The main purpose of this report is to have a sound understanding of credit risk management system and procedure followed in the National Bank Limited. Other objectives are to analyze the CRM process of the bank and to focus on the credit risk grading system for analyzing the credit assessment procedure of National Bank Limited. This report gives a vast information about working process, strategies of operation, the process of credit grading, policy, different criteria prescribed by Bangladesh Bank and management of Credit Banking Division of National Bank Ltd.

Introduction

The risk is inherent in all commercial operations. For Banks and Financial institutions, Credit risk is an essential factor, which needs to be managed properly. Credit risk virtually is the possibility that a borrower will fail to repay the debt in accordance with the terms of sanction. Credit risk, therefore, arises from the bank’s lending operations. In the present day’s state of deregulation and globalization, banks range of activities have increased, so also are the risks. Expansion of bank’s lending operations covering new products have forced the banks to confront newer risk areas and therefore to work out proper risk addressing devices. Credit risks are so exhaustive that a single device cannot encompass all the risks. Moreover, lending risks today have assumed such diverse nature, that newer techniques are to be applied to effectively contain the risks. In order to effectively contain risks, credit risk management has to be done in order to enable the bank to proactively manage loan portfolios in order to minimize losses and earn the acceptable level of return for the shareholders. In the present scenario of fast-changing, dynamic global economy and the increasing pressure of globalization, liberalization, consolidation, and disintermediation, it is essential to undertake robust credit risk management policies and procedures, sensitive and responsive to these changes.

National Bank Limited is committed to extending high-quality services to its clients through different financial products and profitable utilization of fund by undertaking various lending operations including financing trade, commerce & Industry etc. In conducting lending operations NBL always bears in mind the essence of proper risk identification and their effective management. It is also recognized that failure in proper identification and management of risks may result in a large quantum of bank advances turning into non-performing.

In the above backdrop, National Bank Limited underscoring the need for an effective credit risk management process has prepared the policy guidelines for Credit Risk Management. The policy will be reviewed annually by the Board of Directors of our bank.

The policy shall be distributed to the concerned officials, all divisional Heads, Branches, Regional Offices and top management officially. The policy shall be strictly followed by all concerned. Any deviation from the guidelines to be clearly identified and justification for approval to be provided.

The main objectives of the guidelines are as under:

- To provide directional guidelines to all concerned with the analysis of risk management.

- To adopt an appropriate working method.

- To keep legal aspects relating to loans and advances.

- To introduce and adopt the uniform practice of working.

- To make working procedure rational.

- To make lending correct information based.

- To identify the proper landing area.

- To analyze all aspects related to credit and ascertain the viability of lending.

- To make credit documentation exhaustive.

- To ensure proper supervision, monitoring & follow up.

The guidelines have been split into the following: –

POLICY GUIDELINES (which covers)

- Lending Guidelines

- Credit Assessment & Risk Grading

- Approval Authority

- Segregation of Duticontext in line with our institutional structure.

- Internal Audit

PROCEDURAL GUIDELINES (which covers)

- Approval Process

- Credit Administration

- Credit Monitoring

- Credit Recovery

BACKGROUND OF THE STUDY

This report contains the credit risk grading and credit risk management of National Bank Ltd. Truly speaking credit risk is essential for the success of the banks and financial institutions. The risk is an integral part of the business and attaches due importance to various risks involved in the banking business. Basically, credit risk derives from lending to corporations, individuals and other banks or financial institutions.

In this report, I have tried to mention credit risk grading process and ways of measuring credit risk grading, guidelines prescribed by Bangladesh Bank, Guiding Principle of Credit appraisal of NBL for credit officer.

I have worked in three departments of credit of National Bank, Imamgonj Branch. In this report, I have tried my best to make a comprehensive analysis of credit risk management.

Rationale of the study

As a student of a faculty of business studies, it is helpful to gain the practical knowledge about an organization and its overall activities. By doing this kind of activities, we can enrich our practical knowledge.With the application of acquired knowledge, we will be able to develop ourselves and compete globally.So we can say that the rationale of this is comprehensive.

Objectives of the study

The objectives of this study are as follows:

- To have a sound understanding of credit risk management system and procedure followed in the National Bank Limited.

- To gain knowledge about the credit-related operations and maintenance in this bank.

- To analyze the CRM process of the bank and to make recommendations if needed.

- To focus on the credit risk grading system for analyzing the credit assessment procedure of National Bank Limited.

- To have a general idea about the credit risk management performance of this bank.

Methodology of the study

The methodology includes the sample selection, sources of data and method of data analysis.

Sample selection

The organization to be discussed is National Bank Limited. All the departments and functional areas will be covered with more emphasis on credit division.

Sources of data

The study is conducted on the basis of both primary and secondary data.

Primary Data

The primary data are collected from all the departments of National Bank Limited by interviewing personnel of the respective departments. The heads of the departments or senior executives have been interviewed. However, the analysis and the explanation are the authors’ own.

Secondary Data:

The secondary data of the study are based on a review of existing brochures, documents, and database of National Bank Limited. The industry best practices are largely based on Bangladesh Bank manual, guidelines, and databases. Books and published articles on this topic have also been consulted.

Data analysis

The credit risk management data of National Bank Limited will be analyzed in a descriptive manner.

Scope of the study

The scope of the study is entire National Bank Limited. This report is a descriptive study which tries to focus on the theories and practices of credit risk management in the context of

the financial institutions in Bangladesh. It will not focus on the comparable credit practices of other banks. In connection with this effort, a case study has been conducted on National bank limited giving more emphasis on the credit side of the institution compared to the other sides.

Justification of the study

In recent days, people are becoming more aware of the management of their resources. As the banks do business by lending their depositors’ money, they have even more responsibility to manage their credit portfolio smoothly. Bank’s reputation is a critical factor in its success and therefore modern banks must follow appropriate guidelines, policies and relevant manuals regarding credit extension and recovery. The usage of banking service for any type of financial activities is increasing day by day. People are taking loans to start different types of businesses.

It is now very important to know the internal processes of the banks and financial institutions to make informed decisions regarding their integrity, scope, ability, and capacity.

Management of credit portfolio is one of the major operations of the banks. Therefore, as a 1st generation bank, National Bank Limited should give much attention to this area and this study will attempt to analyze their efforts and draw a complete picture of their practices.

Company Profile of National Bank Limited:

National Bank Limited is one of the pioneers of a first generation private commercial bank incorporated in 1983. Since inception, NBL to provide modern banking facilities to the mass people is opening branches in rural areas alongside urban areas giving due importance. Presently, the bank created a strong market base through 121 branches and 10 SME centers throughout the country. Customer’s satisfaction and involvements get priority in our daily activities.

The bank got priority as a pioneer in different sectors for taking innovate steps in the development of counter’s economy and upgrading the socio-economic status of rural people. Moreover, to encourage expatriates and to generate trust in sending money through legal channel, the bank took some challenging steps and became the pathfinder.

Meeting the need of the customers through modern technology with efficiency and searching new sectors of business, the bank strives to increase its trends of growth. The not only dedicated to profit maximization, it also remains active in fulfilling its social responsibilities.

Besides participating in building the national economy, NBL is always a caring bank in adding value to the assets of the shareholders. In short, these are the focus of our banking ethics.

Historical Background :

National Bank Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. Established as the first private sector bank fully owned by Bangladeshi entrepreneurs, NBL has been flourishing as the largest private sector Bank with the passage of time after facing many stress and strain.

At present we have 149 branches under our branch network. In addition, our effective and diversified approach to seize the market opportunities are going on as the continuous process to accommodate new customers by developing and expanding rural, SME financing and offshore banking facilities. We have opened 10 branches and 5 SME/Agri branches during 2011.

The then President of the People’s Republic of Bangladesh Justice Ahsanuddin Chowdhury inaugurated the bank formally on March 28, 1983, but the first branch at 48, Dilkusha Commercial Area, Dhaka started commercial operation on March 23, 1983. The 2nd Branch was opened on 11th May 1983 at Khatungonj, Chittagong.

Vision :

Ensuring highest standard of clientele services through the best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front-ranking bank of the country are our cherished vision.

Mission: Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, accountability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Role of Banks in the Modern Economy

The prosperity of a country depends upon its economic activities. Like any other sphere of modern socio-economic activities, banking is a powerful medium of bringing about socio-economic changes of a developing country. Agriculture, Commerce, and Industry provide the bulk of a country’s wealth. Without adequate banking facility, these three cannot flourish. For a rapid economic growth, a fully developed banking system can provide the necessary boost. The whole economy of a country is linked up with its banking system.

Functions of the bank

The functions of the bank are now wide and diverse. Of all the functions of the modern bank, lending is by far the most important. They provide both short-term and long-term credits. The customers come from all walks of life, from a small business to a multi-national corporation having its business activities all around the world. The banks have to satisfy requirements of different customers belonging to different social groups. They function as a catalytic agent for bringing about economic, industrial and agricultural growth and prosperity of the country.

Product and Service

Service of the Professional Personal

The officers of National Bank limited have to their credit, decades of banking experience with national/international banks at home and abroad.

A State-Of-The-Art Technology Banking

The Bank will provide a state-of-the-art technology banking such as Any Branch Banking, ATM Services, Home-Banking, Tele-Banking, etc.

Retail Banking

Bank offers individuals the best services, including to provide complete customer satisfaction:

- Deposit services.

- Current Account in both Taka and major foreign currencies.

- Convertible Taka Accounts.

- Local and foreign currency remittances.

- SME Banking.

- Any Purpose loan

Corporate Banking

National Bank Limited caters to the needs of the corporate clients and provides a comprehensive range of financial services, which include:

- Corporate Deposit Accounts.

- Project & Infrastructure Development Finance, Syndicated Finance, Linkage Finance, Investment Business Counseling, Working Capital and other finances.

- Bonds and Guarantees.

Commercial Banking

Being a commercial bank, National Bank Limited provides comprehensive banking services to all types of commercial concerns. Some of the services are:

- Trade Finance.

- Commodity Finance.

- Issuance of Import L/Cs.

- Advising and confirming Export L/Cs. – Bonds and Guarantees.

- Investment advise.

Online Banking

National Bank limited offers ‘Any branch’ banking service (to limited scale) that facilitates its customers to deposit, withdraw and transfer funds through the counters of any of its branches within the country.

Merchant Banking Advisory Services

The Bank will provide Merchant Bank advisory services, offer complete packages in areas of promotion of new companies, evaluation of projects, mergers, take-over, and acquisitions, liaise with the Government with regard to rules and regulations, management of new issues including underwriting support etc.

Capital Market Operation

The Bank will also introduce capital market operation which will include Portfolio Management, Investors Account, Underwriting, Mutual Fund Management, Trust Fund Management etc.

Farm and Off-Farm Credits (Rural)

Out of Bank’s social commitment towards the population at the grass-root level, it will participate in farm and off-farm credit programmers in rural Bangladesh to bring in economic buoyancy in the periphery.

Credit To Women Entrepreneurs

The Bank believes in ‘Equal Opportunity Policy’ and as such has been contemplating to introduce credit programmers for willing and talented women entrepreneurs.

Counter for Payment of Bills

Dedicated counters are available at National Bank Limited’s branches to receive the payment of various utility bills.

Other Services

- Remit funds from one place to another through DD, TT, and MT etc.

- Conduct all kinds of foreign exchange business including the issuance of L/C, Traveler’s Cheque etc.

- Collect Cheque, Bills, Dividends, Interest on Securities and issue Pay Orders, etc.

- Act as a referee for customers.

- Locker facility for safekeeping of valuables and documents.

Deposits and advances

Deposits Schemes

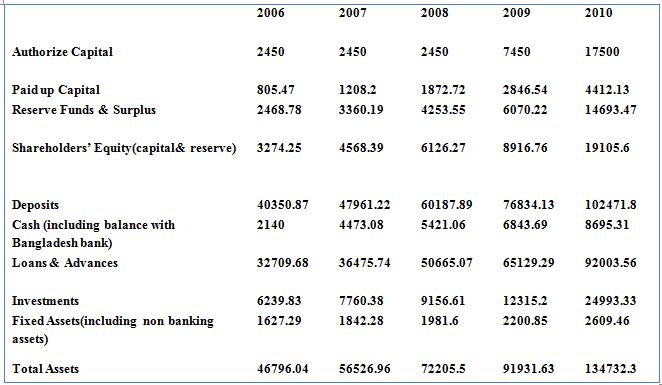

Deposit of the Bank showed a continuous increase during the year and in 2010 stood at TK.102471.8 million. The growth over the previous year was 33.37 percent. The growing customers’ confidence in National Bank helped the necessary broadening of customer range that spanned private individuals, corporate bodies, multinational concerns and financial institutions. The Bank introduced various products/ schemes to attract the depositors.

Cash and Balances with Banks and Financial Institutions

Cash and Balances with Bangladesh Bank were TK. 8695.31 million as against Tk. 6843.69 million in 2010. The funds are maintained to meet Cash Reserve Requirement (CRR) and Statutory Liquidity Requirement (SLR) of the Bank. TK. 1101.57 million as at 31 December 2010. The Bank maintained sufficient balances with correspondents outside Bangladesh to facilitate prompt settlement of payments under Letter of Credits commitments.

Investments

Investments of the Bank were TK. 24993.33 million showing an increase of 11.53 percent during the year under review. Investment activities centered around meeting the Bank’s SLR and were mostly in the form of Government Treasury Bills having varying dates of maturity. The average yield on the bills was 7.00% per annum.

