Historical Background of EXIM Bank Limited:

EXIM Bank Limited was established under the rules & regulations of Bangladesh bank & the Bank companies’ Act 1991, on the 3rd August 1999 with the leadership of Late Mr. Shahjahan Kabir, founder chairman who had a long dream of floating a commercial bank which would contribute to the social-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream. In deed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. Nazrul Islam Mazumder became the honorable chairman after the demise of the honorable founder chairman.

Of its very beginning, EXIM Bank was known as BEXIM Bank, which stands for Bangladesh Export Import Bank Limited. But for some legal constraints the bank renamed as EXIM Bank Limited, which means Export Import Bank Of Bangladesh Limited. The bank starts its functioning from 3rd August 1999 with Mr. Alamgir Kabir, FCA as the advisor and Mr. Mohammad Lakiotullah as the Managing Director. Both of them have long experience in the financial sector of our country. By their pragmatic decision and management directives in the operational activities, this bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management.

Banking sector in Bangladesh is already an established and prospective site. People of this country are very much related with this sector.

Figure 1: EXIM Bank Limited at the Life cycle in banking industry.

To confine a recognizable position in this sector for a new company will be more cutthroat than previously launched companies, because they have to enter with significant features and advanced facilities to magnetize the subscribers of the existing companies.

The authorized capital and paid up capital of the bank are TK. 350.00 Crore and TK. 214.00 Crore respectively. The bank has migrated all of its conventional banking operation into Shariah based Islami banking since 1st July, 2004.

Corporate Information

(As per Annual Report 2006-07)

Vision & Mission

Vision

The gist of EXIM Bank Limited’s vision is “Together Towards Tomorrow”. EXIM Bank Limited believes in togetherness with its customer, in its march on the road to growth and progress with services. To achieve the desired goal, there will be pursuit of excellence at all stages with a climate of continuous improvement, because, EXIM Bank Limited believes the line of excellence is never ending. Bank’s strategic plans and networking will strengthen its competitive edge over others in rapidly changing competitive environment. Its personalized quality service to the customers with the trend of constant improvement will be cornerstone to achieve our operational success.

Mission

The Bank has chalked out the following corporate objectives in order to ensure smooth achievement of its goals:

To be the most caring, customer friendly and service oriented bank.

To create a technology based most efficient banking environment for its customers.

To ensure ethics and transparency in all levels.

To ensure sustainable growth and establish full value of the shareholders.

Above all, to add effective contribution to the national economy.

Eventually the Bank emphasizes on:

- Providing high quality financial services in export and import trade

- Providing efficient customer service

- Maintaining corporate and business ethics

- Making its products superior and rewarding to the customers

- Display team spirit and professionalism

- Sound Capital Base

- Enhancement of shareholders wealth

- Fulfilling its social commitments by expanding its charitable and humanitarian activities.

- Objectives of EXIM Bank Limited

1. To receive, borrow or raise money through deposits, loan or otherwise and to give guarantees and indemnities in respect of all debts and contracts.

2. To establish welfare oriented banking systems.

3. To play a vital role in human development and employment generation to invest money in such manner as may vary from time to time.

4. To carry on business of buying and selling currency, gold and other valuable assets.

5. To extend counseling and advisory services to the borrowers/entrepreneurs etc. in utilizing credit facilities of the bank.

6. To earn a normal profit for meeting the operational expenses, building of reserve and expansion of activities to cover wider geographical area.

Organogram of EXIM Bank Limited:

Organogram of the Panthapath Branch

Products:

Investment / Finance:

Corporate Finance

Industrial Finance

Project Finance

Syndicate Investment

Mode of Investment

Murabaha

Bai Muazzal

Izara Bil Baia

Wazirat Bil Wakala

Quard

Local Documentary Bill Purchased

Foreign Documentary Bill Purchased

Foreign Exchange:

Non Resident Foreign Currency Deposit Account (NFCD)

Foreign Currency Deposit Account

Deposit:

Al-Wadia Current Deposit

Mudaraba Savings Deposit

Mudaraba Short Term Deposit

Mudaraba Term Deposit

One Month

Three Months

Six Months

Twelve Months (1 year)

Twenty Four Months (2 years)

Thirty Six Months (3 years)

Foreign Currency Deposit

Mudaraba Savings Scheme

Monthly Savings Scheme (Money Grower)

Monthly Income Scheme (Steady Money)

More than Double the deposit in 6 years (Super Savings)

More than triple the Deposit in 10 years (Multiplus Savings)

Mudaraba Hajj Deposit

EXIM Bank Limited emphasizes on non-fund business and fee based income. Bid bond / bid security can be issued at customer’s request. EXIM Bank Limited has posed to extend L/C facilities to its importers / exporters through establishment of correspondent relations and Nostril Accounts with leading banks all over the world. Moreover, customers can deposit their Telephone bill of Grameen Phone in all the branches except Motijheel and the customers of Palli Biddut Samity of Gazipur can deposit their electricity bill to Gazipur branch.

Mudaraba Monthly Savings Scheme (MSS):

Objective of the Scheme:

A monthly savings scheme. Secure your future with ease. A small savings of today will provide you comfort tomorrow.

Savings Period and Monthly Installment Rate:

The savings period is for 5, 8, 10, or 12 years.

Monthly installment is TK. 500/-, 1000/-, 2000/-, or 5000/-.

Not less than 65% of investment income shall be distributed among the Murabaha Depositors as per weightage. The deposit will bear weightage 1.16, 1.17, 1.18, 1.19 respectively.

Bank reserves the right to change the weightage of deposit & percentage of distribution of Investment Income.

Monthly Installment Deposit:

The savings amount is to be deposited within the 10th of every month. In case of holidays the deposit amount is to be made on the following day.

The deposits may also be made in advance.

The depositor can have a separate account in the bank from which a standing instruction can be given to transfer the monthly deposit to the scheme account.

If the depositor fails to make the monthly installment in time, then 5% on overdue installment amount will be charged. The charged amount to be added with the following month(s) installment and the lowest charge will be TK. 10/-(Taka Ten).

Withdrawal:

Generally, withdrawal is not advised before a 5 (five) year term, but if it is withdrawn before the above term, profit will be paid at savings rate. However, no profit will be paid if the deposit is withdrawn within 1 (one) year of opening the account.

In case the depositor wishes to withdraw between the 5, 8, 10, or 12 years period then full profit will be paid for a completed term and savings rate will be applicable for the fractional period.

Quard Advantage:

After 3 (three) years of savings in this scheme the depositor (if adult) is eligible for a quard up to 90% of his/her deposited amount. In that case, profit rates on the quard will be applicable as per prevailing rate at that time.

Reasons for disqualification from this scheme:

If the depositor fails to pay 3 (three) installments in a row, then he/she will be disqualified from this scheme and profit will be applicable as mentioned in withdrawal clause.

If a depositor fails to pay 5 (five) installments in a row after completion of any one of these terms, then the Bank reserves the right to close the account and profit will be paid as mentioned in withdrawal clause.

In case of death of the depositor, the scheme will cease to function. The amount will be handed over to the nominee of the deceased depositor. In case of absence of the nominee, the banks will handover the accumulated amount to the successor of the deceased.

Achievement from the Scheme:

The accumulated amount may be more or less of following table:

Deposited Amount

Payable Amount

5,000

9,603

10,000

19,206

20,000

38,412

50,000

96,030

1,00,000

1,92,060

2,00,000

3,84,120

5,00,000

9,60,300

Rules:

A form has to be filled at the time of opening the account. Attested photographs are advised.

The depositor can select any of the installment amounts which can not be subsequently changed.

In case of minors, the guardians may open and supervise the account in his favor.

A single person can open more than one account for saving under several installment amounts.

The accumulated deposit with profit will be returned within one month of completion of a term.

The depositor should notify the bank immediately on any change of address.

The government tax will be deducted from the profit accumulated in this scheme.

If necessary, at the request of the depositor, the scheme can be transferred to another branch.

Income Tax on profit paid shall be deducted at the time of payment.

The Bank reserves the right to change the rules and regulations of the scheme as and when deemed necessary.

Mudaraba Monthly Income Scheme (MI S):

Objectives of the Scheme:

A monthly scheme that really makes good sense. A sure investment for a steady return. Actually, steady money makes your money work for you.

Proper utilization of savings from stipend, wage earning, retirement benefit and so on.

Higher monthly income for higher deposit.

Formalities of Opening an Account:

An account is to be opened by filling up a form.

The Bank will provide the customer a deposit receipt after opening the account. This receipt is non-transferable.

Deposit Amount

Income (TK.)

TK. 1,00,000/-

1,000/-

On going…

Highlights of the Scheme:

Minimum deposit TK. 1,00,000/-.

The scheme is for a 3 (three) year period.

The income is estimated which may be more or less at the year end and accordingly the same shall be adjusted. The deposit will bear weightage.

Not less than 65% of Investment Income shall be distributed among the Mudaraba Deposit holders as per weightage.

Bank reserves the right to change the weightage of deposit & percentage of distribution of Investment Income.

Quard Facility:

A depositor can enjoy investment facility (excluding Quard) up to 80% of the deposited amount under this scheme complying investment norms of the bank. In this case, profit will be charged against the investment facility as per Bank’s norms. During the tenure of the investment, the Monthly Income will be credited to the investment account until liquidation of the invested amount inclusive of profit.

Disbursement of Monthly Income:

Monthly income will be credited after on month, i.e., on the due date of the next month to the depositor’s account.

Premature Encashment of the Account:

If the deposit is withdrawn before a 3 (three) year term, then saving rate plus 0.75% of profit will be applicable and paid to the depositor. However, no profit will be paid if the deposit is withdrawn within 1 (one) year of opening the account and monthly income paid to the customer will be adjusted from the principal amount.

Additional Terms and Conditions:

Applicant must open/have an Al-wadia CD or Mudaraba SB A/C with the branch in which monthly income will be credited automatically.

The government taxes will be paid to the debit of monthly income.

Mudaraba Super Savings Scheme:

Objectives of the Scheme:

Savings help to build up capital and capital is the principal source of business investment in a country. That is why savings is treated as the very foundation of development. To create more awareness and motivate people to save, EXIM Bank Limited offers super savings scheme.

Terms and Conditions of the Scheme

Any individual, company, educational institution, government organization, NGO, trust, society etc. may invest their savings under this scheme.

The deposit can be made in multiples of TK. 5,000/-.

Any customer can open more than one account in a branch in his/her name or in joint names. A Deposit Receipt will be issued at the time of opening the account.

The Deposit will approximately be double in 6 (six) years.

Highlights of the Scheme:

Some examples are given in the table below. Any amount can be deposited in multiples of TK.5,000/-.

Deposit

Payable at Maturity (appr.)

5,000/-

10,002/-

10,000/-

20,004/-

20,000/-

40,008/-

50,000/-

1,00,020/-

1,00,000/-

2,00,040/-

2,00,000/-

4,00,081/-

5,00,000/-

10,00,203/-

Savings will be treated as projected and it will be adjusted after the declaration of profit at the end of the year. The weightage of deposit will be 1.17.

Not less than 65% of investment income shall be distributed among the Mudaraba Deposit holders as per weightage of deposit.

Premature Encashment of the Scheme

In case of premature encashment before 1 (one) year, no profit shall be paid.

In case of premature encashment after 1 (one) year but before 3 (three) years, profit shall be paid at Savings Rate plus 0.75%.

In case of premature encashment after 3 (three) years but before maturity, profit shall be paid at Savings Rate plus 1.00%.

In case of any unexpected situation

In case of death of depositor before the term, the amount will be given to the nominee according to the rules of premature encashment. In the absence of nominee, the heirs/successors will be paid as per succession certificate.

In case of issuing duplicate receipt, the rules of issuing a duplicate receipt of Term Deposit will be applicable.

The nominee may, at his option, continue the scheme for the full term.

Quard Facility under the Scheme

A depositor can avail quard up to 90% of the deposit under this scheme.

Additional Terms and Conditions

Bank reserves the right to change the weightage of deposit & percentage of distribution of Investment Income.

At the time of payment, Income Tax shall be deducted upon profit. Mudaraba Multiplus Savings Scheme

Objective of the Scheme:

To gather public’s idle money in exchange of high return within the shortest possible time.

Terms and Conditions of the Scheme

Any individual, company, educational institution, government organization, NGO, trust, society etc. may invest their savings under this scheme.

The deposit can be made in multiples of TK. 5,000/-.

Any customer can open more than one account in a branch in his/her name or in joint names. A Deposit Receipt will be issued at the time of opening the account.

The period of deposit is 10 (ten) years.

Highlights of the Scheme

Some examples are given in the table below. Any amount can be deposited in multiples of TK.5,000/-.

Deposited Amount

Amount payable after maturity

5,000/-

15,879/-

10,000/-

31,758/-

50,000/-

1,58,793/-

1,00,000/-

3,17,587/-

Payable amount will depend on projection and will be adjusted after the declaration of profit at the end of the year. The weightage of deposit will be 1.17.

Not less than 65% of investment income shall be distributed among the Mudaraba Depositors as per weightage.

In case of premature encashment

In case of premature encashment before 1 (one) year, no profit shall be paid.

In case of premature encashment after 1 (one) year but before 3 (three) years, profit shall be paid at Savings Rate plus 0.75%.

In case of premature encashment after 3 (three) years but before 5 (five) years, profit shall be paid at Savings Rate plus 1.00%.

In case of premature encashment after 5 (five) years but before 8 (eight) years, profit shall be paid at Savings Rate plus 1.50%.

In case of premature encashment after 8 (eight) years but before maturity, profit shall be paid at Savings Rate plus 2.00%.

In case of unexpected situation

In case of death of depositor before the term, the deposit amount will be given to the nominee according to the rules of premature encashment. In the absence of nominee, the heirs/successors will be paid on production of succession certificate.

In case of issuing duplicate receipt, the rules of issuing a duplicate receipt of Term Deposit will be applicable.

The nominee may, at his option, continue the scheme for the full term.

Quard Facility against the Scheme

The depositor can enjoy loan up to 80% of the deposit under this scheme.

Additional Terms and Conditions

Bank reserves the right to change the weightage of deposit & percentage of distribution of Investment Income.

At the time of payment, Income Tax shall be deducted upon profit.

Capital and Reserve Fund:

The Bank started its voyage with an authorized Capital of TK.1,000 million while it’s initial Paid up Capital was TK. 225.00 million subscribed by the sponsors in the year 1999. The Capital and reserve of the Bank as on 31st December 2006 stood at TK. 3,111.68 million including paid up capital of TK. 1,713.75 million. In the year 2006, the Bank has issued Rights share to strengthen its capital base. In this course the Bank has gather an amount of TK. 571.25 million. The Bank also made provision on unclassified investments which is amounted to TK. 351.47 million.

Deposit:

Deposit is one of the principal sources of fund for investment of commercial banks and investment of deposit is the main stream of revenue in banking business. The total deposit of the Bank stood at TK. 35,032.02 million as on December 2006 against TK. 28,319.21 million of the previous year which is an increase of 23.70%. This growth rate may be termed as a remarkable achievement for the Bank. The present strategy is to increase the deposit base through maintaining competitive rates of Profit and having low cost of funds.

Total amount of Investment of the Bank stood at TK. 32,641.27 million as on December 31, 2006 as against TK. 26,046.34 million as on December 31, 2005 showing an increase of TK. 6,594.93 million with growth rate of 25.32%. Investments are the core asset of a Bank. The Bank gives emphasis to acquire quality assets and does appropriate lending risk analysis and follows all the terms and conditions of CRM (Credit Risk Management) while approving commercial and trade investments to clients.

SWOT Analysis:

SWOT analysis is the detailed study of an organization’s exposure and potential in perspective of its strength, weakness, opportunity and threat. This facilitates the organization to make their existing line of performance and also foresee the future to improve their performance in comparison to their competitors. As through this tool, an organization can also study its current position, it can also be considered as an important tool for making changes in the strategic management of the organization.

Strengths:

EXIM Bank Limited has already established a favorable reputation in the banking industry of the country. It is one of the leading private sector commercial bank in Bangladesh. The bank has already shown a tremendous growth in the profits and deposit sector.

EXIM Bank Limited has provided its banking service with a top leadership and management position. The Board of Directors headed by its Chairman Mr. Md. Nazrul Islam Mazumder is a skilled person in business world.

EXIM Bank Limited has already achieved a high growth rate. The number of deposits and the loans and advances are also increasing rapidly.

EXIM Bank Limited has an interactive corporate culture. The working environment is very friendly, interactive and informal. And, there are no hidden barriers or boundaries while communicate between the superior and the employees. This corporate culture provides as a great motivation factor among the employees.

EXIM Bank Limited has the reputation of being the provider of good quality services to its customers.

Weakness:

The main important thing is that the bank has no clear mission statement and strategic plan. The banks not have any long-term strategies of whether it wants to focus on retail banking or become a corporate bank. The path of the future should be determined now with a strong feasible strategic plan.

The bank failed to provide a strong quality-recruitment policy in the lower and some mid-level position. As a result the services of the bank seem to be Deus in the present days.

The service quality is poor with regard to Multinational Banks located here.

Some of the job in EXIM Bank Limited has no growth or advancement path. So lack of motivation exists in persons filling those positions. This is a weakness of the Bank that it is having a group of unsatisfied employees.

In terms of promotional sector, EXIM Bank Limited has to more emphasize on that. They have to follow aggressive marketing campaign.

Opportunity:

In order to reduce the business risk, EXIM Bank Limited has to expand their business portfolio. The management can consider options of starting merchant banking or diversify into leasing and insurance sector.

The activity in the secondary financial market has direct impact on the primary financial market. Banks operate in the primary financial market. Investment in the secondary market governs the national economic activity. Activity in the national economy controls the business of the bank.

A large number of private banks coming into the market in the recent time. In this competitive environment EXIM Bank Limited must expand its product line to enhance its sustainable competitive advantage. In that product line, they can introduce the ATM to compete with the local and the foreign bank. They can introduce credit card and debit card system for their potential customer.

In addition of those things, EXIM Bank Limited can introduce special corporate scheme for the corporate customer or officer who have an income level higher from the service holder. At the same time, they can introduce scheme or loan for various service holders. And the scheme should be separate according to the professions, such as engineers, lawyers, doctors etc.

Opportunity in retail banking lies in the fact that the country’s increased population is gradually learning to adopt consumer finance. The bulk of our population is middle class. Different types of retail lending products have great appeal to this class. So a wide variety of retail lending products has a very large and easily pregnable market.

Threats:

All sustain and upcoming multinational, foreign and private banks pose enormous threats to EXIM Bank Limited.

The default risks of all terms of loan have to be minimizing in order to sustain in the financial market. Because the default risks lead the organization toward bankruptcy. EXIM Bank Limited has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem.

The low compensation package of the employees from mid level to lower level position threats the employee motivation. As a result, good quality employees leave the organization and it effects the organization as a whole.

The word “Brand” is derived from the Old Norse word “Brandr” which actually means “to burn” as a brand was and still is the means by which owners of livestock mark their animals to identify them.

According to the American Marketing Association, “A Brand is a name, term, sign, symbol, or design or a combination of them intended to identify the goods and services of one seller or group of sellers and to differentiate them from those of competition.”

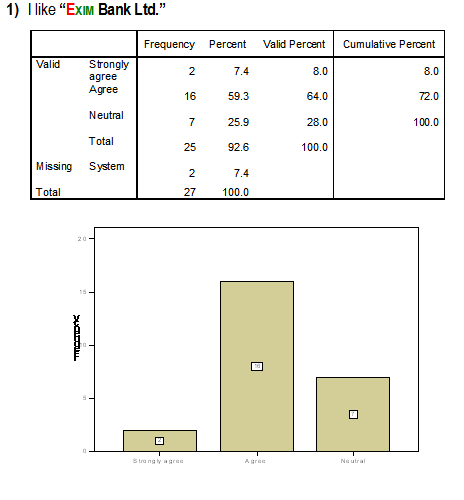

To establish a powerful, relevant identity in the mind of the customers, one has to select the “Brand Element” for his/her product. The brand elements of EXIM Bank Ltd. are as follows:

Brand name: The brand name must be familiar to its target audience and also it must be different, distinctive and unusual. It is easy to pronounce. The name of the brand is-

Actually this EXIM is the abbreviation of “Import Export”. Which altogether as the Import Export Bank Ltd. or the EXIM Bank Ltd. The bank is actually deals with the import or the export related activities. The name comes from that point of view.

Brand mark: in this stage we have to clarify the brand slogan, packaging and logo.

Slogan: A slogan can be an effective way to reach the target customer. This Banks Brand Slogan is-

Shariah Based Islami Bank:

Logo: the service logo is relevant with its category so that people can easily identify the product with the help of this logo. The bank’s logo is-

Color: Color of the Bank’s name and logo is very reasonable. As it is a Bangladeshi Bank and working in this country, it tries to capture the theme of the national flag of the country which is- “Red” and “Green”.

Brand Element

Memorability

Meaningfulness

Transform-ability

Adaptability

Protectability

Name

Figure 3: Choice Criteria

In “7 Parameter” the brand need to follow some important dimensions sequentially. Those are as follows:

Product Engineering

Performance: The service performance must be appreciated by all. It must have to be dominated the banking industry. It has to provide the service at its best as well at the same time it has to be more efficient.

Features: Its features must be attractive towards the customers. Like-

The bank has made “Powerful Banking” for its customers specially for the Commercial customers of all generation, which mainly focuses on businessmen. This bank gives them extra faith and satisfaction.

This bank is totally Islamic rules & regulation based.

It’s a 9 to 5 five bank with offering the entire general banking as well.

This bank has a very good reputation in the customers mind and people see this bank as the symbol of loyalty and believe.

Conformance Quality: The bank must maintain its quality services. For this they must use better technologies and instruments as well as human power.

Reliability: Everyone can trust this bank. Because this bank is achieving its target gradually by the help of its target customers.

Serviceability: The service of the bank is almost up to the standard. They always try to fulfill its customer’s desires. Providing the quality service is their motto as well.

There are several driving forces to raise the creation of Blue Ocean. Technological advantages in the industry even help to build Blue Ocean, in terms of productivity. When ever you have technological support, then less time require for production. So value delivery chain becomes easier.

Value innovation is the corner stone of Blue Ocean strategy. We call it value innovation because instead of focusing on beating the competition, you focus on making the competition irrelevant by creating a leap in value for buyers and your company, thereby opening up new and uncontested market space. Value innovation places equal emphasis on value and innovation. Value without innovation tends to focus on value creation on an incremental scale, something that improves value but is not sufficient to make you stand out in the market place. Innovation with out value tends to be technology-driven, market pioneering, or futuristic, often shooting beyond what buyers are ready to accept and pay for it.

Value innovation occurs only when company align innovation with utility, price and cost positions. It is a new way of thinking about and executing strategy that results in the creation of a Blue Ocean and break from the competition. Importantly, value innovation defies one of the most commonly accepted dogmas of competition-based strategy: the value cost trade-off. Blue Ocean in terms of Exim Bank Ltd. is its value what I am giving to the target audience the overall banking solution for the first time with pure customer satisfaction which is made by its work speed, less complications and reliability.

To reconstruct buyer value elements in crafting a new value curve, we have developed the four-action framework. This Four- Action Framework tries to show the breaking trade off between differentiation and low cost and to create a new value curve. Elements that used in this model are Eliminate, Reduce, Raise, and Create.

Eliminate Factors that banking industry can grant for elimination.

Reduce Factors that should be reduced the well below of the industries standard.

Raised Factors that should be raised all above the industry‘s standards.

Created Factors should be created that the industry has never offered.

Mr. David Aker has proposed some 10 guidelines to build a successful brand. Those guidelines are not always matches with every products or services. But those guidelines which match with my concern company are provided below.

Brand Identity

Have an identity for each brand. Consider the perspectives of the brand-as-person, brand-as-organization, and brand-as-symbol, as well as the brand-as-product. Identify the core identify. Modify the identity as needed for different market segments and products. Remember that an image is how you are perceived, and an identity is how you aspire to be perceived.

“Brand identity of Exim Bank Ltd. has a brand personality that is innocent. Banking solution is the core product and the Image has got an identity by its name, and logo. Also establish a relationship between brand and its customer by generating the functional and emotional benefit.”

Value Proposition:

Know the value proposition for each brand that has a driver role. Consider emotional and self-expressive benefits as well as functional benefits. Know how endorser brands will provide credibility. Understand the brand-customer relationship. A brands value proposition is a statement of the functional, emotional, and self-expressive benefits delivered by the brand that provides value to the customer. An effective value proposition should lead to a brand –customer relationship and drive purchase decision.

The central concept of Exim Bank Ltd. is the fusing of functional and emotional benefits: a strong brand identity has both functional and emotional benefits. This dual concept strongly pushes a brand.

Consistency Over Time:

Have as a goal a consistent identity, position, and execution over time. Maintain symbols, imagery, and metaphors that work. Understand and resist organizational biases toward changing the identity, position, and execution.

It creates a bad impression about a brand, if its name, symbol, or logo is change in different perspective. So consistency is necessary about a brand name, slogan, logo, and it’s positioning as well. We cannot change Exim Bank Ltd. to another name. That will loose the brand identity. To keep Exim Bank Ltd.’s brand image we have to consistence in every element of brand management. Another thing is to keep the ownership of brand, brand position and symbol, we have to consistence. But to some extent we need to be change in terms of global marketing.

IMC or Integrated Marketing Communication is a vehicle value proposition, its position in the mind of the prospect. And its main objective is to build brand equity.

We consider the final and perhaps most flexible element of the marketing mixes. Marketing Communication are the means by which firms attempt to inform, persuade, and remind consumers, directly or indirectly, about the brands that they sell. In a sense, Marketing Communication represents the “voice” of the brand and a means by which it can establish a dialogue and build relationships with consumers.

The promotional activities of Exim Bank Ltd. consists the following:

Newspaper Advertisement

Magazine advertisement

Ads in television (Actually the sponsoring TV events)

Billboards

Here we try to analyze five deferent types of IMC of Exim Bank Ltd. These are-

Newspaper Advertisement

Magazine advertisement

Ads in television

Billboards

Then I will propose the following IMC option for Exim Bank Ltd.-

Radio advertisements.

Welfare activities.

Figure 5: Newspaper Advertisement

Scope of Marketing:

This advertisement on Newspaper is offered by Exim Bank Ltd. is actually for reminding the customers both actual and potential, about the bank and its services. A long observation provides the fact about the

bank that Exim Bank Ltd. never allows a pure and healthy advertisement over on TV or newspaper or anywhere else. They had a strategy of going below the line as always.

But here is given an example which Exim Bank Ltd. has done before for their promotions. Except this sort of advertisements, the Bank never allows to do other activities on newspaper for their promotions.

v Competitive Strategy

Exim Bank Ltd. is a market challenger. In there advertisements, they use frontal attack to some extent to other banks by offering various packages and better, speedy service.

Segmentation

Exim Bank Ltd. actually has a aim on focusing on the whole country. That means they want to place their branches in every possible areas. So that they can serve each people at best. To covering up that aim, Exim Bank Ltd. started increasing its branches in various locations. They are placing their branches in different areas based on the economical importance.

The bank is doing its segmentation by the following manner:

Behaviorally segmentation

Psychographic segmentation

Under psychographic segmentation it uses the following criteria:

Lifestyle

Personality/Trends

Under behaviorally segmentation it uses-

Loyalty status – (switcher)

Readiness stage

Usage rate

User status

Attitude toward product

Targeting

For evaluating each market segment’s attractiveness and selecting the segment to enter- Exim Bank Ltd. has followed – all offers for all customers. There is no specialization. Because this advertisement shows that one offer for different product for different market coverage.

For targeting the different segments Exim Bank Ltd. focuses on the following criteria-

Behaviorally segmentation

User status- Switchers

Usage rate- heavy, medium and less

Loyalty status- Switcher for those consumers who have no particular choices.

Readiness stage- Aware but not interested so to create interest among ex user.

Attitudes towards product- Hostile attitude among the subscribers and it is very tough to convince there consumers.

Marketing Mix

Product From this advertisement we identity the level of product-

Core product – connecting people

Basic product – banking stuffs

Expected product – maximum services

Promotion

Here Exim Bank Ltd. uses newspaper as print media. Obviously it can easily attract people toward the advertisement and the size is also large enough. This offering is very attractive and publicizing with different way which gives an advantage to create a desire among the users or the customers.

Scope of Marketing:

Through this add Exim Bank Ltd. focus on their service for all people by giving them “First” priority.

Figure 6: Billboard

Competitive Strategy:

As Exim Bank Ltd. is a market challenger. It uses Frontal strategy in this advertisement. Because by using this strategy they attack the market leaders and other competitors. Through this advertisement promotes- they are capable to satisfy each and every one of Bangladesh and also want to proof that they are better than other competitors.

Segmentation

In this add Exim Bank Ltd. focuses on the overall people of Bangladesh rather than focusing on a particular segment. Exim Bank Ltd. uses following criteria-

Behavioral Segmentation

Psycho graphic Segmentation

The basis of psycho graphic segmentation-

Life style

Personality

The bases of behavioral segmentation are –

User status

Benefits

Occasion

Readiness status

Their segmentation is effective as it including

Measurable – Everyone in Bangladesh

Accessible- Everyone can be effectively reached and served as it gives value toward all subscribers by offering all position.

Substantial- As they focus on the over all country so they can easily make profit.

Differentiation- By offering “Islami banking” they are positioning to all people of Bangladesh.

Actionable – They invest a lot to achieve their goal by satisfying all.

For evaluating each market segment’s attractiveness and selecting the segments for the bank has followed the following one:

Through this advertisement Exim Bank Ltd. wants to cover the potential customers. For targeting the different segments they also focuses on the following criteria-

Age- people of all age

Gender- Male and female

Occupation – Professional and technical, manager, official, unemployed, others

Education – Educated or uneducated

Family life cycle- young, single, married, no children, others etc.

Psycho graphic of segmentation:

Lifestyle – culture-oriented, sport-oriented, outdoor-oriented, others

Personality – compulsive, gregarious, authoritarian, ambitious, others

Behaviorally Segmentation:

Benefits – Good benefits, low charges, good service, fast and reliable process.

User status- Potential user, first time user

Occasion – Any occasion

Readiness status- Aware and interested, intend to buy or use

Positioning Strategy

For achieving competitive advantage Exim Bank Ltd. did not differentiate itself. It discovers different need and group in the marketplace and targets those needs and groups that it can satisfy in a superior way.

How many differences

From this advertisement we have seen Exim Bank Ltd. using unique selling proposition. For communicating of delivery the positions statement for the people are –

To- all

Is- Exim Bank Ltd.

What- Banking Industry

That- Financial Service

Positioning Strategy

For identifying competitive advantage through this advertisement we can see Exim Bank Ltd. follows service differentiation, people differentiation as well.

Service differentiation- Better service for all by giving all individual customer- “First” position.

Product Mix

There are various types of product line in Exim Bank Ltd. product mix with different features. Through this advertisement Exim Bank Ltd. promotes overall product line within their product mix.

Promotion

Here Exim Bank Ltd. uses billboard for promoting their products. As people allover Bangladesh went outside almost everyday the billboard can definitely catch their eyesight. Here they use “Logo” and “tagline” with their image identification. So it attracts people even from distance places.

v Scope of Marketing

Exim Bank Ltd. does not provide direct advertisement over TV. They do not have any TVC for their customers. Rather they just act as sponsor of various ‘news heading’. This is actually a very good move. Because, most of the people at least watch the private channel news everyday and it has been proved by research.

Exim Bank Ltd. “Banijjo Shongbad” at Channel i (earlier) and then Exim Bank Ltd. “Shongbad Shirnaam” at DIGANTA Channel are recently their most effective TV promotion.

Competitive Strategy

As Exim Bank Ltd. is a market challenger it uses this advertisement. Because this strategy implies to find out the potential customer in a very quiet way and it never harms or attract attention the opponents. Nowadays, most of the banks are very much curious to grab this opportunities.

Segmentation

For the whole market’s buyers needs, characteristics and behavior-through this advertisement Exim Bank Ltd. uses the following criteria-

Demographic Segmentation

Behavioral Segmentation

Psychographic Segmentation

Under demographic segmentation Exim Bank Ltd. has divided the market on the bases of

Age (only the adults are allows and served as customers)

Occupation (Students or non earning people are restricted)

Education (for the non-educated people; micro credit loan facilities are available)

The bases of psychographic segmentation are-

Life style

Personality

The bases of behavioral segmentation are –

Usage rate

Benefits

Their segmentation is effective as it including

Accessible- In this advertisement Exim Bank Ltd. promotes the entire group..

Actionable – This advertisement shows that the company is very much concern about the business related activities that they are providing all kinds of help for the news. Because they are related with the business as well.

Targeting

For evaluating each market segment’s attractiveness and selecting the segment to enter – Exim Bank Ltd. has followed “Product specialization”.

Through this- Exim Bank Ltd. offers all packages for all market segments.

Exim Bank Ltd. targets the following selected segments-

Age- 22 +

Gender- Male, female

Occupation – Service, business and others

Education – Educated, non educated

Positioning strategy:

For identifying competitive advantage through this advertisement we can see Exim Bank Ltd. follows product same products, services and image for all.

How Much Difference

From this advertisement we can see Exim Bank Ltd. uses unique selling proposition as its promotional activities.

For selecting the right competitive advantage Exim Bank Ltd. emphasizes on-

Islamic aptitude: – As important difference.

Red and Green color: – As distinctive difference.

Service:- Reliable, fast.

Relationship: – Superior difference.

For communicating of delivery the positions statement for “clients” is –

“Shariah Based Islami Bank”

Proportioning Strategy

From “Ries and Trout” argument here we find that Exim Bank Ltd. is actually the follower. Because, they has identified the segment “Sharah Based bank” which is occupied by some other banks as well.

Marketing Mix

Product

From this advertisement we identity the level of product of “Exim Bank Ltd.” is-

Core product: Banking services

Basic product: Foreign exchange

Expected product: At a reasonable cost.

Augmented product: Fast, reliable and confidential support.

Product Classification It is both tangible and intangible service of Exim Bank Ltd. which is promoting the working people by offering an Islamic based banking solution for their own good as well as market share.

Pricing

Exim Bank Ltd. follows competition based pricing for its services. They also have to obey the direction of the Bangladesh Bank. It charges less by adding different features and introducing new packages for their customers at a lower charge.

Promotion:

Exim Bank Ltd.” uses TVC as mass communication. Watching TV is the most common leisure activity in our country today. It is the media where the consumers spreads the most attentive time. Through this advertisement tries to give a picture of modern educated banking facilities for all which is acquainted with corporate world with strong bounding of relationship.

ConsumerPerceptionsof Retail Banking Services

An Study on Exim Bank Ltd.

Marketing means identification and satisfaction of customer needs. They need information about customers, competitors and other factors in the marketplace. The task of marketing research is to assess the information needs & provide management with relevant, accurate reliable, valid and current information.

Problem Identification Research Problem Solving Research

____________________________ _______________________

Market Potential Research Segmentation Research

Market Share Research Product Research

Market Characteristics Research Price Research

Sales Analysis Research Promotion Research

Forecasting Research Distribution Research

Business Research

Figure 7: Classification of Marketing Research

There has another two types of Research. These are:

Qualitative Research

Quantitative Research

Step # i Problem Definition

Step # ii Develop an Approach

Step # iii Research Design Formulation

Step # iv Data Collection or Fieldwork

Step # v Analysis

Step # vi Report Presentation

Here, there are some important tasks required. Discussion with the decision maker, Interviewing the industry experts, secondary data analysis and External factors etc are required here in this field of research.

In Bangladesh there are many commercial or financial organizations. Most of these organizations are working in the same manner. For example: “the Banks”. These banks (both the private & the public) are trying to help their customers by utilizing their idle money by making some business in the economy. For that the organizations are giving various profits to its customers.

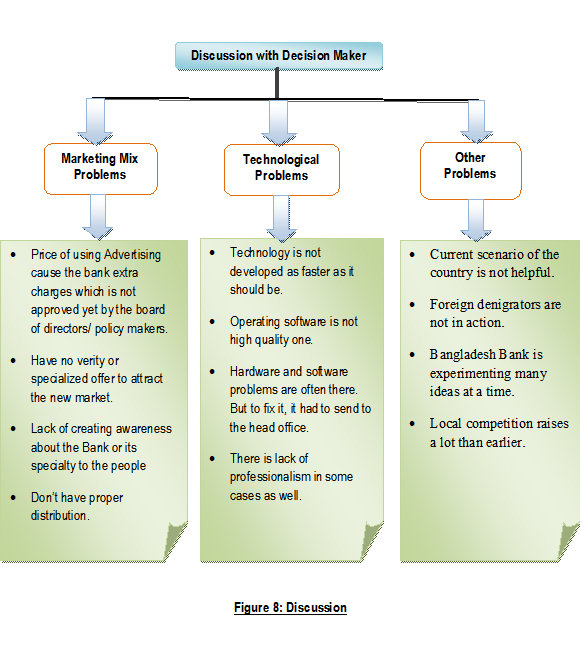

Discussion with the decision maker:

The problem audit is a comprehensive examination of a marketing problem with the purpose of understanding its origin and nature. Although we know that, the decision makers (DM) are always concern with the symptoms. Like what is going on and what will the impact due to this cause. But the researches are always deal with the causes. That actually means- they try to prove that the thing should be done this way and if it done, the result will be more or less this.

I have discussed with some of the decision makers of the concern bank. Among them, Mr. Naeemul Kabir (VP), Mr. SK Md. Abul Ahsan (S.P.O), Mr. Ferdaus Khan (S.P.O), Mr. Arman, Mr. Rana, etc. are some very important persons. They gave me some very good point and ways to think. Later I have found that yes, they guided me to a genuine way to think. Through the discussion with them, we have pointed out some very important problems. The problems are given below:

1.Current Situation is never a favorable one for the industry.

2. There is always a threat remains from the political point of view.

3 Foreign investors are turning faces due to various reasons.

Here, I am assuring that all the factors of 7 C’s have been interacted.

Interview with the experts:

Developing some new & modern policies for Retail Banking of Exim Bank Ltd.

Policy level should be built in a very strong way.

Need to setup strong security network for the Banking solvency.

Create user interface through web site so that they can find basic information about the banking activities and it’s using guide line.

Security, awareness are needed. Educate the people about online banking and its future. So that mass people can take the benefit of e-banking.

Technical expertise is requiring for the whole support.

Hardware and software should be developed for such services.

Management Decision Problem

What should we do to overcome the problem of customers’ dissatisfactions?

What are the probabilities of success of Exim Bank Ltd. in this business?

Marketing Research Problem

To determine all the “triggering factors“ which are liable for the growth of Exim Bank Ltd. in the banking sector as well as the opportunities that we have regarding this services have to deliver through a superior mechanism.

Triggering Factors:

What should be the operating price?

What are the criteria of customer needs?

What way should they promote the services?

What will be the supports of the network that it will work on?

What are the criteria of improving the software and the hardware of this service?

To identify the reasons behind the problem of Exim Bank Ltd. we have initially identified some variables which are significantly correlated with the proposal, when an individual decides to use the service of the bank, he considers the operating price, their needs, availability, affordability, acceptability, support and software and hardware facility of these service so using these service is based on the simultaneous activation of these variable. These variables are to be described under the research design, then for data collection we have to select a sample for analyzing data we have to determine the relevant analysis technique and to the findings will be interpreted with the existing body of knowledge.

Model development

Model development is a very important part of approach to the problem of marketing research. In our research we have developed two different marketing models.

a. Verbal

b. Graphical

c. Mathematical

Verbal Model:

In these models we have selected some variables which are the main barriers of problem and prospects of Exim Bank Ltd. in Bangladesh. So here firstly we have selected both dependent and independent variables. So here the independent variables are price, availability, acceptability, network, software. On the other hand to find out the key independents variables if it is solved then the main dependent variables will be worked. Here the main dependent variables are perception and the satisfaction of customer. So the model would be to satisfy the customer all variables like- price, availability, acceptability, network, service, software will be in proper form.

Graphical Model:

It is a visual mode. Here we are trying to isolate all the variables and suggest the direction of relationship. We don’t want to provide numerical relationship through this model:

Mathematical model:

We have also developed a mathematical model mode of Exim Bank Ltd. The model is:

Y= a0 + b1x1 + b2x2 + b3x3 + b4x4

Here:

Y= Satisfaction of customer

a = constant (price)

x1 = availability

x2 = acceptability

x3 = Security

x4 = Network and software.

RQ # 01 Is “Banking” a profitable business in our country.

RQ # 02 Is Exim Bank Ltd. a common and familiar bank in the country.

RQ # 03 Is it an affordable banking solution for the customers.

RQ # 04 Is Location based commerce services important to the customers (convenient).

RQ # 05 Is Customized banking services important to the customers (better opportunities).

RQ # 06 Is Service Awareness important to the customers (WOM).

RQ # 07 Is Service charge of Exim Bank Ltd. is important to the customers.

RQ # 08 Is Service availability is important to the customers.

RQ # 9 Is Service Acceptability important to the customers.

RQ # 10 Is Quick Responsiveness important to the customers.

RQ # 11 Is Reliability important to the customers.

RQ # 12 Is Expertise of service important to the customers.

RQ # 13 Is the Documentation Process important to the customers.

RQ # 14 Is monetary security of service significant to the customers.

RQ # 15 Is the interior and the exterior design is important to the customers.

RQ # 16 Is Confidentiality of service significant to the customers.

We have found the following hypothesis that we need to get as our findings from the survey. It will provide us the result which will help us to make the research objective done.

H1 1: The class of the bank is important to the customers.

H1 2: Familiar bank is very much accepted towards the customers.

H1 3: Service charge of the bank is important to the customers.

H1 4: The location of the bank is important to the customers.

H1 5: Customized options or better services are important to the customers.

H1 6: Service Awareness of is important to the customers.

H1 7: Service cost acceptability is important to the customers.

H1 8: Service availability is important to the customers.

H1 9: Service acceptability is important to the customers.

H1 10: Quick Responsiveness is important to the customers.

H1 11: Reliability is important to the customers.

H1 12: Accuracy of service is important to the customers.

H1 13: Documentation process as well as the privacy is significant to the customers.

H1 14: Monetary security of service is significant to the customers.

H1 15: Interior and the exterior is important to the customers.

H1 16: Confidentiality of service is significant to the customers.

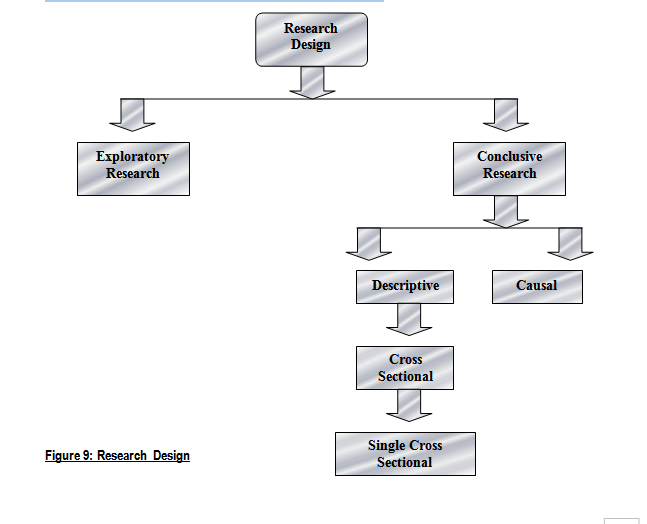

I am following the research design for conducting my research on Exim Bank Ltd. We can get more information through research design as a result we can structure as well as solve research problem.

Types of Research Design

I am working our research on Exim Bank Ltd. which find out the problems and prospects in Bangladesh. So my research is following the standard criteria of research design:

Exploratory Research

The first step of research design, I am following the exploratory research. This research also called qualitative research. In this research I have done two steps.

Figure 10: Problem Definition

Second I have done the second steps which we call development of an approach. In this steps develop approach to the problem:

Theory development.

Model development:

Verbal

Graphical

Mathematical

Research Question.

Hypothesis.

On the other hand, I have done conclusive research which we call quantitative research. In this research we have done descriptive research and casual research.

Descriptive Research

In this research design I have tried to describe our marketing characteristics of Exim Bank Ltd. through cross- sectional design.

Causal Research

In this research design I have manipulating variables of Exim Bank Ltd.

Survey Method

In this method I have given a structured questioner to 25 respondents for collecting data. There are different types of survey method for data collection. But I have done my survey methods through personal survey. I have followed only one step:

Survey methods

personal survey:

In employee, clients

In employee student: In this method I went to some employees and clients who are unique Exim Bank Ltd. related people and clients. Who are aware of the banking sector in Bangladesh and who are also ready to use these services.

Scaling Method

I have created a non-comparative scale where my measurements are located through scaling method. There are two types of scaling. In this method, I am following both primary and secondary scaling.

Primary scaling: in this scaling I am identifying the nominal, ordinal, interval and ratio through my questioner.

Secondary Scaling: in this scale, there are two types of method, one is comparative and another is non-comparative. But I have focused only one which is non-comparative scaling method. In the non comparative scaling method I have

focused only itemized scaling. In this part I have set out all scale in likert scale which is also call five number scale

Scaling:

a. Primary: b. Secondary

Nominal Non- comparative:

Ordinal ! Itemized

Interval !! Likert Scale

Ratio

Questionnaire Development

Sample Questionnaire has been attached here with the report.

Sampling Techniques

Normally there are six steps of sampling technique. So when while doing my research I also follow these steps:

Step 1: Target population: I am doing my research on Exim Bank Ltd. So my target population for this research is the total subscribers of the concern bank and its clients. There is almost 1700-2000 clients are in the Exim Bank Ltd., Panthapath branch.

Step 2: Sampling Unit: I have divided my sampling unit on the basis of some variables, such as Gender, Income, and occupation etc.

Step 3: Sample Elements: I have already set some criteria for selecting the sample elements. The criteria are:

People who are the client or the employee of Exim Bank Ltd.

Who are aware of Exim Bank Ltd.?

Step 4: Sampling Techniques: In these sampling techniques I am following only non-probability sampling method.

Figure 11: Sampling Techniques

Step 5: Sample Size: I have set out sample size on the basis of our resource that is 25.

Step 6: Execution: I have set all the steps of sampling. Finally I have to set other things like coverage, time, place etc. as well.

Coverage — Panthapath Branch, Dhaka

Time — 2008

Place — November / December.

Field Work & Findings:

I am doing my field work through giving questioners to the 25 respondents and returning back those after they have fulfilled all the questions answers properly. This way I have got so many ideas about the customers thought and perceptions regarding the concern bank.

e Time

e Cost

As most of the research paper faces the problem of short time and cost, I have also experienced the same. My prime limitation was the time. I have got too short time to conduct such a research. Thus there may be some short form and some ignorance in the research paper.

Again, the cost is another factor that has made me a bit worried for a few moments. But thanks to Almighty that I have over come the limitations. But the fact is that, there may be some sign of the sufferings of the limitation in the research paper.

1) What is your age?

Frequency

Percent

Valid Percent

Cumulative Percent

Interpretation:

To get the data from the clients of the bank, I have made 5 criteria’s. Among the 25 respondents, 7 (28%) of them are between the age of 30-40 years. Next, 6 respondents (24%) are at a range of 40-50 years. 5 respondents (20%) are in between 50-60 years.16% of the respondents that means 4 persons are at an age of over 60 years and only 3 respondents (12%) are in a age range of 20-30 years. This actually means there are all types and aged people had given their views about the concern bank.

Often it has been seen that, different aged people have different ways to think a same thing. Thus if we can capture all grouped people in our survey, then it is obvious that we will have the perfect result. At this case, it was happened successfully.

2) You are: (male or female)

Frequency

Percent

Valid Percent

Cumulative Percent

Valid MALE

19

70.4

76.0

76.0

FEMALE

6

22.2

24.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

In any survey or data collection, there should be a granted ratio of gender. 50% would be the best option but at this case, I failed to have that. Exim Bank Ltd., Panthapath branch is a foreign exchange based branch. Thus, it is a very busy branch compared to other branches of it. So, there are many business based people are their main and focused customers. Among them, very few of them are female. So, it puts an impact on my survey as well. Here, only 6 (24%) respondents are female and rest 19 respondents (76%) are male. So the whole research becomes a male dominant one.

Again, this chart is not giving me the whole picture. Often it has been seen that there are so many accounts in the name of the female customers in this Exim Bank Ltd., Panthapath branch. But most of them are operated by their accepted male operators (husband/ brother/ father etc.). Thus although there are many female customers account exists in the bank, but they are not operated by them. That’s may be one reason why the ratio of male and female are not an acceptable figure.

Your monthly income:

Frequency

Percent

Valid Percent

Cumulative Percent

Valid below 20000

10

37.0

40.0

40.0

20001-40000

11

40.7

44.0

84.0

40001 and above

4

14.8

16.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Here I have asked about the client’s monthly income. Their answers shows that 10 (40%) respondents have an income below 20,000 BDT. And 11 respondents (44%) have an income around 20,001 to 40,000 BDT monthly. Rest of the respondents that means 4 people (16%) have a monthly income over 40,000 or so. This shows a clear idea that most of the customers have a standard monthly income and so they can operate their accounts smoothly. Again, most of them are businessmen. It might have a big impact regarding the income graph-why almost 60% people have a monthly income of more than 20,000 BDT.

4) What is your occupation?

Frequency

Percent

Valid Percent

Cumulative Percent

Valid government service

10

37.0

40.0

40.0

private service

12

44.4

48.0

88.0

business

3

11.1

12.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Here I have found an interesting thing. That in an import-export related bank, most of them are job holders! I was shocked at first. I couldn’t believe initially. Then I’ve learnt that the people who use to come at the general banking section (1st floor), are actually the service holders indeed. It’s possible only because there are so many private organizations and firms placed around the bank. Most of these accounts are being opened for their salary purpose. Thus at the general banking section, there are many service oriented people gathered every now and then.

But what about the business people of Exim Bank Ltd. goes? They actually gather at the 2nd floor where the CREDIT division is established. They hang around there for their export and import related activities. They are very busy and hot tempered as well. I almost had to down on my knees to get their opinion for this purpose. Thanks to God that I successfully made it.

5) “Private Bank’s are more profitable & safe to invest the money.” – What do you think?

Frequency

Percent

Valid Percent

Cumulative Percent

Valid yes

18

66.7

72.0

72.0

no

7

25.9

28.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

In general, the people have a perception that the banks are very profitable business in this country. Thus there are many banks are here in Bangladesh. Here at Exim Bank Ltd., Panthapath branch; I have found that 18 respondents (72%) are having the same belief regarding the banks. Rest 7 respondents (28%) think differently. The good thing is, although it is not enough but at least some people are having a clear idea about the banking activities. Because, if u thinks it is indeed always a profitable business, then you will rarely accept the changes of the policies and the new actions. As a result, you will be dissatisfied. And we know dissatisfaction is a very dangerous thing for business.

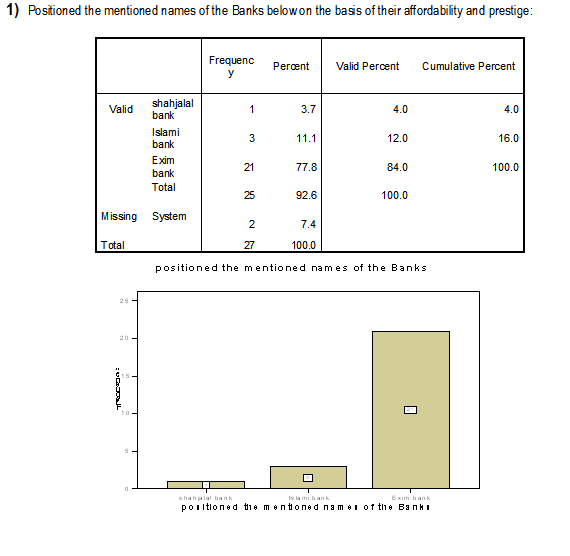

Interpretation:

Here I just wanted to know that how many respondents are willing to say that the Exim Bank Ltd. is at the first place. This will show their dedication and the support as well as their satisfaction level regarding the bank. I got it clear the at least the account holders are satisfied the way they are being treated over here. The statistic shows, 21 responds (which is actually 84%) people are well satisfied or they think that Exim Bank Ltd. is at the top regarding the prestige and affordability.

May be this is because it is a foreign exchange based as well as a shariah-based bank. That’s the reason people are happy with having transaction over here. They are having class services and up to date facilities and again they are being psychologically being hit too. Thus most of the respondents are thinking that it is prestigious and affordable.

1) Why do you have accounts in this branch of “Exim Bank Ltd.”?

Frequency

Percent

Valid Percent

Cumulative Percent

Valid convenient

11

40.7

44.0

44.0

reliable

2

7.4

8.0

52.0

reference

12

44.4

48.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

There are different people who are having their accounts here at Exim Bank Ltd. for different reasons. By asking why, I have got that 44% (11) respondents have said that they have accounts here because they feel that it is very convenient branch for the (may be because of the location or for the nearby resident or anything else). 48% (12) respondents have said that they are here through some references (one account holder brings his/her friends or relative by saying that the services and the benefits are very good here- this way). Rest 8% or 2 respondents come here just assuming that it is a reliable bank just because it has a title which is “Shariah-based Islami Bank”

2) What kind of promotional activities you have seen of “Exim Bank Ltd.”?

Frequency

Percent

Valid Percent

Cumulative Percent

Valid advertisement

15

55.6

60.0

60.0

word of mouth

10

37.0

40.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

From the very beginning Exim Bank Ltd. has put less effort in advertising. They have not enough advertising channels too. Despite of their fewer advertisements, they have reached to its target customers quite successfully. Here it has been proved by the analysis that almost 60% (15) respondents have seen the advertisements or use it. And rest 40% (10) respondents knew about the bank through word of mouth.

3) Are you Satisfied with all you get being an account holder of “Exim Bank Ltd.” ?

Frequency

Percent

Valid Percent

Cumulative Percent

Valid yes

21

77.8

84.0

84.0

no

4

14.8

16.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

The result shows everything here. The current facilities and offerings made 84% (21) respondents satisfied. Hopefully the rest 16% will be caught in near future too. So it is a very positive side of Exim Bank Ltd. Actually the way this bank is offering it’s services and serving the people, it is obvious that people will be satisfied. They may not have a world class service but they have a very good understanding and dedication for their customers. That’s the key of Exim Bank Ltd.’s success I think.

4) In future when I will open an account, I will do it from “Exim Bank Ltd.”-

Frequency

Percent

Valid Percent

Cumulative Percent

Valid definitely will

11

40.7

44.0

44.0

probably will

8

29.6

32.0

76.0

may be

6

22.2

24.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Here, I wanted to know whether the customers will repurchase from here or not. Through this question it will be ensured that the customers will think about the bank again if they need to use any banking solution in future. Among the 25 respondents, 11 (44%) respondents have said that they will definitely think about the Exim Bank Ltd. if they need to have any bank account or other banking related services. Another 8 respondents (32%) have said that probably they will think about the bank. That means, these 32% customers will think about this bank but they would go to other banks as well. But again, these respondents have a chance to re-purchase the service from here as well. But the rest 24% people (6 respondents) may not buy from here. 24% is a very big margin. So, the Exim Bank Ltd. need to rethink about those (24 + 32)% people seriously if they want to be in the long run.

Interpretation:

Exim Bank Ltd. is very serious about their customer’s needs wants and demands. The authorities and the employees of this bank always demand this fact. Let’s see whether the customers are also think the way the bank’s people think or not.

14 respondents (56%) directly think same way as the bank’s think. Another 11 respondents (44%) have given their neutral view about this argument. So we can’t presume whether they are saying it positively or not. As there is no idea about their opinion, so we can assume it as positive statements. But the good think is no one is directly stands against the banks responsiveness.

1) They are very much reliable

Frequency

Percent

Valid Percent

Cumulative Percent

Valid Strongly agree

3

11.1

12.0

12.0

Agree

11

40.7

44.0

56.0

Neutral

11

40.7

44.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

When I have asked about the Exim Bank Ltd.’s reliability issue, the customers are again positively answered. 14 respondents (56%) are very much agree with the fact that they are very much reliable. Another 11 respondents (44%) have a neutral position which is taken as positive here.

It means not only the employees and the policy makers are thinking positive about the banking activities but also the customers are also believe it properly. Thus they are transecting with the bank for years.

2) They are very much expert in the business

Frequency

Percent

Valid Percent

Cumulative Percent

Valid Strongly agree

1

3.7

4.0

4.0

Agree

13

48.1

52.0

56.0

Neutral

11

40.7

44.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Exim Bank Ltd. is operating the business in a very expert style. They are very respectful to the Bangladesh Bank’s policies and very much serious to fulfill those issues. Again, they are very cooperative to their customers as well. They always try to help the customers at their best.

14 respondents (56%) believe that the above statements are true. That’s why they are here. Another 44% (11) respondents may have a bit doubt but they are not saying it clearly. But overall, it is a very positive sign that not a single one respondent said negative about this issue. This is very much positive for the bank.

3) They have a very pure documentation process

Frequency

Percent

Valid Percent

Cumulative Percent

Valid Strongly agree

3

11.1

12.0

12.0

agree

14

51.9

56.0

68.0

Neutral

8

29.6

32.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Exim Bank Ltd. has very good documentation process. They preserved all the banking documents in a very well and presently way. Thus those are found any time when those are needed. Although they are not following any high technology or so but the having a very good record of the documents- where are those placed and the serial is been properly maintained too.

17 respondents (68%) have also thought or agree with the fact. That they never seen any mistakes or faces any problems regarding the documentation process. Rest 8 respondents (32%) give a neutral opinion. This is not positively marked but not negative as well.

4) They are very serious about their transparency

Frequency

Percent

Valid Percent

Cumulative Percent

Valid Strongly agree

3

11.1

12.0

12.0

Agree

14

51.9

56.0

68.0

Neutral

8

29.6

32.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Transparency means the valid, clean and the legality of the activities. Through asking this question, I wanted to brought out whether the customers of Exim Bank Ltd. have seen anything negative or not. Surprisingly, no one have said negative about this issue. 8 respondents (32%) have said neutrally but rest 68% or 17 respondents have said the transparency is there at the bank. So it is very good to know and very pleasing as well to see that the customers are the voices of the bank. It proves that the customers are well satisfied and believing the bank very well.

5) Their working & processing speed is very effective

Frequency

Percent

Valid Percent

Cumulative Percent

Valid Strongly agree

1

3.7

4.0

4.0

Agree

8

29.6

32.0

36.0

Neutral

13

48.1

52.0

88.0

Disagree

3

11.1

12.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Working speed is a very important issue for the banking service. It determines the working process speed or to be exact we can say that it means how long it takes to complete a task. After having so many transactions and being very much expert, the officials demand that they are very efficient and take very less time to complete individual tasks.

According the bank’s officials, most of the customers are also think that the working speed is very good at Exim Bank Ltd., Panthapath branch. 9 respondents (36%) agreed with them and another 13 respondents (52%) given neutral views. So we assume that their neutral views are not negative.

But there are 3 respondents (12%) are dissatisfied for the bank’s working speed. This 12% people need to be taken care properly. Otherwise these 12% will increase in no time.

6) Designing “Interior-Exterior” of the bank is effective.

Frequency

Percent

Valid Percent

Cumulative Percent

Valid Agree

6

22.2

24.0

24.0

Neutral

7

25.9

28.0

52.0

Disagree

9

33.3

36.0

88.0

Strongly disagree

3

11.1

12.0

100.0

Total

25

92.6

100.0

Missing System

2

7.4

Total

27

100.0

Interpretation:

Each and every bank should pay attention towards the banks interior and exterior design. Because it carries a lot to the customers mind. For example; if we see the “DHAKA BANK” from the outside, we can easily recognize it without even seeing its signboard. Just because of their powerful exterior designing. Again, if we talk about the Brac Bank, then it comes about their interior designing. It is so beautiful and reasonable in words. Like that, Exim Bank Ltd. should pay hid on their interior and exterior too. It is very important to catch the potential customers as well as to hold on the existing.

It’s an alarming notice, that 12 (36%) respondents are saying the bank is not good in terms of its interior or the exterior. There is not enough space inside the bank to move freely. Often, there are long queues in front of the cash. GB (general banking) has such small space that it is not attracting the customers or if it is so, then obviously in a negative way. Another 7 respondents (28 %) keep themselves away from this argument simply by placing the neutral button. Only 6 respondents (24%) think this is okay.

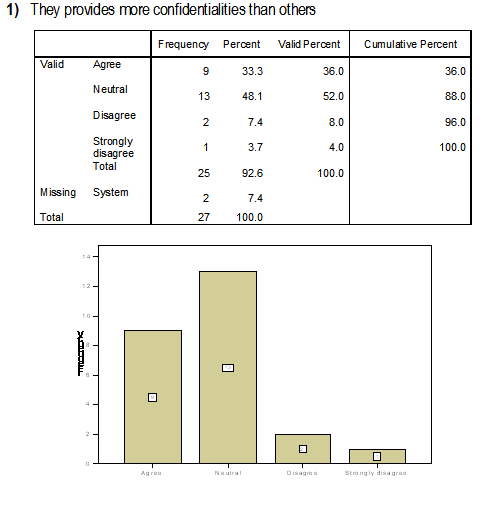

Interpretation:

It is a very sensitive issue for the customers. They always want to hide their information in front of others. So they always want such banking operators who will never disclose their liabilities or any other information. People will go to that bank, which will ensure them that they will keep all the information confidential.

9 respondents (36%) think Exim Bank Ltd. is good enough to keep their information and will never disclose to anybody. Another 13 respondents (52%) gave neutral opinion. Only 3 respondents (12%) think the bank cannot keep their information confidential properly. So the authority of this bank should provide assurance to those people regarding their personal information properly.

General Banking department

In general banking department they follow the traditional banking system. The entire general banking procedure is not fully computerized.

The cash counter I think is congested and the procedure is traditional.

There is no computer in Remittance Section. That is why the service is not as prompt as the customer’s demand.

Lack of variety of services is also a drawback of the general banking area of the EXIM Bank Bangladesh Limited. The Bank provides only some traditional limited services to its client. As a result, the bank is falling behind in competition.

They are not using Data Base Networking in Information Technology (IT) Department. So they have to transfer data from branch to branch and branch to head office by using floppy disk and sure it is not a good system.