Rural People Crop Loan of Bangladesh Krishi Bank

BKB is providing credit facilities to the farmers for the development of agriculture and entrepreneurs engaged in development of agro-based and cottage industries. BKB is guided in accordance with the policies and principles of the Government of the People’s Republic of Bangladesh. BKB gives importance to accumulation of rural small savings through its branches. Bangladesh Krishi bank offers different deposit banking facilities like Current Deposit Account, Short Term Deposit Account, Savings Bank Account, Fixed Deposit Account and other Time Deposits. The Bank provides loans and advances to different sectors, namely crop and fisheries, agro based industry (which includes large and medium industry, small and cottage industry), poverty alleviation, retail business and services like transportation, communication, insurance, working capital loan etc. BKB finances production of all the summer and winter crops, horticulture and nursery etc. The Bank attaches importance to use scientific method and modern technology in fish cultivation. It extends adequate credit support for excavation and re-excavation of ponds, round the year cultivation of species, which have rapid growth, cultivation of sweet water prawn and other fishes. The Bank makes use of expertise of the concerned government agencies for bringing more ponds or water bodies under cultivation and increasing productivity. As an agricultural country different types of crops and fruits are produced here. The Bank also pays due importance to setting up agro-industries for preservation, processing and marketing of agricultural produces having backward linkage with basic sub-sectors of crop, fishery, livestock and forestation. Manufacturing and marketing of agricultural implements are also encouraged. Moreover, there is enough scope for export of these items through processing mechanism and value addition. Considering the needs of the target groups since late seventy’s BKB has been implementing a series of Micro-Credit programs out of which 10 programs have recently been completed and 31 programs are in operation at present.

Bangladesh Krishi Bank as friend of Farmers and Rural People Crop Loan:

Out of total annual allocation of Loan portfolio, 60% is earmarked for Crop financing. The Credit program covers all the seasonal crops produced in the country. The loan is disbursed as per norms set by the Bangladesh Bank. The rate of interest for this sector is 10%. The rate of interest may however, vary from time to time. Both the landowner and sharecroppers are normally the target group for this loan. Marginal farmers are also eligible for the loan.

- Crop loan is sanctioned on annual basis.

- Credit passbook is issued to each borrower.

Fisheries Loan:

To accelerate fish production BKB provides loan for excavation and re-excavation of ponds, development of marshy lands, establishment of fish hatcheries and new fisheries projects. The Loans are given in the following sub sectors:

- Fish culture in existing pond/tank

- Fish culture by re-excavation of old/derelict tank/tank

- Fish culture by excavation of new tank/tank Shrimp culture:

- Shrimp culture in traditional system (Bagda or Tiger Shrimp)

- Shrimp culture in scientific system

- Shrimp culture in semi-intensive method

- Prawn culture in sweet water (Galda) This loan is given mainly in coastal areas for developed technology based shrimp culture. Fish & Shrimp hatchery (fingerlings production):

- Fingerlings production in sweet water

- Shrimp fingerlings production (fingerlings of commercially profitable technology).

Live Stock Loan:

Livestock sector plays an important role in the development of agriculture. BKB provides loan for Bullock, Milch Cow, Goatery, Beef fattening and other draft animals. It is basically Medium Term Loan. Under Livestock head BKB provides loans for Bullocks, Milch cow, Goatery, and Beef Fattening job. Aim of the projects is creation of self-employment. In beef fattening program one person gets Tk. 25,000 for purchasing five calves. The calves are to be nourished and brought up in scientific way to sale them, healthy cows. This is a collateral free, supervised loan Beef Fattening Program: With a view to creating self-employment for the poor and un-employed people of the country the bank has introduced a new program titled “Beef Fattening”.

Objectives of the program:

- Create self-employment opportunity for poor and un-employed people.

- Meet national deficit of animal protein.

- Bring positive change in the attitude of the people through training.

- Ensure participation of bank officials in the program and increase their sense of duty and consciousness.

Main Aspects:

- Purely supervised credit.

- The bank officials giving guarantee are responsible for recovery of loan.

- Each borrower will get maximum Tk. 25,000/-for 5 calves ( each Tk. 5,000/-)

- Loan is collateral free.

- Repayable within one year.

Continuous Loan:

- The bank is providing continuous loan for different types of activities as cash credit/working capital loan on short term basis.

- Continuous loan is given for processing, preservation and marketing of agricultural products.

Agro Equipment & Farm Machinery Loan:

With the Changing scenario the traditional agricultural system is being replaced by mechanized one. In order to meet up the changing demand of this sector, BKB offers credit facilities both for production and marketing of different agricultural equipment and farm machinery including irrigation equipment. All sorts of irrigation equipment’s like LLP, HPTW, STW, DTW are eligible under the sector. Bangladesh Krishi Bank presents loans for mechanizing cultivation and irrigation. People are interested now to switch from traditional machinery and system to modern ones. So this is a timely approach. If someone eager to apply modern techniques in firming can visit a BKB branch. Well, BKB also patronize manufacture and marketing of farm equipment.

Besides the bank offers credit for poultry and dairy farms and for export oriented food and fish processing plants.

Agro Processing Industries:

As an agricultural country different types of crops and fruits are produced here. Moreover recently sectors like poultry, dairy, fisheries have flourished enormously. There is enough scope for export of these items through processing mechanism and value addition. The agro based industries are – Poultry firm, Dairy firm, Food processing plant, Fish freezing/Processing Industries etc. Reputed local businessmen and prospective foreign investors are highly acceptable and encourage to the bank for establishment of any sorts of agro-processing industries in Bangladesh. Project under joint venture as well as direct foreign investors are specially taken care of.

Poultry farm: Poultry broiler farm, Poultry layer farm, Poultry (broiler/layer) hatchery. Poultry farm related/dependent project Dairy farm: Milk production, Milk collection, Milk processing (ghee, butter, and pasteurized milk etc. production) and marketing.

Food processing project: Fruit based food preparation, processing, preservation & marketing, Flour, bread & biscuit vermicelli, noodles, chips, chanachur, corn flakes, potato flakes, French fry, popcorn, baby food, starch etc. Juice, jam, jelly, tomato ketchup, sauce, pickle etc. production & marketing, Spices processing, Different type’s oil mill, dal mill etc. Small processing industry at farm level, Dehydrated fruit canning, packaging, preservation & marketing Exportable items:

Fish processing, Freezing plant, Dehydration plant (for dry fish processing), Salting and Dehydration of Jew fish, Leather process & leather based products item.

Vegetables Import substitutes: Leather and Leather Goods, Fish net/net thread production, Garments accessories (garments allied industry like washing plant, packaging etc.), Organic fertilizer, mixed fertilizer, urea super granules etc. production & marketing, Insecticides production, Bio-pesticide, neem based pesticide production.

Poverty alleviation Programs or Projects:

In consideration of the importance of Micro-Credit and with the objective of generating employment as well as encouraging social development BKB has undertaken several Micro Credit programs of its own and also in collaboration with local and foreign agencies. The programs have been designed to cover all segments of poor population whether skilled or unskilled such as small and marginal farmers, landless laborers, destitute women, disabled, unemployed youth and rural artisans etc. About 1417047 beneficiaries have been provided with Tk. 14469.90 million since its inception (up to 30 September, 2009). Considering the needs of the target groups since late seventy`s BKB has been implementing a series of Micro-Credit programs out of which 10 programs have recently been completed and 31 programs are in operation at present. These diversified micro-credit programs are being implemented by BKB to achieve the following objectives:

- To create employment opportunities through income generating activities.

- To empower the rural women to establish their own rights.

- To improve the living standard of the rural people.

- To alleviate poverty of the poor people.

- To make easy access to institutional credit facilities and resources.

- To mobilize rural savings.

- To make optimum utilization of rural resources.

- To engage inactive human resources of the rural areas in productive/economic activities.

- To engage rural people in development process of the country.

- To eliminate exploitation done by the money lenders.

A Salient feature of BKB`s ongoing Micro-Credit Programs under poverty alleviation for the landless farmers and the poor rural people is given below:

A Salient Feature of BKB`s ongoing Micro-Credit Programs under

Poverty Alleviation is Given Below:

Credit program for the landless and Marginal Farmers:

This program has been launched with BKB`s own fund in 1992-93 financial year through its all branches. Landless and marginal farmers get short term credit under this program. Persons/ Peasants having not more than 1.50 acres of cultivable land and annual income of highest Tk 25000/- are eligible for getting credit under this program. After formation of groups and obtaining training the group members get credit without any collateral security. But they have to hypothecate the goods and assets created by the loan. In lieu of collateral they have to take responsibility as guarantor for the recovery of loan within the group. The present interest rate is 10%. 52 equal weekly installments are fixed and the recovery will be taken place accordingly.

About 474181beneficiaries have been provided with Tk. 4698.40 million since its inception (up to 30 September, 2008).

Beef fattening Joint Program:

This is a bank`s own financed program. Bank launched this program in 1994. The main objective of this program is to fill up the deficiency of animal protein in the country as well as creation of self-employment for poor and unemployed people living in the villages. Under this program a person can get a loan amounting up to Tk.25000/- for 5 calves against guarantee of a bank official or local elite. The rate of interest is 10%. The loan is to be repaid with interest in one installment within one year. About 89025 beneficiaries have been provided with Tk.1481.30 million since its inception (up to 30 September, 2008).

Swanirvar Credit Program:

Bank has been implementing Swanirvar credit program without collateral security since 1979. Employment creation for the landless and marginal farmers, increasing their standard of living, creation of social and ethical values, eradication of illiteracy, providing creation of health and family planning services etc. are the objectives of this program .The beneficiaries under the program are landless, rural poor & destitute having maximum 0.40 acres of cultivable land and maximum annual income is Tk.20, 000/-. 212 branches of 31 districts (regions) are involved in this program. The beneficiaries have to form groups (each Consisting 5 members) and a center (consisting 5 groups). BKB & Swanirvar Bangladesh is operating this program jointly. The credit is collateral free but Group guarantee for each other is needed. Maximum loan amount is TK.15, 000/- per beneficiary. It is Short term credit (to be recovered in 52 equal weekly installments within one year). Disbursement of loans to the beneficiaries is made duly recommended by Swanirvar staffs. Swanirvar Bangladesh is responsible for group formation, giving training to the beneficiaries and recovery of loan. Rate of Interest is 16%. (6% Service charge for Swanirvar, 10% Interest for BKB). About 274115 beneficiaries have been provided with Tk.1577.80 million since its inception (up to 30 September, 2008).

Small Farmers & landless Laborers Development Project (SFDP):

This project is being implemented jointly by BARD & BKB from 1995 through 21 branches under 6 Regions (districts) of Bangladesh Krishi Bank. The objectives of the project are to increase production, employment creation and increase income of the small landless farmers & laborers through formation of small groups, generation of own capital and provision for capital support for undertaking various income generating activities. Under this project Tk. 19.80 million has been disbursed to 2710 beneficiaries on average per year and recovered Tk. 15.80 million per year. Cumulative recovery rate is 97%. The beneficiaries under this program are small farmers having maximum 0.50 acres of cultivable land & landless laborers having 0.51- 1.50 acres of cultivable land. Selection of target family, group formation, and supervision of group activities, supervision of loan utilization and all kinds of field works are done by BARD. Opening of group account, sanctioning and disbursement of loan & maintaining savings account etc. are done by BKB. Bank provides credit from its own source after formation 5-10 members group. The loan is collateral free, but assets and goods derived from credit are hypothecated.

Lien of group savings & group pressure replace the collateral. Loan is disbursed for any recognized items which is accepted by bank & identified by members of group. Interest rate is 15% of which 10% for BKB, 5% for BARD. Chairman or secretary of the group recovers the loan. Loan is recovered in weekly/fortnightly/monthly installments within maximum 18 months.

About 28266 beneficiaries have been provided with Tk.215.20 million since its inception (up to 30 September, 2008). This program terminated on 30th June, 2006. South Asia Poverty Alleviation Program: This program was launched on the basis of Dhaka conference of SAARC countries in 1993. This is a joint venture program with UNDP. But it is banks own financed program. UNDP organizes the beneficiaries, trains them and recommends the loan. The responsibility of credit realization lies with the managers of village organizations. This is an area based credit program. Only Kishorganj (a district) sadar upazilla is the command area of this program. The maximum credit limit is Tk. 25000/- per beneficiary. 25 beneficiaries form a group. Rate of interest is 15% (BKB 10% and the manager of village organization 5%).The loan is collateral free and is recovered in weekly installments within one year. About 53723 beneficiaries have been provided with Tk.445.70 million since its inception (up to 30 September,

2008).

United Nations Capital Development Fund (UNCDF):

This program started in 1983 with the objective of financing rural & cottage industries. Now it is running on revolving fund. This is a joint venture program with BKB, BSCIC & UNCDF.

UNCDF provides one third of fund while BKB provides two thirds. BSCIC selects borrower and provides extension services. The program covers 29 districts. BKB provides credit from joint fund and maintains account. Rate of interest is 10% – 14%. This is a collateral free credit. Raw materials, finished goods and capital asset created out of credit are kept as hypothecation against credit provided to the beneficiaries. About 24837 beneficiaries have been provided with Tk.136.70 million since its inception (up to 30 September, 2008).

Rural Women Employment Creation Project ADB Loan No 1067 BAN (SF):

This is a joint project started in 1993 for experimenting with the idea of co-participation of government Organizations (GOs) and Non-Government Organizations (NGOs) aiming at employment creation for poor women in the rural areas. Department of women Affairs (DWA), 19 NGO`s in 12 thanas (upazilla) and BKB jointly implementing the project. NGOs organizes individuals into groups, train them under the supervision of DWA and recommends for credit funded by ADB. This is also a collateral free credit. Interest rate is 12%. About 67402 beneficiaries have been provided with Tk.154.70 million since its inception (up to 30 September 2008). This program terminated on 30th June, 2007.

BKB-NGO Micro Credit Program:

This program is a replication of Rural Women Employment Creation Project (RWECP).NGOs organizes individuals into groups, provides them training and recommends for credit. BKB provides credit from its own fund. This is also a collateral free credit. Interest rate is 12.5%. About 16636 beneficiaries have been provided with Tk. 136.00 million since its inception (up to 30 September 2008).

Credit under National Poverty Alleviation Program through Goat Rearing:

This program has been introduced in 2002 aiming to eradicate poverty through goat rearing. Directorate of livestock provides with extension service while BKB provides credit from its own fund for a period of 4 years term. This is a collateral free credit provided from all branches of BKB. Interest rate is 10%. About 24354 beneficiaries have been provided with Tk. 236.50 million since its inception (up to 30 September 2008).

Milching Cow Credit Program for the Women:

The program launched in the year 1997. The main objectives of the program were proper utilization of the unemployed women increasing milk production and helping the up-lift of the condition of the women folk. Under this program one village of a branch area is selected. One woman from each family of the selected village is eligible to get this credit facility. An applicant gets maximum Tk. 10,000/- to purchase a calf. Interest rate is 8%. The loan is realized within one year in weekly installments. This is a collateral free supervised credit. An officer or field worker of the branch is engaged in supervising the credit under the direct control of the branch manager. Livestock officers help the beneficiaries in treatment and rearing the cow. About 612 beneficiaries have been provided with Tk. 8.20 million since its inception (up to 30 September 2008).

Special Micro Credit Program for the Disabled:

This program has been introduced in 2002 aiming to income generation & development of socioeconomic condition through employment creation for the disabled persons. Department of Social Welfare and Disabled Foundation provide extension services. This is a collateral free credit provided from all branches of the bank. Interest rate is 10%. About 530 beneficiaries have been provided with Tk. 5.60 million since its inception (up to 30 September 2008).

Manipuri Small Traders Credit Program:

This program have been introduced in 2003 aiming to provide working capital to handloom industry operated by the Manipuri women living in the greater Sylhet areas. Bank officials organize the Manipuri women having handloom and training/education/experience of operation.

Eligible women are organized into 5 member groups. This is also a collateral free credit provided from the bank`s own fund. Interest rate is 10%. About 684 beneficiaries have been provided with Tk.21.50 million since its inception (up to 30 September 2008).

Special Credit Program for the Rakhains under the district of Cox`s Bazar:

This program has been launched in 2003 aiming to provide working capital credit for producing handloom and cottage industrial products and marketing. The loan is disbursed to the Rakhain community living in the district of Cox`s Bazar. Bank officials organize Rakhains into 5 member groups. This is a collateral free credit programmer from banks own fund. Interest rate is 10%.

About 469 beneficiaries have been provided with Tk. 15.10 million since its inception (up to 30 September 2008).

Tree Plantation Programs:

In 2002 and 2003 BKB has launched 8 Tree Plantation Programs-viz: All types of tree nursery including herbal, Horticulture Development, Fruit and forest tree plantation, Bamboo production, Herbal gardening, Coconut gardening, Patipata (a plant used in making mat) production, Cane production. These programs have been introduced in all branches of the bank to grow more and more trees aiming to eradication of poverty, proper use of fallen land, increase of tree production facilitating herbal treatment and development of environment. Credit under these programs is collateral free up to Tk. 25,000/-. Interest rate is 8%. About 20043 beneficiaries have been provided with Taka 203.50 million since its inception (up to 30 September 2008).

Establishment of Breeding Farm of Black Bengal Goat Program:

This program has been taken to ensure supply of kids of Black Bengal Goats in order to support the national program of poverty alleviation through goat rearing. Under this program a farm comprising 50 she goats is considered as a small farm and a farm comprising 51-200 she goats is considered as a big farm. The loan is medium term. Credit limit is Tk. 30,000/- for a small farm consisting of 10 she goats (with a he- goat). This credit limit is calculated for making up goatshed, purchasing of she-goats & he-goat and initial feed cost. This limit is proportionate for a small farm having up to 50 numbers of she-goats. For a medium farm credit limit is to be calculated deducting the cost of goat shed. This cost is borne by the entrepreneur. About 304 beneficiaries have been provided with Taka 14.60 million since its inception (up to 30 September 2008).

Poverty Alleviation through Production and Improvement of Sheep:

This is a government directed program which has been launched in the last part of the fiscal year 2004-05. Primarily this is to be implemented throughout the selected 22 upazilla under selected 11 districts of BKB`s jurisdiction. Directorate of livestock provides with extensive services while BKB provides credit from its own fund. Under this program credit amount up to taka 50,000/- is collateral free. Interest rate is 8%. This loan is to be repaid within four years in 6 equal installments including one year grace period. About 360 beneficiaries have been provided with Tk 3.80 million since its inception (up to 30 September 2008).

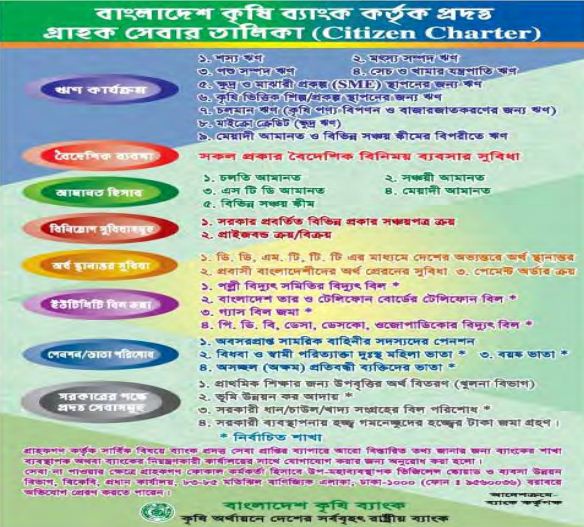

Services of Bangladesh Krishi Bank:

The Selection and Recruitment Process of Bangladesh Krishi Bank

To know the future demand of human resources, the HR division of Krishi Bank usually provides all the other divisions and branches with a general form at the beginning of the year. From the information collected from these forms, the HR division gets an estimate of the human resource requirement for the year. No long term human resource forecasting is done in BKB. The following table illustrates the number of branches of the bank and manpower in different years:

The recruitment goals of BKB are to attract and retain highly qualified human resources who will perform best in their respective areas. The bank not only tries to attract well qualified candidates but also tries to identify and recruit people who are really interested to work in the bank for an acceptable period of time.

Types of Recruitment

BKB practices two types of recruitment

- Yearly recruitment: this is done each year, according to the HR plan

- Need-based recruitments: this is done when there is a sudden vacancy

Recruitment Sources and Methods

The external sources are:

- Different universities

- Competitors and other organizations

- Unsolicited applicants

Recruiting will be handled by the HR Division and the overall planning for this will be done based on the Annual Manpower Plan. However, the respective business department/function requiring the profiles should have the responsibility and mandate to short-list the candidates. The skill based recruitment will be done for entry level positions.

Therefore, the plan for campus recruitment will have to tie up with the placement season of various universities that are targeted for recruitment. The HR Division needs to identify a set of campuses based on the courses conducted there, any past experience of candidates from these campuses and the emerging requirements of the bank.

The HR Division will need to take a decision regarding the source of external recruitment considering variables like –

- Available spread of candidates

- Cost impact

- Time needed

And the external recruitment methods include:

- Advertising in newspapers, company website etc.

- Employee referrals

- Internships

Selection Process

The different steps if the selection process is described below in detail:

Receipt of Applications

This is the first selection hurdle to join BKB. Candidates either send their CVs in application for a specific vacancy, or they send unsolicited CVs for any suitable position. The HR division collects job applications against each job vacancy. In case of newspaper advertisements, the applicants are given at least 3 weeks to apply. After a specific period, each and every job is closed for applying. Now-a-days applicants are asked to fill-up online application forms.

Sorting out of Applications

The next step is the short listing of CVs. Usually the HR division is engaged in the short listing. But the HR division may delegate this step to the respective divisions (for which the selection is being carried out) to save time. To recruit experienced bankers, CVs may be sorted out from the collection of unsolicited CVs received. Or, another possibility is to find out experienced and competent bankers in other banks. Once potential candidates are thus found out, they are contacted and called for interviews.

Informing Candidates

After the applications are sorted out and a preliminary list is prepared, the candidates are informed and are called for a written exam (for entry level positions) or an interview (for experienced banker for mid level or senior level positions). For written tests, the bank issues admit cards through courier services seven to ten days prior to the exam.

Written Tests

The employment test is generally an aptitude test which measures the candidates’ verbal ability, numerical ability, reasoning ability etc. The HR division contacts IBA/BIBM to design and conduct the recruitment tests on behalf of the bank. The HR division provides them with the desired academic qualification and the name of the vacant posts to construct the question paper for the test.

Interview

The interviews that are conducted are panel interviews and not structured. The interview board consists of the MD, DMDs, and the Head of HR. Even in the selection of fresh graduates for Trainee Assistant or Management Trainee positions, those top level and executive level managers are present. The interview board also consists external from Bangladesh Bank or Finance Ministry. Usually only one interview is conducted for selecting a candidate for a position. But in case of recruiting experienced bankers, sometimes more than one interview is conducted.

Final Approval by Competent Authority

After the interview is conducted and the interviewees are evaluated, the management committee decides who is to be selected and who is to be rejected. After this final decision, an ‘Offer Letter’ is made for each selected candidate. Once the candidates accept this offer, they are given the ‘Appointment Letter’. The candidates that are rejected are not informed.

Physical Examination

After the appointment letters are printed, the candidates are given one month for joining. First, the candidates have to go through physical examinations. If the result of these physical examinations is satisfactory, then the candidate is eligible to join the bank.

Joining and Placement

After the physical examination, the candidate needs to bring the result of the medical tests along with all the necessary documents and academic certificates for joining. After going through the formal joining and placement process, the candidates are finally employees of Bangladesh Krishi Bank.

Performance Appraisal, Future Fund and Gratuity

Performance of Bangladesh Krishi Bank

Get a competitive salary with a wide range of fringe benefits. In order to sustain the employee performance in the job employee of the organization provide different facilities for modern life house rent allowances, medical allowances, transportations allowances, house utility bills. The Bank also gives various festive bonuses as well as other bonuses like performance bonuses, security bonuses etc. According to Annual Confederation Report (ACR) officers also give different cash awards and special increments. Promotion of employee is very regular like other recognizes commercial banks. Employees also get facilities of future fund, gratuity and annuity.

Appraisal in this bank always provides according to the employees respective performances other than any prejudice.

General Future Fund

There is a fund which governed by same rules of Government employees fund rules. All payment employees keep a certain amount of money on the fund.

Gratuity

Every confirmed and full time employee who has rendered three year continual service in the Bank or more, a gratuity become a two months basic salary for each completed year of service. It may be granted to him to retirement/resignation/termination or his families at the event of his death while his service. The dismissed employee shall not be entitled to any gratuity.

Records and Service

The record service shall be maintained separately for each employee. An employee may inspect his service book once in a year in the presence of the authorized office and after such inspection, he shall put his signature with date indicating that the entries are correct and complete. If an employee in course of his inspection discovers any inaccuracy or omission in the service book, he may point it out in writing to the authorized officer within 15 days of the inspection.

Working Condition

The offices of Bank situated in the heart of the city, generally in commercial surroundings. Offices are centrally air conditioned and well decorated with modern furniture and sophisticated technical Banking equipment. With the advancement of technology, officers of the bank is now become paperless; most of the banking tasks are recorded are accomplished here with strong banking software. Inter and intra office communications are generally held by the telephone, fax, internet and cell phones. The interior of the office looks glorious. Employees do their task in a safe and healthy environment.

Loan Facilities

Employees of this organization enjoy various loan facilities like House building loan, car loan etc. under some schemes. Employees are in the higher post enjoy more amounts of loan facilities.

Performance Bonus and Other Bonus

Employees according to their performance and their position in the higher key get bonuses. Each year their basic salary increases in according to the inflation and market condition. As well as employees get festive bonus.

Allowances

Employees get house rent allowance; convenience allowance, lunch allowance, medical allowance, entertainment allowance etc.

Employees also get transfer allowance, visiting bill for work purpose visit, remuneration for special performances, bonuses etc. Employees receive allowance for doing extra duty for working more than 21 days in a similar or higher post.

Medical Facilities and Health Insurance

Officers of the bank enjoy health insurance policy. The bank pays the premium before starting their jobs as probationary officer. They should be certified from the banks recognized medical center as fit for successful performance. Staff welfare fund has been created for securing the employs accidental loss.

Employee Feedback

We have asked several employees about their satisfaction with the salary and other benefits. They all are satisfied with the regular promotion system of the bank and their basic pay is more or less similar with the other commercial Bank in the Market. According to our observation and their commitment they are satisfied with the certain passion and their salaries.

Conclusion

Profit and loss alone cannot measure the success of Bangladesh Krishi Bank. The success of BKB lies in its huge rural branch network through which it serves a large number of farmers and agribusiness. BKB serves in many areas where any other bank will not go due to lack of profitability. BKB proudly states it as “Gram bungler gonomanusher bank”. BKB is awfully state owned bank and established to finance agricultural activities including agribusiness. BKB disburses around 50% of total agricultural credit in the country. It brings villagers to the banking channel and helps them to create savings for future use. It also ensures payment of remittance through banking channel in rural areas. It helps government to disburse subsidies through banking channel in rural area such as subsidies on oil used for irrigation and fertilizer. Therefore, BKB is successful in attaining its objectives and Asian banking award is the recognition of its success.

The success of a commercial bank depends largely in the quality of service rendered to the clients. Quality of service depends on the competence and the quality of the employees of the organization. Therefore, the authority of Bangladesh Krishi Bank has to be careful in recruiting the right person for each job. As we have seen, the recruitment and selection process of BKB has rooms for improvement. The policy and process should be revised. Although the process they have been adopting so far has been somewhat effective, to adapt to the change with time, the process should be revised and streamlined.