Introduction

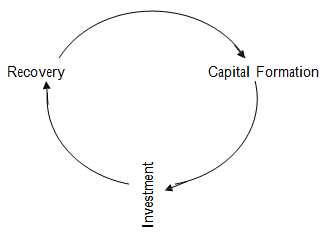

Capital formation, from both domestic and foreign sources, is the first step to get in the economic development process. Once a targeted level of capital formation is achieved, the question of investment comes. With no investment situation due to lack of feasible areas to invest, capital formation can earn nothing. And lastly, the invested funds are required to be serviced at their maturity. This is the development loop, in a sense. Previously, when Bangladesh starts as a new country, capital formation was a problem as the country suffers severely from scarcity of funds. During that time, most of the capitals were generated through international borrowing, foreign direct investment, aids, and grants or through governmental channel. But now people have funds in their hand as they save and there are sufficient areas to invest. In a developing country like ours the areas of investment are unlimited. We invest to improve our welfare, which for our purposes can be defined as monetary wealth, both current and future (Jones, 2002). And investment is not the end of the story; the invested funds are needed to be settled in a timely fashion so that the fund again gets its way to be flooded down in the economic process either by reinvestment or by immediate consumption. Till now, we cannot achieve soundness in this process and our development loop stops in the midway that is considered one of the main reason for our economic backwardness. Loans that are considered sound at the time of sanctioning become unsound with the passes of time and turn our wheels of economic development in a backward way.

Figure 1: Capital formation œ Investment œ recovery loop

Recovery

Capital Formation

This very much unexpected situation becomes customary at present economic scenario and draw the attention of the concerned authority. Because, financial institutions are suffering from this economic hazard acutely. All are concerned and cautioned to develop situation specific tools to be used to handle the unstructured situations structurally. The loan loss is a total loss of time, money and effort. Whether or not savings and investment play a leading role in development, serving as —the engine of growth“, has on the other hand been a source of controversy since the early days of development economics (Meier and Rauch, 2000). The focal point of the study is to identify the major reasons of non- performing loan, specific areas where loan defalcations are commonplace and some ways to control it in present economic structure with some forecasted ways that may be followed in future.

Methodology

The study comprises the view of the professionals in the respective fields. The primary sources of data collection are given priority over the secondary sources. Secondary sources are analyzed to develop a framework for the study, to get a clear orientation over the documented practices throughout the world. Face to face communication is explicitly used to collect information so far as data collection through primary sources are concerned. So, error depends on the responses of the respondents only. In the study, financial institutions basically mean banks. Because, the investment function is primarily done by the banking institutions. Respective personnel in the investment and recovery section were the major respondents of this study. Some major clients (insignificant) are also interviewed to borrow their ideas. Total number of respondents in this study amount to 87 personnel from 26 branches of 9 banks and 12 borrowers who basically avail the investment facilities. The responses are accumulated and descriptive statistics are used to draw the conclusions theoretically. The conclusion drawn here is not the concrete one as it depends on the responses collected that is very much theoretical and varies from person to person, situation to situation and country to country as well.

Non-Performing Loans: Defined

Loan becomes non-performing when it cannot be recovered within certain stipulated time that is governed by some respective laws. So, non-performing loan is defined from the institutional point of view, generally from the lending institutions side. Loan may also be

non- performing if it is used in a different way than that for which it has been taken. This is the users point of view. But, here we will confine the definition to the institutional point of view. In this case, loan becomes non-performing when it is classified as bad and loss for which Bangladesh Bank requires 100% provisioning by the scheduled commercial banks (as per BRPD circular). Under Basel-II, loans past due for more than 90 days are non-performing.

Reasons of loans being non performing Default culture is not a new dimension in the arena of investment. Rather in the present

economic structure, it is an established culture. The redundancy of the unusual happening becomes so frequent that it seems that people prefer to be declared as defaulted. In developing and under-developed country, the reasons of being default have a multidimensional aspect. Various researches have concluded various reasons for a loan to be default. Some of them are discussed below that are very much pertinent to the study.

a. Reduced attention to borrowers

This is related to the Hawthorne effect. Researchers at Hawthorne Electric Company in the US in the 1920s wondered what effect changes in lighting; heating and similar variables would have on factory workers. To the researcher‘s amazement, productivity increased throughout the study, during which time lighting was varied greatly from normal to dim to brilliant and back, the heat was turned up and down, etc. The puzzled researchers eventually concluded that the workers were responding positively because they were the subjects of interest, not because of changes in their

working conditions. Workers perceptions that someone is paying attention to them get better results than perceptions of inattention, of being ignored. Borrowers may also perform in this manner.

b. Moving along the risk curve

This might be called the Petroski Effect. In —To engineer is human: The role of failure in successful design“, Henry Petroski, a forensic civil engineer fascinated with the failure of large structures notes that each new major bridge, for example, always has to be higher, longer, stronger or cheaper than the last bridge of similar design. Something that works tends to be the subject of attempts at replication and improvement in new environments. This means that risk increase and are always to some degree unknown as the low risk situations become saturated.

c. Increasing loan size increases risk

This may be called the Inverted Pyramid Effect. In the 1980s the manager of a donor funded project to develop rural credit unions in Malawi were pleased to note a large increase in deposit mobilization in a small credit union in a remote location. Project funds were used to enable borrowers to obtain loans equal three times their deposit or share balances. But one day, the expansion ended, as did the credit union. This may be easily explained with a numerical example: one farmer deposited 100 and borrowed 300. He kept 100 and gave a relative or friend 200, which that person deposited in the credit union. That person then borrowed 600, kept 200 and gave 400

to another relative or friend. After everyone in the village had participated and the loot was shared, the exercise ended. This is also seen clearly in loan use progressions

by members of Grameen Bank in our country. d. Lenders lack plans to deal with risk

Donor-funded credit programs are usually designed without a clear focus on risk. In micro finance promotion there seems to be no clear vision of risk or no industry-wide concern about means of addressing it, other than running a tight ship. The literature is largely concerned with outreach, measured by number of borrowers, and covering administrative costs. The jury is still out of micro-lender performance, which is currently supported by a tidal wave of donor funds that lifts all but the most leaky of ships. This inattention to risk may be called The Pollyanna Effect.

e. Borrowers probe a credit operation‘s weaknesses

Credit programs have no special claim to infallibility. A borrower may be determined

to repay on time but because of some unexpected events fail to do so. If the lender does not follow up promptly with a query, the borrower will take note. She may simply be grateful not to have been embarrassed. A second way in which borrowers are tempted to probe a credit program‘s weaknesses is when some borrowers blatantly refuse to pay on time or skillfully avoid payment. Borrower‘s probing of a lender‘s weaknesses may be called the Jurassic Park Effect. The dinosaurs in this popular film tested the structures and devices used to contain them within certain areas of Jurassic Park and eventually gained control over the entire park to the dismay, discomfort and eventual departure or demise of their human captors. In addition, the park‘s dinosaurs become more aggressive after the developers lost control of dinosaur breeding as a result of unexpected risks. This was captured by the remark of one actor that, —life finds a way“.

f. Rent-seekers capture the credit program

Credit programs attract rent seeking of all sorts, especially when some subsidy is

involved. In certain cases hijacking is blatant, as when the pattern of funding follows election year cycles. This was a prominent feature of crop credit insurance in Costa Rica in one election year, and more egregiously in Mexico through the 1980s, when massive crop failures were reported every six years and massive indemnities were paid. In Bangladesh in 1991 a newly elected government decreed that agricultural loans of less than Tk. 5000, be forgiven, regardless of the source of the loan, which made collection on small loans more difficult generally for several years. It is proved to be almost foolproof recipes for unsustainable programs, the victims of the Hijack Effect.

g. Lenders and project designers have low expectation

In some cases credit is provided by donors because it is the easiest thing to offer, it makes many people happy and it corresponds to a certain view of development and the conditions required for it to occur. In this case repayment is not terribly important

to donors because the objective is almost overwhelmingly to get the money working

in order to stimulate development. This cause of declining repayment performance may be called the Something-must-be-done Effect. Lacking more precise and effective tools, donors and governments embrace credit to accomplish purposes that it cannot realize in a sustainable manner or that are highly unlikely to be achieved. Reasons for this include fungibility and the impact of other, non-financial constraints lowering retains to the activities for which credit is provided.

h. The lender is unwilling to collect

Another possibility is that the lender is unwilling to collect. Unwillingness may arise from a number of factors, but almost always requires soft funds that the lenders can afford to lose. Unwillingness to collect may result from the realization that the credit program was poorly designed, destined to fail. It may also reflect a view that the beneficiaries are poor while the sponsors are not, and that a sense of fairness precludes any serious action against defaulters. This can be called the Patronizing Effect.

i. Lack of good models

Another possibility is that lenders are simply not familiar with successful examples of dealing with bad and doubtful debts. This is likely in transaction economics in North and Central Asia where commercial banking is still something of a novelty compared

to banking in service to economic planning. It also occurs, as in Bangladesh and Nepal, where state domination of the banking system has been accompanied by a high tolerance of non-repayment associated with politicization of financial markets. Legal recourse in these situations is remote, costly, and uncertain. This lack of credible models can be called High Default Culture Effect.

j. Loan sanctioned by corruption

In countries like Bangladesh, sometimes loan sanctioning authority sanctions loans for satisfying their self-interested behavior. Thus, they engage themselves with the clients and corrupt the total system by giving some benefits for taking something in return. This may be called as Give and Take the Chance Effect. This is the result of

too much politicization and power-relatedness in the institutional system.

k. Donors give loans to dominate

Till now, we depend on the donations made by donor countries. The strategies that

most donor country follows are to weaken our system so that they can hold the bargaining option to ensure their dominance. They seem to help us by earning our bread and butter, but in the long run, they are paving the way to let us die in future. This may be termed as Live and Let Die Effect.

l. Weak follow up weaken the system

In our society, people give more importance on current consumption. So they do not mind to spend the borrowed fund to spend for consumption if they are not strictly followed up. People hold a very short vision of thinking for today leading sufferings tomorrow. So, a significant portion of capital goes to unproductive sector that may be termed as Die Another Day Effect.

Here, the twelve above-mentioned causes and their ultimate effects are the direct outcome of various research works conducted throughout the globe in different time. More interestingly, the study that is conducted under the concerned topic also finds out the same reasons of major loans to be defaulted at the time of maturity. The responses of the participants are accumulated and descriptive statistics are used simply to rank the various reasons for such economic distress. These are listed below in order of importance

and priority.

Table 1: Reasons of loans to be defaulted

| Ranks | Effects | Reasons |

1 2 3 4 5 6 | Pollyanna Effect Hawthorne Effect Petroski Effect Jurassic Park Effect Inverted Pyramid Effect High Default Culture Effect | Lenders lack plans to deal with risk. Reduced attention to borrowers. Moving along the risk curve. Borrowers probe a credit operation‘s weaknesses. Increasing loan size increases risk. Lack of good models. |

Hawthorne Effect Petroski Effect Jurassic Park Effect

Inverted Pyramid Effect High Default Culture Effect Lenders lack plans to deal with risk.

Reduced attention to borrowers. Moving along the risk curve.

Borrowers probe a credit operation‘s weaknesses. Increasing loan size increases risk.

Lack of good models.

The rank that is made above is the outcome of the responses from the professionals for

the time being. It is not supposed to be exclusive and very much related to a specific time period and cannot be generalized, as the sample size is insignificant as compared with the population. But, it obviously reflects an indication of present weaknesses so far as investment is concerned.

Capital formation-investment-recovery loop extended: a direct consequence of non- performing loan

Economic development will always be in its infancy if sufficient capital cannot be

formed. Capital formation has at least two dimensions, i. e., domestic and international. This study, for ensuring simplicity, considers domestic capital formation. This is basically the function of thrift organizations, like banks and other financial institutions, to motivate the households to save from their small earnings. The attraction should be institutionalized so that the savings can be utilized in economic process. Households should be motivated to save and to deposit the same so that the idle savings can be used economically. Sometimes, they are self-motivated. Economists have identified at least three broad reasons for saving (Frank, Bernanke, 2001); life cycle saving: savings to meet

long-term objectives, such as retirement, college attendance, or for the purpose of a

home; precautionary saving: savings for protection against unexpected setbacks, such as the loss of a job or a medical emergency; bequest saving: savings done for the purpose of leaving an inheritance. But, sometimes they require external inducement that is basically done by the financial institutions or government. Along with household savings, there is another form of investment that basically comes from corporation. Akyuz and Gore (1996) argue that the most important contribution to high savings and investment rate in the East Asian Tigers was not exclusively household savings, but the ”investment profit nexus.‘ Corporate profits were actively encouraged by the state and this corporate savings

were one of the main contributors to the sustained high investment rate.

Savings can be held in different forms, as financial assets, as stores of value, as well as informal financial assets such as savings in informal financial institutions. The financial liberalization paradigm maintains that savings in the informal sector are as a result of inefficient and repressed financial markets. The lack of access to financial saving instruments and the market fragmentation, means that people have to resort to non- financial savings (Gupta, 1985). S. Nissanke (1991, mimeo) points out the prevalence of

non- financial savings in rural households of East African countries, where financial savings at times constitute only 5-6% of total household savings. Household savings in India are remarkably high (Singh, 1995), as well as Italy (Jappelli and Pagano, 1994). Getting the small savings from the households, financial institutions form large capital so that it can be invested in the development of various sectors like industry, business, development and others. When savings get investing status, it works for the economic development, provided that the investment is rightly done. In an article entitled —The Vice of Thrift“, The Economist (1998, p. 85) states, —It has become clear that the surge in investment in East Asia in the 1990s was a sign of weakness, not strength. Much of the money was wasted on speculative property deals or unprofitable industrial projects.“ The very logic of investment function should be to ensure sustainable development in a country like us. Because, sustainable development paves the way of further development. The consequences have both positive and negative dimensions to the investing authority though in the economy it always should have a positive result upto a limit. If the invested funds can be captured timely, it can again form new capital creating a good option of reinvestment or consumption. Both of these reinvestment and consumption functions create a positive impact on the economy.

Economy is in the vicious circle of poverty

economic framework and structure. Apparently, it may seem that it‘s good so far as

economic development is concerned, as the money remains invested in the economic process. But the reality is that the funds may fail to achieve its ultimate target, it may be unutilized or underutilized or even in extreme case, the funds may flow out of the economy. Then the loss will be a total loss both to the investing authority and to the society as well. Thus, it will lead the economy to be stagnant for the time being, and if not checked, forever. It will also accelerate the path of being and remaining poor for the time being.

Assurance of a timely recovery of the invested fund ensures societal economic development as these funds again flow into the economy in the form of either investment

or consumption. The fast the loop moves, the fast the economy develops.

In case of a different consequence, when the loop breaks, economy experiences a different look like the above where the rate of savings and investment declines leading to lower the income that hamper the process from both perspective; at one side, standard of living declines (by lowering the expenditure for living), and on the other, by saving nothing as the total earnings are expensed to continue the livelihood.

Findings to be capitalized

The study has some other important findings to be highlighted. These may help the respective authorities to ensure more control over the investment. Some points are pointed out below for special consideration.

1. Small size loan outperform large loan

Loans that are small in volume are less sensitive and less risky. The present structure shows that most of the small loans are unclassified and financial institutions have to spend less time and effort to deal with such loan.

2. Go for short-term and avoid long term loan if possible

Long-term loans are very common to create problem at maturity. But, in case of short-term loan, most often it is serviced within the specified period. Again, after

maturity, the fund can be reinvested in similar situations. In this way, the single

amount can be invested for three to four times in a year and the actual return is higher than the nominal rate.

3. Go for syndication in case of large loan

In case of large loan, loan syndication ensures both earnings and timely repayment on part of the borrower. In our country, loan syndication is a recent phenomenon and the use of this facility is not common.

4. Micro credit is less risky than industrial loan

Micro credit is self-liquidating in most of the cases whereas the servicing of industrial loan depends on the success story of the industry for which the loan was sought.

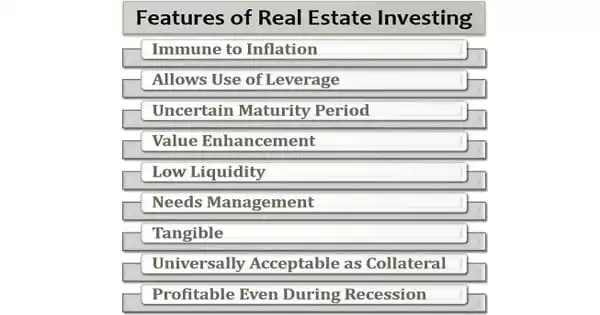

5. Bai is superior than money for money

Bai means buy and sale. In Islamic Banking, Bai mechanism is followed. They purchase goods or services on behalf of the clients and sale these goods and services

to them. But, the conventional banking believes to lend fund directly. In this case, sometimes it becomes very difficult to look after the use of the ultimate fund and if used in unproductive areas, the fund is very common to be defaulted. Realizing this less risky mechanism of fund investment, most of the conventional banks are trying to open some Islamic branches and some other deciding to transfer their complete operation from conventional to Islamic type of banking.

6. Commercial loan is self liquidating than infrastructure loans

Loan for commercial purposes is less risky than loan in infrastructure purposes. So invest more in commercial areas. Here commercial loans include working capital loan, trade loan, L/C etc. Infrastructure loans are composed of loans for various physical assets to be installed inside or outside the business premises.

7. Risk is primary and return is secondary consideration

Presently, most of the financial institutions give more importance on risk assessment than on return. But, traditionally, return is given more importance and even in some situation, risk was not considered at all. This tendency, on part of the loan sanction officer, poses a great threat to the timely recovery of the loan. So, present day officer wants to have a detailed risk analysis before sanctioning loans to the clients.

The main theme of all of the findings is that risk and return is positively related. Risk less investment will bring less return for the investing company carrying the guarantee of getting the money back at maturity. But, if the investing party wants to earn premium in the market, they have to deal with risk where the probability of getting the invested funds back will be reduced greatly as the risk increases. This is the consideration of the investing parties basically. So, they have to make a wise bundle of investment areas to diversify their risk with a view to earn maximum profit. This is not the objective of the study. Now the question of capital formation-investment-recovery loop comes with an expansionary status. Because, investment function holds not only an individualistic focus but also it has a socialistic approach, more importantly. In a developing country like

Bangladesh, it does something more than a developed one.

Ways to recover timely to turn non-performing loans into a performing one: a basic learning from the study

Recovery is not a problem, just the end of one process that fed into the next process. This

is our self-developed problem due to our lack of knowledge, negligence, inefficiency and

lack of commitment. As this is the social devil we should avoid this. The study reveals

some ways to control recovery crisis.

1. Law and order situation

Most of the respondents are dissatisfied with the present law and order situation prevalent in our country. This is the finding of the author that loans often become defaulted as the defaulter can use the loopholes of the law to reap unusual benefit. The climate should be extortion free that will help to generate surplus, thus recovery will be more. Above all, political stability is the precondition for ensuring a stable business climate and due to this reason; recovery problem becomes a social crisis in our environment.

2. Risk assessment

In our previous discussion, risk seems to be an uncontrollable factor but is a must for dealing with investment. But, this sensitive and crucial factor is bypassed most of the time. Some financial institutions, even, have no satisfactory guidelines to be followed

to assess risk. Bangladesh Bank makes it mandatory to follow lending risk analysis (LRA) developed by the consultants of Financial Sector Reforms Project (FSRP) that was introduced in 1993. But, the situation should be different where individual banks are supposed to develop their own tool depending on their own needs and specification.

3. Motivation

A high level of motivation works like a tonic of loan recovery problem. A national level award may be arranged for the best loan performer. He may also be given some monetary incentives in the form of tax deduction or others. A congenial relationship with the banker and the borrower also helps a lot where borrowers are kept regular contact with the banker.

4. Recovery Agency

The concept of recovery agency is not new. But, in our country, it is not developed

till now. To the surprise of the author, only one bank is thinking to employ one recovery agency for the first time to collect a bad and loss loan.

5. Less relaxation

From the management point of view, loan recovery should not be relaxed by a single moment. It may go to be a time barred debt. As the age of the loan lingers, the possibility of getting the fund back becomes dimmer. So, relaxation is strictly prohibited. Most of the nationalized banks loans become defaulted due to the lingering process.

6. Collateral management

For each and every type of loans, it is important to maintain sufficient collateral. Keeping collateral is not enough; it should be managed properly with the regular check of the value, ownership, physical condition and other legal status etc. Collateral should always have sufficient value to recover the debt.

7. Developing situation specific models

Different cases, in terms of the types, sensitivity and complexity; require different treatment. Professional management can be used to develop situation specific tools that may help to deal with different situation differently. In present situation, most of the loan officers still use traditional ways to deal with such situations that ultimately leads to an unsatisfactory conclusion.

8. Real time training

Repayment prospects of the loan depend to a large extent on the competence of the management of the borrowing unit (Chowdhury, 2002). People, in practice, warrants that they are badly in need of training to be introduced with the modern complex business solutions that will increase the competence level. These are necessary from time to time just to update the knowledge and to be in a position to handle the real life problems smartly.

9. Trade-offs

Each and every bank can design their own investment portfolio depending on their opportunity. Investment may be done in some areas where the option to be defaulted

is less. Investment portfolio may include more short term and small sized loans that are self-liquidating.

10. Monitoring

Bank must ensure periodic monitoring and proper feedback so that the borrower cannot reveal any weakness from banker‘s side. A strong post-sanction inspection with pre-sanction inspection guarantees the timely recovery of fund to a greater extent. Credit information Bureau (CIB) of Bangladesh Bank (BB) can work in a better way to supply with timely and accurate credit information. The credit information which so far been collected by BB from scheduled banks and other financial institutions are not broad-based and systemized to be used for credit policy and other purposes (Chowdhury, 2002). This is unsatisfactory for us as in other countries there are some organizations that collect credit information and supply the same if required for some charges.

Conclusion

World is getting worse just to make people more smart and divergent to turn the worse into better. This phenomenon is common in every phases of life. So, it cannot

be avoided rather should be handled in a wise able way. The time may come when people will have a lot of funds with no opportunity to invest. Then, we have to face a new problem to search for new and dynamic areas to invest. But, till now, our concern should be the successful recurrence of the loop as early and fast as possible.

That will be the present day objective of coming out of the status of either least

developed or developing country. In this case, government should have proper patronization to ensure a good climate for investment.