A tax swap typically entails selling an underperforming stock or security and claiming a capital loss on the transaction. It is a strategy that entails selling a capital-loss-ridden investment and replacing it with a similar, but not identical, investment. It is a taxation change that eliminates or reduces one or more taxes while establishing or increasing others while keeping overall revenue constant. The loss of a tax swap can reduce capital gains on a later purchased asset, resulting in tax savings.

The most common use of the term “tax swap” refers to the practice of using a capital loss on one asset to offset a capital gain on another, thereby reducing taxation on investment income. The term can refer to both desired shifts, such as toward Pigovian taxes (typically sin taxes and ecotaxes), and undesired shifts, such as a shift away from multi-state corporations and toward small businesses and families.

Definition:

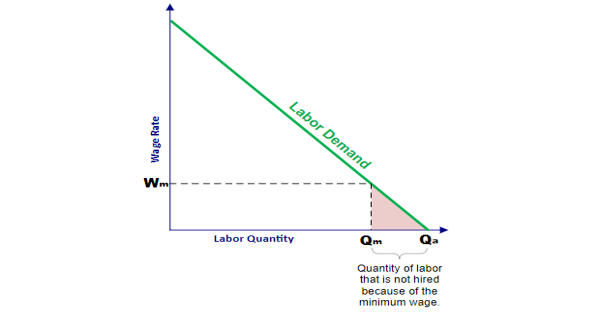

A tax swap is an economic phenomenon in which the taxpayer transfers the tax burden to the purchaser or supplier by raising the sales price or lowering the purchase price during the commodity exchange process.

(1) Tax swap refers to the redistribution of the tax burden. Its economic essence is the redistribution of everyone’s national income. The absence of national income redistribution does not constitute an active tax shift.

(2) A tax swap is a measurable economic movement. It excludes any emotional components. Tax shift has nothing to do with whether taxpayers take the initiative to raise or lower prices or accept price fluctuations passively. The economic relationship between the taxpayer and the tax bearer is unrelated to the tax shift, whether it is a class opposition or a unity opposition.

(3) Tax swapping is accomplished through price changes. The price mentioned here includes not only the output price but also the element price. The price changes discussed here include not only direct price increases and decreases, but also indirect price increases and decreases. There will be no price changes or tax changes.

A tax swap typically consists of two transactions: selling the losing investment in the first transaction, then purchasing a similar, higher-priced investment in the second transaction.

It possesses the three characteristics listed below:

(1) It is closely related to price changes;

(2) It is the redistribution of tax burdens among economic entities, as well as a redistribution of economic interests. As a result, inconsistency between taxpayers and tax bearers will inevitably occur;

(3) It is the taxpayer’s proactive behavior.