Executive Summary

The broad objective of the study was to conduct the performance analysis of the various departments of ONE Bank Limited, Gulshan Branch over the years of its operation in the Commercial Banking sector in Bangladesh. The specific objectives identified are to relate theoretical knowledge with practical experience in several functions of the bank. Identify and evaluate different functional services offered by the bank to its clients. The process and the personnel involved in the various departments of the bank, to know about the pattern of the clients who are undertaking taking the services from the bank. Analyze the financial performance of the various departments of ONE Bank Limited, Gulshan Branch over the years of banking operations. The influence of Marketing Strategies in the operations of ONE Bank Limited, Gulshan Branch and analyze the possible Internal Factors (Strengths and Weaknesses) and External Factors (Opportunities and Threats) for ONE Bank Limited.

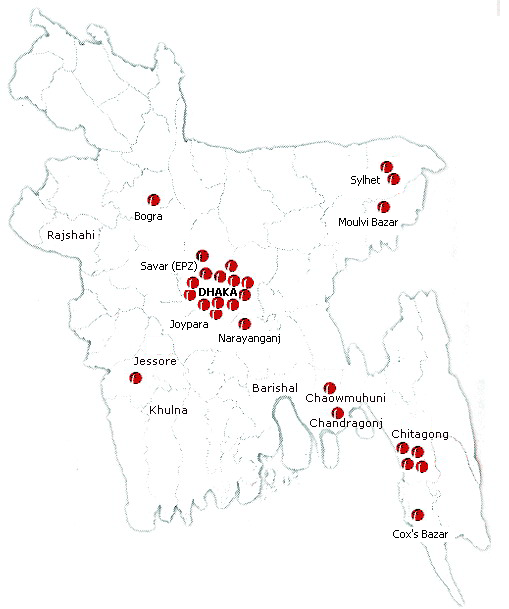

ONE Bank Limited, a growing private sector commercial bank started its operations from May 1999 and have been progressing throughout the years of operations in Bangladesh. Since its establishment ONE Bank Limited has opened 26 branches in different cities such as Dhaka, Chittagong, Sylhet, Noakhali and in many other commercial areas in Bangladesh. In the near future, more branches are to be inaugurated to provide better quality of banking service to the customers.

This internship report is focused on the various departments of ONE Bank Limited, Gulshan Branch. Gulshan Branch one of the important branches of OBL has been operating with all the functional units or departments, which a most concerned branch requires to have. It has been successful in handling all the departments well enough and the clients are getting the maximum benefits from the service given through the Gulshan Branch.

The branch includes departments which follow the activities of General Banking, Retail Banking, Foreign Exchange and Credit facilities to the clients rendering the required services.

This report covers the findings and analysis of all the departmental activities carried out by ONE Bank Limited, Gulshan Branch. Financial performance of the departments is analyzed and the marketing strategies involved in the operations of the branch are verified. Along with it, the report also focuses on the SWOT Analysis and the SPACE Matrix done in order to find out what sort of steps and strategies are to be implemented by ONE Bank Limited, Gulshan Branch. In doing so, the bank can excel in providing better quality of products and services to

On the basis of convincing reasons, ONE Bank Limited management believes that in the coming years the Bank will try its level best to sustain its earning capacity and maintain a steady growth. With the current performance of the Bank and with little improvement here and they will certainly make ONE Bank Limited one of the best Private Bank in Bangladesh in the near future.

1.1 Background of the Report

The Internship program is an integral part of the BBA program that all the students have to undergo of American International University – Bangladesh (AIUB). The students are sent to various organizations where they are assigned projects. At the end of the program, the internships are required to place the accomplishments and findings of the project through the writing of the internship report covering the relevant topics. During this program, supervisor guides each student – one from the university and the other from the organization.

This report is the result of a 10 weeks (June03 – August 09, 2007) internship program in ONE Bank Limited, Gulshan Branch. This report contains Introduction about the report in Chapter 1; Overview of ONE Bank Limited in Chapter 2; The Analysis and the description of the different departmental activities of ONE Bank Limited, Gulshan Branch. in Chapter 3; The Findings of the different departments in Chapter 4; SWOT Analysis and SPACE Matrix for ONE Bank Limited in Chapter 5; Recommendations in Chapter 6; Conclusion in Chapter 7. The topic of the report has been consulted & directed by the internship supervisor from American International University – Bangladesh (AIUB).

1.2 Introduction of Topic

Banking sector, considered as ever growing child, in any country plays a pivotal role in setting the economy in motion and in its development process, while the banking structure -the number and size distribution of banks in a particular locality and the relative market power of specific banking institutions determines the degree of competition, efficiency and performance level of the banking industry. Bangladesh’s banking sector consists of Central Bank (named as Bangladesh Bank), Commercial Banks, Development Banks and Specialized Financial Institutions. The Commercial Banks comprise of Nationalized Commercial Banks (NCB), Local Private Banks, Foreign Private Banks, and Islamic Banks. In recent years, it is observed a mushroom growth in the banking sector in Bangladesh.

The very active and lively presence of private sector has stirred competition among the traditional Commercial Banks. The shadow of fierce competition in banking industry can be observed through the recent achievement of the Private Commercial Banks.

The competition to pursue clients and imitate one another is so intense that one bank lures efficient staff of another bank offering higher facilities to get better edge. Private Commercial Banks often introduce new and diversified financial products to provide wider option to customers. Without having an effective customer base, it becomes difficult for any bank to compete and sustain in the competitive market for the banking services.

In order to retain and attract new customers towards any particular bank, the bank management needs to have a clear operational efficiency and must thoroughly analyze the scopes for further development. Therefore it is a key area for the commercial banks to closely monitor their performance level, which comprises the functional units, that provides services to its clients.

So, taking the opportunity to highlight the analysis of the performance of the different functional units and prepare the study for my internship, I was allowed to share the practical experience with ONE Bank Limited, Gulshan Branch.

1.3 Rationale of the Study

The study was conducted on the various departments of ONE Bank Limited, Gulshan Branch. Gulshan Branch of ONE Bank Limited is considered to be one of their prior concerned branches, as there are many business and financial institutions located in the adjacent areas near Gulshan. Therefore, the activities carried out by the personnel of the various departments needs to be well acquainted with the customer oriented services. So, being a business graduate it was challenging experience for me to concentrate on customer services being provided by ONE Bank Limited. Meeting the customer requirements with the well-maintained operations of the departments was figured out and analyzed. Apart from the educational knowledge, the study put extra weight regarding the practical field and real life activities followed in the bank. Moreover, the study carried out also added value to the technical mechanisms and operations of the OBL. Along with my experience, the bank will be able to identify their flow of operations and can identify in which functional departments, the bank needs to put extra concentration so that the operations are well acquainted with the desired services offered by the bank to its clients.

1.4 Scope of the Report

The basic scope of conducting this study is to analyze the performance of various departments of ONE Bank Limited considering the Gulshan Branch. Through investigation and analysis of the respective departments over the years of operation can highlight the banks performance when compared to other commercial banks operating in the country. Due to modern concept in the banking operations are being practiced by different banks, the banking arena is considered to be very competitive. Therefore in keeping up with the performance through customer oriented services, ONE Bank Limited must be aware of its total operation procedure which can be determined by the performance of the respective departments.

In this research work, the overall view of the banking system, its history and mechanism, policies and appraisal of ONE Bank Limited and other areas of activity is extensively analyzed and the findings is clarified along with in depth study. The main part of the study covers the General Banking, operational scenario of Credit Department, Foreign Exchange, Remittance, Retail Banking Departments of ONE Bank Limited, Gulshan Branch. This will eventually refer that how the bank help the customers securing their cash and assets, getting credit facility, exporting and importing the goods and how it remits money of the foreign clients, etc.

1.5 Objective of the Report

1.5.1 Broad Objective

The broad objective of the study is to conduct the performance analysis of the various departments of ONE Bank Limited, Gulshan Branch over the years of its operation in the Commercial Banking sector in Bangladesh.1.5.2 Specific Objectives

The specific objectives of this study are as follows:

Relate theoretical knowledge with practical experience in several functions of the bank.

Identify and evaluate different functional services offered by the bank to its clients.

The process and the personnel involved in the various departments of the bank.

To know about the pattern of the clients who are taking the services from the bank.

To analyze the financial performance of the various departments of ONE Bank

Limited, Gulshan Branch over the years of banking operations.

Influence of Marketing Strategies in the operations of ONE Bank Limited,

Gulshan Branch

Analyze the possible Internal Factors (Strengths and Weaknesses) and External

Factors (Opportunities and Threats) for ONE Bank Limited.

1.6 Methodology

1.6.1 Area of Investigation:

As the Banking Sector is very large, therefore I only focused on specific departments of banks and taking only consideration of the operations of ONE Bank Limited, Gulshan Branch, where I have been assigned to serve as an Internee. I have highlighting the operations of:

General Banking Department

Foreign Exchange Department (Import and Export)

Credit and Loan Department

Retail Banking Department

1.6.2 Source of Information:

The study is conducted on the basis of both primary and secondary data.

1.6.2.1 Primary Data:

The primary information was gathered through interviews, observation and group discussion. The primary data are collected from all the departments of ONE Bank Limited, Gulshan Branch by interviewing personnel of the respective departments. The heads of the departments or senior executives have been interviewed. However, the analysis and the explanation are the authors’ own.

1.6.2.2 Secondary Data

The secondary information was gathered through Annual Reports, Periodic Publication of the Bank, Bangladesh Accounting Standards, General Banking Manuals, Financial Statements of the banks, websites, etc. The data of the study are based on a review of existing brochures, documents and database of ONE Bank Limited.

1.6.3 Sampling Plan

1.6.3.1 Sampling Procedure:

The sampling procedure was conducted on the Deliberate Sampling method, where the respondents and the interviewees are considered on my convenience and priority.

1.6.3.2 Sampling Unit

In order to carry out the research work, I focused on taking the interviews of the Personnel involved in the different departments, Manager and Senior Level Employees, Business Clients.

1.6.4 Data Processing & Analyzing

The collected data was processed through computer encoding as well as manually, depending on the nature of the query being solved. The processed data was being analyzed. Finally, on the basis of the analysis results, the study concluded the answers to the research objectives for the final stage of the study and the report preparation.

1.7 Limitations

In every research work there exist some limitations that the researcher faces while conducting different activities. In the process of the research work, I came across certain limitations that hamper the actual findings and analysis of my research work. Some of the constraints that I have faced while conducting the research work are as follows:

Æ The interviewees, who are the personnel involved in the various departments of the bank, may not be well acquainted with the formal procedures of the research work. The respondents may be biased on certain issues that hamper the total evaluation of the research work.

Æ The study conducted can be hampered, as the total evaluation of the industry cannot be covered in a short period of time. In the cumulative time period of 10 weeks the actual phenomenon on the performance of the various departments of the bank can just be highlighted and some issues were overlooked.

Æ A structured filing procedure is often neglected which also poses difficulty in understanding the sequential procedure.

Æ The personnel of the bank are usually busy with their daily activities and routine tasks; therefore interacting with them during their office hours was difficult sometimes. Although most of the officers were very helpful and friendly but as because they have been busy with their works, they could not give much time to light up my knowledge about the Bank’s activities.

Æ Lack of proper books, journals and articles available for the banks, sometimes created limitations for me to understand the banking terms and conditions.

Æ The banking policies and manuals of OBL are of confidential in nature and thus it is difficult to collect the necessary literature and documents within this short time.

None the less, I tried my level best to make this report a good one and despite of many limitations in my approach, I expect that the reader of this report will have a broader view and idea about the different services and the performance rendered of the different departments of ONE Bank Limited concerning the Gulshan Branch.

NOT For Print

ORGANIZATION OVERVIEW

2.1 Background of the Organization

ONE Bank Limited was incorporated in May 1999 With the Registrar of Joint Stock Companies under the Companies Act. 1994, as a commercial bank in the private sector. The Bank is pledge-bound to serve the customers and the community with utmost dedication. The prime focus is on efficiency, transparency, precision and motivation with the spirit and conviction to excel as ONE Bank Limited in both value and image.

The name ‘ONE Bank’ is derived from the insight and long nourished feelings of the promoters to reach out to the people of all walks of life and progress together towards prosperity in a spirit of oneness.

ONE Bank Limited is a private sector commercial bank dedicated in the business line of taking deposits from public through its various saving schemes and lending the fund in various sectors at a higher margin. However, due attention is given in respect of risk undertaking, risk hedging and if not appropriately hedged, reflection of the same in pricing. In the financing side, the bank’s major concentration is in trade finance covering about 20.88% of total financing as on YE2006 which is mainly a short-term investment. The banks financing concentrate in both, working capital finance and long-term finance. OBL has major concentration of financing in medium and large industries. Since the short-term finance carries low risk compared to long-term finance; the financing strategy of OBL will assist the bank to keep the risk at minimal.

While financing the industrial sector, the major concentration of the bank appeared to be in the textile and RMG sector; both the above sectors cover 30.89% of the total portfolio. OBL also involved in cement construction and transport sector financing. In the investment portfolio, OBL have substantial investment in quoted and non-quoted shares of different organization including some very prospective financial institutions. The bank has shown its acumen in reducing its exposure from ship scrapping sector, steel re-rolling where the bank had investment earlier. With the increase in exposure to RMG, the bank has increased its non-funded business income substantially. With an age of only 8 years, the OBL has taken initiative to launch IT based banking products like ATM facilities, E-banking etc that are praiseworthy. At present OBL is operating 26 branches across Bangladesh, out of which 12 branches are in Dhaka and the remaining 14 branches are operating in different areas of the country.

2.2 Corporate Mission and Vision Statements & Corporate Slogan of ONE Bank Limited

2.2.1 Vision Statement

To establish ONE Bank Limited as a Role Model in the Banking Sector of Bangladesh and to meet the needs of the Customers, provide fulfillment for the People and create Shareholder Value.

2.2.2 Mission Statement

Constantly seek to better serve the valued Customers.

Be pro-active in fulfilling the Social Responsibilities for the company.

Review all business lines regularly and develop the Best Practices in the industry.

Working environment to be supportive of Teamwork, enabling the Employees to perform to the very best of their abilities.

2.2.3 Corporate Slogan

…WE MAKE THINGS HAPPEN

2.3 Corporate Information

Name of the Company

ONE Bank Limited

Genesis

The One Bank Limited (hereinafter called OBL) is a third generation private sector bank incorporated on May 12, 1999 as a public limited company under Companies Act 1994 and listed in Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE).

Date of Incorporation

12th May 1999

Date of Functioning

14th July 1999

Registered Office

Corporate Head Quarter

2/F, HRC Bhaban, 46 Kawran Bazar C/A, Dhaka-1215

Web page

www.onebankbd.com

obl@onebankbd.com

Auditor

ATA KHAN & Co.

Chartered Accountants

LawyerLee, Khan & Partners

Mr. Mahbubur Rahman

Mr.Ali Asgar Chowdhury

Board of Directors:

1) Mr. Sayeed Hossain Chowdhury (Chairman)

2) Mr. Zahur Ullah (First Vice Chairman)

3) Mr. Hefazatur Rahman (Second Vice Chairman)

4) Mr. Asoke Das Gupta

5) Ms. Farzana Chowdhury

6) Mr. M. H. Choudhury

7) Mr. A.S.M. Shahidullah Khan

8) Mr. Kazi Rukunuddin Ahmed

9) Mr. Ajmalul Hossain QC

10) Mr. Shawket Jaman

11) Mr. Khandkar Sirajuddin Ahmed

12) Mr. Farman R Chowdhury (Managing Director)

Company Secretary: Mr. John Sarkar

Chief Consultant: Mr. Mirza Ejaz Ahmed

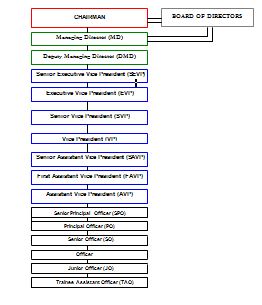

2.4 Management Hierarchy of ONE Bank Limited

2.5 Branches of ONE Bank Limited

Serial No. | Branch Name | Address |

1 | Corporate HQ | 2/F, HRC Bhaban, 46 Kawran Bazar C/A, Dhaka-1215 |

2 | Principal Branch | ‘Zaman Court’, 45, Dilkusha C/A, Dhaka |

3 | Motijheel Branch | SharifMansion (Ground Floor) 56-57 Motijheel Commercial Area Dhaka 1000 |

4 | Gulshan Branch | 97, Gulshan Avenue, Dhaka |

5 | Kawran Bazar Branch | G/F, HRC Bhaban, 46 Kawran Bazar C/A, Dhaka-1215 |

6 | Uttara Branch | House # 14, Road # 14B, Sector # 4 UttaraModelTown, Dhaka-1230 |

7 | Imamganj Branch | 18, Roy Iswar Chandra Shill Bahadur Street,(1st floor) Imamganj, Dhaka-1100 |

8 | Dhanmondi Branch | House # 21, Road # 8, Dhanmondi R/A, Dhaka |

9 | Mirpur Branch | Plot # 2, Road # 11 Section-6, Block-C Mirpur-11, Dhaka |

10 | Banani Branch | Plot 158, Block E Banani R.A. Dhaka |

11 | Kakrail Branch | MusafirTower, 90 Kakrail, Dhaka |

12 | Progoti Sarani Branch | Ridge Dale Cha-75/2, Uttar Badda, Dhaka |

13 | Ganakbari (EPZ) Branch | SomserPlaza (2nd Floor) Ganakbari, Savar, Dhaka |

14 | Joypara Branch | Monowara Mansion, Joypara Bazar Latakhola, Raipara Dohar, Dhaka |

15 | Narayangonj Branch | HaquePlaza, Plot # 05, B.B. RoadChasharaC.A. Narayangonj |

16 | Agrabad Branch | 95, Agrabad C/A, Chittagong |

17 | Khatungonj Branch | 110-111, Khatungonj, Chittagong |

18 | Jubilee Road Branch | KaderTower, 2nd Floor, Tinpool, 128 Jubilee Road, Chittagong |

19 | ChittagongPort Booth | Terminal Bhaban, ChittagongPort Authority Chittagong |

20 | Cox’s Bazar Branch | Monora Complex, East Laldighir Par, Court Hill Lane, Main Road, Cox’s Bazar |

21 | Sylhet Branch | ‘Firoz’ Centre (Ground floor) 891/KA, Chouhatta, Sylhet |

22 | Islampur Branch, Sylhet | Kaium complex, (1st floor) Islampur Bazar, Sylhet |

23 | Sherpur Branch | Royel Market (1st Floor), Sherpur, Moulvi Bazar, Sylhet |

24 | Chowmuhuni Branch | Bhuiyan Market, D.B. Road Railgate, Chowmuhuni, Noakhali |

25 | Chandragonj Branch | Chandragonj Bazar Lakshmipur |

26 | Jessore Branch | M.S. Orchid Centre 44 M.K.Road, Jessore |

Proposed Branch of ONE Bank Limited: Elephant Road Branch, Dhaka

2.6 Location Map of the Branches of

ONE Bank Limited in Bangladesh

2.7 Financial Highlights of ONE Bank Limited for the

Last Five Years

Taka in Million

SI No

Particulars

2006

2005

2004

2003

2002

1

Authorized Capital

1,200

1,200

1,200

1,200

1,200

2

Paid up Capital

888

807

690

600

221

3

Statutory Reserve

381

262

168

98

63

4

Capital

1,650

1,307

1,077

847

414

5

Total Deposits

20,253

18,030

10,915

8,847

7,607

6

Total Loans & Advances

15,681

13,851

9,613

6,051

5,126

7

Investment

3,321

2,165

1,229

688

630

8

Import Business Handled

21,601

17,435

15,255

9,814

8,234

9

Export Business Handled

16,360

11,916

6,974

5,213

3,371

10

Guarantee Business Handled

947

1,367

948

633

449

11

Total Income

2.886

2,007

1,433

1,061

968

12

Total Expenditure

2,211

1,520

932

800

751

13

Net Interest Income

398

315

385

166

169

14

Operating Profit

674

626

501

261

217

15

Operating Expenses

452

310

234

147

124

16

Profit after tax and provisions

347

302

195

91

114

17

Total Assets

23,143

20,105

13,419

9,975

8,316

18

Number of Correspondents

270

268

258

223

187

19

Number of Employees

580

386

300

209

178

20

Number of Branches

23

18

15

10

7

21

Loan Deposit Ratio

77.43%

76.82%

88.07%

68.39%

67.38%

22

Capital Adequacy Ratio

10.03%

9.47%

11.51%

14.34%

9.09%

23

Tier-1 (Capital)

8.69%

8.44%

10.51%

14.34%

7.92%

24

Return on Assets

3.12%

2.87%

3.35%

2.85%

2.76%

25

Earnings per Share

39.06

37.46

24.10

23.44

29.61

26

Dividend Cash

10%

15%

–

–

–

Bonus Share

17%

10%

17%

15%

19%

27

Net Asset Value (Book Value/ Shareholders’ Equity per Share

171.03

159.34

142.60

131.56

163.80

Source: ONE Bank Limited Annual Report 2006

Balance Sheet attached in the Appendix 2 & 3, pg 196,197 & 198

2.7.1 Profit Performance of the Last Five Years

ONE Bank’s profit is continuously increasing. ONE Bank Limited is a high profit earning organization. Its performance shows an uplift trend. It is shown in the following graph: The operating profit for the bank increased 7.67%. (See Figure 1)

Taka in Million

| Year | 2002 | 2003 | 2004 | 2005 | 2006 |

| Growth in Operating Profit | 217 | 261 | 501 | 626 | 674 |

Figure 1

2.7.2 Capital and Reserve

Capital and reserve of the bank as on 31st December, 2006 was Tk. 1,650 Million, which was Tk.1,307 Million in 2005. The paid up capital of the bank rose to Tk. 888 Million as on 31st December 2006. The bank raised the Statutory Reserve from Tk. 262 Million in 2005 to Tk. 381 Million in the year under review.

2.7.3 Deposits

At the end of December 31, 2006 the deposit of the ONE Bank Limited was Tk. 20,253 Million against Tk. 18,030 Million during the corresponding period of the year 2005. The growth in deposit is 31.42% compared to the previous year.

2.7.4 Loans and Advances

The Loans and Advances of the Bank showed an average growth in 2006. The total loan and advances amounted to Tk. 15,681 Million as on 31st December 2006 against Tk.13,851 million in year 2005, which shows an increase of 13.21%. In the year 2005, the growth was more impressive of an increase of 44.09%.

2.7.5 International Trade

The International Trade constitutes major business activities conducted by ONE Bank Limited. The import business of the bank indicated a significant increase in the year. The import business during the year 2006 reached Tk. 21,601 Million against Tk. 17,435 Million of the year 2005, which reflects a growth of 24 %. Main import items were industrial raw materials, cement clinkers, yarn & fabrics for the RMG industry, vessels for scrapping, edible oil and customer items.

The export business during the year 2006 was Tk 16,360 Million compared to Tk.11,916 Million in the previous year, which reflects a growth of 37.29% Planned and calculated thrust to finance the leading Ready Made Garments (RMG) units contributed towards improving the Bank’s performance in the export sector. The growth in export business can be further achieved but due to catastrophe in geographical arena, micro economic instability and the instable political condition made the growth slower than it was expected.

2.8 Total Number of Employees of

ONE Bank Limited, Gulshan Branch

Designation | Number |

Vice President/ Manager | 1 |

Assistant Vice President | 2 |

Senior Principal Officer | 3 |

Principal Officer | 3 |

Senior Officer | 3 |

Officer | 5 |

Junior Officer | 4 |

Assistant Officer | 3 |

Trainee Assistant Officer | 4 |

Messenger | 2 |

Gardener | 1 |

Driver | 1 |

Total Number of Employees | 32 |

2.9 Hierarchy of the Employees of

ONE Bank Limited, Gulshan Branch

Chapter 3

Topic analysis and description

The Topic Analysis and Description are subjected to the specific objectives that have been identified and based upon those criteria’s; these factors are evaluated in the perspective of various departments of ONE Bank Limited, Gulshan Branch.

The Departments of ONE Bank Limited, Gulshan Branch

3.1 General Banking Department

All business concerns earn a profit through selling either a product or a service. A bank does not produce any tangible product to sell but does offer a variety of financial services to its customers. General Banking is the starting point of all the banking operations. It is the department, which provides day-to-day services to the customers. Everyday it receives deposits from the customers and meets their demand for cash by honoring Cheques. It opens new accounts, remit funds, issue bank drafts and pay orders etc.

3.1 Division of General Banking in ONE Bank Limited, Gulshan Branch

3.1.1 Accepting Deposits

3.1.2 Accounts Opening

3.1.3 Check Book Issue

3.1.4 Transfer of Account

3.1.5 Closing of Account

3.1.6 Cash Department

3.1.7 Dispatch Section

3.1.8 Remittance

3.1.9 Other services

3.1.9.1 ATM Service

3.1.9.2 Locker Service

3.1.9.3 Online Facility

3.1.1 Accepting Deposits

Accepting deposits is one of the classic functions of Commercial Banks. The relationship between a banker and his customer begins with the opening of an account by the former in the name of the latter. Initially all the accounts are opened with a deposit of money by the customer and hence these accounts are called deposits accounts. Banker solicits deposits from the members of the public belonging to different lifestyles, engaged in numerous economic activities and having different financial status. There is one officer performing various functions in this department.

The deposits those are accepted by ONE Bank Limited may be classified in to:

3.1.1.1 Demand Deposits

3.1.1.2 Time Deposits

3.1.1.1 Demand Deposits

The amount in accounts are payable on demand so it is called demand deposit account.

OBL accepts demand deposits through the opening of—

3.1.1.1.1 Current Account

3.1.1.1.2 Savings Account

3.1.1.1.3 Foreign Currency Account

3.1.1.1.1 Current Account

Both individuals and businesses open this type of account. Frequent transactions are (deposits as well as withdrawal) allowed in this type of account. A Current A/C holder can draw checks on his account, any amount, and any numbers of times in a day as the balance in his account permits.

Criteria of Current Account followed by OBL

ü Generally opened by businessmen, government and semi-government organizations; with proper introduction

ü No interest is provided for deposited amount;

ü Overdraft is Allowed in this account;

ü Minimum opening balance is TK.5000

ü A minimum balance of Tk. 5000/- has to be maintained. Bank has the right to change this minimum balance requirement.

Minimum Balance Service Charge

Annual Service Charge

Account Closing Charge

Tk. 300/-, at half year rest, if balance comes down bellow 5000/-

Up to 1 crore Tk. 500/-

Above 1-5 crore Tk. 1000/-

Above 5 crore Tk. 1500/-

Tk. 100/-

There are several types of current account available at the OBL–

ü Individual Current Account.

ü Partnership Current Account

ü Proprietorship Current Account

ü Limited Company Current Account

ü Account of Societies/Clubs etc.

3.1.1.1.2 Savings Account

Individuals for savings purposes open this type of account. Current interest rate of these accounts is 7.5% per annum. Interest on SB Account is calculated and accrued monthly and credited to the account half yearly. Interest calculation is made for each month based on the lowest balance at credit of an account in that month.

Criteria of savings account followed by OBL:

ü An appropriate introduction is required for opening the A/C;

ü Frequent withdrawal is not encouraged;

ü A depositor may withdraw money from his/her account four times in a week;

ü 7 days notice is required for withdrawal of large amount;

ü Minimum amount of TK.2000 is required as initial deposit and to earn interest;

ü Depositor may withdraw his/her deposited money up to 25% of the Balance in his/her account without notice. The bank may realize service charge in its discretion;

ü Depositor will get interest on the amount deposited in his/her account irrespective of any limit;

There are two type of saving account-

ü Individual Saving Account

ü Joint Saving Account

To open a saving account the followings are required-

ü Passport size photo-2 copies

ü Introducer’s signature in the a/c opening card

ü Nationality certificate/Photocopy of valid passport/Voter ID card

ü Nominee form duly filled in

ü Transaction profile duly filled in

Minimum Balance Service Charge

Annual Service Charge

Account Closing ChargeTk. 300/-, at half year rest, if balance comes down bellow 2000/-Up to 1 crore Tk. 200/-

Above 1-5 crore Tk. 1000/-

Above 5 crore Tk. 1500/-

Tk. 200/-

3.1.1.1.3 Foreign Currency Account

Another type of account is foreign currency account, where the individuals who live in abroad or works there can open an account in the Bank and send money from abroad on that account.

To open a current account the followings are required-

ü Passport size photo-2 copies for each member

ü Introducer’s signature in the a/c opening card

ü Nationality certificate/Photocopy of valid passport/Voter ID card

ü Nominee form duly filled in

ü Transaction profile duly filled in

ü Photocopy of Work Permit

ü Employment Certificate duly mentioning salary

3.1.1.2 Time Deposits

A deposit which is payable at a fixed date or after a period of notice is a time deposit. OBL accepts time deposits through—

3.1.1.2.1 Fixed Deposit Receipt (FDR)

3.1.1.2.2 Short Term Deposit (STD)

While accepting these deposits, a contract is done between the bank and the customer. When the banker opens an account in the name of a customer, there arises a contract between the two. This contract will be a valid only when both the parties are competent to enter in contracts. As account opening initiates the fundamental relationship & since the banker has to deal with different kinds of persons with different legal status, OBL Officials remain very much careful about the competency of the customers.

3.1.1.2.1 Fixed Deposit Account

These are deposits, which are made with the bank for a fixed period specified in advance. The bank needs not to maintain cash reserve against these deposits and therefore, bank gives high rate of interest on such deposits. A FDR is issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest and the date on which the deposit will fall due for payment. OBL offers FDR for different amounts at different interest rates for different period of time. In the receipt holders’ name and other particulars are kept as secrete documents on the bank. In the documents the name of nominee is also incorporated. If any holder of the receipt wishes to en-cash receipt before the maturity the bank usually do not pay the interest. But ONE Bank Limited, as goodwill pays a lump-sum amount of interest to the FDR holder.

Procedure of Opening Fixed Deposit Account

Before opening a Fixed Deposit Account a customer has to fill up an application form, which contains the followings: (See Appendix 4, pg 199)

ü Amount in figures

ü Beneficiary’s Name and Address

ü Period

ü Rate of Interest

ü Date of Issue

ü Date of Maturity

ü How the account will be operated (singly or jointly)

ü Signature(s)

ü F.D.R. No.

ü Special instructions (if any)

After fulfilling the above information and depositing the amount, FDR account is opened and a FDR receipt is issued and it is recorded in the FDR Register, which contains the following information:

ü FDR Account No.

ü FDR (Fixed Deposit Receipt) no.

ü Name of the FDR holder with address

ü Maturity period

ü Maturity date

ü Interest rate

Payment of Interest of Fixed Deposit

In case of Fixed Deposit Account the bank does not have to maintain a cash reserve. So ONE Bank Limited offers a high interest rate in Fixed Deposit accounts.

It is usually paid on maturity of the fixed deposit. OBL calculates interest at each maturity date and provision is made on that “Miscellaneous creditor expenditure payable accounts” is debited for the accrued interest.

Interest Rate of Fixed Deposit

Rate of Interest varies depending on the period of maturity date as well as the amount.

Time |

Interest Charged |

| 3 Months and above but less than 6 months | 12% |

| 6 Months and above but less than 1 year | 12% |

| 1 year and above | 12.25% |

Loss of FDR

In case of a lost FDR, the customer is asked to record a GD (General Diary) in the nearest Police Station. After that, the customer has to furnish an Indemnity Bond to OBL. A duplicate FDR is then issued to the customer by the bank.

Renewal of FDR

The FDR becomes automatically renewed for like periods and amounts, unless this are withdrawn by the depositor or, the bank notifies the depositor in writing at least 15 days in advance of the original Or, any renewed maturity date (s) of its desire to terminate the account or change any term and condition of the account.

3.1.1.2.2 Short Term Deposit (STD)

In OBL, Limited companies, corporate groups, various other big companies, organizations, Government Departments keep money in STD accounts. Frequent withdrawal is discouraged and requires 7 days prior notice. STD Account opening procedure is similar to that of the saving account. Initial Account opening minimum amount requirement Tk. 2000.

In Short Term Deposit account, the deposit should be kept for at least seven days to get interest. The interest offered for STD is less than that of savings deposit. 5% interest is paid on their deposit. The bank is benefited because they have to pay less interest and the customers are also benefited because anytime they can divert money.

In OBL, usually customers give an instruction to the Bank that their current account will be debited whenever its deposited amount crosses a certain limit and this amount will be transferred to the STD account.

| Minimum Balance Service Charge | Annual Service Charge | Account Closing Charge |

| Tk. 300/-, at half year rest, if balance comes down bellow 2000/- | Up to 1 crore Tk. 500/- |

Above 1-5 crore Tk. 1000/-

Above 5 crore Tk. 1500/-

Tk. 300/-

3.1.2 Account Opening Section

It is said that, there is no banker customer relationship if there is no A/C of a person in that bank. By opening an A/C banker and customer create a contractual relationship. However, selection of customer for opening an account is very crucial for a Bank.

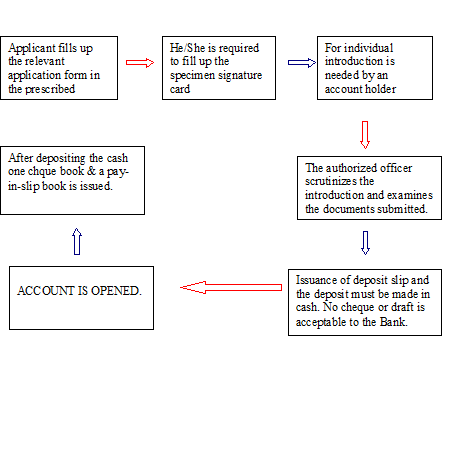

3.1.2.1 Account Opening Procedure in a Flow Chart

Before opening of a current or savings account, the following formalities must be completed

1) Application on the prescribed form;

2) The customer information must be filled up with the form;

3) Introduction: The following persons can introduce an A/C opener:

i. An existing current/savings account holder of that branch;

ii. An officer of that branch (not below the rank of an Assistant Officer.);

iii. A respectable person of the society or locality who is well known to the Manager/2nd man of the branch concerned;

4) Furnishing photographs;

5) Banker will supply a set of printed forms required for opening the account, which will normally include:

i. Specimen Signature Cards (SSC);

ii. Deposit Slip Book

iii. Check Book Requisition slips;

6) Customer should carefully read and full-fill the application form;

7) Putting specimen signatures in the specimen card.

8) Any special instructions with regard to operation of the account should be noted on the relevant signature card boldly duly authenticated by the A/C holder should be obtained;

9) The required Account Number for the new Account from the Account Opening Register should be obtained;

10) Obtain the signature and A/C number of the Introducer on the advice and getting the signature properly verified by an Authorized official of the Bank;

11) The Deposit slip properly filled in and signed by the customer;

12) Then the new A/C number should be written at the appropriate place of the Deposit slip and mark new Account on both the copies of the deposit slip and request the customer to deposit the money at the cash counter;

13) Place the signature cards, Advice of new account, a copy of Deposit slip, photographs and other necessary papers/documents etc. in a file;

14) Obtain approval of the Authorized officer for opening the new account on all relevant papers while giving approval for opening an account the Authorized official should be satisfied about the of the Introducer;

15) The Authorized officer on the advice of new A/c and on the specimen signature cards should also attest the signature of the new A/C holder;

16) After approval of the opening of the A/C, get the Cheek book requisition slip signed by the customer;

17) Deliver the checkbook to the customer after properly marking the Account number, name and place of the branch on each leaf of the checkbook;

On completion of account opening open a file for the new a/c holder and file all relevant papers forms etc. Signature cards, copies of Advice, Deposit slip Debit ticket etc. is distributed to concerned departments;

Documents required for all types of Accounts & Customers:

ü Advise of New Account (in duplicate)

ü Specimen signature cards (in duplicate)

ü Account Opening Agreement Form

ü Photographs of Account Holders (in duplicate)

ü Nationality certificate/Photocopy of valid passport/Voter ID card

ü Deposit Slips Book

ü Cheque book Requisition slips

ü Letter of mandate authorizing another person/s to operate the A/C on behalf of the Account holder, where necessary.

ü Nominee form duly filled in

ü Transaction profile duly filled in

3.1.2.2 Additional documents are to be obtained for opening some special accounts

v Proprietorship Firm

ü Name of authorized persons, designation, specimen signature card.

ü Trade licence.

ü Tax Receipt ( For export/ import )

ü Declaration of Proprietorship

ü Mandate if operation by third party is to be allowed.

v Partnership Firm

ü Account must be opened in the name of the firm.

ü The firm should describe the names and addresses of all partners.

ü Partnership deed is required which duly attested by Notary Public

ü Trade licence from city corporation is needed.

ü Tax receipt ( For import/ export )

ü Photocopy of Registration Certificate duly attested by Notary Public in case of a Registered Firm.

ü Letter of Partnership duly signed by all the partners, in case of non-Registered Firm.

ü Resolution signed by all the partners to open the A/C.

ü Mandate as to operation of the A/C.

v Clubs/Societies/Trustee/Associations/Non-trading Institutions etc

ü Certified copy of Resolution for opening and operation of account

ü Certified copy of Bye-laws & Regulations/ Constitution.

ü Copy of Government approval (if registered).

ü In case of death, A/C should be stopped until the club nominates another person.

ü Trust deed is needed-for trustee.

3.1.3 Issuing Chequebook to the Customers

3.1.3.1 Issue of Fresh Cheque Book

Fresh checkbook is issued to the account holder only against requisition on the prescribed requisition slip attached with the checkbook issued earlier, after proper verification of the signature of the account holder personally or to his duly authorized representative against proper acknowledgment.

3.1.3.1.1 Procedure of issuance of a Fresh Cheque Book

ü A customer who opened a new A/C initially deposits minimum required money in the account.

ü The account opening form is sent for issuance of a Cheque book

ü Respected Officer first draws a Cheque book

ü Officer then sealed it with branch name.

ü In-charge officer enters the number of the Cheque Book in Cheque Issue Register.

ü Officer also entry the customer’s name and the account number in the same Register.

ü Account number is then writing down on the face of the Cheque book and on every leaf of the Cheque book including Requisition Slip.

ü The officer who has the signing authority signs in the leaf where the next requisition slip exists in the Cheque book.

ü The name of the customer is also written down on the face of the Cheque book and on the Requisition slip.

ü The word “Issued on” along with the date of issuance is written down on the requisition slip.

ü Number of Cheque book and date of issuance is also written on the application form.

ü Next, the customer is asked to sign in the Cheque book issue register.

ü Then the respected Officer signs on the face of the requisition slip put his initial in the register and hand over the Cheque to the customer.

3.1.3.2 Issue of Duplicate Cheque Book

Duplicate Cheque Book instead of lost one should be issued only when an A/C holder personally approaches the Bank with an application Letter of Indemnity in the prescribed Performa agreeing to indemnify the Bank for the lost Cheque Book. Fresh Cheque Book in lieu of lost one should be issued after verification of the signature of the Account holder from the Specimen signature card and on realization of required Excise duty only with prior approval of manager of the branch. Cheque series number of the new checkbook should be recorded in ledger card and signature card as usual. Series number of lost Cheque Book should be recorded in the stop payment register and caution should be exercised to guard against fraudulent payment.

3.1.3.3 Issue of New Cheque Book (FOR OLD ACCOUNT)

All the procedure for issuing a new Cheque book for old account is same as the procedure of new account. Only difference is those customers have to submit the requisition slip of the old Cheque book with date, signature and his/her address. Computer posting is then given to the requisition slip to know the position of account and to know how many leaf/leaves still not used. The number of new Cheque book is entered on the back of the old requisition slip and is signed by the officer.

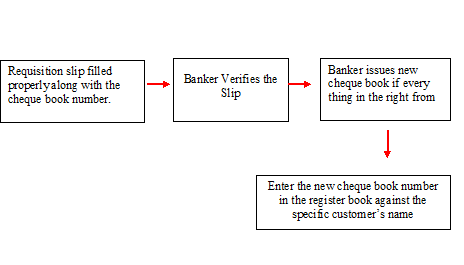

3.1.3.3.1 Procedure of issuance of a New Cheque Book

If the Cheque is handed over to any other person then the account holder the bank addressing the account holder with details of the Cheque book issues an acknowledgement slip. This acknowledgement slip must be signed by the account holder and returned to the bank. Otherwise the bank will not honor any Cheque from this Cheque book.

At the end of the day all the requisition slips and application forms are sent to the computer section to give entry to these new Cheques.

3.1.4 Transfer of an Account

ü The customer submits an application mentioning the name of the branch to which he wants the account to be transferred.

ü His signature cards, advice of new account and all relevant documents are sent to that branch through registered post.

ü The balance standing at credit in customer’s account is sent to the other branch through Inter Branch Credit Advice (IBCA).

ü No exchange should be charged on such transfer.

ü Attention is also given in this connection.

3.1.5 Closing of an Account

Upon the request of a customer, an account can be closed. After receiving an application from the customer to close an Account, some procedures are followed by a banker. The customer should be asked to draw the final Cheque for the amount standing to the credit of his A/C less the amount of closing and other incidental charges and surrender the unused Cheque leaves. The A/C should be debited for the account closing charges etc. and an authorized officer of the Bank should destroy unused Cheque leaves. In case of joint A/C, the application for closing the A/C should be signed by all the joint holders.

A banker can also close the account of his customer or stop the operation of the account under following considerable circumstances:

ü Death of customer P Specific Charge for fraud forgery

ü Customer’s insanity and insolvency P Order of the court

3.1.5.1 Stop payment of Cheque

A banker can stop payment of Cheque of his customer under following considerable circumstances:

ü Firstly the account holder will apply to stop the payment of his Cheque

ü There is a register for this purpose. It is kept by the authorized officer.

ü The officer will see the condition of account and verify everything.

ü In the ledger book, the officer will mark with red ink and the Cheque will not be paid.

3.1.5.2 Dishonor of Cheque

If the Cheque is dishonored, there is no practice in OBL to send memorandum (Cheque return memo) to the customers. But if the customer wants to know the reason of the dishonor of the cheque than the bank send memorandum stating the reason in the following way:

ü Refer to drawer.

ü Not arranged for.

ü Effects not cleared May be present again.

ü Exceed arrangements.

ü Full cover not received.

ü Payment stopped by drawer.

ü Payee’s endorsement irregular/illegible/required.

ü Payee’s endorsement irregular, require Bank’s confirmation.

ü Drawer’s signature differs/ required.

ü Alterations in date/figures/words require drawer’s full signature.

ü Cheque is post dated/out of date/mutilated.

ü Amount in words and figures differs.

ü Crossed Cheque must be present through a bank.

ü Clearing stamps required/requires cancellation.

ü Addition to the discharge of Bank should be authenticating.

ü Cheque crossed “Account Payee Only”

ü Collecting Bank’s discharge irregular/required.

But if the Cheque is dishonored due to insufficiency of funds, OBL inform the A/C holder immediately.

3.1.6 Cash Section

The cash section of ONE Bank Limited, Gulshan Branch deals with all types of negotiable instruments, cash and other instruments and treated as a sensitive section of the bank. It includes the vault, which is used as the store of cash, instruments. If the cash stock goes beyond this limit, the excess cash is then transferred to Bangladesh Bank. Keys to the room are kept under control of cash officer and branch in charge. The amount of opening cash balance is entered into a register. After whole days’ transaction, the surplus money remains in the cash counter is put back in the vault and known as the closing balance. Money is received and paid in this section. (See Figure 7)

3.1.6.1 Cash Payment

ü First, the client comes to the counter with the Cheque and gives it to the officer in charge there. The officer checks whether there are two signatures on the back of the Cheque and checks his balance in the computer. After that the officer will give it to the cash in charge.

ü Then the cash in charge verifies the signature from the signature card and permits the officer in computer to debit the client’s account by giving posting. A posted seal with teller number is given.

ü Then the Cheque is given to the teller person and he after checking everything asks the drawer to give another signature on the back of the Cheque.

ü If the signature matches with the one given previously then the teller will make payment keeping the paying Cheque with him while writing the denomination on the back of the Cheque.

ü If the instrument is free of all kind of error the respected officer will ask the bearer to sign on the back of it.

ü He will then put his/her initial beside the bearers’ signature. She/he will also sign it on its face, will write down the amount by red pen and will put on a scroll number from his/her scroll register.

ü Then the Cheque will be sent to the cash counter. At the cash counter bearer will be asked again to sign on the back of the instrument.

ü The cash officer will then enter the scroll number in his/her register and will pay the money to the bearer.

ü At the end of the day these scroll numbers of the registers will be compared to ensure the correctness of the entries.

3.1.6.2 Cash Receipt

ü At first the depositor fills up the Deposit in Slip. There are two types of deposit in slip in this branch. One for saving account and another for current account.

ü After filling the required deposit in slip, depositor deposits the money.

ü Officers at the cash counter receives the money, count it, enter the amount of money in the scroll register kept at the counter, seal the deposit in slip and sign on it with date.

ü Then this slip is passed to another officer who enters the scroll number given by the cash counter in his/her register along with the amount of the money, sign the slip and keep the banks’ part of the slip. Other part is given to the depositor.

ü All deposits of saving account are maintained by one officer and other accounts by another officer.

ü At the end of the day entries of both of these registers are cross checked with the register kept at the cash counter to see whether the transactions are correct or not.

3.1.7 Dispatch Section

Those documents that are enter in the branch or exit of the branch must go through this section.

3.1.7.1 The main objective of this section is

ü Keeping records of the documents send to other branches or banks;

ü Letters are send to their respective destination;

ü Send these documents safely and correctly;

ü Receives documents come through different medium, such as postal service, courier service, via messenger etc;

3.1.7.2 Two types of letters are continuously received. These are:

ü Inward (Registered/Unregistered) letters

ü Outward (Registered/ Unregistered) letters

At first recording is required whether it is Inward or Outward Registered/Unregistered letters. Then letters are disbursed to their respective destination. Inward letters are firstly segmented according to their different sections and after that an entry is given to the Inward Register book.

3.1.8 Remittance

Among different services rendered by a Commercial Bank to its customers, Remittance facilities are very important and popular to the customer. Remittance of funds means sending money from one place to another, Money Order, Telegraphic Money Order through Telegraphic/ Post Office are the common method of sending small amount. But for larger amounts banks provide this facility to its customers by means of receiving money at one branch of the bank and arranging for payment in another branch within/ outside the country.

This facility is extended to its customers to enable them to avoid risk arising out of theft, loss, etc. in carrying of cash money from one place to another for making payment to some one at some other places or to utilize themselves at some other places.

ONE Bank Limited, Gulshan Branch is also providing the assistance to its clients to make their required Remittance. Considering the urgency and nature of transaction the methods of Remittance is categorized as under:

3.1.8.1 Category of Remittance

3.1.8.1.1 Payment Order (PO)

3.1.8.1.2 Demand Draft (DD)

3.1.8.1.3 Telegraphic Transfer (TT)

3.1.8.1.4 Money Transfer (MT)

3.1.8.1.5 Traveler’s Cheques (TC)

3.1.8.1.1 Payment Order (PO)

This is an instrument issued by the branch of a bank for enabling the Customer/ purchaser to pay certain amount of money to the order of a certain person/ firm/ organization/ office within the same clearing house area of the pay order issuing branch.

The payment order is used for making a remittance to the local creditor. As prevalent, the payment orders are in the form of receipts, which are required to be discharged by the beneficiaries, where applicable on revenue stamps of appropriate value, against payment in cash or through an account. The payment order is not a negotiable instrument and cannot be endorsed or crossed like a banker’s draft.

Characteristics a Pay Order

a) The issuing branch and the paying branch are the same. (Self drawing)

b) Applicable for payment with the clearing house area of the issuing branch.

c) This is may be open or can be crossed.

Procedure for issuing a Pay Order

a) Obtain P.O. application form duly filled in and signed by the purchaser/applicant.

b) Receive the amount in cash/transfer with commission amount.

c) Issue P.O.

d) Enter in P.O. Register

Procedure for Payment of a Pay Order

a) Examine genuinely of the Pay Order

b) Enter in P.O. Register, give contra entry.

c) Debit if found ok for payment.

Payment Order Charges

Taka |

Commission

Vat

Upto 1 Lac

100

15

Tk. 1 Lac to 5 Lac

150

23

Tk. 5 Lac and above

200

30

3.1.8.1.2 Demand Draft (DD)

The demand draft is a written order by one branch of a bank upon another branch of the same bank to pay a certain sum of money to or to the order of a specified person. This is an order instrument in which the issuing branch gives instruction to the payee/ drawee branch to pay certain amount of money to the order of certain person /firm/organization

ü A draft is always an order and never a ‘bearer’ instrument.

ü It is a negotiable instrument like a Cheque i.e. it can be endorsed, collected, and delivered to the endorsee.

ü D.D. may be issued to any person and it can also be issued in favor of a firm, company or local authority on written request duly signed by the purchaser.

Issue of a Demand Draft

ü The purchaser is asked to complete the press-ribbed form, which is treated as an application as well as credit voucher.

ü If against cash- the application is given to the customer to deposit the cash with the cashier.

ü Voucher (Application form) passed duly signed & sealed is delivered to remittance department for preparation of DD. The application for remittance is to be signed by the drawer of Cheque.

A DD works in the following way-

Applicant fills the form of the bank È DD is handed over the customer where name of paying bank and the bank from where payment will be made are mentioned.È Copy of DD along with the advice is send to the Paying Bank È DD comes to bank on which it is drawn the bank honors it.

Care in Writing a Demand Draft

(a) DD leaves are consumed serially

(b) Written correctly in a neat hand writing

(c) Payees name

(d) Issuing branch name

(e) Date, Serial number (branch wise, beside the printing number putting an oblique

(f) Amount in words and figures

(f) Name of Drawee Branch

(g) Test for Tk. Amount & above

(h) Signed by two PA holders & handover with cost memo to the purchaser

(i) Preparation of IBCA and dispatch.

Payment of Demand Draft

After Receipt of IBCA: The IBCA received from issuing branch is responded by the drawee branch and then this becomes voucher.

Dr. General A/ C- Drawer Br.

Cr. Bills Payable A/c-D.D. Payable.

Particulars of DD is entered in D.D. Payable Register under initial of an officer.

Commission

The commission of D.D issuance is 0.15% at the principal amount upto Tk 10 Lac with 15% VAT and 0.10% at the principal amount of Tk 10 Lac and above with 15% VAT

The D.D cancellation charge is Tk.50/-

3.1.8.1.3 Telegraphic Transfer (TT)

It is an instruction duly tested sent by telex/fax/telegram/ telephone/ express mail etc. to the drawee branch for paying a certain sum of money to a specified person. This mode of transfer of fund may be effected at the written request an account holder of the branch and against value received from him. It is preferable to obtain a confirmatory cheque from the customer.

Characteristic Telegraphic Transfer

ü Issued by one branch to another branch and massage is tele-communicated

ü Remittance / transfer of money is done through tested tele messages.

ü Remittance is effected on the basis of tested message.

ü Test key apparatus is required.

Issue of T. T

Obtain T.T. application form duty failed in and signed by the purchaser/applicant with full account particulars of the beneficiary. Receive the amount in cash/transfer with prescribed commission, postage, and telephone/telex charge. Prepare T.T. message inserting test number (code number). Enter in T.T. issue register. Issue advice to the payee branch.

Dr.: Cash or Cheque

Cr.: Gen. A/C Paying Branch

Cr.: Income A/C – Commission on T. T.

Cr.: Telegram charges. (Cost Memo given to the purchaser)

T. T. message prepared in duplicate, checked and signed by the in charge and Manager, tested and transmitted. IBCA prepared in duplicate. The original sent to paying branch as confirmation of message.

Commission

The commission of TT issuance is 0.15% at the principal amount upto Tk 10 Lac with 15% VAT and 0.10% at the principal amount of Tk 10 Lac and above with 15% VAT

The T.T cancellation charge is Tk.50/-

3.1.8.1.4 Money Transfer (MT)

In the prescribed format the purchaser / the drawer branch instruct the drawer branch to pay a specified sum of money to the payee named in the IBCA preferably by crediting his account.

Issuance Procedure of M.T

ü Application in writing in prescribed form

ü Deposit of money including commission

ü Issue of cost memo

ü Entry in M.T. issue register serially

ü M.T. advice in IBCA (in block letters) with Test.

Vouchers for Money Transfer

Dr. Cash / Party A/C

Cr. General A/C (Drawee Br)

Cr. income A/C Commission

Cr. Postage Charge.

Commission

The commission of MT issuance is 0.15% at the principal amount upto Tk 10 Lac with 15% VAT and 0.10% at the principal amount of Tk 10 Lac and above with 15% VAT

The M.T cancellation charge is Tk.50/-

3.1.8.1.5 Traveler’s Cheques (TC)

Traveler’s Cheques are issued by the banks to the people going abroad the risk of loss or inconvenience in carrying cash while traveling. The purchaser has to fill Travel & Miscellaneous Form (TM) prescribed by Bangladesh Bank. Bangladesh Bank gives particulars of the Passport, confirmed Ticket, Airline and the destination. While issuing TCs the purchaser is required to sign the TC in the prescribed place in presence of the issuing Teller and again countersign on same at another prescribed place at the time of encashment before encashing / Paying banker abroad. The Paying cashier will tally both the signatures and if they agree, he will make payment of the TC. TCs of reputed Companies/ Banks are universally accepted for payment at all important financial centers and big cities of the world. American Express Bank Limited’s Traveller’s Cheques are issued by the ONE Bank Limited, Gulshan Branch.

The salient features of T.C. are:

i) The buyer of T.C. needs not to be a customer of OBL.

ii) The buyer has to deposit money with the branch of OBL equivalent to the amount of the T.C. he wants to buy.

iii) Each T.C. is signed by the buyer at place marked “when countersigned below with this signature”, before the OBL Officer.

iv) T.C. is issued in single name .It is not issued in joint names or names of clubs, societies and companies.

v) There is no expiry period for the T.C.

Charges of issuing TC by ONE Bank Limited

The Endorsement Charge plus Handling charges min. Tk. 200/-

Total Value of Remittance (Outward) from January 2005 to June 2007

Year |

Month |

Number of Remittance

|

Value in Taka ‘000 |

Total Value in Taka ‘000 | ||

2005 | January | 06 | 627 |

| ||

February | 04 | 463 |

| |||

March | 04 | 951 |

| |||

April | 01 | 156 |

| |||

May | 05 | 716 |

| |||

June | 03 | 297 |

| |||

Half Year | 23 | 3,210 |

| |||

| July | 02 | 857 |

| ||

August | 04 | 1,018 |

| |||

September | 03 | 790 |

| |||

October | 05 | 1,639 |

| |||

November | 02 | 327 |

| |||

December | 02 | 2,835 |

| |||

Total Value of Outward Remittance in 2005

|

41 |

|

10,676 | |||

2006 | January | 03 | 2,037 |

| ||

February | 02 | 742 |

| |||

March | 08 | 3,775 |

| |||

April | 09 | 1,844 |

| |||

May | 06 | 6,315 |

| |||

| June | 05 | 2,283 |

| |||

Half Year | 33 | 16,996 |

| |||

| July | 05 | 1,267 |

| ||

August | 05 | 4,608 |

| |||

September | 02 | 9,489 |

| |||

October | 01 | 128 |

| |||

November | 05 | 4,656 |

| |||

December | 06 | 6,199 |

| |||

Total Value of Outward Remittance in 2006 |

57 |

|

43,343 | |||

2007 | January | 02 | 2,545 |

| ||

February | 01 | 76 |

| |||

March | 03 | 153 |

| |||

April | 04 | 2,545 |

| |||

May | 06 | 1,289 |

| |||

June | 03 | 230 |

| |||

Total Value of Outward Remittance in 2007 (Half Year End)

|

19 |

|

6,838 | |||

The above Table 1 and the Figure 8 represents the Total Value of Remittance (Outward) of ONE Bank Limited, Gulshan Branch from the period of January 2005 to the half year ended in June 2007. During this period of 2 and half years, it shows that the Outward Remittance has increased gradually in 2006 compared to 2005. But the half year end of 2007 shows the value of Outward Remittance has decreased.

The above Figure 9 shows the Outward Remittance of the year 2005. The Table shows that the months from July to December, the value of Remittance is greater than the figures of the months from January to June. The later half of the year experienced greater amount of Outward Remittance which indicates that there were more remittance than the earlier months.

The above Figure 10 shows the Outward Remittance of the year 2006. When compared to the figures of 2005, the trend of 2006 is not similar than the previous year. The chart portrays that, the month’s experienced uneven distribution of Remittance. Some months shows very high amount of Remittance, whereas some months showed comparatively less figures.

The above Figure 11 shows the Outward Remittance of the half year end of 2007 from the period of January to June. ONE Bank Limited, Gulshan Branch rendered more amount of Remittance in the month of January and April, whereas the other months had less amount of Outward Remittance.

Total Value of Remittance (Inward) from January 2005 to June 2007

Year |

Month |

Number of Remittance

|

Value in Taka ‘000 |

Total Value in Taka ‘000 |

2005 | January | 34 | 59,871 |

|

February | 25 | 57,962 |

| |

March | 38 | 95,049 |

| |

April | 32 | 84,257 |

| |

May | 35 | 89,313 |

| |

June | 34 | 86,534 |

| |

Half Year | 198 | 4,72,986 |

| |

| July | 28 | 73,655 |

|

August | 31 | 1,06,887 |

| |

September | 35 | 1,26,780 |

| |

October | 33 | 1,03,215 |

| |

November | 32 | 80,781 |

| |

December | 48 | 1,19,520 |

| |

Total Value of Inward Remittance in 2005

|

405 |

|

10,83,824 | |

2006 | January | 43 | 78,467 |

|

February | 34 | 53,124 |

| |

March | 39 | 66,375 |

| |

April | 39 | 83,267 |

| |

May | 54 | 99,585 |

| |

| June | 42 | 96,420 |

| |

Half Year | 251 | 4,77,238 |

| |

| July | 45 | 60,800 |

|

August | 36 | 76,009 |

| |

September | 46 | 1,21,003 |

| |

October | 41 | 55,573 |

| |

November | 46 | 57,719 |

| |

December | 38 | 48,575 |

| |

Total Value of Inward Remittance in 2006

|

503 |

|

8,96,917 | |

2007 | January | 33 | 40,907 |

|

February | 42 | 48,128 |

| |

March | 44 | 50,918 |

| |

April | 50 | 63,709 |

| |

May | 56 | 1,10,691 |

| |

June | 61 | 1,65,815 |

| |

Total Value of Inward Remittance in 2007 (January to June) |

286 |

|

4,80,168 | |

The above Table 2 and Figure 12 represents the Total Value of Remittance (Inward) of ONE Bank Limited, Gulshan Branch from the period of January 2005 to the half year ended in June 2007. During this period of 2 and half years, it shows that the Inward Remittance has decreased in 2006 compared to 2005. But the half year end of 2007 shows the value of Outward Remittance has increased and at the year end of 2007, probably the amount of Remittance can increase. Due to the downfall of the economy in the period of 2006, there were less Inward Remittance, but as the Economy of Bangladesh is developing, the amount of Remittance is also increasing. The Inward Remittance is considered Positive for the economy as people are remitting money into the economy both from local and abroad.

The above Figure 13 shows the Inward Remittance of the year 2005. The Table shows that the months from July to December, the value of Remittance is greater than the figures of the months from January to June. The later half of the year experienced greater amount of Inward Remittance, which indicates that there were more remittance than the earlier months.

The above Figure 14 shows the Inward Remittance of the year 2006. When compared to the figures of 2005, the trend of 2006 is not similar than the previous year. The chart portrays that, the month’s experienced uneven distribution of Remittance. Some months shows very high amount of Remittance, whereas some months showed comparatively less figures. The amount of Inward Remittance is less in the year 2006 than the amount of 2005.

The above Figure 15 shows the Inward Remittance of the half year end of 2007 from the period of January to June. ONE Bank Limited, Gulshan Branch is experiencing more amount of Remittance and the trend is increasing month wise. Every month experienced greater volume of Remittance figures and this to due to the Economic Development observed in Bangladesh. More and more Inward Remittance portrays better growth for the economy and it can be forecasted that by the end of year 2007, the amount of Inward Remittance will be much greater than the earlier years (2005 and 2006).

3.1.9 Other Services

3.1.9.1 ATM (Automated Teller Machine)

Automated Teller Machine (ATM) is one of the modern financial services provided by bank. This is providing customer collection of money any time he desires. Now a day life is to fast. To consider this, bank creates this service where any customer needs not to follow the banking hour to collect money from his deposit. The objective of such major investment is to create Customer Convenience. Clients and customers can access their Cash on a round the clock basis, 365 days a year. The Bank is a member of the shared ATM Network provided by Electronic Transaction Network Ltd. (ETN). At present 10 ATMs are available throughout Dhaka City and in the cities of Chittagong and Sylhet. It is also a Debit Card. Customer firstly deposit money against this A/C then gets ATM service. (See Appendix 5, pg 200)

Procedure of applying for a ATM Card

ü A person who desires to get an ATM Card should open an ATM Account in the bank.

ü An ATM form supplied to the customer specifying the account, which includes information such as Name of the account, Account number, Address, Telephone No etc.

ü After filling the form the officer verifies the form.

ü Jointly an ATM account can be opened.

ü Then the client is supplied a deposit slip to deposit the cash.

ü Then the client gets an ATM/Debit Card.

Terms and Condition

ü At the applicant’s request the Bank may issue the cardholder a card and PIN if the applicant is a depositor of the Bank and remains an account at any bank.

ü The cardholder will pay such charges and fees for the provision of the card and /or PIN as the Bank may prescribe from time to time.

ü Holders of Valid E-Cash ATM/Debit are eligible to enroll for the utility bill payment service using the card and/or PIN, POS or other payment terminal.

ü All transactions including utility bill payment initiated by the use or purported use of the card shall be debited from the cardholder.

ü A cardholder can withdraw from his account Tk 20,000 per day. But by inserting a card at a time no cardholder can withdraw more than Tk 2000.

Charges for using an ATM Card

Tk. 1500/- annual fees for each Card.

3.1.9.2 Online Banking Operation

ONE Bank Limited branches are connected through the online banking facilities. The transactions of a particular bank are transmitted through the Micro-Bank software from INFLEX Solutions to the Head Office, where every data is stored in the database.

Real-time On-line Any branch Banking for the clients is used to facilitate the clients to deposit / draw or remit funds to and from their accounts, from one bank to another.

Meanwhile, for the Smooth operation and efficient functioning of the system they have completed the proper training to the related personnel.

Branches under On-line Banking Service

All the Branches and the Head office come under the umbrella of on-line any branch-banking network, which have been used for some years of operations.

Facilities of Online Banking System

Customers of one Branch of OBL are able to make transaction like cash withdrawals and deposits, electronic fund transfer, balance inquiry, account statements etc. from any of the OBL Branches under the umbrella of Online Banking across the country.

3.1.9.3 Locker Services

ONE Bank Limited branches have the facility of locker service for the purpose of safe guarding the valuable property of customers.

The person or organization that has any account in bank branch can enjoy this service. They keep their valuable assets in banker’s custody. Customers have right to look after with a key of their individual lockers provided by bank.

ONE Bank Limited, Gulshan Branch also provides locker services to its clients. The lockers are available at different sizes and the price is fixed according to the sizes preferred by the clients.

Locker Services | Yearly Charge | Security Deposit |

Small | Tk 1,200/- |

Tk 1,000/- for all types of lockers |

Medium | Tk 1,800/- | |

Large | Tk 2,500/- |

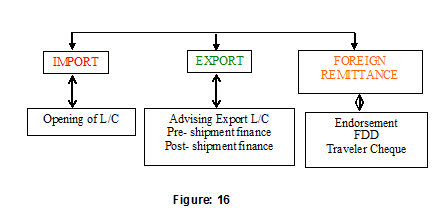

3.2 Foreign Exchange Department

Foreign Exchange Department

Modern banks facilitate trade and commerce by rendering valuable services to the business community. Apart from providing appropriate mechanism for making payments arising out of trade transactions, the banks gear the machinery of commerce, specially in case of international commerce, by acting as a useful link between the buyer and the seller, who are often too far away from and too unfamiliar with each other. According to Foreign Exchange Regulation act 1947, “Any thing that conveys the right to wealth in another country is foreign exchange”.

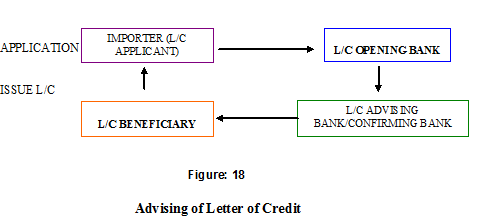

Foreign Exchange department plays significant roles through providing different services for the customers. Opening or issuing letters of credit is one of the important services provided by the banks. Letters of credit is the key player in the foreign exchange business. With the globalization of economies, international trade has become quite competitive. Timely payment for exports and quicker delivery of goods is, therefore, a pre-requisite for successful international trade operations. Growing complexity of international trade, separation of commercial parties across the globe and operating in a totally unknown environment underlined the need for evolving a system that balances between the expectations of the seller and the buyer. Documentary Credit has emerged as a vital system of trade payment, and fulfilled the requisite commercial need. This system substantially reduces payment-related risks for both exporter and importer. Not surprisingly, therefore, the letter of credit is the classic form of international export payment, especially in trade between distant partners. The bank upon presentation of stipulated documents (e.g., bill of lading, invoice, and inspection certificate) makes payment, acceptance or negotiation of the credit by the seller.

Function of Foreign Exchange (An overview)

Foreign exchange

3.2.1 Import Department

3.2.1.1 Import Procedure

An importer is required to submit the following documents in order to get a license to import through ONE Bank Limited, Gulshan Branch –

ü A bank account with the branch;

ü Import Registration Certificate (IRC);

ü Tax Payer’s Identification Number (TIN);

ü Pro forma Invoice Indent;

ü Membership Certificate from a recognized Chamber of Commerce & Industry or Town Association or registered Trade Association;

ü Letter of Credit Authorization (LCA) Form properly filled in duplicate signed by the importer;

ü L/C Application duly signed by the importer;

ü One set of IMP Form;

ü Insurance Cover Note with money receipt;

ü VAT Registration Certificate (for Commercial Importers);

ü In case of Public Sector, attested photocopy of allocation letter issued by the allocation authority, Administrative Ministry or Division specifying the source, amount, purpose, validity and other terms and conditions against the imports;

Any such documents as may be required as per instruction issued/to are issued by the Chief Controller of Imports & Exports (CCI&E) from time to time.

On receipt of the LCA Form and the other documents, the branch officials carefully scrutinize the documents and lodge the same in their respective registration books and duly verify the signature of the importer put on the LCA Form.

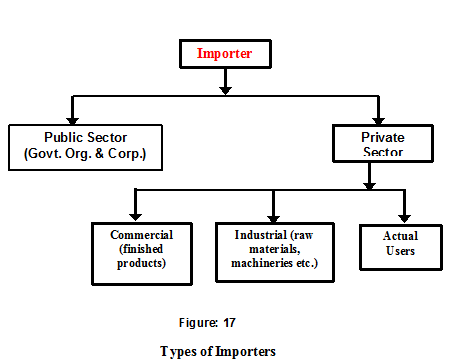

To import, a person should be competent to be an ‘Importer’. According to the “Import & Export Control Act, 1950”, the office of the Chief Controller of Imports & Exports (CCI&E) provides the registration (IRC) to the importer. After obtaining the IRC, the person has to secure a “Letter of Credit Authorization” (LCA) registration from the

Registration Unit of Bangladesh Bank. After getting the LCA registration, a person becomes a qualified importer. He is the person who requests or instructs the opening bank to open an L/C is also called the “Opener” or “Applicant” of the credit.

3.2.1.2 Types of Importer