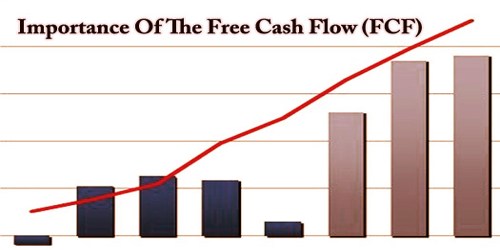

Free Cash Flow (FCF) is a calculation of financial performance which measures how much operating cash flows exceed capital spending. Unlike earnings or net income, free cash flow is a profitability measure that excludes the income statement’s non-cash expenses and includes equipment and asset spending, as well as changes in working capital from the balance sheet. In other words, FCF measures the ability of a company to produce what the investors most care about: cash that is available for discretionary distribution.

FCF reconciles profit by adjusting for non-cash expenses, changes in assets, and capital expenditures (CAPEX). It measures what proportion available money an organization has left over to pay back debt, pay investors, or grow the business, in the end, the operations of the corporate are bought. The most common types include:

- Free Cash Flow to the Firm (FCFF) also referred to as “unlevered”

- Free Cash Flow to Equity also knows as “levered”

Some investors prefer FCF or FCF per share to earnings or earnings per share as a profitability measure, because it removes non-cash items from the statement of income. Knowing the free cash flow of the company makes it possible for management to decide on future ventures which would improve the shareholder value. In addition, having an abundant FCF means a company can pay its monthly dues. Furthermore, companies can use their FCF to expand business operations or to pursue other short-term investments.

Here is the free cash flow (FCF) formula:

Earnings before Interest and Taxes (1-Tax Rate) + Amortization and Depreciation – Change in Net Working Capital – Capital Expenditure

Contrasted with income fundamentally, free cash flow (FCF) is more straightforward in indicating the organization’s capability to deliver money and benefits. A lessening in money due (inflow) could mean the organization is gathering money from its clients speedier. An expansion in stock (surge) could show a structure store of unsold items. Remembering working capital for a proportion of productivity gives a knowledge that is absent from the salary articulation.

Free cash flow ( FCF) is simply an important metric for determining how quickly a business can expand and return capital to shareholders. Meanwhile, businesses that have a stable free cash flow due to a prosperous future may be valued by other institutions looking to invest. Couple this with a low-valued share price; investors can generally observe investments with companies that have high FCF. FCF is additionally helpful because the foundation for potential shareholders or lenders to judge how likely the corporate are able to pay their expected dividends or interest.

Many investors consider FCF to be very much in contrast with other indicators because it also acts as an important basis for stock pricing. Similarly, shareholders should think about the anticipated value of potential dividend payments using FCF minus interest payments. Free cash flow ( FCF) also contains the Free Cash Flow to the Corporation (FCFF), which reflects the cash flow available to both shareholders and creditors, and the Free Cash Flow to Investors (FCFE), which reflects the cash flows available to shareholders for potential acquisitions, debt payments, and distribution. Companies also have different guidelines on which assets they declare as capital expenditures, thus affecting the computation of FCF.

Information Sources: