Strategic asset allocation (SAA) is a long-term portfolio approach that entails selecting asset class allocations and rebalancing them on a regular basis. It’s a fixed allocation that puts its faith in the market rather than individual instincts. The investor sets target designations for different resource classes and rebalances the portfolio occasionally. Rebalancing happens when the resource assignment loads tangibly go amiss from the essential resource allotment loads because of hidden additions/misfortunes in every resource class.

The target allocations are determined by a variety of factors, including the investor’s risk tolerance, time horizon, and investment goals. Strategic asset allocation aims to help you work gradually toward a financial objective while avoiding emotional short-term judgments based on current market occurrences. A SAA procedure is utilized to broaden a portfolio and produce the most noteworthy pace of return at a given degree of hazard. It is like a purchase and-hold methodology in that objective resource loads are picked and kept up throughout a significant stretch of time.

The SAA strategy’s target allocations are determined by various aspects, including the investor’s risk tolerance, time horizon, and return objectives. When the original allocations diverge sufficiently from the initial settings due to differential returns, the portfolio is rebalanced. Elements that influence vital resource allotment loads incorporate danger resilience, time skyline, and bring goals back. Financial backers use resource distribution as a method of differentiating their portfolios. The SAA method follows a contrarian approach to investing.

The target allocations in strategic asset allocation (SAA) are determined by numerous factors, including the investor’s risk tolerance, time horizon, and investment objectives. In addition, if the parameters vary, the allocations may alter. The weights of strategic asset allocation are influenced by a variety of factors.

Risk tolerance: Higher volatility can be tolerated by investors with a high-risk tolerance. As a result, they will most likely give equities a higher asset class weight than bonds and cash. Stocks would likely receive a lower asset class weight from investors with a low risk tolerance, while bonds and cash would receive a higher asset class weight.

Investment horizon: Riskier asset classes would be preferred by investors with a longer investment horizon. The rationale for this is that, because the investor has a longer investment horizon, they are able to “weather the storm” and hold on to their investments during periods of low market activity without having to liquidate to fulfill their retirement or liquidity needs.

A 20-year-old student, for example, would most likely adopt a SAA strategy that primarily consists of equities. A senior who is retiring in two years and needs money to fund his retirement would most likely invest mostly in bonds in a strategic asset allocation.

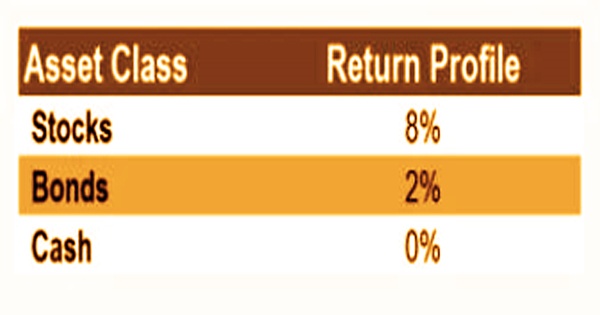

Return objectives: Strategic asset allocation weights are heavily influenced by the investor’s intended returns. Consider the annual return profiles of stocks, bonds, and cash, for example:

If an investor wanted a 6.5 percent yearly projected return on their portfolio, she would have to use the following weightings: 75% equities, 25% bonds, and 0 %cash. As a result, an investor’s intended return has a substantial impact on the strategic asset allocation weight. To obtain the target return, a higher asset allocation to a certain asset class is required.

Key resource allotment is viable with a purchase-and-hold system rather than strategic resource distribution, which is more fit to a functioning exchanging approach. The SAA approach includes staying with financial backers unique designation throughout extensive stretches of time instead of responding to what exactly is right now happening in the business sectors. Modern portfolio theory stresses diversification to decrease risk and increase portfolio returns, therefore strategic and tactical asset allocation strategies are based on it.

When an asset class performs well in comparison to other asset classes, the SAA approach is to sell positions in that asset class and distribute the proceeds to the asset classes that are performing poorly. The SAA is a more passive investment strategy, whereas tactical allocation entails more active portfolio management. Investors’ ideal asset allocation approach is determined by their investing style.

Information Sources: