Introduction

Well- educated, dedicated, skilled and enterprising workforce is the sine-qua-non for the progress and development of a service oriented industry like Bank. From very first emergence and inception of modern civilization, Bank plays a pivotal role in case of overall financial and socioeconomic development of any modern country. The economic development of our country mainly depend upon the efficiency of the banking results is so far as, whether the bankers have been able to read the economic situation properly and are successful in selecting the promising industrial sectors seeking import and export assistance to grow. With the rapid changes of time mans are readily depend on banking services in case of handling cash, transferring cash, and also financing in various industrial and business projects. So it is very much needed to develop the general banking practices in order to provide better day-to-day banking services to the valued customers. Because a service oriented industry a bank should believe that customers is all and the king. The government of our country and the central bank i.e., the Bangladesh Bank has decided to extend considerable help in every respect of general banking to concerned people. Like other nationalized and non-nationalized commercial banks the Jamuna Bank limited serves the nation by providing various modern banking services and products. So as an Internee I thought of having special knowledge on this field of increased importance.

Background of the study

Internship is a prerequisite for completing the practical side to fulfill the BBA program. Theoretical sessions alone cannot make a business student efficient and perfect in handling the real life business situation. Only a lot of knowledge will be little important unless it is applicable in practical life. So we need proper application of our knowledge to get some benefit from our theoretical knowledge to make it more fruitful. When we engage ourselves in such fields to make proper use of our theoretical knowledge in our practical life situation, only then we come to know about the benefit of the theoretical knowledge. Such an application is made possible through internship. The internship program has the following three phases:

1) Orientation of the organization: to introduce the internee with the structure, function and performance of the organization.

2) The project part: pertaining to a particular problem or searching topic matching with the internee’s capacity, interest on the organization.

3) The report writing: to summarize the internee’s analysis finding and achievements in the preceding two phases.

Scope of the study

The field of my study is the operation of Sonargaon Road branch of JAMUNA Bank Ltd. For conducting this study an overall knowledge of the total banking system will necessary because the departments banking are linked with each other due to some partial proceeding. The scope of the organization part covers the organization structure, background, objective, function, departmentalization and business performance of JBL as a whole. The main part covers the operation scenario of a branch of JBL. This refers how the bank helps the customer in general banking and foreign exchange banking. It also covers loan and advances facilities of JBL, credit appraisal system, and activities of credit department.

Objective of the report

The objectives of the report is to make us known the practical situation of commercial banks of Bangladesh in overall activities and prepare me to face the complex situation of banking in this country .The primary objective of this report is to commonly with the requirement of JBL. However the objectives of this study are something broader. Objectives of the study are summarized in the following manner.

General objectives:

The general objective is to prepare and submit a report on “Overall Banking System of JAMUNA Bank Ltd”.

Specific objectives:

- To apply theoretical knowledge in the practical field.

- To present an overview of JAMUNA Bank Ltd

- To develop our skill on the banking sector

- To earn valuable knowledge about the general banking system

- To know the customer service of banking sector.

- To observed the practice of modern technology in banking sector.

- To know about foreign exchange system

- Practical knowledge about transaction.

- To know the money and credit policy of JBL and Bangladesh

- To assess the strength and weakness.

- To identify possible areas of improvement

Methodology of the study

At eh time of my internship period, I tried to use both primary and secondary data that I have gathered from different sources. For preparing this report primarily I got some data from face to face conversation of different employees of JBLSonargoan Road branch and some from different reports and features of the bank. Sometime I have undergone group discussion, asked some questionnaires to the responsible officer of that work and interviewed with some of them. I observed different parties and their transaction from a very close eye .all of this observation and data are included in this report.

Source of data:

These sources are as follows:

Primary source:

Primary data are collected through two ways. These are:

a) Questionnaire: some primary data are collected by taking interview and by discussion with the executives and officer of JBL.

b) Observation: Here primary data are collected through spending three month in the JBL during the working hour. Here I observed the total banking process of JBL.

Secondary source:

Secondary data are collected from the following sources:

a) annual reports of JBL

b) Published documents

c) Official files

d) Data available with the website of JBL.

e) Different publication of Bangladesh bank and Bangladesh economic review 2006.

Limitation of the study

Every matter has got some limitation. So this is also not an exception. The limitations of this internship report are been sated below:

- Due to time and cost restriction, the study is concentrated in selected areas. To continue study in such a vast are requires a big deal of time. As an internee I had only three month which is not enough.

- As a financial organization a bank has some restriction to serve all the real data of the bank to the general people as a result the study is mostly depends on official files and annual reports.

- Available data also could not be verified. In most cases I simply did not have any option but to furnish with data without verification.

- JBL as a commercial bank they are very busy and they could not able to give me enough time for discussion about various topics

Background of Jamuna Bank Limited

The name bank derives from the Italian word banco “desk/bench”, used during the Renaissance by Florentines bankers, who used to make their transactions above a desk covered by a green tablecloth. However, there are traces of banking activity even in ancient times. (From Wikipedia, the free encyclopedia)

In fact, the word traces its origins back to the Ancient Roman Empire, where moneylenders would set up their stalls in the middle of enclosed courtyards called macella on a long bench called a bancu, from which the words banco and bank are derived. As a moneychanger, the merchant at the bancu did not so much invest money as merely convert the foreign currency into the only legal tender in Rome- that of the Imperial Mint. (From Wikipedia, the free encyclopedia)

The definition of a bank varies from country to country. Under English law; a bank is defined as a person who carries on the business of banking, which is specified as:

- Conducting current accounts for his customers

- Paying cheque drawn on a him, and

- Collecting cheque for his customers.

Jamuna Bank Limited

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 with its Head Office at Printers Building (2nd & 8th Floor), 5, Raja Avenue, Dhaka-1000. The Bank started its operation from 3rd June 2001.

Jamuna Bank Limited is a highly capitalized new generation Bank with an Authorized Capital and Paid-up Capital of Tk.1600.00 million and Tk.390.00 million respectively. The Paid-up Capital has been raised to 429.00 million and the total equity of the bank stands at 725.00 million as on June 30, 2005. Currently the Bank has 35 (Thirty Five) branches 14 in Dhaka, 6 in Chittagong, 2 in Gazipur, 3 in Sylhet, 1 in Bogra, 2 in Naogaon, 1 in Munshigang, 1 in Shirajganj, 1 in Rajshahi and 1 in Narayanganj (including Nine Rural Branches).

The Bank undertakes all types of banking transactions to support the development of trade and commerce of the country. JBL’s services are also available for the entrepreneurs to set up new ventures and BMRE of industrial units.

Jamuna Bank Ltd., the only Bengali named new generation private commercial bank was established by a group of winning local entrepreneurs conceiving an idea of creating a model banking institution with different outlook to offer the valued customers, a comprehensive range of financial services and innovative products for sustainable mutual growth and prosperity. The sponsors are reputed personalities in the filed of trade, commerce and industries.

The Bank is being managed and operated by a group of highly educated and professional team with diversified experience in finance and banking. The Management of the bank constantly focuses on understanding and anticipating customer’s needs. The scenario of banking business is changing day by day, so the bank’s responsibility is to device strategy and new products to cope with the changing environment. Jamuna Bank Ltd. has already achieved tremendous progress within only two years. The bank has already ranked as one of the quality service providers & is known for its reputation. Jamuna Bank offers different types of Corporate and Personal Banking Services involving all segments of the society within the purview of rules and regulations laid down by the Central Bank and other regulatory authorities.

Board of Directors

The Board of Director of JBL consists of 14 members. The boards conducted with chairman, Directors, Sponsors and Company secretary division individuals.

Vision

Jamuna Bank wants to become a leading banking institution and to play a pivotal role in the development of the country.

Mission Statement

The Bank is committed to satisfying diverse needs of its customers through an array of products at a competitive price by using appropriate technology and providing timely service so that a sustainable growth, reasonable return and contribution to the development of the country can be ensured with a motivated and professional work-force.

The Management

The management of the JBL designed with several designations such as managing Director, AMD, Senior Executive VP, SVP, and SAVP.

Branch Network

Jamuna Bank performing its Banking Service all over the Country with 35 Branches most of them situated in Dhaka and others in Chittagong, Sylhet, Rajshahi, Comilla, and Khulna.

Strategies of JBL

- To raise capital up to Tk. 1000.00 million by March 2006.

- To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund

- To strive for customer satisfaction through quality control and delivery of timely services

- To identify customers’ credit and other banking needs and monitor their perception towards the performance in meeting those requirements

- To review and update policies, procedures and practices to enhance the ability to extend better service to customers.

- To train and develop all employees and provide them adequate resources so that customer needs can be reasonably addressed.

- To promote organizational effectiveness by openly communicating company plans, policies, practices and procedures to employees in a timely fashion

- To cultivate a working environment that fosters positive motivation for improved performance

- To diversify portfolio both in the retail and wholesale market

- To increase direct contact with customers in order to cultivate a closer relationship between the bank and its customers.

Objectives of JBL

- To earn and maintain CAMEL Rating ‘Strong’

- To establish relationship banking and improve service quality through development of Strategic Marketing Plans.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To introduce fully automated systems through integration of information technology.

- To ensure an adequate rate of return on investment

- To keep risk position at an acceptable range (including any off balance sheet risk)

- To maintain adequate liquidity to meet maturing obligations and commitments.

- To maintain a healthy growth of business with desired image.

- To maintain adequate control systems and transparency in procedures.

- To develop and retain a quality work-force through an effective human Resources Management System.To ensure optimum utilization of all available resources

- To pursue an effective system of management by ensuring compliance to ethical norms, transparency and accountability at all levels.

Financial Position of JBL

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

General Function of Jamuna Bank Limited

Opening an account

Account opening is the first and preliminary work for a bank. Opening of an account binds the Customer and Banker into a contractual relationship. It is the most important and preliminary work for a bank. Account Opening is very important task for any kind of banking activities. Customer relationship establishes through opening an account. Generally who are receiving bank service the bank may call them as a customer. But bank considers them as customers who have an account with them.

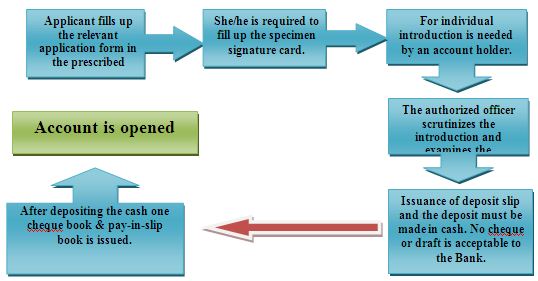

Procedure of Opening of an Account:

Banker’s his to maintain some common principles and procedures for open all most all deposit accounts. Major information is essential for identification of the account holders individually so that banker can discharge his obligations to every one correctly and to the extent due.

Fig: Account Opening Procedure in a flow chart

Types of Account:

There are several types of deposit accounts. Each account has different characteristics and every account has some specific purpose to serve. JBL offers the following key Personal Banking Services. According to their uniqueness they are described as follows:

- A. Savings Account:

It is the general account of the JBL (Sonargaon Road Branch) individual or more than two persons can open a savings account on JBL. The officers and authorize persons are issuing cheque book, deposit slips and statement of account to the holder of savings. The officer justifies the information that is submitted by the account holder for opening of the account. The officers of the bank process account-opening formalities.

- B. Current Deposit Account:

JBL is one of the newly established well-reputed third generation private commercial bank in Bangladesh. It operates very diverse current account operation. They serve various types of customers, like current account for private limited company, current account for public limited company, current account for partnership business, etc.

C. Foreign Currency Account:

The JBL also operate Foreign Currency Account for Bangladeshi Wage Earners or for Foreign Nationals/Company/Firms etc. to send their valued earned foreign currency into the country.

- D. Short Term Deposit Account (STD):

JBL also offers Short Term Deposit to its valued customers. Short Term Deposit is a deposit account where the payment of interest is paid on month basis. These items include the deposits for a period ranging from 7 (seven) days to 89 (eighty-nine) days. These types of liabilities are payable on special notice or after a specified period other than the fixed deposits. Some of these types of deposits are of the nature of time deposits. The rate of interest on STD account is 4.5% per annum. There are some rules and regulations that must be maintained by the STD account holder. If the STD account holder wants to withdraw the money from the account they have to inform the bank before, otherwise the account holder may not get the interest in full amount.

Particulars | Approved Revised Rate |

| Short Term Deposit (STD) | 6.50% |

| Savings Deposit : Rural / Urban | 7.00% |

| Savings Deposit : Non-Chequing & No withdrawal for 6 (six) months | 7.50% |

| Savings Deposit : Non-Chequing & No withdrawal for 1 (one) year | 8.00% |

Fixed Deposit Receipt (FDR):

JBL offers various types of FDR to its client’s. Their maturity may be 1 (One) month, 2 (Two) months, 3 (Three) months, 6 (Six) months and 12 (Twelve) months, etc. In JBL customers can open FDR in individually or jointly for any amount for a fixed period. For opening of FDR no introducing are required. Only one copy of passport size photograph of the account holder and another copy of the nominee is needed. Customers can get the interest after the maturity period of the FDR. H/She can also en-cash the FDR before the maturity of the period. In this case he will not enjoy the regular interest rate on the FDR. The rates of interest are presented in the following table:

Particulars | Approved Revised Rate |

FDR for 1(one) month and above | 10.50% |

FDR for 3 (three) month and above | 12.25% |

FDR for 6(six) month and above | 12.50% |

FDR for 12(twelve) month and above | 12.50% |

Foreign exchange and Remittance

Foreign trade refers to trade between the residents of two different countries. Each country functions as a sovereign state with its set of regulations and currency.

Foreign Exchange means the currency of other country. Firms and organization requires foreign exchange to purchase goods and services from abroad or for purposes of investment or speculation. Bank is the only concern, which has the legal right to handle foreign trade and foreign exchange. Foreign Exchange is a process, which is converted one national currency into another and transferred from one country to the other countries.The difference in the national of the exporter and importer presents certain peculiar problems in the conduct of International trade and settlement of the transaction arising here form, such important problems are:

- Different countries have different monetary units.

- Restrictions imposed by countries on import and export of goods

- Restrictions imposed by nations on payment from and into their countries

- Difference in legal practice in different countries

- Foreign Exchange means foreign currency

Foreign Remittance

Jamuna Bank Ltd. has a network of 19 branches in Bangladesh and 4 more branches are going to be added to network soon.

Remittance services are available at all branches and foreign remittances may be sent to any branch by the remitters favoring their beneficiaries.

Remittances are credited to the account of beneficiaries instantly through Electronic Fund Transfer (EFT) mechanism or within shortest possible time.

Jamuna Bank Ltd. has correspondent banking relationship with all major banks located in almost all the countries/cities. Expatriate Bangladeshis may send their hard earned foreign currencies through those banks or may contact any renowned banks nearby (where they reside/work) to send their money to their dear ones in Bangladesh.

To facilitate sending money in Bangladeshi Taka directly, Jamuna Bank Ltd. has Taka Drawing Arrangement with many banks/exchange companies in different countries. The expatriate Bangladeshis may send their money in BDT through the branches/subsidiaries of Jamuna Bank Ltd.

International Trade Finance

International Trade forms the major business activity undertaken by Jamuna Bank Ltd. The Bank with its worldwide correspondent network and close relationships with key financial institutions provides an extensive trade services network to handle your transactions efficiently. Personnel experienced in International Trade Finance staff the key branches in Dhaka, Chittagong, Sylhet and Naogaon. These offices are the focal point for processing import and Export transactions for both small and large corporate customers. The bank offer a complete range of Trade Finance services. The professionals will work with you to develop solutions tailored to meet your requirements, through mobilizing the full range of trade services locally, and drawing on the global resources. The bank can offer you professional advice on all aspects of International Trade requirements, namely:

- Issuing, advising and confirming of Documentary Credits.

- Pre-shipment and post-shipment finance.

- Negotiation and purchase of Export Bills.

- Discounting of Bills of Exchange.

- Collection of Bills. Assist customers to insure all risks.AndForeign Currency Dealing etc.

List of Foreign Correspondents

To provide International Trade related services the bank have established Correspondent Banking relationship with 336 locations of 106 world reputed Banks in more than 100 countries.

Functions of Foreign Exchange

The Bank acts as a media for the system of foreign exchange policy. For this reason, the employee who is related of the bank to foreign exchange, especially

Foreign business should have the knowledge of these following functions:

- Rate of Exchange

- How the rate of exchange works

- Forward and spot rate

- Methods of quoting exchange rate

- Premium and discount rate

- Risk of rate of exchange

- Causes of fluctuations of rate of exchange

- Exchange control

- Convertibility

- Exchange position

- Intervention on money

- Foreign exchange transaction

- Foreign Exchange trading

- Export and import letter of credit

- Non-commercial letter of trade

- Financing of foreign trade

- Nature and function of foreign exchange market

- Rules and regulation used in foreign trade

- Exchange arithmetic

Letter of Credit (L/C)

A letter of credit is an instrument used by a bank to its customer placing at the letters disposal such agreed sums in foreign currency are stipulated. A letter of credit is a letter from one banker to another authorizing the payment of a specified sum to the person named in the letter on certain specified conditions. Commercially, letters of credit are widely used in the international import and export trade as means of payment. In an export contract, the exporter may require the foreign importer to open a letter of credit at the importer’s local bank for the amount of the goods. This will state that it is to be negotiable at a bank in the exporter’s country in favor of the exporter; often the exporter (who is called the beneficiary of the credit) will give the name of the negotiating bank.

Forms of Letter of Credit

A letter of credit may be of two forms. These are as follows:

- A. Revocable Letter of Credit:

If any letter of credit can be amendment or change of any clause or cancelled by consent of the exporter and importer is known as revocable letter of credit. A revocable letter of credit can be amended or canceled by the issuing bank at time without prior notice to the beneficiary.

- B. Irrevocable Letter of Credit:

If any letter of credit can not be changed or amended without the consent of the importer and exporter is known as irrevocable letter of credit. Irrevocable letter of credit constitutes a firm undertaking a high degree of assurance that he will pay to his goods or services provide he complies with terms of the credit.

Types of Letter of Credit

Letter of credit is classified into various types according to the method of settlement employed. All credits must clearly indicate in major categories:

- Sight payment credit

- Deferred payment credit

- Negotiating credit

- Revolving credit

- Transferable credit

Parties to a Letter of Credit

A letter of credit is issued by a bank at the request of an importer in favor of an exporter from whom he has contracted to purchase some commodity or commodities. The importer the exporter and the issuing bank that is involved in various capacities and at stages to play an important role in the total operation of the credit.

- The Opening Bank

- The Advising Bank

- The buyer and the Beneficiary

- The Paying Bank

- The Negotiating Bank

- The Confirming Bank

Procedures of Opening Letter of Credit

After receiving the performed invoice from the exporter the importer by applying for the issue of a documentary credit, the importer request to his bank to make a promise of payment to the supplier. Obviously, the bank will only agree to this request if it can rely on reimbursement by the applicant. As a rule accepted sole security for the credit particularly are not the shorts of commodity that can not be traded on an organized market. The applicant must therefore have adequate funds in the bank A/C or a credit line sufficient to cover the required amount.

Banks deals in documents and not in goods. The client must have a current account with the bank. The bank has issued the credit obligation to pay on condition which presenting the stipulated documents within the prescribed time limit. The applicant cannot prevent a bank from honoring the documents on the grounds that the beneficiary has not delivered the goods on redder reissues as contracted.

The importer submits the following documents before opening of the L/C:

- Tax Identification Number (TIN)

- Valid Trade License

- Import Registration Certificate

The Bank will supply the following documents before opening of the L/C:

- LCA form

- Application and Agreement Form

- IMP Form

- Necessary charge documents for documentation

The above documents/papers must be duly signed and filled in by the party according to the instruction of the banker.

Documentary Letter of Credit (Export/Import Documentation)

Documentary Letter of Credit is such kinds of commercial letter which a bank issue on behalf of foreign seller (exporter) according to the direction of the purchasers (importers). The documents shown under are known as export document from the importer’s side. These are as follows:

- Bill of Exchange

- Bill f lading

- Airway bill/ railway receipt

- Commercial invoice

- Insurance policy

- Certificate of origin

- Packing list

- Bill of entry

The exporters submit the following documents/papers to the negotiating bank:

- Bill of Exchange/draft

- Bill of lading

- Airway bill/ railway receipt

- Commercial invoice

- Insurance policy

- Certificate of origin

- Packing list

- Weightiest and measurement list

- Others etc.

Loan and Advance

Commercial banks collect money from one group of people as deposits and distribute them within the other group of customers as loans and advances and it is the most important function of commercial bank. By this way the bank earns profit.

Bank cannot lend its fund fully. As per Banking Company Act 1991 every banking company has to maintain a specified minimum (presently 16%) of the total of its demand and time liabilities in form of cash and approved securities with Bangladesh Bank. So, Jamuna Bank Limited has to carefully invest in loan/advances to get maximum performance from the investment.

Credit Facilities

- The main focus of Jamuna Bank Ltd. Credit Line/Program is financing business, trade and industrial activities through an effective delivery system.

- Jamuna Bank Ltd. offers credit to almost all sectors of commercial activities having productive purpose.

- The loan portfolio of the Bank encompasses a wide range of credit programs.

- Credit is also offered to major thrust sectors, as earmarked by the govt., at a reduced interest rate to develop frontier industries.

- Credit facilities are offered to individuals including housewives, businessmen, small and big business houses, traders, manufactures, corporate bodies, etc.

- Loan is provided to the rural people for agricultural production and other off-farm activities.

- Loan pricing system is customer friendly.

- Prime customers enjoy prime rate in lending and other services.

- Quick appreciation, appraisal, decision and disbursement are ensured.

- Credit facilities are extended as per guidelines of Bangladesh Bank (Central Bank of Bangladesh) and operational procedures of the Bank.

Interest Rates of Loans & Advances

SL | Type of Landings | Interest Rate |

1. | Agriculture Loan | 10% (Mid Rate) |

2. | Term Loan to Large & Medium Scale Industry | 14.00% (Mid Rate) |

3. | Term Loan to Small Industry | 13.50% (Mid Rate) |

4. | Working Capital to Industry | 14.00% (Mid Rate) |

5. | Export | 7.00% |

6. | Trade/Commercial Financing | 14.50% (Mid Rate) |

7. | Housing Loan | 14.50% (Mid Rate) |

8. | Consumer Loan | 15.00% (Mid Rate) |

9. | Credit to Non Bank Financial Institution | 13.00% |

10. | Others | 15.00% (Mid Rate) |

Cash Credit:

Cash credit and continuing credit are the form of credit schemes that are short-terms renewable loans with a special credit time. The interest rate is calculated on a daily limit basis. As credit activities, the cash credit facility is given on security like the collateral.

- Check the accounts to find out the money are needed or not.

- Stock (primary or preliminary security)

- Stock as a form of collateral

- Land as a form of collateral

There are two types of cash credit. They are as follows:

- Cash credit (Hypothecation)

- Cash credit (Pledge)

A. Cash credit (Hypothecation):

The short-term advance is given on the basis of hypothecation of good basically these loans are given to improve the financial condition of the business. The letter of hypothecation is created against the goods in favor of the bank and the borrower binds himself to give possession is handed over the charge is converted into pledge. This type of facility is generally given to the reputed borrowers of undoubted integrity.

B. Cash credit (Pledge)

Under this agreement, cash credit is sanctioned against pledge of goods or raw materials. By singing the letter of pledge, the borrower surrenders the physical possession of the goods under the banks effective control as security for bank dues. The ownership of goods remains with the borrower. The pledge creates an implied LIEN in favor of the bank on the underlying merchandise. In the event of the failure but the borrower to honor his/her commitment, the bank can sell the goods for the purpose of recovering the credit. No collateral security is normally asked for grant of such credits.

C. Secured Overdraft (SOD):

A loan facility on a customer with a current account at the bank permitting him/her to overdrawn up to a certain agreed limit for an agreed period. The terms of loans are normally that it is repayable on demand or at the expiration date of the agreement. This credit facility thus allows a customer to overdraw to a certain agreed limit for a certain period.

There are two types of secured overdraft. They are as follows:

- Secured Overdraft (Bid Bond).

- Secured Overdraft SOD (G)

D. Term Loan:

Jamuna Bank limited is advancing both short and medium term credit to the commercial sector on the basis of their capital structure, constitution and liquidity consideration. Interest rate is 12% for SSI and 13% for MSI. It is given against land and building along with machinery, personal guarantee of Directors and hypothecation of raw materials.

Products and Service of Jamuna Bank

The Bank has an array of tailor made financial products and services. Such, products are Monthly Savings Schemes, Consumer Credit Scheme, Lease Finance, and Personal Loan for Women, and Shop Finance Scheme etc. JBL also introduced Q-cash ATM cards for its valued customers giving 24 hours banking services through Debit Cards. JBL offers the following services to its valued customer:

- Retail Banking

- Deposit Schemes

- Remittance and Collection

- Import and Export handling and Financing

- Loan Syndication

- Project Finance

- Investment Banking

- Lease Finance

- Hire Purchase

- Personal Loan for Woman

- 24-hours Banking: Q-Cash ATM facility

- Islamic Banking

- Corporate Banking

- Consumer Credit Scheme

- International Banking

Highlights of different services offered by JAMUNA Bank Limited:

Bank provide means and mechanism of transferring command over resources from those who have an excess of income over expenditure to those who can make use of the same for adding to the volume of productive capital. The bank provide them with the safety, liquidity, profitability by means of different savings media offering varying degrees of a mix of liquidity, return and safety of savings. The bank uses this savings in higher degrees of return and maximizes their profit in business. Jamuna Bank Limited is the Third generation most modern commercial bank, which has passed 9 years in operation and now enjoying the tenth year of operation. In this age of competition, every bank is passing the operational functions in hard competition. Yet it a newborn bank though it is affected by this danger. JBL is marching in an aggressive way to reach the all levels of clients and customers, which ensure certain, and mentioning position in the market.

JBL as one of the leading commercial bank provides various services to its customers. These services are given below:

JBL Personal Banking Service

Personal Banking services of Jamuna Bank offers wide-ranging products and services matching the requirement of every customer. Transactional accounts, savings schemes or loan facilities from Jamuna Bank Ltd. make available you a unique mixture of easy and consummate service quality.

JBL offers the Personal Banking Services like Current Deposit Account, Savings Deposit Account, Short Term Deposit Account, and Fixed Deposit Accounts. It also offers attractive rates on various deposit schemes.

The banks make every endeavor to ensure the clients’ satisfaction. The cooperative & friendly professionals working in the branches will make your visit an enjoyable experience

JBL Corporate Banking Services

The motto of JBL’s Corporate Banking services is to provide a personalized solution to our customers. The Bank distinguishes and identifies corporate customers’ need and designs tailored solutions accordingly.

Jamuna Bank Ltd. offers a complete range of advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package. Whether it is a project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transaction, the Corporate Banking Managers will offer you the accurate solution. The corporate Banking specialists will render high class service for speedy approvals and efficient processing to satisfy customer needs.

- Telecommunications.

- Information Technology

- Real Estate & Construction ·

- Wholesale trade

- Transport · Hotels, Restaurants ·

- Non Bank Financial Institutions

- Loan Syndication ·

- Project Finance · Investment Banking

- Lease Finance · Hire Purchase · International Banking ·

- Export Finance

- Import Finance

Other services of JBL:

Personal Loan for Women:

this product is designed specially for the working women and housewives. Housewives with reasonable income of the spouses are also eligible to avail this loan. The loan can be availed for the purchase of household appliances, house renovation.

Foreign Trade:

International Trade forms the major business activity undertaken by Jamuna Bank Ltd. The Bank with its worldwide correspondent network and close relationships with key financial institutions provides an extensive trade services network to handle your transactions efficiently.

Lease Financing:

Jamuna Bank Ltd., the highly capitalized private Commercial Bank in Bangladesh has introduced lease finance to facilitate funding requirement of valued customers & growth of their business houses. JBL lease facility is extended to the items like Luxury bus, Mini bus ,Taxi cabs.

Industrial Credit:

Jamuna Bank Ltd. offers a complete range of advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package. Corporate Banking business envelops a broad range of business.

Agriculture Loan:

Jamuna Bank Provides Loans for Agro Industries at a concession.

Other highly customized services of JBL:

Q-Cash Round The Clock Banking

Jamuna Bank Q-Cash ATM Card enables you to withdraw cash and do a variety of banking transactions 24 hours a day. Q-Cash ATMs are conveniently located covering major shopping centres, business and residential areas in Dhaka and Chittagong. ATMs in Sylhet, Khulna and other cities will soon start be introduced. The network will expand to cover the whole country within a short span of time.

With Jamuna Bank Q-Cash ATM card customer can:

- Cash withdrawal Round The Clock from any Q-Cash logo marked ATM booths.

- POS transaction (shopping malls, restaurants, jewellaries etc)

- Enjoy overdraft facilities on the card (if approved)

- Utility Bill Payment facilities

- Cash transaction facilities for selective branches nationwide

- ATM service available in Dhaka and Chittagong Withdrawal allowed from ATM’s of Jamuna Bank Ltd., AB Bank, The City Bank, Janata Bank, IFIC Bank, Mercantile Bank, Pubali Bank, Eastern Bank Ltd. respectively

- And more to come Is Q-Cash

Online Banking

Jamuna Bank Limited has introduced real-time any branch banking on April 05, 2005. Now, customers can withdraw and deposit money from any of its 35 branches located at Dhaka, Chittagong, Sylhet, Gazipur, Bogra, Naogaon, Narayanganj, Dinajpur, Kushtia,Rajshahi, Bashurhat, Sirajganj and Munshigonj. The valued customers can also enjoy 24 hours banking service through ATM card from any of Q-cash ATMs located at Dhaka, Chittagong, Khulna, Sylhet and Bogra.

All the existing customers of Jamuna Bank Limited will enjoy this service by default.

Key features:

- Centralized Database

- Platform Independent

- Real time any branch banking

- Internet Banking Interface

- ATM Interface

- Corporate MIS facility

Delivery Channels:

- Branch Network

- ATM Network

- POS (Point of Sales) Network

- Internet Banking Network

Islamic Banking Branch

In the year 2004, Jamuna Bank Limited opened another Islamic banking branch at Jubilee Road, Chittagong on November 27, 2005. The already existing Naya Bazar Islamic Banking branch started its operation from October 25, 2003, the total Islamic banking branches stands at 02 (two). JBL’s Shariah Council consists of 06 (Six) members, among the m 02 (two) are Khatib, 01 (one) is Ex-Economic Advisor, 01 (One) is Vice Chancellor, Islamic University, 01 (One) is Principal and other one is Eminent Banker. During the year 2004, the Shariah Council of JBL conducted 03 meetings to discuss all aspects of Islamic Branches operation.

Deposit Schemes:

Schemes are the most important sources of enhancing banks deposit. Mainly bank is the lender of money, which is deposited by various types of depositor. These schemes are different in nature and types and also in interest rates. These deposits give the customers to deposit the idle money in profit earning schemes and also provide the security. Jamuna Bank limited as third generation modern and technology based modern commercial bank offers various types of customer’s friendly deposit schemes to its valued customers. These schemes are highly profit earning to the depositors and also unique in security. The schemes are outlined below:

Fixed Deposit Receipt (FDR):

JBL offers various types of FDR to its client’s. Their maturity may be 1 (One) month, 2 (Two) months, 3 (Three) months, 6 (Six) months and 12 (Twelve) months, etc. In JBL customers can open FDR in individually or jointly for any amount for a fixed period. For opening of FDR no introducing are required. Only one copy of passport size photograph of the account holder and another copy of the nominee is needed. Customers can get the interest after the maturity period of the FDR. H/She can also en-cash the FDR before the maturity of the period. In this case he will not enjoy the regular interest rate on the FDR. The rates of interest are presented in the following table:

Particulars | Approved Revised Rate |

FDR for 1(one) month and above | 10.50% |

FDR for 3 (three) month and above | 12.25% |

FDR for 6(six) month and above | 12.50% |

FDR for 12(twelve) month and above | 12.50% |

NEW SCHEMES

Marriage Deposit Scheme

Marriage of children, especially daughter is a matter of great concern to the parents. Marriage of children involves expense of considerable amount. Prudent parents make effort for gradual building of fund as per their capacity to meet the matrimonial expense of their children specially daughters. Parents get relief and can have peace of mind if they can arrange the necessary fund for marriage of their children, no matter whether they survive or not till the marriage occasion.

It can be a great help to the parents if there is any scope of deposit of a modest amount as per their financial capacity, which grows very fast at high rate of interest yielding a sizeable amount on maturity.

With this end in view JBL has introduced Marriage Deposit Scheme, which offers you an opportunity to build up your cherished fund by monthly deposit of small amount at your affordable capacity.

Savings Plan and Benefit:

Tenor | Monthly Deposit | Maturity value |

5.5-years | Tk.1000/- | Tk.86,875/- |

Tk.1500/- | Tk.1,30,315/- | |

Tk.2000/- | Tk.1,73,750/- | |

Tk.2500/- | Tk.2,17,190/- | |

7.5-years | Tk.1000/- | Tk.1,32,430/- |

Tk.1500/- | Tk.1,98,645/- | |

Tk.2000/- | Tk.2,64,860/- | |

Tk.2500/- | Tk.3,31,075/- | |

10.5-years | Tk.1000/- | Tk.2,20,760/- |

Tk.1500/- | Tk.3,31,140/- | |

Tk.2000/- | Tk.4,41,520/- | |

Tk.2500/- | Tk.5,51,900/- | |

12-years | Tk.1000/- | Tk.2,76,440/- |

Tk.1500/- | Tk.4,14,660/- | |

Tk.2000/- | Tk.5,52,875/- | |

Tk.2500/- | Tk.6,91,095/- | |

15-years | Tk.1000/- | Tk.4,24,115/- |

Tk.1500/- | Tk.6,36,175/- | |

Tk.2000/- | Tk.8,48,230/- | |

Tk.2500/- | Tk.10,60,290/- | |

18-years | Tk.1000/- | Tk.6,36,020/- |

Tk.1500/- | Tk.9,54,030/- | |

Tk.2000/- | Tk.12,72,040/- | |

Tk.2500/- | Tk.15,90,050/- |

Education Savings Scheme

Education is a basic need of every citizen. Every parent wants to impart proper education to their children. Education is the pre-requisite for socio-economic development of the country. As yet, there is no arrangement of free education to the citizens from the government level. As such, there should be pre-arrangement of fund to ensure higher education of the children. Otherwise higher education may be hindered due to change of economic condition, income of the parents at the future time when higher education shall be required. Today’s higher education is becoming expired day by day. Parents can get relief and can have peace of mind if they can arrange the necessary fund for higher education of their children. As such, JBL has introduced ‘Education Savings Scheme’ which offers you an opportunity to build up your cherished fund by monthly deposit of small amount at your affordable capacity or initial lump sum deposit to yield handsome amount on a future date to meet the educational expenses.

Savings Plan and Benefit:

Option: A

Benefit withdrawal option | |||

Tenor | Monthly Deposit | Option-1Lump sum withdrawal on maturity | Option-2Monthly benefit during the next 5(five) years after maturity encashing principal deposit and interest |

4-years | Tk.1000/- | Tk.58,420/- | Tk.1225/- |

Tk.1500/- | Tk.87630/- | Tk.1840/- | |

Tk.2000/- | Tk.1,16,840/- | Tk.2450/- | |

Tk.2500/- | Tk1,46,050/- | Tk.3060/- | |

6-years | Tk.1000/- | Tk.97,640/- | Tk.2050/- |

Tk.1500/- | Tk.1,46,460/- | Tk.3075/- | |

Tk.2000/- | Tk.1,95,280/- | Tk.4100/- | |

Tk.2500/- | Tk.2,44,100/- | Tk.5125/- | |

8-years | Tk.500/- | Tk.72,930/- | Tk.1530/- |

Tk.1000/- | Tk.1,45,860/- | Tk.3060/- | |

Tk.1500/- | Tk.2,18,790/- | Tk.4590/- | |

Tk.2000/- | Tk.2,91,720/- | Tk.6120/- | |

Tk.2500/- | Tk.3,64,650/- | Tk.7650/- | |

12-years | Tk.500/- | Tk.1,38,220/- | Tk.2900/- |

Tk.1000/- | Tk.2,76,440/- | Tk.5800/- | |

Tk.1500/- | Tk.4,14,660/- | Tk.8700/- | |

Tk.2000/- | Tk.5,52,875/- | Tk.11,600/- | |

Tk.2500/- | Tk.6,91,095/- | Tk.14,500/- | |

Note: i. Duties and taxes are payable by the customer as per government rules.

ii.The customer has the option for withdrawing total accumulated amount including principal on maturity date at a time or taking monthly benefit during the next 5(five) years after maturity encashing principal deposit and interest.

Monthly Benefit Scheme (MBS)

Jamuna Bank Limited has introduced Monthly Benefit Scheme (MBS) for the prudent persons having ready cash and desiring to have fixed income on monthly basis out of it without taking risk of loss and without encashing the principal amount. This scheme offers highest return with zero risk. You can plan your monthly expenditure with the certain monthly income under the scheme.

Deposit Plan and Benefit:

Tenor | Monthly benefit/profit against deposit of Tk.1.00 (one) lac |

5-years | Tk.1020/- |

3-years | Tk.1000/- |

1-year | Tk.875/- |

6-months | Tk.850/- |

Note: Government tax and other charges, if any are included with the above benefit/figure.

Overdraft facility:

The concerned customer can avail loan facility upto 80% of the initial deposit.

Terms & Conditions:

- Bank reserves the right to change the rate of profit during the tenure of deposit.

- No loan facility will be allowed from any other Bank(s)/Financial Institution against the deposited amount except JBL.

- The initial deposited amount and term shall not be changed before maturity.

- If the Scheme is closed within 6-months, customer will get the deposited amount only and no interest/profit will be paid for the Scheme. If it is closed after 6-months, customers will get the deposited amount alongwith the interest at the normal savings rate upto the time of closure.

- Duties and taxes on the deposit, if any, are payable by the customers as per government rules.

- Money Laundering Prevention Act shall be exercised as per rules of Bangladesh Bank.

Double/Triple Growth Deposit Scheme

For people who have cash flow at this moment and want to get it doubled/tripled quickly JBL has introduced Double/Triple Growth Deposit Scheme that offers you to make double/triple your money within 6(six) years and 9.5 (nine and a half) years respectively resulting a high rate of interest.

Deposit | Period | Maturity value |

Fixed amount | 6-years | Double amount |

Fixed amount | 9.5-years | Triple amount |

Eligibility:

- Any person having age of above 18-years can participate in this scheme through opening a savings or current account with any branch of JBL

- Customer must be Bangladeshi Nationals/Citizen.

- Persons below 18-years of old may open this account with his/her legal guardian

Loan Scheme

Consumer Credit Scheme (CCS)

Because of limited income, the middle class and the lower middle class people especially the salaried professionals of our county usually cannot afford to buy essential household durable like refrigerator, television, air co9nditioner, video cassette recorder/player, furniture etc. After fulfillment of their basic needs. As such they cannot raise their standard of living to their desired level. Precisely, middle class and fixed income groups are in continuous race to elevate the standard of their living and quality of life. To materialize their cherished goal of becoming the owners of the desired goods, Jamuna Bank Ltd. is offering and attractive opportunity of installment buying thorough a consumer Credit Scheme “Comfort” in the Bank.

Consumer credit is relatively new field of micro credit activities, people with limited income can avail of this credit facility to buy any household effects including car, computer, household and other commercial durable JBL plays a vital role in extending the consumer credit.

A.Loan (General):

Short term, medium term and long term loans allowed to individual or firm or industries for a specific purpose but for a definite period and generally repayable by installments fall under this head. This type of lending are mainly accommodate to financing under the categories:

# Large and medium scale industry

# Small and cottage industry

Very often term financing for (a) Agriculture and (b) Others are also including here.

B.Cash Credit (Hypo)

Advances allowed to individuals or firms for trading as well as whole- sale purpose or to industries to meet up the working capital requirements against hypothecation of goods as primary security fall under this type of lending. It is a continuous credit. It is allowed under the categories:

# Commercial lending-when the customer is other than industry.

# Working capital-when the customer is an industry.

C.Cash Credit (Pledge):

Financial accommodation to individual or firm for trading as well as whole-sale purpose or to industries as working capital against pledge of goods as primary security fall under this head of advance. It is also a continuous credit and like the above allowed under the categories:

# Commercial leading

# Working capital

D.SOD (General):

Advances allowed to individual/firm against financial obligation (i.e. lien of FDR/PSP/BSP/Insurance policy, etc.) and against assignment of work order for executing of contractual works fall under this head. This advance is generally allowed for definite period and specific purpose i.e. it is not a continuous credit. It falls under the categories ‘Others’.

E.SOD (Import):

Advances allowed for purchasing foreign currency for opening L/C for import of goods fall under this type of lending. This is also an advance for a temporary period, which is known as pre-import finance and fall under the category ‘Commercial Lending’.

F.PAD

Payment made by the bank against lodgment of shipping document of goods imported through L/C fall under this type of head. It is an interim type of advance connected with import and is generally liquidated shortly against payments usually made by the party for retirement of the documents for release of import goods from the customs authority. It falls under the category ‘commercial lending’.

G.LIM

Advances allowed for retirement of shipping document and release of goods imported through L/C taking effective control over the goods by the pledge in go down under banks lock and key fall under this type of advance. This is also temporary advance connected with import that is known post-import finance falls under the category ‘commercial lending’

H.LTR

Advances allowed for retirement of shipping documents and release of goods imported through L/C without effective control over goods delivered to the customers fall under this head. The goods are handed over the import under trust with the arrangement that sales proceed should be deposited to liquidate to liquidate the advances within a given period. This is also temporary advance connected with import that is known post-import finance and falls under the category ‘commercial lending’.

I.IBP

Payment made through purchase of inland bills/cheques to meet urgent requirements of the customer’ falls under this type of credit facility. This temporary advance is adjustable from the proceed of bill/cheques purchase for collection. Its falls under the category ‘commercial lending’.

J.ECC

Financial accommodation allowed to a party for export of goods falls under this head and is categorized as ‘Export Credit’. The advance must be liquidated out of export proceeds within 180 days.

K.PC

Advance allowed to a party against specific L/C firm contract for processing/packing of goods to be exported falls under this head and is categorized as ‘Packing Credit’. The advances must be adjusted from proceeds of the relevant export within 180 days.

L.FDBP

Payment made to party through purchase of foreign documentary bills fall under this head. This temporary advance is adjustable from the proceeds of the negotiable shipping/export documents. It falls under the category ‘Export Credit’.

M.LDBP

Payment made to a party through purchase of local documentary bills fall under this head. This temporary liability is adjustable from proceeds of the bill.

N.SS

This classification contains accounts where such irregularities have occurred but such where such irregularities are considered to be either ‘technicalities’ or temporary in nature. The main criteria for a sub-standard advance are that despite these ‘technical’ or temporary irregularities no loss is expected to arise. These accounts will require close supervision by management to insure that the situation does not deteriorate further. Provision @10% of the base is required for debts in this classification where base is the outstanding balance less interest kept in interest Suspense account less the value of eligible security.

Personal Loan for Women

Personal loan for women was approved for women (employed/self employed/ unemployed). The expected return of the scheme will help improve the overall spread of JBL’s assets portfolio.

Objectives of Loan for women:

* The Bank shall get wide publicity with proper launching of the product backed by advertisement at regular intervals.

* Create diversified client based.

* Increase spread of the loan portfolio.

* In hence the scope of deposit mobilization.

Performance analysis of bank regarding with other Bank

Trend analysis of Deposit:

Deposit trend of Exim Bank:

The total deposit of the bank increased to Tk. 9945.23 million as on December 31, 2002 from Tk. 7255.02 million as at the end of the previous year indicating an increase of 37.08% than the previous year. The EXIM Bank remains committed to increasing deposit base by growing low cost personal and business accounts, and thereby lowering the banks over all cost of fund. As on December31, 2008 the banks deposit reached 15242.97 million, which is more than 5297.74 million than last year

Table no-4

Year | Amount Of Deposit (Tk In Million) |

2008 | 98319.21 |

2007 | 89078.18 |

2006 | 75,242.97 |

Deposit Trend of NCC Bank Ltd:

Bank’s deposit as at 31st December 2008 stood at Tk. 21,478.22 million with an increase of 33.66% over last year’s figure of Tk. 16,069.23 million. The chart below shows the growth of deposit for last 05 years.

Deposit trend of Jamuna Bank Ltd.

Year | Million of Deposits (Tk) |

2004 | 10450.161 |

2005 | 14454.129 |

2006 | 17284.811 |

2007 | 19279.721 |

The deposit trend of Jamuna Bank from 2004 to 2007 which we observed is very much rapidly increasing. The tremendously increase the deposit from 2004 to 2005 which was 10450.161 to14454.129. Finally in 2007 the deposit increase to19279.721 million deposit.

Trend analysis Loans and Advances:

Loan and advance position of EXIM Bank

During the year 2002, credit experienced vibrant activities with significant growth. Total loans and advances at the end of the year increased by tk.2823.01 million, 55.01% growth over the preceding period. This is due to increased commercial and trade financing term leading and working capital support. The classified loan Position is almost nil. This was achieved by rendering due attention and monitoring high-risks advance. As a result, classified advance is amounted to tk. 7.63 million, which is only 0.09% of total loans and advances. The bank is trying to operate its credit activities with the target of achieving Zero classified loans.

Table no-5

Year | Amount (TK in Million) |

2008 | 26046.34 |

2007 | 19332.44 |

2006 | 12,289.10 |

2005 | 7,954.56 |

2004 | 5131.55 |

Loan and advance position of NCC Bank:

Bank’s credit policy has been reviewed and revised during the year 2005 to make the same need oriented and also to comply with Bangladesh Bank directives conveyed through guidelines for Core Risks Management and Prudential Guidelines for Consumer Finance. As a result, Bank’s credit activities could be made more organized. With the support of various non conventional products like Small Loan Scheme, Housing Loan Scheme, Festival Loan, etc. Bank’s lending base could be expanded further which contributed to the profitability during the year. Banks SME lending and credit facilities extended to maize producers of country’s northern area’s farmers also received good response and acclamation in the financial sector.

During the year total advance of the Bank stood at Tk. 20,533.13 million with an increase of 34.98% over the last year’s figure of Tk. 15,211.15 million and Advance Deposits ratio being 0.96: 1 in 2008.

Loan and advance position of Jamuna Bank:

Year | Amount (Million of tk ) |

2004 | 6,722.804 |

2005 | 11,011.834 |

2006 | 12,796.630 |

2007 | 14,863.642 |

2008 | 18,697.528 |

Trend analysis of Profit:

Profit of Exim Bank;

Year | Million of Profit (Tk) |

2007 | 285.429 |

2008 | 654.813 |

2009 | 805.423 |

2010 | 1065.970 |

If we analysis profit figure of Exim Bank then we can see that the trend of profit is very much increasing from the past year. In 2007, where the profit was 285.429 million but in 2010 it increase to 1065.970 million. So we can say profit trend is satisfactory.

Profit of NCC BANK

Year | Million of Profit (Tk) |

2007 | 527.839 |

2008 | 954.853 |

2009 | 1,446.645 |

2010 | 1,871.719 |

If we analysis profit figure of NCC Bank then we can see that the trend of profit is very much increasing from the past year like Exim Bank. In 2007, where the profit was 527.839 million which was more than Exim bank and it also increases in 2010 which is 1871.719 million. So we can say profit trend is very much satisfactory.

Profit of JAMUNA bANK:

Year | Million of Profit (Tk) |

2007 | 348.742 |

2008 | 479.437 |

2009 | 923.123 |

2010 | 1243.1857 |

If we compare the profit trend of Jamuna Bank with other two Banks then we see that the profit trend of Jamuna Bank is also satisfactory. Its profit trend is higher than Exim Bank but Lower than Ncc Bank. In 2007, where the profit of Exim Bank and Ncc Bank are 285.429 million and 527.839 million but the profit of Jamuna Bank is 348.742 and it increases to 1243.1857 million.

Ratio ANALYSIS OF Jamuna Bank Ltd.

| Sl. No. | Particulars | 2005 | 2004 | 2003 |

| Performance Ratio% | ||||

| 1 | Current Ratio | 0.242 | 0.423 | 1.027 |

| 2 | Return on Assets | 2.39 | 2.35 | 1.47 |

| 3 | Return on Average Assets (after Tax) | 1.32 | 1.34 | 0.81 |

| 4 | Return on Average Equity | 28.25 | 29.46 | 14.53 |

| 5 | Net Interest Margin (average) | 3.24 | 3.35 | 2.49 |

| 6 | Net Interest Margin | 2.93 | 2.87 | 1.93 |

| 7 | Efficiency Ratio | 40.42 | 39.74 | 49.24 |

| 8 | Return on Investment | 6.20 | 6.91 | 2.93 |

| 9 | Profit margin | 20.76 | 19.59 | 13.11 |

| 10 | Return on Risk Weighted Assets | 4.03 | 4.68 | 3.57 |

| 11 | Burden Coverage | 74.19 | 65.66 | 56.95 |

| 12 | Ratio of fees Income | 12.07 | 9.57 | 8.41 |

| 13 | Interest Yield | 10.68 | 11.58 | 11.02. |

| 14 | Marginal cost of Fund | 6.82 | 7.19 | 6.61 |

| 15 | Burden yield on Advances | 12.09 | 11.90 | 12.38 |

| 16 | Profit on Lending | 4.87 | 4.27 | 5.35 |

| 17 | Interest expenses to Total Expenses | 78.59 | 81.29 | 82.58 |

| 18 | Salary Exp. To Total Overhead Expenses | 39.82 | 48.46 | 50.11 |

| 19 | Return on paid-up Capital | 46.5 | 36.35 | 15.68 |

| 20 | Productivity Ratio | 31.37 | 27.01 | 30.06 |

| 21 | 2 | 6.34 | 6.46 | 7.32 |

| Asset Quality Ratio% | ||||

| 1 | Nonperforming Loan to Total Loan | 0.46 | 0.04 | 0.02 |

| 2 | Loan loss reserve to total loan | 1.13 | 1.01 | 1.02 |

| 3 | NPL Reserve to NPL | 20.00 | 36.75 | 100.00 |

| 4 | Loan to Deposit | 76.18 | 64.33 | 48.98 |

| Capital Ratio% | ||||

| 1 | Total Risk-Based Capital Ratio | 10.17 | 11.54 | 15.57 |

| 2 | Leverage Capital ratio (Capital) | 15.18 | 15.91 | 14.19 |

| 3 | Leverage Capital ratio(equity) | 17.23 | 17.67 | 15.22 |

INTERPRETATION OF RATIO ANALYSIS:

Here, a three years ratio analysis has been carried out in order to identify the trend of JBL during their period 2003-2005. As the annual report of the year 2006 has not been prepared yet by the Bank analysis, I cannot interpret and analyze the ratios of that year. The analysis of current ratio indicates that it is in declining trend starting from 1.027 to 0.242. This is a negative symptom for the bank, which reveals that a bank has less current asset in hand to pay off its current liabilities. In 2005, current ratio was 0.242, which was far below the standard normal of 2:2. Therefore, this is an alarming trend for the bank.

The profitability ratio analysis shows the ROE and the ROA of the bank. The ROE shows that it is in an increasing trend from a 14.53 to 28.25% in 2005. This indicates that the stockholders are having a higher rate of return for investing their capital or placing their funds at risk. The ROA also shows an increasing trend in the last there years starting from a 1.47 to 2.39%. This indicates a higher managerial efficiency and capability in converting the institution assets into net earnings.

The Net interest Margin also shows an increasing trend starting from 1.93% in 2003 to 2.93% in 2005. This is a tremendous growth in the spread between interest revenues and interest costs of the bank. The Net Bank Operating Margin also shows an upward trend starting from 0.5% to 1.6% in 2005. This also shows managerial efficiency in achieving higher operating reveries and controlling operating costs for the bank.

The Earnings per Share shows an upward trend starting from Tk-14.25/share to Tk46.58/share in 2005. This indicates that the stockholders are having higher earring sagest each share that they hold in the bank.

Profit Margin for the bank shows a rapid growth for the last three years starting from a 13.11% in 2003 to 20.76% in 2005. This indicates the efficiency of the management in the effectiveness of expense management and service pricing policies.

The Return on Investment Ratio of the bank is also in an upward trend from 2.93% to 6.20% in 2005. The increase in the degree of asset utilization reflects better portfolio management policies (especially the mix and yield on the bank’s assets).

SWOT ANALYSIS OF JAMUNA BANK

Strengths

- JBL is newly commercial bank in banking sector but they builds strong reputation in short time. They provide extra ordinary service to their customer.

- The top management of the bank, the key strength for the JBL has contributed heavily towards the growth and development of the bank.

- Strong network through out the country and provide quality of service to every level of customer.

- JBL has been founded by a group of prominent entrepreneurs of the country.

- Installation and use of highly sophisticated, automated system that enables the bank to have on time communication with all branches reduces excessive paperwork and vanes time for valued customer transaction.

- Form the very begging JBL tries to furnish their work surroundings with modern equipment and facilities.

- Tele banking gives the customer the opportunity to make inquiries and service request over the phone.

- The corporate culture of JBL is very much interactive compare to our other local organization.

Weakness:

- Advertising and promotion is one of the weak point of JBL. JBL does not have any effective plan for aggressive marketing activities.

- Higher service charge in some areas of banking operation than that of nationalized banks discourages customers from opening or maintaining accounts with this bank.

- PC bank is not comprehensive banking software. It is desirable that a more comprehensive banking system should replace PC bank system.

- At the entry level and mid level officer’s experience considerable low remuneration packages that some other local banks.

- There is a very little practice for increasing motivation in the workers by the management.

Opportunity:

- JBL can pursue diversification strategy in expanding its current line of business. The management can consider options for starting merchant banking or diversity in to leasing and insurance. By expanding business portfolio, JBL can shrink business risk.

- The credit facility offered by JBL has attracted security and status conscious businessmen and well as service holders with higher income group.

- JBL can evaluate the option of lunching Credit card and Visa debit card system.

- JBL should move towards the On-line banking operations. It is high time that they should go for this because some banks are already in to the On-line banking operation.

- Enter new markets or segments.

- Expand product line to meet broader range of customer need

Threats

- Default culture is very much familiar in our country. For a bank, it is very harmful. As JBL is new, it has not faced it seriously yet. However as the bank grows older it might become a big problem.

- The Central Bank exercises strict control over all banking activities in local banks like JBL. Sometimes the restriction impose barrier in the normal operations and policies of the bank.

- Rival bank easily copy the product offering of JBL. Therefore the bank is in continuous of product innovation to gain temporary advantage over its Competitors.

- Sometime political loans are the threat for this banking service.

- Frequent Taka Devaluation and foreign exchange rate fluctuations and particularly Southeast Asian currency crisis adversely affects the business globally.

- The worldwide trend of mergers and acquisition in financial institutions is causing concentration the industry and competitors are increasing in power in their respective areas.

- Due to existence of unsaved demand in financial sector, it is expects that more financial institutions will introduced in the industry very shortly, and we have already seen such cases in our country that lots of new banks are coming in the scenario with new services. JBL should always be prepared for the competition in the coming years.

Recomandation and Findings

Findings

While working at JBL karwanbazar branch, I have attained a newer kind of experience. After collecting and analysis data I have got some problem of the JBL. These problems completely from my personal viewpoint, which is given below:

- Lack of update products is a drawback of the general banking area of the JAMUNA Bank. New products such as student loan, medical loan, marriage loan are not available in JBL.

- From the clients view introducer is one of the problems to open an account. It is general problem to all commercial bank.

- They face troubles with those clients who have not any knowledge in banking transactions and banking rules.

- As the deposit is heart of running the banking activities JAMUNA Bank Deposit growth not good. Because JAMUNA Bank deposit rate is low other than commercial bank such as Dhaka Bank, Prime bank Mercantile Bank, HSBC Bank, Bank Asia etc.

- JBL has not recruited competent people to filling its lower and mid level position they recruit only once a year. This is really tough to recruit high skilled employees.

- Lack of proper training arrangement of employees

- As a result of technological change such as use of new software There are few staffs who have lacking in computer knowledge are not efficient enough to finish every task immediately so before utilizing new technology proper training should be arrange.

- Clients generally complain that rate of interest for various type of credit is quite high. In many cases productivity from loaned investment is inadequate that borrower become incapable in repaying loan.

- one problem is that bank always follows the policy of risk averse in the world today all the organization are moving in approach of risk taking. As a result it is facing some problems and also facing competition from other bank

- The recovery of capital in small business loan section is threatened

- JAMUNA Bank has insufficiencies of Authorized Dealer Branch in respect of the total foreign business. Bank has only six branches, which have AD licenses. As a result in total foreign exchange business is very small in respect of total market.

- Per-shipment inspection certificate should obtain from the exporter of back to back L/C. Because it reduce it fraud and forgery in case of import against master export L/C, but all the time this pre-shipment inspection certificate are not wanted by the bank

- JBL does not promote itself for catering its services to the public or the business organization

Recommendation:

Some necessary steps are recommended bellow on the basis of collected data, observation, expert staffs opinion and my knowledge and judgments. For the probable solutions of the identified problems ensure better process to JAMUNA Bank in future.

- The branch manager should ensure proper distribution of works responsibility among personnel strictly and monitor the activities of the officer so that the clients get efficient service.

- In the face of competitive and customer dominated scenario JBL must come up with innovative products to meet up the demand of time. Such as study loan, medical loan, debit card, dual currency credit card etc.

- Interpersonal relationship needs to be built among the employees and superiors.

- A philosophy of working for the customer instead of working for boss must be introduced

- Job description should be clarified and proper training facilities should ensure to improve the performance of bottom line management.

- The entire department should be well informed regarding their goals and objectives. It is essential to execute company objective into individual target.

- Care should also be taken so that good borrowers are not discarded due to strict adherence to the lending policy.

- Bangladesh bank should more active to provide CIB report

- JBL Should expand its own credit Card and Automated Teller Machine (ATM) because of present market demand of the customer and the educated customer now wants technology based banking but customers are confused about services.

- JAMUNA Bank should develop effective online banking system to compete with other commercial banks.

- If the entire banking system is fully online on computerizes system perfectly then they satisfy the customer by providing fast service with minimum service charge.

- It can be recommendation that if all the branch of The JBL a vivid account manual for the account holder, it will be better for the bank.

- A complain box for the customer, each and every complaint form the customer has been received and find out the problems and therefore try to eliminate the problems of the customer as soon as possible.

Conclusion

There are a number of Private Commercial Banks, Nationalized Commercial Banks and foreign Banks operating their activities in Bangladesh. The JAMUNA Bank Ltd. is one of them. For the future planning and the successful operation for achieving its prime goal in this current competitive environment this report can be helpful guideline.

To compete in the environment of advancing technology and faster communication the JBL should depend more heavily on the quality service and information technology. No doubt about it that JBL achieve superior position in our banking industry but to cope with customer JBL should think how to make it services proactive. To compete with other bank’s operation in Bangladesh, JBL should introduce easier way for faster processing of credit analysis. As a leading bank of Bangladesh, JBL contributes in the business with promising future. I can hope that JBL can spread their business with increasing various scheme and other utility services.