Credit Card Division of Southeast Bank Limited

Southeast Bank Limited is one of renowned, profitable and modern private banking financial institution of Bangladesh with vision to become a premier financial institution and contribute to the economy. It offers all available second-generation products and services to its target market; one of its premium products is the VISA credit card it offers. The card includes many competitive features and trying to augment its market position from different aspects in a highly competitive and mostly saturated marketplace.

The report is based on that credit card and its customer satisfaction level; attributed by credit cardholders of different demographics and contains detailed, structured analysis of customer satisfaction weighted direct and indirect data which has been fetched from structured questionnaire survey. The report and its core analytical parts has been supported by detailed description to credit card and it’s operation; from definition to competitive analysis which will help to build maximum understanding on inside, outside and competitive factors of credit card.

The need of analyzing customer data and measuring customer satisfaction level of credit cardholders has been originated from my internship experience where it is found that credit cardholders are facing problem and their satisfaction level is not uniform in nature, holds confusing dispersion in each others opinion. To fulfill my internship objectives and finding a solution to this problem, it became an intuitive decision to know about the customers, their emphasized stimulus of satisfaction and finally their overall satisfaction level upon which some specific conclusion could be made along with complete understanding of the whole scenario.

The research data for analysis and measurement has been collected by a standard survey questionnaire for this type of marketing research; which includes both specific and general statement of customer satisfaction on a product. Credit cardholders scored their opinion on positively formed statements and their score has been calculated on per statement and total basis.

After analyzing data by applying popular descriptive statistical techniques and tools, it is found that the customers sample size is representing the population in terms of satisfaction. The twin patterned analysis on both specific and general data indicates a neutral or medium position in the Likert scale of measurement, describing that the customers or credit cardholders on an average have neutral opinion on each statement and on entire questionnaire survey. As the result from survey is the main finding of research, so it can be said that the result is representing quantitatively and qualitatively, the customer satisfaction level of credit cardholders of Southeast Bank Ltd. The satisfaction level of credit cardholders on an average lies within dissatisfaction and satisfaction, referring to the result. It is not advisable to be delighted with medium or break-even position rather they should strive for the highest extreme. So, it is necessary for the bank to devise effective plan, to take the customer satisfaction level of credit cardholders to a new height for the betterment of their business.

Credit Card in Detail

A credit card is a small plastic card issued to users as a system of payment or withdrawing cash to fulfill short-term financial need. It allows its holder to buy goods and services based on the holder’s promise to pay for these goods and services in due time. The issuer of the card creates a revolving credit account and grants a line of credit to the consumer based on monthly income from which the customer can borrow money for payment to a merchant or as a cash advance to the customer. In some cases, it is defined as „Plastic Money‟ which is very popular mostly in developed nation, though the developing nations are also using this plastic money facility through different financial institution as it‟s offers risk-free mobility of huge sum of money at home and aboard with minimal regulations to use. A customer gets increased purchasing power by using credit card which increases the flow of funds to different sectors and makes the monetary system stable, smooth and highly operational because the greater the money changes hand, the better it helps to stabilize the economic indicators of individual, corporation and country. The person who enjoys credit limit through card has to abide by the rules and regulation, given by issuing authority to sustain good personal financial reputation.

A credit card is different from a charge card; a charge card requires the balance to be paid in full each month. In contrast, credit cards allow the consumers a continuing balance of debt, subject to interest being charged. A credit card also differs from a cash card, which can be used like currency by the owner of the card. Most credit cards are issued by banks or credit unions, and are the shape and size specified by the ISO/IEC 7810 standard as ID-1. This is defined as 85.60 × 53.98 mm in size.

Financial institutions introduce this card to increase their market competitiveness and flourish its income and asset. It‟s a short-term loan intends to fulfill working capital requirement.

They customize this card to several schemes or redesign it‟s concept by segregating it‟s usage on level of customers need at home or aboard liked silver, gold or platinum card which varies in limit, due time and charges. Moreover, they also introduce many complementary and supplementary features to remain attractive and unique in highly competitive marketplace. Credit cards are generally operated by central monetary system, but some companies are there to coordinate the overall process between central authority, banks and customers; the mostly used brands of credit cards are VISA, MasterCard and American Express. They connect consumers, merchants and financial institutions around the world with products and services that make payments more convenient and more secure.

History of Credit Card

The concept of using a card for purchases was described in 1887 by Edward Bellamy in his Utopian novel „Looking Backward‟. Bellamy used the term „Credit Card‟ eleven times in this novel. The modern credit card was the successor of a variety of merchant credit schemes. It was first used in the 1920s, in the United States, specifically to sell fuel to a growing number of automobile owners. In 1938 several companies started to accept each other’s cards. Western Union had begun issuing charge cards to its frequent customers in 1921. Some charge cards were printed on paper card stock, but were easily counterfeited.

The use of credit card originated in USA during the 1920s, when individual firms like oil companies and restaurants began issuing them to customers for payment convenience. Around 1938, companies started to accept each others card. Credit cards were not always plastic. There have been credit tokens made of metal coins, metal plates, celluloid, metal, fiber, paper and now mostly plastic cards. The inventor of first bank issued credit card was John Biggins of Flatbush National Bank of Brooklyn in NYC. In 1946, Biggins started the „Charge-it‟ Program between bank customers and local merchants. In 1950, Diners Club issued the credit card in USA. American Express Bank issued the in 1958. Bank of America introduced its‟ first credit card „Bank Americard‟ which is now VISA later in 1958. In 1966 the aforementioned group of California banks formed the Interbank Card Association (ICA) to create „Master Charge‟ was renamed simply Mastercard later on.

Although credit cards reached very high adoption levels in the US, Canada and the UK in the mid twentieth century, many cultures were more cash-oriented, or developed alternative forms of cash-less payments such as Carte bleue or the Eurocard in Germany, France, Switzerland and others. In these places, adoption of credit cards was initially much slower. It took until the 1990s to reach anything like the percentage market-penetration levels achieved in the US, Canada, or UK. In some countries, acceptance still remains poor as the use of a credit card system depends on the banking system being perceived as reliable. Japan remains a very cash oriented society, with credit card adoption being limited to only the largest of merchants, although an alternative system based on RFIDs inside cell phones has seen some acceptance. Because of strict regulations regarding banking system overdrafts, some countries, France in particular, were much faster to develop and adopt chip-based credit cards which are now seen as major anti-fraud credit devices. Debit cards and online banking are used more widely than credit cards in some countries.

The design of the credit card itself has become a major selling point in recent years. The value of the card to the issuer is often related to the customer’s usage of the card, or to the customer’s financial worth. This has led to the rise of Co-Brand and Affinity cards, where the cards design is related to the „affinity‟ (a university or professional society, for example) leading to higher card usage. In most cases a percentage of the value of the card is returned to the affinity group.

Nowadays, the credit card means many to many people. In years it has adopted much safety, unique and easy features to deal with customers‟ financial problem in most sophisticated and cordial way. Many banks have also made it centralized advance product or service. People are using it to maintain status symbol or to have financial mobility.

The recent recession in developed country or breakdown of economic system or bankruptcy case to many old and heavyweight banking and non-banking financial institution can be largely attributed to credit defaulters, which made the investment as bad n‟ loss to company affairs rather than short-term liquid assets and regular income generating item. Some unsafe practice of credit risk management division of those firms is also responsible for their bankruptcy. However, many other macro and micro economic factors are also related with the recession which is not suitable to discuss in this purpose.

Credit Card of Southeast Bank Limited

Introducing a credit card which is supported by VISA was a remarkable competitive move against the competitors in 2005 which was actually introduced late but was prudent to do. As SEBL likes to see itself a high profit generating, market oriented, corporate focused bank, it was a demand of time to get some market share of credit card in local market. They way SEBL operates in the market, it was very important to introduce this service as it tries to stay focused on corporate and individual client. Apparently, major portion of SEBLs‟ income, asset, revenue, profit comes from corporate banking or clients but they arte driven by meticulous business insight which allowed them act competitively in the marketplace. They are in an agreement with VISA brand in a 50-50 profit and operation partnership as VISA has 60% market share of overall credit card market. Moreover, it is also cost-efficient decision to work with VISA than MasterCard as it costs a bit more than VISA and in a developing country like Bangladesh, people are very careful about cost and charges and may not take MasterCard though the difference of charge and features is insignificant. It is the customer demand or thought that drives the market. Not having MasterCard could be a strong drawback because SEBLs competitors are taking this chance by adopting open market policy and their spending on promotion and business development which is seemingly higher than SEBL. So they are offering VISA and MasterCard. A SEBL VISA credit card is generally issued for 2 years, charges market interest rate and provides generally 1.5 times multiplied credit limit on monthly income. Most of the customers are job holder as their short-term financial need is greater than the business man or any professionals and so 60% of the cardholders are living on salaried income.

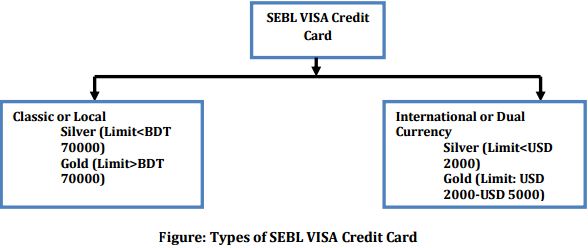

Types of SEBL Credit Cards: – The credit card service of SEBL can be classified into two major categories and each category has two differentiating segment that are not same in features and facilities. Two major categories both are supported by VISA but the outlook, function, features are not same. Also some status symbol is also associated with both categories. The main two categories are Local Card and International or Dual Currency Card.

- Local Card refers to a card that can only be operated within the periphery of card issuing country or in which country the financial institution belongs. The local cardholder can only purchase or avail any product or services that lies within the Measuring Customer Satisfaction Level of Credit Cardholders of Southeast Bank Ltd. Page 33 country and has VISA supported POS machine. Customer can only withdraw money from and pay the bill in the country. Majority of the client are local cardholders. Local card is termed as Classic Card also. The two segment of Local or Classic card is Silver and Gold card. Each segment of card has major difference in credit limit, fees and charges etc. If anyone wants to enjoy a credit limit less than BDT 70000 per month then silver card is appropriate for him or vice versa for enjoying gold card. The most enjoyable matters in these two card is the limit and status maybe as many people may found it equal to high stature saying that he or she have gold card in his wallet.

- International or Dual Currency Card refers to a credit card that can be used across the country border anytime based on the financial necessity in aboard like shopping, hospital bill, tuition fees payment, internet purchase or settlement of any charge or expenditure along with all other facility which is available for local cardholders. Any ATM booth that supports VISA card can be a place to withdraw at most 50% of the credit limit in cash and has up to 50 days interest free payment facility. Here, they also have silver and gold cards, all the calculations here are prepared in USD amount which is highly acceptable, liquid and easy to exchange. The exchange rate that is used to calculate bills and charges are based on floating market exchange rate of USD. The differentiating factors for international cards‟ segment are also similar to some extent. A person who wishes to have a credit limit of USD 2000 can apply for Dual Currency Silver Card and who wants limit of more than USD 2000 up to USD 5000 can have gold card to fulfill the need.

Features and Benefits:- The features or benefit that SEBL credit card provides have many competitive advantage in the market but it also has some lacking in the same marketplace which may not be very significant to individuals but it could be so when it is evaluated generally.

Dual Currency card: – SEBL Visa Dual Credit Card has unique feature of allowing limits both for local and international usage in a single card. However, one may opt for separate cards if he or she finds the same thing convenient for him or her. SEBL Visa Dual Credit Card is accepted at any merchant locations, payment counters or payment system, displaying VISA logo in any part of the world. It is joined with widely accepted ATM and payment network and has competitive interest and fees.

50 Days Interest free Credit Facility: – SEBL Visa Credit Card allows free credit facility on purchase up to minimum 20 days and maximum 50 days without any interest if there is no outstanding amount on the card account in the previous month’s bill. Actually, the 50 days includes normal 30 days usage period and extra 20 days for payment.

50% Cash Drawing Facility at ATMs and any Southeast Bank Branch: – SEBL Credit Cardholder can draw cash up to 50% of the credit limit against his or her card. Cash may be drawn from all ATMs or payment counters having VISA logo. Cash withdrawal facility is also available from any of SEBL branches across the country.

Cardholders can withdraw money from any branch by filling a cash withdrawal form. No interest free grace period is available for any cash advance. Whenever cash is withdrawn, interest will be charged.

Card Cheque Facility: – Card cheque is a cheque that is issued by card division in the name of customer. It‟s a transferable account payee cheque which can be placed against local credit limit and transaction will be deemed as purchase with no interest applied on it. When a cardholder needs cash, then he can write-up a card cheque to his savings account number which is considered as high-value clearing cheque and can be cleared and deposited to savings account in 24 hrs through card division. The limit of withdrawal by card cheque is 99%. After clearing being done, the amount will be transferred to savings account.

International Roaming Bill Payment: – Credit cardholders can pay international roaming bill of his or her mobile phone when staying aboard or have roaming services bill to be paid. Auto debit instruction can be given so that bank can deduct charges and fees without disturbing the customer. Apart form international roaming service bills, GP postpaid subscribers can also pay their bill through auto or direct debit.

Free Supplementary Card: – It is an extra card that is issued by the card division in response to the request of the cardholder to fulfill the short-term financial need of the family members or the nearest ones and the credit account will be jointly operated.

This card is given to trusted persons nominated by cardholder and generally cardholders prefer first bloods or wife. The supplementary cardholder can enjoy the half of the limit of main cardholder and it creates another 50% line of credit in the name of mother cardholder. The main differences between two cards are supplementary cards can only be used for purchasing goods from VISA supported shops, it has no extra or annual fee and this card will be authorized and maintained by the principle cardholder.

SMS Push-Pull Service: – SEBL credit cardholders can get general information of their cards by sending and receiving short text messages from cell phone. The text message can be sent from any mobile operators‟ network across the country. They can get mobile instant upgrade of bills and recent purchases, also debit instructions and credit details can be collected by push-pull service in BDT 115 yearly after adding VAT.

24-7 Customer Service: – SEBL has active 24hrs customer service officers to answer the queries of client anytime. Client can call or contact with the customer officer for placing complains or requesting answers to queries.

Fees and Charges of SEBL VISA Credit Card:- The charges or fees; major or minor; whichever associated with credit card is very competitive market rate so that customer gets best possible banking products and services at fair rate. In 2012, the fees and charges have been changed to downward than 2011, which is very competitive and in some extent much lower than competitors‟ fees and charges like DBBL or Prime Bank who has very high annual and others fees (some are hidden) than SEBL. SEBLs‟ card could be considered as the lowest charged card in the whole market. They have no or less hidden fees than any other card; however the hidden fee concept differs from person to person. The fees and charges are subject to change in time to time with a short notice and card division has full discretion to alter or modify fees, charges and statement related issues. Cash withdraw from booth; branch and card cheque will charge processing fee of 1% or BDT 200 whichever is higher. Every portion of banks income or charges to client excludes 15% VAT on charges.

Charge of Interest to Credit Card: – Rate of interest that is charged on credit card is based on market interest rate that is set by central bank. The interest is totally a monthly income to card division. Not a single penny from credit card goes to branches affairs; rather they work as intermediary between card division and customer. Interest rate is generally 2.5% per month which will charged on daily basis to any cardholder passed the due payment date and have unpaid due from transaction date to payment date.

In case of cash advance withdrawal, the interest of 2.5% per month will be charged and calculated on daily basis from the date of transaction until cash advance is paid in full. Credit card maybe considered as a burden to many who can‟t maintain his personal fund properly because only one day‟s due after last payment date could incur daily basis interest expense on total outstanding amount to be paid in full from transaction date. Besides, there are late payment fee, VAT and compounding interest expenses if not paid in time. Interest could turn into a giant nightmare if not being paid swiftly; also a customer could lose credit reputation in long run.

Mode of Withdrawal: – Credit cars can be used generally in three ways to meet ant short-term financial need or instant purchase. Most of the customers are job holder as their short-term financial need is greater than the business man or any professionals and so 60% of the cardholders are living on salaried income and 25% are businessman, lastly the rest of the group that is 15% are generally independent professional like lawyers, chartered accountants, doctors, engineers, architects, creative designers. Students and others like freelancers can not avail a credit line by showing high amount of turnover or savings.

Sometimes bank authority uses their due diligence to issue a card to known or financially reputed client though he or she might not lie under eligibility criteria.

Most of the people use cards to buy products and services from VISA supported shop or vendors who have VISA Point of Sales (POS) machine available there. Nowadays, many vendors got POS machines to attract customers and increase sales. Most of the retailers doesn‟t deduct additional amount for transaction from client but some electronics or accessories shop may deduct 1-2% of the purchase price for transaction but the frequency of them in the marketplace is very few. We can found the POS machine of DBBL, National Bank, BRAC Bank, Standard Chartered most in volume in the marketplace.

Credit Cardholders can withdraw cash from any ATM booths within or outside the country. A percentage of interest will be charged when withdrawing cash which is currently 2.5% per month, will be charged from the day of withdrawal to statement generation date. If someone withdraws cash from other banks booth, then that intermediating bank will charge 1% or BDT 200 whichever is higher per withdrawal. Suppose, the other said bank is DBBL and you are withdrawing cash from the booth, additional amount that is charged as processing fee will be debited from SEBLs‟ card divisions account from VISA server.

If a cardholder needs to withdraw cash but he can‟t locate an ATM booth but he finds a SEBL branch in the close vicinity, then he can also withdraw by filling up a cash advance form that is same in nature and available at any branch of SEBL within the country. The branch will also charge processing fee that is 1% or BDT 200 whichever is higher and most importantly 15% VAT will be given based on the processing fee. Processing fees always includes the VAT calculation.

Cardholder can also withdraw money through card cheque but the money will be transferred to savings account from where the cash can be withdrawn by placing normal cheque to the counter. In this case, only processing fees will be charged but no interest rate.

Mode of Payment: – Payment systems of bills are common in banks offering credit cards. Clients can payment either in cheque or in cash at any of the SEBL branches.

For cash payment, a card payment slip is available at every branch of the bank. Bills should be paid in before due date, otherwise client could incur late payment charges and interest on daily basis. A client generally gets 50 days for interest free payment (which includes 30 days monthly period and 20 days extra payment period) if purchase just after the statement generation date. For SEBL the statement generates at 14th day of a month and it varies from bank to bank. If anyone becomes unable to pay in due time but has paid 5% of the total bills amount in due time then the late fee will be exempted.

For cheque payment, all other things are same as cash payment but the cheque has to be placed before one week of due date. A cardholder can pay any bills or due amount to third party by writing card cheque.

Any payment made by the cardholder will be treated as over limit amount, overdue amount, cash advance, service charges and purchase. The outstanding bill amount can also be paid by auto loan listing which means an instruction given by the principle cardholder to deduct the payable amount automatically before due date from his or her savings account. For dual currency card, the payment of charges and amount would be paid by bank draft in mostly acceptable currencies or by converting at existing rate while generating statements. Card division has full discretion to change the payment system, fees and charges, facilities, limit and so on.

Process Design

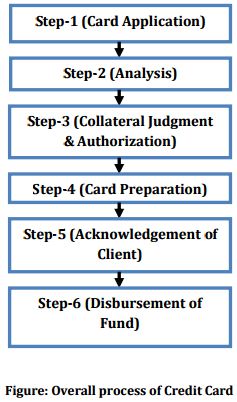

Credit card is being considered as risky product of a bank and there are many formalities and procedures that are needed to be followed by the authority and client. The overall process from application to disbursement of fund; from retail branch level operation to treasury level operation contains wide and multilateral function. It requires the support of different division in varied level like retail, credit, credit risk, card and treasury at the end. Measuring its riskiness and sensibility, process warrants a swift and efficient decision to be made so that authority and client both remain satisfied. The whole process takes 8-10 days to be completed.

The overall process of multilateral credit card operation is described below step by step as drawn above for better understanding.

Step- 1 (Card Application):- The first step of credit cards‟ operation process starts with relationship and banking practices between branch and applicant. It relates the applicant or potential client with retail credit or branch banking division of Southeast Bank Ltd. An applicant has to fill up the application form and submit necessary document to the respective officer as per the requirement. Nowadays, credit card has become a centralized product of the bank and it‟s only an entitled product of card division. So, card division has appointed many sales executive only for cards. The applicant has to abide by the terms and conditions strongly. If anyone doesn‟t read the terms and conditions carefully, then some acts may mislead the client and build negative ideology regarding card and bank like the so called hidden charges. A VISA Credit Card application form requires following information-

- Personal Info: – Name, Educational Qualification, Sex, DOB, Marital Status, Parents‟ Name, Nationality, Religion, Passport Details, TIN, Addresses, Living Info, Contact Numbers etc.

- Professional Info:- Job status, Name of Company, Nature of Business, Designation, Year of Joining or Establishment, Address, Tenure of Attachment

- Bank Reference

- Spouse Particulars

- Income Details:- Salary/Business Income (Basic, Allowance, Gross); Additional Income (all with supporting documents)

- Auto Payment Instructions

- Other Card Details

- Reference (Relative and Non-Relative)

- Supplementary Card Details:- Name, Relation, Authorization

- Photograph and Signature on Declaration

- SMS Instruction for minimum or maximum alerting amount

This concludes the forms but not the application because some documents are needed as supporting to the forms information which varies in terms of occupation.

After receiving the documents given by particular applicant, branch checks documents.

Finally completes the application procedure as instructed.

Applying for credit card or loan, relationship with the bank is very important. If an applicant has long-term good relation or reputation with banks, then it becomes easy to take any decision regarding an applicant. On the basis of the reputation or relation, the minimum collateral can be excused. Generally, SEBL seeks FDR which will be valued as more as 120% than the credit line or limit. If a person has an income of BDT 50000, then he could get credit limit of BDT 100000 at max by making the FDR as Lien Safety Instrument. For an unknown client, branch can also ask for a blank cheque that doesn‟t have any lien instrument. Bankers Committee is also deciding to introduce a new requirement for credit card application which is Credit Information Bureau (CIB) Report of Bangladesh Bank, linked with the database server of Bureau of Statistics; which encloses record of previous and present loan condition of an applicant. This ends the desk level operation of credit card at branch or retail banking.

Step-2 (Analysis):- At this step, the branch sends the application to the Credit Committee of Card Division at Head Office who analyzes the proposal of all short-term loans. They thoroughly look at the branch officials‟ recommendation report about an applicant and analyses the attached or enclosed documents and information. Credit Committee is headed by the Second Manager of Card Division who prepares a review report with the help of one or two senior officers. This review report generally, explains the validity, legitimacy and strength of the documents and information. If a branch has recommended the application highly, it requires little analysis. They also take the company in which applicant is working or runs. If anyone working at any mere organization and earning BDT 100000 per month, there is possibility that his application might not get approval or the credit limit requested by him, whereas an employee of Unilever, earning BDT 40000 per month could easily get the requested limit or approval. They decides a tentative credit limit and charges for the applicant and forward the scrutinized review report to the Head of the Division who approves or rejects the application. Branch recommendation and credit reputation is a big factor while analyzing a proposal. Card Division has full discretion to change any decision regarding card related affairs.

Step-3 (Collateral Judgment):- Card Division at this step, analyze and process the safety instrument (if available) like FDR Lien, Blank Cheque etc. this is sometimes based on due diligence policy of bank, evaluating the financial strength and credit reputation of applicant in the marketplace. They place locking instruction over „Bank Ultimus‟ software to restrict the safety instrument from being enchased without clearance from Card Division.

Step-4 (Card Preparation):- Now Card Division generates PIN and card number for the approved application and compiles necessary card information before ordering cards. Bank sends requisition to VISA agent for preparing a card for bearing card number. The name, photo, signature of cardholder, date of issue and expire and some terms are printed on the card and the 12 digit number is embossed.

Step-5 (Acknowledgement of Client):- After the card is being prepared, the plastic card and clients statement including the name, address, card number is sent to the cardholders mailing address by post. This entails some instruction for the cardholder to respond in a designated way to card division upon receiving the card. After receiving confirmation from client about the receipt of card, the card division sends the last mail which includes the PIN number, terms-conditions of usage etc. PIN number is the most confidential items in the statement which should be maintained with utter secrecy. After having the PIN, the cardholder can instantly use the card. The cardholder can acknowledge the receipt of mail by phone call or email swiftly.

Step-6 (Disbursement of Fund):- Just after sending the first mail and fist acknowledge, the card division connects with the Treasury Division and instructs to post the credit amount to the cardholders account. The Treasury is the only authority to put money in an account of external client or cash clearing agent. Besides, treasury does many policy and major fund movement related activities after analyzing risk proportion. Generally, they stress for loan to deposit ratio that is 80%, it means, the bank have to maintain practically 100% of deposits to get 80% of the advances, here the spread is 20%.

Operations of Credit Card

The credit card operation is similar as a whole where several channels are engaged. It starts from the punching of card at merchants point, in between it includes other parties like VISA, SEBL, Cardholder and ends with notification of successful payment through client machine at merchants point. The whole cycle of operations contains four parties whose are Merchant, VISA, SEBL and Client; the operational direction moves clockwise and anti-clockwise which is highly controlled by their banking software which is interlinked with client and database server of SEBL and VISA Inc. the whole cycle of operation complete in synchronized IT system at superb speed of computer. The operational procedures are explained for general purchase only below with supporting figures. The others mode of usage are quite similar than the primary steps where instead of merchant, ATM booth or other client machines may be involved with.

Step-1 > At the first step of operation, a credit cardholder who wishes to purchase a merchandise or services from any merchant point who has VISA Point of Sales (POS) machine, will punch his or her plastic card through client machine which is POS. After punching the card, the client machine will ask for an authorization code which is unique in number for each particular POS machine holders. The POS machines are linked with the payment support system of VISA and vendor bank. The merchant will put the code and payment amount in local currency.

Step-2 > At the second step, the client machine after having authorization code and payment amount will directly connect with the VISA Server of Asia region which is located in Singapore to complete the payment procedure. VISA has a particular vendor account for every financial institution it transacts with globally. VISA will get connected with the corresponding bank of credit cardholder that is SEBL and will place a debit instruction against the account of SEBL.

Step-3 > Now, SEBL will receive the debit instruction of VISA and will find out the cardholders details to debit the credit card account. After having confirmation that the credit is valid and contain enough money to pay off. He debits the clients credit card account in response to the debit instruction of VISA. Bank doesn‟t pay from his own account rather he deducts or charges clients account as he has already transferred money to clients limit.

Step-4 > After debiting the clients account with all charges like processing fee and any other needed. Bank will credit his own account with the money of client so that VISA receives the money from SEBL on behalf of credit cardholder to pay off the payable amount.

Step- 5 > After having the SEBL account credited in VISA server with necessary amount, VISA reconciles his and SEBLs account and prepares the payment status for both parties.

Step-6 > At the end point, merchant receives the confirmation of successful payment from VISA that means VISA has got the payment from SEBL for his credit cardholder. Merchant prints the payment slip from POS Machine and takes the money and signature of customer. This finishes the operations procedure.

The whole operation takes 30-40 seconds to complete and it‟s almost same for other modes of usage where merchants position can be replaced by branch or booth while transferring money or withdrawing cash. The processing fee depends on the amount, type and volume of purchased product and services which virtually variable in banks.

Business and Strategy related aspects

Southeast Bank Ltd. started its Credit Card operation in 2005 and completed six years of operation since its inception. At this point of time it‟s necessary to look back and review the every aspects of business strategy of the Credit Card operation of the bank. It will cover the initial, existing and future business strategy of Card Division, its role, achievement, position in the industry, present opportunities and options and lastly direction for future market coverage. The reason for formulating strategy is to deliver modern payment services to customer and good image of the bank. Some factors may be worthy to mention before getting into deep.

Business Type: – Business of credit card is generally of two types namely issuing and acquiring. An issuer issues card, approves transaction request, pays the acquirer for transaction and bills the cardholder accordingly. On the other hand, an acquirer provides the merchant with card authorization terminal, obtains transaction approval from issuer, pays the merchant for service provided and bills the issuer accordingly. SEBL is the issuer and VISA is the acquirer. Interest on credit card is the main income for an issuer while it is commission on transaction for the acquirer, both party share 50-50 profit and income. A business house has the option to choose any or both of the types. There are three popular brands of credit card; those are VISA, MasterCard, and American Express.

Processing System: – Operation of credit card can be managed in two different systems-

- In Own Processing system, bank remains the owner of the card management system and connectivity with VISA remains under the banks possession. Bank needs to make all compliances of VISA where product diversity and advantage can be facilitated from in house though it involves high cost for bank.

- In Third party processing system, bank is a shareholder of card management system and connectivity with VISA is shared. VISA compliances remain with the third party and bank is independent for complete support and solution and involves lower cost than own processing. Apparently SEBL follow this system now.

Target Market: – The target market has been the mid income level salaried persons of financial institutions‟ and established corporate business houses from the inception. The specific segment of customer has been chosen in consideration of their regular income, disciplined lifestyle, acceptable education level and habit of revolving credit with good repayment; which inevitably would result in best fund utilization, profitability per card and ensuring steady and sustainable growth with less vulnerability to non-performing loan. Apart from these, their attention has been also focused on the self employed professionals and business men who are good depositors, exporters and borrowers of the bank over whom they have sufficient control.

But recent economic downturn and liquidity shortage has stressed on secured allocation of card with secured target segment. Now they are also targeting the mid-high salaried professionals and earning businessmen but they became choosy for the companies they are working and running. They are evaluating the positional strength of the applicant in the company or in the business organization. Moreover, they became selective for company selection amongst many in the industry in terms of evaluating factors like industry position, profitability, acceptability, public concern, turnover rate and market coverage etc. In recent days, salaried employees of an organization are preferable than businessmen and selfemployed. Salaried people‟s interest for credit card is much more then the business men as people with fixed income are suffering for inflation and downturn, they need more money other than monthly income to fulfill their different short-term financial need of living which is nearly 60% of the market. Sat Masjid Road Branch from its inception has recorded a total number of 84 credit card clients under its processing, amongst them majority are service holder.

Role of Card Division: – Card Division is the main working body of the bank who deals with all types of card related affairs. Card division has continuously been attributing the most competitive features in the product. Card division has its independent sales and monitoring team for fulfilling target, avoids fraudulent practices around cards and meeting the challenges of market.

- Orders cards and prepares them for particular client

- Takes record of inward and outward cards

- Issues and cancels card

- Decides the credit limit

- Analyses the documents and safety instruments given by client

- Evaluates the branch recommendation and clients status

- Takes action for recovery and adjusts the collateral account.

- Designs, directs and oversees the tripartite agreement

- Maintains relationship with clients

- Measures risk of client and bank

- Coordinates the fund allocation and disbursement with other functional division on necessity and with merchants

- Maintains business and accounts with VISA and other card suppliers

- Prepares the sales and marketing strategy of cards

- Follows circulars and execute in a way that ensures highest profitability and market share

- Designs the competitive features for products

Performance of Card Division: – The overall performance of card division is satisfactory but not as impressive as it passed through with some shortage and drawback internally and externally. From 2005 to October, 2009 card division had not been separated from head office books of affairs but after that card division is an independent functional division with centralized account of products. The performance of this division can be measured by looking at the quantitative figure of some variables like Number of cards, Operating Income-Expenditure, Net Operating Profit, Outstanding amount, Classification rate. Some schematics show more or less positive movement and good position; outstanding amount and classification amount increases as the volume and fund involvement increases based on the data of last five years from 2007 to 2011. Income and expenses includes before tax interest and operating expenses.

Existing Sales Strategy: – The existing business or sales strategy is needed to be revised to some extent to capture more market share but when it was formulated; it was enough to become competitive. Some of these steps are really very appreciable.

