Introductory

These accounts are the basis of our accounting system, keeping monthly totals of income, costs, expenses, assets, and liabilities. The balances that appear on income statements, balance sheets, trial balances, and other financials are based on the account totals in the COA.

The Clients & Profits X chart of accounts is completely customizable. We can have as few or as many accounts as us need (there’s no real limit to the quantity of accounts). Each account has an account number, classification, sub-class, and categories for cash flow and ratio reports. Separate accounts can be set up for different profit centers and departments. Every account keeps real-time running balances for up to 24 accounting periods.

Budget amounts can be quickly set up for any or all accounts and periods using last year’s totals. Account totals can roll up into other accounts. The accounts are set up with the rollup information in the Chart of Accounts. Choose the Rollup option when printing financials to rollup, or hide, the account totals in the designated account. Accounts can also be made confidential. Confidential accounts work like regular accounts, but can’t be used by non-managers.

Overview of AIS

Unlike many other accounting subjects, such as intermediate accounting, accounting information systems (AIS) lacks a well-defined body of knowledge. Much controversy exists among college faculty as to what should and should not be covered in the AIS course. To some extent, however, the controversy is being resolved through recent legislation. The Sarbanes-Oxley Act (SOX) of 2002 established new corporate governance regulations and standards for public companies registered with the Securities and Exchange Commission (SEC). This wide-sweeping legislation impacts public companies, their management, and their auditors. Of particular importance to AIS students is SOX’s impact on internal control standards and related auditing procedures. Whereas SOX does not define the entire content of the AIS course, it does identify critical areas of study for accountants that need to be included in it.

Begin the study of AIS with the recognition that information is a business resource. Like the other business resources of raw materials, capital, and labor, information is vital to the survival of the contemporary business organization. Every business day, vast quantities of information flow to decision makers and other users to meet a variety of internal needs. In addition, information flows out from the organization to external users, such as customers, suppliers, and stakeholders who have an interest in the firm. An overview of these internal and external information flows. The business organization divided horizontally into several levels of activity. Business operations from the base of the pyramid.

These activities consist of the product-oriented work of the organization, such as manufacturing, sales, and distribution. Above the base level, the organization is divided into three management tiers: operations management, middle management, and top management. Operations management is directly responsible for controlling day-to-day operations. Middle management is accountable for the short-term planning and coordination of activities necessary to accomplish organizational objectives. Top management is responsible for longer-term planning and setting organizational objectives. Every individual in the organization, from business operations to top management, needs information to accomplish his or her tasks.

Company profile

Company Name : Coca-Cola Beverage Shop.

Shop location : Bashundhara

Product : Only Coca cola

Strategy : Commercial production.

Status : Partnership Business.

Business Line : Producing & exporting

Number of Partner : Three.

Authorized Capital : Tk.10000000000cores

Initial Investment : Tk.500000000cores

Company’s mission

The world is changing all around us. To continue to thrive as a business over the next ten years and beyond, we must look ahead, understand the trends and forces that will shape the business in the future and move swiftly to prepare for what’s to come. We must get ready for tomorrow today. That’s what our 2020 Vision is all about. It creates a long-term destination for our business and provides us with a “Roadmap” for winning together with our bottling partners.

Mission

Roadmap starts with the mission, which is enduring. It declares the purpose as a company and serves as the standard against which we weigh the actions and decisions.

- To refresh the world.

- To inspire moments of optimism and happiness.

To create value and make a difference.

Company’s vision

Vision

Vision serves as the framework for our Roadmap and guides every aspect of the business by describing what we need to accomplish in order to continue achieving sustainable, quality growth.

- People: Be a great place to work where people are inspired to be the best they can be.

- Portfolio: Bring to the world a portfolio of quality beverage brands that anticipate and satisfy people’s desires and needs.

- Partners: Nurture a winning network of customers and suppliers, together we create mutual, enduring value.

- Planet: Be a responsible citizen that makes a difference by helping build and support sustainable communities.

- Profit: Maximize long-term return to shareowners while being mindful of our overall responsibilities.

Productivity: Be a highly effective, lean and fast-moving organization

Winning Culture

Winning Culture defines the attitudes and behaviors that will be required of us to make the 2020 Vision a reality.

Company’s values

Values

values serve as a compass for our actions and describe how we behave in the world.

- Leadership: The courage to shape a better future

- Collaboration: Leverage collective genius

- Integrity: Be real

- Accountability: If it is to be, it’s up to me

- Passion: Committed in heart and mind

- Diversity: As inclusive as our brands

- Quality: What we do, we do wellon the Market

Focus

- Focus on needs of our consumers, customers and franchise partners

- Get out into the market and listen, observe and learn

- Possess a world view

- Focus on execution in the marketplace every day

- Be insatiably curiousWork Smart

- Act with urgency

- Remain responsive to change

- Have the courage to change course when needed

- Remain constructively discontent

- Work efficientlyAct Like Owners

- Be accountable for our actions and inactions

- Steward system assets and focus on building value

- Reward our people for taking risks and finding better ways to solve problems

- Learn from our outcomes — what worked and what didn’tBe the Brand

Inspire creativity, passion, optimism and fun

Accountants as Users

In most organizations, the accounting function is the single largest user of IT. All systems that process financial transactions impact the accounting function in some way. As end users, accountants must provide a clear picture of their needs to the professionals who design their systems. For example, the accountant must specify accounting rules and techniques to be used, internal control requirements, and special algorithms such as depreciation models. The accountant’s participation in systems development should be active rather than passive. The principal cause of design errors that result in system failure is the absence of user involvement.

