The study of designing and implementing a tax that maximizes a social welfare function subject to economic constraints is known as optimal tax theory or optimal taxation theory. Because the social welfare function is typically a function of individuals’ utilities, most commonly some form of utilitarian function, the tax system is chosen to maximize the aggregate of individual utilities.

Optimal taxation is taxation that reflects society’s choices between the competing goals of equality and economic efficiency, with the goal of maximizing social welfare as the starting point. Optimal tax theory encompasses a variety of models that concentrate on specific aspects of the tax system. Three characteristics are shared by these various models. First, each model specifies a set of government-feasible taxes, such as commodity taxes, as well as the government’s revenue requirements. The models typically exclude lump-sum taxes because they would cause no economic distortion.

Second, each model specifies how individuals and businesses react to taxation. Individuals have preferences for goods and leisure; firms use a specific technology to produce goods; and individuals and firms interact within a specific market structure.

Third, the government has an objective function for assessing various tax configurations. In the most basic models, the government’s goal is to reduce the excess burden imposed by the tax system while raising a predetermined amount of revenue. The more complex models strike a balance between efficiency and equity concerns. Vertical equity, rather than horizontal equity or the benefit principle, is typically the focus of equity models.

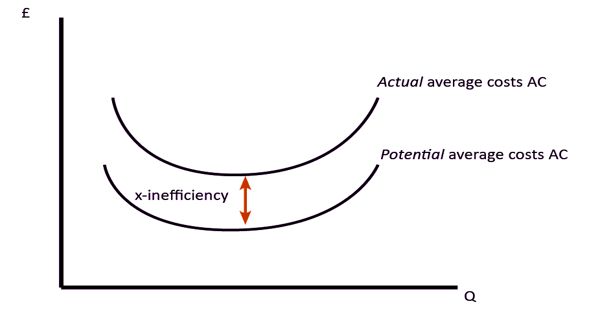

According to the standard theory of optimal taxation, a tax system should be chosen to maximize a social welfare function while taking into account a number of constraints. Taxation is required to fund the provision of public goods and other government services, as well as to redistribute wealth from rich to poor people. Most taxes, however, distort individual behavior because the taxed activity becomes less desirable; for example, taxes on labor income reduce the incentive to work.

The optimal configuration of commodity tax rates is one of the oldest strands of the optimal tax literature. The central question is whether uniform commodity tax rates, which tax all goods and services at the same rate, are optimal. This problem is commonly known as the Ramsey problem, after Frank Ramsey’s solution in his 1927 article. The short answer is that uniform commodity taxes are rarely optimal, even after accounting for the administrative costs of administering differentiated tax rates.

Ramsey’s optimal commodity taxation is based on the rule of inverse elasticity, which states that taxing goods with low elasticities of demand at a higher rate reduces efficiency loss. The criticism of this rule stems from the fact that essential goods to meet basic needs have a low price elasticity of demand, whereas luxury goods have high price elasticity.

The optimization problem entails minimizing the distortions caused by taxation while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes (where individuals cannot change their behavior to reduce their tax burden) and Pigouvian taxes (where market consumption of a good is inefficient and a tax brings consumption closer to the efficient level).