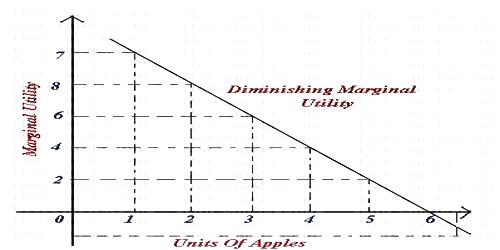

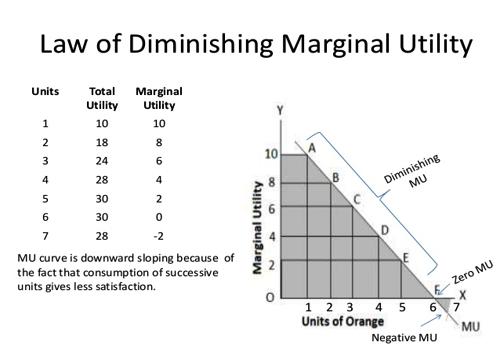

Concept of the Law of Diminishing Marginal Utility

The marginal utility of a commodity diminishes at the consumer gets larger quantities of it. Marginal utility is the change in the total utility resulting from one unit change in the consumption of a commodity per unit of time.

This law was first developed by a German economist Hermann Heinrich Gossen. This law is also known as the first law of Gosse. The law of diminishing marginal utility states that the marginal utility derived from the consumption of every additional unit goes on diminishing, other thing remaining the same. Therefore, the first unit of consumption for any product is typically highest, with every unit of consumption to follow holding less and less utility. Consumers handle the law of diminishing marginal utility by consuming numerous quantities of numerous goods.

The law of diminishing marginal utility is comprehensively explained by Alfred Marshall. According to his definition of the law of diminishing marginal utility, the following happens:

“During the course of consumption, as more and more units of a commodity are used, every successive unit gives utility with a diminishing rate, provided other things remaining the same; although, the total utility increases.”

The law of diminishing marginal utility is based on two important facts :

- Though human wants are unlimited, each single want is satiable.

- Commodities are not perfect substitute for each other

The law of diminishing marginal utility is based upon three facts. First, total wants of a man are unlimited but each single want can be satisfied. As a man gets more and more units of a commodity, the desire of his for that good goes on falling. A point is reached when the consumer no longer wants any more units of that good. Secondly, different goods are not perfect substitutes for each other in the satisfaction of various particular wants. As such the marginal utility will decline as the consumer gets additional units of a specific good. Thirdly, the marginal utility of money is constant given the consumer’s wealth.

The basis of this law is a fundamental feature of wants. It states that when people go to the market for the purchase of commodities, they do not attach equal importance to all the commodities which they buy. In case of some of commodities, they are willing to pay more and in some less. There are two main reasons for this difference in demand. (1) the linking of the consumer for the commodity and (2) the quantity of the commodity which the consumer has with himself. The more one has of a thing, the less he wants the additional units of it. In other words, the marginal utility of a commodity diminishing as the consumer gets larger quantities of it. This, in brief, is the axiom of law of diminishing marginal utility.

Therefore, as a consumer consumes more and more units of a commodity, intensity of his/her want for the commodity goes on falling and reaches a point where a consumer do not want any more units of the commodity. That is, when saturation point is reached marginal utility of a commodity becomes zero. Thus, as the amount of consumption of a commodity increases, marginal utility decreases. The second fact is that the different commodities are not perfect substitutes for each other. Hence, when an individual consumes more and more units of a commodity, the intensity of his particular want for the commodity diminishes.

Importance of the Law of Diminishing Marginal Utility:

The importance or the role of the law of diminishing marginal utility is as follows:

- By purchasing more of a commodity the marginal utility decreases. Due to this behaviour, the consumer cuts his expenditures to that commodity.

- In the field of public finance, this law has a practical application, imposing a heavier burden on the rich people.

- This law is the base of some other economic laws such as law of demand, elasticity of demand, consumer surplus and the law of substitution etc.

- The value of commodity falls by increasing the supply of a commodity. It forms a basis of the theory of value. In this way prices are determined.

Information Source;