1.1 EXECUTIVE SUMMARY

National Credit And Commerce Bank Limited (NCCBL) was incorporated in Bangladesh as a banking company under the companies Act 1994. The principal place of business is the registered office at 7-8 Motijheel Commercial Area, Dhaka 1000. It has 53 branches all over Bangladesh at 31 December 2007. It carries out all banking activities through its branches in Bangladesh. The bank is listed with Dhaka stock exchange limited and Chittagong stock exchange limited as a publicly quoted company for its shares. The bank commenced its banking business with sixteen branches from May 17, 1993.

Despite volatile economic atmosphere of the country, the bank performed well in respect of deposit mobilization and profit earning during the year under review. The bank was able to harvest the result of its efforts to enhancing quality of assets and recovery of dues from default borrowers. The year 2007 was another milestone of success for the bank in terms of earning profit and consolidating position at various spheres of operations. The bank followed cautious policy during the year in the face of prevailing turbulent atmosphere of the country. The profit figure at the end of the year stood at Tk.178.02 crore recording an increase of 40.16% over the previous year’s figure of Tk.127.01 crore. The bank has given due emphasis on increasing fee-based and off-balance sheet income during the year which helped increasing total income and thereby profitability. The paid-up capital has increased to Tk.1, 352.01 million against Tk. 1,201.79 million of 2006 and reserve fund has also increased to Tk.1,995.36 million registering 64.15% increased over last year’s Tk.1,215.58 million. The capital adequacy remained at 10.61% as against 9.78% of previous year.

Under credit declared credit policy the bank operates through a number of conventional and various credit schemes including small business loan, Housing loan, and Festival loan which help playing effectively in the market and ensures steady earnings for the bank. Bank’s leasing unit and syndicated loans have also contributed to the income during the year as before. Our agri-credit scheme sustained its viability by contributing to the profitability. During the year total Advance stood at Tk. 32,687.75 million. Advance/deposit ratio was 93.66% in 2007. Investment figure of the bank as on 31st December, 2007 stood at Tk. 6,266.62 million as against Tk. 3,552.08 million of the previous year. Considering the good rate of return, the bank emphasized on making investment in Govt. Treasury bill with a view to utilizing its liquid fund on temporary basis so that the same can be liquidate to meet urgent requirements. Bank largely depends in its foreign exchange business to ensure profitability. To look after the business and also to ensure prompt service to the Import & export, officers having exposure and expertise in foreign exchange business have been posted both at head office & authorized dealer branches. During 2007, the bank handled export & import business to the tune of Tk. 9,577.92 million & Tk. 28,779.21 million respectively. Bank’s wide network of correspondence plays vital role in facilitating its International trading. At present, total number of correspondents is 398.

Through effective fund management, the bank could earn Tk. 28,260 million during the year through dealing room operation. The operational profit of the bank during 2007 was TK.1, 780.24 million as against TK.1, 267.57 million in 2006, rate of growth being 40.17%. Return on Assets (ROA) was 1.59.

During the year the bank opened 07 (Seven) Branches which raised the total number of branches to 53 and it will also be expanded to open 04(four) more new Branches in 2008.The number of Executives & Officers as on 31.12.2007 was 956 against 847 on 31.122006.The board of directors has been pleased to recommend 30% Bonus share (stock dividend) for its valued shareholders for the year 2007. By calculating all the ratio analysis and CAMEL rating we can say that the NCC bank is in good positions.

1.2 INTRODUCTION

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word ‘Bank’ was probably derived from the word ‘Bench’ as during ancient time Jews used to do money-lending business sitting on long benches.

First modern banking was introduced in 1668 in Stockholm as ‘Svingss Pis Bank’ which opened up a new ear of banking, activates through out the European Mainland.

In the North Asia region the Afgan traders popularly known as kabuliwallas introduced early banking system. Muslim businessman from Kabul, Afghanistan came to India & started money-lending business in exchange of interest sometime in 1312 A. D. They were known as ‘Kabuliwallas’.

Banks are now beyond those old concepts. Now Bank represents a significant & influential sector of business world wide. Most individuals and origination make use of the Banks, either as depositors or borrowers. Bank play a major rule in maintaining confidence in the monetary system through their close relationship with regulatory authorities and governments regulations imposed on them by those governments.

In modern economy banking system is very important. Now a day we can not think without banking system. Banks contribute as a financial intermediary. It takes deposit from surplus sources and gives on crisis sectors. In order to develop a better economic system, bank’s role is very necessary. In order to meet this need in our country many banks have been established. A lot of private and govt. banks are available in our country. To meet financial crisis international banks are interested to come in our country.

Middle class people’s volume is the largest in our country. They would like to increase their standard of living. For this reason convenient goods are needed for their daily life. But it is very difficult to buy for middle class people or fixed income group. They can not collect a large amount of money at a time. In order to meet this problem a modern credit concept has been emerged in our country. The name of this credit concept is ‘consumer’s credit scheme’. It is a sophisticated credit scheme which has emerged maximum banks of our country. It is also a popular scheme all over the world.

1.3 ORIGIN OF STUDY

The report fulfills and imperative requirement of the course. During the 3-month internship program, students are assigned to an organization to observe a practical application or the theoretical knowledge. At last, a report with proper analysis and possible solution of the problematic zone of the organization needs to be submitted.

1.4 SIGNIFICANCE OF THE STUDY

Human beings habit is to consume more and more commodity. People who are middle class income group or fixed income group always wants to consume sophisticated commodity. People who earn a lot of that means who is engaged with business, doctor, Lower etc. are earning a lot of and consuming. But it is a critical problem for fixed income group. They can not manage a lot of money at a time.

At present a lot of technological commodities are available at market. This middle class people are very much interested to buy those commodities. Because none can avoid the need of consumer and shopping goods such as television, radio, fan, CD player, refrigerator, car, apartment etc. Even people are very interested to buy computer. Day by day all of these commodities are becoming as core need of human beings.

In order to support this fixed income group a concept of banking ‘consumer credit scheme’ in emerged and has got popular acceptance the across the world. Because taking loan under this scheme people of middle income group are able to satisfy their need.

Different banks of our country have launched this scheme. NCC Bank Ltd. is a popular bank in our country. This bank promoted the scheme to uphold the living status of fixed income group people. But it is also a critical need to satisfy the effectiveness of the consumer’s credit scheme on the perspective of Bangladesh.

In the MBA programmed the department of marketing, University of Rajshahi has been fostered a practice of ‘internship’ work. In last semester of MBA program students are bounded to complete this study. As I am a student of MBA program it is better opportunity for me to drive study on this topic.

At last I would like to say that it is a very important study for MBA program. It would play an important role on practical life.

1.5 OBJECTIVES OF THE STUDY

The main objectives of this study are to find out the challenges and issues of marketing consumer’s products as well as credit scheme of NCC Bank Limited. The objectives are focused on the effectiveness of the scheme. Before setting up this report certain objectives were in dept in mind and the research work went accordingly. The objectives are enumerated below:

- To know the history of the National Credit and Commerce (NCC) Bank Limited.

- To know about the overall general banking system of NCC Bank Limited.

- To understand the major banking activities a banker performs those.

- To highlight the bank accounting system as different manuals and from practical and from practical orientation.

- To find accounting standards appropriate and applicable in the bank accounting system.

- To know about the rules and regulations of the bank.

- To know about present possession of National Credit and Commerce Bank limited in competitive market.

- To study existing bankers customers relationship.

- To know the importance of consumer’s credit scheme.

- To determine the present condition of consumers credit scheme at NCC.

- To identify the factors affecting in marketing of consumer credit scheme.

- To identify the problems those are arisen in implementation of consumer’s credit scheme.

- To find out ways to solve those problems.

1.6 METHODOLOGY

The report is composed of information collected from both secondary source and primary data collection survey. The primary information has been collected from the institutional and as well as some general clients of the bank. The secondary data collected from the National Credit and Commerce Bank archive, Annual report and used for the organization part of the report. Some opinions and ideas have been incorporated in this paper through interactive Sessions and interviews with the top management and mid level executives of the Organization.

“This study is exploratory in nature. Different books and journals are used as a means of this study. Primary information regarding the National Credit and Commerce Bank Limited has been obtained through personal interviews of some of the officials of the bank.” – William Zikmund

For primary data, I have conducted a survey of different respondents to collect the observations and analyze the data for evaluating the business development trend of the branch.

Secondary Data:

I have used different types of secondary data in completion of my internship report. Sources of secondary data are as follows:

Internal & External Sources:

Þ Annual Report of National Credit and Commerce Bank Ltd;

Þ Bangladesh Bank Report;

Þ Different books related to Business development;

Þ Periodicals published by the Bangladesh Bank;

Þ Different publications regarding banking functions, foreign exchange operation, and credit policies;

Þ Information regarding new products development.

Primary Data:

I have collected primary data by interviewing clients of the National Credit and Commerce Bank at Jatrabari branch. I have also included valuable insights of the employees. These data helps me to determine the business development trend of the branch. I have collected the primary data as follow:

Þ Face to face interview with the client’s;

Þ Through structured questionnaire;

Þ Discussion with the officers concerned;

Þ Exposure on different desk of bank;

Þ File study.

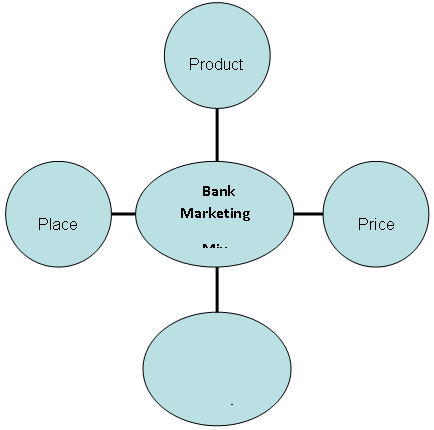

1.7 TECHNIQUES RELATED TO THE ANALYSIS

As well a view of marketing analysis has been kept. We know that the marketing practices are the combination of 4p’s that means how a marketer manages this 4p’s. The 4p’s of marketing are product, price, place, promotion. So, the shade of the study has been analyzed on the basis of 4p’s.

1.8 LIMITATION OF THE STUDY

Almost all the research project quite a few problems creep up while conducting the study. I faced the similar difficulties at the time of my study. Due to some unavoidable reasons my effort could not be successful to this extend. The internship report was not free from limitations. The manager of NCC Bank has provided all the necessary information with his best abilities. Key limitations of the study are as follows:

Þ Time was the most important limitation in preparation of the internship report. The program allotted only 3(three) months for entire study, which disable many opportunities for a comprehensive study.

Þ Relevant papers and documents were not available sufficiently.

Þ It was little difficult to get the actual information. In many causes the questionnaire had to be explained elaborately to the respondent. Much concerned was raised by the respondents such as, why the study is being undertaken, what would it reveal, are there any risk involved in answering this questions etc.

Þ In many causes up to date information is not available.

Þ As the officers were very busy with their daily work, they could provide very little time.

Þ Due to time constraints the sample size for the survey is small.

Þ The annual report does not contain some valuable information that is necessary to calculate some important ratio to see the bank performance.

There were some restrictions to have access to the information confidential by concern authority.

CHAPTER-II

OVERVIEW OF NCC BANK LTD

2.1 BACKGROUND OF NCC BANK LTD

National Credit and Commerce Bank Ltd. bears a unique history of its own. The organization started its journey in the financial sector of the country as an investment company back in 1985. The aim of the company was to mobilize resources from within and invest them in such way so as to develop country’s Industrial and Trade Sector and playing a catalyst role in the formation of capital market as well. Its membership with the browse helped the company to a great extent in this regard. The company operated up to 1992 with 16 branches and thereafter with the permission of the Central Bank converted in to a full fledged private commercial Bank in 1993 with paid up capital of Tk. 39.00 corore to serve the nation from a broader platform.

Since its inception NCC Bank Ltd. has acquired commendable reputation by providing sincere personalized service to its customers in a technology based environment.

The Bank has set up a new standard in financing in the Industrial, Trade and Foreign exchange business. Its various deposit & credit products have also attracted the clients-both corporate and individuals who feel comfort in doing business with the Bank.

2.2 CORPORATE MISSION – VISION

Mission:

To mobilize financial resources from within and abroad to contribute to Agricultures, Industry & Socio-economic development of the country and to pay a catalytic role in the formation of capital market.

Vision:

To become the Bank of choice in serving the Nation as a progressive and Socially Responsible financial institution by bringing credit & commerce together for profit and sustainable growth.

2.3 Goal of the Bank

To share a significant portion of the banking sector’s by utilizing available manpower and also state of the art technology for maximizing the shareholders wealth.

1. Long-term goal: To maximize the wealth of the shareholders.

2. Short-term goal: To earn satisfactory rate of return on investment providing wide range of banking services.

2.4 Features of NCC Bank Limited

There are so many reasons behind the better performance of National Credit and Commerce Bank Limited than any other newly established banks:

Þ Highly qualified and efficient professionals manage the bank.

Þ National Credit and Commerce Bank Limited has established a core Research & Planning Division with efficient persons.

Þ The bank has established correspondent relationship more than 100 of foreign banks.

Þ The computerized operation system in all branches of NCCBL has provided the frequent and prompt customer service.

Þ The strict leadership along with the supervision of efficient management directs all the branches.

Þ The inner environment and teamwork of all branches in NCCBL motivated all experienced employees to achieve the ultimate objective of NCCBL.

Þ National Credit and Commerce Bank Limited has become a member of the SWIFT system to expedite foreign trade transaction.

Þ National Credit and Commerce Bank Limited has become introduced some scheme for the purpose of saving of low income people which are not available in other like “ Ajebon Pension Scheme”.

Þ The bank offers attractive saving rate than other financial institutes.

Þ National Credit and Commerce Bank Limited provides loan to the customers at lower interest with easy and flexible condition than the others do.

Þ National Credit and Commerce Bank Limited charges lower commission from their customer in comparison wit other banks.

Þ Along with the profit generation National Credit and Commerce Bank Limited also maintain social responsibilities.

Þ The bank always guided their potential customer by giving valuable advises.

2.5 Board of Directors

At present the Board of directors consists of 14 members including the Chairman and Vice Chairman of the NCC Bank. Out of all members 14 of them are the sponsors of the shareholders. Most of the members are reputed industrialist and business persons of our country. The Chairman heads the Board. Each of the directors is the member of the Board.

The particulars of the Board are presented as under.

| NAME | DESIGNATION |

| Mr. Tofazzal Hossain | CHAIRMAN |

| Mr. A.S.M. Main Uddin Monem | VICE CHAIRMAN |

| Alhaj MD. Nurun Newaz | DIRECTOR (CHAIRMAN, EXECUTIVE COMMITTEE) |

| Mr.Abdus Salam | DIRECTOR (CHAIRMAN, AUDIT COMMITTEE) |

| Mr. Mahbubul Alam Tara | DIRECTOR |

| Mrs. Masuda Begum | DIRECTOR |

| Mr. Khondkar Zakaria Mahmud | DIRECTOR |

| Mr.Md. Shahjahan | DIRECTOR |

| Mr.Md. Mohamad Ali | DIRECTOR |

| Mr. Fakhrul Anwar | DIRECTOR |

| Mr. Manzurul Hassan Talukder | DIRECTOR |

| Mrs. Anjuman Ara Begum | DIRECTOR |

| Mrs. Rojbehan Banu | DIRECTOR |

| Mr. Mohammed Nurul Amin | MANAGING DIRECTOR & CEO |

| Mr.Md. Tarikul Alam | SECRETARY |

| Ata Khan & Co. |

Chartered Accountants

67, Motijheel C/A, Dhaka-1000

Bangladesh.AUDITORSLee, Khan & Partners

Suit No. 5/8, 4th Floor, City Heart

67, Naya Paltan, Dhaka-1000

Bangladesh.LEGAL ADVISOR

2.6 PERFORMANCE » AT A GLANCE

Six years Financial Highlights

TAKA IN MILLION PARTICULARS200820092010 Authorised Capital2,500.002,500.002500.00 Paid up Capital975.041,201.791352.01 Reserve fund and other Reserve884.901,215.581995.36 Equity fund1,859.942,417.373,326.52 Deposits21,478.2228,147.3434,901.77 Loans and Advances20,533.1324,678.3632,687.75 Investment3,010.453,552.086,266.62 Import Business16,296.3017,646.8028,779.21 Export Business7,776.308,557.009,577.92 Operating Income2,932.003,913.195,269.03 Operating Expenses1,913.662,645.623,488.78 Operating Profit1,018.341,267.571,780.25 Profit before Tax687.61,056.511,356.32 Profit after Tax352.08479.22677.18 Retained Profit10.317.838.13 Total Assets (excluding contra)26,114.1332,615.0142,522.85 Fixed Assets308.14353.71522.00 Number of Branches414853.00 Number of Employees8578969251,0001,1181,230.00Earning per Share44.4730.9946.9136.1139.8850.09Dividend: Cash (%)-10-1010 ——Bonus (%)1510301012.530.00Return on Equity (ROE) (%)20.5916.120.8318.9319.8220.23Return on Assets (ROA) (%)1.140.951.331.351.631.59Capital Adequacy Ratio8.019.019.059.029.7810.61Non performing Loans as % of Total Advances9.399.757.874.824.954.17Volum of Non-performing Loans1,234.141,253.351,188.40981.541,212.261,353.31Amount of provision against Classified Loans633.75733.86650.06405.75523.58644.11Amount of provision against Unclassified Loans118.34118.34138.9202.14282.09388.78Advance/Deposit Ratio (%)81.85%87.58%94.66%95.60%87.68%93.66%

2.7 FINANCIAL HIGHLIGHTS

FINANCIAL HIGHLIGHTS

For the year 2006-2007

| SI. No. | Particulars | Year under Review (2007) Taka | Previous Year (2006) |

Taka1Paid-up Capital1,352,012,1361,201,788,5662Total Capital3,326,529,1812,417,368,4933Capital surplus / (Deficit)190,521,381191,681,6194Total Assets42,522,853,99332,615,007,7925Total Deposits34,901,774,20328,147,342,3356Total Loans & Advances32,687,753,16524,678,356,2937Total Contingent Liabilities10,337,793,4539,518,074,5258Credit Deposit Ratio0.94:010.88:019Profit after tax & provision677,176,546479,219,80710Percentage of classified loans against total Loans & Advances4.17%4.95%11Amount of classified loan during current year1,353,310,0001,212,264,00012Provision kept against classified Loans644,108,800523,577,01413Provision surplus / (deficit)–14Cost of Fund ( %)10.86%10.51%15Interest earning Assets39,266,481,98930,008,631,49616Non-interest earning Assets3,256,372,0042,606,376,29617Return on Investment (ROI)8.30%7.78%18Return on Assets (ROA)1.59%1 .47%19Income from Investment519,684,376276,369,82720Earning per Share ( Taka)50.0935.4421Net income per Share (Taka)50.0935.4422Price Earning Ratio (Times)8.818.16

2.8 Profit and Loss Account

PROFIT AND LOSS ACCOUNT

2010 2009 Taka Taka Interest income3,861,806,484 3,012,129,525 Less: Interest paid on deposits and borrowings 2,738,449,472 2,047,143,589 Net interest income1,123,357,012 964,985,936 Income from investments 519,684,376 276,369,827 Commission, exchange and brokerage 707,853,807 489,031,412 Other operating income 179,680,977 135,660,233 Total operating income 2,530,576,172 1,866,047,408 Salary and allowances 449,461,009 367,663,793 Rent, taxes, insurance, electricity etc. 70,861,458 57,214,963 Legal expenses 3,931,197 4,025,901 Postage, stamp, telecommunication etc. 30,166,863 20,727,648 Stationery, printing, advertisement etc. 21,834,886 19,261,704 Managing Director’s salary and allowances 3,340,000 2,730,000 Director’s fees 1,456,000 1,185,500 Audit fees 120,000 120,000 Depreciation and Repair of Bank’s assets 84,045,290 63,733,131 Other expenses 85,116,287 61,808,842 Total operating expense 750,332,990 598,471,482 Profit before provisions1,780,243,182 1,267,575,926 Provision for loans and advances Specific Provision 207,934,561 130,784,000 General Provision 106,686,414 79,957,086 314,620,975 210,741,086 Provision for Off-balance sheet exposures 51,688,967 — Provision for Gratuity 30,000,000 — Provision for Investment Fluctuation in Shares 23,607,932 — Provision for Other Assets (1,000,000) 321,771 Total provision 418,917,874 211,062,857 Profit before provision for loans and advances & other provision1,361,325,308 1,056,513,069 Contribution to NCC Bank Foundation 5,000,000 — Profit before tax 1,356,325,308 1,056,513,069 Provision for tax 679,148,762 577,293,262 For current year 658,972,487 512,809,657 For prior years — 61,536,962 Deferred Tax 20,176,275 2,946,643 Profit after tax for the year 677,176,546 479,219,807 Add: Balance of profit brought forward

from last year. 7,826,980 10,312,214 Total profit available for distribution 685,003,526 489,532,021 Appropriations Statutory reserve 20% of net profit before tax 271,265,061 211,302,614 Proposed Cash Dividend @ 10% for 2006 — 102,178,857 Proposed Stock Dividend @ 30% for 2007 @12.50% for 2006

405,603,641 150,223,570 676,868,702 481,705,041 Retained earnings carried forward 8,134,824 7,826,980 Earning per share 50.09 35.44

Dated: Dhaka, 12 March 2008

2.9 Balance Sheet

NCC BANK LTD

Balance Sheet

As at 31 December 2010

PROPERTY AND ASSET 2010 2009

Taka Taka

Cash:

In hand (including foreign currencies) 467,251,137 248,445,816

Balance with Bangladesh bank and

Sonali bank (including foreign currencies) 1,825.530,019 1,540,115,288

Balance with other bank and

Financial institutions

In Bangladesh 348,402,749 1,286,728,163

Outside Bangladesh 107,112,038 135,282,499

455,514,787 1,422,010,662

Money at call and short notice —– 560,000,000

Investments

Government 6,104,515,246 3,410,634,030

Others 162,099,963 141,444,513

6,266,615,209 3,552,078,543

Loans and advances

Loans, cash credits, overdrafts etc. 30,616,557,011 23,038,761,590

Bills purchased and discounted 2,071,196,154 1,639,594,703

32,687,753,165 24,678,356,293

Fixed assets including premises,

Furniture and fixtures 521,995,601 353,707,057

Other assets 298,194,075 260,294,133

Non-banking assets – –

TOTAL ASSETS 42,522,853,993 32,615,007,792

LIABILITIES AND CAPITAL 2010 2009 Taka Taka

Liabilities:

Borrowings from Other Banks,

Financial Institutions and Agents 1,917,516,640 155,555,365

Deposits & other accounts:

Current accounts 4,365,185,051 3,603,928,441

Bills payable 669,649,754 371,294,841

Saving bank deposits 3,248,236,813 2,569,312,503

Fixed deposits 21,608,793,301 17,534,252,160

Term deposits 4,963,395,284 3,924,315,390

Bearer certificates of deposits 46,514,000 144,239,000

34, 901,774,203 28,174,342,335

Other liabilities 2,744,966,287 2,177,300,913

Total liabilities 39,564,257,130 30,480,198,613

Shareholders Equity Share Capital

Paid up capital 1,352,012,136 1,201,788,566

Bonus Share 405,603,641 150,223,570

Statutory reserve 998,726,567 727,461,506

Other reserve-Assets revaluation Reserve 194,119,695 47,508,557

Profit & loss account-Retained Earning 8,134,824 7,826,980

TOTAL SHAREHOLDERS’ EQUITY 2,958,596,863 2,134,809,179

TOTAL LIABILITIES & SHARE 42,522,853,993 32,615,007,792

HOLDERS EQUITY

CONTRA ENTRIES

Off balance sheet items:

Contingent liabilities

Acceptances and endorsements 3,964,968,285 2,764,847,529

Letters of guarantee 2,701,361,259 2,751,437,756

Letters of credit issued 3,628,467,338 3,987,117,291

Bills for collection 15,332,571 14,671,949

Other contingent liabilities:

Claims against the bank not —- —–

acknowledged as debt

Capital commitments —– —–

EDF 27,664,000 —-

Total Off Balance Sheet Items 10,337,793,453 9,518,074,525

CHAPTER-III

THE SYSTEM OF MARKETING OF BANKING PRODUCTS

3.1 Marketing for Bank

Marketing is a total system of business activities designed to plan ,price, promotion and distribution satisfying goods and services to present and potential customer. According to the official definition of the American Marketing Association Marketing is the performance of Business activities that direct the flow of goods and services from producer to customer or user.

The concept of Bank Marketing has been defined by various Banks Marketing as that part of management activity that seeks to direct the flow of banking service profitability to selected customers. The adoption of the marketing concept will recognize that banks customer are changing in terms of their wants, needs, desires , expectations , and problems Banks must define these in explicit terms and them evaluate their offering in customer’s terms. That is satisfying customer’ needs at a profit to the Banks.

3.2 Marketing Mix Adopted by the Bank

Marketing mix is the mixture of controllable marketing variables that the firm uses to pursue the sought level of sales in the target market.

We can say that the 4P’s are interrelated and must be blended into one integrate whole to satisfy some target market needs and performances.

So , marketing mix is a set of product, price, promotion and place which are interrelate.

3.3 The Marketing of Banking Products

The products of banks are essentially services. The products of Banks of are essentially services. Any satisfaction the customer gets form the performance of the service rather then forms the ownership of goods. Banks are in the Business of marketing cash security, cash accessibility, monetary transfers and time to enable customers wants to be satisfied to day without waiting until tomorrow when their own saving are higher. So, Banking product means services, which are able to satisfy the present and potential customer.

Banks Offer the following products or services:

PRODUCTS:

A. Deposit Products

- Current A/C

- Savings Bank Deposit A/C

- Short Term Deposit (STD) A/C

- Term Deposit A/C

- Premium Term Deposit A/C

- Instant Earnings Term Deposit A/C

- Special Savings Scheme

- Special Fixed Deposit Scheme(FDR)

- NFCD

- RFCD

- Money Double Program

- Foreign Currency A/C

- Special Deposit Scheme(SDS)

- Others

1. Current Account:

National Credit and Commerce Bank Limited opens current accounts for its clients to facilitate their day-to-day operations. The amount deposited in the current account can be withdrawn at any time. No interest is given on the current account. In certain cases however interest is available at an agreed rate where withdrawals are subject to a written notice for a specified period. The minimum balance requirement for this account TK.1000/- and TK. 100/- is deducted from the account in case of closing the current account. A person can open a current a/c or any entity. The entity can be a partnership firm, limited company, proprietorship firm, association, clubs etc. For opening a current account of the above, the requirements and steps, which are followed by this branch, are like: –

For a person:

There is an individual application form for opening personal current a/c. The person, who wants to open this type of a/c, is said to fulfill the following requirement:

a) Name/ Father’s Name/ Husband’s Name:

b) Present and Permanent Address:

c) Occupation:

d) Mandate in Writing:

e) Declaration of Nominee:

f) Letter of Introduction:

g) Specimen Signature:

h) Two copies of passport size photograph:

i) Initial deposit of Tk.5000/-

For Join Stock Companies, Association, Clubs etc.

In case of opening a current a/c of join stock companies, association, clubs etc. the following requirements are said to fulfill:

a) True copies of certificate of incorporation or registration (in case of companies and registered bodies).

b) True copies of certificate of commencement of business (in case of limited company).

c) True copies of memorandum and articles of association (in case of limited company). The rules of regulation by laws (in case of associations, clubs etc.)

d) True copy of resolution of the board of directors of managing committee / governing body, regarding conduct of account.

e) Certificate list containing names and signature of the board of directors/ officer Bearers.

v For Partnership / Proprietorship Company:

To open a current a/c on the name of any partnership or proprietorship company, the following document are required:

a) Filled up application form stating about the name and address of the firm.

b) Partnership deed.

c) Trade License.

d) Two copies of photographs.

e) Endorsement of an a/c holder of the same branch. (for partnership companies).

f) Undertaking / declaration about the partnership is taken by the bank in a white paper (for proprietorship firm)

v For Private & Public Limited Company:

The documents are required by the bank to open a current a/c be:

- Copy of the certificate of incorporation or registration.

- Copy of the certificate of business.

- True copy of memorandum of association and articles of association abide by laws.

- True copy of resolution of the board of directors / managing committee / governing body regarding conduct of the account.

- Certificate list containing the names and signature of the board of directors / officer bearers.

In order to open an account, the customer is first of all asked to fill up the application form given from the bank. The bank requires few documents of the client due to the producers, such as proposal for opening an a/c, name and full address (both present and permanent).

2. Saving Account:

The bank provides savings account services for the ease of its clients. It offers both personal and corporate Savings Account to its clients in every branch. The current rate on the deposit amount is 7% and the minimum balance requirement is TK. 1000.00. The bank requires no other service charges in opening this type of account. The closing charge for this account is TK. 100.00.

The necessary requirements for opening a saving account:

a) Name,

b) Father’s or Husband Name

c) Permanent and Present Address,

d) Occupation

e) Special Instruction regarding operation of the a/c

f) Mandate in Writing

g) Declaration of nominee

h) Letter of introduction.

i) Specimen signature

j) Two copies of passport size photograph

k) Initial deposit of Tk. 1000.

3. Short Term Deposit:

It is also interest bearing depository service. The current rate for short-term deposit is 6% per annum. This is a fund generating service for bank with lower cost compared to other.

Entries Passed:

A deposit slip shall be prepared crediting the STD a/c with the amount of the deposit.

Cash————-Dr.

STD a/c (Party)———Cr.

If the amount shall be deposited by check or transfer of a/c, the following entries shall be passed—

Party C/D, S/D a/c———-Dr.

STD a/c——————————–Cr.

The a/c opening form shall be pasted in the passing file in numerical order. The credit voucher shall be passed in the STD a/c of the party. In case of letter of authority to debit the STD a/c of the customer, voucher will be prepared and the following entries shall be passed:-

STD a/c (Party)—————Dr.

C/D (Party)————————Cr.

Minimum 7 days notice period is required for withdrawal of any sum of money from STD a/c. banker is not legally liable to the customer, if the check is dishonored under the following conditions, although the check is properly drawn:

Þ If the fund is insufficient.

Þ If the payment is stopped by the drawer.

Þ If payment is stopped by the court by issuing garnishee order.

Þ Any competent authority issues attached order.

Þ Check is presented after the death of the customer.

Þ Notice of assignment.

Þ Check presented after the business/banking hour as declared earlier.

4. Term Deposits:

Deposits are also accepted by the bank against acknowledgment in the form of receipts for the specified amount and fixed periods. They are known as term deposits receipts for the specified amount and fixed periods. They are known as term deposits attracting higher rates of interest graded on the basis of the periods of deposits.

The longer the period, the higher is the rate of interst on them. The receipt are not negotiable and not transferable. Sometime encashment of a receipt before maturity is allowed upon surrender of the interest. Unlike the current and savings deposits no bank account is opened for these deposits in the names of depositors.

5. Premium Term Deposit A/C:

It is also interest bearing depository service. The current rate for premium-term deposit is 13% per annum.

6. Instant Earnings Term Deposit A/C:

This is also interest bearing depository service. The current rate for premium-term deposit is 11% per annum.

7. Special Savings Scheme

Name of the scheme is “NCC bank special savings scheme”. Two types of account can be opened under this scheme. One for term of 5 (Five) years and another for a term of 10 (ten) years. Rules for both the accounts shall be the same. Monthly installments of deposit will be Tk. 500/= and its multiple up to Tk. 10,000/= only as mentioned below to be deposited every month during the entire period of the scheme as fixed at the time of opening the account. Account may be opened for any installments but later on the same is not changeable.

The depositor(s) will be paid a fixed amount after expiry of the term as follows:

| Monthly Installment | 5 Years | 10 Years |

| 1000/- | 76,268/- | 2, 01,608/- |

| 1500/- | 1, 14,402/- | 3, 02,412/- |

| 2000/- | 1, 52,530/- | 4, 03,216/- |

| 2500/- | 1, 90,670/- | 5, 04,020/- |

| 3000/- | 2, 28,804/- | 6, 04,824/- |

| 3500/- | 2, 66,938/- | 7, 05,628/- |

| 4000/- | 3, 05,072/- | 8, 06,432/- |

| 4500/- | 3, 43,206/- | 9, 07,236/- |

| 5000/- | 3, 81,340/- | 10, 08,040/- |

| 10000/- | 7, 62,680/- | 20, 16,080/- |

RULES:

Þ Introduction may be waived but photograph will be required to open the A/C. Account in the name minor can also be opened.

Þ A person is allowed to open more than one account for different installment in a branch/bank.

Þ No withdrawal shall usually be allowed before 5 (five) years. If any account is needed to be closed before 5 (five) years, interest at prevailing rate on saving A/C shall be paid along with the principal.

Þ No interest on the deposited amount shall be paid be paid if the A/C is close before 6 (six) months. In case of premature closure of any account Tk. 100 to be realized as account closing charge.

Þ In case of withdrawal of money by closing the A/C after 5 (five) years (for 10 years term) full amount applicable for 5 (five) years term and interest at prevailing rate on saving A/C for the rest period along with principal shall be paid.

Þ Monthly installment will have to be deposited by 10th day of each month (In case of holidays, deposit can be made on next working day). Advance installments are always acceptable.

Þ In case of lapses in depositing installment, the deposit slip of that particular installment to be used with month wish unto date late fees @2% per month per installment (on due installment) mentioning in the respective column of deposit slip along with due installment to be deposited.

Þ If an account holder fails to deposit 3 (three) consecutive installment before the expiry of 5 (five) years time the A/C shall be treated out of this scheme and interest at prevailing rate on savings A/C shall be paid.

Þ Deposit book to be issued for the mentioned installment size and period at the time of account opening.

Þ In case of mission of deposit book a sum of Tk. 100/= to be realized while issuing duplicate book but in that case, pages of installment so far paid earlier to be removed/cancelled from the duplicate book.

Þ No pass book to be issued in favor of the account holder.

Þ Under the scheme and account holder can instruct the bank to make payment of installment to the debit of his/her separate A/C with the branch.

Þ Depositors may nominate one or more persons against the account as “Nominee”. In case of death of A/C holder, transaction in the A/C will be suspended and payment will be made to the nominee(s). If there is no nominee, payment will be made to made to the legal heirs of the deceased (depositor’s) against succession certificate.

Þ In any Excise Duty/Income tax etc. is levied by the government on deposit/interest earned the same will be paid by debiting depositors accounts.

Þ On completion of any term (5/10 years) payment shall be made after one month from the date of deposit of last installment.

Þ Maximum up to 80% loan on deposit may allow to the A/C holder at ruling lending rate of the Bank.

8. Special Fixed Deposit Scheme (FDR):

The clients can invest in different deposit rates for different maturities. The bank encourages its clients to invest in fixed deposit rate as it is one of the effective means of acquiring large amount of deposit from people.

NCCBL offers following attractive rates of profit to its Depositors on Term & Savings Deposits:

| Nature of Deposits | Band of Rate of Interst |

| Fixed deposit or Bearer Certificate for 3 months | 11.50% |

| Fixed deposit or Bearer Certificate for 6 months | 11.75% |

| Fixed deposit or Bearer Certificate for 1 year | 12.00 % |

9. NFCD (Nonresident Foreign Currency Deposit)

NFCD account can be opened for a term of 1 month, 3 months, 6 months and 12 months in USD, GBP, German Mark, Japanese Yen or EURO Currency with any of their AD branches. The minimum amount of deposit should be USD 1000.00 or GBP 500.00 or equivalent amount in other currency.

NFCD account can be operated or renewal basis up to an unlimited period. The account holder can operate such account as long as he /she desires after the final return from abroad. A non-resident Bangladesh national can also open an NFCD account by deposit of foreign currency earned in foreign country within 6 months from the date of his/her final return from abroad.

Interest will be accrued on the balances of foreign currency deposit in NFCD account at the equivalent rate of interest applicable on EURO currency deposits. Interest so earned on the NFCD balances will be tax-free.

Balance of NFCD account in foreign currency can be remitted to any country freely. This balance is also convertible in BD Taka at the prevailing exchange rate.

10. RFCD (Nonresident Foreign Currency Deposit)

Persons ordinarily resident in Bangladesh may open and maintain with us Resident Foreign Currency Deposit (RFCD) accounts with foreign exchange brought in at the time of their return from travel abroad. Any amount brought in with declaration to custom authorities in form FMJ and up to us $ 5000 brought in without any declaration, can be credited to such accounts. However, proceeds of export of goods or services in Bangladesh or commission arising from business deals in Bangladesh shall not be credited to such accounts.

Balances in these accounts shall be freely transferable abroad. Fund from these accounts may also be issued to account holders for the purpose of their foreign travels in the usual manner (i.e. with endorsement in Passport and Ticket up to USD 300/- in the form of Cash currency notes and the remained in the form of TC).

These accounts may be opener in us Dollar, Pound, Staling, DM or Japanese Yen and may be maintained as long as the account holder’s desire.

Interest in foreign exchange shall be payable on balances in such accounts. if the deposits are for a term of not less than one month and the balance is not less than USD 1000/- or $ 500/- or its equivalent. The rate of interest shall be 0.25 present less than the rate at which interest is paid on balance of back in their foreign currency clearing accounts maintained with the Bangladesh bank.

- 11. Money Double Program

The bank encourages its clients to invest certain amount money for certain period of time; it is one of the effective means of acquiring large amount of deposit from people. The NCCBL provides double (twice) amount of deposit

after completion six(6) years. For example as;

| DEPOSIT | PERIOD (6) YEARS |

| 1,00,000 | 2,00,000 |

| 5,00,000 | 10,00,000 |

| 10,00,000 | 20,00,000 |

RULES & REGULATIONS FOR ACCOUNT WITH NCC BANK LIMITED

1) Savings Bank/Current Deposit/Fixed Deposit/ Special Deposit / Premium Term Deposit/Instant Earning Term Deposit/SSS/MDP/NFCD/RFCD/FC Account may be opened in the name of adult individual or jointly who is/are mentally sound.

2) Savings Bank Account may be opened in the name of Club, Association. Society and similar institutions.

3) Savings Bank Account may be opened in the name of illiterate persons and minor person after observing/completion

of necessary formalities.

4) Current Deposit/Fixed Deposit Account may be opened in the name of Firm, Corporate Bodies, Joint Stock

Companies.

5) Short Term Deposit Account may be opened in the name of Corporate Bodies. Joint Stock Companies.

6) A suitable introduction acceptable to the bank is required for opening bank account except Fixed Deposit Account.

7) Initial deposit for opening Savings Bank Account is Tk. 1.000.00. for Current Deposit Account and Short Term

Deposit A/c is Tk 5,000.00

8) Incidental Charges to be realized twice in a year in June & December @ Tk. 200.00 from Savings A/c. and Tk. 500.00

from CD, STD & all loan A/cs.

9) Withdrawals from Savings, Current and STDaecount can be made only by cheques supplied by the bank duly

signed with the specimen signature of the A/c holder (s) recorded with the bank.

10) In case of Savings Bank A/c the depositor (s) may withdraw money from the account twice in a week and may

withdraw money upto 25% of the balance without notice but for withdrawal money exceeding 25%, 7 (seven) days

notice is required. If the depositor persistently withdraws more than twice in a week or a sum exceeding 25% of

the balance in the account without notice, the bank may realise service charge in its discretion in addition to

forfeiture of interest for that month.

11) In drawing cheques the amount both in words and figures should be written distinctly and cheques should be drawn

in such a way as to prevent the insertion of any other words or figures which may facilitate fraudulent alterations.

12) All deposits to account should be accompanied by Pay-in-slips and the depositors should satisfy themselves that the

deposits are verified by the received and date stamp of the Bank and the signature of the Bank’s officials. No receipt

will be recognised unless it bears the initial or signature of Bank’s officials.

13) The Bank collects local cheques /DD etc. on clearing free of charge and for all other collection usual bank charges

will be realised as per bank’s rule.

14) The Bank shall endeavour to collect Cheques/DD etc. as promptly and carefully as possible but it cannot accept

any responsibility in case of delay or any loss.

15) Notices of stop payment will be carefully registeres, but the Bank cannot undertake any responsibility in case of

same being overlooked.

16) Cheques drawn payable to Firms or Limited companies may not be accepted for credit of personal account even

though drawn payale to bearer.

17) Statement of accounts will be supplied to the account holder (s) every month free of cost. Statement can be

supplied on request against payment of Tk 20.00 for each month’s statement.

18) If a depositor likes to close his/her/their A/c, service charge for Savings A/c. Tk.100.00 and for CD & STD A/c.

Tk. 500.00 will be deduct from the A/c.

19) Cheques deposited with us drawn on other banks but returned unpaid from clearing house, penalty of Tk.50.00

will be charged & for returned un paid cheque from outside clearing house Tk. 100.00 will be charged for each

such presentation.

20) If any Excise Duty/Income Tax etc. is levied by the Government of Deposit/Interest earned, the same will be paid

by debiting depositor’s account.

21) The Post Office/Courier Service and other Agents for delivery shall be considered the agent of the account holder

for all deliveries of letters, remittance etc. and no responsibility can be accepted by the Bank for any dely, non

deliveries etc.

22) The Bank reserves the right to refuse issuance of fresh cheque Book or to close any account without assigning any

reason which in its opinion is not satisfactorily conducted.

23) The Bank reserve to itself the right to alter or add to or cancel any of the forgoing rules at any time.

B. Loans and Advance Products

i. Cash Credit (CC) Hypo / Pledge

ii. Transport Loan

iii. Staff Loan

iv. Lease finance

v. Working Capital Financing

vi. Commercial and Trade Financing

vii. Long Term (Capital) Financing

viii. House Building Financing

ix. House Repair & Innovation

x. Retail and Consumer Financing

xi. SME Financing

xii. Agricultural Financing

xiii. Import and Export Finance

xiv. Long Term (Capital) Financing

xv. Loan Against Imported Machinery(LIM)

xvi. Loan Against Trust Received

xvii. Payment Against Document

xviii. Security Over Draft(SOD)-FO

xix. Security Over Draft(SOD)-G

C. Cards:

i. ATM Card ii. Credit Card (Local, International and Dual)

NCC Bank Visa Credit Card:

NCC Bank has launched its Visa Credit Card Service on August 22, 2005 and we are offering three types of cards which are Visa Classic, Visa Gold (Local) and Visa Dual Currency Card (Globally and locally). Since then were able to reach 5000 cards, both corporate and general.

Why NCC Bank Credit Card?

Þ Lowest interest rate in the country (2% per month)

Þ Dual Currency Visa Credit Card

Þ One supplementary card free of cost for lifetime (Spouse only)

Þ Treasure point facilities including foreign part

Þ Shortest process for Dual Currency card, only 24 hours

Þ Roaming Mobile Phone bill payment facilities

Þ Use of additional 142 ATM’s Booth and 600 POS of Dutch-Bangla Bank

Our Commitments:

We promise the followings in our services:

Þ Dedicated service at your door steps

Þ Sporty

Þ Faster service

Þ Security of cards

Þ Team work

Þ Patient at our services

Þ Transparency

Þ Quick decisions

Wide Range of Acceptance:

NCC bank Visa Credit Card is accepted at over 5,000 merchant outlets around the country. Our wide range of merchants include Hotels, Restaurants, Airline and Travel Agents, Shopping Malls, Hospitals, Jewelry Shops, Mobile Phone and Internet Service Providers, Petrol Pumps and many more! Now NCC Bank Visa Credit Cards can also be used at all 142 ATM’s Booth and 600 POS (Point of Sale) of Dutch-Bangla Bank.

Instant Cash Advance:

You do not need to carry cash any more if you have a NCC Bank Credit Card. You can withdraw cash up to 50% of your credit limit from any ATM across the country that shows Visa logo.

Credit Facilities:

NCC Bank Visa Credit Card offers you free Credit facility up to 45 days and minimum of 15 days without any interest (Purchase only).

Supplementary Card:

NCC bank Visa Credit Card holder can also enjoy spouse Credit Card free of cost for lifetime and issue more Supplementary card.

Reward Programs:

As a NCC Bank Visa Credit Card holder, you will accumulate Treasure points for every purchase made by using Visa Credit Card. For every Tk. 50 and USD 1 spent on your Credit Card, you will earn 1 and 1.5 Treasure Point accordingly and be closer to redeeming the reward of your choice.

Flexible Payment Option:

With the NCC Bank Visa Credit Card, you have the convenience to pay as little as 5% of your outstanding (or Tk. 500, whichever is higher) on the Card account every month, thus having the power and flexibility to plan your payments.

Auto-Debit Payment Facility:

With the NCC bank Credit Card, you no longer have to stand in long queues for paying your monthly bill. You can pay your monthly bill through NCC Bank Account by instruction Auto-Debit.

Corporate Visa Credit Card:

Corporate is characteristic of individuals acting together; “a joint identity”; “the collective mind”; “the corporate good”.

The new dimension of NCC Bank Visa Credit Card is Corporate Credit Card which has already started to benefit the Corporate Houses.

Objective of Corporate Customers:

Þ Fast and Accurate Services

Þ Effective Communication

Þ Attractive Pricing (Annual fee 50% discount on card fee)

Þ Strong Communication

Þ Smiling faces of the Bankers

Þ Good Ambience in the Bank

Our Corporate Offer:

| Particular | Small (10-100 | Medium (101-500) | Large (500 above) |

| Card Fee | 50% | 50% | (Negotiable) |

| Rate of Interest | 2% | 2% | 2% |

| Cash Withdrawal | 2 | 2 | 2 |

| Purchase | 2 | 2 | 2 |

| Maximum period of interest free | 45 Days | 45 Days | 50 Days |

| Replacement Card Fee | Charges | Charges | Free |

| Late Payment Charge | Charges | Charges | Free |

| Excess Over Limit Charges | Charges | Charges | Free |

Balance Transfer Facilities:

If anyone holds other Bank Credit Card, then NCC Bank will issue a credit card with equivalent limit and will issue a pay order by debiting card A/C from balance transfer option for the equivalent amount of total outstanding in order to full settlement and cancellation of other Bank A/C.

How to apply:

Prescribed application form is available at:

a) Card division of NCC bank head office

b) All branches of NCC bank

Required Documents with application form:

a) Photograph

b) TIN certificate

c) Salary certificate for salaried personnel

d) Trade License memorandum and article of association / partnership deed for businessman

e) Bank statement

f) Copy of any utility bill as proof of residence

g) Passport copy (if any)

h) Driving license/Voter ID/Office ID (if any)

i) Car/House ownership document (if any)

Age Limit: 21 to 60 years

Minimum Income: Tk. 10000 for Classic card and Tk. 30000 for Gold Card

Reach Us National Credit and Commerce Bank Ltd.

Card Division:

Peoples Insurance Building (10th Floor),

36, Dilkusha Commercial Area,

Dhaka-1000, Bangladesh

Phones: +88.02.955.0575; +88.0.955.0557; Fax: +88.02.955.0611

Email: cardncc@dhaka.net ; Website: www.nccbank.com.bd

24 Hours Call Center:

+88.02.955.0521; +88.02.956.9029

+880.181.714.0369

D. Remittance Products:

Correspondence arrangement with more than 330 Financial Institutions all over the World for Wage Earners Remittance we have Agency arrangement with 12 reputed Exchange Houses covering major Locations of our Expatriates.

The remittance products include the following features:

i. Special Interest rate on Savings and Term Deposits

ii. Wage Earners Welfare Deposit Pension Scheme

iii. Loans for Real Estate (Land purchase and House construction/renovation)

iv. Advance against Regular Remittance

Using the services of these global network, non resident Bangladesh nationals can send money from abroad to their home country within a few minutes without any risk, Besides Money Gram, they have also arrangement with foreign money exchange companies like U.S.E. Exchange Co. Redha-al-Ansari Co. etc. through which Bangladeshi expatriates can remit these money to their relatives in home country very easily and safely using SWIFT network. MoneyGram and SWIFT mechanism ensure 100% secured and quickest possible mode of money transfers from abroad tour country and Bangladeshi money receivers are enjoying these facilities through us. NCC bank ltd. is rendering exceptional services to its clients by arranging such private remittance of money from foreign countries to Bangladesh.

Here is some Foreign Remittance Agents with NCC Bank Ltd.; such as:

Þ MoneyGram (World Wide)

Þ Placid Xpress (United States of America)

Þ Xpress Money (Medalist & European Union)

Þ Dhaka Janata Xpress (Italy)

Þ Alfardan (U.A.E / Qatar / Dubai)

Þ U.A.E Exchange (U.A.E)

Þ Habib Qatar (Qatar)

Þ Arab National Bank Ltd. (ANBL) (Saudi Arabia)

Þ World Street (Dubai/U.A.E)

Þ SWIFT

Foreign currency transactions are converted into equivalent taka currency using the exchange rates on the date of such transaction. Assets and liabilities in foreign currencies are converted into taka currency at the

weighted average rate as of 31 December 2006. All exchange gains and losses are credited / charged to the profit and loss account.

MoneyGram

National credit and commerce bank limited is very happy to announce to have joined hands with MoneyGram payment systems Inc to serve expatriates to send money back home quickly from anywhere in the word. Moreover, money can also be sent quickly through MoneyGram from Bangladesh to other parts of the world as is done through the banking channel. At the moment they are concentrating on home remittances being sent by the expatriates.

MoneyGram payment system Inc is a non-back provider of electronic money transfer service. MoneyGram is providing its customers a service of an unsurpassed quality and superior value. MoneyGram has over 25,000 agent locations throughout the world. Persons anywhere require transferring cash quickly, reliably, conveniently and at attractive prices to more than 170 countries can depends MoneyGram agents for the service.

Finally using the MoneyGram service could not be simpler. All one has to do is to visit a conveniently situated MoneyGram agent anywhere in the world and hand over the money they want to send their relatives or friends along with the one-off transacting fee.

Þ Sender completes a “Send” form and gets a receipt. MoneyGram agent gives a Ref. No. which has to be passed to the receiver.

Þ Recipient the goes to NCC bank branch in Bangladesh. Fills out a “Receive” form and show proper identification.

Þ NCC bank makers and inquiry on the MoneyGram computer network to obtain authorization to pay recipient and recipient receives the fund.

MoneyGram is one of the fastest way to transfer money. Customers using MoneyGram can send or receive money usually within 10 minutes from anywhere in the world.

At NCC bank they provide the recipients immediate attention ad due care. They have made it a point to pay the recipient within minutes. The recipients need not require having a bank account. They do not levy any extra charge. They give a better exchange rate to the recipient. The recipient can approach any for the NCC bank branches at his convenience for payment.

- Ø The sender gives receiver ‘(8) Eight Digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(8) Eight Digit secret reference number’.

Xpress Money

- Ø The sender gives receiver ‘(16) sixteen digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(16) sixteen digit secret reference number’.

Placid Xpress

- Ø The sender gives receiver ‘(4-8) five digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(4-8) five digit secret reference number’.

Dhaka Janata Xpress

- Ø The sender gives receiver ‘(9) nine digit secret PIN number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(9) nine digit secret PIN number’.

Alfardan

- Ø The sender gives receiver ‘(16) sixteen digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(16) sixteen digit secret reference number’.

U.A.E Exchange

- Ø The sender gives receiver ‘(8) eight digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(8) eight digit secret reference number’.

Habib Qatar

- Ø The sender gives receiver ‘(13) thirteen digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(13) thirteen digit secret reference number’.

Arab National Bank Ltd. (ANBL)

- Ø The sender gives receiver ‘(12) twelve digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(12) twelve digit secret reference number’.

World Street (UAE/Dubai)

- Ø The sender gives receiver ‘(9) nine digit secret reference number’.

- Ø Receiver fills up the ‘Receive Form’ with all information real and correct with ‘(9) nine digit secret reference number’.

Below procedures are same for above Foreign Remittance

- Ø The foreign remittance officer receives the form and he checks the information given in the form by using the ‘Website Basis Software’ which has all the information of receiver.

- Ø He must have a commissioner certificate with attested photograph of him. or his passports photocopy 1st 5 pages as identification of himself for collect the remittance money. or he can collect a NCCBL card form the NCCBL for farther collect the remittance money.

- Ø If this information given there are correct than he print out the information page from the software and prepare the cash receipt with all formalities like attach a Govt. Stamp opposite side of the cash receipt.

- Ø The receiver must give (2) two signatures one is on the stamp and the other one is below the stamp.

- Ø Then the officer sends the receiver to the cash department with those vouchers to collect the remittance money. If he need cash money.

- Ø If he wants to transfer his remittance money in his account. If he has an account with the NCCBL than he can transfer his remittance money in his account.

SWIFT

(Society for Worldwide Inter bank Financial Telecommunication)

National credit and commerce bank limited is a member of the Society for Worldwide Inter bank Financial Telecommunication s.c.r.l. (in abbreviation S.W.I.F.T. s.c.r.l.). Through this fast, reliable and secure global communication NCC bank has gained 24 hours connectivity with over 7000 financial institution in 200 countries for transmission of LCs, Guarantees, funds transfers, Payments, etc.

E. Brokerage House:

i) Member, Dhaka Stock Exchange Ltd.

ii) Full Service Depository Participant

iii) A

F. Consumer service:

i) Bill Payment

ii) TT, DD, MT, PO service.

iii) Certificates

Product strategy:

| Customer / Market | Existing | New |

| Existing | Market penetration | Market Development |

| New | Service/ production Development | Diversification |

There are four alternative planning product strategies.

i) Market penetration:

Offering more existing service to existing customer or client, is market penetration offering more service to existing customers.

ii) Market development:

Offering more existing service to new client that is market development tries to attention new client.

iii) Service/ product Development:

Development New service / products to existing customer what is service/ product development. Banks are following this strategy.

iv) Diversification:

Develop new service for new customer, that is, diversification. bank has more diversify products to new customer.

3.4 The Banking Price

Banking interest rate means banking price. Price is important since it represent the only element of marketing mix that creates revenue. The banking system doses not in fact price all its services. Since some are offered free to customer. The most important price in the Banking system relate to interest rates. The government controls basic interest rates. Banks provides various interests to deposits and receiving interest form rates.

Various creditors which are showed in the table:

Price:

A. Different Interest Rate:

Products-Deposits | Rate |

| Current A/C |

0%

Savings Bank Deposit A/C

6.00%

Short Term Deposit A/C

6.00%

Special Savings Scheme(SSS)

12.00%

FDR [Three Month

11.50%

FDR [Six Month]

11.75%

FDR [One Year]

12.00%

Products-Loan | Rate |

| Cash Credit (CC) Hypo / Pledge | 16% |

| Transport Loan | 16% |

| Staff Loan | 6% |

| Lease finance | 17% |

| Working Capital Financing | 14.00% |

| Commercial and Trade Financing | 14.50% |

| HouseBuilding Financing | 15.00% |

| House Repair & Innovation | 17% |

| Retail and Consumer Financing | 16.00% |

| SME Financing | 17.00% |

| Agricultural Financing | 13-14% |

| Import and Export Financing | 7.00% |

| Long Term (Capital) Financing | 14.00% |

| Loan Against Imported Machinery(LIM) | 16% |

| Loan Against Trust Received | 16% |

| Payment Against Document | 16% |

| In Land Document Bill Purchase | 12-16% |

| Security Over Draft(SOD)-FO | 16% |

| Security Over Draft(SOD)-G | 3% Above |

B. Different Charges:

SL | ITEM | CHARGES |

1 | LOCAL COLLECTIONS |

A. Where there is a Clearing House

B. Where there is no clearing house

C. Cheques deposited with us drawn on other Banks but returned unpaid from clearing house

D.Cheques drawn on us dishonoured (cash.clearing or transfer)only in case of insufficient balance

Free

At actual, Minimum Tk. 25.00

Tk.50.00(Flat), Outside clearing house Tk. 100.00

Tk. 100.00(Flat) per instance from the account of the depositor.

2OUTSTATION COLLECTION

Collection of outstation cheques/Bills (clean/documentary) (ODBC/OBC)

i) Upto Tk.25,000.00

ii) Tk. 25001 .00 to Tk. 1 .00 lac

iii) Above Tk. 1 .00 lac to Tk. 5.00 lac

iv) Over Tk. 5.00 lac

@ 0.15% minimum Tk. 30.00

@ 0.15% minimum Tk. 60.00

@ 0.10% minimum Tk. 150.00

@ 0.05% minimum Tk. 300.00 and maximum TK.40000

3

LOCAL REMITTANCES

A. DD/TT/MT issuance

B. Telegram/Telex/Telephone charges for TT/DD issued (Incase of MT Tk. 1 5.00 as postage to be recovered)

C. Cancellation of DDATT/MT/PO

D. Issuance of duplicate instrument (on completion of usual formalities)

@ Tk. 0.10% minimum Tk. 30.00

At actual, minimum Tk. 30.00 (instrument upto Tk.100/- no charges to be realised)

Tk. 50.00 (Flat)

Tk. 100.00 (Flat)E. PO and SDR issuance i) UptoTk. 10,000.00: Tk. 10.00

ii) Tk. 10,000.00 to Tk.1 lac : Tk. 30.00

iii) Above Tk. 1 lac to Tk. 5 lac : Tk. 50.0 iv) Above Tk. 5 lac to Tk. 10 lac : Tk. 100.00

v) Above Tk. 10 lac to Tk. 25 lac : Tk. 150.00

vi) Above Tk. 25 lac : Tk. 200.00

04

PURCHASE OF CHEQUES & INLAND BILLS

i) Upto to Tk. 25,000.00

ii) Above Tk. 25,000.00 upto Tk. 1.00 lac

iii) Above Tk. 1 .00 lac upto Tk. 5.00 lac

iv) Over Tk. 5.00 lac

Commission

@ 0.25%, min. Tk. 50.00

@ 0.25%, min. Tk. 100.00

@ 0.25%, min. Tk. 250.00

@ 0.10%, min.Tk. 750.00

Above Tk. 10 lac @ 0.10%, min. Tk.1 ,250.00

Postage/Telex/Fax/Telephone

At actual, min. Tk. 25.00 Interest

Interest

As per Commercial lending rate

05

LOCKER SERVICE

i) Rent

ii) Security Deposit

iii) Replacement of Lost/Damage Key

Small Size : Tk. 1,500.00

Medium Size : Tk. 2,000.00 Large Size : Tk. 2,500.00 For Staff 50%

Tk. 2,000.00 per Locker

At actual Plus Service Charge Tk. 500.00

06

ISSUANCE OF SOLVENCY CERTIFICATETk. 250.00 per instance

07

ISSUANCE OF BALANCE CERTIFICATETk. 100.00 per instance

08

ISSUANCE OF FOREIGN CURRENCY BALANCE CERTIFICATETk. 250.00 per instance

09

SERVICE CHARGE ON DEPOSIT ACCOUNTS

i) Current Deposit/STD

ii)Savings Deposit

iii) All Loan A/C

i) Tk. 500.00 half yearly irrespective of balance

ii) Tk. 200.00 half yearly irrespective of balance

iii) Tk. 500.00 half yearly on each loan account.

10

ACCOUNT CLOSING CHARGESi) STD/CD : Tk. 500.00

ii)SB :Tk. 100.00

iii) All Schemes and FDR : Tk. 100.00

(For Pre-mature encashment)

11

ISSUANCE OF CHEQUE BOOKS

i) Against All types of Accounts

ii) New Cheque book in case of lost one

i) Tk. 1.00 per leaf

ii) Tk. 50.00

12

ACCOUNT TRANSFERTk.200.00 per Account Transfer

13

STOP PAYMENT INSTRUCTIONTk. 50.00 per instance

14

ON LINE SERVICE : A. Any Branch Banking (Cash-Withdrawal)i) Upto Tk. 1 0,000.00 : Tk. 1 0.00 per transaction

ii) Above Tk.10,000.00 to Tk. 1 lac: Tk. 20.00 per transaction

iii) Above Tk. 1 lac : Tk. 30.00 per transactionB. Intercity Transaction (Cash Deposit)@ 0.10% of the transacted amount, min. Tk. 100.00 per transactionC. Other facilitya) Account Balance Inquiry : Free b) Account Statement : Tk. 25.00 per Statement for per month

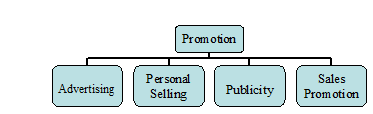

3.5 The Banking Promotion

The term production is used to refer of persuasive information which in conjunction with other elements of marketing mix, relates to the target market. The banks have to decide how information about the organization and its services will be disseminated. Four elements of the marketing communication mix generally recognized.

Figure: The Banking promotion

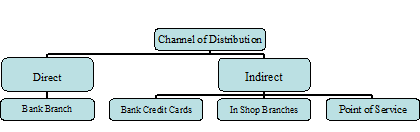

3.6 Place (The Banking channel of distribution)

Channel of distribution performs all of the activities to move a product and its title from production. Some private banks Ltd. in Bangladesh are following channel of distribution, which are shown below:

Figure: The Banking channel of distribution

Some of the private banks Ltd in Bangladesh are using cards representative Banks branch etc. to provide Banks service to customer. But Bank provides their service Bank branch. The NCCBL includes the following branches are as:

Branches

SL.NO. | NAME OF THE BRANCH |

01 | MOTIJHEEL BRANCH |

02 | BABUBAZAR BRANCH |

03 | BANGSHAL BRANCH |

04 | MITFORD BRANCH |

05 | MOGHBAZAR BRANCH |

06 | HASNEY TOWER |

07 | DILKUSHA BRANCH |

08 | DHANMONDI BRANCH |

09 | GULSHAN BRANCH |

10 | MALIBAGH BRANCH |

11 | JATRABARI BRANCH |

12 | MIRPUR BRANCH |

13 | FOREIGN EXCHANGE BRANCH |

14 | ISLAMPUR BRANCH |

15 | UTTARA BRANCH |

16 | ELEPHANT ROAD BRANCH |

17 | NABABGONJ BRANCH |

18 | MADHABDI BRANCH |

19 | Nawabpur Road Branch |

20 | MADARIPUR BRANCH |

21 | BANANI BRANCH |

22 | JUBILEE ROAD BRANCH |

23 | NOOR CHAMBER |

24 | COX’S BAZAR BRANCH |

25 | HALISHAHAR BRANCH |

26 | KHATUNGONJ BRANCH |

27 | O R NIZAM ROAD BRANCH |

28 | KADAMTALI BRANCH |

29 | FENI BRANCH |

30 | LAXMIPUR BRANCH |

31 | MAJIRGHAT BRANCH |

32 | MADUNAGHAT BRANCH |

33 | AREA OFFICE, CTG |

34 | BARAIYARHAT BRANCH |

35 | ANDERKILLA BRANCH |

36 | HAJIGONJ BRANCH |

37 | CHAKARIA BRANCH |

38 | CHAUMUHANI BRANCH |

39 | KHULNA BRANCH |

40 | JESSORE BRANCH |

41 | RANGPUR BRANCH |

42 | SYEDPUR BRANCH |

43 | PATGRAM BRANCH |

44 | RAJSHAHI BRANCH |

45 | BOGRA BRANCH |

46 | LALDIGHIRPAR BRANCH |

47 | CHOWHATTA BRANCH |

48 | MOULVIBAZAR BRANCH |

49 | BARALEKHA BRANCH |

50 | JAGANNATPUR BRANCH |

51 | COMMIA BRANCH |

52 | SHSVER BRANCH |

53 | SHYAMOLI BRANCH |

CHAPTER-IV

4.1 Findings of the study

As my study is concentrated with the existing marketing of product or service to offer customers. I have tried to compare its strategies, policies and effectiveness and measure the satisfaction level of customers with the NCC Bank Ltd.

To measure customers’ satisfaction is vary difficult. Because it is the applied research that always becomes different views from different clients.

Now I present existing marketing of products and performance that shown in below with charts and figures following ways.

4.2 Target Customer

Target market determination is very important factors for every business organization. In banking sector it is also very important to determine target market appropriately. To determine the target market, market should be divided into several segments. Then bank can choose one or more segment as their market the segment chosen by the NCC Bank Ltd as target market.

Target Customers

Customers | NCC Bank Ltd |

| Large Industry (Spinning, Garments, Lather etc ) | Ö |

| SME(Shop, Cottage Industry etc) | Ö |

| Consumer(Bill) | Ö |

| Students(Education Loan) | Ö |

| Agriculture | Ö |

| Service Provider | Ö |

| Micro Credit | × |

| Export- Import | Ö |

| Remittance | Ö |

| Property Developers | Ö |

| Employees | Ö |

| Staff | Ö |

| Loan with simple condition | × |

4.3 Product

Banking is a service based organization. So it is very difficult for the banks to identify and develop various, types of service. It is also difficult to identify the unexpressed / latent demand of clients. Also there is very intensive competition in banking service and it is increasing very rapidly.

Services provided by the NCCBL

Services | NCC Bank Ltd |

| Deposit receiving | Ö |

| Locker facility | Ö |

| Debit card facility | Ö |

| ATM facility | Ö |

| 24 hours service | × |

| Door to door service | × |

| Online facility | × |

| Counseling | × |

| Money transferring | Ö |

| Foreign Exchange facility | Ö |

| Loan facility | Ö |

| SMS banking | × |

| SMS billing | × |

| Flexi-load (Mobile) from deposit A/C | × |

By observing the above table we understand that NCC Bank Limited (NCCBL) holds maximum service. But NCCBL does not provide innovative service.

4.4 Price

It is very tough to set prices of services. So, it is also very difficult to set prices of various bank services. Also intensive competition makes it more difficult. The four banks generally consider the following factors for determining the prices

Considerable factors to determine interest rate

Types | Factors |

Deposit | i) Consumer |

ii) Competitors

iii) Interest rate of lending money

iv) Amount of depositing money

v) Liquidity of the NCCBL

Loan

i) Investment

ii) Interest of deposit

iii) Security

iv) Time

Interest on deposit:

The interest rates on deposits are varies on time and bank to bank. The interest rates of the NCCBL are given below.

Interest on deposit

Deposits | Rate |

| Current A/C | 0% |

| Savings Bank Deposit A/C | 6.00% |

| Short Term Deposit A/C | 6.00% |

| Special Savings Scheme(SSS) | 12.00% |

| FDR [Three Month | 11.50% |

| FDR [Six Month] | 11.75% |

| FDR [One Year] | 12.00% |

NCCBL provides comparatively lower interest rate for FDR. Sometimes clients claim that other banks give high interest rate for the customers.

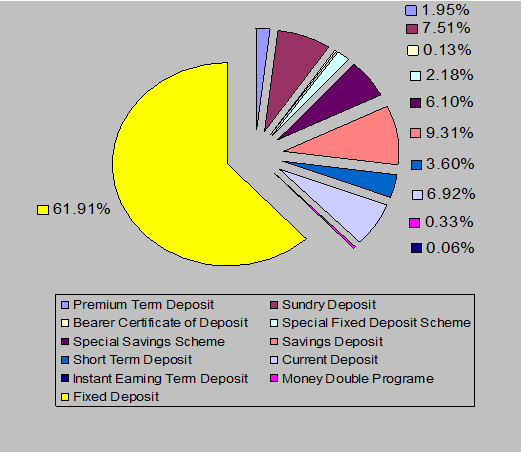

Deposit Mix – 2010

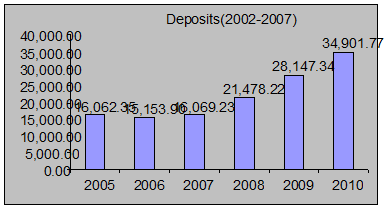

Deposit (2005-2010)

Figure (In Million)

From the chart we show that the amounts of deposit are gradually increasing from year to year.

Charges on Transaction:

There are some general transactions are provided by various banks. The charges on this transaction are also varying bank to bank. The charges of several transaction of the NCCBL are as follows:

Charges on Transaction

Transaction | Charges |

| DD/TT/MT issuance | @ Tk. 0.10% minimum Tk. 30.00 |

| Telegram/Telex/Telephone charges for TT/DD issued (Incase of MT Tk. 1 5.00 as postage to be recovered) | At actual, minimum Tk. 30.00 (instrument upto Tk.100/- no charges to be realised) |

| Cancellation of DDATT/MT/PO | Tk. 50.00 (Flat) |

| Issuance of duplicate instrument (on completion of usual formalities) | Tk. 100.00 (Flat) |

PO and SDR issuance i) UptoTk. 10,000.00: Tk. 10.00

ii) Tk. 10,000.00 to Tk.1 lac : Tk. 30.00

iii) Above Tk. 1 lac to Tk. 5 lac : Tk. 50.0 iv) Above Tk. 5 lac to Tk. 10 lac : Tk. 100.00

v) Above Tk. 10 lac to Tk. 25 lac : Tk. 150.00

vi) Above Tk. 25 lac : Tk. 200.00

Interest on loan facility:

Interests on loan mainly vary on the amount, time and mortgage. This is the main sources of bank income. The interest rates on loans of NCCBL are shown in the figure:

Interest on loan facility

Loan | Rate |

| Cash Credit (CC) Hypo / Pledge | 16% |

| Transport Loan | 16% |

| Staff Loan | 6% |

| Lease finance | 17% |

| Working Capital Financing | 14.00% |

| Commercial and Trade Financing | 14.50% |

| HouseBuilding Financing | 15.00% |

| House Repair & Innovation | 17% |

| Retail and Consumer Financing | 16.00% |

| SME Financing | 17.00% |

| Agricultural Financing | 13-14% |

| Import and Export Financing | 7.00% |

| Long Term (Capital) Financing | 14.00% |

| Loan Against Imported Machinery(LIM) | 16% |

| Loan Against Trust Received | 16% |

| Payment Against Document | 16% |

| In Land Document Bill Purchase | 12-16% |

| Security Over Draft(SOD)-FO | 16% |

| Security Over Draft(SOD)-G | 3% Above |

From the figure we have shown that interests on loans are comparatively higher than any other banks. So NCCBL should reschedule interest rates on loans for better customer service.

The NCCBL’s loan and advances are shown in chart (Figure in million)

4.5 Place

Customers are separated from the bank. They are living in various in the country. So, to attract the customers, to serve them it is necessary to reach. Distribution channel should be such away that to achieved the benefits provides by the bank.

Banking activities as a service it provides direct distribution channel. So, more branches indicate more efficiently in distribution. NCCBL holds 53 branches and considers factors to open the bank branch.

Considerable factors to open the bank branch

Factors | NCCBL |

| Urban Area | Available |

| Semi-urban Area | Available |

| Rural Area | Merely Available |

NCCBL must consider not only urban area but also rural area for expanding banking service.

Numbers of Cash Counters:

For providing efficient cash services every bank has separate cash counters. They may provide cash services with one or more cash counters. I represent numbers of cash counters at Jatrabari Branch of NCCBL.

Numbers of Cash Counters

Cash Counters | Numberts |

Bill | 4 |

Received | 2 |

Payment | 1 |

From the table we see that Jatrabari Branch of NCCBL may expand payment and bill counters for quick and efficient service.