Compliance of the rules & regulation of BAS (Bangladesh Accounting

Standard) 1 & 30 in preparing the financial statements Of EXIM Bank

of Bangladesh Limited

EXIM Bank of Bangladesh Limited was established in 1999 under the leadership of Late Mr. Shahjahan Kabir, Founder Chairman who had a long dream of floating a commercial bank which would contribute to the socio-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream.

Indeed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. Nazrul Islam Mazumder became the Honorable Chairman after the demise of the honorable founder chairman.

This Bank starts functioning from 3rd August, 1999 with its name as Bengal Export Import Bank Limited. On 16th November 1999, it was renamed as Export Import Bank of Bangladesh Limited with Mr. Alamgir Kabir as the Founder Advisor and Mr. Mohammad Lakiotullah as the Founder Managing Director respectively. Both of them have long experience in the financial sector of our country. By their pragmatic decision and management directives in the operational activities, this bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management. The authorized capital and paid up capital of the bank is Tk. 20,000.00 million and Tk 9223.56 million. The Bank has migrated all of its conventional banking operation into Shariah Based Islami Banking since July/2004.

Dr. Mohammed Haider Ali Miah succeeded Mr. Ahmed on July 25, 2012 and has created a new dimension in EXIM history becoming the first ever in-house Managing director and CEO of the Bank. Under his far-sighted leadership, EXIM Bank has not only achieved uppermost level of performance in almost each arena of its activities but also gained confidence to place itself as one of the dynamic banks through delivering transparent and standard banking services to the customer in a compliant manner.

Broad Objective:

The broad objective of the report is to study the “Compliance of the rules and regulations of BAS-1 and BAS-30 in preparing the financial statement of EXIM Bank of Bangladesh Limited.

Specific Objectives:

The followings specific objectives of the study are identified:

- To understand the rules and regulations of BAS-1 and BAS-30.

- To observe the Compliance of the rules and regulations of BAS-1 and BAS-30 in preparing the financial statement of EXIM Bank Ltd.

- To detect the non-compliance rules and regulations (if any).

Methodology:

The study requires a systematic procedure from selection of the topic to preparation of the final report. The overall process of methodology has been given below:

Data Sources:

Primary sources: Face to face conversation with Bank officers.

Secondary Sources:

- Annual Report of EXIM Bank of Bangladesh Limited.

- Bangladesh Financial Reporting Standards (BFRS).

- Bangladesh Accounting Standards (BAS).

- Website Information.

Corporate culture of EXIM Bank:

This bank is one of the most disciplined banks with a distinctive corporate culture. Here they believe in shared meaning, shared understanding and shared sense making. Their people can see and understand events, activities, objects and situation in a distinctive way they mould their manners and etiquette, character individually to suit the purpose of the bank and the needs of the customers who are of paramount important to us. The people in the bank see themselves as a tight night teams that believes in working together for growth. The corporate culture they belong has not been imposed; it has rather been achieved through their corporate conduct.

Functions of the EXIM Bank of Bangladesh Limited:

- The main task of the EXIM Bank is to accept deposited from various customers through various accounts.

- Provides loans on easy terms and condition.

- It creates loan deposit.

- The bank invest it fund into profitable sector

- It transfers money by Demand Draft (DD), Pay Order (PO) and Telegraphic Transfer etc.

- The bank is doing the transaction of bill of exchange, Cheque etc. on behalf of the clients.

- EXIM Bank assists in the Foreign Exchange by issuing Letter of Credit.

- The bank insures the securities of valuable documents of clients.

- It brings the increasing power of dimension of transaction.

Banking with Shariah Principles:

Export Import Bank of Bangladesh Limited is the 1st bank in Bangladesh, who has converted all of US operations of conventional banking into shariah-based banking since July, 2004. They offer banking services for Muslims and non-Muslims alike allowing their customers choice and flexibility in their savings and investments. Their products are approved by our Shariah Board comprising of veteran Muslim scholars of our country who are expert in all matters of Islamic finance. The process by which Noriba’s investments are designed and executed allows the Bank to offer a combination of Sharia compliance and capital markets expertise that is unique throughout the world.

Noriba is committed to the strict adherence to the requirements of the Sharia as a result of the Bank’s sole focus on Sharia-compliant investments and the full supervision of its financial products & transactions by the Noriba Sharia Board.

Noriba experts specifically design each of the Bank’s investment vehicles with the approval of the Noriba Sharia Board. Once the given product or transaction has been arranged, the Noriba Sharia Board carefully screens it for compliance before giving final approval for its implementation.

Achievement:

EXIM Bank has migrated at a time all their branches from its conventional banking operation into shariah based Islamic banking operation without any trouble. Lot of uncertainties and adversities where there into this migration process. The officers and executives of their bank motivated the valued customers by counseling and persuasion in light with the spirit of Islam especially for the non- Muslim customers. Their IT division has done excellent job of converting and fitting the conventional business processes into the processes based on shariah. It has been made possible by following a systematic procedure of migration under the leadership of their honorable managing detector.

Project Analysis & Findings

Introduction of the Topic:

In Bangladesh, the ICAB (the Institute of Chartered Accountants of Bangladesh) regulates the practice of financial accounting. The Institute of Chartered Accountants of Bangladesh is a professional accountancy body in the Bangladesh. It is the sole organization in the Bangladesh with the right to award the Chartered Accountants designation. The ICAB is a member of IASB and it has adopted several IAS as BAS (Bangladesh Accounting Standards) and also accepted some IFRS as BFRS (Bangladesh Financial Reporting Standards).Like other financial institution EXIM Bank is also following BAS1& BAS30 which is the basic regulations as well. This project will analyze to what extent EXIM Bank is following BAS (Bangladesh Accounting Standard) 1 & 30 in preparing financial statements.

The Necessity of BAS1 & BAS30:

These standards reflect the culture, history and the characteristics of accounting problems facing that country. In some countries, the professional bodies formulate the financial accounting standards, while in many others governments and regulators establish these standards. As a result much of the 20th century had witnessed a high degree of variation in the international accounting practices. It is very necessary for every financial institution to follow same standards as it has the worldwide applicability. International Accounting Standards as adopted in Bangladesh in order to infer the quality of regulation and self-regulation in Bangladesh and to determine whether membership with Big 4 accounting firms, which provide superior technology, training and quality control, leads to higher quality as measured by compliance with disclosure requirements. Foreign investment dependence has necessitated the compliance with accounting standards, in particular with international accounting standards by the companies, more explicitly, financial institutions, of Bangladesh. To ensure the quality of reporting and step ahead with international accounting standards financial institution of Bangladesh should have to follow BAS(Bangladesh accounting standard) 1 & 30. To honor the letters of credit (LCs) for import or export, it is essential to understand the strengths, of a local bank by the corresponding foreign bank. To assess such strength the foreign bank needs to review the financial statements of local banks and that can only be possible when the financial statements are prepared in compliance with BASs which is standardize according to IAS.

Benefits &Challenges of following BAS & BAS30:

The Companies Act 1994 legislates for companies operating in Bangladesh to prepare financial statements which show a “true and fair view” and the Laws on Securities and Exchange provide some guidelines for listed companies, the lack of accounting standards to guide the preparation of these reports has always been a problematic issue. The lack of accounting standards has made international lending/donor agencies very uneasy to the extent that, in recent times, these agencies have put the Government of Bangladesh under immense pressure to standardize financial reporting practices in the country. For preparing financial statements every institution should follow one common rules and regulations. BAS (Bangladesh Accounting Standard) 1 & 30 guides to include minimum requirements to prepare financial statements. It also helps our Central bank Bangladesh

Bank to audit other banks information which is following similar standards. .In an effort to generate comparability and reliability in accounting information to help investors, creditors and others each country has developed its own national financial accounting standards. The objective of issuing such IAS as BAS is to ensure global and local convergence of accounting and financial reporting system. For preparing financial statements, convergence around the world has become important. Particularly for a country like Bangladesh, it is essential to ensure such convergence. For the economic development facilities through inflows of foreign direct investment (FDI) and improved worldwide banking channel, participation in global accounting convergence is all the more essential. To make the foreign investors understand the strength, capability, payback period, returns on investment etc., of a company/industry through financial statements, it is required to prepare those statements, in such a manner so that the foreign investors can understand them easily.

The main challenges for following BASs are, first of all, the shortage of knowledgeable personnel. In Bangladesh, the number of professional accountants is very limited. It is not possible to appoint professional accountants for all the companies, which are big in volume. Due to lack of an adequate number of professional accountants, the person responsible for the preparation of financial statement is not capable enough to understand the contents of IFRS and implement those while preparing the financial statements. There are other challenges, too. There is, thus, a lack of adequate expertise to measure the value of different elements such as fair value of financial instruments, present value of retirement benefit etc. Due to lack of such expertise, in some cases it may not be possible to prepare the financial statements complying with the BASs.

Data Analysis:

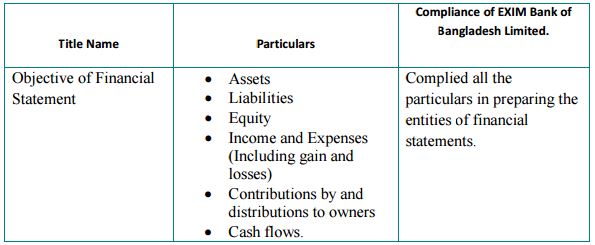

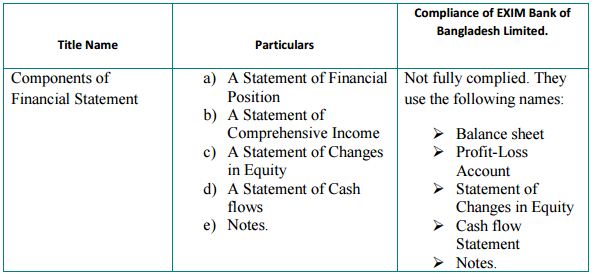

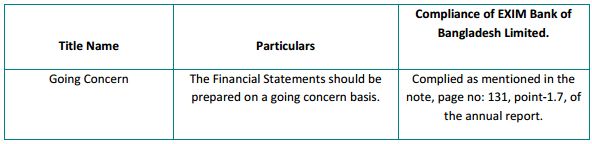

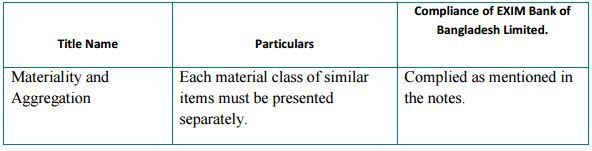

The following table mainly focuses on the compliance of some relevant rules and regulations under BAS (Bangladesh Accounting Standard) 1 in preparing the financial statement of EXIM Bank of Bangladesh Limited.

Compliance with BAS-1:

- BAS (Bangladesh Accounting Standard 1.9:

The objective of financial statements is to provide information about the financial position, financial performance and cash flows of an entity that is useful to a wide range of users in making economic decisions. To meet this objective, financial statements provide information about an entity’s above particulars and EXIM Bank has fulfilled all the requirements.

- BAS (Bangladesh Accounting Standard) 1.10:

A complete set of financial statements comprises all the above particulars but EXIM Bank is not following the similar components.

- BAS (Bangladesh Accounting Standard) 1.25:

The company reported a loss during the year as it was within the initial years of trading and the customer base has not yet been fully established. Overheads were higher as expected in relation to the launch of a new venture in relation to expected income. The results are the directors consider that the company will be able to rely upon sufficient additional support from the parent undertaking for at least the next 12 months, to be able to meet all its commitments as they fall due.

- BAS (Bangladesh Accounting Standard) 1.29:

An audit involves obtaining evidence about the amounts and disclosures in the financial statements is sufficient to give reasonable assurance that the financial statements are free from material misstatement, whether caused by fraud or error.

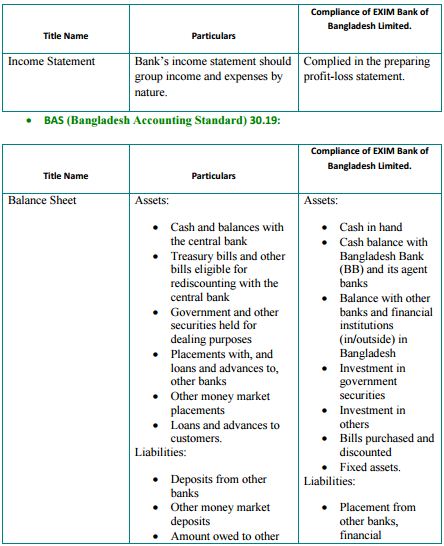

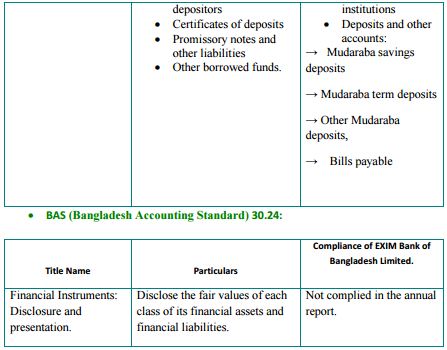

Compliance with BAS (Bangladesh Accounting Standard) -30:

- BAS (Bangladesh Accounting Standard) 30.9:

Major Findings:

- EXIM Bank of Bangladesh Limited follows Objectives of financial statement, Component of financial statement, Going concern, Materiality and Aggregation, Off-sitting, Reporting period, Comparative information, Consistency of presentation, Statement of financial position, Current assets, Current liabilities, Statement of cash flow and Disclosures about dividends etc. of BAS-1.

- Under BAS-1.10 EXIM Bank of Bangladesh Limited does not fully comply the components of Financial Statement.

- EXIM Bank of Bangladesh Limited prepared Cash flow Statement from operating activities in direct method.

- EXIM Bank of Bangladesh Limited also follows Income statement, Balance sheet, financial instruments disclosure and presentation, Maturities of assets and liabilities and Concentrations of assets, liabilities and off balance sheet items etc. of BAS-30.

- EXIM Bank of Bangladesh Limited follows the Minimum requirements for Balance Sheet items according to BAS-30 (Para 19) but the names of the headings are slightly different from the requirements.

- Under BAS-30.24 EXIM Bank of Bangladesh Limited does not comply the fair value of each class of its financial assets and financial liabilities.

- EXIM Bank disclosed off-balance sheet contingencies items but it does not follow the commitments items.

- EXIM Bank of Bangladesh Limited follows some of the classifications according to BAS-39 such as held to maturity investment and held for trading.

- EXIM Bank of Bangladesh Limited adopts BAS-30.40 for assets, liabilities and off-balance sheet items in terms of geographical areas, customer or industry groups.

- Bangladesh Bank does not give permission of all applied rules to the EXIM bank of Bangladesh Limited as it is a shariah based Islamic bank than the other traditional banks.

Recommendations:

- EXIM Bank of Bangladesh Limited should disclose the fair value of its financial assets and financial liabilities clearly that will be helpful for the people.

- EXIM Bank of Bangladesh Limited should disclose commitments items of OffBalance Sheet items for maintain the proper international rules.

- EXIM Bank of Bangladesh Limited should give all notes to the financial statement.

Conclusion:

EXIM bank has become one of the leading and most successful bank not only among the third generation bank but also it superseded many other banks and financial institution belonging to second and even first generation banks from the point of view of its excellence business performance. This bank is one of the most disciplined banks with a distinctive corporate culture. Here they believe in shared meaning, shared understanding and shared sense making. The main task of the EXIM Bank is to accept deposited from various customers through various accounts EXIM Bank provides loans on easy terms and condition. It creates loan deposit. The bank invest it fund into profitable sector. It transfers money by Demand Draft (DD), Pay Order (PO) and Telegraphic Transfer etc.

The bank is doing the transaction of bill of exchange, Cheque etc. on behalf of the clients. EXIM Bank assists in the Foreign Exchange by issuing Letter of Credit. The bank insures the securities of valuable documents of clients. It brings the increasing power of dimension of transaction.

BAS are very important to all organizations. EXIM Bank observes some relevant rules and regulations of BAS-1 and BAS-30 in preparing the financial statement. It is said that they complete almost everything of the observed rules and regulations of BAS-1 and BAS-30. Only BAS-30.24 is not complied by EXIM Bank in preparing the financial statement of 2011. So, it is expected that they should provide the fair value of financial assets and financial liabilities clearly that will be helpful for the people.