The weighted average of a country’s currency against a basket of other currencies is known as the real effective exchange rate (REER). The weights are calculated by comparing a nation’s currency’s relative trade balance to that of each other country in the index. This conversion scale is for the most part used to decide an individual country’s cash esteem comparative with other significant monetary standards. An expansion in a country’s REER means that its fares are turning out to be more costly and its imports are becoming less expensive. It is losing its exchange seriousness.

The REER is stated as a percentage of a base year’s value. It compares the value of a country’s currency to the weighted average of its main trading partners’ currencies. REER is used to determine how well a currency is performing in comparison to other currencies as well as in comparison to itself in the past. It’s a crucial quantitative tool that every trader should be aware of. It is a measure of a country’s international competitiveness in relation to its trading partners.

The general exchange equilibrium of a nation’s cash is thought about against every one of the current nations in the record for ascertaining the loads. This swapping scale decides the particular monetary forms esteem contrasted with other significant monetary forms in the file. The recipe is weighted to consider the overall significance of each exchanging accomplice to the nation of origin. A rising REER implies that a country’s competitive advantage is eroding. The worth of a currency is its nominal effective exchange rate (NEER) as compared to a weighted average of other foreign currencies.

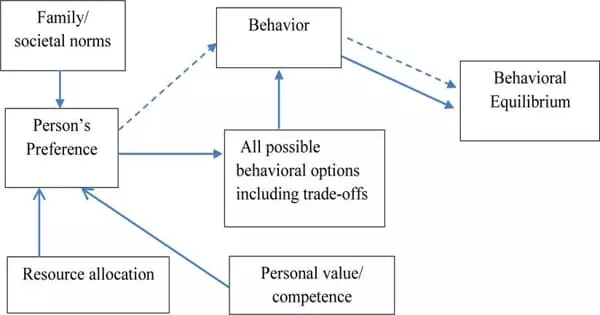

Although the actual effective exchange rate is volatile in the near term and is not a useful indication for intraday trading, it may be utilized in a longer-term FX (Forex) trading strategy. A country’s currency may be undervalued, overvalued, or in equilibrium with the currencies of other countries with whom it trades. A condition of balance implies that interest and supply are similarly adjusted and costs will stay stable. The real effective exchange rate of a money is determined by changing the ostensible compelling conversion standard to incorporate value lists and different patterns.

The REER of a country assesses how successfully that equilibrium is maintained. REER is calculated by averaging bilateral exchange rates between one country and its trading partners and then weighting it to account for each partner’s trade allocation. The REER of a nation is determined by taking the average of bilateral real exchange rates (RER) between it and its trading partners, weighting it using each partner’s trade allocation, and then correcting for inflation.

The formula for REER is

REER = CERn × CERn × CERn × 100

where:

CER =Country exchange rate

Breaking down the formula:

- After applying weightings to each rate, the average of the exchange rates is determined. If a currency has a 60% weighting, for example, the exchange rate is increased to the power of 0.60. Each exchange rate and its weighting are treated in the same way.

- Multiply all of the exchange rates.

- Then multiply the final result by 100 to create the scale or index.

The real effective exchange rate (REER) is essentially the nominal effective exchange rate less price or labor cost inflation. Bilateral exchange rates are used in certain computations, whereas actual exchange rates are used in others. The latter compensates for inflation by adjusting the exchange rate. To register the REER of a countries money, the NEER is to be changed by the suitable unfamiliar value level and it is to be collapsed by the nation of origin value level. REER demonstrates the value a buyer pays for purchasing an imported item. It incorporates the taxes and other exchange costs associated with bringing in the item.

REER is an average that indicates when a currency is overvalued in respect to one trade partner or undervalued in reference to another trading partner, regardless of how it is computed. A country’s currency’s REER can be determined using a variety of ways. It tends to be determined by gauging the normal of the reciprocal trade rates between the nation and its exchange accomplices utilizing the exchange portion of each. REER can be utilized to gauge the harmony worth of a nation’s cash, recognize the fundamental variables of a nation’s exchange stream, and examine the effect that different components, like contest and innovative changes, have on a nation and eventually on the exchange weighted file.

The most popular methods for calculating REER are using the consumer price index or unit labor cost. The REER can be influenced by factors other than commerce. The actual effective exchange rate ignores price fluctuations, tariffs, and other factors that may influence cross-national commerce. If one nation’s prices are greater than another’s, commerce in the more-priced country may decline, lowering its REER.

Whatever the technique for computation might be, the REER shows the balance worth of the cash. It estimates the nation’s exchange capacities and fare import condition. The weighting utilized in the REER computation then, at that point must be acclimated to mirror any progressions in exchange. It recognizes the trade flow’s underlying causes and takes into account all variations in the worldwide pricing. REER is an essential metric that should be taken into account while developing policies and analyzing a country’s economic growth.

Information Sources: