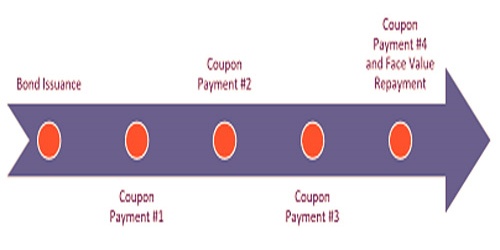

A coupon bond is a debt obligation with coupons attached that reflect semi-annual interest payments, often referred to as a bearer bond or bond coupon. Such detachable paper slips are referred to as coupons and show the interest payments owed to the bondholder. There are no records of the buyer kept by the issuer in the case of coupon bonds; the name of the buyer is also not printed on any form of a certificate. Securities that have higher coupon rates offer speculators more significant returns on their venture. Bondholders get these coupons during the period between the issuance of the bond and the development of the bond.

Such bonds have been issued in the past in the form of bearer certificates. This implies that ample evidence of ownership was in the physical possession of the certificate. Per coupon has its date of maturity written on it. The bondholder may carry it to a bank or broker when a coupon matures, and collect the interest payment. Because most modern bonds are not issued in a certificate or coupon form, coupon bonds are rare. Rather, bonds are framed electronically; however, a few holders actually like to claim paper authentications. The coupons were imprinted on the bond, from which they could be withdrawn and introduced for installment.

Example of Coupon Bond

The coupon bond actually refers, in the form of certificates or coupons, to the rate it projects rather than its physical existence. The bondholder detaches the interest coupons one by one on the interest rates over the life of the bond. For instance, the actual bond certificate will have 60 coupons attached to a 5-year bond that pays interest monthly. The bond coupons are deleted and offered for payment as the five years pass by.

Coupons are normally depicted by the coupon rate. There were both positive and negative viewpoints to this secrecy of purchasers. To start with, the purchaser could stay unknown in the event that they so wanted. Second, the separable coupons made gathering the intrigue installments basic. However, on the downside, these bonds with no purchasing history posed significant fraud opportunities and were enticing targets for robbers. The coupon rate is called the yield that the coupon bond pays on the date of its issuance. There may be adjustments in the value of the coupon rate.

Toward the finish of the bond life, none of the coupons will remain and the bond testament can be gone into the bank or agent to gather the presumptive worth of the bond. Securities with higher coupon rates are more alluring for speculators since they give better returns. Nowadays, because most bonds are produced electronically and do not come with physical certificates, physical copies of bonds are rare. The word “coupon” is still used, however, but it actually refers to the nominal yield of the bond.

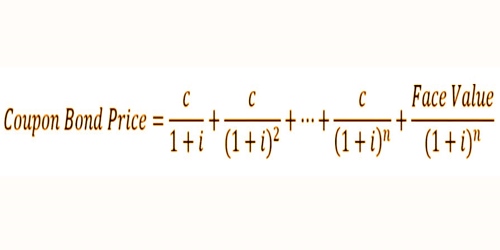

Coupon bonds are marginally unique in relation to conventional bonds in light of the fact that the intrigue paid to bondholders isn’t deductible for annual duty purposes by the backer. Upon the issuance of the security, a coupon rate on the security’s assumed worth is determined. The guarantor of the security consents to make yearly or semi-yearly premium installments equivalent to the coupon rate to financial specialists. Those payments are made before the maturity of the bond. Similar to the pricing of other types of bonds, the present value formula defines the price of a coupon bond. The formula is:

Where:

c = Coupon rate

i = Interest rate

n = number of payments

Coupon bonds are typically bearer bonds; the interest payment may be paid from anyone who supplies the requisite coupons to the issuer, regardless of whether that person is the actual owner of the bond. Physical coupon bonds are less common today, as most bonds are not physically printed and the actual bondholder never even sees the bond certificate. Modern bonds are commonly enlisted bonds with physical testaments that give the particulars of the obligation and the name of the enrolled holder who gets intrigue installments naturally from the responsible organization.

Information Sources: