CREDIT RATING ON IFIC BANK LIMITED:

| Long Term | Short Term | |

| Surveillance Rating 2008 | A | ST – 2 |

| Entity Rating – 2007 | A | ST – 3 |

| Outlook | Stable | |

| Date of Rating | June 29, 2009 | |

Credit Rating Information and Services Limited (CRISL) has assigned A (pronounced as single A) rating in the long term and ST – 2 in the short term to International Finance Investment and Commerce (IFIC) Bank Limited for the year 2008. The above rating has been given in consideration of the Bank’s good fundamentals such as good capital adequacy, good financial performance, sound liquidity position, increasing trend in market share and decreasing trend in NPL. However, the above has been constrained, to some extent, by high loan deposit ratio, decline in internal capital generation ratio and dependence on term deposits. Bank/ Financial Institutions rated in this category are adjudged to offer adequate safety for timely repayment of financial obligations. This level of rating indicates a corporate entity with an adequate credit profile. Risk factors are more variable and greater in periods of economic stress than those rated in the higher categories. The short term rating indicates high certainty of timely payment. Liquidity factors are strong supported by good fundamentals and the risk factors are very small.

Credit Rating Information and Services Limited (CRISL) also viewed the bank with “stable outlook” on the basis of its consistent increase in operational efficiency.

Mentionable that the above ratings were based on the position of the bank as of December 31, 2008 and the date of rating by CRISL was June 29, 2009.

Technology:

Since the beginning of its journey as a commercial bank in 1983, IFIC Bank has been giving great emphasis on the adoption of modern technology. It became the pioneer in the field of automation by introducing computerized branch banking right in the same year. Subsequently, all the branches were brought under similar automated platforms with upgraded software applications to offer all the critical banking features. At present all 65 domestic branches are fully computerized under networked environment.

The Bank has taken up a new project with Misys International Banking System Inc. (UK) to further upgrade its banking operation to state-of-art world class on-line banking solutions to provide faster and even more convenient centralized services to the clients.

Besides, the Bank is also operating fully on-line Automated Teller Machine (ATM) services under the banner Q-Cash at a number of locations in Dhaka and Chittagong. The ATM facilities are available to the customers at Q-Cash booth.

Since the importance of Web presence in the Internet is absolutely critical, IFIC Web Site www.ificbankbd.com has long been launched for the convenience of the customers, where all the activities and information are constantly being posted and updated. A Central Mailing System is operational at the Head Office to let the customers have direct electronic access to the selected staff.

Nature of the Loan:

Bank advances loans for short, medium and long terms. The term of the loan is determined on the basis of gestation period of a project and generation of income by use of the loan.

Nature of Loan at a glance

| Loan Type | Short Term ( up to 1 year) | Medium Term (over 1year to 5 years) | Long Term (over 5 years ) |

| Name of Loan | Cash Credit Hypothecation, LTR,PAD,SOD,L/C

| SOD work Order,PLS,CCS,Car Loan,Doctors Credit Scheme,Small Loan | General Loan, HouseBuilding Loan, Staff Loan , Lease Finance. |

Here

LTR=Loan against Trust Receipt L/C=Letter of Credit

PLS=Personal Loan Scheme PAD=Payment against Documents

CCS=Consumer Credit Scheme SOD=Secured Overdraft

Types of Borrowers :

A borrower should be legally competent to enter into a contract, as borrowing is a contract between the lender and the borrower. Minors, lunatics, drunkards and insolvents cannot enter into a valid contract and cannot, therefore, be entertained as borrowers. Before entertaining an application for loans and advances, banker should verily borrowers’ capacity to contract and, his power to borrow, so as to effectively charge the security offered as a cover for the advances.

There are certain conditions to be fulfilled by the consumer to apply for the loan. Consumer should be eligible to apply for a loan. Service person get loan only when the retirement date must be after the date of expiry of loan. The target customer of the Bank is all people. Business, service, doctors, suppliers, contractors are he customers. Now it can be classified into four types:

Types of Borrower at a glance

| SI No.

| Borrowers

| Name of the Loan

| %

|

| 1.

| Business

| General Loan, Cash Credit (CC) Hypothecation, Packing Credit, LTR (Loan against Trust receipt), PAD (Payment against document). Lease Finance, Small Loan, Letter of Credit

| 50

|

| 2.

| Service

| Personal Loan

| 5

|

| 3.

| Both

| HouseBuilding Loan, Consumer Credit Scheme, Car Loan

| 20

|

| 4.

| Others (Doctors, Suppliers, Contractors, Deposit holders. Staff and Executive)

| Doctors Credit Loan, Secured Overdraft, Staff Loan

| 25

|

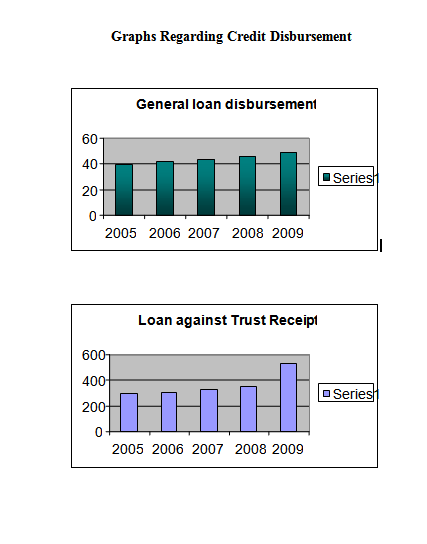

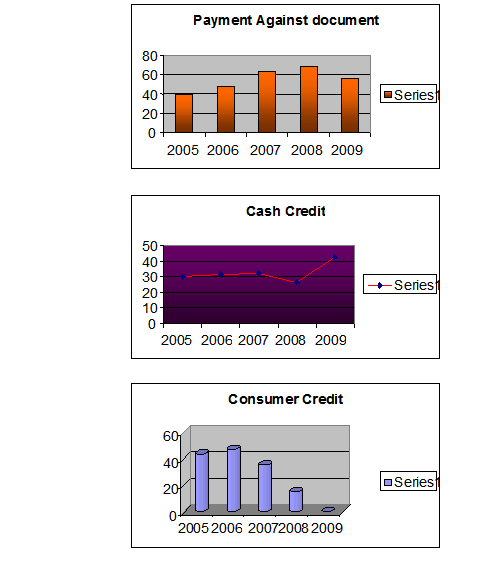

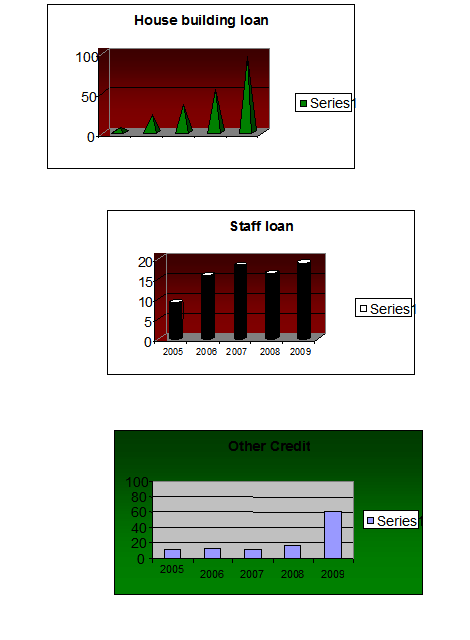

Disbursement Situation of Different Types of Loan:

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

| General Loan Disbursement | 39..58 | 41.57 | 43.89 | 45.48 | 48.83 |

| Loan against Trust Receipt | 290.46 | 304.32 | 326.73 | 348.27 | 533.70 |

| Payments against Documents | 39.45 | 47.54 | 63.98 | 68.07 | 56.53 |

| Cash Credit (HYPO) | 29.9 | 31.7 | 32.58 | 26.7 | 42.7 |

| Consumers Credit | 43.57 | 47.23 | 35.47 | 15.26 | 000 |

| HouseBuilding Loan | 6.38 | 22.01 | 34.29 | 52.91 | 94.027 |

| Staff Loan | 9.13 | 15.85 | 18.47 | 16.44 | 19.09 |

| Other Credit Scheme | 11.98 | 13.07 | 11.07 | 17.07 | 60.71 |

Disbursement Situation:

The bank has many loans from the beginning of the bank. The total disbursement of loans within 2006 to2009 from this bank is given below

| Year | 2006 | 2007 | 2008 | 2009 |

| Total no of Loan | 17438.9 | 21366.73 | 37793.89 | 20536.26 |

Funded and Non-Funded Loan:

Mercantile bank Limited offers more type of funded loan than Non-funded loan. But disbursement, non-funded loan more disburse than funded loan.

| Name of Loan | 2007 | 2008 | 2009 |

| Funded | 1309.45 | 1621.16 | 1420.59 |

| Non-funded | 1109.21 | 918.27 | 903.27 |

Figure: Trends of Funded and Non-funded Loan

The above figure shows that no of non-funded loan which includes letter of credit and bank guaranty is always more than no of funded loan. Through this data it can be said that the bank is better in performing its foreign exchange division as most of the non-funded loan is comprised of letter of credit.

Classification of Loans and Advances:

The management of the institution as well as their supervising authority i.e. the Central Bank evaluates the assets of the institution keeping in view the aforesaid aspects. This evaluation at stipulated intervals is called “Classification of Advances”. It is in fact, placing all loans and advances under pre-determined different heads/ classes based on the depth of risk each and every loan has been exposed to and to bring discipline in financial sector so far risk elements concerned in credit portfolio of banks.

At present loans and advances are classified under three heads according to degree of risk element involved these are-

- Sub-standard

- Doubtful

- Bad

1.Substandard: A loan value of which is impaired by evidence that the borrower is unable to repay but where there is a reasonable prospect that the loan’s condition can be improved is considered as substandard.

2. Doubtful: A loan is doubtful when its value is impaired by evidence that it is unlikely to be repaid in full but that special collection efforts might eventually result in partial recovery.

3. Bad: A loan is considered as bad when it is very unlikely that the loan can be recovered.

Good loans are classified as un-classified loans. Naturally depth of risk is more in doubtful or bad loans than unclassified ones.

Figure: Status of Classified Loan

CHAPTER-V

CONCLUDING PART

- Literature Review

- Analysis and Results

- Interpretation of the Results

- Recommendation

- Rectify the Existing Problems

- Implementation

- Conclusion

Literature Review

To find out the various aspects related with measuring credit worthiness of the potential borrowers in IFIC Bank. Literature is conducted through searching published books and journals, financial statement, data from bank website.

With better understanding of the borrower’s credit worthiness, bank can determine the actions required .They can identify their own strengths weaknesses, where they stand for their goal and chart out path future progress and improvement.

Credit worthiness of the potential borrowers can help to loan disbursement.

Analysis and Results:

For analysis of the study multiple regression model especially stepwise regression analysis has been adopted .For the purpose of regression analysis, twenty four variables have been taken. The simple regression models that have been drawn can be expressed as the following:-

Y=bO +b1X1+b2X2+b3X3+…………..+bnXn

The above multiple regression models have been fitted using the data collected through survey on thirty borrowers of IFIC Bank. The statistical package SPSS version 15.00 has been used for necessary calculation.

Interpretation of the results:-

INT=f(X1,X2,X3,X4,X5,X6,X7,X8,X9,X10,X11,X12,X13,X14,X15,X16,X17,X18)

X1=Purpose of loan

X2=Repayment period

X3=Interest rate

X4=No of installment

X5=Penalty rate

X6=Amount of loan

X7=Repayment

X8=Overdue

X9=Outstanding

X10=Occupation

X11=Age

X12=Education

X13=District

X14=Family size

X15=Co applicant

X16=Gender of the applicant

X17=Net worth

X18=Loan rationing

Dependent Variable: Interest rate

I=f(X1,X2…………….Xn)

Here n=18

INT=6.581+(-.017)X1+.297X2+(-.026)X3+.068X4+.103X5+1.301X6+(-.510)X7+(-.027)X8+(-.050)X9+(-.088)X10+(-.o19)X11+.002X12+.111X13+.092X14+.535X15+(-.026)X16+.250X17+(-.483)X18

6.581 is a constant rate.X1 is negatively related with interest rate. If interest rate is increased then X1 is decreased by -1.7%.X2 is positively related and it is increased with interest rate by 29.7%. X3,X7,X8, X9,X10,X11,X16 and X16 are also negatively related with interest rate and if interest rate is increased then these variables are decreased and if interest rate is decreased then these variables are increased.X4,X5,X6,X12,X13,X14,X15 and X17 are positively related with interest rate and it is increased with interest rate.

Dependent variable: loan rationing

Loan rationing=f(X1, X2, X3,…………….Xn )

Here n=19

loan rationing=1.00+(2.66E-014)X1+(8.01E-016)X2+(1.83E-015)X3+(-2.57E-015)X4+(-1.14E-014)X5+(-1.10E-014)X6+(-9.57E-015)X7+(-4.53E-014)X8+(9.07E-015)X9+(-1.31E-015)X10+(-2.36E-016)X11+(2.10E-016)X12+(8.70E-017)X13+(-2.08E-015)X14+(7.28E-015)X15+(2.37E-014)X16+(-8.52E-015)X17+(2.837)X18+(-2.839E)X19

Here 1.oo is constant rate. And X1,X2,X3,X9,X12,X13,X15,X16,X18 are positively related with loan rationing and X4,X5,X6,X7,X8,X10,X11,X14,X17,X19 are negatively related with loan rationing.

Recommendation:advantage and to deliver quality service, top management should to modify the services.

Rectify the Existing Problems:

As there is no classified loan, branch should monitor the loans & advances closely to avoid classification in future.

Dhanmondi Branch should extend with their all out effort to increase the credit portfolio and to procure more low cash deposit, increase non funded business so as to minimize dependency on interest earning from IFIC Bank general account and to improve overall business performance of the branch to maintain earning.

Dhanmondi Branch should set up more CC camera in the branch to hold more control of manager in the branch. It can install CC camera in accounts department and clearing department as it is an important past of the branch and it is not always possible for the manager to visit all departments which has become important.

Dhanmondi Branch can contact with the existing customers to make the dormant accounts operative.

When a joint stock company comes to open an account if it’s an existing one, the account opening officer should ask the copies of the Balance Sheet and Income Statement. These will reflect the financial growth of the company and its soundness but in practice bank do not do this. If they have all these that will help them to examine money laundering risk.

There are numbers of new private banks and some have already activated with their extended customer service pattern in a completely competitive market. Where as IFIC Dhanmondi branch is far behind. They are not competitive in customer service because the officers do not behave in professional manner in fort of customer. Some time they are late in there service, which ultimately disturbs the respective customer.

Dhanmondi branch personnel should train up about all sort of information regarding SWIFT and its service. Due to lack of proper knowledge about the operation procedures and services provided to the customers by SWIFT, certain customers are facing problem, as they have to wait for certain time to get service as there was one officer know about the procedure of SWIFT. He is not fully independent of handling SWIFT. Official training is the solution to this problem. For customer’s convenience in Foreign Exchange Department of IFIC Bank Ltd. should provide more personnel to deliver faster services to their honorable customer.

Now a day conventional banking concept is outmoded. Now banks are offering more ancillary services like credit card, online services and many others. IFIC Bank Ltd. should differentiate its services through adopting the modern facilities and implementing in the branch level.

To deliver quality service top management of this breach should try to mitigate the gap between customer’s expectation and employee’s perception and customer’s convenience should give priority.

Administrative cost of this branch is on the high side, which has a major impact on profitability. Te manager should bring down the administrative cost and take all effective steps, strategy and action plan to reduce the cost at the desired level.

IFIC Bank should always monitor the performance of its competitors in the field of Foreign Trade.

Without proper knowledge in different laws, rules which set by Bangladesh Bank efficiency of employees cannot be optimize. Bank can arrange training program on these subjects and can test its employees which will improve their qualities.

IFIC Bank Ltd. should focus on their promotional activities. They should also focus on the marketing aspects to let customers know about their products and offerings and more promotion is should be given to attract new customer.

IFIC Bank Ltd. must develop electronic banking system to moderate the service. Technological advantage of a bank ensuring its competitive edge in the market place which can only be achieved by improved technology, efficient manpower and better services. If bank get more market share through all these than it will reduce operating cost and generate new revenue. The bank can offer to its customer better service if all of its departments are computerized and incorporated under local area network (LAN).

Without using modern technology no bank can even think of remaining in the business in near future. So the bank must decide right now how it can equip its branches with modern technology. Use of modern technology in one sense can increase cost but another sense it increase higher productivity and it attract big clients. It can introduce ATM service again in all branches which will bring speed in banking services.

Bank is providing both internal and external training for the officers but bank should be scrupulous about the training facilities so that officials can implicate this in their job. People are very choosy about environment now a day, so bank premises should be well decorated and IFIC Bank Ltd. should look into the matter very seriously as well. Side by side it will give customers better felling about the bank.

Implementation:

Some other important factors that should be focused on the development process:

- Time consumed at service level should be minimized at optimum level.

- Evaluate customer’s needs from their perspective and explain logically the shortcomings.

- Customer’s convenience should receive priority over other.

- Improve office atmosphere to give customers better feeling.

- Use of effective management information systems.

- Use appropriate techniques in evaluating customer need professionally.

- To deliver quality service top management should try to mitigate the gap between customer’s expectation and employee’s perception.Comments:

The bank can offer to its customer better service if all of its departments are computerized and incorporated under local area network (LAN).

At the entry position the bank should enroll more expertise people to augment quality services.

Now a days-conventional banking concept is outmoded. Now banks are offering more ancillary services like credit card, on line services and many others. IFIC Bank Ltd. should differentiate its services adopting the modern facilities.

Bank is providing both internal and external training for the officers but bank should be scrupulous about the training facilities so that official can implicate this in their job.

People are very choosy about environment now a day, so bank premises should be well decorated and IFIC Bank Ltd. should look into the matter very seriously.

Bank should provide advances towards the true entrepreneur with reconsidering conventional system of security and collateral, moreover, the whole process should be completed within an acceptable time.

Conclusion:

The Banking sector in any country plays an important role in economic activities. Bangladesh is no exception of that. As because it’s financial development and economic development are closely related. That is why the private commercial banks are playing significant role in this regard. This report focused on and analyzed Operational Performance of IFIC Bank Limited, Dhanmondi Branch. IFIC Bank Limited is a new bank in Bangladesh but its contribution in socio-economic prospect of Bangladesh has the greater significance. Total deposit of IFIC Branch was Tk.50017.96 million as on 31st December 2009, whereas total Loans and Advances were Tk 37793.89 million. Here we observe its deposit figure is not so strong, so the bank should take necessary action for increasing deposit promptly. IFIC attaining offer special deposit scheme with higher benefits, which is a crying need for long-term position in financial market. Because of the entrance of more banks in the financial market, deposits will be spreaded over. So it is high time to hold some permanent customers by offering special deposit scheme otherwise in future amount of deposit may come down. To strengthen the future prospect of branch, it is emergency to collect more deposit. Comparably the IFIC’s local remittance is less than the other banks because of less number of branches. IFIC should extend its branches to become a sustainable financial institution in this country. Yet last year IFIC has obtained second position in CAMEL rating. As a new branch Dhanmondi Branch of IFIC has been able to maintain its recovery position in sector-wise credit financing is up to the satisfactory level. At last it should give more emphasis in this sector to acquire more profit.

APPENDIX A

Regression

Appendix B

Warnings

| For models with dependent variable Interest Rate, the following variables are constants or have missing correlations: Co applicant, Relationship of applicant. They will be deleted from the analysis. |

Variables Entered/Removed (b)

| Model | Variables Entered | Variables Removed | Method |

| 1 | Loan rationing, Outstanding, District, Family Size, Collateral, Personal Guarantee, Net worth, Occupation, Gender of applicant, Purpose of Loan, Repayment, Education, Overdue, Penalty Rate, Amount Proposed, Age, Repayment period, No. of installment(a) | . | Enter |

A Tolerance = .000 limits reached.

B Dependent Variable: Interest Rate

Model Summary

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .952(a) | .906 | .753 | 1.45533 |

a Predictors: (Constant), Loan rationing, Outstanding, District, Family Size, Collateral, Personal Guarantee, Net worth, Occupation, Gender of applicant, Purpose of Loan, Repayment, Education, Overdue, Penalty Rate, Amount Proposed, Age, Repayment period, No. of installment

ANOVA (b)

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 225.651 | 18 | 12.536 | 5.919 | .002(a) |

| Residual | 23.298 | 11 | 2.118 | |||

| Total | 248.948 | 29 |

A. Predictors: (Constant), Loan rationing, Outstanding, District, Family Size, Collateral, Personal Guarantee, Net worth, Occupation, Gender of applicant, Purpose of Loan, Repayment, Education, Overdue, Penalty Rate, Amount Proposed, Age, Repayment period, No. of installment

B. Dependent Variable: Interest Rate

Coefficients (a)

| Model | Un standardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | B | Std. Error | ||

| 1 | (Constant) | 6.581 | 8.345 | .789 | .447 | |

| Purpose of Loan | -.017 | .759 | -.007 | -.022 | .983 | |

| Repayment period | .297 | .541 | .165 | .549 | .594 | |

| No. of installment | -.026 | .067 | -.186 | -.393 | .702 | |

| Penalty Rate | .068 | .605 | .019 | .112 | .913 | |

| Personal Guarantee | .103 | .369 | .045 | .280 | .785 | |

| Collateral | 1.301 | .259 | .957 | 5.018 | .000 | |

| Repayment | -.510 | 1.411 | -.099 | -.362 | .724 | |

| Overdue | -.027 | .272 | -.016 | -.099 | .923 | |

| Outstanding | -.050 | .267 | -.024 | -.188 | .854 | |

| Occupation | -.088 | .117 | -.115 | -.747 | .471 | |

| Age | -.019 | .060 | -.062 | -.311 | .761 | |

| Education | .002 | .085 | .004 | .027 | .979 | |

| District | .111 | .189 | .080 | .589 | .568 | |

| Family Size | .092 | .480 | .034 | .191 | .852 | |

| Gender of applicant | .535 | .991 | .079 | .540 | .600 | |

| Net worth | -.026 | .620 | -.007 | -.042 | .967 | |

| Amount Proposed | .250 | .889 | .061 | .281 | .784 | |

| Loan rationing | -.483 | 3.849 | -.015 | -.125 | .902 | |

A. Dependent Variable: Interest Rate

Excluded Variables (b)

| Model | Beta In | t | Sig. | Partial Correlation | Co linearity Statistics | ||||||

| Tolerance | Tolerance | Tolerance | Tolerance | Tolerance | |||||||

| 1 | Amount of loan | .(a) | . | . | . | .000 | |||||

| Amount Sanction | .(a) | . | . | . | .000 | ||||||

A. Predictors in the Model: (Constant), Loan rationing, Outstanding, District, Family Size, Collateral, Personal Guarantee, Net worth, Occupation, Gender of applicant, Purpose of Loan, Repayment, Education, Overdue, Penalty Rate, Amount Proposed, Age, Repayment period, No. of installment

B. Dependent Variable: Interest Rate

Variables Entered/Removed (b)

| Model | Variables Entered | Variables Removed | Method |

| 1 | Amount Sanction, Education, Interest Rate, Repayment period, Net worth, Age, Gender of applicant, Outstanding, District, Overdue, Personal Guarantee, Occupation, Penalty Rate, Family Size, Repayment, Purpose of Loan, Collateral, No. of installment, Amount Proposed(a) | . | Enter |

A. Tolerance = .000 limits reached.

B. Dependent Variable: Loan rationing

Model Summary

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 1.000(a) | 1.000 | 1.000 | .00000 |

A. Predictors: (Constant), Amount Sanction, Education, Interest Rate, Repayment period, Net worth, Age, Gender of applicant, Outstanding, District, Overdue, Personal Guarantee, Occupation, Penalty Rate, Family Size, Repayment, Purpose of Loan, Collateral, No. of installment, Amount Proposed

ANOVA (b)

| Model | Sum of Squares | D f | Mean Square | F | Sig. | |

| 1 | Regression | .242 | 19 | .013 | . | .(a) |

| Residual | .000 | 10 | .000 | |||

| Total | .242 | 29 |

A. Predictors: (Constant), Amount Sanction, Education, Interest Rate, Repayment period, Net worth, Age, Gender of applicant, Outstanding, District, Overdue, Personal Guarantee, Occupation, Penalty Rate, Family Size, Repayment, Purpose of Loan, Collateral, No. of installment, Amount Proposed

B. Dependent Variable: Loan rationing

Coefficients (a)

| Model | Un standardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | B | Std. Error | ||

| 1 | (Constant) | 1.000 | .000 | . | . | |

| Penalty Rate | -1.14E-014 | .000 | .000 | . | . | |

| Purpose of Loan | 2.66E-014 | .000 | .000 | . | . | |

| Repayment period | 8.01E-016 | .000 | .000 | . | . | |

| Interest Rate | 1.83E-015 | .000 | .000 | . | . | |

| No. of installment | -2.57E-015 | .000 | .000 | . | . | |

| Personal Guarantee | -1.10E-014 | .000 | .000 | . | . | |

| Collateral | -9.57E-015 | .000 | .000 | . | . | |

| Repayment | -4.53E-014 | .000 | .000 | . | . | |

| Overdue | 9.07E-015 | .000 | .000 | . | . | |

| Outstanding | -1.31E-015 | .000 | .000 | . | . | |

| Occupation | -2.36E-016 | .000 | .000 | . | . | |

| Age | 2.10E-016 | .000 | .000 | . | . | |

| Education | 8.70E-017 | .000 | .000 | . | . | |

| District | -2.08E-015 | .000 | .000 | . | . | |

| Family Size | 7.28E-015 | .000 | .000 | . | . | |

| Gender of applicant | 2.37E-014 | .000 | .000 | . | . | |

| Net worth | -8.52E-015 | .000 | .000 | . | . | |

| Amount Proposed | 2.839 | .000 | 22.177 | . | . | |

| Amount Sanction | -2.839 | .000 | -22.286 | . | . | |

A. Dependent Variable: Loan rationing

Excluded Variables (b)

| Model | Beta In | T | Sig. | Partial Correlation | Collinearity Statistics | ||||||

| Tolerance | Tolerance | Tolerance | Tolerance | Tolerance | |||||||

| 1 | Amount of loan | .(a) | . | . | . | .000 | |||||

a Predictors in the Model: (Constant), Amount Sanction, Education, Interest Rate, Repayment period, Net worth, Age, Gender of applicant, Outstanding, District, Overdue, Personal Guarantee, Occupation, Penalty Rate, Family Size, Repayment, Purpose of Loan, Collateral, No. of installment, Amount Proposed

b Dependent Variable: Loan rationing

Appendix-C

APPENDIXD

DEPOSITE RATIO

| 2009 | 2008 | 2007 |

| 83.82% | 80.89% | 79.00% |

| 2009 | 2008 | 2007 |

| 16.18% | 19.11% | 21.00% |

| 2009 | 2008 | 2007 |

| 89.12% | 91.84% | 85.22% |

| 2009 | 2008 | 2007 |

| 47.46% | 43.80% | 54.68% |

| 2009 | 2008 | 2007 |

| 65.41% | 61.42% | 60.26% |

| 2009 | 2008 | 2007 |

| 12.62% | 14.51% | 16.02% |

LOAN & ADVANCES RATIOS:

| 2009 | 2008 | 2007 |

| 50.77% | 52.11% | 57.56% |

| 2009 | 2008 | 2007 |

| 49.23% | 47.89% | 42.44% |

| 2009 | 2008 | 2007 |

| 65.81% | 73.92% | 72.35% |

| 2009 | 2008 | 2007 |

| 79.33% | 77.94% | 80.13% |

| 2009 | 2008 | 2007 |

| 36.47% | 39.50% | 43.44% |

| 2009 | 2008 | 2007 |

| 35.36% | 36.29% | 32.03% |

| 2009 | 2008 | 2007 |

| 58.39% | 70.81% | 75.26% |

| 2009 | 2008 | 2007 |

| 293.34% | 275.44% | 208.76% |

INTEREST PAID OR COST OF SERVICES:

| 2009 | 2008 | 2007 |

| 0.41% | 0.50% | 0.84% |

| 2009 | 2008 | 2007 |

| 30.36% | 29.16% | 26.04% |

| 2009 | 2008 | 2007 |

| 0.35% | 0.40% | 0.66% |

| 2009 | 2008 | 2007 |

| 4.91% | 5.57% | 5.47% |

| 2009 | 2008 | 2007 |

| 6.57% | 6.75% | 10.77% |

| 2009 | 2008 | 2007 |

| 93.43% | 93.25% | 89.23% |

REVENUES:

| 2009 | 2008 | 2007 |

| 14.29% | 10.75% | 10.25% |

| 2009 | 2008 | 2007 |

| 2.49% | 4.34% | 5.02% |

| 2009 | 2008 | 2007 |

| 85.52% | 72.93% | 73.48% |

| 2009 | 2008 | 2007 |

| 14.48% | 27.07% | 26.52% |

INTEREST PAID VS CHARGED:

| 2009 | 2008 | 2007 |

| 4.94% | 6.55% | 10.82% |

| 2009 | 2008 | 2007 |

| 414.89% | 243.86% | 248.53% |

| 2009 | 2008 | 2007 |

| 4.22% | 4.78% | 7.95% |

| 2009 | 2008 | 2007 |

| 60.07% | 66.01% | 65.92% |

| 2009 | 2008 | 2007 |

| 75.17% | 97.05% | 100.54% |

| 2009 | 2008 | 2007 |

| 444.04% | 261.52% | 278.52% |

| 2009 | 2008 | 2007 |

| 64.29% | 70.78% | 73.88% |

TURNOVER RATIOS & PERODS:

| 2009 | 2008 | 2007 |

| 103.73% | 97.62% | 96.81% |

(days)

| 2009 | 2008 | 2007 |

| 347.0385562 | 368.7751834 | 371.8537269 |

PROFITABILITY / EFFICIENCY RATIO:

| 2009 | 2008 | 2007 |

| 2.18% | 1.79% | 1.58% |

| 2009 | 2008 | 2007 |

| -0.36% | 0.66% | 0.71% |

| 2009 | 2008 | 2007 |

| 1.82% | 2.45% | 2.30% |

| 2009 | 2008 | 2007 |

| -4.14% | -4.96% | -5.04% |

| 2009 | 2008 | 2007 |

| 6.09% | 6.14% | 6.06% |

Bibliography:

In this report the overall considerations of IFIC Bank Limited has been discussed. I have collected this information from the following sectors:

S.N. Maheshwari, 2006, “Kalyani’s Banking Law and Practices”- (11th Edition), Xpress Grafics.

Roger LeRoy Miller, David Van House, “Money, Banking and Financial Markets” – (2nd Edition), Thomson south-western

ourt Collage Publishers

Eugene F. Brigham, Michael C. Ehrhardt, “International Financial Management” – (10th Edition), Thomson south-western

Ministry of Finance (MOF), Government of Bangladesh (GOB). (1998-99, 1999-2000), Activities of Bank Financial Institutions.

“Bank Company law”, 1991, Bangladesh Bank.

Annual Report of Bangladesh Bank 2005-2009

Annual Report of IFIC 2005-2009

Comparative Banking Lecture Sheet.