The difference between the fixed portion of a given swap and the yield on sovereign debt security with a comparable maturity is the swap spread. Since government bonds (e.g. US Treasury securities) are considered risk-free securities, the risk levels perceived by the parties to the swap agreement are usually expressed in swap spreads. Swaps themselves are subordinate agreements to trade fixed revenue installments for drifting rate installments. For instance, if a 5-year swap’s current market rate is 1.35% and the current yield on the 5-year Treasury note is 1.33%, the 5-year swap spread will be 0.02 percentage points or 2 basis points. Swaps are also quoted as the spread of swaps (another option is the swap rate).

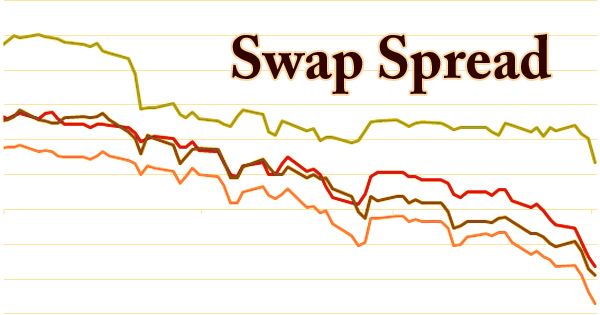

Since a Treasury bond (T-bond) is regularly utilized as a benchmark and its rate is viewed as default hazard free, the trade spread on a given agreement is controlled by the apparent danger of the gatherings taking part in the swap. Typical indices of market risk and a measure of the risk aversion prevalent in the market are called the swap spreads of interest rate swaps. In determining current market conditions, swap spreads are widely used by economists. As seen in hazard increments, so does the swap spread. Thusly, swap spreads can be utilized to evaluate the reliability of partaking parties.

Fixed income rates are also quoted in “SWAPS +” where the swap rate is added to the amount of basis points in question. There is simply the yield on an equal-maturity Treasury plus the swap spread for the swap rate. Enormous positive swap spreads by and large show that a more noteworthy number of market members are happy to swap their danger presentations. Swap spreads are likewise utilized as monetary markers. Higher swap spreads are characteristic of more serious hazard avoidance in the commercial center.

Swaps are deals in which two parties agree to swap cash flows between a fixed and a floating rate holding, allowing individuals to control their risk. In general, the group that receives the fixed-rate flows on the swap raises its chance of the prices. As the quantity of counterparties ready to fence their danger introductions increment, the bigger the measures of cash that gatherings are quick to spend to enter swap arrangements. In general, such a pattern indicates a strong risk aversion among market participants, which can be attributed to a high degree of systemic market risk.

During the 1990s, Swap Spread became a common indicator of credit spread in Europe. In addition, wide spreads can imply reduced market liquidity. In general, this is exacerbated by the larger share of the resources engaged in the swap deals. Simultaneously, if rates fall, there is the danger that the first proprietor of the fixed-rate streams will renege on a guarantee to pay that fixed rate. To make up for these dangers, the beneficiary of the fixed-rate requires a charge on top of the fixed rate streams; this is the swap spread.

The swap spread, the difference between the swap rate and the yield on a government bond of similar maturity, is then determined using the formula below:

Swap Spread = 3% – 1.5% = 1.5%

Large companies and governments use Swap Spreads to finance their activities. Usually, as opposed to the US government, private companies pay more or have positive swap spreads. Hence, wider swap spreads mean that the marketplace has a higher general degree of risk aversion. It is also a systemic danger gauge.

Example of a Swap Spread: In the event that a 10-year swap has a fixed place of 4% and a 10-year Treasury note (T-note) with a similar development date has a fixed place of 3%, the trade spread would be 1% or 100 premise focuses: 4% – 3% = 1%.

Information Sources: