1.1 Scene behind the study

Banks play an important role in the development of a country. Bangladesh Government and Central Bank developed implemented different rules and regulation on behalf of the healthier economy. World Bank also gives his favorable eyes to restructure the bank society.

‘BBA – for 21st centuries banking’ is the most dynamic innovation for the new millennium. This internship program is part of our Academic structure. I have tried my best in be oriented with the practice of banking in real life.

Modern Banking plays an important part in promoting economic development of country. Banks provide necessary funds for executing various programs underway in the process of economic development. They collect savings of large masses of people scattered throughout the country, which in the absence of banks of banks would have remained ideal and unproductive. These scattered amounts are collected, pooled together and made available to commerce and industry for meeting the requirements. Economy of Bangladesh is in the group of world’s most undeveloped economies. One of the reasons may be its underdeveloped banking system. Government as well different international organizations have also identified those underdeveloped banking system cause some obstacles to the process of economic development. So, they have highly recommended for reforming financial sector.

Since 1990, Bangladesh Government has taken a lot of financial sector reform measurements for making financial sector as well as banking sector more transparent and formulation and implementations of these reform activities has also been participated by different international organization like World Bank, IMF etc.

In 1996, World Bank published ‘Bangladesh: Agenda for action’ in which it has suggested a lot of recommendations for economic development of our country. These recommendations include special presentation for reforming banking sector. In this agenda, World Bank has suggested to introduce BBA as follows:

‘Professional sings the banking business will generate large, long term pay offs in the form of a more efficient banking system apart from functional and technology related training required at Bangladesh Bank and the commercial banks. Consideration should be given to starting a Bachelor of Business Administration program at ASA University Bangladesh (ASAUB).’

Our high banking official has also felt the importance of having entry level officer who are well educated in banking field. Accordingly, BBA program has been started in earlier of this year. The entire fourth term of this BBA program has been designed for gaining practical knowledge about banking and all the BBA students are required to go to various financial institutions for practical exposure. Having completed practical orientation, all the students are also required to submit a report in their experience.

1.2 Objectives of the study

The primary objective of the study is to attend the course of Practical Orientation in Banks but the objective behind this study is something broader. Objectives of the study are summarized in the following manner:

- To comply with the entire branch banking procedures.

- To make a bridge between the theories and practical procedures of banking day to day operations.

- To analyze the performance of the branch as well as IFIC Bank limited as a whole.

1.3 Significance of the Report

This report is prepared to give a concrete idea about the dealing and transactions of any commercial bank. I believe that my report will help a lot those who want an orientation about banking. Bank management also can be using the information of my observation for their managerial decision if needed.

1.4 Methodology

This report has been prepared on the basis of experience gathering during the period of internship from 16th January 2012 to 16th April 2012. Within this period I visited three department namely General Banking, Advances and Foreign Exchange departments.

Firstly total duration was divided into total working days that come to a total working day of 90 days (3 Months) and were distributed in following manner:

Departments | Duration | Days |

| General Banking | From 16th January to 15th February 2012 | 30 days |

| Advances | From 16th February to 15th March 2012 | 30 days |

| Foreign Exchange | From 16th March to 16th April 2012 | 30 days |

I have worked different kinds of desks. I have collected some data for organize the report. Both primary and secondary data sources were used to generate this repost.

Primary Data Sources:

- Schedule survey

- Informal discussion with professionals

- Observation while working in different desks etc.

Secondary Data Sources:

- Previous internship reports

- Corporate news & letters

- Manuals

- Different publications of Bangladesh Bank

1.5 Structure of the Report

This report has been prepared in different chapter in order to explain my experience in the easiest way. Introduction is presented in the chapter 1, which contains scenes behind the study, objectives of the study, significance of the study & methodology. Second (2nd) Chapter contains about IFIC Bank’s over view and its mission, vision as well as Bank’s operation in detailed, in the chapter 3, I try to focus my knowledge which I gathered from Internship Program, In chapter 4, I focused SWOT Analysis & my recommendation about IFIC Bank Limited and finally in chapter 5, I gave a proper conclusion of IFIC Bank Limited.

1.6 Limitations of the study

Twelve weeks observation and orientation is not enough to be an expert on commercial banking though I have been received the maximum assistance from the every individual of the IFIC Bank Mohammadpur Branch. Definitely, I could not produce an outstanding report for the time limitations.

Al though internship program is a practical oriented program, it face some difficulties. The major difficulties I have faced during my period in IFIC Bank LTD, Are as follows:

- Initially, adjustment with the new environment. A sudden change of studentship to a job- like situation is a problem.

- Usually company is not willing to provide their actual data of financial statement for maintaining confidentiality.

- Short time another major problem for a sound internship report. To prepare a report on some issues take much time but in practice we are given a short time.

- Finally, the lack of the depth of my knowledge and he analytical capacity for writing such report is also a shortcoming of this study.

2.1 Portrait of the Bank

International Finance Investment and Commerce (IFIC) Bank Limited started banking operations on June 24, 1983. Prior of that it was set up in 1976 as a joint venture finance company at the instant of the Government of the People’s Republic of Bangladesh. Government then held 49% shares while the sponsors and general public held the rest. The objectives of the finance company were to establish venture Banks finances companies and affiliates abroad and to carry out normal functions of a finance company at home. When the Government decided to open up banking in the privet sector in 1983 the above finance company was converted a full-fledged commercial bank. Along with this, the Government also allowed four other commercial banks, which were, then fully Government owned. While in all these Banks Government is holding normal 5% shares, an exception was made in the case of the Bank. It retained 40% shares of the Bank. The decision by the Government to retain 40% shares in IFIC Bank was in pursuance of the original objectives, namely, promotion of the participation of Government and private sponsor to establish joint venture Banks, financial companies, branches and affiliates abroad.

2.2 Ownership Structure

The sponsors hold ownership of the Bank in the private sector and Government of the People’s Republic of Bangladesh. Sponsors and individuals now own about 62% of the share capital and the Government owns a little more than 38% of the shares.

2.3 Corporate Profile

| Name of the Company | International Finance Investment and Commerce (IFIC) Bank Limited |

| Started Banking Operation | June 24, 1983 |

| Owner of IFIC Bank Limited |

Mr. Salman F. Rahman |

| Company Logo |

|

Legal Form | IFIC Bank Limited was incorporated in Bangladesh and registered with joint stock companies and firms as a public company limited by shares |

| Company Registration Number | 4967, Dated October 08, 1976 |

| Authorized Capital | Tk. 1600 Million |

| Paid up capital | Tk. 671 Million |

| Listing Status | Listed with Dhaka stock Exchange LTD (DSE) and Chittagong stock Exchange LTD (CSE). CSE in 1986 $1995 Respectively |

| Market Category | A Category |

| Tax Payer identification Number TIN | 210-200-0537, LTU, Dhaka |

| Vat Registration Number | 9021077014 |

| Registered Office | BSB Bhabon (17th, 18th & 19th Floor)8 Rajuk Avenue, Dhaka – 1000 Tel: 9563020-29, Fax: 9562015 Email: info@IFICbankbd.com Website: www.IFICbankbd.com |

| Auditors | Howlader Yunus & Company, Chartered Accountants |

| Name of Chairman | Mr. Salman F. Rahman |

| Name of Managing Director | Mr. Mohammad Abdullah |

| Number of Employees | 3152 |

| Number of Branches | 100 |

| Number of Shareholder | 9562 |

2.4 Board of Directors

| Mr. Mohammad Lutfar Rahman | Chairman |

| Mr. Abu Tahir Mohammad Golam Maruf | Director |

| Mr. Murshed murad Ibrahim | Director |

| Mr. Aminul Rahman | Director |

| Mr. Md. Yasin Ali | Director |

| Mr. Didarul Alam | Director |

| Chowdhury Nafeez Sarafat | Director |

| Mr. Gulzar Alam Chowdhury | Director |

| Mr. Tanim Noman Sattar | Director |

| Mr. Mahmudul Huq Bhuiyan | Director |

| Mr. Arastoo Khan | Director |

| Mr. Syed Monjurul Islam | Director |

| Mr. Mohammad Ali Khan | Director |

2.5 List of the Branches of IFIC Bank Limited

Serial No. | Branch Code | Branch Name | Name Code |

1 | 2030 | AGRABAD BRANCH | 0801 |

2 | 2056 | ALANKER MORE BRANCH | ALAN |

3 | 2155 | ASHUGANJ BRANCH | ASGM |

4 | 1197 | ASHULIA BRANCH | ASHU |

5 | 1112 | BAJITPUR BRANCH | BJIT |

6 | 1096 | BANANI BRANCH | BANA |

7 | 6187 | BANESHWAR BRANCH | BNSW |

8 | 1011 | BANGSHAL BRANCH | 0808 |

9 | 1070 | BASHUNDHARA BRANCH | BASH |

10 | 5064 | BARISHAL BRANCH | BARI |

11 | 3138 | BEANI BAZAR BRANCH | BEAN |

12 | 6188 | BELKUCHI BRANCH | BELK |

13 | 4166 | BENAPOLE BRANCH | BENA |

14 | 5202 | BHOLA BRANCH | BHOL |

15 | 1177 | BOARD BAZAR BRANCH | BORD |

16 | 6082 | BOGRA BRANCH | 0812 |

17 | 4067 | BORO BAZAR BRANCH | BORO |

18 | 2034 | BRAHMANBARIA BRANCH | BBAR |

19 | 2054 | CDA AVENUE BRANCH | CDAB |

20 | 6086 | CHAPAI NAWABGANJ BRANCH | CHAP |

21 | 2040 | CHAWK BAZAR BRANCH | CBZR |

22 | 2050 | CHOUMUHANI BRANCH | CHOU |

23 | 2035 | COMILLA BRANCH | COMI |

24 | 2148 | COMPANY GANJ BRANCH | CPNY |

25 | 2044 | COX’S BAZAR BRANCH | COX |

26 | 2157 | CHANDINA BRANCH | CHAN |

27 | 1193 | DANIA BRANCH | DANI |

28 | 1178 | DHAMRAI SME/KRISHI BRANCH | DHAM |

29 | 1006 | DHANMONDI BRANCH | 0814 |

30 | 6083 | DINAJPUR BRANCH | DINA |

31 | 1014 | ELEPHANT ROAD BRANCH | 0810 |

32 | 1023 | FARIDPUR BRANCH | FDP |

33 | 2152 | FATIKCHARI BRANCH | FATK |

34 | 1008 | FEDERATION BRANCH | 0807 |

35 | 2041 | FENI BRANCH | FENI |

36 | 1109 | GHORASAL BRANCH | GHO |

37 | 3151 | GOALA BAZAR BRANCH | GOAL |

38 | 1002 | GULSHAN BRANCH | 0802 |

39 | 2137 | HATHAZARI BRANCH | HATH |

00 | 9900 | HEAD OFFICE | HO |

40 | 1005 | ISLAMPUR BRANCH | 0799 |

41 | 4061 | JESSORE BRANCH | 0811 |

42 | 6058 | JOYPURHAT BRANCH | JOYP |

43 | 4168 | KALIGANJ SME/KRISHI BRANCH | KALI |

44 | 6189 | KASHINA THPUR SME/KRISHI BRANCH | KASH |

Serial No. | Branch Code | Branch Name | Name Code |

45 | 1017 | KAWRAN BAZAR BRANCH | 0816 |

46 | 1195 | KERAIGANJ BRANCH | KERN |

47 | 2031 | KHATUNGANJ BRANCH | 0800 |

48 | 4060 | KHULNA BRANCH | 0804 |

49 | 1121 | KONABARI BRANCH | KONA |

50 | 4062 | KUSHTIA BRANCH | KUSH |

51 | 1025 | LALMATIA BRANCH | LAL |

52 | 2153 | MADAM BIBIR HAT BRANCH | MBHB |

53 | 1118 | MADHABDI BRANCH | MADB |

54 | 1019 | MALIBAGH BRANCH | MALI |

55 | 1013 | MIRPUR BRANCH | MIRP |

56 | 1094 | MOHAKHALI BRANCH | MOHA |

57 | 1001 | MOTIJHEEL BRANCH | 0796 |

58 | 1004 | MOULVI BAZAR BRANCH | 0797 |

59 | 3046 | MOULVI BAZAR BRANCH (DIST.) | MBD |

60 | 1115 | MUKTARPUR BRANCH | MKT |

61 | 1022 | MYMENSINGH BRANCH | MSIN |

62 | 1201 | MOHAMMADPUR BRANCH | MOHD |

63 | 6085 | NAOGAON BRANCH | NAOG |

64 | 1003 | NARAYANGANJ BRANCH | 0798 |

65 | 1110 | NARSINGDI BRANCH | NAR |

66 | 1175 | NAWABGANJ SME/KRISHI BRANCH | NAWB |

67 | 1029 | NAWABPUR BRANCH | 0817 |

68 | 1020 | NAYA PALTAN BRANCH | NAYA |

69 | 1016 | NETAIGANJ BRANCH | NTG |

70 | 4163 | NOAPARA BRANCH | 0815 |

71 | 1028 | NORTH BROOKE HALL ROAD BRANCH | NBHR |

72 | 6084 | PABNA BRANCH | PBNA |

73 | 1027 | PALLABI BRANCH | PLLB |

74 | 1173 | PANCHABOTI BRANCH | PANC |

75 | 4169 | PORADAH BRANCH | PRDA |

76 | 1072 | PRAGATI SARANI BRANCH | PROG |

77 | 6080 | RAJSHAHI BRANCH | 0805 |

78 | 6081 | RANGPUR BRANCH | RANG |

79 | 1198 | RUPGONJ BRANCH | RUP |

80 | 4065 | SATKHIRA BRANCH | 0813 |

81 | 1171 | SAVAR BAZAR BRANCH | SAVR |

82 | 2042 | SHAH AMANAT MARKET BRANCH | SAM |

83 | 1007 | SHANTINAGAR BRANCH | SHAN |

84 | 1092 | SHARIATPUR BRANCH | SHAR |

85 | 2132 | NOZUMIA HAT BRANCH | NOJU |

86 | 6179 | SHETABGONJ SME/KRISHI BRANCH | SHET |

87 | 2045 | SHEIKH MUJIB ROAD BRANCH | SMR |

88 | 3047 | SHIREEMONGAL BRANCH | SMGL |

89 | 1090 | STOCK EXCHANGE BRANCH | STOK |

90 | 3043 | SUBID BAZAR BRANCH | SUBD |

91 | 3033 | SYLHET BRANCH | 0803 |

Serial No. | Branch Code | Branch Name | Name Code |

92 | 1126 | TAKERHAT BRANCH | TKHT |

93 | 1091 | TANBAZAR BRANCH | TANB |

94 | 1076 | TANGAIL BRANCH | TANG |

95 | 2036 | TERRI BAZAR BRANCH | 0809 |

96 | 1174 | TONGI SME/KRISHI BRANCH | TONG |

97 | 3139 | TULTIKAR BRANCH | TULT |

98 | 3049 | UPOSHOHAR BRANCH | UPO |

99 | 1024 | UTTARA BRANCH | 0818 |

2.6 Mission of IFIC Bank Limited

IFIC mission is to provide service to our clients with the help of a skilled and dedicated workforce whose creative talents, innovative, actions and competitive edge make our position unique in giving quality. Service to all institutions and individual that we care for. We are committed to the welfare and economic prosperity of the people and the community. For we drive from them our inspection and drive for onward progress to prosperity. We want to be the leader among banks in Bangladesh and make our indelible make as an active partner in regional banking operation beyond the national boundary.

In an intensely competitive and complex financial and business environment, we particularly focus on growth and profitability of all concerned.

2.7 Vision of IFIC Bank Limited

To be the best private Commercial Bank In Bangladesh and International in terms of efficiency .capital adequacy .asset quality .sound management and profitability having strong liquidity.

2.8 Goals & objectives of IFIC Bank Limited

Maximization of profit through customer satisfaction is the main objective of the Bank, in addition the others relevant objectives are:

- To be market leaders in high quality banking products and services.

- Active excellence in customer service through providing the most modern and Advance state of art technology in the different spheres of banking.

- To participate in the industrial development of the country to encourage the new and educated young entrepreneurs to undertake productive venture and demonstrate their Creativity and there by participate in the national development.

- To provide credit facilities to the small and medium size entrepreneur located in urban and sub urban area and easily accessible by our branches.

- To reduce dependence of moneylender.

- To make the small and medium enterprise self –reliant.

- To develop saving attitude and making acquaintance with banking facilities.

- To inspire for undertaking small projects for creation employment through income.

- To ensure the high return on investment

- To strive for profit and sound growth.

- To play a significant role in the economic development of the country.

- To protect money laundering.

2.9 Five (5) Operations Abroad

Joint Venture

- Bank of Maldives:

In 1983, IFIC Bank set up a joint venture bank named Bank of Maldives Limited (BML). It is the first bank of Maldives. In 1992, as per contract, IFIC Bank hand over the management of BML to Maldives.

- Oman – Bangladesh Exchange:

To facilitate remittance by Bangladeshi in Oman, IFIC bank set up a money exchange company as a joint venture named Oman – Bangladesh Exchange.

Brach Abroad

- Pakistan Branch:

IFIC Bank opens its first overseas branch in Karachi, Pakistan. It opened its second branch at Lahore in Pakistan.

- Nepal Bangladesh Limited:

In December 1993, he Bank got permission to establish a joint venture bank with 50% equity capital in Nepal. The Bank known as, Nepal Bangladesh LTD came into operation in June 1994.

2.10 Capital & Reserves

The Bank started with an Authorized Capital of Tk. 100 million in 1983. Paid up capital at that time stood at Tk. 71.50 million only. Over the last 19 years, the authorized and paid up capital has increased substantially. The paid capital stood at Tk. 406.39 million on December 31, 2001. The Bank has built up a strong reserve base over the years. In last 19 years its Reserves and Surplus have increased overly. As against Tk. 21.20 million only in 1983 Reserve and surplus increased to Tk. 622.53 million in 2001. This consistent policy of building up Reserves has enabled the Bank to maintain a better adequacy ratio as compared to others. With the active support and guidance from the Government, the bank has been showing a steady and improved performance. In its fifteen years operation the bank has earned the status of leading in terms of both business and goodwill starting modest deposit of only Tk. 863.40 million in 1983 the Bank has closed its business with Tk. 17616.68 million of deposit as on December 31, 2001. The annual growth rate has mostly been higher compared to both baking sector growth and individual growth rates achieved by others. AS against a profit of Tk. 21.94 million in 1984, the Bank earned a record profit of Tk. 248.00 million for the year ended in December 2001

2.11 Human Resource (HR) Development

The Bank has a Human Resource (HR) Development & Research Department to develop human resources internally. The academy is equipped with professional library, modern training aids professional faculty and other facility. It is now under personnel & Human Resource Development & Research Division. The Academy conducts regularly foundation courses, specialized courses and seminars on different areas of banking to take care of the professional needs Total man power stood at 1737 as on December 31, 2001.

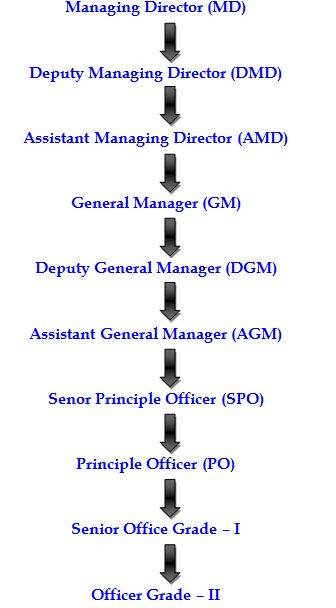

2.12 Organizational Hierarchy of IFIC Bank Limited

2.13 At a Glance of IFIC Bank Limited – Mohammadpur Branch

In December 5, 2011 IFIC started their 98th branch in Ring Road, Mohammadpur with an aim to attain satisfaction of customers by bringing state-of-art and cost-effective banking services at the doorstep of customers.

IFIC Bank’s Chairman of Executive Committee of the Board of Directors Mr. Mohammad Lutfar Rahman inaugurated the branch at Ring Road as the Chief Guest. Member of the Board of Director Mr. Monirul Islam, Managing Director of the Bank Mr. Mohammad Abdullah, Deputy Managing Director (Business) Mr. Mati-ul-Hasan and top executives were also present at the inaugural ceremony.

In 16 January 2012 I started my Internship program in IFIC Bank Limited Mohammadpur

Branch and here I also notify that, this branch is very much new branch and this branch has very few amounts of employees and staff. Although Mohammadpur Branch is a new branch of IFIC but on an average 14 employees are served in this branch. Due to the new branch at present this branch has no profit at all. Branch Manager Mohammad Monirul Islam (FAVP) is very much ambitious about this branch. All the Officer & staffs are very helpful and active & they gave me necessary instruction about banking activities when I was an internship student of IFIC Bank Limited Mohammadpur Branch.

2.14 Mission of IFIC Bank Limited – Mohammadpur Branch

Mohammadpur Branch’s Mission is…

- To provide service to Clients & Customers

- Keep the position unique in giving better service

- Committed to the welfare & economic prosperity

- To provide banking network from man to man

- To maximize profile & ensure better service

- To ensure maximum protection of wealth

- To ensure actual rate of Interest

2.15 Employees of IFIC Bank Limited – Mohammadpur Branch

Name of the employees | Designation | |

1 | Mohammad Monirul Islam (FAVP) | Branch Manager |

2 | Md. Abu Mayeen Palash | Second Officer |

3 | Md. Mostafizul Rahman | Officer Grade – I |

4 | Md. Maruf-Al-Hasnat | Officer Grade – I |

5 | Md. Jabed Hossain | Officer Grade – II |

6 | Md. Imran Mahmud Mia | Computer Officer |

7 | Md. Jabed Parvez | Cash Officer |

8 | Md. Salauddin | Cash Officer |

9 | Shirin Sultana | Cash Officer |

10 | Mrs. Kamrun Nahar | Office Assistant |

11 | Mr. Gias Uddin | Office Attendant |

12 | Md. Rana | Office Attendant |

13 | Md. Kamal | Office Attendant |

14 | Md. Abdur Rouf | Security Guard |

15 | Md. Salam | Security Guard |

2.16 Various Accounts & Accounts Features

Savings Accounts

- Initial Balance Tk. 1,000

- Yearly Interest Rate 6.50%

- Debit Card free for 1 year

Super Savings Plus (SSP)

- Minimum Balance Tk. 10,000

- 7% Interest Rate for Balance Tk. 10,000 – Tk. 50,000

- 8% Interest Rate for Balance over Tk. 50,000

- Interest will be compounded monthly

- Free Account Maintenance Charge

- Insurance coverage of Tk. 5 Lac for accidental death & Tk. 50,000 for normal death

- No Insurance premium

Double Return Deposit Scheme (DRDS)

- Any amount of Deposit will be doubled in 5 years & 9 months

Millionaire Dream Plan ((MDP)

Monthly Installment (Tk.) | Term | Amount Payable after maturity (Tk.) |

16,900 | 4 Years | 10,02,079 |

12,800 | 5 Years | 10,01,002 |

8,200 | 7 Years | 10,01,919 |

4,850 | 10 Years | 10,04,140 |

Special Features:

- Insurance coverage of Tk. 5 Lac for accidental death & Tk. 50,000 for normal death

- Annual Insurance Premium of Tk. 500 will be paid by bank.

Monthly Deposit Scheme (MIS)

Principle Amount (Tk.) | For 3 Years |

1,00,000 | 1,000 Tk. |

Special Features:

- Loan facilities

Current Accounts

- Initial Balance 2,000 Tk. (For Company & Organizational Purpose)

Pension Savings Scheme (PSS)

Monthly Installment (Tk.) | Amount payable after maturity (11% Interest Rate) | |

3 Years | 5 Years | |

500 | Tk. 21,247 | Tk. 39,593 |

1.000 | Tk. 42,495 | Tk. 79,186 |

2,000 | Tk. 84,990 | Tk. 1,58,373 |

3,000 | Tk. 1,27,484 | Tk. 2,37,559 |

5,000 | Tk. 2,12,474 | Tk. 3,95,932 |

10,000 | Tk. 4,24,948 | Tk. 7,91,865 |

15,000 | Tk. 6,37,422 | Tk. 11,87,797 |

20,000 | Tk. 8,49,896 | Tk. 15,83,730 |

25,000 | Tk. 10,62,370 | Tk. 19,79,662 |

50,000 | Tk. 21,24,740 | Tk. 39,59,325 |

School Savings Plan (ScSP)

Initial Deposit (Tk.) | Monthly Installment (Tk.) | 5 Years Term | 7 Years Term |

Amount payable after maturity (10.00%) | |||

2,000 | 500 | 42,336 | 64,404 |

4,000 | 1,000 | 84,672 | 1,28,809 |

6,000 | 1,500 | 1,27,009 | 1,93,213 |

8,000 | 2,000 | 1,69,345 | 2,57,618 |

10,000 | 2,500 | 2,11,681 | 3,22,022 |

12,000 | 3,000 | 2,54,017 | 3,86,427 |

15,000 | 5,000 | 4,15,309 | 6,34,301 |

Special Notice Deposit (SND)

Types of Deposits | Interest Rate |

| Less than Tk. 1 Crore | 2% |

| Th. 1 Crore and above but less than Tk. 25 Crore | 2.50% |

| Tk. 25 Crore and above but less than Tk. 50 Crore | 4% |

| Tk. 50 Crore and above but less than Tk. 100 Crore | 2% |

| Tk. 100 Crore and above | 2% |

Fixed Deposit Receipt (FDR)

| FDR (Tenure 1 Month) |

- Less than Tk. 0.80 Crore

- Tk. 0.80 Crore and above

10.50% (Rate of Interest)

12.00% (Rate of Interest)

FDR (Tenure of 3 Months)

12.50%

FDR (Tenure of 6 Months)

12.50%

FDR (Tenure of 1 Year)

12.50%

2.17 Accounts Opening Formalities

General Requirement for all accounts:

- Passport sized photographs of account-holder(s) / nominee duly attested

- Signature(s) of account account-holder(s), introducer, etc, duly admitted/verified

- Personal Information Form(s)

- Know the Customer (KYC) Profile

- Transaction Profile (Not applicable for Special Scheme & Fixed Deposit)

- All applicable columns have been duly filled-in by applicant.

Proprietorship Concern (additional requirement):

- Copy of Trade License

Partnership Firm (additional requirement):

- Copy of Partnership Deed

- List of Partners with their addresses

- Copy of Trade License

- Certificate of the Registrar of Firms in case of registered firms only (certified photocopy to be retained by bank and original to be returned after authentication)

Limited Company (additional requirement):

- True copy of the Memorandum and Articles of Association of the Company duly certified by RJSE

- Certified true copy of the certificate of incorporation of the company

- Certified true copy of resolution of the Board of Directors of the Company for opening bank account which should be consistent with the Articles of Association

- Certificate of Commencement of business of the Registrar of Joint Stock Company

- List of Directors with address along with form 10&12

- Copy of Trade license

Association / Club / Charitable Institution / Trust / Society (additional requirement):

- Certified true copy of the Constitution/By-laws/Trust/Deed/Memorandum and Articles of Association

- Certificate of Registration of the Association/Club/Charity/Trust/Society

- List of members of the Governing Body/Executive Committee of the Association/ Club/ Charity/ Trust/ Society with their address

- List of Directors with address

- Certifies true copy of resolution of the Governing Body/ Executive Committee of the Association/ Club/ Society/ Trust which should be consistent with the Article of Association.

2.18 Various Products

Simply product is a solution of customer needs and wants. A product is an element in the market offering. Product is anything that can be offered to a market for attention.

IFIC Cards

IFIC Card is powered by VISA, world’s largest electronic payments network. IFIC Bank has been issuing VISA branded Credit Card, Debit Card & Prepaid Card. Customer can choose any of the above card according to his/her need.

IFIC Credit Cards

IFIC Bank VISA Credit Cards are issued in two types namely Gold and Classic for both local and international use. The Local Cards can be used at any ATM displaying VISA Logo for withdrawal of cash and at any POS displaying VISA Logo for purchase of goods & services within Bangladesh whereas the International Cards can be used at any ATM and POS displaying VISA logo anywhere in the world. International credit card is a dual currency card and as such you can use the same plastic at home & abroad. Classic cards are for lower limits and less costly.

IFIC Debit Cards

IFIC Bank VISA Debit Card can be used at any ATM displaying VISA Logo for withdrawal of cash and at any POS displaying VISA Logo for purchase of goods & services within Bangladesh. ATM transactions are to be secured by Personal Identification Number (PIN) known by the concerned customer only. POS transactions will not require PIN. However, all the transactions are to be authorized by the system electronically. IFIC debit card is issued against any individual savings/ current account maintained with any branch of IFIC Bank Limited. The designated savings/current account can be operated by using the debit card without using cheques 24 hours in a day, 7 days in a week, and 365 days in a year. The customers are not required to pay any charge for transactions at Merchant Point of Sale (POS) for purchasing goods and services. For cash withdrawal from ATM/Branches, a little charge may be applied. No interest will be calculated on cash withdrawal or purchases. No minimum amount due and no hassle of payment of monthly bills.

IFIC Prepaid Cards

IFIC Bank VISA Prepaid Card can be used at any ATM displaying VISA Logo for withdrawal of cash and at any POS displaying VISA Logo for purchase of goods & services within Bangladesh. ATM transactions are to be secured by Personal Identification Number (PIN) known by the concerned customer only. POS transactions will not require PIN. However, all the transactions are to be authorized by the system electronically. Prepaid card is safer than carrying cash and more convenient than writing cheques. IFIC Prepaid card is issued by the branches instantly on filling-up the Application Form and making initial deposit. There is no need to have any account with the Bank. Prepaid card are suitable for the customers who does not maintain any account with IFIC. No interest will be calculated on cash withdrawal or purchases. No minimum amount due and no hassle of payment of monthly bills.

IFIC POS

Bank POS are available at all the branches of the Bank. Any IFIC Card Holder can withdraw cash from any branch of IFIC Bank Ltd. through Bank POS. Credit Card Holders can withdraw cash up to 100% of their credit limit.

IFIC Customer Care

Customers can feel free to visit our Card Division on any working day or dial 9559703 or PABX: 9563020 Ext. 500, 502 or Fax: 9570282 or email: mailto:’card@IFICbankbd.com’ for further information. Please dial 9559703 or 01713229817 at any time for help.

2.19 Term Loans

IFIC Bank Limited Mohammadpur Branch gives in the following Term Loan:

- Industries Loan

- Others Loan

- Staff House Building Loan (SHBL)

- Staff Loan against Provident Fund (SLPF)

- Loan against PSS

- House Building Loan

- Consumers Credit Scheme

Industrial Loan:

- It is a term loan.

- It is given for three (3) years at equal installment.

- Grass period is allowed of this types of loan.

- Grass period is the period that require to earn visible returns.

Others Loan:

- Loan provider for other purpose which is productive and less risk rather industrial sector are treated as others loan.

- The terms and condition of these types of loan are as industry loan.

Staff House Building Loan (SHBL):

120 times of BASIC salary is provided as SHBL. Bank rate +1% interest is charged to the loan amount. Repayment adjusted from their monthly salary. Repayment is made at equal monthly installment.

Staff Loan against Provident Fund (SLPF):

10% of basic in contributed by employee Repayment is adjusted from there on the salary. Maximum sanction from Provident Fund.

Loan against PSS:

This loan is provides against PSS fund. 80% are given of the PSS fund. This is 100% secured for the bank.

House Building Loan:

This loan is give for the construction of building house. It is gives for three (3) years at equal monthly installment. This loan is not provides frequently.

Consumers Credit Scheme:

Under this scheme credit is given to the customer to purchase necessary and luxury commodities like computer, motor vehicle, television, refrigerator, music system sewing machine, furniture etc. Other then the employee it is given to the valuable client. It is a 24, 36, 48 installment system @ 15.50% interest.

2.20 Small Enterprise Financing

IFIC Bank gives in the following important sectors of small enterprise:

- Easy Commercial Loan

- Retailers Loan

- Transport Loan

- Commercial House Building Loan

- Possession Right Loan

- Contractor’s Loan

- Letter of guarantee

- Loan against imported merchandise (LIM)

- Loan against trust receipt (LTR)

- Bidder’s Loan

- Project Loan

2.21 Consumer Financing

IFIC Bank Ltd. Introduced Consumer Credit Scheme for its customer during 1999 duly approved by the Board of Directors of the bank in their 251st meeting held on April 4, 1999 with the following loan product:

- Vehicle loan

- Domestic appliances loan

- Office equipment loan

- Entertainment purpose loan

- Loan for intangible loan

- Others.

The purpose of this section is to provide direct loan guidelines to the branches for providing consumer financing under consumer Finance Scheme. Guidelines under the prudential Regulation and Direction of Bangladesh bank have been formulated. These guidelines will assist the branches as to how the CCs loan port-folio should be managed. The committee studied existing products available in the market.

Considering the market demand and investment opportunities in Consumer Financing Sector, the committee has formulated the following 7 products for our bank to be launched under Consumer Financing Scheme:

- Easy loan ( Secured personal loan)

- Consumer durable loan

- ‘Parua’ ( Education loan)

- ‘Thikana’ ( House building loan)

- Any Purpose Loan

- Peshajeebi loan ( Loan for professional)

- Auto loan

- Festival loan

Easy loan (Secured Personal loan):

Any individual can apply for this loan to meet personal financial requirement. This potential borrower with minimum age 18 years must have an account with IFIC Bank Ltd. Repayment will be made in lump sum within expiry or as per acceptable terms and interest to be serviced as and when due.

Consumer Durable loan:

This applicant for this loan are employee of Govt./semi Govt./Corporation/autonomous bodies, employee of reputed multinational corporation and large local corporate, employees of reputed university/ college/school, employees of reputed NGOs/Aid Agencies, other salaried persons acceptable to the bank, taxpaying businessmen having adequate cash flow taxpaying self employed person and individual having reliable source of income. The purpose of this loan is to purchase of consumer durables like – computer, television, refrigerator, washing machine, air conditioner, music systems, motor cycle and a lot of other things by Consumer Durable Loan. IFIC Bank is providing maximum 1.00 lac taka to be repayable in by 12 to 36 monthly installments.

Consumer Durable Loan Repayment Schedule

Loan Amount | Interest Rate | Monthly installment | ||

36 months | 24 months | 12 months | ||

Maximum Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

Parua (Education loan)

IFIC Bank offers Education Loan that can make a student’s dream comes true. IFIC Bank firmly believes that expense for education is an investment for future. Only education can fulfill the dreams of an individual as well as a nation. IFIC Bank is providing maximum Tk. 8.00 lac to be repayable in 12 to 48 monthly Installments.

Parua (Education Loan) Repayment Schedule

Loan Amount | Interest Rate | Monthly installment | |||

48 months | 36 months | 24 months | 12 months | ||

Tk. 100,000/- | @16.50% | Tk. 2,861/- | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

Thikana (House Building loan)

Home is an address, a shelter for entire life, and this is what one leaves behind for the family. A house is the single biggest investment that you will make in your lifetime. To own a home from savings takes a long time and full payment at a time is difficult too. Don’t wait your entire life saving. Trust us, take a Home loan from IFIC and realize your dreams now. IFIC Bank is providing maximum Tk.75.00 lac to be repayable in 12 to 180 monthly installments.

Thikana (Home Loan) Repayment Schedule

Loan Amount | Interest Rate | Monthly installment (Tk.) | |||

15 years | 14 years | 13 years | 12 years | ||

Tk.1,00,000/- | @ 15.00% p.a. | 1,401/- | 1,429/- | 1,462/- | 1,503/- |

11 years | 10 years | 9 years | 8 years | ||

1,553/- | 1,615/- | 1,694/- | 1,796/- | ||

7 years | 6 years | 5 years | 4 years | ||

1,932/- | 2,117/- | 2,381/- | 2,785/- | ||

3 years | 2 years | 1 years | |||

3,469/- | 4,851/- | 9,029/- | |||

Any Purpose Loan

This applicant for this loan are employee of Govt./semi Govt./Corporation/autonomous bodies, employee of reputed multinational corporation and large local corporate, employees of reputed university/ college/school, employees of reputed NGOs/Aid Agencies, other salaried persons acceptable to the bank, taxpaying businessmen having adequate cash flow taxpaying self employed person and individual having reliable source of income. IFIC Any Purpose Loan caters to various needs of salaried people. With minimum formalities you can get a loan for an amount up to Tk.3.00 lac to be repayable at 12 to 36 monthly installments. The loans are easy & absolutely hassle free.

Any Purpose Loan Repayment Schedule

Loan Amount | Interest Rate | Monthly installment | ||

36 months | 24 months | 12 months | ||

Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

Peshajeebi Loan (Loan for Professional):

This type of loan is only for the people who are Doctor/ Engineer/ IT professional/ Management Consultant or any other professional, sometimes you just need that little bit extra money for whatever reason? Don’t make yourself worry about it. Come to us at IFIC Bank and trust that we’ll help you to realize your dreams.

IFIC Bank is providing Maximum Tk. 10.00 lac to repayable in 12 to 48 monthly installments. Quick Processing & Least Formalities.

IFIC Peshajeebi Loan Repayment Schedule

Loan Amount | Interest Rate | Monthly installment | |||

48 months | 36 months | 24 months | 12 months | ||

Tk. 100,000/- | @16.50% | Tk. 2,861/- | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

Auto Loan

Owning a car means freedom of convenience for moving out, affords punctuality, shelter from rain and heat during traveling and above all guarantees the much needed safety. Owning a car is a dream of many people. To materialize your dream, now we have Auto Loan with more flexible, affordable and convenient package option.

IFIC Bank is providing maximum Tk. 20 lac to be repayable in 12 to 60 monthly installments.

Auto Loan Repayment Schedule

Loan | Interest | Monthly installment (TK.) | ||||

60 months | 48 months | 36 months | 24 months | 12 months | ||

Tk.1,00,000/- | 15.50% | 2,407/- | 2,810/- | 3,493/- | 4,874/- | 9,051/- |

Tk.20,00,000/- | 15.50% | 48,140/- | 56,200/- | 69,860/- | 97,480/- | 1,81,020/- |

2.22 Credit

Credit portfolio of the Bank consists of Trade Financing, Project loans for new projects and BMRE of the existing projects, Working Capital financing and Small Scale Industrial financing. Besides, the Bank financing the need of individual borrowers under Consumer Credit Scheme. The Bank is also involved in financing Agriculture sector.

Credit portfolio of the bank was under as on 31.12.2011

Particular | Amount | Percent |

| Agriculture | 23.29 | 0.82% |

| large & Medium Industry(TL) | 548.89 | 19.35% |

| Working Capital | 303.13 | 10.68% |

| Export Finance | 150.84 | 5.32% |

| Import Finance | 488.87 | 17.24% |

| Transport | 59.81 | 2.11% |

| Commercial lending | 616.55 | 21.74% |

| House building loan | 484.87 | 17.08% |

| Consumer Credit Scheme | 111.29 | 3.92% |

| Others | 48.96 | 1.73% |

| Total | 2836.15 | 100.00% |

2.23 Local Remittance

Sending money from one place to another for the customer is another important service of banks and this service is an important part of country’s payment system. For this service people, especially businessmen can transfer funds from one place to another place very quickly. There are five kinds of techniques for remitting money from one place to another place. These are:

- Demand Draft (DD)

- Pay order (PO)

- Telegraphic Transfer (TT)

- Telephone Transfer (TT)

- Mail Transfer (MT)

Telegraphic and Telephone Transfer are almost same, both are them are known as TT in short. So the basic three types of local remittances are discussed below:

Demand Draft (DD)

A demand Draft is also called the Bankers Draft. It is an instrument, issued by a particular branch, drawn on another branch of the same bank, instructing to pay a certain amount of money. DD is very much popular instrument for remitting money from one place to another place. The remitter of funds can purchase a DD making the amount payable to anyone including him. The banker is discharged from liability only by payment in due course.

Pay Order

A pay order (PO) is an instrument to remit fund within a clearing zone. The PO can only cashed through the issuing branch.

Telegraphic Transfer (TT)

Telegraphic Transfer (TT) are affected by telegram, telephone, telex as desired by the remitter. Transfer of funds by telegraphic Transfer is the most repaid and convenient but expensive method. Sometimes the remitter of the funds required the money to be available to the payee immediately. In that case the banker is requested to remit the funds telegraphically. Such type of remittance is called Telegraphic Transfer (TT) but in practice banker uses a test serial to maintain secrecy.

2.24 Cash Department

Cash department is most vital and sensitive organ of the branch as it deals with all kinds of cash transactions. This department starts the day with cash in vault. Each day some cash that is opening cash balance are transferred to the cash offices from the cash vault. Net figure of this cash receipts and payments are added to the opening cash balance. The figure is called closing balance. This closing balance is then added to the vault and this is the final cash balance figure for the bank at end of any particular day. Cash department in the IFIC Bank, Mohammadpur Branch is authorized dealer of foreign currency. So it can deal with buy in grand selling of foreign currency.

2.25 Target customer of IFIC Bank Limited – Mohammadpur Branch

- Individual person

- Sole proprietorship firm

- Partnership firm

- Public Limited Company

- Private Limited Company

- Government & Semi Government Organization

- Bank employee

2.26 Bank’s Balance Sheet (31, December 2011)

IFIC Bank Limited

Mohammadpur, Branch

Balance Sheet

For the month ended of 31 December, 2011

Particulars | Tk. | Tk. |

| Cash & Bank Balance | 53,36,057 | |

| Total Cash in hand | 53,36,057 | |

| Loans & Advances: |

SOD (Secured Over Draft)

2,01,360.31

Total Loans & Advances

2,01,360.31

IFIC Bank General Account

3,71,46,779.73

Other’s Assets:

Furniture & Fixtures

Stamps in hand

Suspense Accounts

Sundry Assets

66,101

1,425

23,080

73,50,000

Total others Assets

74,40,606

Profit & Loss Accounts

10,82,064.47

Grand Total

5,12,06,867.51

Deposits:

Current Account

Savings Accounts

Super Savings Plus (SSP)

Special Notice Deposits (SND)

Fixed Deposit Scheme (FDR)

Double Return Deposit Scheme (DRDS)

Sundry Deposits

Monthly Interest Scheme (MIS)

1,83,42,571

37,97,514.17

70,64,291.59

39,821.21

2,05,55,000

7,00,000

1,82,189.14

5,00,000

Total Deposits

5,11,81,387.11

Others Liabilities

25,480.40

Total Liabilities

25,480.40

Grand Total

5,12,06,867.51

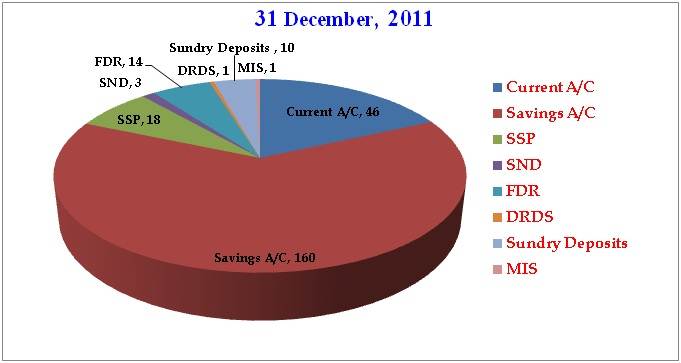

2.27 Bank’s Deposits (31, December 2011)

Types of Deposits | Numbers of Accounts |

| Current Account | 46 |

| Savings Accounts | 160 |

| Super Savings Plus (SSP) | 18 |

| Special Notice Deposits (SND) | 3 |

| Fixed Deposit Receipt (FDR) | 14 |

| Double Return Deposit Scheme (DRDS) | 1 |

| Sundry Deposits | 10 |

| Monthly Interest Scheme (MIS) | 1 |

| Total Number of Deposits During 31 December, 2011 | 253 |

2.28 Bank’s Balance Sheet (31, January 2012)

IFIC Bank Limited

Mohammadpur, Branch

Balance Sheet

For the month ended of 31 January, 2012

Particulars | Tk. | Tk. |

| Cash & Bank Balance | 42,18,387.60 | |

| Total Cash in hand | 42,18,387.60 | |

| Loans & Advances: |

Staff Loan Provident Fund

SOD (Secured Over Draft)

1,50,880

1,57,827.88

Total Loans & Advances

3,08,707.88

IFIC Bank General Account

7,01,36,960.32

Other’s Assets:

Furniture & Fixtures

Stock of Stationary

Stamps in hand

Suspense Accounts

Sundry Assets

30,88,351

3,945.60

1,095

23,080

72,68,278.80

Total others Assets

1,03,84,750.40

Profit & Loss Accounts

7,77,435.18

Grand Total

8,58,27,241.38

Deposits:

Current Account

Savings Accounts

Super Savings Plus (SSP)

Special Notice Deposits (SND)

Fixed Deposit Scheme (FDR)

Double Return Deposit Scheme (DRDS)

Sundry Deposits

Millionaire Dream Plan (MDP)

Pension Savings Scheme (PSS)

Monthly Interest Scheme (MIS)

82,44,243.25

97,35,211.05

99,09,080.89

8,78,221.21

5,22,01,300

9,00,000

366123.58

4,850

19,000

20,00,000

Total Deposits

8,42,58,029.98

Bills Payable:

Pay Order

15,42,731

Total Bills Payable

15,42,731

Total Deposits

8,58,00,760.98

Others Liabilities

25,480.40

Total Liabilities

25,480.40

Grand Total

8,58,27,241.38

2.29 Bank’s Deposits (31, January 2012)

Types of Deposits | Numbers of Accounts |

| Current Account | 61 |

| Savings Accounts | 197 |

| Super Savings Plus (SSP) | 33 |

| Special Notice Deposits (SND) | 3 |

| Fixed Deposit Receipt (FDR) | 33 |

| Double Return Deposit Scheme (DRDS) | 2 |

| Sundry Deposits | 12 |

| Millionaire Dream Plan (MDP) | 1 |

| Pension Savings Scheme (PSS) | 1 |

| Monthly Interest Scheme (MIS) | 2 |

| Total Number of Deposits During 31, January 2012 | 345 |

2.30 Bank’s Balance Sheet (31, February 2012)

IFIC Bank Limited

Mohammadpur, Branch

Balance Sheet

For the month ended of 31 February 2012

Particulars | Tk. | Tk. |

| Cash & Bank Balance | 95,36,146.49 | |

| Total Cash in hand | 95,36,146.49 | |

| Investments: |

Price Bond

1,000

Total Investments

1,000

Loans & Advances:

Staff Loan Provident Fund

SOD (Secured Over Draft)

1,53,723.88

7,75,760

Total Loans & Advances

9,29,483.88

IFIC Bank General Account

8,38,53,379.80

Other’s Assets:

Furniture & Fixtures

Stock of Stationary

Stamps in hand

Suspense Accounts

Sundry Assets

31,58,351

48,789.77

770

23,080

71,75,928.43

Total others Assets

1,04,06,919.2

Profit & Loss Accounts

15,96,696.11

Grand Total

10,63,23,625.48

Deposits:

Current Account

Savings Accounts

Super Savings Plus (SSP)

Special Notice Deposits (SND)

Fixed Deposit Scheme (FDR)

Double Return Deposit Scheme (DRDS)

Sundry Deposits

Millionaire Dream Plan (MDP)

Pension Savings Scheme (PSS)

School Savings Plan (SsP)

Monthly Interest Scheme (MIS)

78,96,999.25

76,66,147.33

76,76,196.88

75,981.21

78,580

9,00,000

12,03,661.01

9,700

52,500

10,000

20,00,000

Total Deposits

10,60,71,185.68

Bills Payable:

Pay Order

86,959.40

Total Bills Payable

86,959.40

Total Deposits

10,61,58,145.08

Others Liabilities

1,65,480.40

Total Liabilities

1,65,480.40

Grand Total

10,63,23,625.48

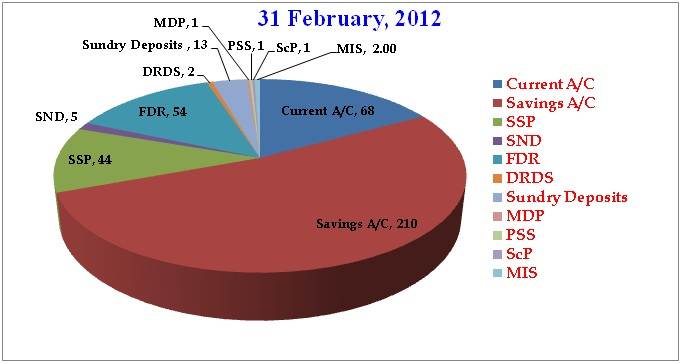

2.31 Bank’s Deposits (31, February 2012)

Types of Deposits | Numbers of Accounts |

| Current Account | 68 |

| Savings Accounts | 210 |

| Super Savings Plus (SSP) | 44 |

| Special Notice Deposits (SND) | 5 |

| Fixed Deposit Receipt (FDR) | 54 |

| Double Return Deposit Scheme (DRDS) | 2 |

| Sundry Deposits | 13 |

| Millionaire Dream Plan (MDP) | 1 |

| Pension Savings Scheme (PSS) | 1 |

| School Savings Plan (SsP) | 1 |

| Monthly Interest Scheme (MIS) | 2 |

| Total Number of Deposits During 31, February 2012 | 401 |

First of all, I would like to thanks my honorable instructor in IFIC Bank Limited – Mohammadpur Branch those who gave the special care and important instruction about the banking activities through my Internship Program. Total duration of my Internship program was 3 months but I think I can able to learn lots of things in this short time of Internship. I hope if I want to work in a private or public limited bank in Bangladesh that time my banking knowledge which I gathered from IFIC Bank Limited – Mohammadpur Branch through internship program will obviously help me very much. It also develops my personal career. So, in here the internship report I would like to focus such thinks or such activities which I learnt from my Internship Program at IFIC Bank Limited – Mohammadpur Branch.

3.1 Knowledge from Account Opening Section

This section opens accounts. Selection of customer is very important for the bank because banks success and failure largely depends on their customer. If customer is bad, they may create fraud and forgery by their account with bank and thus destroy goodwill of banks. So, this section takes extreme caution in selecting its customer base. This section opens the account fir the customer. In general banking, the account section plays a very important role. Selection of s\customer for opening account is very crucial for the instruction. It hampers the goodwill also. So the bank should be extreme caution about this section.

Some codes of Accounts in IFIC Bank Limited – Mohammadpur Branch

Types of Deposits | Code |

| Savings Accounts (SB) | 031 |

| Current Account (CA) | 001 |

| Super Savings Accounts (SSP) | 035 |

| Fixed Deposit Scheme (FDR) | 200 |

| Double Return Deposit Scheme (DRDS) | 041 |

| Pension Savings Scheme (PSS) | 5200010 |

For Example: Savings Accounts: 1201 – 409556 – 031

In here 1201 is the code of Mohammadpur Branch, 409556 is an unique number of Account & 031 is the code of Savings Accounts.

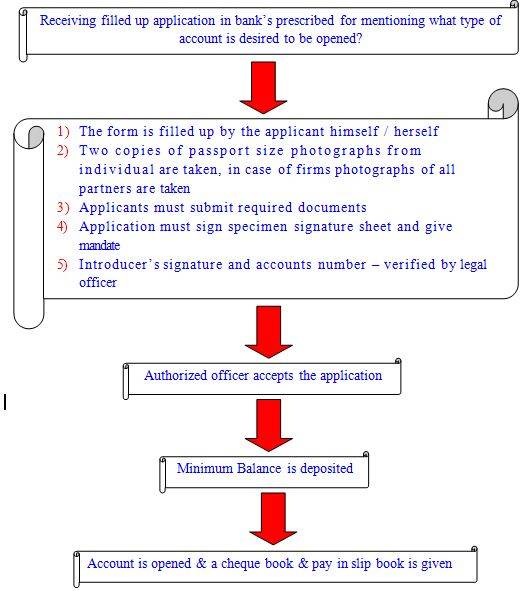

In here I would like to focus the procedure of Account Opening by flow chart:

Procedures of FDR liquidation is given below:

- Only the account holder himself and the authorized person can liquid the FDR after maturity.

- In case of joint name, authentication from both is necessary.

- In case of ‘Either f Survivorship’ clause – anyone can liquid.

- In case of Death the survivor cannot en cash the FDR even if there exist the either or survivor clause succession certificate from the court is needed.

- IF demanded before the maturity the last expired duration is considered to pay interest.

FDR section provides another service on behalf of the government. These services – this bank issues and en cash the following two government securities:

i. Five Years Bangladesh Sanchay Patra

ii. Pratirakha Sanchay Patra

This section of this branch is also fully computerized. No ledger, no other subsidiary books are maintained separately in this section. All entry is given directly in the computer and then necessary information is printed when required.

Closing Procedures of an Account:

For two reasons an account can be closed:

1) By banker: Banker has the right to close the account if the customer does not maintain any transaction six year and the balance is become lower than the minimum balance.

2) By Customer: If the customer has to close his account he will write an application to the manager and the manager then close the account.

Firstly, the concerned customer has to apply for closing his/ her account. Then to close the account the cheque book is to be returned to the bank. After charging the account closing charge the Manager will close the account. Closing charges are as follows:

For saving bank account = 20 Taka

For Current account = 30 Taka

The rest amount of money laid in the respective account is paid to the customer by a payment order. In case of Payment Order certain commissions and VAT are cut off from the account.

3.2 Knowledge from Loan Section

Procedures of Loan Section are given below:

- Application for loan

- Application applies for the loan in the prescribed from of band.

- Getting Credit Information:

The bank collects credit information about the applicant to determine the credit worthiness of the borrower. Bank collects the information about the borrower from the following sources:

i. Personal investigation

ii. Confidential Report from other bank Head Office/ Branch/ Chamber of the commerce.

iii. CIB Report from central Analyzing these information

3.3 Knowledge from Remittance Section

The procedures of issuing Pay Order are given below:

- Customer submit application to the officer along with money

- Give necessary entry in the bills payable register where payees name, date, P.O-no, etc are mentioned

- After approved the instruments by authority, it is delivered to the customer

- Signature of the customer is taken on the counterpart

Rate of Commission:

Commission | Up to Taka |

Tk. 15 | Tk. 1 to Tk. 1,000 |

Tk. 25 | Tk. 1,001 to Tk. 1,00,000 |

Tk. 50 | Tk. 1,00,001 to Tk. 5,00,000 |

Tk. 100 | Tk. 5,00,001 to Above |

The procedures of issuing Demand Draft (DD) are following:

- Deposit money with DD application

- Necessary entries are given to register

- Issuing of the Account payee only crossed instrument.

The procedures of issuing outgoing Telegraphic Transfer (TT) are given below:

- Deposit of money by the customer along with application form

- In receipt of money a cost memo is given to the customer containing TT serial number, which is informed to the awaiting party branch by the customer.

- Tested telex message is prepared, where TT serial number notifying party name is mentioned.

- The telex department confirms transmission of the message.

The procedures of issuing outgoing Telegraphic Transfer are given below:

- After receiving the telex, it is authenticated by tested

- TT serial number is verified by the “TT in concern branch” register

- Voucher is released in this respect giving accounting treatment

3.4 Knowledge from Cash Section

Functions of Cash Department:

Cash Payment

- Cash payment is made only against cheque

- This is the unique function of the banking system which is known as ‘payment on demand’

- It makes payment only against its printer valid cheque.

- After completing the payment of cash then cash office use this seal on valid cheque:

Cash Receipt

- It receives deposits from the depositors in form of cash

- So it is the ‘mobilization unit’ of the banking system

- It collects money on its receipts forms

- After receiving money cash officer use this seal on cash receipt or cash voucher:

Cash payment or Cheque cancellation process:

- Receiving Cheque by the employee in the Cash counter

- Verification of the following by the cash officer in the computer section:

i. Date if the cheque (it is presented within 6 month from issue date)

ii. Issued from this branch

iii. Amounts in figure and sentence written does not differ

iv. Signature of the drawer does not differ

v. Cheque is not torn or mutilated

- Gives pay cash seal and sends to the payment counter

- Payment officer makes payment.

Book maintained by this section:

Vault Register

It keeps accounts of cash balance in vault in the bank.

Cash Receipt Register

Cash receipt in whole of the day is recorded here.

Cash Payment Register

Cash Payments are made in a day are entered here.

Rough vault Register

Cash calculation for final entry in vault register is done here, as any error correction here is not acceptable.

Cash Balance Book

Balance here is compared vault register. If no difference is found, indicates no error.

In book 1 & book 5, notes and currency are recorded by mentioning their denominations and number of each domination. Same set if this book is maintained separately for both local and foreign currency.

3.5 Knowledge from Cheque Issue, Receiving & Clearing Section

The following procedures are maintained for issuing a cheque book:

- Firstly the customer will fill up the cheque requisition form

- The leaves of the Cheque book under issue shall be counted to ensure that all the leaves sand the requisition slip are intact and the name & account number shall be written on all the leaves of the cheque book and on requisition slip.

- The name and the account number of the customer shall be written in the cheque book register against the particular cheque book series.

- The then officer in charge signs the register, cheque book and the requisition slip.

- Then the cheque book is handed over to the customer after taking acknowledgement on the requisition slip.

A cover file containing the requisition slip shall be effectively preserver as vouchers. It any defect is noticed by the ledger keeper, he will make a remark to the effect on the requisition slip and forward it to the cancellation officer to decided whether a new cheque book should be issued to the customer or not.

Cheque Receiving & Clearing Process:

Every Bank deals two types of cheque. Like:

1) Normal / Regular Value Cheque

2) High Value Cheque.

- Less than 5,00,000 cheque is called Normal / Regular Value Cheque

- 5,00,000 Tk. Cheque or more than 5,00,000 Tk. Cheque is called High Value Cheque.

- When bank collects this Regular / High Value cheque it will be remain stay in Bangladesh Bank’s Clearing House next day.

- When a bank received a valid cheque (both Regular & High value) then banker use this seal:

Important matters for receiving the Cheque:

- Focus on the Date of Cheque.

- If Bangladesh Bank’s Cheque the time limit will be 3 month/ 90 days.

- If others Private Bank’s Cheque the time limit will be 6 months/ 180 days.

- Check the similarity of the amount of Tk. (in word & amount) with the Deposit slip

- Check the Depositor’s signature on the overwriting place of the cheque.

- Check the Depositor’s mobile number in the cheque.

- If everything is alright then bank receives the cheque with giving the Receiving Seal & Signature of Receiving Officer & also receives the main copy of the Deposit slip.

- At last Bank gives the Carbon Copy of Deposit Slip to the Customer.

- After receiving with giving the Cross, Endorsement & Clearing Seal on Cheque Bank will Entry this cheque to the computer as well as the Cheque Receiving Book.

Vital Reason for Cheque Return from Bangladesh Bank Clearing House:

- Insufficient Fund

- Amount in figure & word differs

- Cheque out of date / post-dated

- Drawer’s signature differs

- Payment stopped by drawer

- Crosse cheque to be presented through a bank

- Payee’s endorsement required

For Clearing, every bank use several seal on valid cheque. Those are given below:

- ‘Cross Seal’ will be use in the left corner of the Cheque.

- ‘Endorsement / Authorized Seal’ will be use in the back side of the Cheque. In here, office those who have the ‘Power of Atony’, only he/ she can gives the sign on it.

- ‘Clearing Seal’ will be use in the back side of the Cheque. (when the cheque will be remain stay in Bangladesh Bank Clearing House)

- If any cheque will cross the daily dealing time of the Cheque that time bank will use ‘to be late tomorrow clearing’ seal in the customer copy of the receipt voucher.

- If the cheque will Tk. 5,00,000 or more than Tk. 5,00,000 that time bank will use ‘Same day clearing seal’ in the back side of the cheque.

Example: it bank will receive this cheque on March 12, 2012 that time bank will credit to the party A/C in same day (March 13, 2012)

- If bank have any doubt about the customer’s signature that time after verifying the signature of the customer banker will use ‘signature verified seal’ on the valid cheque.

- If the cheques will any branch of IFIC Bank Limited that time banker will use ‘Posted Seal’ on the Cheque. Interesting thing is that, same branches cheque will not go the Bangladesh Bank Clearing House for clearing. In here IFIC banker can able to clear this cheque.

- If the cheque will transfer related that time banker can use ‘Transfer Received seal’. In here this cheque mention that, cheque is been transfers from another branch or bank.

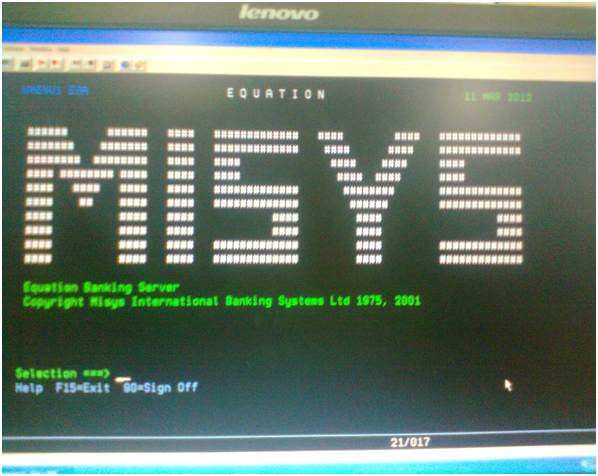

3.6 Knowledge from IFIC Banking Software – MI SYS

Now a day in Bangladesh every bank doing their banking transactional activities by online process. Like every bank IFIC Bank Limited has online banking software named MISYS. In Bangladesh there are 2 banks are using this software. One is AB Bank Limited & another is IFIC Bank Limited. Total price of this software is BDT 28,000,000. For posting every transaction IFIC bank use this software.

In my internship program I can able to learn few function of this software but not huge because I was an internship student not the banker so from my own personal interest I can able to learn this software by an instructor of IFIC Bank Limited – Mohammadpur Branch.

So in here I would like to focus some functions of MISYS software.

For Account Opening System:

- ANC > Enter

- Customer type (F4 For Select)

- Customer Name > Full Name > Short Name

- Defective Branch > MOHD (Mohammadpur Branch)

- Default Tax > TX

- Click (until red column will come)

- Example: 1201 – 409556 – 0321

- Press F3 for Exit

- OCA > Enter

- Type Customer ID (409556)

- A/C Type (EA / CA / CD) > Enter

- Currency > BDT > Enter

- Press F3 For Exit

- CAA > Enter

- Type Customer ID (409556)

- Press F3 for Exit

- AIM > Enter

- Type everything about customer > Enter

- Press F3 for Exit

- CIM > Enter

- Type everything about customer > Enter

- Press F3 for Exit

Cheque Book Posting System:

- CBR > Enter

- Account Number > Enter

- Shift + F12 > Enter

- Cheque Book Type > 1 (for Select) > Enter

- Press F3 for Exit

- CBI > Enter

- A/C Number

- First Serial Number of CD / SB (1 for select)

- Press F4 for selecting the types of cheque book

- Shift + F12 > Enter

- Charge Code > CB > Amount > Enter

- Press F3 for Exit

- WCT > Enter (for Print)

- Press F3 For Exit

For knowing A/C Balance:

- AB > Enter

- Type Account Number > Enter

FDR Posting System:

- WFD > Enter

- Reference No. > [ . ]

- F5 for View

- F3 for Exit

- Type 6 > Enter

- F3 for Exit

Posting Correction:

- CSI > Enter

- Item Reference > HO57

- HO57 > Item No. > Type 1 For Select

- Shit + F10 > Enter

- F3 for Exit

Find out the Profit & Loss of all branch:

- Shift + $AA > Enter

- Date (specific date)

- Shift + F7 or F8 (for knowing)

Clearing Cheque Posting System:

- AGI > Enter

For Debit…

- Department > OC >Enter

- F6 > Enter

- A/C No. > Code > 104 > Enter

- Amount > BDT

- Detail > Outward Clearing Date > No. of Item

- Mohammadpur Branch > Enter

For Credit…

- 1201 – 884200 – 050 (Head Office A/C No.)

- Currency > BDT

- Amount > Code > 510 > Enter

- F3 for Exit

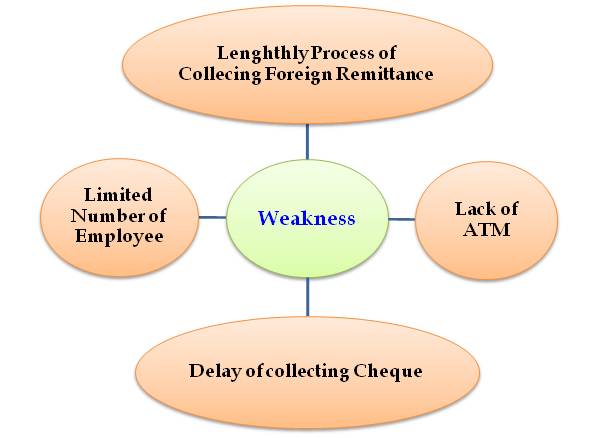

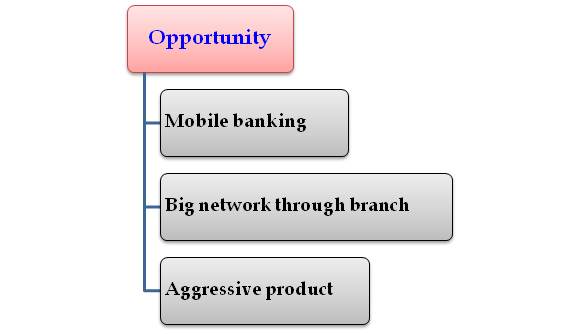

4.1 SWOT Analysis of IFIC Bank LTD. Mohammadpur Branch

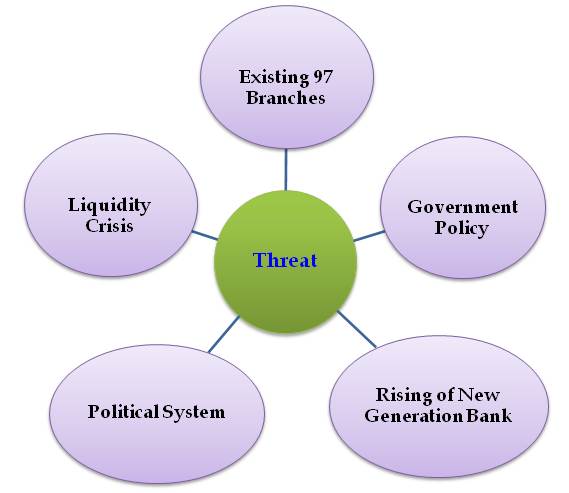

SWOT means overall evaluation of an organization by its activities such as Strength, Weakness, Opportunity & Threat. Now I am going to discuss about IFIC Bank Limited Mohammadpur Branch.

4.2 Recommendation about IFIC Bank LTD. Mohammadpur Branch

It has a large portfolio with huge asset to meet up its liabilities and the management of this bank is accomplished with the expert bankers and managers in all level of management and with a little knowledge about banking, it is not an easy job to find out the difficulties of this branch. Rather than recommending I would like to give my opinion to improve the banking service and make the customer more satisfied.

Renovation of customer service

Since a number of new banks are coming to existence with their extended customer service pattern in a completely competitive manner. Customer services must be made dynamic and prompt. Now a days, people especially business people have very little time to waste. So the bank should make its service prompt so that people need not give more time in the banking activities.

Providing more industrial loans

It seemed to me that the bank having a large amount of deposit is not simply encouraging the large scale of producers that is this bank is not providing that much of long term industrial loans to accelerate the economy as well as to help the economy to solve unemployment problem.

Speed up Processing of loan application

If loan-processing time is lengthy, it will not get good borrower. Most of this time is spent for correspondence between Head Office and Branch. So the branch should speed up its loan processing time. For reducing loan-processing time, branch manager should be given more power to sanction loan. This power can eliminate the time. Branch should have independent appraiser for appraising term loan proposal.

Bank should be innovative and diversified in its services

This branch provides only conventional services. Modern banking today is introducing various kinds of deposit account with different attractive features each of which may attract different groups of people. For example, Saving Certificate Scheme introduced by Islami Bank is one of its unique services in the banking in Bangladesh. Even the bank does not provide any ‘Customer Loan’ facility, which has been found very much profitable for those banks who have introduced it in their banking services.

Bank should diversify its banking services and add new features in its services so that it can attract customers from all groups of people. Financial Engineers of IFIC Bank should be innovative in developing new banking services, which will attract customers and reduce costs. It can introduce customer loan scheme, provide bridge loan, or can engage in lease financing. It can also underwrite shares of newly incorporated public companies.

Bank should immediately enter into the credit card market

This bank does not have any plan to enter into the Credit Card Market. It is well versed that tomorrow’s payment will be consisted of only plastic money (Credit Card). A large part of business transaction will be done by credit card in near future. In western world, more than 50% of transactions are in credit card. If this bank does not prepare from now on, it cannot compete in the future market. So, the branch should give special attention to the introduction of Credit Card.

Introduce modern technology

Without using modern technology no bank can even think of remaining in the business in near future. So the bank must decide right now how it can equip its branches with modern technology. Use of modern technology in one sense can increase cost but another sense it increases productivity highly and it attract big clients. It can introduce ATM services is branch. Use of automatic machine like cash counter machine, ATM brings speed in banking services.

Information System should be developed

For information transfer, branch uses primitive ways of telex, messenger and personal visit. It makes correspondence with the head office by peon or orderly. For international correspondence the branch uses telex machine, which is very costly. And in the branch, manager has to visit specific desk for collecting information. Paper communication is too involved between manager and employees. But branch can use INTERNET for both local and international correspondence. E–mail can reduce the telex cost substantially. Bank should take urgent decision to create own WEB Page in INTERNET so that it can communicate with others very quickly.

Development of human resources

Human resource is another sector for the branch to be developed urgently. Human resources, in the branch, are not equipped with adequate banking knowledge. Majority of the human resources are lack of basic knowledge regarding money, banking finance and accounting. Without proper knowledge in these subjects, efficiency cannot be optimized. Bank can arrange training program on these subjects.

Reduce classified loan on an emergency basis

It is observed in the Loans and Advances department that classified loan is about to 36% of the total loan portfolio. Such a big share of classified loan indicates weakness in the lending policy of branch. Probably bank’s customer selection process is not right. Bank should take special action in order to reduce the amount of classified loan. Although branch is maintaining the required provision for its classified loan, branch should consider recovering classified loan on an emergency basis. For this bank should motivate the defaulter for repaying. If motivation failed, then bank should be stringent about the defaulter and take legal action.

Bank should remove the time card system

The oddest thing in this bank is that it maintains a time card system to maintain the attendance of the employee including manager of the branch. It is definitely effective system but it is simply used to record the work hour of the labors in any manufacturing concern in the western countries to make their payment effectively those who are hourly basis worker. This system cannot be employed to the high officials like Manger of the branch etc. this creates an inferior impact on the mind of the employees that they are ill treated which decrease their service providing quality.

Bank must try to be computerized

There are computers almost in every branch in the IFIC Bank, but it does not mean that the bank is maintaining a network among them. The networking system obviously charges a high installation cost, but it will definitely reduce the overhead costs and an error free banking may be in progress. Moreover by adopting this system the bank can join in modern competition of along with e-commerce concept.

4.3 Recommendation for University

In the forwarding Letter University are using one format for all students and this is not enough. The student has different types of major. Someone have Finance & Accounting and someone have Marketing. In the forwarding letter they should write something more about the internee’s major related working sector. As a result the company or organization can get the idea of the working sector about the Internee. Then the company or organization can nominate the internee based on their working sector. So the university should think about it.

5.1 Conclusion

Form the learning and experience point of view I can say that I really enjoyed my internship period in IFIC Bank Ltd at the Mohammadpur branch from the very first day. I am confident that this 3 months internship program will definitely help me to realize my further carrier in the job market.

There are a number of Private Commercial Banks, Nationalized Commercial Banks and foreign Banks operating their activities in Bangladesh. The IFIC Bank Ltd. is one of them (private). For the future planning and the successful operation for achieving its prime goal in this current competitive environment this report can be helpful guideline. As a leading bank of Bangladesh, IFIC contributes in the business with promising future. I can hope that IFIC can spread their business with increasing various scheme and other utility services.

During the course of my practical orientation I have tried to learn the practical banking to relate it with theoretical knowledge, what I have gathered and going to acquire from various course.