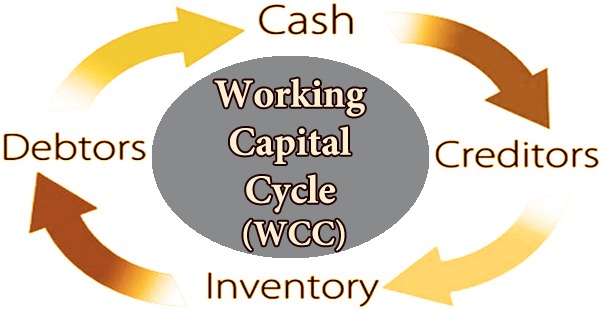

The length of time it takes for a company’s total net working capital (current assets minus current liabilities) to be converted into cash is referred to as the working capital cycle (WCC). It demonstrates the organization’s capacity and efficiency in managing its short-term liquidity position. Organizations normally attempt to deal with this cycle by selling stock rapidly, gathering income from clients rapidly, and taking care of bills gradually to upgrade income. All in all, the working capital cycle (determined in days) is the time term between purchasing merchandise to fabricate items and the age of money income on selling the items.

The longer the cycle, the more money a company is locking up in working capital without producing a profit. As a result, businesses attempt to shorten their working capital cycle by collecting receivables faster and stretching accounts payable. For most companies, the working capital cycle works as follows:

- Materials to make a product are purchased on credit by the company. They have 90 days to pay for the raw ingredients (payable days), for example.

- The company sells its inventory in 85 days, on average (inventory days).

- On average, the company receives payment from clients for products sold in 20 days (receivable days).

- The corporation obtains the ingredients it requires to generate inventory in the first step of the process, but does not immediately disburse any cash (purchased on credit under accounts payable). It will have to pay for the materials in 90 days.

The more limited the working capital cycle, the quicker the organization can let loose its money stuck in working capital. A positive working capital cycle adjusts approaching and active installments to limit net working capital and boost free income. If the working capital cycle is too long, the capital is trapped in the operational cycle, earning no money. As a result, a company strives to shorten its working capital cycles in order to improve its short-term liquidity and business efficiency.

Working Capital Cycle (WCC) Formula:

Working Capital Cycle = Inventory Days + Receivable Days – Payable Days

Now the steps in the cycle and the formula, let’s calculate an example based on the above information:

Inventory days = 85

Receivable days = 20

Payable days = 90

Working Capital Cycle = 85 + 20 – 90 = 15

This means the company is only out of pocket cash for 15 days before receiving full payment.

Developing organizations require cash, and having the option to let loose money by shortening the working capital cycle is the most modest approach to develop. A business needs to have unlimited authority over these four things to have a genuinely controlled and proficient working capital cycle. Sophisticated purchasers examine a target’s working capital cycle closely because it gives them an indication of management’s ability to manage the balance sheet and generate free cash flow.

A company can aim to shorten its working capital cycle (WCC) by:

- Reducing the credit duration offered to consumers, resulting in a shorter average collection period. Cash discounts can help enhance the debtor’s turnover ratio and average collection timeframe, among other things.

- To minimize the time, it takes for inventory to convert to sales, the company can aim to improve/streamline its manufacturing process and focus on various strategies to enhance sales. The earlier stock clearing occurs, the better the working capital cycle will be.

- Working capital cycle reduction can also be aided by effectively negotiating with suppliers of raw materials and items required for production to extend the credit duration.

Organizations with ordinary/positive cycles regularly expect financing to cover the timeframe before they get installment from clients and customers. This is particularly valid for quickly developing organizations. A common warning axiom regarding growth and working capital is to be careful not to “grow the company out of money.” While the normal assortment term and credit period from providers help to abbreviate the working capital cycle, the business’ underlying spotlight ought to be on lessening the time it takes for stock to change over to deals.

Banks would frequently lend against goods and fund accounts receivables. Furthermore, if a corporation sells items to creditworthy enterprises, the bank may finance those receivables (known as “factoring”) by giving early payment of a percentage of the overall income. On the off chance that the time taken is extremely long it could suggest that the business can’t create deals for the merchandise delivered and that’s only the tip of the iceberg and more capital gets secured stock. Either the business should attempt to lessen the time or ought to diminish the measure of stock consequently decreasing the sum secured working capital.

A company can successfully bridge the time gap required to complete its working capital cycle by combining one or both of the above financing alternatives. Most businesses cannot finance the operating cycle (average collection period + inventory turnover in days) with accounts payable financing alone. This shortfall can be covered by the company using profits saved over time, borrowed capital, or a combination of the two.

Information Sources: