Bangladesh is a developing country. And its economy is expanding. For that reason banking sector is also grow up very rapidly. The Banking Industry in Bangladesh is more than 100 years old. The first commercial Bank was ANZ Grind lays Bank, which opened in 1905. Today necessity of Bank as a financial institution is undeniable. Conventional Banks operates their businesses on interest basis. But interest is not allowed in our religion Islam. Keeping this problem in mind Organization of Islamic Conference (OIC) has introduced the concept of interest free Banking. This interest free Banking system will be operated on the basis of profit-loss sharing system. Jamuna Bank Limited is one of these kinds in our country.

Jamuna Bank Limited (JBL) is a solid, forward-looking, modern local Bank with a record of sound performance. The effort that JBL makes in order to portray the bank as a Brand image is very strong and successful. The general image of Jamuna Bank is “Trustworthy, Efficient, Helpful and Committed”. “Prospects and Challenges of SME Credit Scheme of JBL, Mirpur Branch”, is my assign project. I have worked in the Credit division, Remittance, Advance, Foreign exchange side by side I learn other Banking operation.

This report covers three parts. First two parts cover the organization part and the job part. The third and the last part covers the overall project and covers the overview of Foreign Exchange Division, letter of credit in import and export, types of letter of credit and stages of letter of credit of JBL, the main topic of SME Credit Scheme of JBL and finally SWOT analysis & Recommendation and Conclusion.

For a bank, good loans or credit or advances are most profitable assets. The largest portion of operating income is derived from lending. A commercial bank usually wins over its competitors only on the quality and quantity of lending. It is therefore, indispensable for a bank to have a well thought policy for executing its lending operation.

This report represents JBL SME Credit Scheme. Already it has earned a strong positioned in the field of SME Credit Scheme. To hold the position and be perfect in this sector, they will have to keep more and more attention to the customer retention and development of this sector.

Background of the study:

As a financial intermediary bank play an important role to match the surplus & deficit unit. They collect deposit from surplus unit & lend it to the deficit unit. This mobilizations of deposit & allocation of credit to productive & consumer services leads towards the economic development, but commercial banks in Bangladesh was not so much careful in

credit management, which leads to the widespread loan default & ultimately worse the entire financial cycle. Bank usually gives long-term loan to business firm. However credit management is crucial issue. Bank performance or profitability almost depends on proper credit management.

Jamuna Bank Limited (JBL) credit department try their best in maintenance of their credit department. So in my study I wanted to focus on SME Credit scheme of JBL which is a part or sector of credit management. On the other hand, I tried to come up with some guidelines and suggestions after analyzing extensively the pros and cons of the challenges and prospects associated in SME Credit Scheme of JBL.

Origin of the report:

As a part of the Bachelor of Business Administration (BBA) course requirement, I was assigned for doing my Internship in the Jamuna Bank Limited. The topic of my Internship was “Prospects and Challenges of SME Credit Scheme of JBL”.

Objective of the report:

The main objective of this report is to reflect the practical knowledge that is gained during internship period and to relate the theoretical learning of BBA Program. Besides this broad objective, the followings are given emphasis:

- To fulfill the requirement of the Internship Program.

- To present an overview of Jamuna Bank Limited.

- To analyze the prospects and challenges of SME credit Scheme of JBL.

- To make a comparative analysis of SME credit scheme.

- To determine the most important attributes of service quality about SME credit scheme.

Methodology of the Report:

Methodology: This report is the reflection of three months internship program at the Jamuna Bank Limited, Mirpur branch. Data collection is very important in preparing a report. In order to make the report more meaningful I mainly use two types of sources. These are:

Primary Sources: These are the data’s, which are collected for this specific report and which are afresh in nature, were not used before and need to be processed.

Primary sources are:

- Information from several officers.

- Face to face conversation with the employees of different departments andclients.

- Practical work exposure achieved from different desks in the bank.

- Direct observation.

Secondary Sources: Most of the information is collected from secondary sources. This includes annual report, credit policy etc, a number of books, journals, handbooks, periodicals published by Bangladesh Bank and websites.

a. Annual Report 2012 and 2013 of Jamuna Bank Ltd.

b. JBL website “www.jamunabankbd.com ”.

c. Periodicals published by the Bangladesh Bank.

d. Different publications regarding banking functions, operation, and transactions policies.

Introduction:

Bank is a financial institution that collects society’s surplus cash and provides a part of that as loan with a view to earning profit. So we can simply say that Bank is financial organization that deals with money. According to section – 5 of the Bank Company Act – 1991, a company transacting the business of banking is called a banking company. A

manufacturing or trading company will not be deemed to be a bank company even if does accept deposits from the public for financing its manufacturing and trading activities.

Now a day it is completely impossible to think a country without a bank, because banks play a diversified role in the development of an economy. The most important task of bank is building of capital which is the key factor of the development of an economy. Banking sector helps to flourish the industrial sector by supplying the capital of the industries and other services like intermediaries role in case of foreign business. It is impossible to do foreign trade without the help of bank. Banks provide services that help the business sector a lot to carry on the business.

Jamuna Bank Limited is a fast growing private sector bank in Bangladesh. It has created a new horizon of its own in the banking arena of Bangladesh in terms of service to the customers. The bank has expanded and consolidated its customer base in both of its core businesses and retail banking.

To provide clientele services in respect of international trade it has established wide correspondent banking relationship with local and foreign banks covering major trade and financial centers at home and abroad. Currently Jamuna Bank has 91 branches and 149 ATM booths in all over Bangladesh. Besides conventional banking, Jamuna Bank Limited is carrying Islamic Banking activities based on Islamic Shairah principles. The first Islamic Banking branch of the Bank opened on October 25, 2003 at Nayabazar in Dhaka. Afterwards its second branch opened on November 27, 2004 at Jubilee Road in Chittagong. Jamuna Bank Limited is committed to conduct business of its Islamic Banking branches strictly complying Shariah requirements.

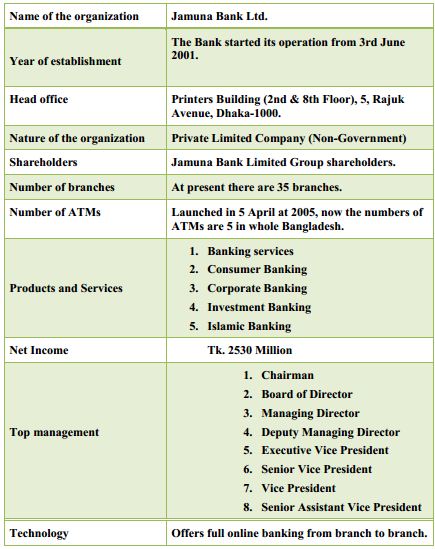

Jamuna Bank Bangladesh at a glance:

Internship Job Responsibility:

Specific responsibilities of the job:

General Banking Responsibilities: In the department of General Banking, I had to learn how to make different banking statements, understand the process of collection of vouchers, receive cheques, prepare salary sheets and locate different vouchers.

Remittance Responsibilities: My responsibilities during my training in this department included entering daily transfer in transfer books, filling-up savings and current account forms, crossing off cheques, preparing demand drafts and providing clients with their cheques.

Card Division: Duties during my training under the Card Division department consisted of filling-up and observing debit card and credit card form, providing debit/ credit card to respected customers and clients, observing debit/ credit card vouchers, and participating with card team to convince consumers.

Advance responsibilities: In the Advance department, I was trained to observe and participate in the (drafting) of different loans e.g. Overdraft loans, Secured Overdraft loans, Temporary loans, Transport loans, Home loans, Loans against Trust Receipt, Consumer Credit schemes, Car loans, Furniture loans etc. Sometimes I had to work in foreign exchange department, the work that I performed are:

- L/C Advising

- LDBC Forwarding

- LDBP Adjusting

- Daily Voucher, Supplementary

- Outward Mail Register

Letter Of Credit (L/C): A letter of credit is a common arrangement in international finance. With a letter of credit, the bank issuing the letter promises to make a loan if certain conditions are met. Typically, the letter guarantees payment on a shipment of goods provided that the goods arrive as promised. A letter of credit can be revocable (subject to cancellation) or irrevocable (not subject to cancellation if the specific conditions are met).

Advising L/C: When export L/C is transmitted to the bank for advising, the bank sends an Advising Letter to the beneficiary depicting that L/C has been issued. Outward Mail Register: It is an official register where everything that goes out of the bank, have been written or recorded manually, for example if the client gets his L/C copy after advising, then LDBC number, outward mail register serial number, and the information about the issuing bank.

Different aspects of job performance:

- Banking jobs are critical and also need lots of time to perform because bankers have to deal with every aspect in order to satisfy clients and also earn revenue for the bank.

- Manager or head of the branch is the man in charge of the bank to take any decision. Officers mainly follow his instructions to perform their jobs successfully.

- General banking is mostly responsible for doing different formulation of works such as preparing report, statements, salary sheets, discussing any reports and providing ideas. They also do some sensitive work related to provide money by receiving cheques, computerized account information, provide interest on deposit

- Remittance is responsible to give daily transactions, receiving and crossing cheques, provide foreign currency which comes from abroad with the support of Western Union Money Transfer. Preparing demand draft and other bill related activities. Open new account like current or saving accounts.

- Advance department mainly do loan related activities, carefully observe each in formations before provide any loan, make loan statements and send the copy to the head office for loan approval. They also check whether the client is giving the payment and interest of the loan and also the condition of each client to loan progress.

- Foreign exchange department deals with opening Letter of Credit (L/C) and providing support to client through bank guarantees and deal with other foreign banks and institutions from the clients‟ point of views.

- Card division mainly provides client information related to debit/credit card. The types of benefits the customer will get if he/she have the card. Often they go for client’s office to convince them to have the credit card. They also prepare different statements and voucher related to card.

Critical observations and recommendations:

- The numbers of employees are not efficient to perform task effectively. For example in general banking or remittance or card division the numbers of employees are more than advance department. So in advance department there is always a rush to perform activities.

- The cash receive and collection booths are fewer in numbers than the clients. Therefore, before any festivals the clients need to wait a lot of time in line which sometimes creates frustrations among clients.

- The officers in charge remain always busy with their works for this they don’t have enough time to provide information even to clients or interns even if they have the intension to do so.

- Advance works are very much critical and sensitive. Because of this it takes long time to perform any task. Officers and in charge always remain very much cautious to perform their activities. If they fail or make any major mistakes then they can be fired or have to pay a penalty for that.

- Sometimes they give pressure to clients to give interest of loans and other sanctions which sometimes create unpleasant environment.

- Slow internet connection often creates problems because the local broad band connection they use is not always speedy to perform tasks effectively. And also sometimes there intranet does work properly, which makes a huge problem for the clients as well as the officers.

- For the success of any organization, employee satisfaction is one of the most important factors and JBL authority should have to look about it.

Main Project

JBL Banking:

Jamuna Bank offers wide-ranging products and services matching the requirement of every customer. We make every endeavor to ensure our clients’ satisfaction. Our cooperative, friendly personnel in the branches will make your visit an enjoyable experience. There are mainly four functional departments in the organization. They are:

- General Banking.

- Advance Banking.

- Foreign Banking.

- Internet/Online Banking.

General Banking:

a) Accounts Opening

b) Consumer Saving Scheme

c) Cash Department

(a) Accounts Opening: General banking system of the JBL provides different types of account facilities. Each account has different restriction and requirements. Saving Account: Saving Account is that type of account where people deposit their money with a tendency to save. A certain percentage of interest is given against the deposit. People can withdraw money twice a week from this account. There are two type of saving account

a. Individual Saving Account

b. Joint Saving Account

Current Account: Current Account and Saving Account are more of less same. The basic difference between a current account and a savings account is that current account does not calculate any interest. The current accounts are usually entrepreneurs, business organization, and companies’ etc. There are several types of current account available at the JBL, they are shown below:

- Individual Current Account.

- Partnership Current Account

- Proprietorship Current Account

- Limited Company Current Account

- Account of Societies Clubs etc.

(b) Consumer Savings Scheme:

Short Term Deposit: Short-term deposit account can be opened with Tk. 5,000 as balance. This account is operated and maintained like a current account. The rate of interest on this type of a/c (account) is 5.25% and withdrawals from this type of a/c require a notice of seven days.

Fixed Deposit: JBL offers FDR for different amounts at different interest rates for different period of time. In the receipt holders’ name and other particulars are kept as secret documents on the bank. In the documents the name of nominee is also incorporated. If any holder of the receipt wishes to en-cash receipt before the bank usually do not pay the interest. But JBL, as goodwill pays a lump-sum amount of interest to the FDR holder.

Monthly Savings Scheme (MSS): The most popular product of Jamuna Bank Limited is JBL Monthly Savings Scheme (MSS). JBL has given highest interest in this scheme. But considering the future liability Bank’s Authority decided to reduce the interest rate.

Double/ Triple Benefit Scheme (DBDS/TBDS): Double/Triple Benefit Scheme is another popular product of JBL. These are high yielding deposit schemes in which depositor’s money will be double and triple at the end of 06 years and 10 years respectively. Depositors can take loan up to 90% of their deposit at normal lending rate of interest of the bank. Minimum amount of this scheme is Tk. 25,000/-. The rate of interest of DBDS is 12.25% and TBDS is 11.61%. But because of high interest rate, the Bank recently closed this product.

Monthly Payable Profit Scheme (MPPS): Depositor can get profit monthly from this scheme, that’s why it is popular to all. Party must have saving account of same branch in opening of MPPS. Because monthly profit transferred to his/her saving account and there is no charge for transferring of monthly profit. Minimum amount of opening an MPPS is Tk. 25,000/-, for five years and interest rate is 12%. It’s also a high interest base deposit. So, very recently the Bank closed this scheme.

FOREIGN EXCHANGE:

Definition of Foreign Exchange: The foreign exchange regulation act refers that foreign exchange means foreign currency and includes any instrument drawn accepted, made or issued under clause (13) of article 16 of the Bangladesh Bank order, 1972, all deposits, credits and balances payable in any foreign currency and any draft, travelers cheques, letter of credit and bill of exchange expressed or drawn in Bangladesh currency but payable in any foreign currency.

Foreign Exchange and Foreign Trade: Foreign exchange like foreign trade is a part of economic science. It deals with the means and methods by which rights to wealth in one country’s currency are converted into those of another country. By the same token, it covers the methods used for conversion, the forms in which such conversions take place and the causes that render these conversions necessary.

Modes of Foreign Exchange: On the basis of the various services regarding the foreign exchange provided by the JBL can be segregated into three categories:

a) Export

b) Import

c) Foreign Remittance

a) Export: Export is the process of selling goods and services to the other country. It has an immense contribution to generating income for the bank.

b) Import: In line with the experience of developing countries, imports payments of Bangladesh increased over the years. The imported items were mainly industrial raw materials, consumer goods, fertilizer machinery and old ships of scraping, recondition cars etc. the growth in import business had been previous year showing an increase of 20%. Efficient handling did the significant items of import and concerned efforts for building up of a potential clientele for the bank.

c) Foreign Remittance: Remittance services are available at all branches and foreign remittances may be sent to any branch by the remitters favoring their beneficiaries. Remittances are credited to the account of beneficiaries instantly through Electronic Fund Transfer (EFT) mechanism or within shortest possible time. Jamuna Bank Ltd. has correspondent banking relationship with all major banks located in almost all the countries/cities. Foreign remittance is another important factor of the JBL. Remittance means to send or transfer money or money-worth from one place to another. In this case, the bank acts as the media to transfer or remit the money. Against the service it charges some commissions from the client.

Prospects and Challenges of SME Credit Scheme of JBL:

Banks are reluctant to expand their SME credit portfolio because they do not consider SME lending an attractive and profitable undertaker. This is because SMEs are regarded as high risk borrowers because of their low capitalization, insufficient assets and their inability to comply with collateral requirements of the banks. Administrative costs are also higher because close monitoring and supervision of the SME operation becomes necessary.

On the other hand, Bank and others financial institutions generally prefer large enterprise clients because of lower transition costs, and greater availability of collateral. The SMEs also fall outside the reach of micro finance schemes, and thus are compelled to depend on formal sources of funds at much higher interest rates, the Bangladesh Bank report said.

The Bank has pointed out some challenges they are facing at the time of granting SME loans. The challenges are as follows:

Challenges:

There is an issue of interest rate charged by banks and financial institutions for SME finance. Very often it is argued that the interest rate on SME loans is too high and needs to be lowered.

Banks also observed that the borrowers’ use SME loan for other purposes instead of using in the SMEs. Fund diversion hinders the optimum growth of SMEs.

In many instances SME applicants/borrowers fail to provide adequate documents at the time of loan application. Due to this reason it takes extra time for sanctioning SME loans.

Sometimes SMEs are not able to provide required collateral and security. Due to this reason banks face problems in granting credit.

Small enterprises are unable, or unwilling, to present full accounting records and other documentation called for by banks. In most cases such records just do not exist, making appraisal of loan applications difficult.

The loan granting procedures are very complex and lengthy; as a result SME entrepreneur’s loan applications sometimes may have been rejected.

Banks consider SMEs as high risk borrowers because of their inability to comply with the bank’s collateral requirements. Most of the banks investigated and mentioned that SMEs are not able to provide required collateral. Due to this reasons banks face problems in SME financing.

Inequality of opportunity is a challenge for SME credit scheme. Female entrepreneurs are treated unfairly because some people think they have lack business experience which is not always right.

Sometimes SMEs are not able to present proper presentation of the business request for SME credit loan, which may cost them termination of Loan.

Prospects:

Lower amount of capital investment to start business: To start SMEs it requires a small amount of fund. So, people with a little capital may start their business. Growth of SMEs may have a positive impact on the overall economic development of Bangladesh.

Low risk involvement: Capital requirement is low in SMEs. SMEs are also diversified in nature. As a result, SMEs are considered as low risk organizations.

Low cost products in domestic market: SMEs are providing a diversified range of products at a lower price in local market. People are getting SME products at a lower price.

Accelerated growth of SMEs: It has been observed that in the last decade almost every year SME sector has experienced positive growth rate in each year. The yearly growth rate is about 8%.

Availability of labor at a lower wage: Bangladesh is a labor abundant country. A large number of laborers can be availed at a lower cost here.

Government and institutional encouragement: Government has established an independent SME foundation to help and encourage the development of SMEs.

Separate SME branches: It has been observed that recently many commercial banks have opened separate specialized SME branches. Among them most pioneers are Brac Bank, Jamuna Bank, Standard Chartered Bank, Dhaka Bank, Eastern Bank Limited, The City Bank, Mutual Trust Bank and National Bank.

Women Entrepreneurs Loans: Some commercial banks have special SME loan schemes for women entrepreneurs, such as ‘Jamuna Nari Uddogh’ of Jamuna Bank Limited, Orjon of Standard Chartered, Protyasha of IFIC, Mukti of Eastern Bank Limited, Prothoma Rin of Brac Bank and Nokshi of The City Bank. Through these schemes, women entrepreneurs may start their own businesses. This will help a lot of women entrepreneurs to become self-dependent.

Findings and Analysis

Analysis:

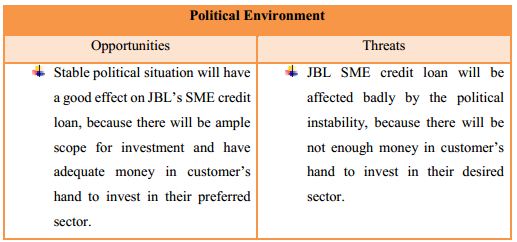

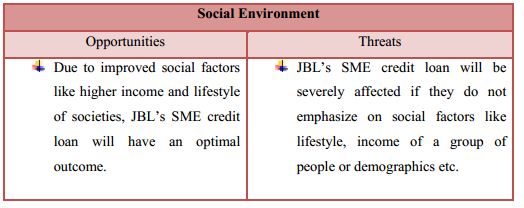

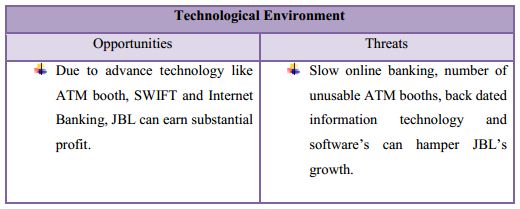

1. SME’s PEST Analysis: The PEST module, which includes political, economic, social and technological factors, can be applied when analyzing external factors, they are:

a) Political Factor Changes in PEST: This is how the local and national government might intervene with, tax policy, trade restrictions and relationships with the rest of the world, laws, trade policies, subsidies for certain industries, industry-specific regulations, government spending and infrastructure, and political stability and local, regional, national, international political issues.

b) Economic Factor Changes in PEST: The economic factors are interest rates, changes in taxation rates or policies, inflation and currency exchange rates, employment and unemployment levels and the misery level.

c) Social Factor Changes in PEST: Spells out demographics (age, gender, race/ethnicity, occupations, family structures and location) employee/career expectations and tolerances, lifestyle, population growth and national cultural trends. Keeping track of these, may point to customer wants/needs or finding potential markets.

d) Technological Factor Changes in PEST: This factor includes how quickly technology changes and how customers use technology to buy things, technological options (mobile device applications, cloud computing, technology

transfer issues and information technology and its impact on access to reliable information) that make it easier for you to get the work done internally, social media, e-commerce, research and development and manufacturing practices.

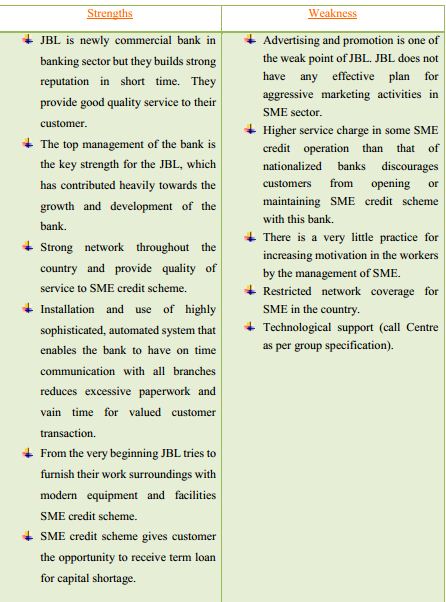

SME’s SWOT Analysis:

Segmentation, Targeting, and Positioning (STP):

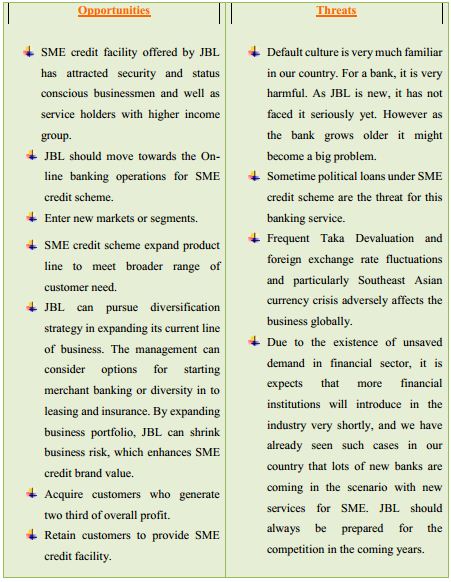

Terms of STP means: market segmentation and target markets and positioning. Market segmentation: Dividing a market into distinct groups of buyers who have different needs, characteristics, or behaviors, and who might require separate products or marketing programs. The table below shows the overall credit market segmentation of Jamuna bank’s.

Table: Lending Rates of Various Types of Loans and Advances

Positioning: Arranging for a product to occupy a clear, distinctive, and desirable place relative to competing products in the minds of target consumers. The table below shows the overall credit positioning of Jamuna bank’s.

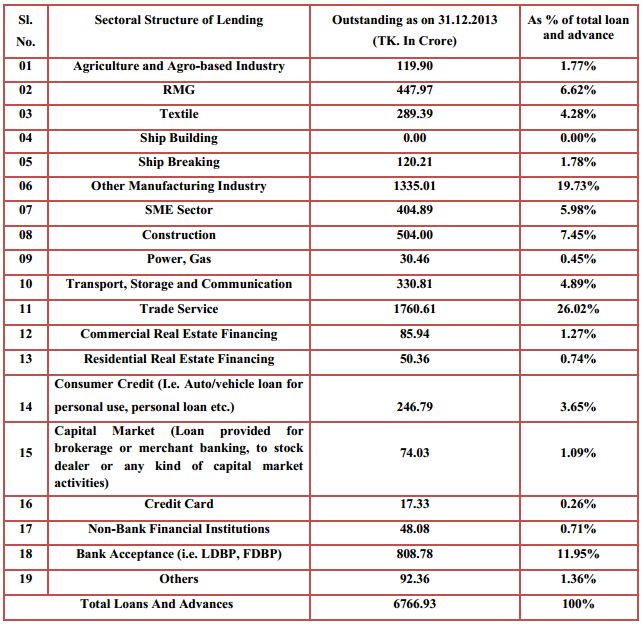

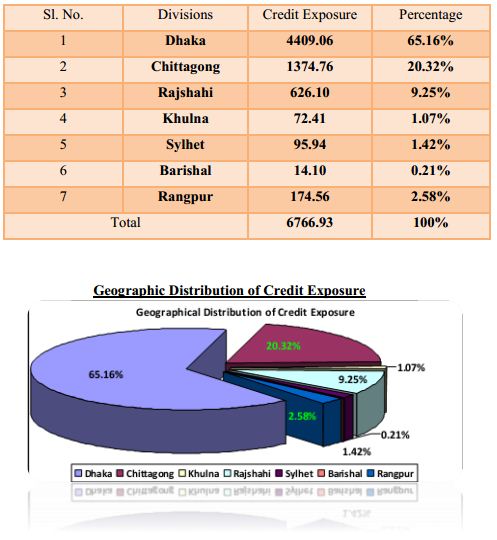

Geographic Distribution of Credit Exposure: JBL business is concentrated in two major cities- Dhaka and Chittagong as country’s business activities are concentrated in these two locations. The following table illustrates credit exposure in different divisions in the year 2013:

Market targeting: The process of evaluating each market segment’s attractiveness and selecting one or more segments to enter. In the table below we can see that their target market for credit (Loan and advances) is increasing each year. In the year 2013 they have given TK. 404.89 crore as SME loan and advance which is 5.98% of total loan and advance.

Findings:

- Jamuna Bank Ltd. provides working capital facilities like SME Credit Scheme and continuously supervise to ensure that appropriate stocks are there to support the financing.

- The Jamuna Bank is too much centralized especially in giving SME credit loans. For each and every work branch office has to get permission from the head office. The head office tightly controls each and every branch office. This dependency on head office causes slow down their activities.

- The employees of credit and foreign exchange departments are very smart and experienced and they have the ability to deal with customers with ease.

- Cash limit is low; sometimes clients cannot get service properly.

- Advertising and promotional activities are very effective for informing customers about new and (financial) attractive service. So, advertising campaign should be stronger for quick improvement of the bank.

Recommendation:

Although this branch is making profit and generating volumes of deposits, a number of problems have been found at JBL, Mirpur branch. To increase the efficacy of customer service in the SME sector, they should try to develop the process of providing services.

There are some following recommendations:

- Bank need to increase its quality of customer service in the SME sector.

- Branch should be innovative and diversified in its service.

- Need to speed up processing of SME Credit Scheme.

- Personal relationship should be built with the SME’s. They can be sent different gift items like calendar, diary etc. on different occasions like Eid, New Year etc.

- The office layout should be designed in a way so that, there is no chance of confusing customer. The SME section will need to be totally separated. As a result, efficacy at the SME section will be increased.

- JBL SME Credit Department should reduce its complex and rigid rules and regulation. The prevailing procedures require many formalities and take many papers etc. in case of taking loan.

- More training should be conducted for the bankers to improve their analytical ability and professional standard regarding risk analysis and other tools and techniques in selecting the borrowers and analyzing the loan proposals.

- Authority should be delegated to the lower level with adequate measures for the necessity and follow-up for making the lending decision and recovery.

- Interest income occupies the major part of the total earning of a bank and bank’s profitability mainly depends on interest earning capacity, so bank should establish a research and development cell for the purpose of the lending analysis and recovery of loans.

Conclusion:

During the three months internship program at Mirpur branch, I have acquired some knowledge from practical banking and compare this practical knowledge with theoretical knowledge. Although all departments are covered in the internship program, it is not possible to go to the departments of each activities of branch because of time limitation. Jamuna Bank limited (JBL) SME credit scheme has widened the scope of risk port-folio of the bank; the branch manager is exercising their prudence, judiciousness and wide judgment in selecting the genuine & good clients. The success of the SME credit scheme will depend on:

- SME practices.

- Personal initiatives.

- Supervision.

- Very careful about strategic selection.

- Constant follow up of the credit portfolio by the manager.

The banking sector of Bangladesh is passing through a tremendous reform under the economic deregulation and opening up the economy. Currently this sector is becoming extremely competitive with the arrival of multinational banks as well as emerging and technological infrastructure, effective credit management, higher performance level and utmost customer satisfaction. Jamuna Bank Ltd. fairly follows the credit policy and practices set by the management of the bank. High employee efficiency, high profitability, rapid growth of deposit and advances and high loan recovery prove evidence of sound financial condition of Jamuna Bank Ltd.