Loans and Advances

The Bank’s total Loans and Advances stood at TK. 92003.56 million in 2010 showing a growth of 28.55 percent compared to Tk. 65129.29 million in 2009. Bank’s clientele comprised of corporate bodies engaged in such vital economic sectors as Trade Finance, Steel-Re-Rolling, Ready Made Garments, Textiles, Ship Scrapping, Edible Oil, Cement, Transport, Construction etc.

Consumer Banking

The Bank continued to offer loans under Consumer Credit Scheme to the fixed income group to enable borrowers to acquire consumer products such as household appliances, office equipment, motor vehicles, mobile phone etc.

Foreign Exchange and Foreign Trade

The bank opened a total number of 24,385 LCs amounting USD 1,117.61 million in import trade in 2010. The main commodities were scrap vessels, rice, wheat, edible oil, capital machinery, petroleum products, fabrics & accessories and other consumer items.

The bank has been nursing the export finance with special emphasis since its inception. In 2010 it handled 18,761 export documents valuing USD 559.78 million with a growth of 5.41 percent over the last year

Merchant Banking

Merchant Banking activity has lately gained popularity in our country. At the initial stage, the activities would center on issue Management, Portfolio Management, pre-placement and underwriting.

Branch Network

The Bank has established a wide network of branches in urban and rural areas totaling 356. National Bank Limited is the largest Commercial Bank in Private Sector in Bangladesh.

Divisional Operations in National Bank Limited

The operations in National Bank limited are carried out by 5 separate departments:

- General Banking (GB)

- Cash

- Accounts

- Trade Finance

- Credit

1) General Banking

The General Banking division, in National Bank Limited, generally performs the following functions:

- Account opening

- Cheque book issue

- FDR issue and encashment.

- Product issue and encashment

- Account transfer from one branch to another branch

- Pay order issue and encashment

- Fund transfer from one account to other accounts

- Inward Remittance and Outward Remittance

- Demand Draft (DD) issue

- Stop payment order

- Issue of solvency certificate

- Inward and outward clearing

2) Cash

Cash division is the center point of any bank. In National Bank Limited, the cash division performs an integral part of its banking operations.

The tellers in the cash division receive cash from the clients and give necessary postings in the PIBS (National Bank Integrated Banking Software). At the time of receipt, ‘cash received’

and ‘posted’ seal is attached to the deposit slip. At the time of payment, the tellers first verify the signatures and then make payment. If the check is for a big amount, then it has to be authorized by the cash in charge and branch in charge. The seals used here are ‘cash paid’, posted’ and ‘signature verified’.

3) Accounts

In National Bank Limited, the accounts related information is fully computer generated. The central IT department generates several important statements such as the General Ledger, Profit and Loss Account, Transaction journal, Overdraft and Advances Position, Full Balance position etc. These statements are disseminated in the network so that every branch can have access to its accounting information at the beginning of each working day.

4) Trade Finance

Trade Finance division operates independently of the branches and it generally deals with the followings:

- Import L/C

- Export L/C

- Local & foreign Bills Purchased

- Remittance

Import L/C

When a client comes to open an L/C, basic queries about the IRC, VAT registration number, TIN etc, are made. If the bank is satisfied with all the documents, an L/C is opened and an operational entry for L/C opening is passed in Micro Bank.

Export L/C

National Bank Limited provides money to the borrowers in terms of Packing Credit and Back to Back L/C.Packing credit is essentially a short-term advance with a fixed repayment date granted by the bank to an eligible exporter for the purpose of buying, processing, manufacturing, packing, and shipping of the goods meant to be exported.

5) Credit

The credit division is also an independent division of National Bank limited. This division basically deals with the extension of credit to the worthy clients and thus to make a profit from the interest charges. The bank invests the money of the depositors and thus the credit division has to be very cautious in terms of credit extension.

The credit division arranges for different types of loans and a high emphasis is given to Small and Medium Enterprises (SMEs). It also issues bank guarantee in favor of the clients. Necessary postings are made through Micro Bank software.

FINANCIAL STATUS

NBL always maintains a prudent balance between Tier-I and Tier-2 capital. Total capital as on December 31, 2010, was Tk. 19,190.79 million and capital adequacy ratio was 12.29 %. National Bank Limited formulated befitting credit risk management criteria and strategies for the creation of balanced lending mix in its portfolio both for short and long-term with the bottom line objective to ensure the risk-adjusted rate of return in its credit transactions. Loan and advances in the year 2010 registered an increase of 41.26% to BDT 92,003.56 million from BDT 65,129.29 million in 2009. During the year 2010, the credit expansion mainly was in bilateral project finance, syndicated finance, export, import, and trade finance as well as SME and Agri finance.

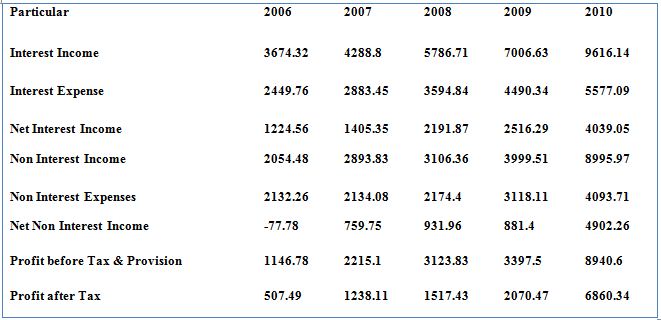

Summary of the Income Statement Item:

Net Profit: Efficient Board and management, strong capital base, wide branch network, support from other stakeholders helped NBL in revenue earnings and profit maximization. During the period NBL earned a profit after tax BDT 6860.34 million with the growth of 231.34% which has BDT 2070.47 in 2009.

Summary of the Balance Sheet Item: Figure in Million

Loan and advances: In the year 2010 registered an increased by 41.26% to BDT 92,003.56 million from BDT 65,129.29 million in 2009. During the year 2010, the credit expansion mainly was in bilateral project finance, syndicated finance, export, import, and trade finance as well as SME and Agri finance.

SWOT ANALYSIS:

SWOT Analysis is an important tool for evaluating the companies Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and can scan the macro environment, which in turn would help the organization to navigate the Turbulence Ocean of competition. Following is given the SWOT analysis of National Bank Ltd:

Strengths

- Top Management

The top management of the bank, the key strength for NBL has contributed heavily towards the growth and development of the bank.

- Company Reputation

The reputation of the bank is increasing day by day. People are relying on this bank gradually.

- Sponsors

The sponsors of the bank are some of the top companies and top business personnel of our country.

- Modern Facilities and Computer

For speedy service to the customer, NBL had installed the money-counting machine at the teller counter. The bank has computerized banking operation under a software called PC banking. Moreover, computer printed statements are available for internal use and occasionally for the customers. NBL is equipped with telex and fax facilities

- Interactive Corporate Culture:

The corporate culture of NBL is very much interactive compared to other local organization. This interactive environment encourages the employee to work attentively.

Weaknesses:

- Limitation of Information System (PC Bank): PC bank is not comprehensive banking software. It is desirable that a more comprehensive banking system should replace PC bank system.

- Hierarchy Problem: The hierarchy problem treated as a weakness for NBL, because the employee will not stay for a long. So there will be a chance of brain drain from this bank to another bank.

- Advertisement Problem: There is another weakness for NBL is an advertisement. Their media coverage is so much low that people do not know the bank thoroughly.

Opportunities

- Diversification: National Bank can pursue diversification strategy in expanding its current line of business.

- Business Banking: The investment potential of Bangladesh is foreign investors. So NBL has the opportunity to expand in business banking.

- Credit Card: There is an opportunity to launch Credit Card in Bangladesh by NBL. Beside this, NBL can acquire services for cards like VISA, MASTER CARD etc. So that they can enhance the market-based card service.

Threats:

- Contemporary Banks: The contemporary banks of National Bank like Dhaka Bank, Dutch Bangla Bank, The Trust Bank, Mercantile Bank is its major rivals. NBL should remain vigilant about the steps taken by these banks, as these will, in turn, affect NBL strategies.

- Multinational Bank: The Rapid expansion of multinational bank poses a potential threat to new PCB’s. Due to the booming energy sector, more foreign banks are expected to operate in Bangladesh. Moreover, the existing foreign banks such as HSBC, AMEX, CITI N.A, and Standard Chattered are now pursuing an aggressive branch expansion strategy

- Default Culture: Default culture is very much familiar in our country. For a bank, it is very harmful. As National Bank is new, it has not faced it seriously yet. However, as the bank grows older it might become big problems.

Credit Risk Management:

A Theoretical Framework

Credit Risk Management: A Theoretical Framework

Part: A

Contemporary banking organizations are exposed to a diverse set of market and non-market risks, and the management of risk has accordingly become a core function within banks. Banks have invested in risk management for the good economic reason that their shareholders and creditors demand it. But bank supervisors, such as the Bangladesh Bank, also have an obvious interest in promoting strong risk management at banking organizations because a safe and sound banking system is critical to economic growth and to the stability of financial markets. Indeed, identifying, assessing, and promoting sound risk management practices have become central elements of good supervisory practice.

What is credit?

In banking terminology, credit refers to the loans and advances made by the bank to its customers or borrowers. Bank credit is a credit by which a person who has given the required security to a bank has the liberty to draw to a certain extent agreed upon. It is an arrangement for deferred payment of a loan or purchase. (Wikipedia dictionary)

Credit means a provision of, or commitment to provide, funds or substitutes for funds, to a borrower, including off-balance sheet transactions, customers’ lines of credit, overdrafts, bills purchased and discounted, and finance leases. (Guideline on credit risk management, Bank of Mauritius)

What is credit risk?

Risk means the exposure to a chance of loss or damage. The risk is the element of uncertainty or possibility of loss that exist in any business transaction. Credit risk is the likelihood that a borrower or counterparty will be unsuccessful to meet its obligation in accordance with agreed terms and conditions. (Wikipedia dictionary)

Credit risk is most simply defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms (Basel Committee on Banking Supervision,2000).

What is credit risk management?

Risk management contains

- Identification,

- Measurement,

- Aggregation,

- Planning and management,

- As well as monitoring of the risks arising in a bank’s overall business.

Risk management is thus a continuous process to increase transparency and to manage risks.

Identification

A bank’s risks have to be identified before they can be measured and managed.

Typically banks distinguish the following risk categories:

— Credit risk

— Market risk

— Operational risk

Measurement

The consistent assessment of the three types of risks is an essential prerequisite for successful risk management. While the development of concepts for the assessment of market risks has shown considerable progress, the methods to measure credit risks and operational risks are not as sophisticated yet due to the limited availability of historical data.

Aggregation

When aggregating risks, it is important to take into account correlation effects which cause a bank’s overall risk to differ from the sum of the individual risks.

Planning and management

Furthermore, risk management has the function of planning the bank’s overall risk position and actively managing the risks based on these plans.

The most commonly used management tools include:

— Risk-adjusted pricing of individual loan transactions

— Setting of risk limits for individual positions or portfolios

— Use of guarantees and credit insurance

— Securitization of risks

— Buying and selling of assets

Monitoring

Risk monitoring is used to check whether the risks actually incurred lie within the prescribed limits, thus ensuring an institution’s capacity to bear these risks. In addition, the effectiveness of the measures implemented in risk controlling is measured, and new impulses are generated if necessary.

Credit Risk Management Process

Credit risk management process should cover the entire credit cycle starting from the origination of the credit in a financial institution’s books to the point the credit is extinguished from the books (Morton Glantz, 2002). It should provide for sound practices in:

- Credit processing/appraisal

- Credit approval/sanction

- Credit documentation

- Credit administration

- Disbursement

- Monitoring and control of individual credits

- Monitoring the overall credit portfolio (stress testing)

- Credit classification and

- Managing problem credits/recovery

Credit Processing/Appraisal

Credit processing is the stage where all required information on credit is gathered and applications are screened. Credit application forms should be sufficiently detailed to permit gathering of all information needed for credit assessment at the outset. Financial institutions should set out pre-qualification screening criteria, which would act as a guide for their officers to determine the types of credit that are acceptable. For instance, the criteria may include rejecting applications from blacklisted customers. These criteria would help institutions avoid processing and screening applications that would be later rejected.

In the case of loan syndication, a participating financial institution should have the policy to ensure that it does not place undue reliance on the credit risk analysis carried out by the lead underwriter

As a general rule, the appraisal criteria will focus on:

- amount and purpose of facilities and sources of repayment;

- integrity and reputation of the applicant as well as his legal capacity to assume the credit obligation;

- performance of the borrower in any credit previously granted by the financial institution,

- the borrower’s capacity to repay based on his business plan, if relevant, and projected cash flows using different scenarios;

- cumulative exposure of the borrower to different institutions;

- physical inspection of the borrower’s business premises as well as the facility that is the subject of the proposed financing;

- current and forecast operating environment of the borrower;

- background information on shareholders, directors and beneficial owners for corporate customers; and

- Management capacity of corporate customers.

Credit-approval/Sanction

Approval authorities should be sanctioned by the board of directors. Approval authorities will cover new credit approvals, renewals of existing credits, and changes in terms and conditions of previously approved credits, particularly credit restructuring, all of which should be fully documented and recorded.The approval process should be based on a system of checks and balances. Some approval authorities will be reserved for the credit committee in view of the size and complexity of the credit transaction.

Credit Documentation

Documentation is an essential part of the credit process and is required for each phase of the credit cycle, including credit application, credit analysis, credit approval, credit monitoring, collateral valuation, and impairment recognition, foreclosure of impaired loan and realization of security. Credit applications must be documented regardless of their approval or rejection. All documentation should be available for examination by the Bangladesh Bank. Financial institutions must establish policies on information to be documented at each stage of the credit cycle. For security reasons, financial institutions should consider keeping only the copies of critical documents (i.e., those of legal value, facility letters, signed loan agreements) in credit files while retaining the originals in more secure custody. Credit files should also be stored in fire-proof cabinets and should not be removed from the institution’s premises.

Financial institutions should maintain a checklist that can show that all their policies and procedures ranging from receiving the credit application to the disbursement of funds have been complied with. The checklist should also include the identity of the individual(s) and/or committee(s) involved in the decision-making process.

Credit Administration

Financial institutions must ensure that their credit portfolio is properly administered, that is, loan agreements are duly prepared, renewal notices are sent systematically and credit files are regularly updated. A financial institution’s credit administration function should, as a minimum, ensure that:

- credit files are neatly organized, cross-indexed, and their removal from the premises is not permitted;

- the borrower has registered the required insurance policy in favor of the bank and is regularly paying the premiums;

- the borrower is making timely repayments of lease rents in respect of charged leasehold properties;

- credit facilities are disbursed only after all the contractual terms and conditions have been met and all the required documents have been received;

- collateral value is regularly monitored;

- the borrower is making timely repayments on interest, principal and any agreed to fees and commissions;

- information provided to management is both accurate and timely;

- responsibilities within the financial institution are adequately segregated;

- funds disbursed under the credit agreement are, in fact, used for the purpose for which they were granted;

- “back office” operations are properly controlled;

- the established policies and procedures, as well as relevant laws and regulations, are complied with; and

- on-site inspection visits of the borrower’s business are regularly conducted and assessments documented (L.R.Chowdhury,2004).

Monitoring and Control of Individual Credits

To safeguard financial institutions against potential losses, problem facilities need to be identified early. A proper credit monitoring system will provide the basis for taking prompt corrective actions when warning signs point to a deterioration in the financial health of the borrower.

In broad terms, the monitoring activity of the institution will ensure that:

- funds advanced are used only for the purpose stated in the customer’s credit application;

- the financial condition of a borrower is regularly tracked and management advised in a timely fashion;

- borrowers are complying with contractual covenants;

- collateral coverage is regularly assessed and related to the borrower’s financial health;

- the institution’s internal risk ratings reflect the current condition of the customer;

- contractual payment delinquencies are identified and emerging problem credits are classified on a timely basis; and

- Problem credits are promptly directed to management for remedial actions.

Monitoring the Overall Credit Portfolio (Stress Testing)

An important element of sound credit risk management is analyzing what could potentially go wrong with individual credits and the overall credit portfolio if conditions/environment in which borrowers operate change significantly. The results of this analysis should then be factored into the assessment of the adequacy of provisioning and capital of the institution. Such stress analysis can reveal previously undetected areas of potential credit risk exposure that could arise in times of crisis.

Possible scenarios that financial institutions should consider in carrying out stress testing include:

- Significant economic or industry sector downturns;

- Adverse market-risk events; and

- Unfavorable liquidity conditions.

Classification of credit

It is required for the board of directors of a financial institution to “establish credit risk management policy, and credit impairment recognition and measurement policy, the associated internal controls, documentation processes and information systems;”

Credit classification process grades individual credits in terms of the expected degree of recoverability. Financial institutions must have in place the processes and controls to implement the board approved policies, which will, in turn, be in accord with the proposed guideline.

Managing Problem Credits/Recovery

A financial institution’s credit risk policy should clearly set out how problem credits are to be managed. The positioning of this responsibility in the credit department of an institution may depend on the size and complexity of credit operations. The collection process for personal loans starts when the account holder has failed to meet one or more contractual payment (Installment). It, therefore, becomes the duty of the Collection Department to minimize the outstanding delinquent receivable and credit losses.

Collection objectives

The collector’s responsibility will commence from the time an account becomes delinquent until it is regularized by means of payment or closed with full payment amount collected. The goal of the collection process is to obtain payments promptly while minimizing collection expense and write-off costs as well as maintaining the customer’s goodwill by a high standard of service. The customers who do not respond to collection efforts – represent a financial risk to the institution. The Collector’s role is to collect so that the institution can keep the loan on its books and does not have to write-off/charge off.

Identification and allocation of accounts

When a customer fails to pay the minimum amount due or installment by the payment due date, the account is considered in arrears or delinquent. When accounts are delinquent, collection procedures are instituted to regularize the accounts without losing the customer’s goodwill whilst ensuring that the bank’s interests are protected.

REGULATORY DEFINITION ON GRADING OF CLASSIFIED ACCOUNTS

Irrespective of credit score obtained by a particular obligor, grading of the classified names will be in line with Bangladesh Bank guidelines on classified accounts, which is extracted from “PRUDENTIAL REGULATIONS FOR BANKS: SELECTED ISSUES” by Bangladesh Bank as under:

The basis for Loan Classification:

(A) Objective Criteria:

- Any Continuous Loan if not repaid/renewed within the fixed expiry date for repayment will be treated as irregular just from the following day of the expiry date. This loan will be classified as Sub-standard if it is kept irregular for 6 months or beyond but less than 9 months, as ‘Doubtful’ if for 9 months or beyond but less than 12 months and as ‘Bad & Loss’ if for 12 months or beyond.

- In case any installment(s) or part of installment(s) of a Fixed Term Loan is not repaid within the due date, the amount of unpaid installment(s) will be termed as ‘defaulted installment’.

In case of Fixed Term Loans, which are repayable within maximum 5 (five) years of time: –

If the amount of ‘defaulted installment’ is equal to or more than the amount of installment(s) due within 6 months, the entire loan will be classified as ‘Sub-standard’.If the amount of ‘defaulted installment’ is equal to or more than the amount of installment(s) due within 12 months, the entire loan will be classified as ‘Doubtful’.If the amount of ‘defaulted installment’ is equal to or more than the amount of installment(s) due within 18 months, the entire loan will be classified as ‘Bad & Loss’.

In case of Fixed Term Loans, which are repayable in more than 5 (five) years of time: –

- If the amount of ‘defaulted installment’ is equal to or more than the amount of installment(s) due within 12 months, the entire loan will be classified as ‘Sub-standard.’

- If the amount of ‘defaulted installment’ is equal to or more than the amount of installment(s) due within 18 months, the entire loan will be classified as ‘Doubtful’.

- If the amount of ‘defaulted installment ‘is equal to or more than the amount of installment(s) due within 24 months, the entire loan will be classified as ‘Bad & Loss’.

(B) Qualitative Judgment:

If any uncertainty or doubt arises in respect of recovery of any Continuous Loan, Demand Loan or Fixed Term Loan, the same will have to be classified on the basis of qualitative judgment be it classifiable or not on the basis of objective criteria.

But even if after resorting to proper steps, there exists no certainty of total recovery of the loan, it will be classified as ‘Doubtful’ and even after exerting the all-out effort, there exists no chance of recovery, it will be classified as ‘ Bad & Loss’ on the basis of qualitative judgment.

The concerned bank will classify on the basis of qualitative judgment and can declassify the loans if qualitative improvement does occur.

COMPUTATION OF CREDIT RISK GRADING

The following step-wise activities outline the detail process for arriving at credit risk grading.

Credit risk for counterparty arises from an aggregation of the following:

Financial Risk

- Business/Industry Risk

- Management Risk

- Security Risk

- Relationship Risk

a) Evaluation of Financial Risk:

This typically entails analysis of financials i.e. analysis of leverage, liquidity, profitability & interest coverage ratios. To conclude, this capitalizes on the risk of high leverage, poor liquidity, low profitability & insufficient cash flow.

Evaluation of Business/Industry Risk:

The evaluation of this category of risk looks at parameters such as business outlook, size of business, industry growth, market competition & barriers to entry/ exit.

b) Evaluation of Management Risk:

A risk that counterparties may default as a result of poor managerial ability including experience of the management, its succession plan, and teamwork.

c) Evaluation of Security Risk:

A risk that the bank might be exposed due to poor quality or strength of the security in case of default. This may entail strength of security & collateral, the location of collateral and support.

d) Evaluation of Relationship Risk:

These risk areas cover evaluation of limits utilization, account performance, conditions/covenants compliance by the borrower and deposit relationship.

CREDIT RISK GRADING PROCESS

- Credit Risk Grading will be completed for all exposures (irrespective of amount) other than those covered under Consumer and Small Enterprises Financing Prudential Guidelines and also under The Short-Term Agricultural and Micro – Credit.

- Borrowers Risk Grade should be stated in the Credit Proposal.

- For Superior Risk Grading (SUP-1) the score sheet is not applicable. This will be guided by the criterion mentioned for superior grade account i.e. 100% cash covered, covered by government & bank guarantee.

- Determine the degree of each factor is a) readily available, b) current, c) dependable, and d) parameters/risk factors are assessed judiciously and objectively.

- Branch credit Officer/Relationship Manager (RM) shall ensure to correctly fill up the Limit Utilization.

- Credit risk grading exercise should be originated by trained credit officer/Relationship Manager (RM) of the branch and should be an on-going and continuous process. They shall complete the Credit Risk Grading Score Sheet and shall arrive at a risk grading in consultation with the Credit In charge/Relationship Manager (RM).

- All credit proposals whether new, renewal or specific facility should consist of a) Data Collection Checklist (Appendix-A), b) Limit Utilization Form, c) Credit Risk Grading Score Sheet, and d) Credit Risk Grading Form.

- The credit officers/Relationship Manager (RM) then would pass the approved Credit Risk Grading Form to Credit Administration Department for updating their MIS/record.

- The appropriate approving authority through the same Credit Risk Grading Form shall approve any subsequent change/revision i.e. upgrade or downgrade in credit risk grade.

EXCEPTIONS TO CREDIT RISK GRADING

- Head of Credit may also downgrade/classify an account in the normal course of inspection of a Branch or during the periodic portfolio review. In such event, the Credit Risk Grading Form will then be filled up by Credit Division and will be referred to Branch/Credit Administration Division/Recovery Division for updating their MIS/records.

- Recommendation for an upgrading of an account has to be well justified by the recommending officers. Essentially complete removal of the reasons for downgrade should be the basis of any upgrading.

- In case an account is rated marginal, special mention or unacceptable credit risk as per the risk grading score sheet, this may be substantiated and credit risk may be accepted if the exposure is additionally collateralized through cash collateral, good tangible collaterals, and strong guarantees. These are exceptions and should be exceptionally approved by the appropriate approving authority.

- Whenever required an independent assessment of the credit risk grading of an individual account may be conducted by the Head of Credit or by the Internal Auditor documenting as to why the credit deteriorated and also pointing out the lapses.

FINANCIAL SPREADSHEET (FSS)

A Financial Spread Sheet (FSS) has been developed which may be used by the Banks while analyzing the credit risk elements of a credit proposal from the financial point of view.

The FSS is well designed and programmed software having two parts. Input and Output Sheets. The financial numbers of borrowers need to be inputted in the Input Sheets which will then automatically generate the Output Sheets.

Approval Authority:

All powers of the bank are vested in the board. Executives/officers in NBL are allowed to exercise only those powers which are delegated to him/ her by the Managing Director & Board in the manner as specified in writing by the Board in the rule book of the Bank and those approved by the Board from time to time for facilitating smooth operations.

In approving credit proposals, all credit risks are authorized by the Officers/Executives under their delegated business power. Pooling or combining of authority limits is not permitted. All large loans, under single party exposure limits, are sanctioned by the Executive Committee of the Board. The aggregate of exposure of a borrower/group is taken into consideration while applying delegated authority. Any breach of lending authority by any Officer/ Executives should be reported to Managing Director, Head of Internal Control & Compliance and Head of Credit.

The Officers/Executives entrusted with approving loans should have aptitude, training, and experience to carry out their responsibilities effectively. Credit approving executives should preferably have, reasonable working experience in credit line (minimum 5 years), understanding (Training & Experience) of financial statement, cash flow, and risk analysis, knowledge of accounting, good understanding of local Industry/ Market conditions, trend and Industry/

Business risk analysis, the rationale of borrowing, working capital assessment technique, business projections, CRG, loan structuring, documentation, overall loan management. Approving executives should have the knowledge of the following areas:

- Introduction to accrual accounting.

- Industry / Business Risk Analysis

- Borrowing Causes

- Financial reporting and full disclosure

- Financial Statement Analysis

- The Asset Conversion/Trade Cycle

- Cash Flow Analysis

- Projections

- Loan Structure and Documentation

- Loan Management.

- A monthly summary of all new facilities approved, renewed, enhanced, and a list of proposals declined to state reasons thereof to be reported by Credit Division to the CEO/MD.

- Concerned Department will keep a historical record of all disbursements.

- Accounting and system controls/FAD will ensure that outstanding are posted to the correct account and properly summarized for management decision-making.

Segregation of Duties:

NBL has an established credit handling set up, where the whole task from receipt of a credit application to disbursement & recovery is handled by the concerted efforts of officers/Executives of the branch, Regional office & Head Office. In the present set up credit proposals are received at the branch. The proposal is processed by the Officers/Executives in the credit department of the branch. If the proposal is accepted the same is placed on the branch credit committee. When the committee recommends the proposal it is placed to the Branch Manager, who finally approves the proposal under his business delegation. When the proposal is beyond the delegated power of the Branch Manager, it is sent to the Regional Head.

Internal Audit (Internal control & compliance)

Internal audit and Inspection Division is charged with conducting audits of all Branches/ Division at Head Office. Audits should be carried out annually and should ensure compliance with regulatory guidelines, internal procedures, Lending Guidelines and Bangladesh Bank requirements.

Internal audit and Inspection Division shall:-

- Carry out compliance annually

- Prepare audit reports, which will contain the status of compliance with credit guidelines, operating procedure, and Bangladesh bank guidelines.

- Submit different returns to the Board & Senior management routinely.

Internal Control & Compliance Division:

Security documents are in place and under the custody of Credit Administration and it must be ensured that disbursement has been allowed after getting clearance from credit administration of branch. Our bank has an operationally independent Internal Control & Compliance Division and they report directly to MD/Audit Committee of the Board. Internal audit is conducted by qualified staff with necessary experience and technical capabilities.

Procedural guidelines

Credit Approval Process

National Bank, conducts its banking operation under branch banking system. For administrative control and smoothening its day-to-day operation and extension of appropriate and quick services, quick credit delivery, some branches have been placed under some Regional offices. Responding to the requirement of customers in the state of lack of full computerization facilities of the branches and online banking facilities some credit sanctioning powers have been delegated to the Branch Managers and the Regional Managers. The credit officers/executives after obtaining credit applications through Branch Manager along with all required papers /documents ensures sufficiency and consistency of the papers/documents. They will originate credit proposals, prepare detailed credit memorandum after undertaking a thorough credit check and conducting credit risk assessment of the client in light of credit policy Guidelines of the Bank.

MANDATORY CHECKING:

- Proposed Credit facilities are compliant with the existing banking regulations.

- CRG has been done.

- Other analysis and assessment have been done properly.

- Competent authority as per Bank’s policy approves facilities in writing.

- All Credit approvals are given on a one-obligor basis.

- The limit is approved as per authority delegated in the rule book.

- Standard facilities are described using standard language.

- Large loans are approved within the ceiling advised by Bangladesh Bank.

- Fresh approvals, renewal, rescheduling, compromise agreement for large loan accounts are placed for approval by the Board as per Bangladesh Bank Guidelines.

- The proposal incorporates that facilities are subject to banking regulation, which shall be mentioned in the sanction letter also.

Approval authorities check that pricing of the facilities is within the Bank’s declared band.

Appeal Process:

Any declined credit will be represented to the next higher authority for re-assessment/ approval.

Credit Administration (For HO, Regional Office & Branch)

Credit Administration function will be critical in ensuring that proper documentation and approvals are in place in respect of disbursement of loan facilities. Credit Administration functions will comprise the following: –

Disbursement:

Before disbursement of the approved facilities, branch Credit Administration shall ensure that the following steps have been properly followed:

- Approval has been obtained.

- Standard loan facility documentation including security documentation has been completed.

- Limit Creation & documentation Check List has been completed.

- Credit officer & Credit Administration officer of the branch has jointly signed documentation checklist before disbursement.

- The approved terms and other requirements have been adhered to by the branch.

- Branch Credit Administration Unit/ (HO Credit Administration – if required) issues security compliance certificate and Loan Disbursement /Limit Loading Checklist & Authorization Form before disbursement.

- Branch Credit Administration Unit/ (HO Credit Administration – if required) check collateral.

- Bank’s legal adviser ensures that the Bank’s security interest is perfected.

- Incomplete documentation receives a temporary waiver from approving authority.

- Branch Credit Administration Unit/ HO Credit Administration ensures that all disbursements are covered by approved credit lines.

- Authorized officers as per our bank’s policy disburse facilities.

- Evidence of disbursements is properly documented.

- Unauthorized approvals are surfaced and proper actions are taken.

- The excess over the limit is allowed under pre-fact credit approvals.

Custodian

- Obtaining Security Documentation as per approval

- Safely Storing Loan/Security Documents Cash collateral such as Fixed Deposit Receipt, Script, Bonds, Marketable Securities etc. are under dual control in a fireproof vault and for this purpose, two custodians and their alternates are to be identified in writing.

- Periodic Review of Documentation

- Ensuring insurance of the insurable objects.

- Ensuring maintenance of Safe in & safe out register properly to track their movement.

- Releasing of collateral of debt obligation instruments under appropriate approval.

- Ensuring keeping the current Insurance policy in the vault and renewal of the policy on a timely basis.

Compliance requirements for credit administration:

- Credit administration shall submit all required Bangladesh Bank returns on credit in the specific format in a timely manner.

- Credit Administration Division shall maintain Bangladesh Bank circulars/regulations/guidelines relating to credit centrally, ensure issuance of corresponding circulars and advise all relevant departments to ensure compliance with the contents of the circular.

- All 3rd party service providers like valuers, lawyers, CPA’s etc shall be approved and their performance reviewed on annual basis.

Credit Monitoring

To minimize credit losses, monitoring procedures and the system should be reinforced and the more effective system should be developed in view of varied complexities involved in various types of credit. The procedures and system must provide the early indication of deteriorating financial health of a borrower.

At a minimum, report on the following to be generated and submitted to management and instruct the branch to regularize the same.

- Overdue principal & interest (Monthly)

- Overdue trade bills (Monthly)

- The excess over limit/ Excess over facility approved (Monthly). Status reports on Excess Over Limit and expired credit limit on a regular basis.

- Status reports on drawing power and Collateral shortfall on a regular basis.

- Breach of loan covenants/ terms and conditions/Documentations deficiencies (Fortnightly)

- No payment and late payment

- Branch monitors OD/CC facilities on a regular basis to ensure accounts turn over.

- Non-Receipt of Financial Statements in time (Annually)

- Objections of internal/external or regulator Inspection/ Audit and advise corrective measures timely.

- Details of Early Alert Accounts and preparation of the list of delinquent account & Special Mention Account (SMA). (Monthly)

- Identification of early alert accounts, delinquent account & Special mention account (Monthly)

- Identification of the accounts, which have assumed SMA status due to non-renewal. (Monthly)

- Listing of the accounts, which shall be SMA if not renewed within 2 months and taking necessary measures. (Monthly)

- Status of timely renewal of limits and informing Branch, regional Office & Credit Division, Head Office 2 months ahead of expiry limit dates.

Early Alert Process:

An account that has risks or potential weakness of material nature, requiring monitoring, supervision or close attention by the Management will be brought under Early Alert Process, otherwise, these weaknesses will result in deterioration of repayment prospects for the assets or in the bank’s credit position at future date.

When an account will show a breach of loan covenants or adverse market rumors an Early Alert report should be raised. An Early Alert Account, when shows that the symptoms causing Early Alert classification have been regularized, the account will be reclassified as a Regular account under the approval of Credit Administration.

As part of Early Alert Process the following takes will be performed:

- Control mechanism to be made more effective and where require to be devised, to ensure that calls/inspections are made regularly on the clients and documented.

- Regular inspections will be conducted to confirm that bank’s security/collateral is secured.

- Call /Early Alert Reports to be analyzed by branch & Head office credit administration to ensure that affairs of the borrower are being run on expected lines and there are no material changes in the status of the borrower.

- Relationship Manager/ credit officer shall regularly monitor the performance of the clients business as well as repayment and shall prepare the status report.

- Relationship Manager/ credit officer shall prepare Early Alert Report within 7 days after identification of weakness and signs or deterioration

Credit Recovery:

Recovery Unit (RU) will directly manage accounts with the status of Sub-standard /DF/BL. Exit accounts graded 4 – 5 may also be transferred to RU for the efficient exit, based on the recommendation of In-charge credit.

Recovery Unit (RU) shall:

- Determine Account Action plan/ Recovery strategy.

- Make all-out efforts to maximize recovery including placing customers into receivership or liquidation as appropriate.

- Provide for adequate and timely loan loss provision, based on actual and expected losses.

- Reschedule accounts as per norms.

- Review classified accounts.

- Initiate legal action as per norms.

- Follow up Court cases regularly and ensure that necessary steps are taken for early resolution.

Non-performing Loan (NPL) Accounts Management:

NPLs shall be assigned to a responsible official within Recovery unit (at Branch/ Regional Office/Head Office level) who will be responsible for coordinating and administering the action plan/recovery of the advance. Recovery Unit (Branch/ Regional Office/Head Office), if required, will seek assistance from HO Credit Division but the responsibility to recover NPL shall be with Recovery Unit (Branch/ Regional Office/Head Office).

Non-performing Loan (NPL) monitoring:

Classified Loan Review (CLR) for NPLs up to 15% of the bank’s capital will be approved by Head of law and Recovery Division. While NPLs above 15% but below 25% shall be approved by Head of Law and Recovery Division with the approval of MD/CEO. NPLs for more than 25% of bank’s capital will be approved by the MD/CEO and Board will be informed.

Incentive Program:

Our bank will primarily pursue the policy of recovery of NPLS of the bank through its dedicated personnel by making them realize the essence of maintaining the quality of bank’s assets. Providing incentives to the officers/staff will be considered as an effective instrument for recovery of Non-performing loans. Such incentives may be awarded in the form of the cash reward, Letter of citation, expedited promotion etc to be decided by the MD/CEO/EC from time to time.

Findings:

The findings of this study are summarized below:

- The credit risk management process of National Bank Limited is quite commendable. Systematic and timely monitoring and appropriate documentation are tried to be maintained.

- Customer satisfaction level is quite good. Informal conversation with some customers reveals that they approve the credit evaluation and management process of National Bank Ltd.

- Filing procedure is not maintained in a definite and clear manner. It is difficult to locate the documents in a chronological and sequential manner. A definite practice, though mentioned in the credit policy is not always maintained by the credit officials.

- The credit sanction and disbursement procedure are quite lengthy.

- Networking system in National Bank Limited has to be improved. The network gets disconnected several times a day which causes delays in the overall process and other operations of the bank.

Problems Identified:

- The format of Credit Risk Grading (CRG) provided by the central bank is Limited to the Credit Officer. There is no choice of credit officers to modify it or make a grading depending on the case.

- The information provided by the borrower to the Banks for taking loans are mostly overstated leading to the acceptable score for taking positive score but this may lead to the bad financing for the Banks.

- Credit Risk Grading (CRG) system gives Fifty Percent weight ages to the Financial Risk and there is the scope of manipulating of financial data in Bangladesh.

- Credit Risk Grading (CRG) gives emphasis only on four financial ratios that may not work properly for all types of Business.

- Credit Risk Grading (CRG) emphasis only on current data that may not reflect the actual position of the business.

- Credit Risk Grading (CRG) emphasis only on Operating Profit Margin that may not work properly for all types of Business.

- Market/Industry risk gives Eighteen percent weight ages but in our country, there is no authenticate date about the market position. As such the credit officer has to depend on the available data that are real sense do not reflect the actual Industry risk.

Conclusion:

Credit risk management is becoming more and more important in today’s competitive business world. It is all the more important in the context of Bangladesh. The tools for improving management of consumer credit risk have advanced considerably in recent years. Therefore, as a responsible and reputed commercial bank, National Bank has instituted a contemporary credit risk management system. From the study, it is evident that the bank is quite sincere in their approach to managing the consumer credit risk though there are rooms for improvement. They have to be more cautious in the recovery sector and preferential treatments to some big clients should also be stopped. However, they follow an in-depth procedure for assessing the credit risk by using the credit risk grading techniques which provides them a solid ground at the time of any settlement.

From the discussion in this research report, it has become clear that credit risk management is a complex and ongoing process and therefore financial institutions must take a serious approach to addressing these issues. They have to be up to date in complying with all the required procedures and must employ competent people who have the ability to deal with these complex matters. Utmost importance should be given to the improvement of the networking system which is essential for modern banking environment and obviously for efficient and effective credit risk management process.

Recommendation:

In the light of the above findings, following recommendations are proposed:

- An uninterrupted network system has to be ensured. It will save the officials from many hassles and will save time.

- The credit sanction procedure should be made quicker since competition is very hard in today’s business world. People do not want to wait for three to four weeks on an average to get a loan which is even protected by security.

- The decision-making process can be made more decentralized. The participative approach should be adopted to gain prompt and effective result.

- The filing is a very important component of proper documentation. It has to be dealt with importance.

- The Credit Officer should be given some flexible while grading in the Format provided by Bangladesh Bank or the Bank can use their own Risk Grading system based on the format provided by Bangladesh Bank.

- The Credit Officers should be trained up so that they can perform quite well in calculating the Risk Grading

- Credit Risk Grading (CRG) system should give weight age at least Seventy Percent to the Financial Risk.

- While Calculating liquidity Ratio, the Credit Officers should use Quick Ratio because it gives a better measure of overall liquidity of a firm.

- While Calculating leverage Ratio, the Credit Officers should use debt Service Coverage Ratio because it indicates the ability of a firm to generate cash to pay interest and principal payments.

- While Calculating Profitability Ratio, the Credit Officers should not give emphasis on Operating Profit Margin because the sales of a company depend on the size of the business.

- The Credit Offices should justify the credibility of the information provided by the Borrower and then they should calculate the Credit Risk Grading.

- There should have a authenticate data that will reflect the actual market position.

- Through proper monitoring the Loans and Advance with an either by the auditors or by the head office management can ensure better Credit Risk Management.