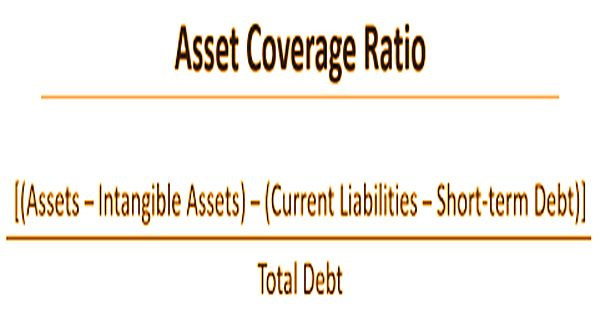

A financial metric that calculates how well a business can repay its debts by selling or liquidating its assets is the asset coverage ratio. The ratio is used to measure a company’s solvency and allows lenders, investors, management, regulatory bodies, etc. to decide how risky a company is. In general, companies have three capital sources: debt, equity, and retained earnings. Often, before lending money, banks and borrowers search for a minimum asset coverage ratio. The asset coverage ratio is calculated as follows:

Here,

- ‘Total Assets’ applies to both a company’s tangible and intangible assets; intangible assets are excluded from this value by investors

- All existing liabilities are added up and the resulting value is reduced from ‘short-term debt’, the debt due in less than 1 year

- In step a, the corresponding value of step b is decreased from the final value. The consequence of this move is divided by the company’s overall debt to meet the asset coverage ratio

The higher the benefits inclusion ratio is, the lower the danger of the assessed organization. The proportion can be utilized in practically identical organization investigation to look at organizations inside a similar industry. Value financial specialists are proprietors of the organization, so if the organization isn’t beneficial they won’t get any profits on their speculation. However, under both circumstances, debt holders need to pay interest (and principal in certain cases) at regular intervals. A corporation with a high asset coverage ratio is thus deemed to be less volatile than a firm with a low asset coverage ratio.

Assets are financed by two primary capital sources: debt and equity. Debt holders need interest and principal to be paid on a scheduled basis. Equity investors apply to the company’s owners and, once the debt holders are compensated, they would collect residual profits. Management may be required to sell company assets in circumstances where the company is not profitable in order to repay debt holders.

Organizations subsidized with not so much value but rather more obligation can accomplish more significant yields on value because of less petitioners on profit. In any case, high obligation levels lead to expanded organization danger and insolvency hazards. Both value and obligation financial specialists can utilize the absolute resource inclusion proportion to get a hypothetical feeling of how much the benefits are worth versus the obligation commitment of the organization. The asset coverage ratio provides the opportunity for creditors and investors to calculate the level of risk associated with investing in an enterprise. When the coverage ratio is determined, the ratios of firms within the same industry or sector may be compared.

Investigators additionally utilize this proportion to measure the monetary steadiness, capital administration, and generally speaking danger of an organization. It’s essential to take note that the proportion is less dependable when contrasting it with organizations of various ventures. Organizations inside specific enterprises may regularly convey more obligations on their monetary record than others. Management is obliged to behave in the best interest of equity holders, and for debt holders, what is in the best interest of equity holders cannot always be ideal. The higher the ratio, the better from the point of view of the lender, since this suggests that assets outnumber liabilities significantly.

On the other hand, a corporation would prefer to increase the amount of capital that it can borrow vs. maintaining a reasonable ratio of asset coverage. When interpreting the asset coverage ratio, there is one caveat to note. Resources found on the accounting report are held at their book esteem, which is frequently higher than the liquidation or selling an incentive in the occasion an organization would need to offer advantages for reimburse obligations. Companies financed with fewer debt and more equity face a reduced risk of bankruptcy but often give individual equity investors a lower return as profits are dispersed to more equity claimants. The ratio of coverage may be inflated slightly. By contrasting the ratio to other businesses in the same sector, this issue can be partly removed.

Information Sources: