In finance, the quick ratio or acid test ratio is a liquidity ratio that measures the ability of a company to pay its current liabilities when they come due with only quick assets. It is defined as the ratio between quickly available or liquid assets and current liabilities. Quick assets are current assets that can presumably be quickly converted to cash at close to their book values. The acid test of finance shows how well a company can quickly convert its assets into cash in order to pay off its current liabilities. It also shows the level of quick assets to current liabilities.

The quick ratio is a measure of how well a company can meet its short-term financial liabilities. Also known as the acid-test ratio, it can be calculated as follows:

(Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

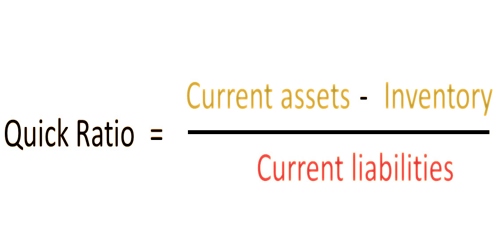

A common alternative quick ratio formula is:

(Current assets – Inventory) / Current Liabilities

The quick ratio measures the dollar amount of liquid assets available against the dollar amount of current liabilities of a company. Liquid assets are the assets that can be quickly converted into cash with minimal impact on the price received in the open market, while current liabilities are a company’s debts or obligations that are due to be paid to creditors within one year.

A result of 1 is considered to be the normal quick ratio. It indicates that the company is fully equipped with exactly enough assets to be instantly liquidated to pay off its current liabilities. A company that has a quick ratio of less than 1 may not be able to fully pay off its current liabilities in the short term, while a company having a quick ratio higher than 1 can instantly get rid of its current liabilities. For instance, a quick ratio of 1.5 indicates that a company has $1.50 of liquid assets available to cover each $1 of its current liabilities.

While such numbers-based ratios offer insight into the viability and certain aspects of a business, they may not provide a complete picture of the overall health of the business. It is important to look at other associated measures to assess the true picture.

A normal liquid ratio is considered to be 1:1. A company with a quick ratio of less than 1 cannot currently fully pay back its current liabilities.

The quick ratio is similar to the current ratio but provides a more conservative assessment of the liquidity position of firms as it excludes inventory, which it does not consider as sufficiently liquid.

The quick ratio is a more conservative version of another well-known liquidity metric the current ratio. Although the two are similar, the quick ratio provides a more rigorous assessment of a company’s ability to pay its current liabilities.

It does this by eliminating all but the most liquid of current assets from consideration. Inventory is the most notable exclusion because it is not as rapidly convertible to cash and is often sold on credit. Some analysts include inventory in the ratio, though, if it is more liquid than certain receivables.

Quick Ratio Calculation –

The formula to calculate the quick ratio is:

QR= CE+MS+AR / CL

Or

QR= CA – I – PE / CL

Where:

QR= Quick ratio

CE= Cash & equivalents

MS= Marketable securities

AR= Accounts receivable

CL= Current Liabilities

CA= Current Assets

I= Inventory

PE=Prepaid expenses

To calculate the quick ratio, locate each of the formula components on a company’s balance sheet in the current assets and current liabilities sections. Plug the corresponding balance into the equation and perform the calculation.

Ratios are tests of viability for business entities but do not give a complete picture of the business’ health. If a business has large amounts in accounts receivable which are due for payment after a long period (say 120 days), and essential business expenses and accounts payable due for immediate payment, the quick ratio may look healthy when the business is actually about to run out of cash. In contrast, if the business has negotiated fast payment or cash from customers, and long terms from suppliers, it may have a very low quick ratio and yet be very healthy.

More detailed analysis of all major payables and receivables in line with market sentiments and adjusting input data accordingly shall give more sensible outcomes which shall give actionable insights.

Generally, the acid test ratio should be 1:1 or higher; however, this varies widely by industry. In general, the higher the ratio, the greater the company’s liquidity (i.e., the better able to meet current obligations using liquid assets).

Like most other measures, a quick ratio does have its potential drawbacks. To begin, analysts commonly point out that it provides no information about the level and timing of cash flows, which are what really determine a company’s ability to pay liabilities when due. The quick ratio also assumes that accounts receivable are readily available for collection, which may not be the case for many companies.

Finally, the formula assumes that a company would liquidate its current assets to pay current liabilities, which is not always realistic, considering some level of working capital is needed to maintain operations.

It is also important to understand that the timing of asset purchases, payment and collection policies, allowances for bad debt, and even capital-raising efforts can all impact the calculation and can result in different quick ratios for similar companies. Capital needs that vary from industry to industry can also have an effect on quick ratios. For these reasons, liquidity comparisons are generally most meaningful among companies within the same industry.

Information Sources: