4.10 Loan Monitoring & Review:

This is a supervisory credit scheme. The success of the scheme depends on the extensive & intensive post disbursement supervision, follow up & monitoring:

- Regular checking the balance of SB/CD/STD accounts of the borrower.

- Regular communication with the defaulter customers & guarantors physically/ over telephone.

- Issuance of letter to customers immediately after dishonor of cheque.

- Issuance of letter to the defaulter customers and respective guarantors.

- Issuance of legal notice to the defaulter customers & guarantors prior to classification of the loans (after 03 overdue installments).

- Issuance of Appreciation / Greetings letter to the regular customers.

- Periodical visit with the customer to maintain relationship & supervision of supplied articles.

- Legal action to be taken after failing all possible efforts to recover the bank’s dues.

Visit to the establishment must be done at least once a month. During visit of the project motivational work to be done with a view to strengthening the sprit & morals of the sponsors. A visit report should be recorded in credit file against each visit. Supervision will be done by the respective branches, which will be monitored by the SME unit, Credit Division, Head Office. Bank’s distinct name board to be displayed on the prominent place of the project /shop/factory with the following writing.

Financed by National Credit & Commerce bank limited, Dhanmondi Branch.

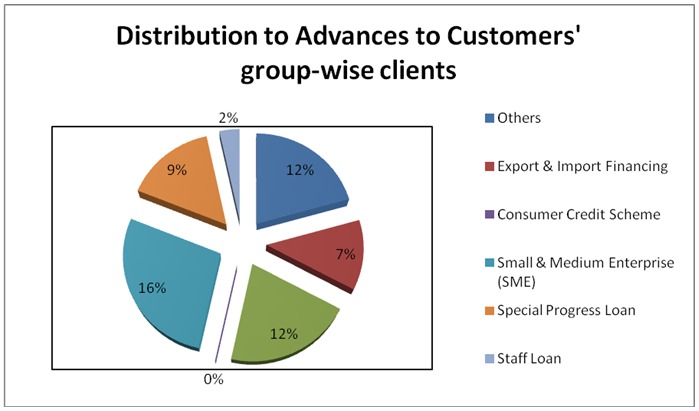

4.11 Distribution of Loan & Advances:

Total loans & advances of NCC Bank Limited as on 31.12.2009 was Tk. 50,387.68 million, out of which advances to customers group-wise clients was Tk. 18955.78 million & industrial loan was Tk. 27354.62 million. Major focus was given to Import & Export Financing (12%), Industry (63%), Construction (5%), Transport & Communication (2%), Storage (1%), Business (25

%), Others (3%) SME (16%), & House Building Loan (14%) etc. out of the total industrial loan major concentration was given to Industry (63%).

4.12 Types of Loan & Advances:

There are four major groups:-

Continuous Loan

- SOD (FO) – Advance is granted to a client against financial obligations. The security of advance is granted to the person to whom the instrument belongs. The discharge instrument is surrender to the bank along with a letter signed by holder/holders. The banks lien is prominently noted on the face of the instrument under the signatures of an authorized bank official. Interest rate is 14% to 16%.

- SOD (G) – Granted against the work order of government departments corporations autonomous bodies & reported multinational private organization. To arrive at logical decision, the client’s managerial capability, equity strength, nature of scheduled work is to be judged. Disbursement is made after completion of documentation formalities, besides usual charge, documents like a notarized irrevocable power of attorney to collect & a letter from the concerned authority confirming direct payment to the bank is also obtained. The work is strictly monitored to review the progress at each interest. Interest rate is 14% to 16%.

- Loan (General) – NCCBL considers the loans, which are sanctioned for more than 1 year as loan (G). Under this facility, an enterprise is financed from the starting to its finishing, i.e. from installment to its production. NCCBL offers this facility only to big industries.

- CC (Hypothecation) – The mortgage of movable property for security loan is called hypothecation. Hypothecation is a legal transaction where

- goods are made available to the lending banker as security for a debt without transferring either possessing. The banker has only equitable charge on stocks, which practically means nothing. Since the goods always remain in the physical possession of the borrower, there is much risk to the bank. So it is granted to parties of undoubted means with highest integrity. Interest rate is 16%.

- CC (Pledge) – Transfer of possession in the judicial sense of essential in the valid pledge. In case of pledge, the bank acquires the possession of the goods or a right to hold goods until the repayment for credit with a special right to sell after due notice to the borrower in the event of non-repayment. Interest rate is 16%.

Term loan

- Lease Finance- This type of financing are usually provided to transportation sector. Now a day this lease financing is one of the popular financing projects. Rate of interest is 15%.

- House Building Loan- This loan is provided against 100% cash collateral, besides; the land & building are also mortgaged with the bank. Interest rate is 16% per annum overdue installment of this loan is obliged to pay very shortly. The loan is under unclassified loan.

Demand Loan

- Loan against Imported Merchandise (LIM) – Advances allowed for retirement of shipping documents & release of goods imported through L/C taking effective control over the goods by pledge fall under this type of advance, when the importer failed to pay the amount payable to the exporter against import L/C, than NCCBL gives loan against imported merchandise to the importer. The importer will bear all the expenses i.e. the warehouse charge, insurance fees, etc. & the ownership of the goods is retaining to the bank. This is also a temporary advance connected with import, which is known as past import finance. Interest rate is 16%.

- Loan against Trust Receipt (LTR) – Investment allowed for retirement of shipping documents & release of goods imported through L/C fall under this heard. The goods are handed over to the importer under trust with the arrangement that sale proceeds should be deposited to liquidate the investments within a given period. This is also a temporary investment connected with import & knows as post- import finance & falls under the category “commercial lending”. Interest rate is 16%.

- Loan Documentary Bill Purchase (LDBP) – Payment made against documents representing sell of goods to local export oriented industries, which are deemed as exports & which are deemed as imports, & which are dominated in local currency/ foreign currency falls under this head. The bill of exchange is held as the primary security. The clients submit the issuance bill & the bank discounts it. This temporarily liability is adjustable from the proceeds off the bill. Interest rate is 16%.

- Inland Bill Purchase (IBP) – Payment made through purchase of inland bills/ cheques to meet urgent requirement of the customer falls under this type of investment facility. This temporary investment is adjustable from the proceeds of bills/ cheques purchase for collection. It falls under the category “commercial lending”.

Loan under SME

- Consumer Credit Scheme- This scheme is aimed to attract consumers from the middle & upper middle class population with limited income. The borrower should have savings or current deposits account with the bank. Minimum 25% of the purchase cost of the bank product is to be deposited by the borrower with the bank is equity before the disbursement of the loan. The rest 75% is to be kept as cash collateral (FDR, Shachay Patra etc.) with the bank. The purchase items are hypothecated with the bank. This disbursement of the loan is effected by debting loan (general) account to the opened in the same of the borrower. Loan amount is disbursed through a/c payee pay order / demand draft directly to the seller after submission of the indent, deposit of client equity & completion of documentation formalities.

- Working Capital Loan- Loans allowed to the manufacturing unit to meet their working capital requirement, irrespective of their size big, medium or large under the category.

- House Repairing /Renovation Loan- This loan is offered for renovation & modernization of the house/ building/flat. The genuine residential owners can avail this kind of loan. Loan can be repaid by monthly equal installments including interest within maximum 5 years. Interest rate is 16%.

- Small Business Loan- This loan is offered to the small & promising entrepreneurs to meet their capital requirement & enable them to operate & expand the business purposely. It is approved against collateral & estimation of the revenue generation of the project for which the loan is sanctioned. The range of this type of loan is Tk. 1 to 5 lac.

- Personal Loan-This loan is provided to salaried persons in various organizations to meet any emergency cash needs. Interest rate is 15% per annum & maximum credit ceiling is Tk. 100000.

4.12.1 Processing Systems of Loans & Advance

NCC bank has a large loans and advance department which provide loans to the people who are able to fulfill bank’s requirements. The following procedure is applicable for giving advance to the customer. These are:

- Duly fill-up first information sheet.

- Application for investment.

- Collecting CIB report from Bangladesh Bank.

- Making Investment proposal.

- Project appraisal.

- Head office approval

- Sanction letter.

- Documentation.

- Charges on securities.

- Recovery.

First information sheet: First information sheet is the prescribed form provides by the respective branch that contains NCC Bank information of the borrower. It contains following particulars:-

- Name of the concern with its factory location.

- Officers address & telephone number.

- Name of the main sponsors with their educational qualification.

- Business experience of the sponsors.

- Details of past and present business, it achievement and failures.

- Name of all the concerns wherein the sponsors have involvement.

- Income tax registration number with the amount of tax paid for the last three years.

- Details of unencumbered assets personally owned by the sponsors.

- Details of liabilities with other Banks and financial institutions including securities held there against.

- Estimated cost of the project & means of finance.

Application for investment: After receiving the first information sheet from the borrower Bank official verifies all the information carefully. He also checks the account maintains by the borrower with the Bank. If the official becomes satisfied then he gives application or investment form to the prospective borrower.

Collecting CIB report from Bangladesh Bank: After receiving the application for advance, NCC Bank sends a letter to Bangladesh Bank for obtaining a report from there. This report is called CIB (Credit Information Bureau) report. NCC Bank generally seeks this report from the head office for all kinds of investment. The purpose of this report is to being informed that whether the borrower has taken loan from any other Bank; if ‘yes’ then whether the party has any overdue amount of root.

Making Investment proposal: After receiving CIB report, concern branch prepare an investment proposal, which contains terms, & conditions of investment for approval of Head Office or Head of the concerned branch. Following documents are necessary for sending the investment proposal:

- Loan application.

- Declaration of the borrower.

- Photocopy of the borrower duly attested.

- Bio data of the borrower.

- Limit sanction.

- Credit report.

- Legal opinion.

- Memorandum of article.

- Trade license.

- Copy of title deeds.

- Tax clearance certificate.

If the officer thinks that the project is feasible then he will prepare a proposal. NCC Bank prepares the proposal in a specific form called investment proposal, it contains following relevant information:

- Borrower.

- Date of establishment, constitution.

- Main sponsors/ director with background.

- Capital structure, address.

- Account opening date, introduced by type of business, particulars of previous sanctions.

- Security (existing and proposed).

- Movement of accounts.

- Components on the conduct of the account.

- Details of deposits, liabilities of allied concerns, liabilities with other Banks.

- CIB report.

- Rated capacity of the project (item wise).

- Production/ purchase during the period.

- Sales during the period.

- Earning received for the period.

Project appraisal: It is the pre-investment analysis done by the officer before approval of the project. Project appraisal in the Banking sector is needed for the following reasons:

- To justify the soundness of an investment.

- To ensure repayment of Bank finance.

- To achieve organizational goals.

- To recommend if the project is not designed properly.

More parts of this post–

SME Banking of NCC Bank Limited (part-1)

SME Banking of NCC Bank Limited (part-2)