvestment Risk)

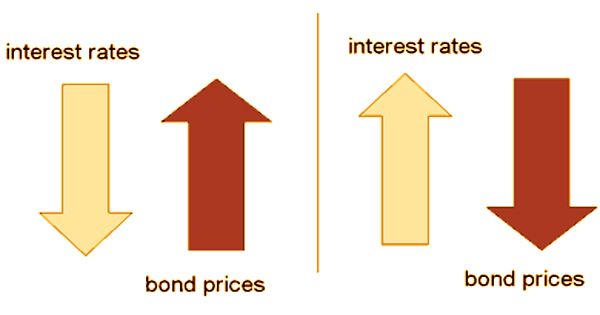

Zero-coupon bonds, since zero-coupon bonds do not pay coupons, will help investors reduce their chance of reinvestment. Nevertheless, an investor also needs to decide if he or she can reinvest in the proceeds when the bond matures. With callable bonds, reinvestment risk also exists, allowing the borrower to pay off the bond before maturity. One of the essential reasons securities are called is on the grounds that financing costs have fallen since the security’s issuance, and the enterprise or the public authority would now be able to give new securities with lower rates, along these lines sparing the distinction between the higher rate and the new lower rate.

In a new defense, reinvestment risk is the possibility that the cash flows of an investment will earn less. For instance, an investor buys a $100,000 Treasury note with an interest rate of 6 percent for 10 years. The investor expects the security to gain $6,000 a year.

Interest rates, however, are 4 % at the end of the term. If the investor purchases another $100,000 Treasury note for 10 years, they can receive $4,000 annually instead of $6,000. Often, they lose part of the principal if interest rates eventually rise and they sell the note before its maturity date.

The risk emerges from the way that premium or profits got through speculation may not be practical to be reinvested in a manner wherein there could be increases in the similar pace of return as the assets contributed that created it. It’s a piece of the agreement the financial specialist consents to when purchasing a callable bond. Even, this also suggests, sadly, that the investor would have to put the cashback to work at the lower prevailing pace. Reinvestment risk also affects other revenue-producing assets, such as dividend-paying securities, in addition to fixed-income instruments, such as bonds.

By investing in longer-term securities, investors may try to combat reinvestment risk, since this reduces the pace at which cash becomes available and needs to be reinvested. This also exposes the portfolio, sadly, to an even higher interest rate risk. Additionally, zero-coupon bonds might be bought since they don’t make normal interest installments. Putting resources into longer-term protections is likewise an alternative since money opens up less oftentimes and shouldn’t be reinvested regularly.

The effect of reinvestment risk can be minimized by investing in actively managed bond funds, since the fund manager may take similar risk reduction measures. A bond ladder, a fixed-income securities portfolio with varying maturity dates, can help mitigate the risk of reinvestment. Over the long run, in any case, the yields on security reserves do in general ascent and fall with the market, so effectively oversaw security reserves give just restricted insurance against reinvestment hazard. Securities developing when financing costs are low might be counterbalanced by securities developing when rates are high.

The reinvestment risk is also the topic of a pension fund. There is always a possibility of reinvesting future proceeds at lower interest rates, especially given the short-term nature of cash investments. Getting a fund manager will help reduce the risk of reinvestment, so some investors are considering allocating capital to actively managed bond funds. However, reinvestment risk also exists because bond yields fluctuate with the economy.

Information Sources: