Chapter 1:

Introduction

Internship program is an external dimension of career development for a business graduate. At the end of the graduation program (Academic part) the students of a business school are sent to different organizations to get some real life experience as internees. Usually this program has duration of three months. Throughout these three months of internship program the internees are being assigned some assignments, which help them to learn the attitude of working in the organization. At the end of the internship program the internees are suppose to submit an internship report and this report submission is the last step that brings a successful end up of graduation program from a business school.

Internship program of NUB mostly focuses on the field that a student is concentrating. Moreover this program gives a student the opportunity to practice his knowledge of theory in the field of practical life. This internship report is based on the author’s internship experience in Standard Chartered Bank, SCB House, 67Gulshan Avenue, Gulshan, Dhaka.

Origin of the Report:

This report has been prepared as a requirement of BBA program of Business Administration Department, NorthernUniversity, Bangladesh. After the completion of 120 credit hours a student has to complete a 12-week organizational attachment. So after completion of 12-week internship at Standard Chartered Bank (SCB) this report has been prepared.

Objective of the Study:

Based on the title of the report “Foreign Exchange Operation (Export/Import) at Standard Chartered Bank”, the study is basically an attempt of assessing international trade procedure practiced by SCB. The specific objectives of the study are:

- To identify existing practices of trade operation at SCB and their procedures, documentations, costs, risk and time involvements.

- To analyze legal and regulatory aspects of international trade procedure, payments, and deviations in operations.

- The role of ICC in documentary credit procedure.

- Mode of payment in international transactions.

- INCOTERMS (International Commercial terms) with defined responsibility of the parties (seller & buyer) and its implication in export-import procedure.

- Advantages & disadvantages of Documentary Credit.

- Charges and commissions against services given by SCB.

Methodology and Data:

Both primary and secondary data have been gathered to attain the objective of the study. Secondary data sources are primarily related to international trade payment practices, ICC documents, and domestic laws and provisions connected with trade payment methods of the country. The report has been organized under four chapters: after an introductory chapter with the objective and methodological issues, chapter 2 deals with overview of SCB. Chapter 3 deals with the procedure of documentary credit and it includes the main part of the study; chapter 4 summarizes findings/observations and put forward few recommendations.

Limitations of the Study:

The overall study was conducted considering a number of limitations. These are as follows:

- The major limitation of the study was confidentiality of the data. As part of the policy of Standard Chartered bank, some data could not be used to enhance the parameter of the analysis. Because of maintaining the secrecy, such data is important to the bank’s interest that’s not revealed to the public.

- No statistical analysis was conducted; and thus the findings are not statistically validated. The research design maintained in this study is basically qualitative in nature.

- Limitation of time was one of the most important factors that shortened the present study. Due to time constraints, many aspects could not be discussed in the study.

- Limitations of conducting survey on “customers’ perception” about the services given by Trade Services, SCB.

- Though the report title is based on “Export-Import Procedure”, however, I only had the chance to work with Import part only.

- Beside all the above restraint, the lack of experience on the part of the researcher in this field may have become yet another limiting factor.

Chapter 2:

Overview of SCB

Background of Standard Chartered Bank:

Standard Chartered Bank (“SCB”) is incorporated in England with limited liability by Royal Charter 1853, now it is one of the world’s best international banks, with operations throughout the globe. Standard Chartered Bank has a history of about 150 years. The name of the bank came from the two original banks – the “Standard Bank” of British South Africa and the “Chartered Bank” of India, Australia and China. Of the two banks, the “Chartered Bank” was established in 1853 by a Royal Charter granted by Queen Victoria of England. The key person behind the Chartered Bank was a Scot, James Wilson who has started “The Economist”, which is still one of the world’s pre-eminent publications. He visualized the advantages of financing the growing trade links with the areas in the East, where none of the other financial institutions were present at that time and therefore the Chartered Bank opened two branches in 1858 in Chennai and Mumbai. On the other hand, the “Standard Bank” was founded by another Scot, John Paterson in 1862. He immigrated to the Cape Province in South Africa and became a successful merchant there. Coming from the similar background, he also visualized the great opportunities through linking between Europe and South Africa.

From the very beginning both the banks were keen to capitalize on the huge expansion of trade between Europe, Asia and Africa and to reap the handsome profits to be made from financing on that trade. Therefore, although they were separate entities, survived the First World Ware and the Depression. But were directly affected by the wider conflict of the Second World War in terms of loss of business and closure of branches and for that they decided to merge in 1969. After the merger the new shares of the Standard and Chartered Banking Group Limited were listed in the London Stock Exchange on January 30, 1970. Although the two banks merged in 1969, but their operations were being executed from two different headquarters, until on June 1980, the original building of the Chartered Bank was demolished and a new headquarter of the Standard Chartered Bank was opened on March 20th, 1986. Right after the merger the bank embarked on a vigorous mission to expand its business in Europe and the USA

In the last thirty years, Standard Chartered Bank has experienced continuous growth, which led to its becoming one of the top 100 listed banks in the world. In the year 1993 and 1994 it was judged as the best bank in the Asia – Pacific region for its excellent service and growth rate as well. The bank excels in providing the most efficient, consistent and timely services through 600 offices in more than 57 countries of Asia, Africa, Middle East and European region incorporated in the UK with its Headquarter as 1 Aldermanbury Square, London. At present, it is maintaining corresponding relationship with over 600 banks in 157 countries. SCB specializes in personal, corporate, institutional and personal finance and custodial service with having a staff of about 33,000 people. SCB is well established in growth markets and aims to be the right partner for its customers. This Bank is trusted across its network for its standard of governance and its commitment to making a difference in the communities in which it operates. Standards Chartered Bank aims to be a banker of choice by understanding, meeting and consistently exceeding their customer requirements. They aim to provide security and value to their customers by offering a wide range of innovative and safe products that are benchmarked against their competitors’ best offerings.

Company Image and Logo:

Standard Chartered Bank is a solid, forward looking, modem foreign bank with a long record of sound performance. The effort that Standard Chartered Bank makes in order to portray the Bank as a brand image is very strong and successful. The general image of Standard Chartered Bank is that it is “Trustworthy, efficient, helpful and committed.” The logo of the bank depicts the merger of two banks.

“We said we wanted to be the world’s best international bank. That is still our aspiration and we are making good progress on that journey.”

Peter Sands, Group Chief Executive

The Global Operating Regions of Standard Chartered Bank:

Standard Chartered is headquartered in London where it is regulated by the UK’s Financial Services Authority. The Group’s head office provides guidance on governance and regulatory standards. Our Wholesale Banking team in London plays a key role in serving corporate clients and financial institutions doing business in our markets. The Standard Chartered Group is operating in 57 countries in various extents. These countries are grouped into 5 regions based on their locations and business core focus.

- Asia Pacific

- Africa

- Latin America

- Middle East and South Asia (MESA)

- UK and USA

150 Years in Asia:

First branches opened in Calcutta, Shanghai and Mumbai in 1858, followed by branches in Hong Kong and Singapore in 1859.

• Over 80% of total Group staff work in Asia

• Largest international bank in India & Pakistan

• Locally incorporated in China in 2007

• Over 80% of Group’s profits generated from Asia

- Bahamas

- Brazil

- Canada

- Colombia

- Falkland Is.

- MexicoAfghanistan

- Australia

- Bangladesh

- Brunei

- Cambodia

- China

- Hong Kong

- India

- Indonesia

- Japan

- Laos

- Macau

- Malaysia

- Mauritius

- Nepal

- Pakistan

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Taiwan

- Thailand

- Vietnam

- The Middle East:

- Bahrain

- Jordan

- Lebanon

- Oman

- Qatar

- UAE

Africa:

- Botswana

- Cameroon

- Cote d’Ivoire

- Ghana

- Kenya

- Nigeria

- Sierra Leone

- South Africa

- Tanzania

- The Gambia

- Uganda

- Zambia

- Zimbabwe

Europe:

- Ireland

- Jersey

- Switzerland

- Turkey

- UK

The Americas:

- Argentina

- Brazil

- Peru

- US

- Venezuela

Standard Chartered Bank in Bangladesh:

The Chartered Bank started its operation in Chittagong in 1947, soon after the creation of Pakistan. The branch was opened mainly to facilitate the post war re-establishment and expansion in this part of South Asia. . After the merger of Chartered bank with Standard bank in 1969, the bank increasingly invested in people, technology and premises as its business grew in relation to the country’s thriving economy. The bank opened its first branch in Dhaka in 1966 and shifted it’s headquarter from Chittagong to Dhaka in1972 after the birth of the Republic of Bangladesh.

- The merger with ANZ Grindlays Bank:

Grindlays Bank was one of the oldest banks operating in this country and its history of operation goes back to 1905. The long standing relationship with the clients in this country had established Grindlays Bank a trusted name in the corporate world and ranked Bangladesh as fourth in worldwide ranking.

At the time of Asian Crisis in 1997, when most of the Asian banks were reeling on the edge of bankruptcy, SCB revealed to acquire the ANZ Grindlays Bank for $1.34 Billion, which was then considered as the biggest gamble that time. This acquisition has added 6000 employees and 4 countries to SCB’s existing network. Moreover, this deal has made SC the largest foreign bank in India, Pakistan and Bangladesh and second largest in UAE. Up to September 2002, both Standard chartered and Standard Chartered Grindlays operated under the same management but as separated entities. But as per contract, from January 01, 2003 both become combined and known as Standard Chartered Bank.

- The Acquisition of American Express Bank Ltd.:

The American Express Bank Ltd. started its operation in Bangladesh in 1996.With its service and creative product development features it has a strong customer base in the outlets of Dhaka and Chittagong. But with a view to change its business strategy, it has closed all its operation in Bangladesh. And Standard Chartered Bank decided to acquire all its accounts. As a result, in July, 2005 SCB acquire the AMEX for $ 24.4 Million which will add 2 branches in Dhaka and 1 in Chittagong and 3 ATM booths in the 2 cities in the existing network of SCB. But as per contract, from November 01, 2005, the acquisition process has been be completed and AMEX is known as Standard Chartered Bank

After acquiring Grindlays, Standard Chartered Bank is a leading foreign bank in Bangladesh, which brings the revolution in banking service industry through adaptation of modern technology and process with a view to enhancing customer satisfaction. Having been established in the British colonial period, the bank has positioned itself as a unique business serving the local community with due professional and ethical fervor. It has been operating in Bangladesh for more than 100 years. To maintain its leading position in the Bangladesh; SCB is always keen to develop long-term beneficial relationship with trustworthy clients. To achieve this end, they have always upgraded their approaches to achieve profitability. It is a powerful tool to price the customers according to their standing and risk grade. But from September 2000 this approach has been replaced by value added framework Over the years, it has created the largest networks among all the foreign banks in Bangladesh with 22 branches, 3 booths and over 1500 employees in different significant places of the country and intends to expand its presence all over the country.

Standard chartered Bank is operating in Bangladesh with 22 branches and 3 booths in Dhaka, Chittagong, and Sylhet.

Mission:

Standard Chartered bank aims to be a banker of choice by understanding, meeting and consistently exceeding their customer requirements. They aim to provide security and value to their customer by offering a wide range of innovative and safe product that are benchmarked against our competitors’ best offerings. Their motto is to be the world’s best international bank.

Vision:

Leading the way by providing best customer services.

Strategy:

Leading the Way:

Standard Chartered aims to be the world’s best international bank. With 70,000 people employed in more than 50 countries (before acquisition of AMEX), we are well positioned to achieve growth from opportunities in some of the world’s most exciting and diverse markets.

We are leading the way through our:

• Growth Markets

• Innovative Products and Services

• Talented and Diverse Teams

• Sustainable Business Strategy

Strategic Intent:

To be the world’s best international bank

Leading the way in Asia, Africa & the Middle East\

Brand Promise:

Leading by Example to be “The Right Partner”

Values:

- Responsive

- Trustworthy

- Creative

- International

- Courageous

Approach:

- Participation: Focusing on attractive, growing markets where we can leverage our customer relationships and expertise.

- Competitive Positioning: Combining global capability, deep local knowledge and creativity to outperform our competitors.

- Management Discipline: Continuously improving the way we work; balancing the pursuit of growth with firm control of costs and risks.

Commitment to Stakeholders:

- Customers: passionate about our customers’ success, delighting them with the quality of our service.

- Our People: Helping our people to grow, enabling individuals to make a difference and teams to win.

- Communities: Trusted and caring, dedicated to making a difference.

- Investors: A distinctive investment delivering outstanding performance and superior returns.

- Regulators: Exemplary governance and ethics wherever we are.

Highlights 2007: A year of Growth:

- Record earnings: Operating income exceeded $11 billion and profit before tax surpassed $4 billion, both for the first time

- Broad-based growth: Headline income grew 28 per cent, with organic income growth accelerating to 23 per cent, a record high

- EPS growth: Normalized earnings per share increased 15.8 per cent to 197.6 cents

- Strong markets: For the first time, profit before tax surpassed $1 billion from Hong Kong and $500 million each from India and the MESA region

- Strong balance sheet: The Group’s liquidity and capital positions remain comfortably above targets, despite market turbulence

- Private banking: Launched The Standard Chartered Private Bank, with offices now spread across 11 locations in seven markets

- Acquisition of American Express Bank to give a further boost to the

- Private Bank and Transaction Banking

- Islamic Banking: Launched Saadiq, our global Islamic Banking brand, in the UAE, Malaysia, Pakistan and Bangladesh

- China: Incorporated in China and launched local reminding banking services

- Sustainable business strategy: Committed $8 –10 billion over the next five years to finance renewable and clean energy projects

Priorities of 2008:

Standard Chartered is well positioned to capitalize on the growing international trade flows as a result of our broad geographical footprint, the depth of our customer relationships, delivery of our product capabilities and the expertise of our people. The Group is investing in dynamic markets and benefiting from the shift in economic power from West to East.

- Superior Financial Performance

- Continuous improvement

- Build leadership

- Be the right partner for regulators & community

Management Agenda 2008:

• Sustain organic momentum

• Deliver growth from our acquisitions

• Continuously improve the way we work

• Build leadership

• Reinforce the brand

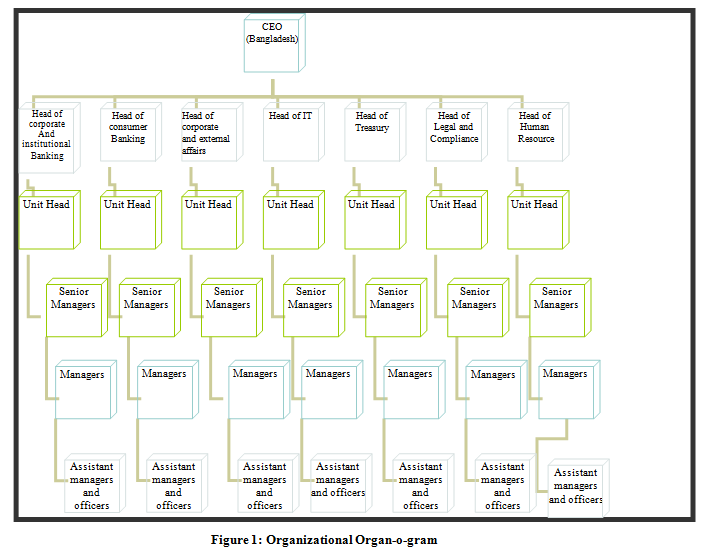

Organizational Structure:

Standard Chartered Bank in Bangladesh follows a hierarchical pattern of command. The Chief Executive Officer (CEO), Mr. Osman Murad reports to the Regional General Manager, MESA in Dubai. All the department heads at the headquarters report to the CEO.

A manager or senior manager who reports to the head of the department. In Chittagong, however, since there are two major business activities, a manager or senior manager, who reports directly to the head of the respective division in Dhaka, heads each. The Custodial Service division at the headquarters reports to the Head of Corporate Banking.

The respective branch managers are responsible for the performance of their unit. Each branch is organized functionally along line divisions with some support facilities and the manager assigns tasks to his/her subordinate personnel and supervises their performance, instructions are often given without necessary details and clarifications.

Chapter3

INTRODUCTION TO DOCUMENTARY CREDITS

Trade Services:

One of the important functions of the commercial banks in the world is to undertake import of merchandise into the country and payment of foreign exchange towards the cost of the merchandise to the foreign suppliers. Foreign exchange department of Standard Chartered bank (SCB) is one of the most important departments among all other departments.

Bangladesh, the import of goods is regulated by the Ministry of Commerce in terms of the Import and Export (Control) Act, 1950; with Import policy orders issued biannually, and Public Notices issued from time to time by the Chief Controller of Imports and Exports (C.C.I&E). According to the Imports and Exports Act, 1950 as adopted in Bangladesh, any one willing to carry import business needs registration with the licensing authority, i.e., Chief Controller of Imports and Exports (CCI&E) and its offices at the important trade centers of the country.

This department handles various types of activities by two separate sections:

ü Import Procedure Section

ü Export Procedure Section

The Trade Services, SCB operates activities through the following ways:

Figure 2: Activities Flow Chart of Trade Services

Import Procedure

ROLES, RESPONSIBILITIES & AUTHORITY OF MANAGERS AND STAFF OF TRADE SERVICES:

Counter:

- The LC application is stamped & received on the counter with date and time and delivered to the respective CSC (CustomerServiceCenter) team through a register.

- The documents submitted for opening L/C are:

- LC application Form

- Pro forma Invoice/ Indent

- LCA Form

- IMP Form

- Insurance Cover Note (LC Value + 10%) & Money receipt, Form “Ga”

- IOF (Inspection Order Form)

- Pay Order/ Request for issuance of Pay Order for the Insurance Company

- Other additional documents if required by Import Policy Order (IPO) or NBR or Bangladesh bank circular (i.e.) viz Block list from Drug Administration, Ministry of Agriculture Import Permit, Fertilizer Association Allocation Letter, BOI Allocation Letter etc.

- In respect of import by industrial unit under bonded warehouse system, open marine policy is acceptable.

CSC (Customer Service Center):

- The LC Application is logged into EximBill and a reference number for it is generated.

- Signature appearing on L/C application is to be verified on the basis of client’s board resolution.

- Check if all the necessary documents are submitted

- Check availability of funds and limit on EBBS and printouts of these are attached with the LC application.

- Check the LC Application for all the necessary information:

Advising method (Swift/ Courier); LC Expiry Date; Amount Tolerance; Port of Shipment & Discharge; Description of Goods; INCO terms; Country of Origin; Customers IRC, VAT & TIN; LCA Form no etc.

- Check BCA (Business Credit Application) of the client to find out if –

- They are allowed to import the goods

- Margins are required

- LC Commission for 1st and consecutive quarters

- If imported through a bonded warehouse or not (VAT is not applicable for bonded warehouse)

- Check Pro-forma Invoice/ Indent for – Name of the beneficiary, LC Value, INCO terms, Port of Loading & Discharge, payment terms, LC Tolerance (if required), HS Code and match it with the LC Application form.

- To check the validity of the indentors i.e. check Bangladesh bank permission approving the indentor to act as agent of the principal (Supplier).

- Check Insurance Cover Note for Port of loading, Name of the Insured (SCB), Account No of the LC Account, Insured Amount (Value + 10%), Voyage from, port of dispatch to applicants warehouse via port of discharge, validity period of the insurance. Check Form “Ga” for Insurance VAT Coverage. Open insurance cover note is applicable for opening Quasi Back-to-Back L/C as per government regulation.

- Check LCA Form for – IRC No., LC amount, Description of Goods, HS Code, Signature, Name and address of the customer. If INCO term is FOB the freight amount should be included in the LCA Form

- Check the IMP Form for Name, signature & IRC no of the customer

- Beneficiary checking:

- Obtain credit report from D&B or from our correspondent

- Use the existing credit report for the purpose if the same is not older than 3 years

- Exceptions, if any needs to be referred to RM

- Check SRL/ OCF to ensure that there is no positive SDN match

- Prepare a memo to issue a Pay-order for the insurance company (if the applicant applied for a PO with the application.)

- LC and AML checklist is filled in and attached with LC application.

- Instruction to TPC is written down along with specific information:

- LC#

- VAT applicable

- PSI required or not as per 1st schedule

- Swift charge

- Product code

- Bill type i.e. Raw Materials – 94, Usance -95, Machinery – 96 etc.

- If no discrepancies found, they are signed by an Asst. Manager/ Officer sent to TPC with authorization from Sr. Manager/Manager.

TPC (Transaction Processing Center):

- Necessary inputs are given on Eximbills:

- Applicant, beneficiary, shipment, expiry, advising bank, insurance etc.

- Commission, fees, VAT, communication and other charges are realized as per information available in the job request sheet of CSC.

- LC text is generated.

- Local regulations with regard to commodity are ensured and necessary clauses incorporated

- Group sanction clause incorporation is ensured.

- Check and authorize functions are performed in Eximbills and message sent via SWIFT system through MT 700 & MT 701 or through Airmail/ Courier

- A letters to respective PSI Company is generated if required; advice is printed and attached with the LC docs for onward escalation to PSI Company by mail.

CSC (Customer Service Center):

- Copy of LC, Swift acknowledgement copy, LCA customer copy, advice and PSI letter (if required) is sent to the counter for delivery by CSC team.

- Any acknowledgement (of receipt of the LC swift message) sent by the advising bank is attached with the LC file.

Counter:

- LC is delivered to the customer from counter or through PSB

- The LC file is then sent to the Vault.

3.2. Issuance of Import Letter of Credit:

An Import/Export Letter of Credit (Import/Export LC) is a written undertaking issued by a bank, acting at the request and on instructions of it’s customers, the applicant of the credit, account party or buyer, in which the bank obligates itself to make payment to the beneficiary (seller of goods or services) up to a stated amount within a prescribed time limit and upon presentation of appropriate documents by the beneficiary that conform to terms and conditions set by the buyer and expressed in the LC. An import LC covers shipment terms, payment terms, description of goods and other conditions applied by applicant.

The basic components of letters of credit:

Letters of credit have the following basic components.

Importer (Applicant/Buyer/Opener/Account Party): The party applying for the issuance of the letter of credit to the issuing bank and thereby creates an account relationship with the bank.

Seller (Beneficiary / Shipper/Consignor): The party in whose favor the letter of credit is issued, usually the seller/exporter, and who will receive payment if all the conditions and terms of the credit are met.

Issuing Bank (Opening Bank): The bank that issues the letter of credit as per instructions/request of the applicant, and takes the responsibility to make payment to the beneficiary, usually the seller/exporter. The issuing bank is generally, but not necessarily located in the importer’s country.

Advising Bank: This is a bank that notifies or advises the exporter that a credit has been opened in exporter’s favor. The Advising Bank does not take any further risk, and has the only responsibility of taking reasonable care that the credit is an authentic one. Advising Bank advises the credit at the request of the issuing bank.

Confirming Bank: The bank that adds its confirmation to a credit upon the issuing bank’s authorization or request. Here, the bank adds its own undertaking (known as confirmation) in addition to that given by the issuing bank at the request of the issuing bank.

Negotiating Bank: The bank which examines the documents presented by the exporter, then negotiates the credit.

Reimbursing Bank: This is the bank, which would reimburse the negotiating bank. It is to be nominated by the issuing bank.

Transferring Bank: The bank, which will transfer L/C, being instructed by the original/first beneficiary, either in whole or in part, either to one or more than one second beneficiary (ies).

Accepting Bank: It is a bank, which will accept documents and pay at maturity draft (s) drawn by the beneficiary as per instructions of the issuing bank.

Nominated Bank: This is the bank, which is authorized (by issuing bank) to pay, incur a deferred payment undertaking, and accept draft or to negotiate.

Drawee Bank: The bank named in the Letter of Credit on which the drafts are to be drawn.

Amount: The sum of money, usually expressed as a maximum amount, of the letter of credit, defined in a specific currency.

Terms: The requirements, including documents that must be met for the collection of the credit.

Expiry: The final date for the beneficiary to present against the credit.

Banking Day: Banking Day means a day on which a bank is regularly open at the place at which an act subject to these rules is to be performed.

Complying presentation: It means a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of these rules and international standard banking practice.

Confirmation: Confirmation means a definite undertaking of the confirming bank, in addition to that of the issuing bank, to honor or negotiate a complying presentation.

Honor means:

a. to pay at sight if the credit is available by sight payment.

b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment.

c. to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance.

Negotiation: Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank.

Presentation: It means either the delivery of documents under a credit to the issuing bank or nominated bank or the documents so delivered.

Presenter: Presenter means a beneficiary, bank or other party that makes a presentation.

Credit: Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honor a complying presentation.

Latest Negotiation Date: The latest negotiation date is the last day of the period of time allowed by the letter of credit (L/C) for the presentation of documents and/or draft(s) to the bank. The latest negotiation date is not necessarily the L/C expiry date.

Expiry Date and Place: The expiry date and place is the last day of validity of the credit and the place allowed by the letter of credit (L/C) for the presentation of documents and/or draft(s) for payment, acceptance or negotiation.

Draft(s) Drawn On: The draft(s) drawn on answers the question “Which bank or who is the drawee (the payer) of the draft?” The draft is most often drawn on the confirming bank or the issuing bank. In some cases, the draft is drawn on the applicant.

Draft(s) Drawn At: The draft(s) drawn at answers the question “The draft is drawn at what terms?” It can be a sight draft (i.e., payment on demand or on presentation) or a term draft (i.e., payment at a fixed or determinable future time).

Draft(s) Drawn Under: The draft(s) drawn under answers the question “The draft is drawn under which credit and the credit is of which bank?”

Latest Shipment: The latest shipment—latest date of shipment or last date for shipment—is the last day of the period of time allowed by the letter of credit (L/C) for shipment, dispatch or taking in charge.

Port or Point of Origin and Port or Point of Destination: The port or point of origin is the port or place of loading, dispatch or taking in charge. The port or point of destination is the port or place of discharge or delivery. Some of the expressions that may appear in the letter of credit (L/C) indicating the origin and the destination are

- “shipment from … to …”

- “dispatch from … to …”

- “carriage from … to …”

- “delivery from … to …”

- “forward from … to …”

- “taken in charge at … for transportation to …”

Figure 3: Role Diagram of Documentary Credit Procedure

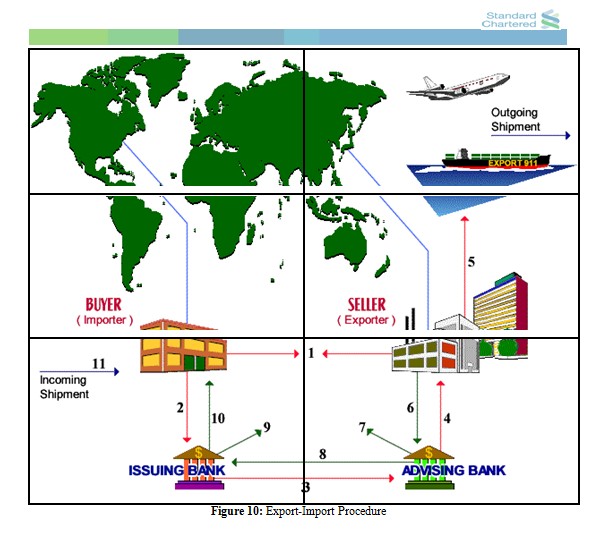

EXPORT-IMPORT PROCEDURE:

1. Buyer and Seller Contract: The buyer (consignee) and seller (shipper) negotiate a sales contract.

2. Consignee to Issuing Bank for Credit Application: The documentary credit is typically arranged by the consignee. Here, the consignee sends a credit application to the issuing bank.

3. Issuing Bank to Corresponding Bank about Credit Arrangements: The issuing bank sends a credit confirmation to the corresponding bank, in the form of a letter of credit.

4. Corresponding Bank to Shipper about Credit Notification: The corresponding bank sends notifications to the shipper (seller) that credit arrangements have been made.

5a. Shipper Dispatches Goods to Carrier: The shipper (seller) dispatches the goods to the carrier.

5b. Shipper Receives Shipping Documents from Carrier: In exchange for dispatching the goods, the shipper receives various shipping documents, including the bill of lading.

6. Shipper Presents Shipping Documents to Corresponding Bank: The shipper forwards the shipping documents to the corresponding bank. These are evidence that the goods have been shipped, and thus that the shipper has completed his performance of the contract.

7. Corresponding Bank Makes Payment to Shipper: The corresponding bank compares the shipping documents to the letter of credit, and if correct, releases payment of the sale to the shipper.

8. Corresponding Bank Forwards Shipping Documents to Issuing Bank: The corresponding bank forwards the shipping documents to the issuing bank. The bill of lading (etc) now represents the right to receive the goods at the point of delivery.

9. Issuing Bank Makes Payment to Corresponding Bank: The issuing bank examines the shipping documents, and if correct, reimburses the corresponding bank for the credit plus service charges.

10a. Consignee Makes Payment to Issuing Bank: When the goods are about to arrive, the consignee (buyer) pays the issuing bank for the goods plus interest and other charges.

10b. Issuing Bank Transfers Shipping Documents to Consignee: In return, the issuing bank releases the shipping documents to the consignee. These represent the consignee’s right to receive delivery of the goods.

11a. Consignee Presents Shipping Documents to Carrier: When the goods arrive, the consignee presents the shipping documents to the carrier, as evidence to receive the goods.

11b. Carrier Releases Goods to Consignee: The carrier in return releases the goods to the consignee

Guidelines Adhered to Trade Services of Standard Chartered Bank:

- Under normal circumstances, Letters of Credit (LC) will be issued on the basis of facilities established for a customer. Limit in system (eBBS) and current BCA must be in place.

- In the absence of facilities, LCs may be opened based on adequate cash margin or liened deposit and subject to appropriate credit approval. The minimum margin is normally 110% of the LC value in equivalent local currency

- LCs to be opened for non-corporate customers should bear the approval of the appropriate authority from respective Unit and Credit Control divisions.

- Any LCs which deviate from the established Business Credit Application (BCA) terms of the customer need to be referred to the Unit Head /Relationship Manager in Client Relationship, Wholesale Banking and or SME Banking under Consumer Banking, for necessary disposal.

- Local L/Cs should be issued as unsecured L/Cs.

- All L/Cs issued must be recorded in the bank’s books in the currency of the credit and at the highest possible drawing amount.

- LC is booked under Product code 086 for Client Relationships accounts and under Product code 390 for SME accounts

- Trade Policy, PPG, CPA & other group memorandum /circulars are Group Standards which are routinely issued, covering several areas of our business and must be adhered to by all units.

- The Foreign Exchange Regulations, Bangladesh Bank circular issued time to time, directives & guidelines issued by NBR or other Government Regulators and Government Import Policy in force and amendments thereto must also be carefully adhered to.

- Letters of Credit are to be issued subject to Uniform Customs and Practice for Documentary Credit (ICC Publication 600) and Uniform Rules for Bank to Bank Reimbursement (URR525) in force.

- As per the guidelines for Foreign Exchange Transactions of Bangladesh Bank, bank should, before opening an LC, see the documentary evidence that firm order for the goods to be imported has been placed and accepted by the importer.

- Bank should also obtain confidential Reports on the beneficiary through branch offices or correspondents abroad or their discretion; satisfy themselves as the standing of the beneficiary by consulting standard books of reference issued by International Credit Agencies. The service of Dun & Bradstreet is currently used for obtaining report at applicant’s cost. Credit report on beneficiary can also be obtained from the correspondents or sister offices abroad. Credit Report needs to be updated every three years.

- As per the guidelines for Foreign Exchange Transactions of Bangladesh Bank, before opening an LC the bank should ensure that there are no Bills of Entry outstanding over 4 months from the date of remittances.

- LC should be processed as per approved BCA within its limit, tenor and other condition.

Basic Requirements of LCs:

Request to issue LCs must be in the bank’s standard LC Application Form. There may be situations that the customer insists to provide LC instructions using their own stationery rather than our standard form. Such request should be discouraged because only our standard form has the conditions which customers are required to accept and sign, where necessary additional conditions to the LC may be submitted in client’s letter head pad or in plain paper under authorized signature and seal.

Request to issue LCs may also be received electronically through the Bank’s Electronic Banking System i.e. Strait2Bank. These messages are authenticated and no manual signature is required.

Documents required submitting along with LC Application:

- Import Registration Certificate (IRC), which will be returned later

- Proof of payment of renewal fees for IRC for the concerned financial year

- NOC from the nominated bank (where nominated bank in IRC is other than SCB)

- TIN (Tax Identification Number) certificate

- VAT certificate

- Valid and renewed Trade License

- Copy of Board Resolution

- A declaration in the company’s letterhead pad, that the importer has paid income tax or submitted income tax return for the preceding year. A new company can declare that the requirement is not applicable or the company is enjoying tax holiday.

- Valid and renewed membership certificate from registered local chamber of commerce and industry or any trade association established on all Bangladesh basis, representing any special trade/business.

- Certificate from previous banks confirming no overdue Bills of Entry in their books in the name of the importer

- Valid Bonded Warehouse license showing SCB as lien bank (applicable for Back to Back Letter of Credit and import under bonded warehouse facility.

Customer instructions in the LC application must be checked to ensure that:

- Applications and annexure are satisfactorily signed off as per Board Resolution

- Government revenue stamp is affixed on the LC application.

- Instructions are complete and precise

- There are no inconsistent /ambiguous terms

- They do not include excessive or overly complex details

- All material corrections are authenticated.

- Description, H.S Code (8-digit), quantity and value (including unit price of goods), terms of contract (CFR, FOB etc.) are specified. Please note IPO permits import on FOB and CFR basis only. For any other INCOTERM, Ministry of Commerce/Bangladesh Bank permission is required.

- Insurance must be checked for insured party, value, goods, mode of transport, shipment from and to, risk coverage and validity.

- Mandatory PSI instruction is incorporated, where applicable and the H.S. Code (8-digit) mentioned by applicant is checked to ensure that the intended product is subject to mandatory PSI or duty payable.

- Deferred payment term/period is within Bangladesh Bank guideline.

- LC application must clearly stipulate the charges on whose account and the type of the LC.

- Amortization of commission: Inform WB Business Finance when commission realized is above USD 50,000/-.

- Shipment as well as remittance validity remains within the current Import Policy Order and Guidelines for Foreign Exchange Transactions.

Reimbursement Instructions:

- When issuing a Letter of Credit TPC should stipulate clear reimbursement instruction, which usually takes either of the following methods:

- Reimbursement to be effected by ourselves (as the L/C Issuing Bank) after receipt of conforming documents at our counter.

- Reimbursement to be honored by the Reimbursing Bank as nominated by the L/C upon its receipt of the reimbursement claim from the Document Negotiating Bank. LC to stipulate in such cases that the reimbursement authority is subject to Uniform Rules for Reimbursement 525 (ICC Publication) in force

- Where TT reimbursement is allowed, reimbursement authorization and LC reimbursement instruction are to contain prior notice period depending on applicant’s requirement.

Making the Network Work:

For the purpose of achieving maximum benefits for the group network our group offices should be used as Advising banks for LCs issued by us unless applicants insists on nominating another bank .

Secured versus Unsecured Situations:

- Secured: where we have control of goods

A secured LC is one where SCB is in full control of the shipment i.e. Bills of Ladings are consigned either

- To order and blank endorsed

- To order and endorsed to order of SCB & SCB holds the full set of shipping documents. Before a Letter of Credit is issued, it is necessary to determine from the transport documents whether the Bank has a constructive title to the underlying goods. Examples of common secured and unsecured situations are as follows:

- Unsecured Situations: Where we do not have control of the goods

Where SCB does not control the shipment i.e. documents of title are consigned to a party other than SCB or SCB is not in possession of a full set of documents of title, it is classified as unsecured. Local LC should be issued as unsecured LCs unless otherwise approved.

Transaction should reflect the nature/size of the customer’s business and the terms of trade for the industry. The maximum tenor for this product is 180 days (validity and tenor). Any exception must be documented and require separate appropriate credit approval.

Control of Goods: Trade Services staff must adhere the following:

- Trade Service will reject the BCA where the BCA is silent about control of goods. It has been confirmed with Group Credit that BCA must explicitly mention whether the goods are controlled or not.

- Whilst there may already be a number of such BCA’s in the system, rather than reviewing all BCA’s, it is suggested, as and when a transaction is identified, Trade staff obtain SCO’s written confirmation that the agreed condition (controlled or uncontrolled) exists for all future transactions under the BCA.

Issuing of LCs through SWIFT:

If applicant requests issuance or amendment of LC, SWIFT should be used to advise the beneficiary, whenever possible.

As all SWIFT messages are subject to strictly defined formats, releasers must check the SWIFT messages with special care to ensure that they conform to the required format. Any violation of the SWIFT format will result in rejection of the message when it is transmitted through the SWIFT system.

All SWIFT messages advising details of the Credits must be effected only in the standard SWIFT formats.

Customer Base:

SCB offers LC issuance facilities to a large number of import customers as part of their overall banking facilities. Country specific client relationship strategies will define the appropriate customer base. LCs can be issued for the following categories of customers:

- Borrowing Customers

The customers who have an appropriately approved LC issuance facility. For issuance of LC on account of borrowing customers, approved terms and conditions of BCA (Business credit Approval) are to be applied.

- Non Borrowing Customers

The customers who do not have approved LC issuance facility and for whom LC may be opened against acceptable security as detailed below:

- In the absence of credit facilities, the LC may be opened against cash cover which may take either of the 2 forms subject to approval of appropriate authority / SCO :

- Margin

- Lien on deposits

- Holding funds under Margin is preferable to holding Lien on deposits mainly because:

- The procedures in holding of margins are simpler compared to lien.

- Margins are usually non-interest bearing whereas, deposits are interest bearing.

- Where LCs are issued subject to margins being taken, these must be credited to File Type “45” in the customer’s name.

- Such margins/liened deposits must only be utilized in part or in full payment of the relative bills drawn under the LC issued.

- It is the responsibility of the Credit Operations team to ensure that the lien has been effected. Trade team need to take confirmation of lien from Credit operations team prior to process any transaction in such case.

- Margin must be kept in equivalent local currency (BDT) as per local Exchange Control regulation unless otherwise as per BCA.

- Additional margin is retained to cover up exchange fluctuations.

- Funds held in the margin account or under lien may be released to the customer 14 days after expiry of the Letter of Credit (in case of normal /cash L/C) and 30 days after expiry of the Letter of Credit (in case of Back-to-Back L/C) and 7 days (in case of local L/C), ensuring that no drawings have taken place. Such release should be authorized by the Sr. Manager, Trade Services, or his delegated manager. The only exception would be when the LC could not be canceled even after expiry for specific reasons such as discrepant documents at our disposal, pending approval from the applicant.

Loss in Transit:

In case, the Advising Bank does not receive our LC due to loss in transit to trace whether there is any evidence of receipt of the original Letter of Credit by the Advising Bank where:

- Check with the courier company if issued by mail

- Check with Communications Unit if issued by SWIFT

To avoid further delays, we may repeat the full contents to the Advising Bank, through SWIFT or mail, as applicable originally. In all cases, this must contain wordings that the repeated document/message is issued in lieu of the original reported lost or similar wordings to this effect with a Possible Duplicate Message indication.

Production Risk Return:

Commission and charges should be realized as per approved schedule of charges and they are to be posted in appropriate GL accounts. Exceptions are allowed for specific clients as per approved waiver list.

Inoperative LC:

LC should not be processed which is subject to a condition precedent that must be satisfied and communicated by an amendment before the credit becomes operative.

Amendment to LCs:

All amendments are to be effected within the terms of the approved limits of the customer and the same approval process as the original LC must be followed. Under normal circumstances, acceptance from beneficiary of an LC amendment is not required as it is implied in his presentation of documents to the nominated bank or issuing bank. However, consent from beneficiary must be sought under the following cases:

- Where, the amendment calls for reduction in the LC value and unit price. In such cases, the customer’s liability must be reduced only on acceptance of the amendment by the beneficiary.

- Where the amendment calls for cancellation of the LC.

- Where the customer insists that the beneficiary must give explicit consent and requires confirmation by the Advising bank.

- Change of beneficiary’s name.

Reversal of Unutilized LCs:

- Unutilized LCs are reversed after expiry on a daily basis:

- Cash LCs (sight and usance) after 14 days

- Local LCs after 7 days

- Back-to-Back LCs for readymade Garments Industries after 30 days

- Margin amounts relating to unutilized portion of expired LCs are referred to Manager, Trade Services / Delegated Team Manager before reversing the same to the credit of Applicant’s account.

- If for specific reason(s) like DO / Shipping Guarantee is issued, shipment advice is received, reimbursement is claimed, but documents are not received etc., the liability can not be reversed, CSC will initiate necessary follow up with all concerned to arrange submission of documents to facilitate reversal of the LC liability as being utilized.

Reconciliation:

Each month, all outstanding LCs must be reconciled. Also, physical verification of all LCs must be carried out at least once in a year. Contra accounts (group & non group) must be balanced at each month end to comply with Group Accounting Policy.

Cancellation of LCs:

- Customer’s request for cancellation of Letter of Credit before expiry date must be given to us in writing. Customer / Applicant’s signature must be verified.

- The request for cancellation should be communicated to the Advising Bank which should be instructed to take the following actions:

- Obtain and confirm to us beneficiary’s consent. Confirm to us that the original Letter of Credit has been returned to them for cancellation.

- Upon receipt of authenticated confirmation from the Advising Bank that the beneficiary has accepted cancellation of the Letter of Credit and that the original LC has been returned to them for cancellation, we should reverse customer’s liability entry.

Quasi Back-to-Back Letter of Credit:

Quasi Back-to-Back Letters of Credit are opened for Ready Made Garments (RMG) / Export Oriented industries, as allowed and specialized textiles; as well as some other export oriented industries, under bonded warehouse facility. Import Letters of Credit are opened on the basis of export Letter of Credit up to a maximum amount of net FOB value of the Master export LC allowed in the Import Policy / Exchange Control Regulations of the country.

Under the Quasi Back-to-Back credit concept, the applicant of the Import LC (Slave LC) is the beneficiary of the export LC (Master LC). Applicant offers the Export LC as a security to the bank for issuance of the Import LC for raw/packing materials. As the applicant for the slave credit, the exporter is responsible for reimbursing the bank for payment made under it on due date regardless of whether or not he himself is paid under the master export credit. Normally the import payment is made from the export proceeds but in any case if the export proceeds are not received applicant is allowed to purchase foreign currency to meet import liability on due date with post fact reporting to central bank and NBR OR Bank may payoff the import liability from the single pool account of exporter approved by Bangladesh Bank in order to settle Back-to-Back import liability.

While opening Back-to-Back Letter of Credit it is essential that Master Letter of Credit should fulfill the following:

- Master LC is Irrevocable and advised through SCB

- Negotiation of LC is not restricted to another bank

- Reimbursement / Payment clause of the LC is unconditional and acceptable

- Bank and country risk approval is held for export L/C issuing bank

- Master export LC should not have any ambiguous or restrictive clause.

While opening Quasi Back-to-Back LC, following points should be ensured:

- Quasi Back-to-Back LC is usance in nature & usance period of Back-to-Back LC should not be more than 180 days

- Value of Quasi Back-to-Back LC should not exceed the admissible percentage of net FOB value of the Master Export LC

- Shipment and Expiry dates should be prior to the Shipment and Expiry date of the Master Export LC (reasonable time gap should be maintained to enable for manufacturing of the goods)

- Master Export LC must be held under lien by the bank while opening Back-to-Back LC. The master LC should be stamped “under lien to Standard Chartered Bank” and should be kept in a secure place. No amendment to master LC is acceptable, if it is not acceptable to the lien bank.

- MOB accounts of respective clients must be reconciled and proof of reconciliation must be systematically filed.

- Open insurance cover note is applicable for opening Quasi Back-to-Back L/C as per government regulation.

Bangladesh Bank’s Guidelines for Foreign Exchange Transactions (volume-1) Section 111 of Chapter 16 and Circular issued by Bangladesh Bank time to time must be followed while handling quasi Back-to-Back L/C.

In view of specific nature of the LCs that contradicts with SCB Group Policy, we have obtained dispensation from the group categorizing such LCs as Quasi Back To Back LC.

Back-to-Back Letter of Credit – Claused:

Claused Back-to-Back Letters of Credit are opened as per approved Product Program for this type of LC. Claused Back-to-Back LC is similar to Quasi Back-to-Back LC except that there is no commitment of payment until receipt of the export proceeds under the Master export LC.

To open Claused Back-to-Back letter of Credit, terms and condition of approved Claused Letter of Credit Product Program and Bangladesh Bank’s approved conditions and regulations in this regard must be followed.

Quasi Back-to-Back/ Back-to-Back L/C TAS Approval:

- Under the PPG it is not necessary to mark bank & country limits upon issuance of the slave L/C (unless master L/C is to be confirmed)

- Customers BCA must allow for back to back transactions (approved credit facility)

- Only if the BCA calls for a confirmed L/C as security must we insist on confirmation

- Unless states in the BCA we will not require a discrepant document line for the beneficiary.

- Any confirmed LC or CBN will require Bank & Country limit as per approved PPG.

SANCTIONS:

ü Iran Sanctions:

Each transaction is to be checked to ensure that they comply with ‘Trade Operations Procedures for Transactions Involving Iran, Suspension of New Business Involving Iran, July 2007, Version 5’ as amended from time to time.

There is no dealing between the US and US persons on the one hand; and the Iran and Iranian government, on the other. For this purpose, suppliers’ credit report is to be checked in case of import to ensure that name, address, structure, management and ownership does not indicate involvement of either US and US person or Iran and Iranian government

It is the policy of the group that we will not handle such transactions unless the transactions are authorized by the Sanctions regulations or is permitted by a license issued by the US Office of Foreign Assets Control (OFAC).

Checks as per Decision Tree embedded in the Policy are to be made to ascertain whether an Export to, or export from Iran is a transaction that can be progressed.

For determination of US and US persons and Iran and the Iranian government “information Outside Documents”, “Assumptions”, “Escalation & Documentation” and “Product Specific Checks”, there are to be guided by the Trade Operations Procedures for Transactions Involving Iran in force.

ü Sudan / Syria Sanctions:

Transactions involving Sudan must be checked in terms of US Sanction against Sudan Policy and must be escalated to Head of Trade Services for necessary determination. Similarly transaction involving Syria needs to be referred to Head of Trade Services.

ü North Korea:

Prohibited in relation to trade with North Korea or involving North Korea-based parties

ü Myanmar:

- All currencies: Prohibited in relation to trade with Myanmar or involving any Myanmar-based entities

- UK sanction: In line with EC Regulation 1081/2000 there is a UK freeze on funds of (listed) individuals connected with government and other authorities in Burma. There is also a ban on the financing of certain Burmese state owned entities.

ü Cuba:

- USD: Prohibited in relation to trade with Cuba or involving any Cuban party

- Other currencies: Permitted provided no US connection

ü Local Sanctions:

Goods from or originating from or goods in flag vessels of Israel is not importable.

Anti Money Laundering / Fraud Check including International Maritime Bureau (IMB) and/ or Sea Searcher Check:

Detailed Check List is amended from time to time, that includes among others, check on specific country, transaction threshold, and structured transactions etc. are to be ensured. Attached is AML checklist which forms an integral part of this DOI.

AML checklist is amended from time to time to ensure that it includes document threshold for IMB/ Sea searcher check and item specific check, i.e. import of vessel/ tanker value for scrapping more than or equal to USD100,000.

SRL/OCF:

SRL/OCF data base is to be checked to confirm among others that no SDN/sanctioned entity is involved in the transaction. LC issuance checklist must be appropriately marked and attached with the LC opening documents. Any positive match is to be escalated to Sr. Manager and/or HOTS for approval/rejection or further escalation.

Transactions involving High Risk Countries and the Financial Action Task Force (FATF) Non-Cooperative Countries and Territories (NCCT):

Any transaction related to the above countries, as updated from time to time, must be escalated to the Manager for necessary determination or escalation. The current list includes Myanmar (Burma), Nigeria, Nauru.

Alchemist:

SWIFT message blocked in Alchemist has to be reviewed and escalated for advice for disposal by acceptance or rejection.

General Guidelines using L/C for the Buyer/Importer:

1. Before opening a letter of credit, the buyer should come to an agreement with the seller on all aspects of quantity and quality of goods to be sent, schedules of shipment, payment procedures, and documents to be supplied. As with the seller, it is very important for the buyer to be fully aware of all terms and conditions that need to be fulfilled before the application for the letter of credit is made.

2. When dealing with letters of credit, the buyer should take into consideration the standard payment methods in the country of the seller.

3. When setting the dates in the letter of credit, the buyer should define a tight but reasonable shipping schedule. If dates are improperly set, this will lead to amendments to the letter of credit leading to additional costs, or simply to non-shipment.

4. The buyer should be prepared to amend or renegotiate terms of the letter of credit with the seller. Amendments are a common procedure in international trade.

5. In order to eliminate foreign exchange risk, the buyer may cover himself by using the futures/forward markets.

6. The letter of credit validity should give the seller enough time to produce and ship the goods. With the expiry date and the latest shipping date, the buyer should give the seller ample time to present documents to the bank. For instance, several countries, particularly those in the Middle East, require that documents be “legalized”. This requires that some of the documents be sent to the destination country’s consulate, in the country of origin, for a stamp before presentation. This is a routine procedure, but it adds a few days or more to the time needed for presentation.

As a general rule, the commercial contract should clearly specify the party responsible for appointing the confirming bank and the party who will pay for the confirmation. Therefore, the buyer should agree in advance that the confirming bank may be chosen by the seller. Most commonly, it is the buyer who bears the cost of confirmation. However, if the buyer is a small company, it is reasonable for the seller to bear the security of confirmation and its costs. This can be stated in the letter of credit.

Shipping Guarantee Issued to Importer:

The need for Shipping Guarantee (SG) arises typically due to inefficiency in the documentary credit. Where the seller documents (including full set of original bills of lading) are routed through the banking channel under a letter of credit, they may still be in transit when the carrying vessel reaches the port of discharge. The problem is particularly acute for short –haul shipments especially with the growth in intra-region for the issuance of Shipping Guarantee. The SG is signed by the consignee and countersigned by a bank, which indemnifies the carrier for release of cargo without presenting of the original Bill of Lading (B/L). On received of invoices, B/L, and other shipping documents, the consignee will pa for or accept the documents; redeem the SG by surrendering an original B/L to the carrier. The original SG is then returned to the bank for cancellation.

.There is two types of SG issued by SCB:

ü Shipping Guarantee (SG)

ü Waybill Endorsement/ Delivery Order (DO)

Shipping Guarantee (SG):

SG is issued to enable customer to take delivery of cargoes before arrival of the relating Bills of Lading. Shipping Guarantee for release of Goods without producing Bill of Lading involves the following steps:

- Shipping Guarantee Application by importer/Buyer

- SCB countersigns SG

- SG countersigned SCB

- Release of goods

- Import documents including original Bill of Lading (B/L) received under L/C

- Original B/L and request for customer to redeem SG

- Carrier releases SG upon customer surrendering original B/L

- Return of SG for cancellation of SG record.

Waybill Endorsement/ Delivery Order (DO):

DO is issued to enable customer to take delivery of cargoes delivered by air/truck for which the waybill; is consigned to SCB. Shipping Guarantee for release of Goods under Air Waybill involves the following steps:

- Shipping Guarantee Application by importer/Buyer

- SCB endorses and return Air waybill to customer

- Air waybill endorsed by SCB

- Release of goods

- Import documents received related to SG

- SCB processes Import documents and: a) accepts/pays under its L/C; or b) obtains customers acceptance/payment if it is a collection

- Upon acceptance/payment of the documents, SCB cancels the SG record

Note: Application, customer -Indemnity in the Bank’s form and copy of Invoice & Air Waybill

Loan Against Trust Receipt (LATR):

LATR is a type of service given by SCB to customer/Importers that facilitates the customer to have loan for a short tenor like 90 days, 120 days or 150 days against the documents. LATR is allowed only in case of raw materials importing. The interest rate charged on LATR that is mentioned in the Banking Facility Letter (BFL) and Business Credit Approval (BCA).

Medium-term/ Long-term Loan:

This type of loan is available to customers in case of capital machinery import; the terms, objective, tenor, interest rate which are also mentioned in the BCA & BFL.

Note: Every facility (L/C, LATR, FOREX Forward Contract, SG, DO, Amendment, Limit/Lien account) has to be mentioned in the BCA & BFL

Export Procedure:

The objective of the government is to encourage exports to the extent possible so as to earn valuable foreign exchange for the country. All efforts have to be made to boost up exports of the country. Therefore, export control is exercised over far less a number of items as compared to import control. The control is mainly on such items which are essentially needed in the country whose indiscriminate exports may affect the domestic economy.

Registration:

Any firms/parties desirous of undertaking export trade are required to obtain Export Registration Certificate (ERC) from the offices of the Chief Controller of Imports and Exports (C.C.I. & E.), Government of Bangladesh. No person is allowed to export any goods from Bangladesh to any other country without obtaining such a certificate.

For the purpose of registration, an application in the prescribed form is required to be submitted to the C.C.I & E authority along with the following documents:

- Nationality Certificate from the Local Authority.

- Trade License from Municipal Authority.

- Bank Certificate.

- Income Tax Certificate.

- Registered Partnership deed in case of partnership concern, Memorandum & Articles of Association and Certificate of Incorporation in case of Limited Company.

- Copy of rent receipt of the business premises.

Export can be made by 3 ways. Such as:

- Advance payment

- Contract

- Letter of credit

Advance payment:

Payment made first after the shipment, i.e. the exporter collect the value of the goods from the importer before the shipment. It is based through the agreement between the buyer & seller. In that case no risk arrange to the exporter as differed payment.

Contract:

When sale is agreed, a contract between buyer and seller is executed specifying the detail terms about the sale, such as full descriptions and quantity of merchandise, value of commodity quoting its FOB, CFR, CIF, etc. With provision for payment at sight, usance terms, whether inspection before shipment is necessary.

Export Letter of Credit:

When export is made against L/C, the exporter should examine the following terms of L/C to avoid any future complicity to execute the order:

- The terms and conditions of L/C are definite, clear and explicit and also in conformity with those of the contract.

- The L/C should be an irrevocable one and be confirmed by the advising bank.

- If the import of goods is under control in buyer’s country, the buyer holds a valid import license.

- If the L/C is transferable or otherwise, it should be clearly mentioned in the L/C.

- The L/C should provide sufficient time for shipment and a reasonable time for shipment and a reasonable time for negotiation. If nothing is mentioned, the shipper would be allowed 21 days to negotiate the documents.

If any of the terms of the L/C appears to be vague ambiguous or too difficult for the banker to ensure compliance, the banker should immediately refer to the concerned correspondent by letter or cable and get the vagueness removed before advising the L/C to the beneficiary (exporter).

Shipment:

On conclusion of the contract securing the sales order, the exporter should set him earnestly to the task of delivering the goods on time. Failure to maintain the delivery schedule will expose the exporter to claim from the buyers for damages on account of non‑shipment or late shipment, and in addition the exporter may also lose the patronage of the buyer for future export orders.

On dispatch of the goods to the docks, C&F agent should be given clear instructions to effect shipment as per schedule and arrange to make necessary payments towards port charges. To observe the customs formalities, the following documents should be sent to C&F agent by the exporter.

- Export Registration Form (ERC)

- Commercial Invoice

- Packing List

- Copy of the Sale contract/Export L/C

- Any other documents relevant to the specific cargo, such as, GSP* certificate or Export permit.

Besides, the following documents are normally necessary at the time of shipment:

EXP Form:

All exports must be declared on EXP Form. These forms will be supplied by the Authorized Dealers for use of the exporter. The Authorized Dealers should, before certifying any export form. Ensure that exporter is registered with the CCI&E under the Registration (Importers and Exporters) Order 1952.

EXP form is not necessary in terms of invisible product. That time goods are exported by “C” form.

Making out and delivery of shipping documents:

To export of goods from Bangladesh to foreign countries by land route or by sea, all carriers whether common or private (Airway, Shipping) and their agents will ensure that the Airway Receipts, Bills of Lading and any other documents of title to cargo are drawn only to the order of an Authorized Dealer designated for this purpose by the respective exporters and delivered to the authorized representatives of the Authorized Dealers concerned and to none else.

Endorsement of shipping documents by the Authorized Dealers:

The Authorized Dealers to whose order the relative Truck Receipts, Bills of Lading etc. are drawn shall endorse the same to the order of their foreign correspondents but in no case they shall make any blank endorsement or endorse it to the order of the consignee unless they have obtained specific or general approval of the Bangladesh Bank therefore.

The exporter should be very careful in the preparation of export documents, otherwise he will face difficulty in the negotiation of export documents and collection of export proceeds from the buyer.

Documents related to Export/Import Procedure:

Pro Forma Invoice or Sales Confirmation:

A pro forma invoice is basically an advance copy of the final invoice. It is different from a quotation. The pro forma invoice is often used by the importer to apply for a letter of credit (L/C) and foreign exchange (import) allocation. Following situations may occur in relation to the issuance of a sales confirmation:

- Buyers may change the order more than once within a few days or weeks.

- The delivery time required by some buyers can be relatively short—within one month.

- The amount of export orders can be large or small.

Bill of Exchange or Draft:

The bill of exchange or draft is usually drawn by the exporter in sets of two or three. It must bear a date and, the number and date of the L/C or export order under which it is drawn, and is signed by the exporter.

It must be made out in the name of the beneficiary’s bank or to be endorsed to the order of the bank depending upon the terms of the Letter of Credit. The draft is to be drawn on the issuing bank.

The draft may be:

- At Sight or

- Usance

Under the Foreign Exchange Regulations in Bangladesh, export proceeds must invariably be repatriated into the country within 4 months from the date of export. Therefore, drafts cannot be drawn with longer period than 120 days sight. Usance bill is to be paid after the period, say, 30, 60, 90 or 120 days, specified in the bill has expired.

Unless the maturity date is tied to a specific date, the importer may refuse to accept the draft until the goods have arrived; such deferred acceptance can extend the maturity date. Amount of the draft must correspond to the value of the invoice and must not exceed the L/C amount or 10% of the L/C amount if it contains the word “About”. |

Under the Exchange Control Regulations in Bangladesh, draft must be drawn to the order of an authorized dealer

It must have interest clause where necessary.

Figure 5: Bill of Exchange or Draft

Clean Draft : In a clean draft, no shipping documents are attached to the draft sent to the remitting bank. The documents are sent together with the goods, directly to the buyer. Therefore, unless the credibility of the buyer is unquestionable, using a clean draft in the shipment of goods is risky. The clean draft is more often drawn for the collection of payment for the services, not goods.

Documentary Draft: In a documentary draft, the shipping documents are attached to the draft sent to the remitting bank. The buyer will be able to receive the shipping documents from the collecting bank only after he/she has accepted the draft for payment later or after he/she has paid the draft.

Commercial Invoice:

A commercial invoice is a statement prepared by the shipper containing full details of the goods shipped. It gives description and price of the merchandise, quantity, quality, packing details, origin of goods and marks. Names and addresses of the seller and buyer, L/C and contract Nos. terms of trade‑FOB. CFR or CIF etc., details of freight charges, insurance premium and other charges, names of vessels, date of shipment, number of bills of lading etc.

Consular Invoice:

It is an invoice signed by a consul, or some other member of the consular service of the importing country. The main purpose of a consular invoice is to enable the authorities of the importing countries to collect accurate information about the volume, value, quality, grade, source, etc. of their imports for assessing import duties and also for statistical purposes.

It is to be scrutinized to ensure the following:

- The invoice is made out in the name of the foreign buyer and signed by the exporter.

- It bears the reference of the L/C or the export order and contains a full description, quantity, number of packing units, shipping marks, etc of the goods shipped.

- The full description of merchandise must be given in the invoice strictly as per L/C or export order.

- The amount of draft and invoice must be same and within the L/C value.

- Required number of invoices as per L/C plus two copies duly signed by the beneficiary should be submitted.

- The mark and number on the packing shown in the B/L must be identical with those given in the invoice and other documents

Packing List:

A, packing list prepared by the exporter serves to indicate the exact nature, quantity, and quality of the contents of each package in a shipment. The list helps the importer to identify the goods and check it according to his order. Banks may require such a list when they have financial interest in the merchandise.

Certificate of Origin:

It is a document certifying the country of origin of the goods. In many countries, permission to import is refused unless a certificate of origin is produced by the buyer. This document may form a part of the invoice itself. The essential feature is a certification of the country of origin indicating where the goods were originally produced and/or manufactured.

Bill of Lading:

The document evidencing the carriage of goods by sea is the Bill of Lading. Bill of Lading is the most important of the documents in connection with export of goods and negotiation of documents. It is a document of title to the goods issued by the shipping company or its agent, acknowledging the receipt of goods for carriage up to destination which are deliverable to the consignee or his agent in the same condition as they are received.

Truck Receipt/ Road Waybill:

The road waybill (road consignment note) or rail waybill (rail consignment note)serves as a receipt for goods and an evidence of the contract of carriage, but it is not a document of title to the goods. The consignee can obtain the goods from the carrier at the destination point without presentation of the road waybill or the rail waybill, as the case may be.

The road waybill or rail waybill must be signed or authenticated and/or bear a reception stamp or other indication of receipt by the carrier or the named agent for or on behalf of the carrier. The signature, authentication, reception stamp, or other indication of receipt by the carrier must be identified on the face of waybill as that of the carrier, and in the case of agent signing or authenticating, the name and capacity of the carrier on whose behalf such agent signs or authenticates must be indicated.

Airway Bill:

The document evidencing the contract of carriage of goods by air is known as the “Airway Bill or Air Consignment Note”. Air‑way bills or Air Consignment Notes are issued by airlines or their agents as a receipt of consignment as carriers.

Other Export/Import Documents:

Beneficiary’s Certificate:

The beneficiary’s certificate, sometimes referred to as the certificate of assurance, is a certification issued by the beneficiary of the letter of credit (L/C) showing, unless wording is specified in the L/C, the summary of a consignment and declaring (i.e., assuring the consignee) that the shipment in question conforms to the specifications in the sales contract. The exporter can issue a beneficiary’s certificate using company letterhead.

Weight Certificate:

The weight certificate—weight list or weigher’s certificate—is most often used in the export goods sold on weight basis. It is issued by the official weigher on the dock or the independent certified weigher. In case of transport other than by sea and unless the letter of credit (L/C) specifically stipulates that the certification of weight must be by means of a separate document, a weight stamp or declaration of weight that is superimposed on the transport document by the carrier or his agent is acceptable.

Health Certificate:

- Phytosanitary or Plant Health Certificate

- The prefix ‘phyto‘ means plant. The phytosanitary certificate—plant health certificate—is issued by the government agricultural department or certified inspector for such agricultural products as seeds, fruits, vegetables, rice, wheat, soybean, corn, and milled materials (e.g. flour and soybean meal), certifying that the goods are free from harmful pests and diseases.

- Veterinary or Animal Health Certificate

The veterinary certificate—animal health certificate—is issued by the certified veterinarian for livestock (e.g. cows, goats, horses, and pigs), poultry (e.g. chickens, ducks and turkeys), and domestic animals (e.g. dogs and cats), certifying that they are free from diseases.

Sanitary Certificate:

The sanitary certificate is issued by the government health department or certified inspector for processed food products, certifying that they are free from diseases or contamination. In some countries, the term sanitary certificate may refer to or be used interchangeably with the term health certificate.

Fumigation Certificate: