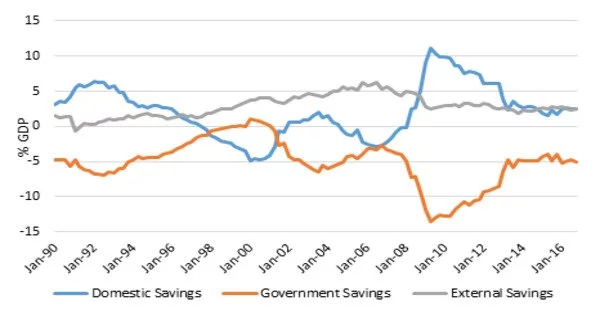

Sectoral balances refer to the accounting identities that describe the relationships between the three main sectors of an economy: the government sector, the private sector, and the foreign sector. It is also known as sectoral financial balances, are a sectoral analysis framework developed by British economist Wynne Godley for macroeconomic analysis of national economies. The sectoral balances are based on the fundamental principle of double-entry accounting, where every transaction has both a debit and a credit.

Sectoral analysis is based on the understanding that when the government sector has a budget deficit, the non-government sectors (private domestic, and foreign) must have a surplus, and vice versa. In other words, if the government sector is borrowing, the rest of the economy must be lending. The balances represent an accounting identity created by rearranging the aggregate demand components, demonstrating how the flow of funds affects the financial balances of the three sectors.

Explanation

The government sector’s balance is the difference between its spending and its tax revenue. If the government spends more than it receives in taxes, it runs a budget deficit. If the government spends less than it receives in taxes, it runs a budget surplus.

The private sector’s balance is the difference between its income and its spending. If the private sector spends more than its income, it runs a deficit. If the private sector spends less than its income, it runs a surplus.

The foreign sector’s balance is the difference between its exports and its imports. If a country exports more than it imports, it runs a trade surplus. If a country imports more than it exports, it runs a trade deficit.

The sectoral balances must add up to zero: Government balance + Private sector balance + Foreign sector balance = 0. In other words, the deficits of one sector must be offset by the surpluses of the other sectors.

This roughly corresponds to the Balances Mechanics developed by Wolfgang Stützel in the 1950s. Scholars at the Levy Economics Institute use the approach to support macroeconomic modeling, and Modern Monetary Theorists use it to illustrate the relationship between government budget deficits and private saving.

Importance

Sectoral balances are important for understanding how an economy functions and how changes in one sector can affect the others. For example, if the government runs a budget deficit, it may stimulate economic growth, but it will also increase the trade deficit or decrease the private sector’s savings. Understanding the sectoral balances can help policymakers make informed decisions about fiscal and monetary policy.