The word switching costs, also called “switching barriers”, are costs incurred by a customer by switching brands, goods, services, or suppliers. While most prevalent switching costs are monetary in nature, psychological, effort-based, and time-based switching costs are also related. Switching costs commonly talk over with the financial costs incurred by a consumer once they switch brands, products, services, or suppliers. Thompson and Cats-Baril (2002) describe switching costs as “the costs of switching suppliers,” while Farrell and Klemperer (2007) write that “a buyer faces a switching cost between sellers when a new seller has to repeat an investment unique to his current seller.”

(Understanding Switching Costs)

A switching cost can crop up within the variety of significant time and energy necessary to alter suppliers, the danger of disrupting normal operations of a business during a transition period, high cancellation fees, and a failure to get a similar replacement of products or services. The principle of cost balancing stems from the notion of creating a loyal client base. It is important to remember however those such costs may contain non-financial costs. Other expenses include charges related to education, time, and effort.

Switching costs are often both tangible and intangible and talk to the value a customer must pay when switching between products, suppliers, brands, or perhaps marketplace. Examples of switching costs include the effort required to notify friends and relatives after an operator switch about a new telephone number; costs related to learning how to use a new cell phone app from a different brand; and costs in terms of time wasted due to the documentation needed when switching to a new energy supplier. Some businesses that are unable to charge for switching higher dollar amounts would ensure long waiting times and product delays, retaining their customer base with purely time-based switching costs.

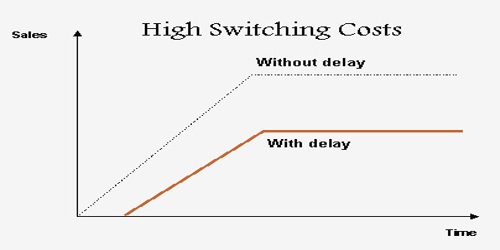

High Switching Costs

Switching costs can be “high” or “low”. The higher the switching costs, the less likely an individual would be willing to switch brands, goods, services, or suppliers. The higher the cost to customers, the less benefit the customer derives from moving to a new brand, commodity, service, or supplier. In fact, switching costs are often found in procedural costs and relational costs. Varieties of switching costs include:

- Exit fees (when breaking contract)

- Equipment costs (when changing service provider)

- Installation costs

- Learning costs (time and effort, training)

- Emotional costs (relationships, new employees, and brand)

- Start-up costs

- Convenience (location)

- Risk (financially, psychologically, and socially)

Efficient businesses usually tend to employ tactics that impose high switching costs on the part of customers to dissuade them from switching to the commodity, brand, or services of a rival. By comparison, both buyers and sellers frequently ignore or underestimate the economic, emotional, and social costs of switching. If a company is ready to cause consumers to incur higher costs, it’s considered a competitive advantage for the company. Many cellular phone providers, for example, charge extremely high cancelation fees for canceling contracts in the expectation that the costs involved in switching to another network would be high enough to discourage their customers from doing so. The latest proposals from various mobile providers to reimburse customers for cancelation fees have, however, nullified those switching costs.

The higher the switching costs, the harder it’s for the customer to go away. These costs are a serious reason for pursuing order-of-magnitude improvements in costs, efficiencies, and benefits to the buyer. Businesses take advantage of this technique to achieve a competitive advantage. Where a buyer’s switching costs are prohibitively high, the situation can be focused on as a monopoly, a seller, a monopsony, and a reciprocal monopoly for both. There are a variety of strategies employed by companies to extend the switching costs incurred by consumers. For example:

- Charging a high cancellation fee for service cancellations

- Incorporating a lengthy or complex cancellation process for service cancellations

- Requiring significant paperwork for service cancellations

Switching costs are the cornerstones of corporations’ competitive advantage and market control. It is important to remember, however, that while corporations can generate high switching costs, rivals can help customers offset those high costs by bearing a portion of those costs. Firms strive to form switching costs as high as possible for his or her customer, which lets them lock customers in their products and lift prices per annum without fear that their customers will find better alternatives with similar characteristics or at similar price points. With the growth of information technology, the importance of understanding switching costs has been stressed, because switching costs tend to be a phenomenon that is particularly strong in the information economy.

Information Sources: