Executive Summary

Apart from the benevolent social services by some business firms, the new concept of Corporate Social Responsibility (CSR) is an emerging one. Businesses are driven by government, labor unions consumer groups and above all by considering CSR as a long time investment in PR. In the context of Bangladesh, it is more relevant for the export-oriented industry, RMG sector, Banking sector etc. Globalization has made CSR practice an imperative for Bangladesh business. CSR concentrates on benefits of all stakeholders rather than just the stockholders. Awareness and sense of necessity for practicing CSR is becoming more and more pronounced as the country has to adapt itself to the process of globalization. But the overall status of CSR in Bangladesh is still very meager. Lack of Good Governance, absence of strong labor unions or consumer rights groups, and inability of the business community to perceive CSR as a survival pre-condition in export and PR investment local market constitute some of elements undermining the evolution of CSR practices. Some untoward incident like boycott from the importer has taught the local business community about the immense importance of CSR and adoption of this modern and competitive practice is gradually increasing in Bangladesh.

Companies are facing the challenges of adapting effectively to the changing environment in the context of globalization and in particular in the Banking sector. Although Consumer Rights Movement, enforcement of government regulations and a structured view regarding the economic importance of CRS are not yet so widespread in the corporate world in Bangladesh, companies have gradually attaching more importance to CSR in the local market as well. They are increasingly aware that CSR can be of direct economic value. Companies can contribute to social and environmental objectives, through integrating CSR as a strategic investment into their core business strategy, management instruments and operations. This is an investment, not a cost, much like quality management. So, business organizations can thereby have an inclusive financial, commercial and social approach, leading to a long term strategy minimizing risks linked to uncertainty.

CSR in Bangladesh can also contribute a lot to community development. The corporate house can develop the community by creating employment, providing primary education, contribution to infrastructure development like road and high-ways and addressing environmental concerns. This is more relevant for a country like Bangladesh where the government interventions in these fields being augmented by corporate alliance can go a long way in developing the economy, society and environment.

CSR concepts and practices in Bangladesh have a long history of philanthropic activities from the time immemorial. These philanthropic activities included donations to different charitable organizations, poor people and religious institutions. Till now, most of the businesses in Bangladesh are family owned and first generation businesses. They are involved in the community development work in the form of charity without having any definite policy regarding the expenses or any concrete motive regarding financial gains in many instances. Moreover, most of the SMEs fall under the informal sector having low management structure and resources to address the social and environmental issues. These limitations drive the top management of local companies to think only about the profit maximization rather than doing business considering the triple bottom line: profit, planet and people (CSR definition of Lotus Holdings). The discussions on CSR practices in Bangladesh in its modern global terms, are relatively new, but not so for the concept itself. Because, being a part of the global market, it is difficult to ignore CSR standard specifically in the Banking sector.

In case of practicing CSR our selected one Bank such as Dhaka Bank always provide greater value in their running operation.

Bangladesh economy has been experiencing a rapid growth since the ’90s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers’ remittance, local and foreign investments in construction, communication, power, food processing and service enterprises ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives as well as to channelize consumer investments in a profitable manner. A group of highly acclaimed businessmen of the country grouped together to responded to this need and established Dhaka Bank Limited in the year 1995. Dhaka Bank is most widely recognized for its donations to social causes and its IT investment. However it has recently stated that it will stop expansion on its ATM network as the current numbers have exceeded demand and hence diminishing returns (if any). Although it is widely believed it is a loss-making/subsidized unit which Dhaka Bank rationalizes as quasi CSR.

Origin of the Report

Since practical orientation is an integral part of the BBA degree requirement, I was deputed by the Department of Business Administration, ASA University Bangladesh to the project work.

During this three months’ I have complete my thesis paper in Dhaka Bank. Basically I am focusing on my report, how the Dhaka Bank doing their CSR activity. I have come across with different functions of this bank. the basic function of a Dhaka Bank and giving special emphasis CSR activity and performance of the CSR activity. This report has been originated as the course requirement of the BBA program. I hope the report will give a clear idea about the activities and role of Corporate Social Responsibility in Dhaka Bank. However, apart from that in this report different CSR activity analysis of this bank have been furnished to have an inner depth of the actual scenario.

Objective of the Study

In case of completing this assignment I have a broad objective. I think before involving any type of term paper or assignment there is certain goal and objective should be formulized. The study has been undertaken with the following objectives:

- To analysis¬ the pros and cons of the conventional ideas about the corporate social responsibility.

- Analyzing the selected Bank’s CSR practices.

- Critically synchronize the result of their performance or profit after practicing CSR.

- How Banking organization handle the CSR activities.

- To know are they truly responsible for the society or not?

- Finally to fulfill the requirement of the project work under BBA program.

Scope of the Report

The scope of the study concludes CSR activity in case of corporate arena. Here it is also stated about the procedure of corporate CSR reporting as per Central Bank rules, local culture, and companies’ act 1994. The experiment was occurred on the Dhaka Bank Ltd. In this report I have focused on all the qualitative and descriptive data which include director’s report, auditor’s report, newspapers, articles, magazines and periodicals. In this report I have also focused how the Dhaka Bank participated in our local culture by their CSR activity. Dhaka bank plays the vital role in our social culture by their CSR activities which I have focused in this report. I have also stated in this report to the limitation and recommendation of Dhaka Bank in case of CSR activities.

Methodology of the Report

To prepare a report one is to depend on information to make it fruitful. I am also not exception of this. To prepare my thesis paper I have collected information from my assigned topic. The information that contains in the thesis is from both primary and secondary sources. As a requirement of analysis project my report is divided into different parts. First part contains introduction and concept of the Corporate Social Responsibility. Second part contains overview of the organization. Third part contains corporate information, management hierarchy and branches of organization. Fourth part contain about the CSR activity of Dhaka Bank. Finally last part contain about the findings, recommendation and conclusion. I have taken help of secondary source of information like annual report, catalogues, website and also different periodicals and articles which contains information about Dhaka bank Ltd.

To conduct a study properly designing of the process is essential. Because reliability and validity of the outcomes of a study is depends on the reliable data and information. In this connection some activities has been carried out collect data and information.

- Data collection method: Relevant information has been collected from the web sites of the company.

- Data type: We will use primary and secondary data in preparing in this assignment.

- Sources: The internal, external and personal information will be used as the secondary data sources.

- Approach: In preparing this assignment we will adopt the approach of internationalization process of business as mentioned in the book of “Corporate Social Responsibility, Keith Devis & blomstrong”.

Primary sources:

- Direct interview and conversation with the assistant manager of Dhaka Bank.

- Officials records, conversation with other colleagues.

- Scheduled survey and informal discussion with professionals

- The CSR Centre at the Bangladesh Enterprise Institute (BEI).

Secondary sources:

- Annual report of the organization from 2009-2010.

- Catalogues, websites, periodicals and different articles.

- Manuals and brochures of Dhaka Bank Ltd and different publications of Bangladesh Bank.

Limitation of the Report

In preparing this thesis paper I have faced some problems such as-

- Lack of adequate knowledge and conceptual framework of CSR.

- Lack of electricity.

- Manipulation of CSR information by management contained in the paper.

- Lacking of auditing process which is related to time and evidences.

- Different CSR policies and methods are maintained in different organization.

- Lack of proper understanding about the CSR information that are needed for the society.

- Lack of proper understanding about the quality of CSR information which are needed for the society.

- Lack of available information about different management bodies.

- Lack of available information about operation of this organization.

- Lack of practicing CSR Act for this Bank.

Structure of the Report

The report has two major parts. The background of the Dhaka Bank and the CSR activities of the Dhaka Bank. Then again if I want to understand the CSR activities of the bank I need to have a clear view of the banking activities. That’s why the other aspect consists of the description of the bank with the CSR activities analysis of the bank to find out the performance of the institution.

Part One: This is Basically Introductory part, the objective and scope of the study, limitations, and research methodology has been highlighted.

Part Two: This part contains the concept of the Corporate Social Responsibility. This part is described, when CSR was introduced and why the bank following the CSR activities. This part also described the definition of CSR.

Part Three: In this part I have mentioned the different types of corporate Social Responsibility which was maintaining the Dhaka Bank. Dhaka Bank participated in our society in many ways. Sometimes Dhaka donate huge amount of money. In this part I have also focused the Dhaka Bank participated in our government sector.

Basic concept of Corporate Social Responsibility

Introduction

Social Responsibility is a concept well known in the corporate world and beyond that. Businesses all over the world have practiced only profit-making actions at past but not for long as the enterprises started to develop complexities and wideness in size and actions so was their reach getting bigger and bigger. As every person has his own social responsibilities towards the society so does the business firms. The idea that business has social obligations above and beyond making a profit is corporate social responsibility. However, it is regretful that though internationally it is being practiced widely. Bangladesh is still lagging behind. The difference between the world standard and the Practice in Bangladesh shows the lacking here and the scope for development.

What is Corporate Social Responsibility (CSR)?

Definitely social responsibility includes the responsibility of people, groups, societies, and business organizations. Here raises the question: Why is there more interest in, and debate about, the social responsibility of business than about the social responsibility of other institutions? It is, of course, perfectly legitimate to raise the issue of the social responsibility of business. But we hear rather less about the social responsibility of, say, the churches, the media, trade unions, the professions, universities, or even the government. When people collectively organize themselves in business organizations of one kind or another, do those impersonal legal entities really acquire social responsibilities, which differ from those of other collective entities?

Many people are uneasy about the profit motive, suspecting that profits emerge only from exploitation. They fear that free enterprise encourages greed and selfishness. They are reluctant to accept the logic of Adam Smith’s famous theory of the invisible hand, which holds that business people promote the general interest more effectively by pursuing their own interests than by directly trying to ‘do good’. I suggest that this is why we hear little about the social responsibilities of the churches, charities, and so on. Business, in contrast, is assumed to have a problem about its social responsibilities because it is driven by profit-motives.

Although no consensus about the definition of corporate social responsibility (“CSR”) exists at present, it may be said to encompass “a company’s commitment to operate in an economically and environmentally sustainable manner, while acknowledging the interests of a variety of stakeholders. An organization’s policy and continuous action in such areas as employee relations, diversity, community development, environment, international relationships, marketplace practices, fiscal responsibility and accountability [all help determine its corporate social responsibility].

3 History of Corporate Social Responsibility (CSR)

Three waves of development

1. Community relations and contributions responsive to local pressures/needs and CEO/Senior Management – 1960s & 1970s

2. “Corporate citizenship model” based on ethical issues (BSR) including “the new Corporate or strategic philanthropy” – 1980s & 1990s

3. “Strategic alliances” closely aligned with corporate objectives – 1999 & beyond traditionally business operated exclusively on the mantra of maximizing profits. As long as “the firm could sell its good[s] or services at prices high enough to make a profit and survive, then its social obligation was fulfilled.”

However, shortly after large companies first emerged in the 1870s, debate quickly emerged as to the appropriateness of their conduct. The 1930s, upon the heels of the Great Depression, “signaled a transition from a primarily laissez-faire economy with industrial power and might in control to a more mixed economy” with a more activist role by organized labor and the government.

The New Deal had much to do with this transition. Further, the government’s creation of various socially oriented programs to ease the country’s economic woes resulted in more socially minded Americans.

Debates as to the appropriate role of business in society sharpened after World War II. Corporate philanthropy was well established by then, but the creation of public interest watchdogs and regulatory agencies such as the American Civil Liberties Union, the Sierra Club, and the Federal Trade Commission stimulated “new interest in business ethics, the standards by which to judge corporate and individual behavior within the moral framework of business and society.”

Howard Bowen’s Social Responsibilities of the businessman, often cited as the seminal text on corporate social responsibility by those in the field, was published in 1953. According to Bowen, the social responsibilities of a businessman consisted of obligations “to pursue those policies, make those decisions, or to follow those lines of action which are desirable in terms of objectives and values to society.” Soon afterwards, all three levels of government started enacting increasingly detailed legislation conducive to socially responsible behavior by businesses. Further, the four key regulatory agencies—the Equal Employment Opportunity Commission, the Occupational Safety and Health Administration, the Environmental Protection Agency and the Consumer Product Safety Commission—were established from 1969 to 1972. These developments created “a whole new world for managers… all of a sudden they are hit with four enormous regulatory agencies making lots and many demands for information and for corrective action.”

A combination of factors propelled the subject of socially responsible business to the frontlines during the 1980s. First, by way of local and national campaigns, the consumer rights movement heightened scrutiny of corporate practices. Further, the Reagan-Bush Era, in which government restrictions on businesses were loosened, caused some business leaders to contrast “what appeared to be an alarming array of crumbling institutions— including weakened federal and local government agencies once charged with protecting those institutions—with the wealth they and their shareholders had amassed over roughly the same period, and [to recognize] an inherent imbalance.” Ultimately, all of this— government’s hands-off approach, business’s growing impact, the media’s and the public’s perception of government’s role, seemingly excessive profits,” along with the unparalleled increases in drug abuse, homelessness, and countless other social ills subtly shifted the public’s perception of business.

Corporate World in Bangladesh

As similar to any other third world developing nation, Bangladesh’s economic sector is still in the infant stage. It is yet to develop fully. There are very few worthwhile industries to be named. The Bangladesh corporate world is at presents just trying to satisfy its local needs. Whatever exports are there shares a little portion of the world market. The resources available are not enough to satisfy the local needs. Hence, companies still follow the classical model of economy, trying to maximize profits and targeting short run profits. As a result, there is hardly any concern about social responsibility. But now a day this scenario is changing. Now many local companies are getting involved in CSR. It is not long since foreign investors took interest in investing in Bangladesh. Along with them, they brought the concept of social responsibility and public welfare. A list of the foreign investors in Bangladesh is as follows: Lever Brothers, British American Tobacco, Standard Chartered Bank, HSBC, Reckitt Benckiser and so on. They have contributed a lot in terms of social responsibility in Bangladesh. Along with them Dhaka Bank, Square Group, Baximco group, Acme group, Rahimafroz, NBL, those local companies have started to keep pace in CSR sector.

Promoting CSR in Bangladesh: The role of the CSR centre

An increasing number of companies and businesses in Bangladesh are engaged in corporate social responsibility (CSR), the vast majority being the multinational corporations (MNCs). Compared to these MNCs, only a handful of local companies in Bangladesh practice CSR. However, a large number of local companies are engaged in philanthropic activities, ranging from donations for religious activities, to social and community development, to setting up facilities that provide healthcare services.

In addition, the private sector plays a major part in providing relief and rehabilitation in the aftermath of natural disasters. A number of local entrepreneurs have formed their own philanthropic foundations or trusts. With more awareness of the philosophy and implementation of CSR, these local firms can find new business opportunities and expand their social impact through wider CSR adoption and practice.

The CSR Centre at BEI

In Bangladesh, the private sector often does not have the resources or the expertise necessary to act on CSR opportunities. Against this backdrop, during various consultations with key stakeholders, an expressed need was felt for an institution to champion CSR in Bangladesh. The primary role of such an institution would be to engage in CSR advocacy and in the raising of awareness and understanding of CSR among stakeholders.

With a vision to champion CSR, the CSR Centre at the Bangladesh Enterprise Institute (BEI) was established in June 2005. As envisioned, it will be a private-sector led initiative, sustaining itself through various tools and services that it will provide. It will work through networks and partnerships and provide a platform for dialogue for various stakeholders to interact and exchange views and ideas. The Centre would be both a service provider and a facilitator.

The first of the two overarching objectives of the Centre is to establish and strengthen local institutional capacity to raise CSR awareness among the stakeholders, and serve as a champion for CSR adoption and implementation. The second objective is to design and implement various CSR interventions that will lead to the development of a CSR service market in Bangladesh.

Planned activities of the Centre include formulation of voluntary principles and standards for industries that are both economically viable and operationally feasible; development of tools and applications to evaluate, implement and monitor CSR adoption and practice thus enable businesses to be more responsive to its stakeholders; providing research on policies and procedures, strategies and standards, quantifying the cost and benefits of CSR to develop a better understanding of CSR in the context of Bangladesh; and enabling informed public dialogue on all aspects of corporate social responsibility with focus on the notion of accountability to all stakeholders,through research, conferences, publications and a website that will be continuously updated withimportant information on labour practices, sustainable development, regulation and public policy.

Since its launch last year, the CSR Centre at BEI has organized 12 roundtables as part of a dialogue series on CSR in Action. Organized monthly, the roundtable serves as a platform for exchanges of views, hear the perspectives of key stakeholders, and raise awareness on CSR practices and implementation challenges in Bangladesh. At each roundtable, three speakers representing a local company, a multinational company and a development agency are invited to present their experience of CSR practice in Bangladesh. The BEI has been advocating CSR within the private sector, through these regular dialogues to highlight the existing CSR practices of local and multinational companies and NGOs in Bangladesh. Till date, the roundtables have attracted over 300 participants who had the opportunity to listen to over 30 speakers from various NGOs, and corporate houses, both local and MNC.

Besides organizing the roundtables, the Centre has developed case studies to showcase best CSR practices in socially responsible firms from various sectors and a short documentary to highlight these practices. In addition, the Centre has developed an environmentally and Socially Responsible Business (ESRB) practices guideline for the banking sector, Taking into account the relationships between banks and other financial institutions on one side, and private enterprises on the other. The Centre will continue to develop products and services to serve as advocacy tools for sector-wide CSR adoption, which in turn will help foster an enabling environment for private sector growth and development.

Development and Analysis of Corporate Social Responsibility

Development and Analysis

Business ethics is a form of the art of applied ethics that examines ethical principles and

moral or ethical problems that can arise in a business environment.

In the increasingly conscience-focused marketplaces of the 21st century, the demand for

more ethical business processes and actions (known as ethics) is increasing.

Simultaneously, pressure is applied on industry to improve business ethics through new

public initiatives and laws (e.g. higher UK road tax for higher-emission vehicles).

Business ethics can be both a normative and a descriptive discipline. As a corporate

practice and a career specialization, the field is primarily normative. In academia

descriptive approaches are also taken. The range and quantity of business ethical issues

reflects the degree to which business is perceived to be at odds with non-economic social

values. Historically, interest in business ethics accelerated dramatically during the 1980s

and 1990s, both within major corporations and within academia. For example, today most

major corporate websites lay emphasis on commitment to promoting non-economic

social values under a variety of headings (e.g. ethics codes, social responsibility charters).

In some cases, corporations have redefined their core values in the light of business

ethical considerations (e.g. BP’s “beyond petroleum” environmental tilt).

The term CSR itself came in to common use in the early 1970s although it was seldom

abbreviated. The term stakeholder meaning those impacted by an organization’s activities

was used to describe corporate owners beyond shareholders from around 1989.

Approaches to CSR

Some commentators have identified a difference between the Continental European and The Anglo-Saxon approaches to CSR.

An approach for CSR that is becoming more widely accepted is community-based development projects, such as the Shell Foundation’s involvement in the Flower Valley, South Africa. Here they have set up an Early Learning Centre to help educate the community’s children, as well as develop new skills for the adults. Marks and Spencer is also active in this community through the building of a trade network with the community – guaranteeing regular fair-trade purchases. An often alternative approach to this is the establishment of education facilities for adults, as well as HIV/AIDS education programs. The majority of these CSR projects are established in Africa. A more common approach of CSR is through the giving of aid to local organizations and impoverished communities in developing countries. Some organizations do not like this approach as it does not help build on the skills of the local people, whereas community- based development generally leads to more sustainable development.

The Responsibilities of Corporate Social Responsibility

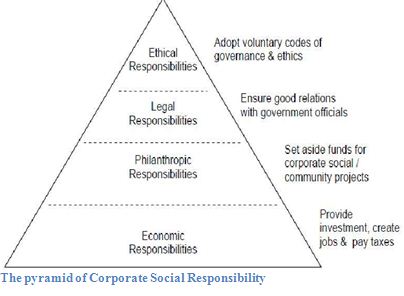

For CSR to be accepted by a conscientious business person, it should be framed in such a way that the entire range of business responsibilities is embraced. It is suggested here that four kinds of social responsibilities constitute total CSR: economic, legal, ethical, and philanthropic. Furthermore, these four categories or components of CSR might be depicted as a pyramid. To be sure, all of these kinds of responsibilities have always existed to some extent. But it has only been in recent years that ethical and philanthropic functions have taken a significant place. Each of these four categories deserves closer consideration.

Organization Overview

An overview of Dhaka Bank Limited (DBL)

Dhaka Bank Limited is the leading private sector bank in Bangladesh offering full range of Personal, Corporate, International Trade, Foreign Exchange, Lease Finance and Capital Market Services. Dhaka Bank Limited is the preferred choice in banking for friendly and personalized services, cutting edge technology, tailored solutions for business needs, global reach in trade and commerce and high yield on investments, assuring Excellence in Banking Services.

Background of Dhaka Bank Limited

Dhaka Bank Limited is a scheduled bank that was incorporated under the Companies Act 1994, started its operation on July 1995 with a target to play the vital role on the socio-economic development of the country. Aiming at offering commercial banking service to the customers’ door around the country, the Dhaka Bank limited established 20 branches up-to this year. This organization achieved customers’ confidence immediately after its establishment.

Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. This is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution.

Capital Base

Authorized Capital: BDT 1000.00 million.

Paid up Capital : BDT 531.07 million (as on 31.12.2003)

Dhaka Bank appoints CRISL for Credit Rating

Credit Rating Agency of Bangladesh Limited (CRAB) has assigned “A1” rating in the Long Term and “ST2” rating in the Short Term to the Dhaka Bank Limited (DBL). Commercial Banks rated in this long-term category are adjudged to be strong banks, characterized by good financials, healthy and sustainable franchises, and a first rate-operating environment. This level of rating indicates strong capacity for timely payment of financial commitments, with low likeliness to be adversely affected by foreseeable events. Banks rated in this short- term category are characterized with commendable position in terms of internal fund generation, access to alternative source of fund and moderate level of liquidity

Mission Statement

Mission

To be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking.

Vision

At the Dhaka Bank,, we draw our inspiration from the distant stars. Our term is committed to assure a standard that makes every banking transaction a pleasurable experience. Our endeavor is to offer you razor sharp sparkle through accuracy, reliability, timely delivery, cutting edge technology, and tailored solution for business needs, global reach in trade and commerce and high yield on your investments.

Goal

Our people, products and processes are aligned to meet the demand of our discerning customers. Our goal is to achieve a distinction like the luminaries the sky. Our prime objective is to deliver a quality that demonstrates a true reflection of our vision – Excellence in Banking

Slogan

Excellence in Banking

Motto

The Bank will be a confluence of the following three interests:

Of the Bank : Profit Maximization and Sustained Growth.

Of the Customer : Maximum Benefit and Satisfaction.

Of the Society : Maximization of Welfare.

Objectives

Be one of the best banks of Bangladesh.

Achieve excellence in customer service next to none and superior to all competitors.

Cater to all differentiated segments of Retail and Wholesale Customers.

Be a high quality distributor of product and services

Use state-of the art technology in all spheres of banking.

Strategies Objectives of DBL

Their objectives are to conduct transparent and high quality business operation based on market mechanism within the legal and social framework.

• Their greatest concerns are to provide their customers continually efficient, innovative and high quality products with excellent delivery.

• Their motto is to generate profit with qualitative business as a sustainable ever-growing organization and enhance fair returns to the shareholders.

• Establish DBL as one of the top five successful Private Commercial Banks by 2010.

• Be committed to the community as a corporate citizen and contribute towards the progress of the nation.

• Build a strong deposit base.

• Introduce new products & services and upgrade existing products & services at comparatively low cost in order to assure quick respond to the changing demands in the market.

• Promote the well being of the employees and raise their morale.

• Strengthen corporate identity and values.

• Fulfillment of their responsibility to the government by paying taxes and Abiding by other rules.

• Bring the entire system under a very advanced IT platform.

• Socialize and present the bank to the community as a corporate partner.

• Encouraging and motivating the new entrepreneurs to establish industries and business in line with development of national economy.

• Enhancing savings tendency of the people by offering attractive and lucrative new savings scheme.

• Financing the foreign trade of the country both Export and Import.

• Enhancing the mobilization of savings both from urban and rural area.

Dhaka Bank Management Overview

1 Departments of DBL

Dhaka Bank maintains the jobs in a proper and organized considering their interrelationship that are allocated in a particular department to control the system effectively. Different departments of DBL are as follows:

Human Resources Division

Dhaka Bank Limited recognizes that a productive and motivated work force is a prerequisite to leadership with its customers, its shareholders and in the market it serves. Dhaka bank treats every employee with dignity and respect in a supportive environment of trust and openness where people of different backgrounds can reach their full potential. The bank’s human resources policy emphasize on providing job satisfaction, growth opportunities, and due recognition of superior performance. A good working environment reflects and promotes a high level of loyalty and commitment from the employees. Realizing this Dhaka Bank limited has placed the utmost importance on continuous development of its human resources, identify the strength and weakness of the employee to assess the individual training needs, they are sent for training for self-development. To orient, enhance the banking knowledge of the employees Dhaka Bank Training Institute (DBTI) organizes both in-house and external training. The major responsibilities of HR are as follows:

The major responsibilities of HR are as follows:

• Employee recruitment

• Posting

• Transfer

• Increment

• Established yearly performance bonus

• Provident fund

• Confirmation

• Training

SWOT Analysis on Dhaka Bank

Strengths

Strong corporate identity

According to the customers, DBL is the leading provider of financial services identity worldwide. With its strong corporate image and identity, it has better positioned itself in the minds of the customers. This image has helped DBL grab the personal banking sector of Bangladesh very rapidly.

Strong employee bonding and belongings

DBL employees are one of the major assets of the company. The employees of DBL have a strong sense of commitment towards organization and also feel proud and a sense of belonging towards DBL. The strong organizational culture of DBL is the main reason behind its strength.

Efficient Performance

It has been seen from customers’ opinion that DBL provides hassle-free customer services to its client comparing to other financial institutions of Bangladesh. Personalized approach to the needs of customers is its motto.

Young enthusiastic workforce

The selection & recruitment of DBL emphasizes on having the skilled graduates & postgraduates who have little or no previous work experience. The logic behind is that DBL wants to avoid the problem of ‘garbage in & garbage out’. And this type of young & fresh workforce stimulates the whole working environment of DBL.

Empowered Work force

The human resource of DBL is extremely well thought & perfectly managed. As from the very first, the top management believed in empowering employees, where they refused to put their finger in every part of the pie. This empowered environment makes DBL a better place for the employees. The employees are not suffocated with authority but are able to grow as the organization matures.

Hospitable Working Environment

All office walls in DBL are only shoulder high partitions & there is no executive dining room. Any of the executives is likely to plop down at a table in its cafeteria & join in a lunch, chat with whoever is there.

Strong Financial Position

It has been seen that the net profit has been gradually rising over the years. Furthermore, DBL is not just sitting on its previous year’s success, but also taking initiatives to improve.

Weaknesses

High charges of L/C

Presently DBL charges same rates for all types of import L/C. But for import L/C of exports-oriented industry, DBL should reduce the charge of L/C. As a result, exporter will be benefited and the country will earn more foreign exchange. The commission often even rises up to 30%.

Discouraging small entrepreneurs

DBL provides clean Import Loan to most of its solvent clients. But they usually do not want to finance small entrepreneurs whose financial standing is not clean to them.

Absence of strong marketing activities

DBL currently don’t have any strong marketing activities through mass media e.g. Television. TV ads play vital role in awareness building. DBL has no such TV ad campaign. Although they do a lot of CSR activities compared to other banks.

Not enough innovative products

In order to be more competitive in the market, DBL should come up with more new attractive and innovative products. This is one of the weaknesses that DBL is currently passing through but plans to get rid of by 2010.

Diversification

DBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking or diversify it to leasing and insurance. As DBL is one of the leading providers of all financial services, in Bangladesh it can also offer these services.

Lack of Proper Motivation

The salary at DBL is very decent, but it lacks other sorts of motivation. Incentives such as bonuses are given for acquiring a particular figure, but all in all these are the only motivational factors

High Cost for maintaining account

7 The account maintenance cost for DBL is comparatively high. Other banks very often highlight this. In the long run, this might turn out to be a negative issue for DBL

Opportunities

Distinct operating procedures

Repayment capacity as assessed by DBL of individual client helps to decide how much one can borrow. As the whole lending process is based on a client’s repayment capacity, the recovery rate of DBL is close to 100%. This provides DBL financial stability & gears up DBL to be remaining in the business for the long run.

Country wide network

The ultimate goal of DBL is to expand its operations to whole Bangladesh. Nurturing this type of vision & mission & to act as required, will not only increase DBL’s profitability but also will secure its existence in the log run.

Experienced Managers

One of the key opportunities for DBL is its efficient managers. DBL has employed experienced managers to facilitate its operation. These managers have already triggered the business for DBL as being new in the market.

Huge Population

Bangladesh is a developing country to satisfy the needs of the huge population, a large amount of investment is required. On the other hand, building EPZ areas and some Govt. policies easing foreign investment in our country made it attractive to the foreigners to invest in our country. So, DBL has a large opportunity here.

El Dorado Program

It is software which enables customers to deposit and withdraw money from any bank with the cheque or deposit of any other bank. Although a select few has implemented this program, this poses as an opportunity for DBL as the number of transactions would drastically increase.

Bigger Market

Although the GDP per head decreased a bit in 2009 from 2008, there is a huge untapped market that requires loans and intends to deposit also.

BASEL II

Implementation of BASEL II would definitely provide benefits. But it requires a lot of monitoring. For this DBL has formed BIU (BASELL II Implementation Unit). BASEL II is basically a framework set forth by Bangladesh Bank to reduce credit risk, operational risk and market risk. This would definitely aid DBL if it is stringently followed.

Threats

Upcoming Banks/Branches

The upcoming private, local, & multinational banks posse’s serious threats to the existing banking network of DBL: it is expected that in the next few years more commercial banks will emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against and win the battle of banks.

Similar products are offered by other banks

Now-a-days different foreign and private banks are also offering similar type of products with an almost similar profit margin. So, if all competitors fight with the same weapon, the natural result is declining profit.

Default Loans

The problem of non-performing loans or default loans is very minimum or insignificant. However, this problem may rise in the future thus; DBL has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem.

Industrial Downturn

Bangladesh is economically and political unstable country. Flood, draught, cyclone, and newly added terrorism have become an identity of our country. Along with inflation, unemployment also creates industry wide recession. These caused downward pressure on the capital demand for investment.

Financial Crisis

Although people have recovered a bit from the shock, it may still pose as a threat. People are still hesitant to take loans or even deposit them.

Dhaka Bank receives CSR Award 2006

Dhaka Bank Limited, one of the leading private commercial banks of the country, has recently received The Corporate Social Responsibility (CSR) Award 2006, for their active participation in the various philanthropic activities. It may be noted that in line with motto of Dhaka Bank Limited towards rendering the best and quality services, Dhaka Bank Foundation was established on November 24, 2002 to act as a solid foundation, which would act as a catalyst in creating awareness on development issues. Managing Director of Dhaka Bank Limited Mr. Shahed Noman receive the award from Dr. Salehuddin Ahamed, Governor, Bangladesh Bank, at a function organized by the Bankers’ Forum at the CIRDAP Auditorium on Saturday April 26, 2008.

Among Dhaka Bank’s contribution towards corporate social responsibility few initiatives may be mentioned like donation to Asiatic Society of Dhaka, Prime Minister’s Relief Fund & Chief Adviser’s Relief Fund to mitigate the sufferings of devastated flood affected people of the country, donated passenger lift to BIRDEM Hospital at a cost of Tk 2.6 million, donated two haemodialysis machines to BIRDEM Hospital at cost of Tk 1.8 million, provided Tk 10 million to Center for Women and Child Health Hospital as donation for setting up pathological laboratory and imaging units, sponsored a 10- bed ward of the proposed Ahsania Mission Cancer & General Hospital by donating Taka 3 million, Installation of Donation Boxes for Ahsania Mission Cancer & General Hospital, Relief Operation for Flood Victims at the cost of Tk 5 Million, Sponsor of Jubo Mela, Support Society for the Welfare of Autistic Children (SWAC), extended support to the Tsunami affected victims of Sri Lanka by donating a cheque of US$ 10,000, renovate the Auditorium of Dhaka Reporters Unity, Donation of Tk 5 Million for Shaheed Ziaur Rahman Shishu Hospital, Bogra, Sponsored Uttara Sporting Club in Premier Division Cricket League and Inter Club Tennis Tournament in Gulshan Club, Sponsor of 6th Bonsai Exhibition & Competition, Financial Assistance for Chaayanaut Cultural Complex, Sponsor of 20th Bangladesh International Junior Tennis Championships, Sponsor of Bangladesh Under 19 Cricket Team, Sponsor of Chittagong Club Cricket Team in Twenty Cup Cricket Tournament in Kolkata, India, Sponsor of Anti Drug Debate Festival, Distribution of Winter Cloths by the Employees, Sponsorship for Bangladesh Eye Hospital, Sponsorship for SHEID Trust, Sponsorship for BADC School, Donation of Tk 1.2 Million to Center for Women & Child Health Hospital per year from 2006, Donation of Tk 1.2 Million to BIRDEM Hospital per year from 2006, Assistance to Educational Trust of Scholastica, Sponsor Dhaka Bank 21st Bangladesh International Junior Tennis Championship, Sponsor 2nd Dhaka Bank Independence Day Inter Club Tennis, Sponsor ICC World Cup Fact Book, Sponsor of Dhaka Bank Victory Day Hockey 2007, Sponsor of 1st Dhaka Bank Cup Golf Tournament 2008, Sponsor of Dhaka Bank Shaheed Smrity Hockey 2008, Sponsor of 22nd Bangladesh International Junior Tennis Championship in 2008 and Sponsor of Dhaka Bank Independence Day Hockey Tournament 2008.

Profit Maximization due to CSR

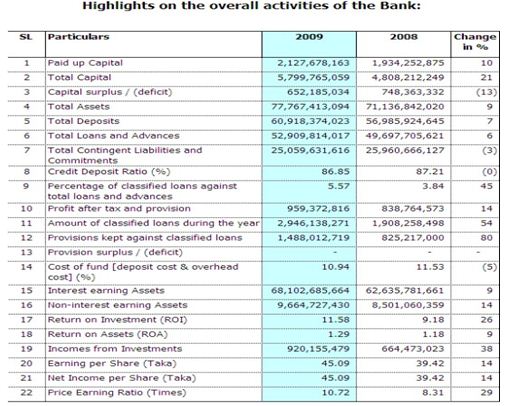

Those organizations that practice CSR more obviously a significant change will be occurred on their profit on that organization. Dhaka Bank’s statement is given below-

From the above statement we have found that in 2008 company’s EPS was 39.42 but in 2009 it is increased in 45.09 because of company’s efficient activities such as effective corporate decision, effective operation, cost minimizing, CSR practicing etc. So we can say in case of profit maximizing there is a significant impact of CSR.

Findings and Recommendations

Findings

After analyzing all the information, the following findings are originated:

- Dhaka Bank has been participating in our society by their CSR activities.

- Dhaka Bank Foundation donated Taka 1.2 Million to BIRDEM.

- Dhaka Bank Foundation donated Taka 1.2 Million to CWCH.

- Dhaka Bank participated in Career Fair

- Dhaka Bank heavily serious for maintaining and representing the Bangladeshi culture (customs, values, belief etc).

- Dhaka Bank arrange different traditional occasion such as shoto borsher Gaan, little poet, making different monument, traditional fair etc.

- Dhaka Bank emphasises on basically public welfare such as donated money for kidney transplant, eye hospital etc.

- Dhaka Bank largely emphasises on social culture and environment.

- Dhaka Bank sometimes taking steps for beautification in our city.

- Dhaka Bank also aranging a concert party in our different occasion.

- Dhaka Bank Presents Umbrella to Bangladesh Police.

- Dhaka Bank employees donate one day’s salary to help flood Victims.

- Dhaka Bank donates Tk 50 Lac to Bangladesh Army Relief Fund.

- Dhaka Bank donates Tk 10 Lac to Prime Minister’s Relief Fund for Cyclone Aila Victim.

- Dhaka Bank welcomes Bangladesh Hockey Team.

- Dhaka Bank maximized their profit due to the CSR activity.

Recommendations

From the analyzing whole assignment we have understand that in modern age for long term survival every company should involve in CSR activities. In where they are operating every company should liable for developing that country’s employment, infrastructure, culture etc. Our selected Bank’s are already involve those activities for long term survival as well as get them free from social liability. To improve Dhaka Bank Corporate Social Responsibility activity the following suggestions are to be followed:

- Dhaka Bank should increase their social activity.

- If Dhaka Bank increases number of employee they can provide more satisfactory service.

- Dhaka Bank should increase the number of PCs with updated hardware and software.

- To create better client the bank should increase the social service activity.

- Whenever people notice that the Dhaka Bank contributes and participate all social welfare activities than people become impress on that Dhaka Bank Ltd. As a result their profit obviously becomes increase because of (high share price, employee loyalty, Govt. favor, social assistant etc).

- Dhaka Bank Limited should participate in our local festivals.

- Dhaka Bank can helps to our government for the development of roads and highways.

- Dhaka Bank should take some necessary steps for the tree plantation.

- Dhaka Bank can setup some primary school in the rural area.

- Dhaka Bank can sponsor in our local festivals.

- Dhaka Bank should providing support and assistance to the poor people who cannot work in the field.

- Dhaka Bank can try keeping our city neat and clean.

- In our areas people sometimes arranging festivals where Dhaka Bank should participate.

- Finally, Dhaka Bank can reducing unemployment problem by their social welfare activities.

Conclusion

In general, it is true that in Bangladesh, the status of labor rights practices, environmental management and transparency in corporate governance are not satisfactory, largely due to poor enforcement of existing laws and inadequate pressure from civil society and interest groups like Consumer Forums. Globally, as CSR practices are gradually being integrated into international business practices and hence is becoming one of the determining factors for market accesses, it is becoming equally instrumental for local acceptability. A focus on CSR in Bangladesh would be useful, not only for improving corporate governance, labor rights, work place safety, fair treatment of workers, community development and environment management, but also for industrialization and ensuring global market access. Since, CSR entails working with stakeholders it is important to work from within and diagnose the stakeholders; concerns so that CSR is truly embedded in the companies. By now, many CSR dimensions are practiced in Bangladesh. Because of global competitiveness and demand, the CSR practices and standards are being implemented in Bangladesh. But we are yet go a long way. There are challenges to implement CSR properly in Bangladesh. Ultimately CSR practices should be better practiced in Bangladesh for better and enhanced performance.