INTRODUCTION:

Credit risk grading is an important tool for credit risk management as it helps the Banks & financial institutions to understand various dimensions of risk involved in different credit transactions. The aggregation of such grading across the borrowers, activities and the lines of business can provide better assessment of the quality of credit portfolio of a bank or a branch. The credit risk grading system is vital to take decisions both at the pre-sanction stage as well as post-sanction stage.

At the pre-sanction stage, credit grading helps the sanctioning authority to decide whether to lend or not to lend, what should be the loan price, what should be the extent of exposure, what should be the appropriate credit facility, what are the various facilities, what are the various risk mitigation tools to put a cap on the risk level.

At the post-sanction stage, the bank can decide about the depth of the review or renewal, frequency of review, periodicity of the grading, and other precautions to be taken.

DEVELOPMENT OF THE SCORE CARD:

The Lending Risk Analysis (LRA) manual introduced in 1993 by the Bangladesh Bank has been in practice for mandatory use by the Banks & financial institutions for loan size of BDT 1.00 crore and above. However, the LRA manual suffers from a lot of subjectivity, sometimes creating confusion to the lending Bankers in terms of selection of credit proposals on the basis of risk exposure. Meanwhile, in 2003 end Bangladesh Bank provided guidelines for credit risk management of Banks wherein it recommended, interalia, the introduction of Risk Grade Score Card for risk assessment of credit proposals.

Since the two credit risk models are presently in vogue, the Governing Board of Bangladesh Institute of Bank Management (BIBM) under the chairmanship of the Governor, Bangladesh Bank decided that an integrated Credit Risk Grading Model be developed incorporating the significant features of the above mentioned models with a view to render a need based simplified and user friendly model for application by the Banks and financial institutions in processing credit decisions and evaluating the magnitude of risk involved therein.

DEFINITION OF CREDIT RISK GRADING (CRG):

The Credit Risk Grading (CRG) is a collective definition based on the pre-specified scale and reflects the underlying credit-risk for a given exposure.

A Credit Risk Grading deploys a number/ alphabet/ symbol as a primary summary indicator of risks associated with a credit exposure.

Credit Risk Grading is the basic module for developing a Credit Risk Management system.

FUNCTIONS OF CREDIT RISK GRADING:

Well-managed credit risk grading systems promote bank safety and soundness by facilitating informed decision-making. Grading systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. This allows bank management and examiners to monitor changes and trends in risk levels. The process also allows bank management to manage risk to optimize returns.

USE OF CREDIT RISK GRADING:

The Credit Risk Grading matrix allows application of uniform standards to credits to ensure a common standardized approach to assess the quality of individual obligor, credit portfolio of a unit, line of business, the branch or the Bank as a whole. As evident, the CRG outputs would be relevant for individual credit selection, wherein either a borrower or a particular exposure/facility is rated. The other decisions would be related to pricing (credit-spread) and specific features of the credit facility. These would largely constitute obligor level analysis. Risk grading would also be relevant for surveillance and monitoring, internal MIS and assessing the aggregate risk profile of a Bank. It is also relevant for portfolio level analysis.

NUMBERS AND SHORT NAME OF GRADES USED IN THE CRG:

The proposed CRG scale consists of 8 categories, of which categories 1 to 5 represent various grades of acceptable credit risk and categories 6 to 8 represent unacceptable levels of credit risk.

| GRADING | SHORT NAME | NUMBER |

| Superior | SUP | 1 |

| Good | GD | 2 |

| Acceptable | ACCPT | 3 |

| Marginal/Watchlist | MG/WL | 4 |

| Special Mention | SM | 5 |

| Sub standard | SS | 6 |

| Doubtful | DF | 7 |

| Bad & Loss | BL | 8 |

RISK DEFINITIONS:

Bangladesh bank has set different criteria for risk grading definitions. However, they can be broadly categorized as:

a) Acceptable Credit Risk and

b) Unacceptable Credit Risk

Following is a detailed discussion of these two broad categories of risks.

ACCEPTABLE CREDIT RISK:

The following 5 categories are considered as acceptable credit risk. The respective risk category features have been provided below:

Superior – (SUP) – 1

- Credit facilities, which are fully secured i.e. fully cash covered.

- Credit facilities fully covered by government guarantee.

- Credit facilities fully covered by the guarantee of a top tier international Bank.

Good – (GD) -2

- Strong repayment capacity of the borrower

- The borrower has excellent liquidity and low leverage.

- The company demonstrates consistently strong earnings and cash flow.

- Borrower has well established, strong market share.

- Very good management skill & expertise.

- All security documentation should be in place.

- Credit facilities fully covered by the guarantee of a top tier local Bank.

Aggregate Score of 85 or greater based on the Risk Grade Score Sheet

Acceptable – (ACCPT) -3

- These borrowers are not as strong as GOOD Grade borrowers, but still demonstrate consistent earnings, cash flow and have a good track record.

- Borrowers have adequate liquidity, cash flow and earnings.

- Credit in this grade would normally be secured by acceptable collateral (1st charge over inventory / receivables / equipment / property).

- Acceptable management

- Acceptable parent/sister company guarantee

Aggregate Score of 75-84 based on the Risk Grade Score Sheet

Marginal/Watchlist – (MG/WL) -4

- This grade warrants greater attention due to conditions affecting the borrower, the industry or the economic environment.

- These borrowers have an above average risk due to strained liquidity, higher than normal leverage, thin cash flow and/or inconsistent earnings.

- Weaker business credit & early warning signals of emerging business credit detected.

- The borrower incurs a loss

- Loan repayments routinely fall past due

- Account conduct is poor, or other untoward factors are present.

- Credit requires attention

Aggregate Score of 65-74 based on the Risk Grade Score Sheet

Special Mention – (SM) -5

- This grade has potential weaknesses that deserve management’s close attention. If left uncorrected, these weaknesses may result in a deterioration of the repayment prospects of the borrower.

- Severe management problems exist.

- Facilities should be downgraded to this grade if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive leverage),

An Aggregate Score of 55-64 based on the Risk Grade Score Sheet.

UNACCEPTABLE CREDIT RISK:

The following 3 categories are considered as unacceptable credit risk. The respective risk category features have been provided below:

Substandard- (SS) – 6

- Financial condition is weak and capacity or inclination to repay is in doubt.

- These weaknesses jeopardize the full settlement of loans.

- Bangladesh Bank criteria for sub-standard credit shall apply.

An Aggregate Score of 45-54 based on the Risk Grade Score Sheet.

Doubtful- (DF) – 7

- Full repayment of principal and interest is unlikely and the possibility of loss is extremely high.

- However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as Bad & Loss.

- Bangladesh Bank criteria for doubtful credit shall apply.

An Aggregate Score of 35-44 based on the Risk Grade Score Sheet.

Bad/Loss- (BL) -8

- Credit of this grade has long outstanding with no progress in obtaining repayment or on the verge of wind up/liquidation.

- Prospect of recovery is poor and legal options have been pursued.

- Proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been provided for.

- This classification reflects that it is not practical or desirable to defer writing off this basically valueless asset even though partial recovery may be affected in the future. Bangladesh Bank guidelines for timely write off of bad loans must be adhered to. Legal procedures/suit initiated.

- Bangladesh Bank criteria for bad & loss credit shall apply.

An Aggregate Score of less than 35 based on the Risk Grade Score Sheet.

REGULATORY DEFINITION ON GRADING OF CLASSIFIED ACCOUNTS :

Irrespective of credit score obtained by a particular obligor, grading of the classified names should be in line with Bangladesh Bank guidelines on classified accounts, which presently are:

- Sub standard – if any loan is past due/overdue for 180 days and above.

- Doubtful – if any loan is past due/overdue for 270 days and above.

- Bad & Loss – if any loan is past due/overdue for 360 days and above.

PROCEDURE FOR COMPUTING CREDIT RISK GRADING:

The following step-wise activities outline the detail process for arriving at credit risk grading.

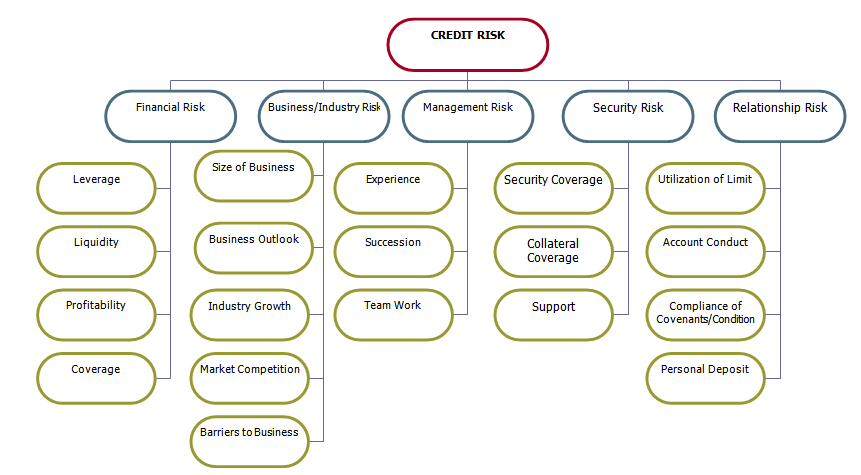

STEP I: IDENTIFYING ALL THE PRINCIPALS RISK COMPONENTS:

Credit risk for counterparty arises from an aggregation of the following:

- Financial Risk

- Business/Industry Risk

- Management Risk

- Security Risk

- Relationship Risk

Each of the above mentioned key risk areas require to be evaluated and aggregated to arrive at an overall risk grading measure.

Evaluation of Financial Risk:

Risk that counterparties will fail to meet obligation due to financial distress. This typically entails analysis of financials i.e. analysis of leverage, liquidity, profitability & interest coverage ratios. To conclude, this capitalizes on the risk of high leverage, poor liquidity, low profitability & insufficient cash flow.

Evaluation of Business/Industry Risk:

Risk that adverse industry situation or unfavorable business condition will impact borrowers’ capacity to meet obligation. The evaluation of this category of risk looks at parameters such as business outlook, size of business, industry growth, market competition & barriers to entry/exit. To conclude, this capitalizes on the risk of failure due to low market share & poor industry growth.

Evaluation of Management Risk:

Risk that counterparties may default as a result of poor managerial ability including experience of the management, its succession plan and team work.

Evaluation of Security Risk:

Risk that the bank might be exposed due to poor quality or strength of the security in case of default. This may entail strength of security & collateral, location of collateral and support.

Evaluation of Relationship Risk:

These risk areas cover evaluation of limits utilization, account performance, conditions/covenants compliance by the borrower and deposit relationship.

STEP II: ALLOCATING WEIGHT TO PRINCIPAL RISK COMPONENTS:

According to the importance of risk profile, the following weights are proposed in guideline for corresponding principal risks.

Principal Risk Components: Weight:

Financial Risk 50%

Business/Industry Risk 15%

Management Risk 15%

Security Risk 10%

Relationship Risk 10%

STEPIII: ESTABLISHING KEY PARAMETERS:

| Principal Risk Components: | Key Parameters: |

| Financial Risk | Leverage, Liquidity, Profitability & Coverage ratio. |

| Business/Industry Risk | Size of Business, Business Outlook, Industry Growth, Competition & Barriers to Business (entry/exit) |

| Management Risk | Experience, Succession & Team Work. |

| Security Risk | Security Coverage, Collateral Coverage and Support |

| Relationship Risk | Utilization of Limit, Account Conduct, Compliance of covenants/conditions & Personal Deposit |

STEP IV: ASSIGNING WEIGHT TO EACH OF THE KEY PARAMETERS:

| Principal Risk Components: | Key Parameters: | Weight: |

| Financial Risk | 50% | |

| Liquidity | 15% | |

| Profitability | 15% | |

| Coverage | 5% | |

| Business/Industry Risk | 15% | |

| Size of Business | 5% | |

| Business Outlook | 3% | |

| Industry growth | 3% | |

| Market Competition | 2% | |

| Entry/Exit Barriers | 2% | |

| Management Risk | 15% | |

| Experience | 5% | |

| Succession | 5% | |

| Team Work | 5% | |

| Security Risk | 10% | |

| Security coverage | 4% | |

| Collateral coverage | 4% | |

| Support | 2% | |

| Relationship Risk | 10% | |

| Utilization of limit | 3% | |

| Account conduct | 3% | |

| Compliance of covenants /condition | 2% | |

| Personal deposit | 2% |

STEP V: GIVING ENTRY TO THE MODEL TO ARRIVE AT SCORE:

After the risk identification & weightage assignment process (as mentioned above), the next steps will be to input actual parameter in the score sheet to arrive at the scores corresponding to the actual parameters.

This report provides a well programmed MS Excel based credit risk scoring sheet (developed by Bangladesh Bank) to arrive at a total score on each borrower. The excel program requires inputting data accurately in particular cells for input and will automatically calculate the risk grade for a particular borrower based on the total score obtained. The following steps are to be followed while using the MS Excel program.

Open the MS XL file named, CRG_SCORE_SHEET

The entire XL sheet named, CRG is protected except the particular cells to input data.

Input data accurately in the cells which are BORDERED & are colored YELLOW.

Some input cells contain DROP DOWN LIST for some criteria corresponding to the Key Parameters. Click to the input cell and select the appropriate parameters from the DROP DOWN LIST as shown below.

STEP VI: ARRIVING AT THE CREDIT RISK GRADING BASED ON TOTAL SCORE:

The following is the proposed Credit Risk Grade matrix based on the total score obtained by an obligor.

| Number | Risk Grading | Short Name | Score |

| 1 | Superior | SUP | 100% cash covered Government guarantee International Bank guarantees |

| 2 | Good | GD | 85+ |

| 3 | Acceptable | ACCPT | 75-84 |

| 4 | Marginal/Watchlist | MG/WL | 65-74 |

| 5 | Special Mention | SM | 55-64 |

| 6 | Sub-standard | SS | 45-54 |

| 7 | Doubtful | DF | 35-44 |

| 8 | Bad & Loss | BL | <35 |

CREDIT RISK GRADING PROCESS:

The followings are the directives forwarded by Bangladesh Bank regarding the risk grading process:

‘Credit Risk Grading should be completed by a Bank for all of its clients whose credit limit is BDT 1.00 crore and above. For Superior Risk Grading (SUP-1) the score sheet is not applicable. This will be guided by the criterion mentioned for superior grade account i.e. 100% cash covered, covered by government & bank guarantee.

Credit risk grading matrix would be useful in analyzing credit proposal, new or renewal for regular limits or specific transactions, if basic information on a borrowing client to determine the degree of each factor is a) readily available, b) current, c) dependable, and d) parameters/risk factors are assessed judiciously and objectively.

Risk factors are to be evaluated and weighted very carefully, on the basis of most up-to-date and reliable data and complete objectivity must be ensured to assign the correct grading.

Credit risk grading exercise should be originated by Relationship Manager and should be an on-going and continuous process. Relationship Manager shall complete the Credit Risk Grading Score Sheet and shall arrive at a risk grading in consultation with a Senior Relationship Manager and document it as per Credit Risk Grading Form, which shall then be concurred by the Credit Officer in consultation with a Senior Credit Officer.

All credit proposals whether new, renewal or specific facility should consist of a) Data Collection Checklist, b) Limit Utilization Form c) Credit Risk Grading Score Sheet, and d) Credit Risk Grading Form.

The credit officers then would pass the approved Credit Risk Grading Form to Credit Administration Department and Corporate Banking/Line of Business/Recovery Unit for updating their MIS/record.

The appropriate approving authority through the same Credit Risk Grading Form shall approve any subsequent change/revision i.e. upgrade or downgrade in credit risk grade.’

EARLY WARNING SIGNALS (EWS):

Early Warning Signals (EWS) indicate risks or potential weaknesses of an exposure requiring monitoring, supervision, or close attention by management. If these weaknesses are left uncorrected, they may result in deterioration of the repayment prospects in the Bank’s assets at some future date with a likely prospect of being downgraded to classified assets.

Early identification, prompt reporting and proactive management of Early Warning Accounts are prime credit responsibilities of all Relationship Managers and must be undertaken on a continuous basis. Despite a prudent credit approval process, loans may still become troubled. Therefore, it is essential that early identification and prompt reporting of deteriorating credit signs be done to ensure swift action to protect the Bank’s interest.

Irrespective of credit score obtained by any obligor as per the proposed risk grade score sheet, the grading of the account highlighted as Early Warning Signals (EWS) accounts shall have the following risk symptoms.

Marginal/Watch list (MG/WL- 4): if –

Any loan is past due/overdue for 90 days and above.

Frequent drop in security value or shortfall in drawing power exists.

Special Mention (SM – 5): if –

Any loan is past due/overdue for 120 days and above

Major document deficiency prevails (such deficiencies include but not limited to; board resolution for borrowing not obtained, sanction letter not accepted by client, charges/hypothecation over assets favoring bank not filed with Registrar, Joint Stock Companies, mortgage not in place, guarantees not obtained, etc.)

A significant petition or claim is lodged against the borrower.

The Credit Risk Grading Form of accounts having Early Warning Signals should be completed by the Relationship Manager and sent to the approving authority in Credit Risk Management Department. The Credit Risk Grade should be updated as soon as possible and no delay should be there in referring Early Warning Signal accounts or any problem accounts to the Credit Risk Management Department for their early involvement and assistance in recovery.

CREDIT RISK GRADING REVIEW:

Credit Risk Grading for each borrower should be assigned at the inception of lending and should be periodically updated. Frequencies of the review of the credit risk grading are mentioned below;

| Number | Risk Grading | Short | Review frequency (at least) |

| 1 | Superior | SUP | Annually |

| 2 | Good | GD | Annually |

| 3 | Acceptable | ACCPT | Annually |

| 4 | Marginal/Watchlist | MG/WL | Half yearly |

| 5 | Special Mention | SM | Quarterly |

| 6 | Sub-standard | SS | Quarterly |

| 7 | Doubtful | DF | Quarterly |

| 8 | Bad & Loss | BL | Quarterly |

RATING SYSTEM OF EASTERN BANK LIMITED:

EBL has its own its risk rating methodology. Each corporate and SME client of the bank has their own ratings. It is termed as Obligor Risk Rating (ORR). Once a rating is given it is closely monitored in each quarter/ half yearly to justify its status or for upgrading or downgrading purpose of the same.

Obligor Risk Rating:

The following table provides the rating and the features necessary for the assignment of rating to each of the obligor. It also states the preferred strategy to be followed for the rated clients. Once an obligor is awarded with a rating then it is reviewed on a quarterly basis. All the clients are closely monitored to see whether there are any violations of the conditions and covenants, deterioration of security, all the performance parameters are reviewed be the respective credit officer based on the quarterly report named ‘portfolio review’ and other excerpts as necessary. Then he recommends the rating to higher authority and if those are approved the new ratings are assigned to each client.

| RATING | Short | No | CRITERIA | STRATEGY |

| GOOD | GD | 1 | Growing Industry (Growth 15%+) Among top 20 in the Industry Strong management with succession Steady growth in financial performance Satisfactory payment record/account turnover Liquidity 3X and above Leverage 0.5X and below Timely submission of financial information Strong Parent/Sister Office Guarantee Good collateral OR 100% cash covered | Retain and grow with client Sell multi products |

| ACCEPTABLE | ACCEP | 2 | Growing Industry (Growth 10%+) Acceptable player in the market Good management with succession Acceptable growth in financial performance Satisfactory payment record/account turnover Liquidity 1.5X and above Leverage 1.5X and below Timely submission of financial information Acceptable Parent/Sister Office Guarantee Acceptable collateral | Retain and grow with client Sell multi products |

| MARGINAL/WATCHLIST

| MG/WL | 3 | Problem in Industry Loosing market share Thin management with no succession Unreliable sales/operating profit. Unsatisfactory payment record/account turnover Liquidity below 1X High Leverage Perpetual delay in submission of financial information Incomplete Loan Documentation Drop in collateral value or collateral shortfall Past due over 60 days | No increase in credit limit Close monitoring thru clear action plan Ensure 100% completion of loan doc. Semi-annual review Follow up for settlement of past dues

|

| RATING | Short | No | CRITERIA | STRATEGY |

| SPECIAL MENTION | SM | 4 | Problem in Industry Loosing market share Severe management problem Company operating at losses with sales going down. Unsatisfactory payment record/account turnover Liquidity below 1X / insufficient cash flow High Leverage Financial Information not available Incomplete Loan Documentation Drop in collateral value or collateral shortfall Diversion of fund Past due over 90 days

| Possible exit/reduction of credit limit Close monitoring thru clear action plan Ensure 100% completion of loan doc. Quarterly review Follow up for settlement of past dues |

| SUB STANDARD | SS | 5 | All criteria of Special Mention Past due over 180 days

| Credit limit for adjustment purpose Clear exit plan to be in place Quarterly review Follow up for settlement of past dues

|

| DOUBTFUL | DF | 6 | All criteria of Substandard Client out of business Past due over 270 days

| Credit limit for adjustment purpose Quarterly review Follow up for settlement of past dues Legal action

|

| BAD & LOSS | BL | 7 | All criteria of Doubtful Past due over 360 days

| Credit limit for adjustment purpose Quarterly review Follow up for settlement of past dues Legal action |

Recently Bangladesh Bank has provided a circular mentioning the classification category for the SME sector vide BRPD circular no 20, dated December 20, 2005 (to be implemented from April 2006) in which it has proposed the following category:

- Superior (SUP)

- Good (GD)

- Acceptable (Acceptable)

- Marginal/ watch list (MG/WL)

- Special Mention Account (SMA)

- Substandard (SS)

- Doubtful (DF)

- Loss (BL)

The original circular is provided in the appendix section of the report.

Findings & Conclusion:

FINDINGS:

Eastern Bank Limited follows a Credit Risk Management Practice that complies with the rules and regulation set by Bangladesh Bank. Eastern Bank has set extensive procedures both at the pre-sanction stage of credit proposal assessment and also at the post –sanction stage. The procedures are transparent, accountable and decentralized in such manner that they ensure maximum effectiveness in risk assessment of credit proposal. Thorough analysis of eastern Bank’s credit assessment procedure and extensive interpretation of Bangladesh Bank circulars regarding credit assessment and risk grading procedure helped in the comparison of the two systems. Eastern Bank’s process hardly deviates from that dictated by Bangladesh Bank.

- Bangladesh Bank credit risk management policies requires bank to set lending guidelines which EBL does and reviews on annual basis. As per BB requirement it is set by top management.

- EBL’s detailed product definition shows that each product falls under Bangladesh Bank broad classification of loan products.

- Eastern bank Limited follows the BB guideline regarding discouraged lending activities and also in addition they have a list of the discouraged business of their own.

- The Bank tries to adhere to the prudential guidelines regarding approval authority set by Bangladesh bank as perfectly as possible.

- Eastern Bank’s organization structure and delegation of responsibility is in line with the structure proposed by Bangladesh Bank.

- Bangladesh Bank requires all commercial banks to use risk grade score card for risk assessment of credit proposals. The Credit Risk Grading matrix allows application of uniform standards to credits to ensure a common standardized approach to assess the quality of individual obligor, credit portfolio of a unit, line of business, the branch or the Bank as a whole. The Credit Risk Grading scale consists of 8 categories which can be broadly classified into two categories that of acceptable and non-acceptable credit proposals. EBL’s obligor risk rating system has 7 categories, each of which is a reflection of the scales provided under CRG, except with that of Superior Credit. EBL’s rating starts from good. The criteria for rating matches more or less with that of CRG only in EBL’s case the outlook is more conservative.

RECOMMENDATION:

EBL’s approach to credit is more conservative than that proposed by Bangladesh Bank. Although this approach might seem more prudent, however in face of increasing competition from new generation banks, EBL needs carry out the following:

- Develop more customized parameters for credit approval process under the general guidelines of Bangladesh Bank to increase its market.

- Data used for assessment of credit proposals should be checked for authenticity and accuracy.

- CRG score depends heavily on the financial data provided by potential borrower. Therefore steps should be taken to make those data more reliable.

- EBL’s RM should be more aware of manipulative qualitative data than business development. There should be procedures and parameters to identify and eliminate such manipulation.

- Continuous improvement of the lending procedure would reduce the default risk of the bank and increase its profitability.

CONCLUSION :

Bangladesh’s banking system is heavily affected by bad loans. This not only makes bank more conservative, contracts the lending system, it discourages investment. As a result growth of the economy is impeded. One major reason for default loan is banks’ ineffectiveness of assessing credit risk of a proposed investment. With time, Bangladesh Bank has set rules and general guidelines to help bank assess risk and mitigate their credit risk. In spite of that many banks fail to attract good credit and run profitably. Thus it is not only the guidelines provided by Bangladesh Bank that a commercial lending institution need to follow but it own lending policies should be in place to ensure maximum effectiveness of credit assessment. With this perspective in mind the report has attempted to analyze the lending procedures of Eastern Bank especially in the SME sector and check whether it complies with that of Bangladesh Bank. In doing so the standard operating procedures of the bank have been delineated in details along with a case study to present a picture of the operation carried out in the field. The report has also discussed banks procedures for managing its non-performing loans and loan classification procedures and cross checked those with the central bank guidelines. The newly proposed Credit Risk Grading Score sheet by Bangladesh Bank has also been discussed in the report with Eastern bank’s very own risk rating system. Above all, the report provides a detailed discussion of some the crucial issues of credit risk management and tries to focus on the practice of Eastern Bank Limited in this regard under the regulatory framework prevailing in the country. The report finds that EBL not maintains its guidelines and procedures in compliance with the Bangladesh bank directives but has a more conservative look to credit risk than that required by Bangladesh Bank. This conservative approach has its pros and cons. Therefore some suggestions has been made at the end to increase the profitability of the bank while still maintaining its appreciative position in credit risk assessment.