The economy of the black market is a commercial enterprise that exists beyond the rules, legislation, and taxes. In economics, there is not one concept of black money. It is money that has been obtained through illegal means or money that is unaccounted for in the language of the layman, that is, for which tax is not paid to the government. Black money recipients must conceal it, invest it only in the underground economy, or try to give it the appearance of legitimacy by laundering money.

The black-market economy has three features that characterize it. First, illegal activities are part of it. The illegal activities that can contribute to the generation of black money are:

- Crime

- Corruption

- Non-compliance with tax requirements

- Complex procedural regulations

- Money laundering

- Smuggling

Second, it prefers cash. In this way, payments discourage law enforcement, bank compliance officers, or tax officials from being identified. This is where an individual wilfully does not pay government-due taxes.

Third, to transform transfers to a legal form, the black market industry uses money laundering. This is where a company takes advantage of the current loopholes in the system and prevents taxes from being paid. The objective of tax evasion is to move the cash from the unlawful business through numerous exchanges to cloud the cash trail. It forestalls bank consistence officials and government authorities from perceiving the indications of an underground business.

The black market, or underground economy, is the most popular source of black currency. Black-market operations may include the sale of illegal drugs, gunrunning, terrorism, and trafficking in human beings. Less serious offences, such as the selling of counterfeit products, stolen credit cards, or pirated copies of copyrighted content, often include black market operations. Merchants need to participate in the bootleg market economy to get more cash-flow than they could lawfully. They may likewise do it to acquire renown, force, and confidence. Most are in a setting where their peers are socially appropriate, if not motivated, by it. To assume that this is the only way they can get ahead, some others have been socially trained.

Black money has some genuine outcomes on the economy of a country. Some of them are examined underneath.

- The black economy accounts for no less than a quarter of overall economic transactions. There is also an interaction between the activities reported and unreported, such that it is difficult to distinguish black money from the economy of white money. A parallel economy like this would destroy the country’s entire economic growth.

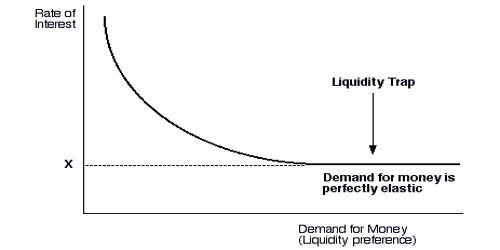

- Black money dominates the country’s financial system. The central bank is unable to control the supply of money to the economy, which triggers higher inflation. This will contribute to the currency’s value dropping. It also adversely impacts a country’s reputation.

- A broad underground economy and black revenue growth contribute to the underestimation of the true size and the incorrect image of the economy by the national revenue data officially complied with. As the unreported economy is obviously exempt from the official records of the Gross National Product, it would be skewed and misleading to estimate the savings and consumption of nations on national income and to calculate other macroeconomic variables for specific policy-making and planning considerations.

- Black money is most commonly used for illicit activities that are harmful to the welfare of the country, such as drug and narcotics trafficking, terrorism, etc.

- Due to black money, the government experiences a great loss in the form of taxation. The direct result of this is the reduction of government revenue. Since, owing to large-scale tax evasion, the Government is not able to obtain adequate tax revenue, it is forced to resort to high taxation and deficit financing, again bearing its ill-economic consequences.

- The black economy’s rise triggers a regressive distribution of income in society. When black money rises faster, the wealthy get wealthier, and the poor get poorer. By concentrating income and resources in a few hands, the divide between the wealthy and the poor is broadened by black money.

- Black money is disposed of by luxurious expenditure on travel and tours, entertainment, ostentatious objects, extravagant election financing, etc. This has also contributed to many social evils, weakening the common people’s values in life.

- Black money has modified the consumer selection coefficients in favor of luxury, contributing to the diversification of productive capital from basic commodities to non-essential goods.

- Black money can also cause the prices of real estate to increase, which can lead to an asset bubble. Because of their willingness and capacity to pay more, black money holders are often in a position to place their prior claim on the scarce commodities on the market, thereby depriving honest and poor citizens of their rightful share.

- Black money is largely responsible for the degradation of society’s general moral norms. The development of black income means a deviation from the established norms in society and is immoral from the point of view of society.

In addition, black money allows a nation’s financial wellbeing to be underestimated. Estimating the amount of black money in any economy is extremely difficult. Organizations that make generous benefits in the underground economy fundamentally need to pay law requirement to look the alternate path every once in a while. In any case, that prompts a bad police power that may move from disregarding offenses to effectively taking an interest in violations.

Information Sources: