Performance Evaluation of First Security Bank Limited from Different point of View

Trend of Assets Growth

Growth rate of Liquid Assets & Fixed Assets

Comparison of Operational Profit & Liquid

Deposit & Profit Comparison

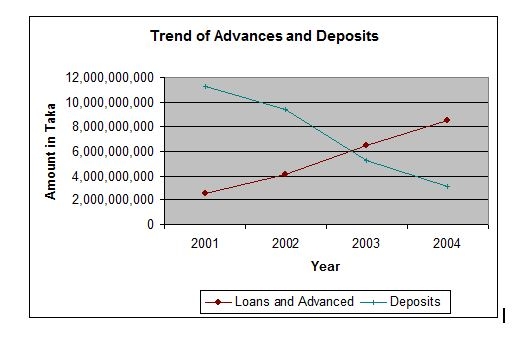

Trend of Advance & Deposit

Total Assets

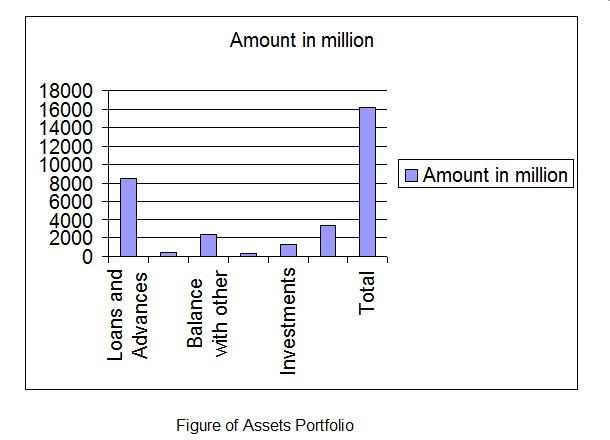

Asset Portfolio

Deposits and other Account

Loans and Advances

Foreign Exchange and Foreign Trade

Import

Export

Inward Remittance

Total Income

Net Interest Income

Operating Profit

Retained Earnings

Earnings per share

Capital fund

Reserve Funds

Investments

Branch Network and Expansion

Human Resources

From owners viewpoint

- Profitability of the Bank:

- Operating Profit margin

- Net Profit margin

- Growth of the Bank:

- Return on assets (RAO)

- Return on Equity (ROE)

- Provision for loan ratio

- Interest Income Ratio

- Non-interest Income Ratio

- Equity Multiplier

Ø Asset utilization:

- Risk of the Bank:

- Interest expense ratio

- Non-interest expense ratio

Tax ratio

From the view point of Depositors

1. Internal Liquidity

- Current ratio

- Quick Ratio

2. Operating Performance

- Capital to deposit ratio

- Deposit to employee ratio

Loan to deposit ratio

CAMEL Rating

- Capital adequacy

- Asset quality

- Earnings

- Management efficiency

- Liquidity

Composite Rating

FINANCIAL PERFORMANCE

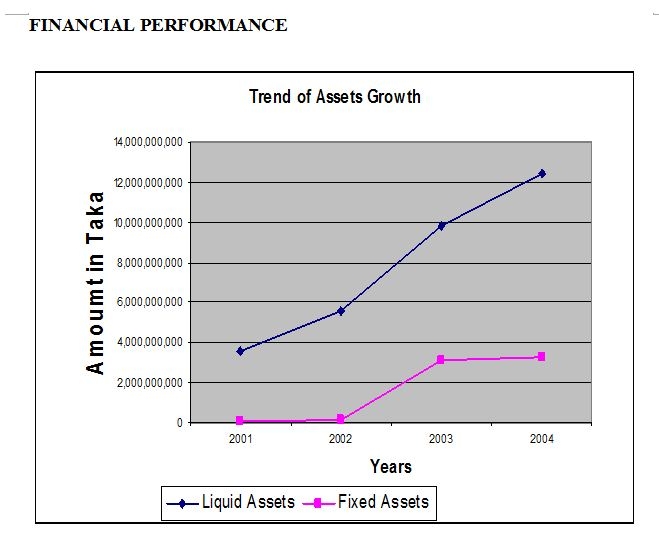

Chart 1

Chart 1 shows a significant improvement of the FSBL in treasury management. In successive years it has a remarkable improvement to increase its current assets while keeping investment in fixed. Even in year 2004 the fixed assets remain approximately close to previous year while there is double-digit growth in liquid asset this helped FSBL to gain from money market fluctuation in interest rate. Though in year 2003 fixed assets has increased more than 100%. But this is due to the set up cost and expansion in business. But following year it was able to maintain the fixed assets close to previous year.

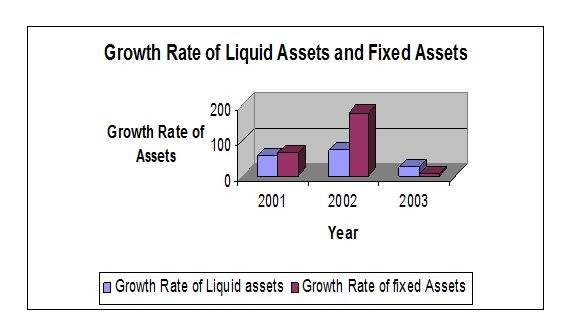

Chart 2

Chart 2 shows rate of growth of the liquid assets and fixed assets. In this chart we see that in year 2002 fixed assets increased more than 150% due to the expansion of business, major investment in this year was in primary cost of opening of new branches including proclamation of land and installment of computer and furniture. But in the following its investment in fixed assets increase more not over 4%. Though keeping fixed assets may help FSBL to get a good score in CAMEL rating but being a third generation newly established not more than 5 years it should invest more in land proclamation and expansion of business to be remain competitive. But an sustainable growth may be ensured keeping fixed cost same level while increasing liquid assets at the same time this can ensure profitability because of short term investment in money market to take the advantage in the fluctuation of interest rate.

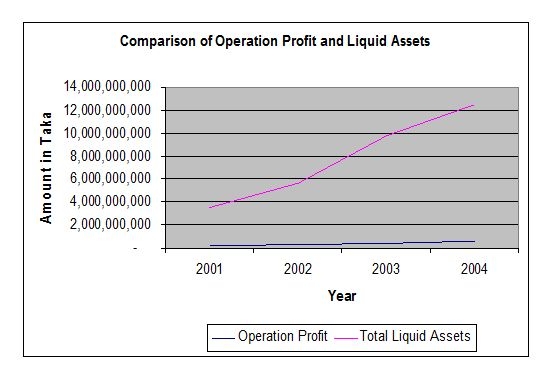

Chart 3 shows FSBL performance in Treasury Management. FSBL’s liquid assets ensured only liquidity. Where its volume of liquid assets increased sharply but it failed to ensure to profitability. It has invested more money in non interest bearing asset (cash and currencies) over the year profit has increased slightly but investment in liquid assets or non interest bearing assets increased straight upward. It is expected that over the year with more experience and strength and being acknowledge about the client transaction behavior it will shift more of it investment from non interest bearing assets to interest bearing assets like T-bills.

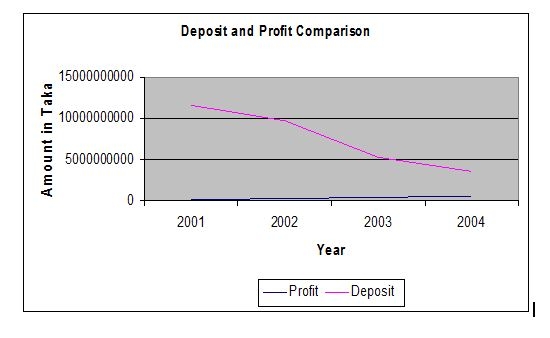

Chart 4 shows that in successive years deposit have fallen sharply. It is because in these successive years Government had taken loan from money market to meet its deficit budgets by increasing at the same time limit of investment in a single name had weaved so it fund flowed from depository financial sector to less risky Government Securities sectors. In this squeeze financial scenario it is very difficult to make any profit. But we see that in this period profit did not decrease even in year 2004 we that profit have increased slightly. Though in these periods core deposit has decreased sharply but FSBL was able to collect deposit from other financial institutions. That is a reason of FSBL to maintain high liquidity. Because it is more like that the deposit from other banks and financial institutions will be call back any time or have to repay on demand. Though this can help to keep cost of fund lower because it reduces dependent on high cost fixed deposit but at the same time it also hamper the growth rate. Over the year savings deposit even fixed deposit has decreased so it very much necessary for this moment to expand business, getting more strength by collecting money from offering saving deposit account or even fixed deposit account. Other wise growth will be stopped.

Chart 5 is showing the deposit and advance position of FSBL over the period. It depicts that though advance over the year has increase rapidly but deposit has decreased gradually. This is due to heavy dependency on borrowing from the other financial institutions. But heavy dependency on the deposit of other financial institute may not be seen a good sing. FSBL should improve it core deposit that is from small severs by offering various types of saving product other wise in case of deposit crunch a deposit run may create a heavy problem in future especially in case of contraction monitory policy.

Total Assets: Trend of total asset is shown in the table from year 2001-2004.

Year | 2001 | 2002 | 2003 | 2004 |

Total Assets | Tk. 4459.52 million | Tk.7227.44 million | Tk. 13369.48 million | Tk.16169.27 million |

Asset Portfolio:

The bank total assets outstanding as of December 31, 2004 amounted to Tk. 16169.27 million as compared to 2003 amounted to Tk. 13369.49. Loans & advances contributed 52.57% cash 2.48% balances with others bank 14.47%, money at call and short notice 2.15%, investments 7.87% and the total other assets 20.46% as against 48.44%, 3.00%, 14.83%, 4.52%, 5.63% and 23.58% respectively in 2003.

Components | Amount in million | % Of Total |

| Loans and Advances | 8500.27 | 52.57 |

| Cash | 402.33 | 2.48 |

| Balance with other Banks | 2338.98 | 14.47 |

| Money at Call and short Notice | 347.50 | 2.15 |

| Investments | 1271.72 | 7.87 |

| Total Other Assets | 3308.47 | 20.46 |

| Total | 16169.27 | 100.00 |