The quantity supplied in economics refers to the amount of products or services manufactured and sold by firms at a given market price. This amount varies at various price levels, but usually, the higher the price, the more likely it is for manufacturers to be able to supply customers with products and services. The quantity supplied contrasts from the genuine measure of supply as lower or greater costs impacts how much inventory makers really put available. A vacillation in the degree of value prompts an adjustment in the amount provided. The fluctuation is called the supply elasticity of prices. Consequently, the quantity delivered depends on the amount of the price, and the price of the commodity is calculated by a regulatory body using price ceilings or floors. A price cap forces vendors at a particular price to sell their products or services.

The quantity supplied is influenced simply by cost. This implies that the lone factor that can make providers change the sum they produce of a specific decent or administration is an adjustment in the cost of this great or administration. In a free market, higher costs usually lead to higher amounts of goods and vice versa. The overall supply of finished goods, however, serves as a limit as it would be a point where costs rise enough to the point where the amount supplied and the total supply are one of the same. The objective of providers is to build their benefits. The leftover interest for an item or administration, as a rule, prompts further interest in developing the creation of that great or administration.

In general, suppliers calculate, at different price points, the amount of goods sold on the market, but they lack control over the quantity ordered. Many factors may affect the quantity delivered, including supply and demand elasticity, government regulation, and changes in input costs. Providers will supply a greater amount at a more exorbitant cost since they will understand a higher benefit. Customers will actually want to purchase items at the correct cost when market influences are permitted to work uninhibitedly with no administration intercession. As suppliers want to sell their goods at a high price and customers want to purchase them at the lowest possible price, the relationship between consumers and suppliers is inverse.

In the case of price reductions, depending on the product or service, the capacity to decrease the amount supplied is limited by a few different factors. One is the supplier’s operating cash needs. Therefore, where buyers and suppliers meet in the middle and where the demand curve intersects the supply curve, the optimal quantity supplied is. The fact is known as the harmony value point. Providers will create and supply their items at such a value point, and customers will pay for those items. There is likewise a reasonable cutoff to the amount of a decent can be put away and how an extended period of time sitting tight for a superior evaluating climate.

It is recommended for a supplier at a price equilibrium not to adjust their quantity given in order to preserve study profits. This is because the quantity demanded stays constant at price equilibrium, since an increase in production will increase the unsold products of the producers, and a reduction in supply will reduce revenue. Essentially, the quantity supplied is intensely affected by the flexibility of market interest. At the point when market interest are versatile, they effectively change considering changes in costs. At the point when they are inelastic, they don’t. Inelastic merchandise are not generally created and devoured in balance.

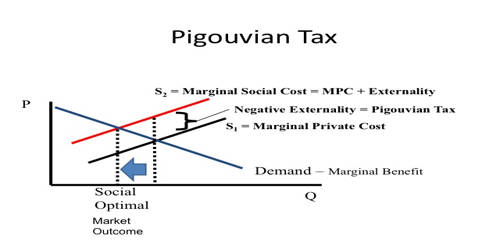

In addition, the manner in which supply changes due to changes in the price of products and services is defined by the price elasticity of the supply, not by the amount supplied, which depends on the level of the price, typically determined by the government or by market forces. Markets should be based on achieving balance, according to economic theory, but several forces prevent a market from achieving equilibrium. As external factors such as government legislation control supply, many markets do not function freely.

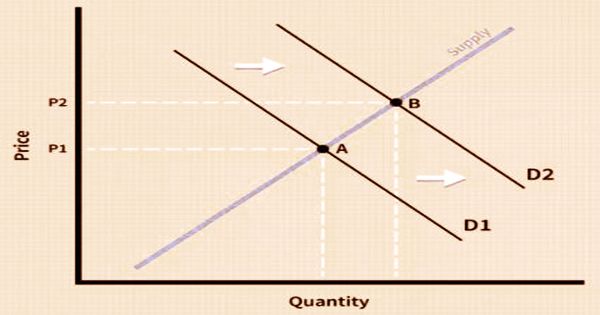

The optimal quantity supplied is the amount whereby purchasers purchase the entirety of the amount provided. To decide this amount, known market interest bends are plotted on a similar chart. The inventory bend is upward-inclining since makers will supply to a greater degree a decent at a more exorbitant cost. As customers demand less amounts of a good as the price increases, the demand curve is downward-sloping. An elastic supply or demand reacts to price fluctuations, and they do not do so when they are inelastic. This is why inelastic products and services are not always in equilibrium.

The following factors that affect the supply curve include:

- Technology: The supply curve moves to the right as there are technical advances in production. On the other side, the supply curve would change to the left if the technology does not improve and increase demand.

- Production Costs: There is an inverse relationship concerning the supply curve between production costs and the input price. Therefore, an increase in the price of input and the cost of output would lead to an opposite shift in the supply curve and vice versa. For example, a reduction in overhead costs of production would move the supply curve to the right, as making a good or service is cheaper.

- Price of Other Goods: The goods or services must be linked in order to impact the supply curve, and consumers must think the relationship is important. The replacements for products vary from the joint products. Corn and soybeans are an example of a product replacement. If the price of maize decreases, more soybeans will be grown by farmers, and more land will be available to grow soybeans. It raises soybean production.

Much of the time, providers need to charge excessive costs and offer a lot of products to augment benefits. While providers can as a rule control the measure of products accessible, available, they don’t control the interest at merchandise at various costs. At the lowest possible price, customers want to be able to meet their desire for goods. If a good is fungible or a luxury, buyers would be able to limit their purchases or opt for alternatives. This dynamic tension in the free market means that, at competitive prices, most items are cleared.

Information Sources: