The sectoral balances (also known as sectoral financial balances) are a sectoral analysis framework for macroeconomic analysis of national economies developed by British economist Wynne Godley. The most fundamental macroeconomic rule is that one person’s spending equals another person’s income. As a result, it should go without saying that because modern economies like ours rely on sales, an economy is doomed to fail without them. If businesses are unable to sell what they produce (their ‘output,’ their unsold stocks will rise, forcing them to reduce production and lay off workers.

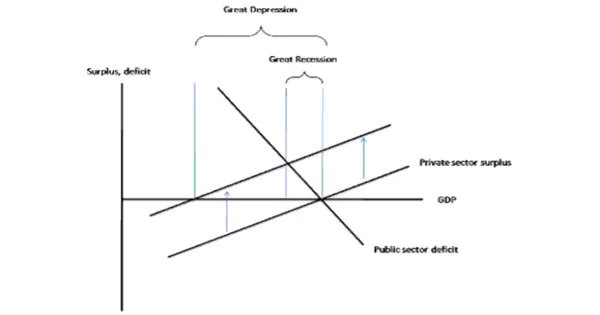

Sectoral analysis is based on the understanding that when the government sector has a budget deficit, the non-government sectors (private domestic and foreign) must have a surplus, and vice versa. In other words, if the government sector is borrowing, the rest of the economy must be lending. The balances represent an accounting identity created by rearranging the aggregate demand components, demonstrating how the flow of funds affects the financial balances of the three sectors.

This roughly corresponds to the Balances Mechanics developed by Wolfgang Stützel in the 1950s. Scholars at the Levy Economics Institute use the approach to support macroeconomic modeling, and Modern Monetary Theorists use it to illustrate the relationship between government budget deficits and private saving.

The fiscal balance of the government is one of three major financial sectoral balances in the national economy, the other two being the foreign financial sector and the private financial sector. By definition, the sum of the surpluses and deficits in these three sectors must be zero. A surplus balance denotes a net savings or net financial asset building position (i.e., more money flows into the sector than flows out), whereas a deficit balance denotes a net borrowing or net financial asset reducing position (i.e., more money is flowing out of the sector than is flowing into it).

Each sector may be defined as follows, using the U.S. as an example:

- Private sector: A surplus balance indicates that US households and businesses are net savers, increasing their financial asset position. In other words, household savings exceed the amount borrowed and invested by businesses. There is a net inflow of funds into the private sector.

- Foreign sector or “rest of the world”: A surplus balance indicates that those living outside of the United States are net savers. This is consistent with a US current account or trade deficit, in which US residents borrow savings from foreign residents to finance import purchases. Foreigners are increasing their net financial asset position by lending to the US so that it can buy their imports. More money is flowing from the private and public sectors in the United States to the foreign sector than the other way around. In 2019, the United States had a current account deficit of 2.8 percent of GDP, implying that the foreign sector had a 2.8 percent GDP surplus; consider this balance from a foreign perspective.

- Government balance (all levels, e.g., federal, state and local in the U.S.): A surplus balance occurs when the government collects more tax revenue than it spends, thereby increasing its net financial asset position. This would imply that the government is a net saver, taking money out of the private sector. A deficit balance indicates that government outlays exceed tax revenue, and the government is reducing its net financial asset position (i.e., increasing its debt position), thereby providing funds to the private sector.

To summarize, the private sector surplus in the United States in 2019 was 4.4 percent of GDP due to household savings exceeding business investment. There was also a current account deficit of 2.8 percent of GDP, indicating that the foreign sector was profitable. By definition, a government budget deficit of 7.2 percent of GDP must exist, so that all three net to zero. In comparison, the United States’ government budget deficit in 2011 was approximately 10% of GDP (8.6% of which was federal), offsetting a foreign sector surplus of 4% GDP and a private sector surplus of 6% GDP.