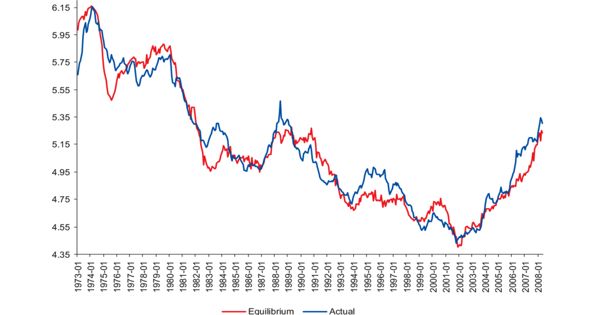

Commodity Price Index

A commodity price index is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures prices. A commodity index is an investment vehicle that tracks the price and the return on investment of a basket of commodities. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals. The value of these indexes fluctuates based on their underlying commodities; similar to stock index futures, this value can be traded on an exchange. It is an index that tracks a basket of commodities to measure their performance. The price index is an index number expressing the level of a group of commodity prices relative to the level of the prices of the same commodities during an arbitrarily chosen base period and used to indicate changes in the level of prices from one period to another.

Commodities do not pay dividends or interest, so an investor is dependent solely on capital gains for investment performance. These indexes are often traded on exchanges, allowing investors to gain easier access to commodities without having to enter the futures market. For most investments, the total return of the investment includes periodic cash receipts–such as interest, dividends, and other distributions–as well as capital gains. The value of these indexes fluctuates based on their underlying commodities, and this value can be traded on an exchange in much the same way as stock index futures. The index was is normalized to a value of 100 on January 2, 1970, in order to permit comparisons of commodities prices over time. To ensure continuity, sometimes the index adjusts via a “normalizing constant” when the weights of the underlying commodities change.

Fig: Commodities Prices to Rising in 2018

A commodity index is an index of the prices of items such as wheat, corn, soybeans, coffee, sugar, cocoa, hogs, cotton, cattle, oil, natural gas, aluminum, copper, lead, nickel, zinc, gold, and silver. Investors can choose to obtain a passive exposure to these commodity price indices through a total return swap or a commodity index fund. The advantages of a passive commodity index exposure include negative correlation with other asset classes such as equities and bonds, as well as protection against inflation. In a market economy, resources like labor and machinery (capital) are distributed on the basis of supply and demand. In such a system, prices serve as the mechanism by which resources are allocated to their most productive uses.

The disadvantages include a negative roll yield due to contango in certain commodities, although this can be reduced by active management techniques, such as reducing the weights of certain constituents (e.g. precious and base metals) in the index