- Booking salaried persons of different financial institutions as SEBL cardholders on priority basis

- Bringing in top depositors and borrowers of branches to permanent customer pool

- Offering limit strictly as per credit worthiness of client to evade systematic risk

- Keeping fees and charges lower, competitive and disclosed

- Launching business development initiative on regular basis targeting others customer base

- Attributing attractive features

- Ensuring good post sales service to retain existing customers

- Sales person under direct control of Card Division

- In-house contract point verification of the applicant

- Keeping Non-Performing Loan (NPL) at lower side which means a loan that is in default or close to being in default

Following the strategy they tried to forecast their business growth in next five year which has shown that their volume of credit card or number of active cardholders will increase but at decreasing rate which doesn‟t suits with the market competition. The rate increases but requires some superb features or tactics need to be added so that percentage of change takes higher leap. The figure reflects some drawback in the strategy that causes a decreasing rate in growth which if not altered could turn the product to failure with huge multilateral loss. The Net Operating Income shows an increase in year by year but the percentage change in Net operating profit and volume both shows an increase of amount or numbers increasing but at a decreasing rate. These could imply two thing, one is the card is going to maturity or the card is not growth up to the mark to face the market competition. I think that Credit Card of SEBL lies at the first step of growth with decreasing speed and need extensive marketing strategy to cope with the competitors.

Aggressive Sales Strategy: – Alternatively SEBL can introduce new more aggressive sales and business strategy as sales strategy contributes much to the profit margin of this risk, sensitive and emerging product of a bank. The following strategy has developed by me with the help of branch official and I think it contains most of the hard points.

- Allowing customer segments equally both for salaried and self-employed persons.

- Allowing higher credit limit

- Allowing balance transfer

- Reduction of fees and charges

- Establishing credit card sales point at each branch

- Establishing separate customer care center

- Establishing own processing house

- Engaging third party sales agent

- Setting higher vulnerability to fraud and bad debt

- Executing massive interactive promotional activities and advertisements

- Increasing the marketing, operational and administrative budget

Operational Strategy: – SEBL started with third party processing system in consideration of its lower cost involvement, letting the business grow and plan for other options thereafter. Third party processing system is somehow able to manage their present card base. But after reaching a substantial card base, it is necessary to adopt own processing system to ensure proper control and cost effectiveness according to them.

After attaining the customer base of 30000 it will not be feasible both from operational and financial point of view to run with third party. Therefore it is necessary to set up own processing in next couple of years for better and prompt service to the customer and hold proper control over the whole show. At first, they will go to own processing system and later they will change the card type of magnetic stripe to EMV (Integrated all-in-one circuit) chip and PIN based card type.

It‟s difficult for them to acquire business and set up POS terminal to merchants point because the merchants are pre-occupied by other banks. Moreover, the implementation cost is very high and commission from card vendor like VISA, MasterCard has come to a nominal percentage which makes the business not feasible for new comers with POS terminals.

Competitive Analysis

In recent competitive marketplace of banking industry, one of the most profitable and booming industry in which nearly 60 market players or banking financial institutions working against each other to become competitive, profitable, attractive and reputed in the eyes and minds of stakeholder who has 360 degree attachment with them. People invest in bank, keep deposits, withdraw money, borrow money and enjoy many other unique or similar banking services. Credit card as a short-term loan has became very lucrative product in our country specifically after 2005 when digital revolution has been swallowed by people of varied demographics at a faster pace. Apart from digitization of life, the pressure of inflation in every necessary and luxury product and service has also changed the way of financial budgeting and fund utilization. Only 10-15 banks have been introduced Credit Card in their portfolio to sail into the flow of modern payment system and to stay unique and competitive in front of the target market.

Southeast Bank Limited is facing a tough competition in Credit Card business where foreign and local bank, totaling 12 banks are competing hard side by side to capture majority market share of credit card. Market share and profitability is the prime components of measuring a company‟s business status among many other indices. At least these two factors will blink into the mind when anyone talks about competitive advantage or positioning of a product, service or company. So SEBL based on the two major factors, seemingly lies under the part of „Market Follower‟ if we can remember the concept of competition level in our marketing textbooks. I am considering it as market follower because a follower can not directly or indirectly compete with the market leader and match him with their market coverage and profitability. SEBL can not go into the market challenger level as their product is neither in growing stage nor in fresh beginning. It lies into the first portion of growth and executing several strategies to get close to the challenger. They are to some dominated by the actions of leader and mostly the challenger. They are targeting both individual and corporate houses to make them their cardholder as the market is saturated almost. They are generally imitating the style and concept of leader and challenger, so they have less market risk and less innovation cost. Though as a heterogeneous product in the market, SEBL has the option to go for „Adaptation‟ strategy which gives them the chance to adapt competitors‟ features and improve them in slightly innovative way. The follower tries to bring the distinctive advantage to its target market so they can be attacked by challenger. They are keeping the cost low and striving for innovation.