Managerial Aspect

Management Aspect: (Journal) In this part described about a company’s regular transactions. According to the all the most common financial transactions are economic exchanges with external parties. These include the sale of goods or services, the purchase of inventory, the discharge of financial obligations, and the receipt of cash on account from customers. Financial transactions also include certain internal events such as the depreciation of fixed assets, the application of labor, raw materials, and overhead to the production process; and the transfer of inventory from one department to another. Financial transactions are common business events that occur regularly.

For instance, thousands of transactions of a particular type (sales to customers) may occur daily. To deal efficiently with such volume, business firms group similar types of transactions into transaction cycles. These transactions are recorded as first in the journal book of an organization. That is must identify by the accounting information system Transactions to record, Capture all details, Properly process into correct accounts, and Provide reports externally and internally.

Management Aspect: (Cash book) Larger firms usually divide the cash book into two parts. The first part is the cash disbursement journal that records all cash payments, such as accounts payable and operating expenses. The second part is the cash receipts journal, which records all cash receipts, such as accounts receivable and cash sales.

A financial journal that contains all cash receipts and payments, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger. The cash book is periodically reconciled with the bank statements as an internal method of auditing.

Cashbook is a famous mobile phone app which helps us tracking our daily expenses anywhere and anytime. If we go out for a business trip and need a quick and handy way to write down all our expenses in order to get reimbursement later on or tax deductions, Cashbook in Android is the perfect tool for us. If we’d like to keep tracking our incomes, daily expenses and monthly balance sheet, we can easily do it anywhere and anytime with Cashbook on Android phone.

- Income and Expense Category: User can add, delete, rename income and expense categories. User defined categories will be saved in database for future use.

- Payer and Payee: User can add, delete, and rename payer and payee information. User defined payer and payee will be saved in database for future use.

- Database backup and restore: User can backup database to SD card. Also, user can restore database from the saved backup in SD card.

- Export database in CSV (for Microsoft Excel) or QIF (for Quicken) format: User can export database to SD card in CSV or QIF format which can be open in Microsoft Excel or any other text file editor. In this feature, user has four ways to specify the records in certain date range:

- All Date

- Within Start and End Date

- After Specific Date

- After Last Export Date

- Today

- This Month

- This Year

Email database in CSV (for Microsoft Excel) or QIF (for Quicken) format: User can send database CSV or QIF file by email attachment. In this feature, user has four ways to specify the records in certain date range:

- All Date

- Within Start and End Date

- After Specific Date

- After Last Export Date

- Today

- This Month

- This Year

- Auto Check Upgrade: User can turn on or off the feature of automatically checking whether there is a newer version of software available in Android Market.

- User Assistance: User can turn on or off the automatic tips on how to use Cashbook

Icon Notification: User can turn on or off the feature of using icon notification when Cashbook is running.

- Use Splash Screen: User can turn on or off the feature to start the program with splash screen.

- Mileage Tracker: It is a perfect solution for tracking vehicle mileage for IRS/expense purpose.

Management Aspect: (Ledger) The general ledger is a collection of the firm’s accounts. While the general journal is organized as a chronological record of transactions, the ledger is organized by account. In casual use the accounts of the general ledger often take the form of simple two-column T-accounts. In the formal records of the company they may contain a third or fourth column to display the account balance after each posting.

Note the direct mapping between the journal entries and the ledger postings. While this posting of journalized transactions in the general ledger at first may appear to be redundant since the transactions already are recorded in the general journal, the general ledger serves an important function: it allows one to view the activity and balance of each account at a glance. Because the posting to the ledger is simply a rearrangement of information requiring no additional decisions, it easily is performed by accounting software, either when the journal entry is made or as a batch process, for example, at the end of the day or week.

Finally, while such T-accounts are handy for informal use, in practice a three-column or four-column account may be used to show the running account balance, and in the case of a four column account, whether that balance is a net debit or credit. Additionally, reference numbers may be used so that each posting can be traced back to its original journal entry.

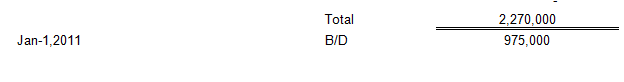

Management Aspect: (Bank book) Larger firms usually divide the bank book into two parts. The first part is the equity based journal that records, such as Capital. The second part is the cash payments journal, which records, such as accounts payable and Insurance policy.

A financial journal that contains all cash receipts and payments, including bank deposits and withdrawals. Entries in the bank book are then posted into the general ledger. The bank book is periodically reconciled with the bank statements as an internal method of auditing.

Bank book is a famous excels application which helps us tracking our daily expenses anywhere and anytime. If we go out for a business trip and need a quick and handy way to write down all our expenses in order to get reimbursement later on or tax deductions, Bank book in Android is the perfect tool for us. If we’d like to keep tracking our incomes, daily expenses and monthly balance sheet, we can easily do it anywhere and anytime with Bank book on Android phone.

Management Aspect: (Trial Balance) trial balance is the equal balance part for the accounting process. An accountant should provide a balanced trial balance result to made a next step of preparing income statement of an organization and as well as the balance sheet of an organization. Based on that all revenue and expenditures are included for calculating this part. The source of information is the relievable for all transactions collected from ledger that ready to disclose the financial information for the both external and internal purposes. All tracked of transactions posted into two different sides. One side is debit items and another side is called credit items side. It actually prepared for monthly, quarterly and common in yearly.

Management Aspect: (Income Statement) Income Statement is the set of all incomes and expenditures. That means all revenues and expenses these are incurred for maintaining the business operations are given in the income statement to find out the excess of income over expenditure or excess of expenditure over the income. It actually prepared for monthly, quarterly and common in yearly. The all period it would be better that the balance of excess of income over expenditure for any company. From this stage the only result forwarded the next stage the preparing of Balance Sheet. Through this account this item going to next year or period. It shown in the Balance Sheet under the retained earnings on stockholders equity.

Management Aspect: A (Retained earnings) Retained earnings is the increasing balance part for the accounting process. An accountant should provide a balanced Retained earnings result to made a next step of preparing Balance Sheet of an organization and as well as the new Retained earnings of an organization. Based on the result of income statement that account is included for calculating this part.

The source of information is the relievable for all transactions collected from income statement and previous year balance sheet that ready to disclose the financial information for the both external and internal purposes. All tracked of transactions posted into two different sides. One side is beginning retained earnings and another side is called ending retained earnings side. It actually prepared for monthly, quarterly and common in yearly.

Management Aspect: (Balance Sheet) balance sheet is the financial feeling hart of an organization. This part is completed with the two systems. Like one British process and or American process. Both processes have two different sides. One is called assets side and another side is called liabilities and owner’s equity/ stockholders equity. Companies are all current assets and as well as fixed assets are recorded under the assets column, such as cash deposit, inventory, land, buildings etc. On the other hand all the company’s liability and equity recorded under the liabilities and owner’s equity/ stockholders equity column, such as accounts payable, common stock, retained earnings etc.

Findings

Coca-Cola Beverage Shop | ||||||

General Journal | ||||||

| Date | Code | Voucher No | Particulars | Ref: | Debit | Credit |

| Jan. 1, 2010 | A1000 | D0F 101 | Cash | 1,500,000 | ||

| A2000 | Bank | 500,000 | ||||

| S1000 | Capital | 2,000,000 | ||||

| (Starting business with cash & bank) | ||||||

| Jan. 3, 2010 | I14000 | D0F 105 | Prepaid office rent | 60,000 | ||

| A1000 | Cash | 60,000 | ||||

| (Office rent paid in Advance) | ||||||

| Jan. 5, 2010 | A9000 | D0F 108 | Machineries | 300,000 | ||

| A1000 | Cash | 200,000 | ||||

| L1000 | A/C payable | 100,000 | ||||

| (machine purchase with cash and credit) | ||||||

| Jan. 9, 2010 | I3000 | D0F 110 | Raw materials | 200,000 | ||

| L1000 | A/C payable | 200,000 | ||||

| (raw materials purchase on credit) | ||||||

| Jan. 10, 2010 | I8000 | D0F 115 | Advertisement | 10,000 | ||

| A1000 | Cash | 10,000 | ||||

| (advertisement paid by cash) | ||||||

| Jan. 11, 2010 | A6000 | D0F 117 | Furniture | 150,000 | ||

| A1000 | Cash | 150,000 | ||||

| (furniture purchased by cash) | ||||||

| Jan. 15, 2010 | I6000 | D0F 127 | Office supply | 55,000 | ||

| A2000 | Bank | 55,000 | ||||

| (office supply purchased with check) | ||||||

| Jan. 23, 2010 | D0F 132 | Insurance policy | 100,000 | |||

| A1000 | Cash | 50,000 | ||||

| A2000 | Bank | 50,000 | ||||

| (Insurance paid by cash & bank) | ||||||

| Jan. 31, 2010 | I7000 | D0F 139 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Feb. 3, 2010 | A4000 | D0F 145 | Inventory | 30,000 | ||

| A2000 | Bank | 30,000 | ||||

| (Inventory purchased by check) | ||||||

| Feb. 10, 2010 | I5000 | D0F 151 | Salary | 25,000 | ||

| A1000 | Cash | 25,000 | ||||

| (Salary paid by cash) | ||||||

| Feb.15, 2010 | A1000 | D0F 159 | Cash | 200,000 | ||

| A3000 | A/C receivable | 50,000 | ||||

| I1000 | Sale | 250,000 | ||||

| (sales by cash and account) | ||||||

| Feb.25, 2010 | L1000 | D0F 167 | A/C payable | 100,000 | ||

| A1000 | Cash | 100,000 | ||||

| Adjusting transaction) | ||||||

| Feb.28, 2010 | I4000 | D0F 173 | Wage | 10,000 | ||

| A1000 | Cash | 10,000 | ||||

| (wage paid by cash) | ||||||

| Feb.28, 2010 | I7000 | D0F 180 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Mar. 10, 2010 | I5000 | D0F 188 | Salary | 25,000 | ||

| A1000 | Cash | 25,000 | ||||

| (salary paid by cash) | ||||||

| Mar. 15, 2010 | A7000 | D0F 197 | Computer | 30,000 | ||

| A1000 | Cash | 30,000 | ||||

| (computer purchased by cash) | ||||||

| Mar. 27, 2010 | A1000 | D0F 208 | Cash | 320,000 | ||

| A3000 | A/C receivable | 80,000 | ||||

| I1000 | Sales | 400,000 |

| (sales by cash and account) | ||||||

| Mar. 31, 2010 | I7000 | D0F 214 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Apr. 5, 2010 | I6000 | D0F 221 | Office supply | 15,000 | ||

| L1000 | A/C payable | 15,000 | ||||

| (O/S purchased by credit) | ||||||

| Apr. 10, 2010 | I5000 | D0F 229 | Salary | 25,000 | ||

| A1000 | Cash | 25,000 | ||||

| (Salary paid by cash) | ||||||

| Apr. 25, 2010 | L1000 | D0F 236 | A/C payable | 100,000 | ||

| A2000 | Bank | 100,000 | ||||

| Adjusting transaction) | ||||||

| Apr. 30, 2010 | I7000 | D0F 241 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| May. 1, 2010 | A8000 | D0F 249 | Delivery truck | 150,000 | ||

| L1000 | A/C payable | 100,000 | ||||

| A1000 | Cash | 50,000 | ||||

| (truck purchased with cash & account) | ||||||

| May. 9, 2010 | I5000 | D0F 257 | Salary | 25,000 | ||

| A1000 | Cash | 25,000 | ||||

| (Salary paid by cash) | ||||||

| May. 31, 2010 | I7000 | D0F 264 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| June. 8, 2010 | A1000 | D0F 272 | Cash | 50,000 | ||

| A3000 | A/C receivable | 50,000 | ||||

| (adjustment entry) | ||||||

| June. 10, 2010 | I5000 | D0F 279 | Salary | 25,000 | ||

| A1000 | Cash | 25,000 | ||||

| (Salary paid by cash) |

| June. 30, 2010 | I7000 | D0F 284 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| July. 3, 2010 | I14000 | D0F 292 | Prepaid office rent | 60,000 | ||

| A1000 | Cash | 60,000 | ||||

| (Office rent paid in Advance) | ||||||

| July. 9, 2010 | I5000 | D0F 305 | Salary | 35,000 | ||

| A1000 | Cash | 35,000 | ||||

| (Salary paid by cash) | ||||||

| July. 20, 2010 | A3000 | D0F 314 | A/C receivable | 300,000 | ||

| I1000 | Sale | 300,000 | ||||

| (sales on account) | ||||||

| July. 31, 2010 | I7000 | D0F 323 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Aug. 8, 2010 | I5000 | D0F 331 | Salary | 35,000 | ||

| A1000 | Cash | 35,000 | ||||

| (Salary paid by cash) | ||||||

| Aug. 25, 2010 | S1000 | D0F 339 | Capital | 50,000 | ||

| A1000 | Withdraw/ Cash | 50,000 | ||||

| (withdraw from the capital) | ||||||

| Aug. 31, 2010 | I7000 | D0F 345 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Sep. 5, 2010 | I3000 | D0F 356 | Raw materials | 100,000 | ||

| A2000 | Bank | 100,000 | ||||

| (raw materials purchase with check) | ||||||

| Sep. 6, 2010 | I9000 | D0F 362 | Transportation | 10,000 | ||

| A1000 | Cash | 10,000 | ||||

| (transportation cost paid by cash) |

| Sep. 10, 2010 | I5000 | D0F 369 | Salary | 35,000 | ||

| A1000 | Cash | 35,000 | ||||

| (Salary paid by cash) | ||||||

| Sep. 30, 2010 | I7000 | D0F 378 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Oct. 2, 2010 | I10000 | D0F 389 | Machinery maintenance | 20,000 | ||

| A2000 | Bank | 20,000 | ||||

| (machinery maintenance paid by check) | ||||||

| Oct. 10, 2010 | A8000 | DOF 395 | Delivery truck | 35,000 | ||

| A1000 | Cash | 35,000 | ||||

| (Salary paid by cash) | ||||||

| Oct. 31, 2010 | I7000 | DOF399 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Nov. 8, 2010 | I5000 | DOF 406 | Salary | 35,000 | ||

| A1000 | Cash | 35,000 | ||||

| (Salary paid by cash) | ||||||

| Nov. 21, 2010 | A1000 | DOF 409 | Cash | 200,000 | ||

| A3000 | A/C receivable | 150,000 | ||||

| I1000 | Sale | 350,000 | ||||

| (sales on account, bank & cash) | ||||||

| Nov. 30, 2010 | I7000 | DOF 414 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Dec. 1, 2010 | I12000 | DOF 423 | Tax | 80,000 | ||

| A1000 | Cash | 80,000 | ||||

| (tax paid by cash) | ||||||

| Dec. 5, 2010 | I5000 | DOF 431 | Salary | 35,000 | ||

| A1000 | Cash | 35,000 | ||||

| (Salary paid by cash) | ||||||

| Dec. 20, 2010 | I13000 | DOF 447 | Profit distribution | 100,000 | ||

| A1000 | Cash | 100,000 | ||||

| (profit distributed by cash) | ||||||

| Dec. 31, 2010 | I7000 | DOF 452 | Office rent | 10,000 | ||

| I14000 | Prepaid office rent | 10,000 | ||||

| (adjusting transaction) | ||||||

| Dec. 31, 2010 | I5000 | DOF 466 | Salary | 35,000 | ||

| L1000 | A/C payable | 35,000 | ||||

| (salary is not paid yet) | ||||||

| Total | 5,570,000 | 5,570,000 |

Coca-Cola Beverage Shop |

Cash Book |

For the year ending December 31, 2010 |

Date | Code | Voucher No | Particulars | Credit |

3-Jan | I14000 | D0F 105 | prepaid office rent | 60,000 |

5-Jan | A9000 | D0F 108 | machinery | 200,000 |

10-Jan | I8000 | D0F 115 | Advertisement | 10,000 |

11-Jan | A6000 | D0F 117 | Furniture | 150,000 |

23-Jan | A5000 | D0F 132 | Insurance policy | 50,000 |

10-Feb | I5000 | D0F 151 | Salary | 25,000 |

25-Feb | L1000 | D0F 167 | A/C payable | 100,000 |

28-Feb | I4000 | D0F 173 | Wage | 10,000 |

10-Mar | I5000 | D0F 188 | Salary | 25,000 |

15-Mar | A7000 | D0F 197 | Computer | 30,000 |

10-Apr | I5000 | D0F 229 | Salary | 25,000 |

1-May | A8000 | D0F 249 | Delivery truck | 50,000 |

9-May | I5000 | D0F 257 | Salary | 25,000 |

10-Jun | I5000 | D0F 279 | Salary | 25,000 |

3-Jul | I14000 | D0F 292 | prepaid office rent | 60,000 |

9-Jul | I5000 | D0F 305 | Salary | 35,000 |

8-Aug | I5000 | D0F 331 | Salary | 35,000 |

25-Aug | S1000 | D0F 339 | Capital | 50,000 |

6-Sep | I9000 | D0F 362 | Transportation | 10,000 |

10-Sep | I5000 | D0F 369 | Salary | 35,000 |

10-Oct | I5000 | DOF 395 | Salary | 35,000 |

8-Nov | I5000 | DOF 406 | Salary | 35,000 |

1-Dec | I12000 | DOF 423 | Tax | 80,000 |

5-Dec | I5000 | DOF 431 | Salary | 35,000 |

20-Dec | I13000 | DOF 447 | Profit distribution | 100,000 |

31-Dec | C/B | 975,000 | ||

| Total | 2,270,000 | |||

Date | Code | Voucher No | Particulars | Credit |

15-Jan | I6000 | D0F 127 | Office supply | 55,000 |

23-Jan | A5000 | D0F 132 | Insurance policy | 50,000 |

3-Feb | A4000 | D0F 145 | Inventory | 30,000 |

25-Apr | L1000 | D0F 236 | A/C payable | 100,000 |

5-Sep | I3000 | D0F 356 | Raw materials | 100,000 |

2-Oct | I10000 | D0F 389 | machinery maintenance | 20,000 |

31-Dec | C/B | 145,000 | ||

| Total | 500,000 |

Coca-Cola Beverage Shop | |||

Trial Balance | |||

For the year ending December 31, 2010 | |||

| Code | Particulars | Debit | Credit |

| A1000 | Cash | 975,000 | – |

| A2000 | Bank | 145,000 | – |

| I1000 | Revenues/sales | – | 1,300,000 |

| A3000 | Accounts receivable | 530,000 | |

| A4000 | Inventory | 30,000 | – |

| I3000 | Raw materials | 300,000 | – |

| I6000 | Office supply | 70,000 | – |

| I7000 | Office rent | 120,000 | – |

| A5000 | Insurance policy | 100,000 | – |

| I8000 | Advertisement | 10,000 | |

| A6000 | Furniture | 150,000 | – |

| I4000 | Wage | 10,000 | – |

| I5000 | Salary | 370,000 | – |

| I9000 | Transportation | 10,000 | – |

| I10000 | Machinery maintenance | 20,000 | – |

| A7000 | Computer | 30,000 | – |

| A8000 | Delivery truck | 150,000 | |

| A9000 | Machinery | 300,000 | |

| I12000 | Tax | 80,000 | |

| S1000 | Capital Stock | 1,950,000 | |

| L1000 | Accounts Payable | 250,000 | |

| I13000 | Profit distribution | 100,000 | |

| Total | 3,500,000 | 3,500,000 | |

Cash | |||||||

Date | Code | V. No | Type | OB | Dr. | Cr. | CB |

| Cash | |||||||

1-Jan-10 | A1000 | D0F 101 | Cash | – | 1,500,000 | – | 1,500,000 |

3-Jan-10 | A1000 | D0F 105 | Cash | – | – | 60,000 | 1,440,000 |

5-Jan-10 | A1000 | D0F 108 | Cash | – | – | 200,000 | 1,240,000 |

10-Jan-10 | A1000 | D0F 115 | Cash | – | – | 10,000 | 1,230,000 |

11-Jan-10 | A1000 | D0F 117 | Cash | – | – | 150,000 | 1,080,000 |

23-Jan-10 | A1000 | D0F 132 | Cash | – | – | 50,000 | 1,030,000 |

10-Feb-10 | A1000 | D0F 151 | Cash | 1,030,000 | – | 25,000 | 1,005,000 |

15-Feb-10 | A1000 | D0F 159 | Cash | – | 200,000 | – | 1,205,000 |

25-Feb-10 | A1000 | D0F 167 | Cash | – | – | 100,000 | 1,105,000 |

28-Feb-10 | A1000 | D0F 173 | Cash | – | – | 10,000 | 1,095,000 |

10-Mar-10 | A1000 | D0F 188 | Cash | 1,095,000 | – | 25,000 | 1,070,000 |

15-Mar-10 | A1000 | D0F 197 | Cash | – | – | 30,000 | 1,040,000 |

27-Mar-10 | A1000 | D0F 208 | Cash | – | 320,000 | – | 1,360,000 |

10-Apr-10 | A1000 | D0F 229 | Cash | 1,360,000 | – | 25,000 | 1,335,000 |

1-May-10 | A1000 | D0F 249 | Cash | 1,335,000 | – | 50,000 | 1,285,000 |

9-May-10 | A1000 | D0F 257 | Cash | – | – | 25,000 | 1,260,000 |

8-Jun-10 | A1000 | D0F 272 | Cash | 1,260,000 | 50,000 | – | 1,310,000 |

10-Jun-10 | A1000 | D0F 279 | Cash | – | – | 25,000 | 1,285,000 |

3-Jul-10 | A1000 | D0F 292 | Cash | 1,285,000 | – | 60,000 | 1,225,000 |

9-Jul-10 | A1000 | D0F 305 | Cash | – | – | 35,000 | 1,190,000 |

8-Aug-10 | A1000 | D0F 331 | Cash | 1,190,000 | – | 35,000 | 1,155,000 |

25-Aug-10 | A1000 | D0F 339 | Cash | – | – | 50,000 | 1,105,000 |

6-Sep-10 | A1000 | D0F 362 | Cash | 1,105,000 | – | 10,000 | 1,095,000 |

10-Sep-10 | A1000 | D0F 369 | Cash | – | – | 35,000 | 1,060,000 |

10-Oct-10 | A1000 | DOF 395 | Cash | 1,060,000 | – | 35,000 | 1,025,000 |

8-Nov-10 | A1000 | DOF 406 | Cash | 1,025,000 | – | 35,000 | 990,000 |

21-Nov-10 | A1000 | DOF 409 | Cash | – | 200,000 | – | 1,190,000 |

1-Dec-10 | A1000 | DOF 423 | Cash | 1,190,000 | – | 80,000 | 1,110,000 |

5-Dec-10 | A1000 | DOF 431 | Cash | – | – | 35,000 | 1,075,000 |

20-Dec-10 | A1000 | DOF 447 | Cash | – | – | 100,000 | 975,000 |

Bank | |||||||

1-Jan-10 | A2000 | D0F 101 | Bank | – | 500,000 | – | 500,000 |

15-Jan-10 | A2000 | D0F 127 | Bank | – | – | 55,000 | 445,000 |

23-Jan-10 | A2000 | D0F 132 | Bank | – | – | 50,000 | 395,000 |

3-Feb-10 | A2000 | D0F 145 | Bank | 395,000 | – | 30,000 | 365,000 |

25-Apr-10 | A2000 | D0F 236 | Bank | 365,000 | – | 100,000 | 265,000 |

5-Sep-10 | A2000 | D0F 356 | Bank | 265,000 | – | 100,000 | 165,000 |

2-Oct-10 | A2000 | D0F 389 | Bank | 165,000 | – | 20,000 | 145,000 |

Capital | |||||||

1-Jan-10 | S1000 | D0F 101 | CAP | – | – | 2,000,000 | -2,000,000 |

25-Aug-10 | S1000 | D0F 339 | CAP | 2,000,000 | 50,000 | – | -1,950,000 |

Prepaid office rent | |||||||

3-Jan-10 | I14000 | D0F 105 | POR | – | 60,000 | – | 60,000 |

31-Jan-10 | I14000 | D0F 139 | POR | – | – | 10,000 | 50,000 |

28-Feb-10 | I14000 | D0F 180 | POR | 50,000 | – | 10,000 | 40,000 |

31-Mar-10 | I14000 | D0F 214 | POR | 40,000 | – | 10,000 | 30,000 |

30-Apr-10 | I14000 | D0F 241 | POR | 30,000 | – | 10,000 | 20,000 |

31-May-10 | I14000 | D0F 264 | POR | 20,000 | – | 10,000 | 10,000 |

30-Jun-10 | I14000 | D0F 284 | POR | 10,000 | – | 10,000 | – |

3-Jul-10 | I14000 | D0F 292 | POR | – | 60,000 | – | 60,000 |

31-Jul-10 | I14000 | D0F 323 | POR | 60,000 | – | 10,000 | 50,000 |

31-Aug-20 | I14000 | D0F 345 | POR | 50,000 | – | 10,000 | 40,000 |

30-Sep-10 | I14000 | D0F 378 | POR | 40,000 | – | 10,000 | 30,000 |

31-Oct-10 | I14000 | DOF399 | POR | 30,000 | – | 10,000 | 20,000 |

30-Nov-10 | I14000 | DOF 414 | POR | 20,000 | – | 10,000 | 10,000 |

31-Dec-10 | I14000 | DOF 452 | POR | 10,000 | – | 10,000 | – |

Machinery | |||||||

5-Jan-10 | A9000 | D0F 108 | MRY | – | 300,000 | – | 300,000 |

A/C payable | |||||||

5-Jan-10 | L1000 | D0F 108 | ACP | – | – | 100,000 | -100,000 |

9-Jan-10 | L1000 | D0F 110 | ACP | – | – | 200,000 | -300,000 |

25-Feb-10 | L1000 | D0F 167 | ACP | 300,000 | 100,000 | – | -200,000 |

5-Apr-10 | L1000 | D0F 221 | ACP | 200,000 | – | 15,000 | -215,000 |

25-Apr-10 | L1000 | D0F 236 | ACP | – | 100,000 | – | -115,000 |

1-May-10 | L1000 | D0F 249 | ACP | 115,000 | – | 100,000 | -215,000 |

31-Dec-10 | L1000 | DOF 466 | ACP | 215,000 | – | 35,000 | -250,000 |

Raw materials | |||||||

9-Jan-10 | I3000 | D0F 110 | RM | – | 200,000 | – | 200,000 |

5-Sep-10 | I3000 | D0F 356 | RM | 200,000 | 100,000 | – | 300,000 |

Advertisement | |||||||

10-Jan-10 | I8000 | D0F 115 | ADD | – | 10,000 | – | 10,000 |

Furniture | |||||||

11-Jan-10 | A6000 | D0F 117 | FUR | – | 150,000 | – | 150,000 |

Office supply | |||||||

15-Jan-10 | I6000 | D0F 127 | OS | – | 55,000 | – | 55,000 |

5-Apr-10 | I6000 | D0F 221 | OS | 55,000 | 15,000 | – | 70,000 |

Insurance policy | |||||||

23-Jan-10 | A5000 | D0F 132 | ISP | – | 100,000 | – | 100,000 |

A/C receivable | |||||||

15-Feb-10 | A3000 | D0F 159 | ACR | – | 50,000 | – | 50,000 |

27-Mar-10 | A3000 | D0F 208 | ACR | 50,000 | 80,000 | – | 130,000 |

8-Jun-10 | A3000 | D0F 272 | ACR | 130,000 | – | 50,000 | 80,000 |

20-Jul-10 | A3000 | D0F 314 | ACR | 80,000 | 300,000 | – | 380,000 |

21-Nov-10 | A3000 | DOF 409 | ACR | 380,000 | 150,000 | – | 530,000 |

Office Rent | |||||||

31-Jan-10 | I7000 | D0F 139 | OFR | – | 10,000 | – | 10,000 |

28-Feb-10 | I7000 | D0F 180 | OFR | 10,000 | 10,000 | – | 20,000 |

31-Mar-10 | I7000 | D0F 214 | OFR | 20,000 | 10,000 | – | 30,000 |

30-Apr-10 | I7000 | D0F 241 | OFR | 30,000 | 10,000 | – | 40,000 |

31-May-10 | I7000 | D0F 264 | OFR | 40,000 | 10,000 | – | 50,000 |

30-Jun-10 | I7000 | D0F 284 | OFR | 50,000 | 10,000 | – | 60,000 |

31-Jul-10 | I7000 | D0F 323 | OFR | 60,000 | 10,000 | – | 70,000 |

31-Aug-10 | I7000 | D0F 345 | OFR | 70,000 | 10,000 | – | 80,000 |

30-Sep-10 | I7000 | D0F 378 | OFR | 80,000 | 10,000 | – | 90,000 |

31-Oct-10 | I7000 | DOF399 | OFR | 90,000 | 10,000 | – | 100,000 |

30-Nov-10 | I7000 | DOF 414 | OFR | 100,000 | 10,000 | – | 110,000 |

31-Dec-10 | I7000 | DOF 452 | OFR | 110,000 | 10,000 | – | 120,000 |

Inventory | |||||||

3-Feb-10 | A4000 | D0F 145 | INY | – | 30,000 | – | 30,000 |

Sales | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

15-Feb-10 | I1000 | D0F 159 | SAS | – | – | 250,000 | -250,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

27-Mar-10 | I1000 | D0F 208 | SAS | 250,000 | – | 400,000 | -650,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

20-Jul-10 | I1000 | D0F 314 | SAS | 650,000 | – | 300,000 | -950,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

21-Nov-10 | I1000 | DOF 409 | SAS | 950,000 | – | 350,000 | -1,300,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Salary | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10-Feb-10 | I5000 | D0F 151 | SLY | – | 25,000 | – | 25,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10-Mar-10 | I5000 | D0F 188 | SLY | 25,000 | 25,000 | – | 50,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10-Apr-10 | I5000 | D0F 279 | SLY | 50,000 | 25,000 | – | 75,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9-May-10 | I5000 | D0F 305 | SLY | 75,000 | 25,000 | – | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10-Jun-10 | I5000 | D0F 279 | SLY | 100,000 | 25,000 | – | 125,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9-Jul-10 | I5000 | D0F 305 | SLY | 125,000 | 35,000 | – | 160,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8-Aug-10 | I5000 | D0F 331 | SLY | 160,000 | 35,000 | – | 195,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10-Sep-10 | I5000 | D0F 369 | SLY | 195,000 | 35,000 | – | 230,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10-Oct-10 | I5000 | DOF 395 | SLY | 230,000 | 35,000 | – | 265,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8-Nov-10 | I5000 | DOF 406 | SLY | 265,000 | 35,000 | – | 300,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5-Dec-10 | I5000 | DOF 431 | SLY | 300,000 | 35,000 | – | 335,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

31-Dec-10 | I5000 | DOF 466 | SLY | 335,000 | 35,000 | – | 370,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Wage | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

28-Feb-10 | I4000 | D0F 173 | WAG | – | 10,000 | – | 10,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Computer | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

15-Mar-10 | A7000 | D0F 197 | COM | – | 30,000 | – | 30,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Delivery truck | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1-May-10 | A8000 | D0F 249 | DET | – | 150,000 | – | 150,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Transportation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

6-Sep-10 | I9000 | D0F 362 | TRP | – | 10,000 | – | 10,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Machinery maintenance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2-Oct-10 | I10000 | D0F 389 | MCM | – | 20,000 | – | 20,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1-Dec-10 | I12000 | DOF 423 | TAX | – | 80,000 | – | 80,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Profit distribution | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

20-Dec-10 | I13000 | DOF 447 | POD | – | 100,000 | – | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Coca-Cola Beverage Shop

Statement of Retained Earnings

For the year ending December 31, 2010

Code

Particulars

Beginning RE

Net operating income

Dividend

Distributed profit

Ending RE

S2000

Retained earnings

0

310000

0

100000

210000

Coca-Cola Beverage Shop

Balance Sheet

31-Dec-10

Code

Particulars

Amount

Assets

Current asset

A1000

Cash

975,000

A2000

Bank

145,000

A3000

Accounts receivable

530,000

A4000

Inventory

30,000

A5000

Insurance policy

100,000

Total Current Asset

1,780,000

Fixed Asset

A6000

Furniture

150,000

A7000

Computer

30,000

A8000

Delivery truck

150,000

A9000

Machinery

300,000

Total Foxed Assets

630,000

Total Asset

2,410,000

Liabilities and Owners Equity

Current Liabilities

L1000

Accounts Payable

250,000

Stockholders’ Equity

S1000

Capital Stock

1,950,000

S2000

Retained earnings

210000

Total Liabilities & Owners Equity

2,410,000

Coca-Cola Beverage Shop

Statement of Cash Flows

For the year ending December 31, 2010

Code

Particulars

Amount

Cash flows from operating activities:

C17000

Cash receipts from customers

770,000

Less : Cash Payments

I7000

Office rent

120,000

I8000

Advertisement

10,000

A5000

Insurance

50,000

I5000

salary

335,000

I4000

Wage

10,000

I9000

transportation

10,000

I12000

Tax

80,000

Net cash provided by operating activities

155,000

Cash flows from financing activities:

S1000

Investment by owner

1500000

I13000

less : Distribution

100000

W16000

less : Withdraw

50,000

Net cash provided by financing activities

1,350,000

Net increase in cash

975,000

Cash balance at January 1, 2009

0

Cash balance at December 31, 2009

975,000

Conclusion & Recommendation

AIS are going to start with a belief that “A man’s feet must be planted in his country but his eye should survey the world.” That means based on the above analytical explanation it could say that in any business could not run so far if that organization not maintain all systematic accounting process. And that ensure by the Accounting Information System or AIS. That’s why each company should follow the actual role of accounting process.

Besides it’s also a responsibility that all financial data disclosed by the company monthly or quarterly or yearly annual report. That will be a bright for the company’s both internal environment and as well as external environment. In conclusion we ask exoneration for any unwanted mistakes in our feasibility study and ask for kind consideration to consider our intense effort in this project preparation phase.