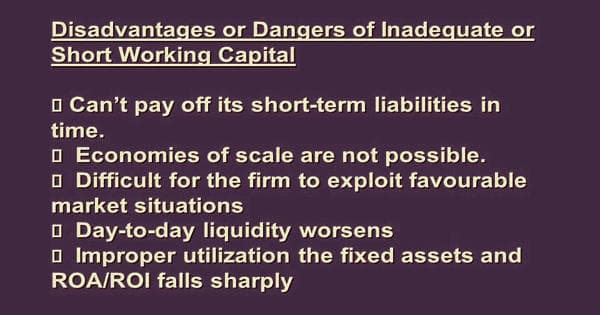

Disadvantages of Insufficient Working Capital

Working capital measures a company’s ability to turn short-term assets into cash. The amount of working capital should be sufficient. An inadequate amount of working capital may create a lot of financial problems in business. Inadequate working capital means a shortage of working capital to meet the day-to-day operating activities of the business concern. Due to an inadequate amount of working capital, a firm cannot function properly. It leads to a low rate of return on investment.

Sometimes, inadequate working capital may be the major cause of closing down the business organization. A firm cannot attract investors and lenders due to poor liquidity and solvency position. Due to a shortage of working capital, raw materials cannot be purchased on time, and payment of labor and other expenses cannot be made on time.

The disadvantages suffered by a firm with insufficient working capital are as follows:

- The growth of the business concern will be stagnated. The reason is that the business concern is not in a position to take up a profitable venture due to the unavailability of working capital funds.

- The firm is unable to take advantage of new opportunities or adapt to change.

- Trade discounts are lost. A firm with sufficient working capital is able to finance larger stocks and can therefore place large orders.

- The objectives of the business concern cannot be achieved. Moreover, the average rate of return cannot be earned by the company.

- Cash discounts are lost. Some firms will try to persuade their debtors to pay early by offering cash discounts.

- The advantages of being able to offer a credit line to customers are forgone.

- Fixed assets cannot be used properly due to inadequate working capital.

- Financial reputation is lost due to the non-payment of trade creditors on time.

- The market opportunities like cash discount and trade discount cannot be availed by the business concern.

- Creditors may apply to the court for winding up if the firm fails to pay their obligations on time.

- Sometimes, business opportunities are not utilized due to the non-availability of adequate working capital.

- Production capacity is not used fully. It results in a low level of production. This leads to failure to meet regular demands. Hence, the customers may switch over to some other products.

- Whenever the goodwill of the company is affected, the creditworthiness of the company is decreased to some extent among the banks and financial institutions.