City Bank is one of the oldest private Commercial Banks operating in Bangladesh. It is a top bank among the oldest five Commercial Banks in the country which started their operations in 1983. The Bank started its journey on 27th March 1983 through opening its first branch at B. B. Avenue Branch in the capital, Dhaka city. It was the visionary entrepreneurship of around 13 local businessmen who braved the immense uncertainties and risks with courage and zeal that made the establishment & forward march of the bank possible. Those sponsor directors commenced the journey with only Taka 3.4 crore worth of Capital, which now is a respectable Taka 330.77 crore as capital & reserve.

City Bank is among the very few local banks which do not follow the traditional, decentralized, geographically managed, branch based business or profit model. Instead the bank manages its business and operation vertically from the head office through 4 distinct business divisions namely

- Corporate & Investment Banking;

- Retail Banking (including Cards);

- SME Banking; &

- Treasury & Market Risks.

Under a real-time online banking platform, these 4 business divisions are supported at the back by a robust service delivery or operations setup and also a smart IT Backbone. Such centralized business segment based business & operating model ensure specialized treatment and services to the bank’s different customer segments.

The bank currently has 87 online branches and 10 SME service centers spread across the length & breadth of the country that include a full fledged Islami Banking branch. Besides these traditional delivery points, the bank is also very active in the alternative delivery area. It currently has 46 ATMs of its own; and ATM sharing arrangement with a partner bank that has more than 550 ATMs in place; SMS Banking; Interest Banking and so on. It already started its Customer Call Center operation. The bank has a plan to end the current year with 100 own ATMs.

City Bank is the first bank in Bangladesh to have issued Dual Currency Credit Card. The bank is a principal member of VISA international and it issues both Local Currency (Taka) & Foreign Currency (US Dollar) card limits in a single plastic. VISA Debit Card is another popular product which the bank is pushing hard in order to ease out the queues at the branch created by its astounding base of some 400,000 retail customers. The launch of VISA Prepaid Card for the travel sector is currently underway.

City Bank has launched American Express Credit Card and American Express Gold Credit card in November 2009. City Bank is the local caretaker of the brand and is responsible for all operations supporting the issuing of the new credit cards, including billing and accounting, customer service, credit management and charge authorizations, as well as marketing the cards in Bangladesh. Both cards are international cards and accepted by the millions of merchants operating on the American Express global merchant network in over 200 countries and territories including Bangladesh. City Bank also introduced exclusive privileges for the card members under the American Express Selects program in Bangladesh. This will entitled any American Express card members to enjoy fantastic savings on retail and dining at some of the finest establishment in Bangladesh. It also provides incredible privileges all over the globe with more than 13,000 offers at over 10,000 merchants in 75 countries.

City Bank prides itself in offering a very personalized and friendly customer service. It has in place a customized service excellence model called CRP that focuses on ensuring happy customers through setting benchmarks for the bank’s employees’ attitude, behavior, readiness level, accuracy and timelines of service quality.

City Bank is one of the largest corporate banks in the country with a current business model that heavily encourages and supports the growth of the bank in Retail and SME Banking. The bank is very much on its way to opening many independent SME centers across the country within a short time. The bank is also very active in the workers’ foreign remittance business. It has strong tie-ups with major exchange companies in the Middle East, Europe, Far East & USA, from where thousands of individual remittances come to the country every month for disbursements through the bank’s large network of 97 online branches and SME service centers.

The current senior management leaders of the bank consist of mostly people form the multinational banks with superior management skills and knowledge in their respective “specialized” areas. The newly launched logo and the pay-off line of the bank are just one initial step towards reaching that point.

Financial performance:

Paid-up Capital in BDT* (mn) 3928.0

Reserve & Surplus in BDT* (mn) 3900.32

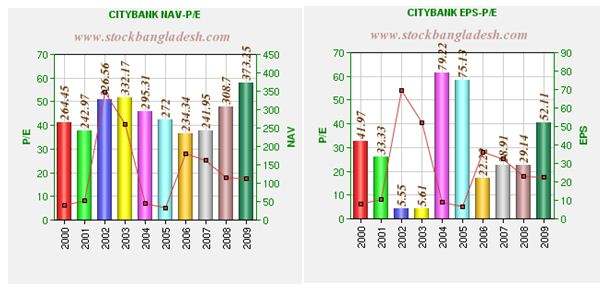

| Year | Earning per share | Net Asset Value Per Share | Net Profit After Tax (mn) | Price Earning Ratio | % Dividend | % Dividend Yield |

| 2010 | ||||||

| 2009 | 52.11 | 373.25 | 818.719 | 17.50 | 25 | |

| 2008 | 29.14 | 308.70 | 398.11 | 17.82 | 15 | |

| 2007 | 28.91 | 241.95 | 343.46 | 25.09 | 15 | – |

| 2006 | 22.22 | 234.34 | 240.02 | 28.09 | 10 | – |

| 2005 | 75.13 | 272.0 | 540.92 | 5.19 | 50 | – |

| 2004 | 79.22 | 295.31 | 380.26 | 6.85 | 50 | – |

| 2003 | 5.61 | 332.17 | 13.46 | 40.55 | — | – |

| 2002 | 5.55 | 326.56 | 13.33 | 54.05 | – | – |

| 2001 | 33.33 | 242.97 | 80.00 | 8.00 | – | – |

| 2000 | 41.97 | 264.45 | 66.67 | 6.35 | – | – |

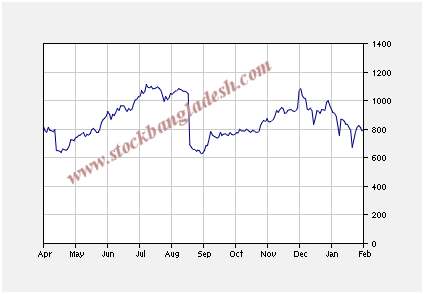

Graphical representation of stock performance:

Fig.: stock price

Calculation of intrinsic value of stock:

We know intrinsic value, P0= Div1/(Ke-g)

Here, we assume that the company has a normal growth and because of normal growth we know,

| Here, g= Growth rate Retention Ratio(RR) = 1-D/P Ratio =1- (DPS/EPS) =1- (25/52.11) =0.52025 ROE = Net Profit After Tax/Stockholders’ Equity ROE =(818.719mn/7828.32mn) =0.10458

|

g = RR*ROE

=0.52025* 0.10458

= 0.05441

| Ke= required rate of return Rf= economy’s risk free rate Rm= the future long run market return β= market risk(based on market survey)

|

Here, Ke = Rf + (Rm – Rf) β

= 0.05 + (0.10 – 0.05)* 1.05329

= 0.10266

| D1= next year’s dividend Do= current dividend |

Now, D1 = D0 (1 + g)

= 25 (1+0.05441)

= 26.36025

Intrinsic Value of stock = 26.36025/(0.10266-0.05441)

= Tk. 546.33

Market Value (as on January 31, 2011) = Tk. 813.75